- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

USD Time Deposit Minimum Amounts, Eligibility Criteria, and Key Notes

Image Source: pexels

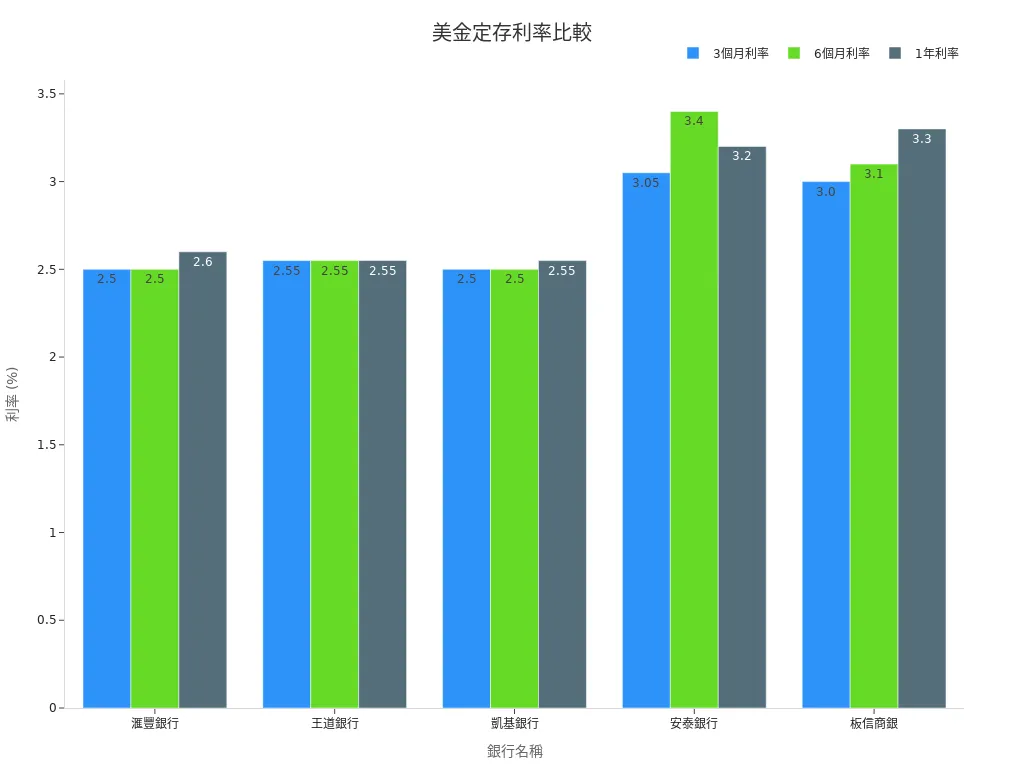

When you explore USD time deposit comparisons in Hong Kong banks, you will find significant differences in minimum deposit thresholds and interest rates. According to the latest statistics from June 2025, HSBC requires a minimum deposit of USD 30,000, while O-Bank requires only USD 300. In terms of interest rates, Ant Bank and Pan Asia Commercial Bank offer higher annual rates.

You can refer to the table and chart below to quickly understand the USD time deposit options offered by different banks.

| Bank Name | 3-Month Rate | 6-Month Rate | 1-Year Rate | Minimum Deposit Amount |

|---|---|---|---|---|

| HSBC | 2.50% | 2.50% | 2.60% | USD 30,000 |

| O-Bank | 2.55% | 2.55% | 2.55% | USD 300 |

| KGI Bank | 2.50% | 2.50% | 2.55% | USD 10,000 |

| Ant Bank | 3.05% | 3.40% | 3.20% | N/A |

| Pan Asia Commercial Bank | 3.00% | 3.10% | 3.30% | N/A |

Key Points

- The minimum deposit amounts for USD time deposits vary significantly across banks, ranging from a few hundred USD to tens of thousands, so you should choose based on your financial situation.

- USD time deposit interest rates vary with the deposit term and amount; longer terms generally offer higher rates, but note that some high rates apply only to new funds or specific customers.

