- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Digital and Virtual Banking Account Opening FAQs

Image Source: unsplash

Do you want to open a bank account easily using a mobile app? You may ask:

- Do I need to visit a branch in person?

You can complete the entire process via the app, no need to visit in person, and it can be done in as little as five minutes, with industry cases showing significant efficiency improvements.

- How fast is the account opening process?

Platform Time Required for Account Opening Hong Kong Virtual Banks About 5 minutes Traditional Banks About 1 hour - Is there a minimum balance or monthly fee?

Most virtual banks have no minimum balance requirement and do not charge monthly fees, offering many attractive options.

Key Points

- Digital bank account opening can be fully completed via a mobile app, without visiting a branch, with a fast and convenient process that takes about 5 minutes at its quickest.

- Most virtual banks have no minimum balance or monthly fees, making them suitable for students and young people to manage funds freely, reducing additional burdens.

- Hong Kong virtual banks are strictly regulated by the Hong Kong Monetary Authority, with deposits protected up to HK$500,000, ensuring the safety of your funds.

- Virtual banks offer multiple deposit and transfer methods, including instant and fee-free Faster Payment System (FPS), which is convenient, fast, and saves on fees.

- Many virtual banks provide attractive account opening incentives, such as cash rewards and fee-free services, allowing you to compare and choose the most suitable plan before opening an account.

Bank Account Opening Process

Image Source: pexels

Account Opening Steps

Do you want to open a digital or virtual bank account? You only need a smartphone, download the bank’s app, and follow the instructions. You don’t need to visit a branch in person, as all steps can be completed at home. The general process is as follows:

- Open the bank app and select “Open Account.”

- Enter personal information, such as name, date of birth, contact phone number, and email address.

- Scan your Hong Kong ID card using your phone’s camera.

- Perform a selfie verification to confirm your identity.

- Link your phone number to receive a verification code.

- Read and agree to the terms, then submit the application.

Tip: You can pause at any time and continue later, so you don’t have to worry about interruptions.

Required Documents

When opening a bank account, the required documents are very simple. You only need to prepare:

- Hong Kong ID card

- Valid proof of Hong Kong address (e.g., utility bill, bank statement, etc.)

- Mobile phone number (for receiving verification codes)

Some banks may require you to provide a photo or PDF of your proof of address. You can simply take a photo or upload it using your phone. You don’t need to bring any documents to a branch, as everything can be completed online.

Account Opening Time

You may wonder, how long does it take to open a bank account? Most Hong Kong virtual banks claim that the application process can be completed in 5 to 10 minutes. As long as you follow the app’s instructions, fill in the information, and complete identity verification, you can usually open an account instantly. However, some banks, such as E.Sun Bank, may require 3 to 7 working days for review, and you will be notified of the result via SMS or email. In most cases, you can use your new account on the same day, enjoying the convenience of digital banking.

Note: If your information is incorrect or your identification documents are unclear, the bank may request additional documents, which could extend the account opening time.

As you can see, the bank account opening process is simple and fast, requiring no in-person visits, making it easy for almost anyone to complete.

Eligibility and Fees

Age and Identity

Do you want to apply for a digital or virtual bank account? You need to be at least 18 years old and hold a valid Hong Kong ID card. This is the basic requirement for most Hong Kong virtual banks. You also need a valid Hong Kong address and phone number, as the bank will use them to verify your identity and contact you.

Some banks have more specific requirements for identification documents, such as:

- You need to provide the original ID card, though some banks also accept passports, driver’s licenses, or household registration documents issued within the last 30 days.

- If you are under 18, you generally cannot apply for a bank account independently. Only in special cases, such as being married with a spouse registered on your ID card, might you be eligible to apply.

- Supplementary card applicants must be at least 15 years old and must be immediate family members or relatives of the primary cardholder. If you are a minor supplementary card applicant, you also need consent from a legal guardian.

You may notice that some banks do not accept applicants with U.S. tax residency. This is because the U.S. has special tax reporting requirements, and banks may reject such applications for compliance reasons.

