- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

2025 Latest Guide to Common Methods for Remitting Money from China to Hong Kong and Their Pros and Cons

Image Source: unsplash

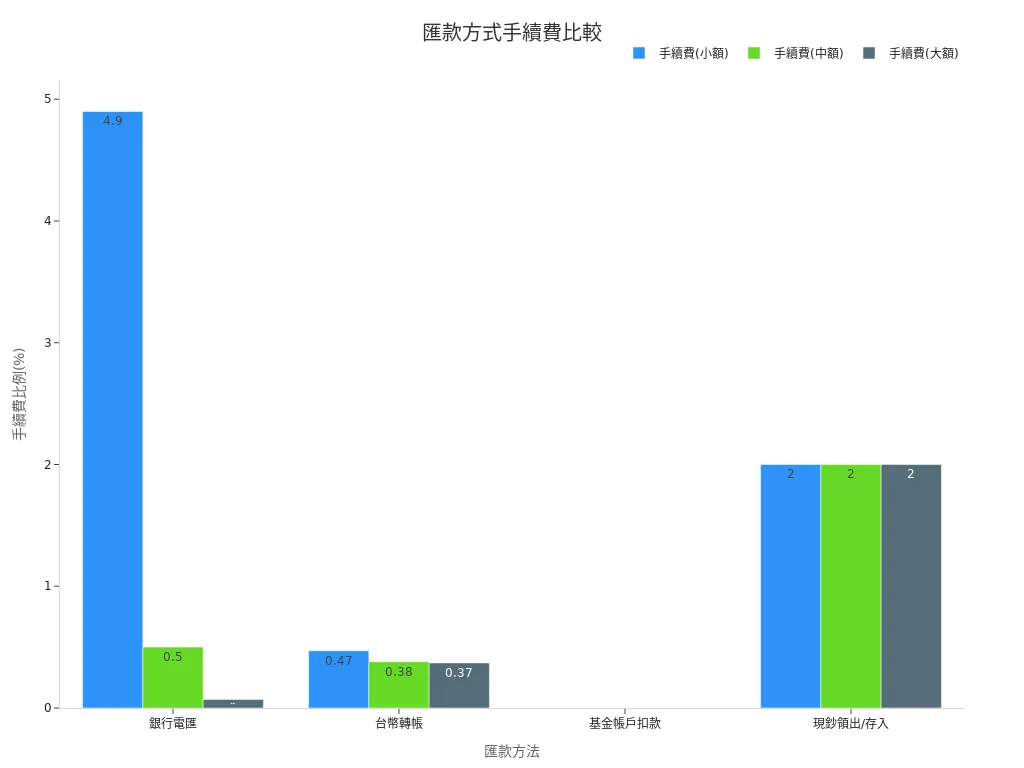

Do you want to remit money from China to Hong Kong? You can use methods such as bank wire transfers, electronic payments, cross-border platforms, or cash carried across the border. Different methods have variations in fees, speed, and security, and you need to be aware of restrictions for remitting money from mainland China to Hong Kong when choosing. You can refer to the comparison table and chart below:

| Remittance Method | Fee Rate (USD 1,000) | Speed | Security |

|---|---|---|---|

| Bank Wire Transfer | Approx. 4.9% | Fast | High |

| Electronic Payment | Approx. 0.5~2% | Fast | Medium |

| Cross-Border Platform | Approx. 0.5% | Fast | High |

| Cash Carried Across Border | Approx. 2% | Slow | Relatively Low |

Key Points

- There are multiple methods for remitting money to Hong Kong, including bank wire transfers, electronic payments, cross-border platforms, and cash carried across the border, each with significant differences in fees, speed, and security; you should balance cost and efficiency based on your needs when choosing.

- Remitting money from mainland China to Hong Kong has strict limits and compliance requirements; you must complete identity verification and provide proof of fund sources to avoid account freezes or fines, with fund security being the top priority.

- Choose methods flexibly based on the remittance amount and urgency: use bank wire transfers or cross-border platforms for large amounts, electronic payments or bank card withdrawals for small and instant remittances, and always operate through legal channels.

Mainstream Methods

Image Source: pexels

Bank Wire Transfer

You can choose bank wire transfers, which is the most traditional method. You need to visit a bank counter, such as Bank of China or ICBC, to purchase foreign currency, then fill in the recipient’s information to transfer money to a Hong Kong bank account. The fee is approximately USD 49 (for USD 1,000), and the process usually takes 1 to 3 business days.

This method is secure but has high fees and a more complex process. You should note that restrictions for remitting money from mainland China to Hong Kong will affect the amount per transaction and the description of the purpose.

Electronic Payment

You can also use electronic payments, such as Alipay HK, WeChat Pay HK, or Octopus. You only need to operate through a mobile app, and the process is simple and fast. Fees range from approximately USD 5 to USD 20, with funds usually arriving instantly. However, exchange rates may vary, and there are limits on transaction amounts. You need to ensure that both accounts are verified with real-name authentication.