- Applying for a USD time deposit requires meeting age requirements and preparing identification documents, with most banks requiring an existing current or savings account for fund management.

- You can choose to apply for a USD time deposit online or at a branch; online applications are convenient and fast, while branch applications offer face-to-face service, so choose the method that suits you.

- Before depositing, carefully review interest rates, early withdrawal penalties, exchange rate fluctuations, and fees, and set up renewal arrangements to ensure flexible fund use and maximum returns.

USD Time Deposit Comparison

Image Source: pexels

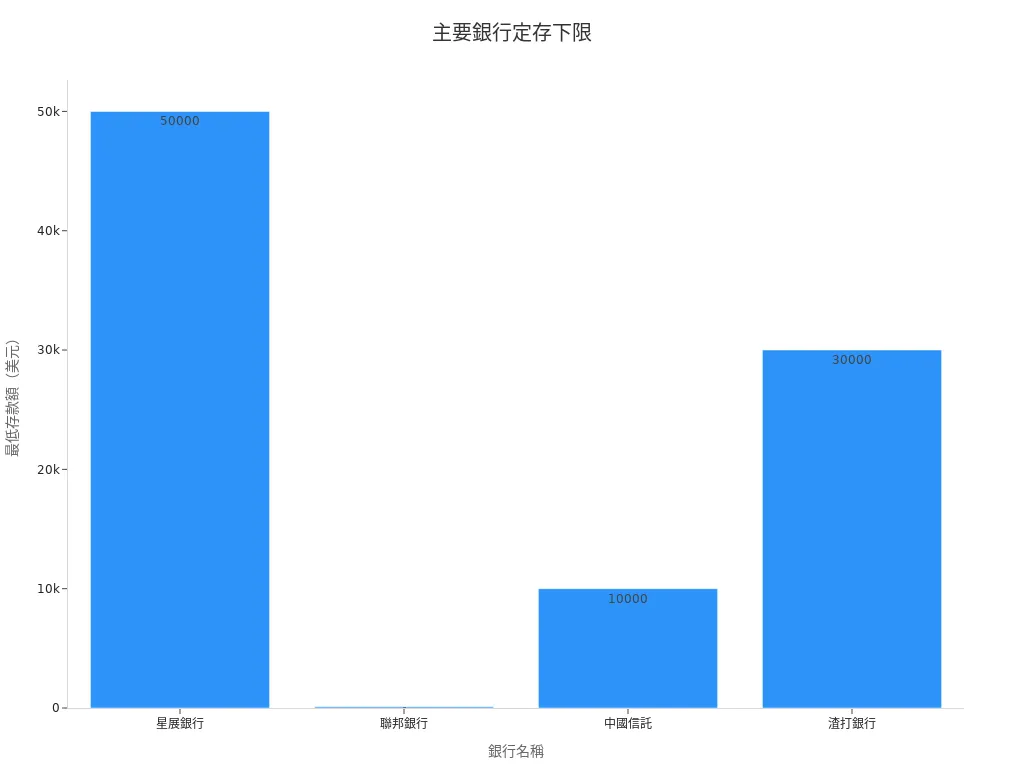

Minimum Deposit Amount

When choosing a USD time deposit, you should first understand the minimum deposit amount requirements of major Hong Kong banks. The thresholds for opening a USD time deposit vary significantly, with some banks requiring only a few hundred USD and others requiring tens of thousands. You can refer to the table below to quickly understand the minimum deposit amounts and related restrictions of major banks:

| Bank Name | Minimum Deposit Amount and Range | Other Restrictions |

|---|---|---|

| DBS Bank | USD 50,000 and above (for DBS Wealth Management clients) | Per-person limit ranges from USD 500,000 to USD 1,000,000 |

| Union Bank | USD 100 and above | Total project limit per person is USD 3,000 |

| CTBC Bank | USD 10,000 and above | Different rates for different amount ranges, with a maximum limit of USD 600 million |

| Standard Chartered Bank | USD 30,000 and above | Limited to new funds, for individual and Priority Banking corporate accounts |

You will find that Union Bank has the lowest threshold, requiring only USD 100 to open an account, making it very suitable for those with limited funds. DBS Bank and Standard Chartered Bank require higher minimum deposits, suitable for those with more substantial funds or wealth management needs. Some banks offer different rates or benefits based on the deposit amount. When conducting a USD time deposit comparison, you should choose a bank based on your financial situation and wealth management goals.

