- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Standard Chartered vs HSBC Marathon Savings Interest Rate Comparison: Which Bank’s Current Account Suits You Best

Image Source: pexels

Do you want to know the latest current account interest rates for major Hong Kong banks in June 2025? You can refer to the table below to quickly compare the current interest rates, preferential deposit caps, and main conditions for Standard Chartered Marathon Savings, HSBC One, Mox, Hang Seng, DBS, and Bank of East Asia. This data comes from official bank announcements and professional websites, verified by multiple sources, ensuring high reliability. You can select the most suitable plan based on your fund size, flexibility, and desire for high interest rates.

| Bank | Current Interest Rate (June 2025) | Preferential Deposit Cap (USD) | Main Conditions |

|---|---|---|---|

| Standard Chartered Marathon Savings | 5.7% | 20,000 | New funds, instant withdrawal |

| HSBC One | 5.7% | 20,000 | Complete multiple tasks |

| Mox | 4.5% | 10,000 | Monthly qualifying transactions |

| Hang Seng | 4.2% | 10,000 | Designated account, fund requirements |

| DBS | 4.0% | 10,000 | Must meet asset threshold |

| Bank of East Asia | 3.8% | 10,000 | Different conditions for new and existing customers |

Key Points

- Standard Chartered Marathon Savings and HSBC One offer the highest current interest rate of 5.7%, suitable for those seeking high returns, but you must meet new fund and task requirements.

- Mox and Hang Seng current accounts have lower interest rates, but their conditions are simple and support flexible withdrawals, ideal for those needing instant access to funds.

- Current account interest rates are generally rising, with some high-interest offers having deposit caps and new fund restrictions; you should pay attention to the terms’ details when choosing.

- Current accounts are flexible and convenient, suitable for daily and emergency funds; fixed deposits offer higher rates, ideal for long-term fund management, and the two can be paired flexibly.

- Regularly checking banks’ latest rates and offers and adjusting fund allocation flexibly can help improve overall returns and financial outcomes.

Interest Rate Comparison

Image Source: unsplash

Latest Data

Do you want to know how to compare current account interest rates across different banks? You can start with two key statistical metrics:

- Interest Rate Spreads (IRS): This metric is the average lending rate minus the average deposit rate. You can use this figure to see the differences in rates and profitability among banks.

- Net Interest Margins (NIM): This metric is calculated as (interest income - interest expense) divided by average earning assets. You can use it to compare the net difference between a bank’s interest income and expenses.