Cross-Border Platform

Cross-border platforms like Wise are very popular. You only need to register on the platform, enter the recipient’s information, and pay using a Chinese bank card.

Fees are as low as USD 5, and the process is fast, usually completed within 1 hour. The platform is compliant and highly secure, but sometimes proof of fund sources is required.

Cash Carried Across Border

You can personally carry cash across the border, but the maximum amount per person per trip is USD 5,000. This method has no fees but carries high risks and is slow. You need to declare the amount, or it may be illegal.

Mainland Bank Card Withdrawal

You can also use a Chinese bank card to withdraw money at ATMs in Hong Kong. This method is flexible and convenient but has daily withdrawal limits, with fees ranging from approximately USD 3 to USD 10. You should pay attention to ATM exchange rates and bank fees.

Tip: You should choose licensed institutions to handle remittances to avoid illegal channels and ensure fund security.

Restrictions for Remitting Money from Mainland China to Hong Kong

Amount Limits

When choosing a remittance method, the first thing you should pay attention to is the amount limits. Different methods have different maximum amounts and conditions. The table below can help you quickly compare:

| Remittance Method | Amount Limits and Restrictions |

|---|---|

| Bank Wire Transfer | Maximum of RMB 80,000 (approx. USD 11,000) per person per day, only to same-name accounts. Commercial transactions exceeding USD 50,000 require contracts or invoices. |

| Electronic Payment | For example, Alipay HK: intermediate verification has a daily limit of approx. USD 1,000, annual limit of USD 12,500. Advanced verification can increase the limit. WeChat Pay has a daily limit of approx. USD 2,800. |

| Cash Carried Across Border | Maximum of USD 5,000 cash per person per trip. Amounts exceeding this must be declared, or it is illegal. |

| Mainland Bank Card Withdrawal | Daily ATM withdrawal limits set by the issuing bank, typically approx. USD 1,000 to USD 2,000 per day. |

| Cross-Border Platform | Limits set based on identity verification level, generally not exceeding USD 10,000 per transaction. |

When using electronic payments, remember to complete identity verification first. Alipay HK’s intermediate verification has a daily limit of approximately USD 1,000, while advanced verification allows higher limits. WeChat Pay and Alipay have a daily limit of approximately USD 2,800.

Bank wire transfers require transfers to same-name accounts, and large amounts need additional proof. Carrying cash across the border is convenient but limited to USD 5,000 per trip, with amounts exceeding this requiring declaration.

Compliance Requirements

When remitting money from mainland China to Hong Kong, you must comply with relevant regulations in China and Hong Kong. For bank wire transfers, you need to fill in the recipient’s information and purpose description, and it’s recommended to handle the first remittance in person at a counter. Large remittances (e.g., exceeding USD 50,000) require proof of fund sources, such as contracts, invoices, or payslips. Electronic payment platforms require you to complete real-name authentication, with limits set based on verification levels. Cross-border platforms like Wise may periodically check fund sources to ensure compliance.

When carrying cash across the border, you must declare amounts exceeding USD 5,000. Otherwise, customs authorities may confiscate excess cash and may pursue legal action. When opening a bank account in Hong Kong, you also need to prepare identification and proof of fund sources to ensure transparent fund flows.

Tip: For each remittance, it’s best to keep transaction records and related proof documents. This can address inquiries from banks or platforms and protect your rights.

Risk Warnings

When choosing a remittance method, in addition to considering restrictions for remitting money from mainland China to Hong Kong, you should also be aware of potential risks. Illegal channels or money changers may have low fees but offer no security for funds, potentially involving money laundering or fraud. Carrying cash across the border carries higher risks, as lost or seized cash is difficult to recover. Electronic payments and cross-border platforms are convenient but require ensuring the platform is legally licensed and regularly checking account security.

Bank wire transfers are secure but have complex procedures and higher fees. You should choose the most suitable method based on your actual needs. Regardless of the method, always operate through legitimate channels to avoid violating restrictions for remitting money from mainland China to Hong Kong and ensure fund security.

Note: Violating amount limits or compliance requirements may lead to account freezes, fines, or impacts on personal credit. It’s recommended to regularly monitor policy changes and adjust remittance strategies promptly.