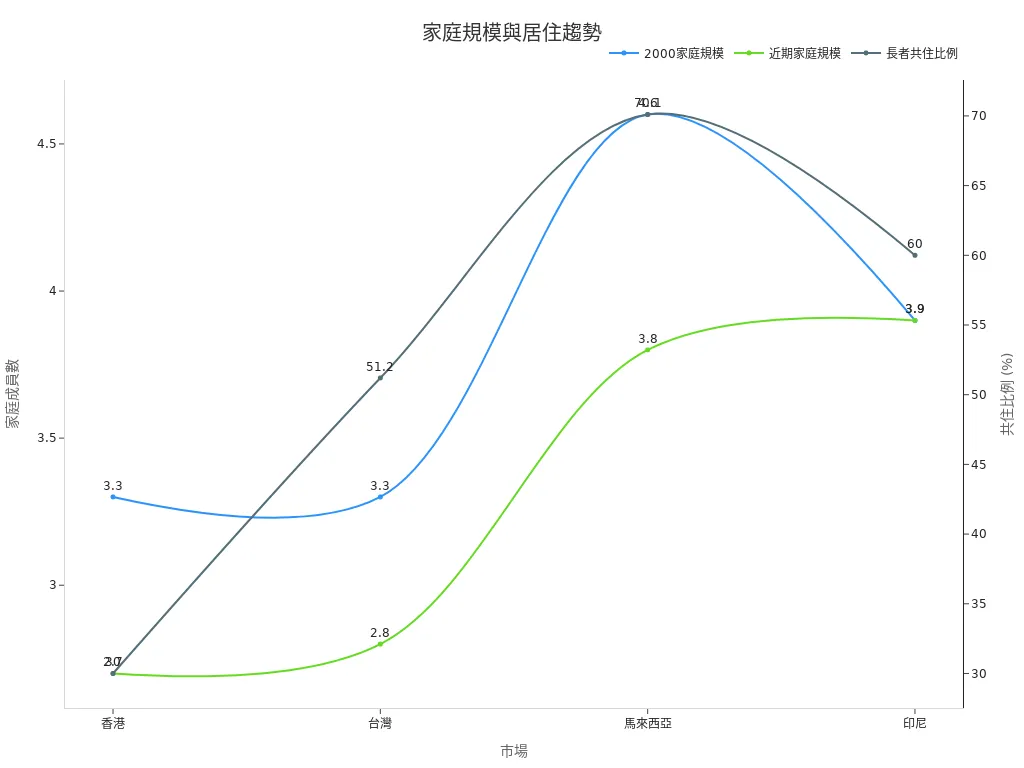

From market trends, family structures in Asia are gradually shrinking, and the proportion of elderly people living with their children is also changing. These changes are reflected in the design of bank age and identity requirements, making the account opening process more aligned with modern family needs.

| Market | Average Household Size Change (2000 to Recent) | Proportion of Elderly Living with Children |

|---|---|---|

| Hong Kong | 3.3 people → 2.7 people | About 30% |

| Taiwan | 3.3 people → 2.8 people | 51.2% |

| Malaysia | 4.6 people → 3.8 people | 70.1% |

| Indonesia | 3.9 people → About 3.9 people | About 60% |

You can see that Hong Kong’s household size is shrinking, and the proportion of elderly people living with their children is relatively low. These data indicate that bank account opening policies are adjusted to accommodate societal structures, making it easier for more people to open accounts.

Minimum Balance

One of your top concerns is likely, “Do I need to maintain a minimum balance?” Most Hong Kong virtual banks do not require a minimum balance. You don’t need to worry about being charged if your account balance is low. This is particularly attractive for those starting to manage finances, students, or young people. You can open an account and manage your funds without pressure.

Some traditional banks require you to maintain a certain balance, or they may charge fees. Virtual banks break this restriction, giving you more freedom to use banking services.

Monthly and Other Fees

You may ask, “Is there a monthly fee for opening an account? Are there hidden charges?” Rest assured, most Hong Kong virtual banks do not charge monthly fees. After opening an account, regular use, transfers, and receiving payments typically incur no additional fees. This fee structure is very user-friendly, especially for those who want to avoid the various miscellaneous fees charged by traditional banks.

However, you should note that some special services (e.g., cross-border remittances, foreign currency exchanges) may incur fees. These fees are generally clearly listed in the app. You can check them anytime to avoid unnecessary expenses.

Tip: Before opening an account, compare the fee schedules of different virtual banks to choose the most suitable plan for you.

In summary, digital and virtual bank account opening has low barriers, with no minimum balance or monthly fees, allowing you to enjoy modern banking services easily.