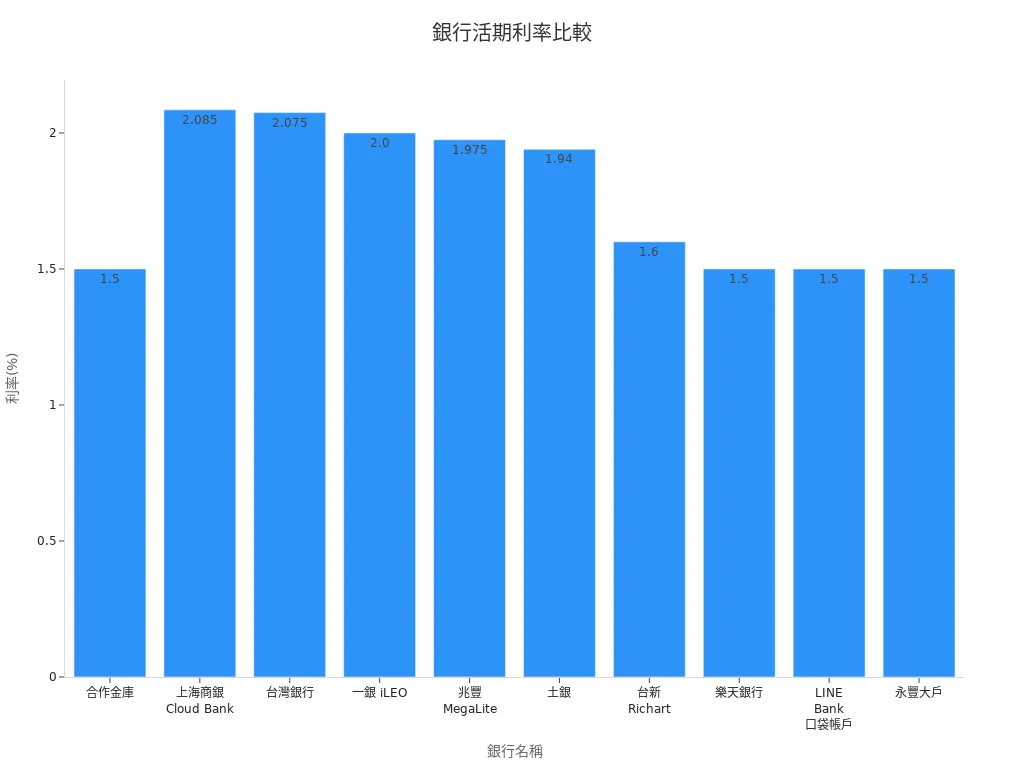

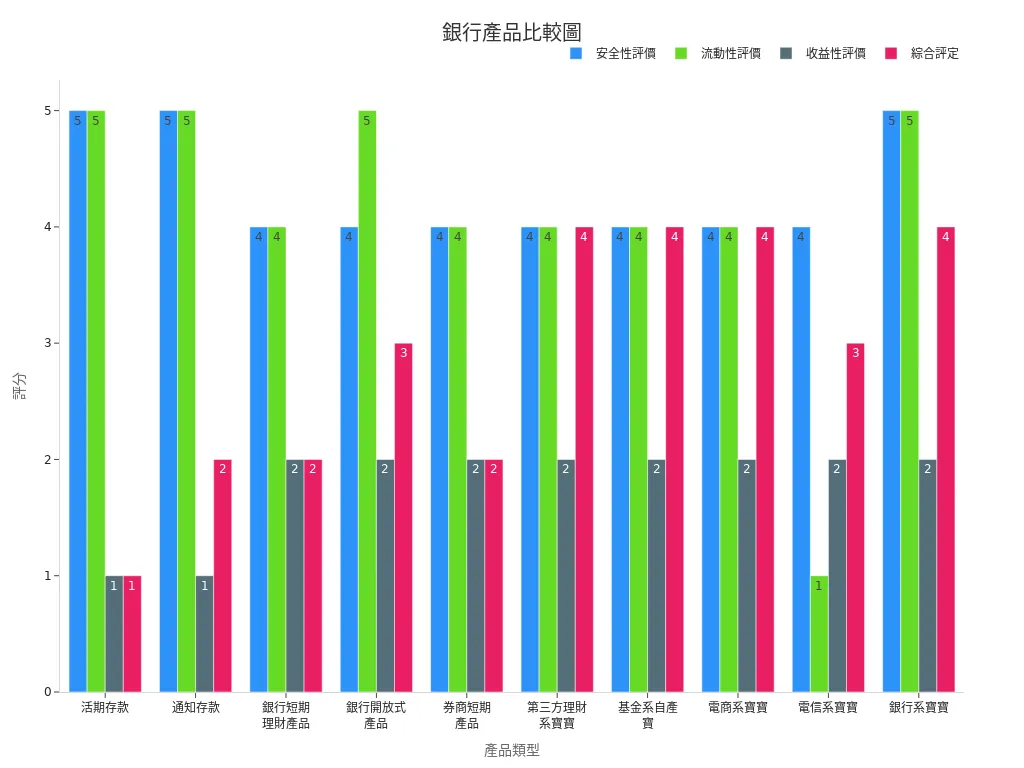

You can refer to the table below to understand the safety, liquidity, and profitability of different deposit products. This data comes from bank announcements and third-party professional reports, helping you quickly grasp the current market situation.