Pros and Cons Comparison

Image Source: pexels

Do you want to know which remittance method is most suitable for you? I’ve compiled a clear and concise comparison table to let you see the fees, speed, convenience, security, and restrictions of each mainstream method at a glance:

| Remittance Method | Fee (USD 1,000) | Speed | Convenience | Security | Restrictions and Notes |

|---|---|---|---|---|---|

| Bank Wire Transfer | Approx. USD 49 | 1-3 business days | Requires in-person or online handling | High | Limited to same-name accounts, daily limit USD 11,000, large amounts require proof of fund sources |

| Electronic Payment | USD 5~20 | Instant | Mobile app operation | Medium | Daily limit USD 1,000~2,800, requires real-name authentication, annual total limit |

| Cross-Border Platform | Approx. USD 5 | Within 1 hour | Online operation | High | Single transaction limit USD 10,000, requires identity verification, some platforms check fund sources |

| Cash Carried Across Border | USD 0 | Slow | Requires personal border crossing | Relatively Low | Maximum USD 5,000 per trip, excess requires declaration, high risk of loss |

| Mainland Bank Card Withdrawal | USD 3~10 | Instant | ATM withdrawal in Hong Kong | Medium | Daily limit USD 1,000~2,000, subject to issuing bank policies |

Fees

You are likely most concerned about fees. Bank wire transfers have the highest fees, approximately USD 49 for remitting USD 1,000. Electronic payments and cross-border platforms have lower fees, typically USD 5 to USD 20. Cross-border platforms like Wise have fees as low as USD 5, making them ideal for cost-saving.

Carrying cash across the border has no fees, but if you use an e-wallet (e.g., STICPAY) to withdraw to a bank, there will be approximately 5% international transfer fees and about USD 30 bank fees. Mainland bank card withdrawals cost approximately USD 3 to USD 10 per transaction, suitable for small, frequent withdrawals.

Tip: For small remittances, electronic payments or cross-border platforms are more cost-effective. For large remittances, bank wire transfers are secure but have significantly higher fees.

Speed

Are you in urgent need of funds? Speed is important. Electronic payments and mainland bank card withdrawals are essentially instant, and cross-border platforms usually complete within 1 hour. Bank wire transfers take 1 to 3 business days and may be slower during holidays. Carrying cash across the border is the slowest, requiring personal border crossing and a complex process.

- If you want instant funds, choose electronic payments or cross-border platforms.

- If you’re not in a hurry, bank wire transfers can be considered.

Convenience

Do you want a simple process? Electronic payments and cross-border platforms are the most convenient. You only need a mobile phone or computer to remit money anytime, anywhere. Mainland bank card withdrawals are also flexible, allowing you to withdraw at ATMs in Hong Kong anytime.

Bank wire transfers require visiting a bank counter or using online banking, with more steps involved. Carrying cash across the border is the most cumbersome, requiring personal border crossing and declarations.

- If you value convenience, electronic payments, cross-border platforms, and bank card withdrawals are the most suitable.

- If you don’t mind the hassle, bank wire transfers and cash carried across the border can also be considered.

Security

Do you want to ensure fund security? Bank wire transfers and cross-border platforms offer the highest security due to formal regulation and compliance checks. Electronic payments have medium security, requiring real-name authentication and secure passwords. Carrying cash across the border has the highest risk, as cash can be lost or seized. Mainland bank card withdrawals have moderate security, requiring attention to ATM fraud and card safety.

Note: You must operate through legitimate channels to avoid illegal money exchanges or money changers to ensure fund security and reduce risks from restrictions for remitting money from mainland China to Hong Kong.

Selection Recommendations

- If you want to remit large amounts (over USD 10,000), bank wire transfers or cross-border platforms are more suitable, but prepare proof of fund sources.

- For small, instant remittances, electronic payments or mainland bank card withdrawals are the most convenient.

- If you prioritize security, choose bank wire transfers or cross-border platforms.

- If you want to save on fees, cross-border platforms and electronic payments are the most cost-effective.

- To avoid impacts from restrictions for remitting money from mainland China to Hong Kong, consider remitting in batches and keeping all transaction records.

You can flexibly choose the most suitable remittance method based on your actual needs and circumstances. Remember to regularly monitor policy changes to ensure each remittance is compliant and secure.

To remit money to Hong Kong, choose a method based on the amount, speed, and security. You can compare different platforms, such as Safe Global Remit, which offers low fees, compliance, and security. You should operate through legitimate channels and regularly monitor policy changes to ensure fund security.

FAQ

What proof documents are needed for remitting to Hong Kong?

You usually need to prepare identification, proof of fund sources, and recipient information. Banks or platforms may sometimes require additional documents.

How long does it take to receive funds after remittance?

Electronic payments and cross-border platforms can deliver funds instantly. Bank wire transfers generally take 1 to 3 business days, while cash carried across the border depends on border crossing time.

Are there age restrictions for remittances?

You must be at least 18 years old to open a bank account or use most remittance platforms. Minors require parental assistance.

Navigating China-to-Hong Kong remittances in 2025 can be daunting due to strict regulations and high fees, frustrating users who need fast, secure transfers. BiyaPay offers a streamlined solution to these challenges. With a quick mobile app registration, you can start cross-border remittances without complex procedures—try it now at BiyaPay!

BiyaPay supports real-time conversions across multiple fiat and digital currencies with transparent rate queries, keeping costs clear. With remittance fees as low as 0.5% and coverage in over 190 countries, it outperforms traditional banks. Backed by international financial regulations, your funds are secure, letting you focus on efficient money management. Visit BiyaPay today to unlock a fast, compliant remittance experience!

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.