Security and Protection

Image Source: unsplash

Deposit Protection

One of your top concerns is likely, “Is my money safe in a virtual bank?” In fact, all Hong Kong virtual banks are strictly regulated by the Hong Kong Monetary Authority (HKMA). Your deposits are covered under the Deposit Protection Scheme, with a maximum protection of HK$500,000 (approximately USD 64,100), the same as traditional banks. Even if the bank encounters issues, your funds are protected, so you don’t need to worry about losses.

Tip: You can check the deposit protection terms in the bank’s app anytime to ensure your rights are protected.

Account Security

When using a virtual bank, you may worry about fraud or account theft. In fact, banks have adopted multiple security measures to protect your funds. These include one-time password (OTP) verification, AI-based unusual transaction detection, phone number verification, and alerts for abnormal logins. These measures significantly reduce the risk of fraud.

| Metric | Data | Description |

|---|---|---|

| Fraud Cases Blocked in 2024 | 376 cases | Up 3% from 2023 |

| Fraud Blocked Amount in 2024 | Approximately USD 3.46 million | Up 34% from 2023 |

| High-Value Fraud Cases Blocked | Multiple cases | Significant effectiveness in preventing large-scale fraud |

| Financial Institution Alerted Accounts Growth Rate | About 26% | First Bank controlled at 16%, outperforming peers |

| Anti-Fraud Measures | AI technology, identity verification, unusual transaction detection, etc. | Comprehensive fraud prevention |

You’ll notice that banks proactively ask questions, extend transfer review periods, and strengthen phone verification, all of which effectively prevent fraud. In 2023, financial institutions successfully blocked over 11,300 fraud cases, with a total blocked amount reaching USD 97.3 million. After electronic payment platforms enhanced phone verification, fraud cases dropped by approximately 90%. Some banks also proactively alert you during unusual transactions and even collaborate with the police to ensure your account’s safety.

Regulatory Oversight

You may ask, “Are virtual banks regulated? Are they risky?” In fact, the HKMA imposes strict oversight on virtual banks. According to the Stablecoin Ordinance, all related financial activities require a license, with a minimum paid-up capital of USD 3.2 million and ongoing compliance. The HKMA has the authority to investigate and sanction violations and can dynamically adjust the regulatory scope to address emerging technological risks.

- The ordinance prohibits unlicensed stablecoin activities, with penalties including fines and imprisonment.

- The HKMA requires banks to comply with anti-money laundering, asset management, and advertising restrictions.

- Multiple international institutions participate in the HKMA’s sandbox projects, reflecting market confidence in Hong Kong’s regulatory environment.

- The ordinance works in conjunction with deposit protection and banking regulations to ensure a comprehensive regulatory system.

You can confidently use virtual banks, as Hong Kong’s regulatory framework is robust, with risks comparable to those of traditional banks. As long as you stay vigilant and follow the bank’s security measures, your funds will be well-protected.

Deposits, Withdrawals, and Transfers

Deposit Methods

Do you want to deposit money into your virtual bank account? The methods are very diverse. You can choose from the following options:

- Faster Payment System (FPS): Simply use another bank’s app, enter your virtual bank account number or phone number, and transfer instantly without fees.

- Bank Transfer: You can use online banking or ATMs from traditional banks to transfer directly to your virtual bank account. Most Hong Kong banks support this feature.

- Cash Deposit Machines: Some virtual banks partner with banks (e.g., Bank of China Hong Kong, Hang Seng Bank) to allow cash deposits via ATMs, though this method is less common.

Tip: When depositing, double-check the account number to avoid transferring to the wrong account.

Withdrawal Methods

Do you want to withdraw funds from your account? It’s very simple. You can:

- Transfer via FPS to Other Banks: In the virtual bank app, select the “Transfer” function, enter the recipient bank details, and the funds will arrive instantly.

- Bank Transfer: Transfer money back to your traditional bank account, then withdraw cash via ATMs.

- Debit Card (Offered by Some Banks): Some virtual banks issue physical debit cards, allowing you to withdraw cash at ATMs across Hong Kong. However, most virtual banks focus on cardless services.

Note: For withdrawals, some banks may charge a small fee (e.g., USD 1-2, approximately HK$8-16, depending on the exchange rate). You can check the relevant fees in the app.

Transfer Channels

Do you want to transfer money to friends or family? Virtual banks offer multiple transfer channels:

| Transfer Method | Arrival Time | Fees |

|---|---|---|

| Faster Payment System (FPS) | Instant | Free |

| Bank Transfer | 1-2 working days | Varies by bank |

| Cross-Border Remittance | 1-3 working days | Approximately USD 5-20 |

You can transfer money using a phone number, email, or account number. Some virtual banks also support cross-border remittances, allowing you to send USD or other currencies directly to mainland China, the U.S., and other regions. However, cross-border remittances incur fees, with exchange rates based on the bank’s daily quotes.