| Product Type | Safety Rating | Liquidity Rating | Profitability Rating | Overall Rating | Main Data Sources and Notes |

|---|---|---|---|---|---|

| Current Account | ★★★★★ | ★★★★★ | ★☆☆☆☆ | ★☆☆☆☆ | Bank announcement data, interest rate around 0.35%, highly flexible but lowest returns, mainly for daily small expenses. |

| Notice Deposit | ★★★★★ | ★★★★★ | ★☆☆☆☆ | ★★☆☆☆ | Official bank data, rates of 0.8% (1-day notice) and 1.35% (7-day notice), mainly for corporate clients. |

| Bank Short-Term Wealth Products | ★★★★☆ | ★★★★☆ | ★★☆☆☆ | ★★☆☆☆ | CBIRC regulations, minimum 50,000 yuan, returns 3%-5%, suitable for investors with larger funds and clear timelines. |

| Bank Open-Ended Products | ★★★★☆ | ★★★★★ | ★★☆☆☆ | ★★★☆☆ | T+0 redemption feature, returns 2%-4.6%, suitable for investors with high liquidity needs. |

| Broker Short-Term Products | ★★★★☆ | ★★★★☆ | ★★☆☆☆ | ★★☆☆☆ | Designed for stock investors, supports real-time subscription/redemption, higher returns than current accounts, but convenience limited by subscription/redemption rules. |

| Third-Party Wealth Management Babies | ★★★★☆ | ★★★★☆ | ★★☆☆☆ | ★★★★☆ | Fund company reports, over 100 million users, scale in hundreds of billions, returns multiple times higher than current accounts. |

| Fund-Owned Babies | ★★★★☆ | ★★★★☆ | ★★☆☆☆ | ★★★★☆ | Fund companies’ own money market products, support fast transfers and multi-channel conversions, improving fund utilization efficiency. |

| E-Commerce Babies | ★★★★☆ | ★★★★☆ | ★★☆☆☆ | ★★★★☆ | Reliant on e-commerce payment scenarios, stable and convenient returns, suitable for online shopping users. |

| Telecom Babies | ★★★★☆ | ★☆☆☆☆ | ★★☆☆☆ | ★★★☆☆ | For prepaid phone credit wealth management, low liquidity, limited market acceptance. |

| Bank Babies | ★★★★★ | ★★★★★ | ★★☆☆☆ | ★★★★☆ | Low entry threshold, real-time withdrawals and transfers, potential to replace current accounts, official bank cash management tools. |

Key Summary

You can see that in June 2025, current account interest rates for major Hong Kong banks have significantly risen. Standard Chartered Marathon Savings and HSBC One both offer up to 5.7% current interest rates, which are highly attractive. Mox, Hang Seng, DBS, and Bank of East Asia offer current rates between 3.8% and 4.5%, which are slightly lower but have simpler conditions, suitable for those who don’t want to complete multiple tasks.

If you’re chasing the highest returns, you can consider Standard Chartered’s Marathon Savings or HSBC One, as long as you meet the new funds or designated task requirements. If you have a smaller fund size or want instant access to funds, Mox and Hang Seng’s current products are more suitable. DBS and Bank of East Asia are ideal for those seeking to diversify funds and pursue stable returns.

In terms of market trends, banks are launching high-interest current account products to attract new funds. You’ll notice that current account rates are no longer as low as in the past, with some products even more competitive than short-term wealth management products. However, you should note that these high-interest offers often come with deposit caps and new fund requirements, and rates may adjust with market conditions.

Tip: When choosing a current account, besides looking at the interest rate, you should also consider the product’s flexibility and condition restrictions. You can regularly compare the latest offers from different banks and adjust your fund allocation flexibly to maximize returns.

Marathon Savings Details

Standard Chartered Rates

If you’re seeking a high-interest current account, Standard Chartered’s Marathon Savings is a popular choice. In June 2025, Standard Chartered Marathon Savings offers options in both HKD and USD. In USD, the annual interest rate is as high as 5.7%. You can deposit up to USD 20,000 to enjoy this preferential rate. The HKD rate varies with market conditions, usually close to the USD rate, but you should note that exchange rate fluctuations may affect actual returns.

You can refer to the table below to quickly understand the main rate information for Standard Chartered Marathon Savings:

| Currency | Annual Interest Rate | Preferential Deposit Cap (USD) |

|---|---|---|

| USD | 5.7% | 20,000 |

| HKD | Approx. 5.5% | 20,000 |

The rates for Marathon Savings may adjust based on market conditions. You should regularly check Standard Chartered’s official website for the latest rate information.

Condition Restrictions

To apply for Marathon Savings, you must deposit new funds. New funds refer to money transferred to Standard Chartered from other banks within the last month, not existing deposits already held with Standard Chartered. You need to open a designated current account and complete the application via online banking or the mobile app. The minimum application amount is typically USD 1,000, with a maximum of USD 20,000.

The biggest advantage of Marathon Savings is its flexibility. You can withdraw funds at any time without early redemption penalties. This is very convenient for those needing liquidity. However, you should note that withdrawing all funds early may result in losing some interest benefits.

You should be aware that Marathon Savings’ rates and conditions may change with market conditions. The bank reserves the right to adjust or terminate offers at any time. You should confirm all details before applying.

HSBC Current Account

One Account

If you want to earn high-interest current account returns with HSBC, you can consider opening an HSBC One account. This account is designed to be simple, targeting young users and those seeking flexible wealth management. You can open the account quickly and conveniently via the mobile app or online banking. The One account supports multiple currencies, including USD, allowing you to manage funds flexibly. You can check your account balance and interest rates anytime, making it easy to make financial decisions.

The biggest attraction of the One account is its high current interest rate of up to 5.7%. This rate is among the top in the market in June 2025. You can deposit up to USD 20,000 to enjoy high-interest returns, provided you complete designated tasks. This product is suitable if you want to earn higher interest than typical fixed deposits using a current account.

Tip: You can use the One account’s multi-currency feature to flexibly convert currencies, seizing opportunities from market exchange rate fluctuations.

Task Requirements

To enjoy the 5.7% high-interest current rate of the HSBC One account, you must complete multiple designated tasks. These tasks include:

- Depositing new funds: You need to transfer new funds from other banks to HSBC, meeting the bank’s required amount.

- Currency conversion: You need to complete one currency conversion in the account, such as converting HKD to USD.

- Becoming a new investment client: You can open an investment account and conduct your first investment transaction.

- Other financial tasks: For example, setting up automatic transfers or participating in designated promotional activities.

After completing the above tasks, the bank will automatically calculate and distribute the high-interest rate for you. You can check task progress and rate status in the mobile app.

This product is suitable if you’re willing to actively manage funds and spend time completing tasks. If you prefer simple deposits without handling multiple financial steps, you may find these requirements somewhat complex. However, for those chasing high returns and willing to actively participate in bank activities, the HSBC One account is a great choice.

Other Banks

Mox

If you want to manage funds with a digital bank, Mox is a good choice. Mox offers a current account interest rate of 4.5%, with a preferential deposit cap of USD 10,000. To enjoy this rate, you must accumulate qualifying transactions monthly, such as spending, transfers, or automatic transfers. If you fail to meet the criteria, the rate will drop to the standard level. Opening a Mox account is simple, suitable if you prioritize convenience and flexibility.

Tip: You can set up automatic transfers or regular spending to ensure you meet Mox’s qualifying transaction requirements each month.

Hang Seng

Hang Seng Bank’s current account interest rate is 4.2%, with a preferential deposit cap of USD 10,000. You need to open a designated account and deposit new funds. Hang Seng has different requirements for new and existing customers. If you’re a new customer, it’s usually easier to access high-interest offers. If you have a larger fund size, you can consider depositing in batches to flexibly utilize different offers.