Tip: Before transferring, check the recipient’s details and fees to avoid unnecessary losses.

Account Opening Incentives and Cancellation

Account Opening Incentives

Do you want to know what benefits come with opening a bank account? Many Hong Kong virtual banks offer incentives to attract new customers. You may see the following common offers:

- Cash Rewards: After opening an account and completing specific tasks (e.g., first deposit, transfer), the bank may offer cash rewards ranging from USD 5 to USD 30, depending on the exchange rate.

- Referral Rewards: Invite friends to open accounts, and both parties may receive additional bonuses or spending rebates.

- Fee Waivers: For the first few months, some services (e.g., cross-border remittances, foreign currency exchanges) may be fee-free.

- Lucky Draws: Some banks hold periodic lucky draws with prizes like cash, vouchers, or electronic products.

Tip: Before opening an account, compare the latest offers from different banks to choose the most suitable plan for you.

Account Cancellation

If you want to cancel your virtual bank account, it’s very simple. Just find the “Close Account” or “Apply for Cancellation” function in the app and follow the instructions. Some banks may require you to verify your identity or clear your account balance. Generally, cancelling an account incurs no additional fees. After completion, the bank will notify you via email or the app, ensuring a transparent process.

Note: Before cancelling, transfer out all funds to avoid any oversight.

Notes

When opening a bank account, keep the following points in mind to protect your interests:

- Risk warnings come from historical data models and market cases. Banks use time series analysis, machine learning, and other methods, but these models have limitations, and you should ultimately rely on your own judgment.

- Hong Kong banks combine quantitative data and experience for sensitivity analysis, stress testing, and external audits to continuously monitor risks.

- In response to errors or false information, banks enhance anti-fraud education, real-time communication, and cybersecurity measures, based on past market experiences.

- Risk management adjusts to market changes, including credit, interest rates, and more, with banks adapting strategies based on the latest conditions.

- Banks diversify capital structures to reduce reliance on a single market, continuously monitor credit accounts and global economic conditions, and flexibly adjust risk management.

Reminder: When opening an account, carefully read the terms, regularly check account security alerts, and contact the bank immediately if you encounter suspicious messages.

By choosing digital or virtual banking, you can enjoy multiple benefits, including regulation by Hong Kong Customs, advanced security technology, deposit protection schemes, and attractive account opening incentives. However, note that some banks have limited transfer or withdrawal options, and you should proactively contact customer service when cancelling an account. It’s recommended to compare different bank account opening plans based on your needs. If you have questions, feel free to leave a comment to discuss and share insights!

FAQ

Can I use a foreign passport to open an account?

You generally need a Hong Kong ID card to open an account. Some banks accept foreign passports but require proof of a Hong Kong address. Check the bank’s latest policies first.

Can I receive payments immediately after opening an account?

After completing account opening and identity verification, most virtual banks activate the account instantly. You can receive payments or transfer funds immediately without waiting.

What should I do if I forget my login password?

You can select “Forgot Password” on the app’s login page. The bank will send a verification code to your phone or email, and you can follow the instructions to reset your password.

Do virtual banks support foreign currency accounts?

| Bank Name | Supports Foreign Currency Accounts | Main Currencies |

|---|---|---|

| ZA Bank | Yes | USD, CNY |

| Mox Bank | Yes | USD, EUR, GBP |

| livi bank | No | - |

You can choose a bank based on your needs.

How much are the fees for transferring to a mainland China bank account?

Faster Payment System (FPS) transfers are generally free. Cross-border remittances to mainland China bank accounts incur fees of about USD 5-20 (depending on the exchange rate). Check the latest fees in the app.

As digital and virtual banking streamline account openings, high cross-border transfer fees and unclear exchange rates remain pain points for users. BiyaPay offers a seamless solution to these challenges. With a quick registration process via its mobile app, you can open an account in as little as five minutes, managing funds anytime, anywhere—start now at BiyaPay!

BiyaPay supports real-time conversions between multiple fiat and digital currencies with transparent rate queries, ensuring cost clarity. Its cross-border transfer fees, as low as 0.5%, cover over 190 countries, far more cost-effective than traditional banks. Visit BiyaPay today to unlock efficient global financial services and elevate your digital banking experience!

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.