DBS

DBS Bank’s current account interest rate is approximately 0.5% to 0.6%. If you’re seeking higher interest, you can consider DBS’s fixed deposits, with a starting rate of about 1.225%. DBS also offers a special program, “DBS Star Advantage TWD Fixed Deposit,” with a rate of about 1.65% for a 6-month term. However, these programs are limited to new funds and are only available to DBS Wealth Management or private clients, with a minimum threshold of USD 1 million. You can refer to the following key points:

- Current account interest rate: Approx. 0.5% to 0.6%

- Fixed deposit starting rate: Approx. 1.225%

- Special fixed deposit rate: Approx. 1.65%, 6-month term

- Limited to new funds and high-net-worth clients

- Recommended for those with ample funds not needed in the short term to switch to fixed deposits

Bank of East Asia

Bank of East Asia’s current account interest rate is 3.8%, with a preferential deposit cap of USD 10,000. If you’re a new customer, it’s easier to access high-interest offers. Existing customers may face stricter conditions. BEA’s current account product is suitable if you want to diversify funds or simply manage daily cash flow.

Note: The promotional terms of different banks may change at any time. You should regularly check the official websites to ensure you have the latest rates and application conditions.

Terms Comparison

New Funds

When choosing current or fixed deposits, you should pay special attention to the “new funds” requirement. Most Hong Kong banks, including Marathon Savings and HSBC One, require you to transfer new funds from other banks to enjoy high-interest offers. New funds typically refer to money transferred from external banks within the last month, not existing deposits already held with the bank. This helps banks attract more new clients and funds.

If you fail to provide new funds, the bank will only offer standard rates, and you won’t enjoy high-interest current or fixed deposit benefits.

- New fund requirements are common for high-interest current and fixed deposit products

- The transfer amount must meet the minimum threshold (e.g., USD 1,000)

- Some banks periodically check the source of funds

Account Types

Different banks have different requirements for account types. When applying for Marathon Savings, HSBC One, or other high-interest products, you usually need to open a designated current or wealth management account. For example, HSBC offers fixed deposit promotions for different currencies for Premier and One Wealth Management clients.

You can choose the appropriate account type based on your fund size and financial goals.

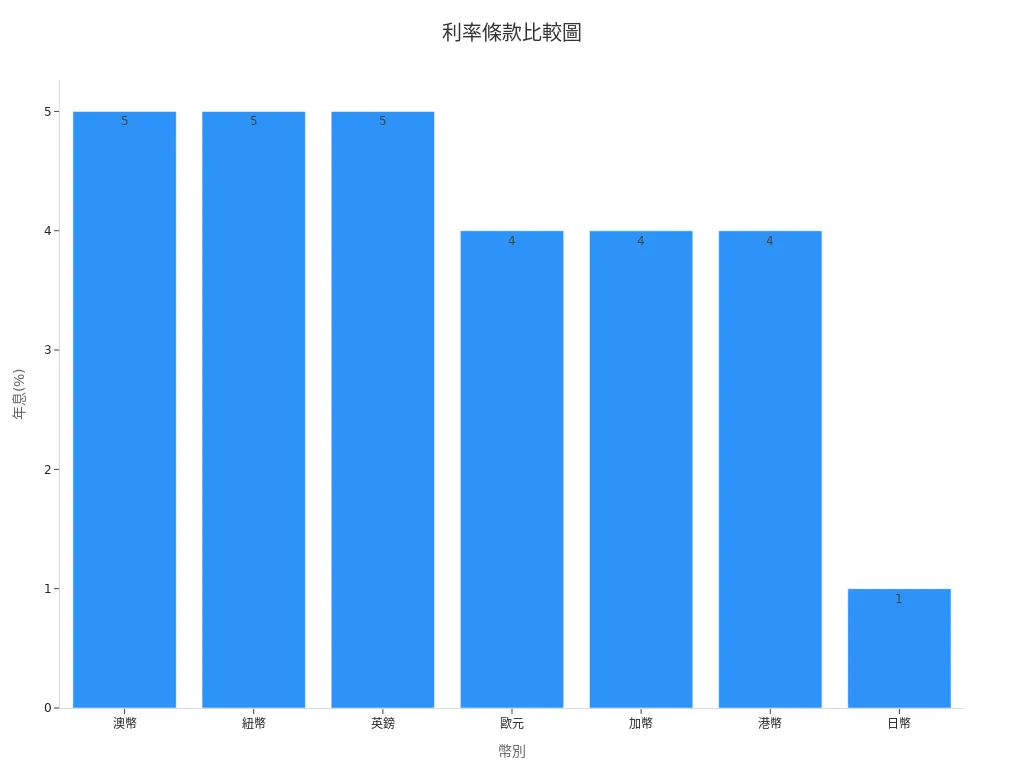

The table below compares account requirements and amount limits for fixed deposits in different currencies:

| Currency | Deposit Term | Promotional Rate (Annual) | Minimum Single Deposit Amount | Maximum Deposit Limit per Client | Applicable Account Types |

|---|---|---|---|---|---|

| AUD | 3 months | 5% | 3,000 USD | 100,000 USD | Premier/One Wealth Management |

| NZD | 3 months | 5% | 3,000 USD | 100,000 USD | Premier/One Wealth Management |

| GBP | 3 months | 5% | 3,000 USD | 100,000 USD | Premier/One Wealth Management |

| EUR | 3 months | 4% | 3,000 USD | 100,000 USD | Premier/One Wealth Management |

| CAD | 3 months | 4% | 3,000 USD | 100,000 USD | Premier/One Wealth Management |

| HKD | 3 months | 4% | 10,000 USD | 500,000 USD | Premier/One Wealth Management |

| JPY | 3 months | 1% | 50,000 USD | 500,000 USD | Premier/One Wealth Management |

Rate Period

When choosing deposit products, you should also pay attention to the applicable rate period. Most high-interest current and fixed deposit promotional rates are only valid for a specific period, such as 3 or 6 months. After the period ends, the bank will automatically revert your deposit to the standard rate unless you reapply for a new offer.

You can refer to the chart below to understand the applicable periods and terms for fixed deposit rates in different currencies:

Tip: You should regularly check the bank’s promotional terms and note automatic renewal arrangements. Some banks automatically renew deposits after the promotional period, but the rate may drop significantly. You can set reminders to avoid missing opportunities to reapply for high-interest offers.

Current vs Fixed Deposits

Image Source: pexels

Liquidity

When you choose a current account, you can withdraw funds anytime, making it highly flexible. If you need instant access to cash, a current account is the most suitable for you. Fixed deposits, however, require locking funds for a set period, and early withdrawals typically result in a loss of some interest. If you have short-term funding needs, a current account is more convenient.

Tip: You can keep daily expenses and emergency funds in a current account to ensure funds are always accessible.

Interest Rates

You’ll notice that current account interest rates are generally lower. For example, in Hong Kong banks, current rates are around 0.2%, yielding about USD 200 in interest per year for a USD 100,000 deposit. Fixed deposit rates are much higher, with 1-year fixed deposits reaching 1.09%, yielding about USD 1,090 for the same amount—a nearly fivefold difference. If you want to boost your returns, you can consider converting excess funds to fixed deposits.

| Deposit Type | Annual Interest Rate | Interest for USD 100,000 Deposit per Year |

|---|---|---|

| Current Account | Approx. 0.20% | Approx. USD 200 |

| Savings Fixed Deposit | Approx. 1.09% | Approx. USD 1,090 |

| Fixed Deposit | Approx. 1.065% | Approx. USD 1,065 |

Note: Savings fixed deposits offer higher rates but are typically for terms longer than 1 year; fixed deposits offer terms under 1 year, providing greater flexibility.

Suitable Audience

If you need flexible withdrawals or want to keep funds for daily use, a current account is the most suitable for you. If you have funds you won’t need for a while and want higher interest, a fixed deposit is more appropriate. You can also consider depositing funds in batches with different terms to enhance overall returns while maintaining some liquidity.

- Current Account: Suitable for daily expenses, emergency funds, and short-term fund management.

- Fixed Deposit: Suitable for funds not needed in the long term and for those seeking stable returns.

- Staggered Fixed Deposits: Suitable for those wanting to balance liquidity and returns.

It’s recommended to allocate current and fixed deposits based on your fund usage and liquidity needs to achieve the best financial outcomes.

Selection Advice

Chasing High Interest

If you’re chasing the highest current account interest rates, you can prioritize Standard Chartered’s Marathon Savings or HSBC One. Both products offer a 5.7% high-interest rate in June 2025, which is highly attractive. You should note that these high-interest offers typically require new funds and have deposit caps. According to market data, several Chinese banks lowered current account rates in 2023, reflecting that overall rate trends may change anytime. You should regularly check bank announcements to seize high-interest opportunities early.

- Current Interest Rate Levels: Choose products with higher rates, such as Marathon Savings.

- Interest Payment Methods: Some banks pay interest monthly or daily, and early withdrawals may affect returns.

- Suitable for those with steady income, savings habits, and those who don’t want to lock funds in fixed deposits.

Flexible Withdrawals

If you value fund flexibility, you can choose Mox or Standard Chartered Marathon Savings. These products support instant withdrawals without early redemption penalties. You can access funds in the account anytime, suitable for daily expenses or emergencies. Mox requires qualifying transactions monthly to maintain the higher rate. You should note that some banks calculate interest on a “first-in, first-out” basis, with withdrawals prioritized from earlier deposits.

Fund Size

If you have a larger fund size, you can consider diversifying deposits across different banks to maximize the use of each bank’s preferential caps. For example, Standard Chartered and HSBC’s high-interest current accounts have a cap of USD 20,000, while Mox, Hang Seng, and Bank of East Asia have caps of USD 10,000. You can allocate funds flexibly based on your fund size to enhance overall returns. If you have a smaller fund size, it’s recommended to choose current account products with simple conditions and low thresholds to ensure every dollar earns higher interest.

Tips

When choosing a current account, you should regularly check the bank’s latest rates and terms. Banks adjust offers based on market changes, and some products’ rates may drop significantly after the promotional period. You can set reminders and periodically compare current account products from different banks to adjust fund allocation flexibly and maximize returns.

If you’re chasing high interest, you can choose Standard Chartered’s Marathon Savings or HSBC One. If you value flexible withdrawals, Mox and Hang Seng are more suitable. Different banks’ rates and terms may change at any time. You should regularly check the latest bank information and make the most suitable choice based on your liquidity and interest rate needs.

FAQ

How long will the high-interest offers for Standard Chartered Marathon Savings and HSBC One last?

You should note that these high-interest offers are typically limited to specific periods. Banks adjust rates based on market conditions. You should regularly check the official websites for the latest updates.

Will I lose interest if I withdraw from a current account early?

You can withdraw from a current account anytime. Some banks, like Standard Chartered Marathon Savings, do not impose penalties, but you may lose some high-interest benefits. Check the terms before withdrawing.

What documents are needed to apply for a high-interest current account?

You typically need to provide identification documents and proof of address. When applying via online banking or the mobile app, follow the instructions to upload documents.

What’s the difference between current and fixed deposit interest rates?

Current account rates are lower but offer flexible funds. Fixed deposit rates are higher but require locking funds for a period. Choose the product based on your needs.

Can I open high-interest current accounts with multiple banks simultaneously?

You can open current accounts with multiple Hong Kong banks simultaneously. Diversifying funds can help enhance overall returns. However, each bank’s promotional caps and conditions vary, so read the terms carefully.

In June 2025, Hong Kong’s demand deposit market is vibrant, with Standard Chartered’s Marathon and HSBC One offering 5.7% rates, while Mox and Hang Seng prioritize flexibility, balancing yield and liquidity. BiyaPay enhances your financial strategy, enabling investment in U.S. and Hong Kong stocks through one account, bypassing complex setups for these markets. Access a wealth management product with up to 5.48% annualized returns, featuring flexible withdrawals to complement demand deposits and stock investments.

BiyaPay’s real-time currency conversions and rate queries keep costs as low as 0.5%, maximizing returns. Regulated by international financial authorities, it ensures secure transactions. Visit BiyaPay today to start investing in U.S. and Hong Kong stocks, pairing high-yield demand deposits with a robust financial plan!

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.