Tip: Some banks offer higher rates or additional benefits for high-net-worth clients but require higher minimum deposit amounts. When comparing USD time deposits, remember to pay attention to these details.

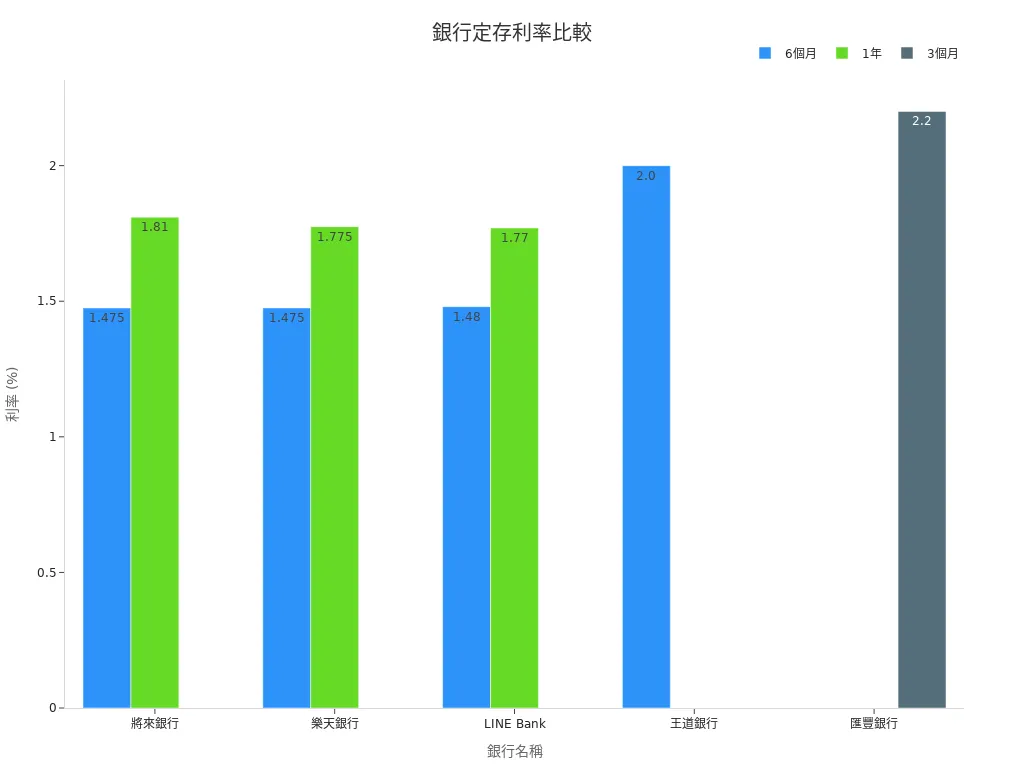

Deposit Term and Interest Rates

When choosing a USD time deposit, in addition to the minimum deposit amount, you should also compare the deposit term options and interest rates offered by different banks. Most Hong Kong banks offer USD time deposits with terms such as 3 months, 6 months, and 1 year. Interest rates vary based on the deposit term and amount.

You can refer to the table below to understand the deposit terms and corresponding interest rates of some banks:

| Bank Name | 3-Month Rate | 6-Month Rate | 1-Year Rate | Additional Notes |

|---|---|---|---|---|

| HSBC | 2.50% | 2.50% | 2.60% | Minimum deposit USD 30,000 |

| O-Bank | 2.55% | 2.55% | 2.55% | Minimum deposit USD 300 |

| KGI Bank | 2.50% | 2.50% | 2.55% | Minimum deposit USD 10,000 |

| Ant Bank | 3.05% | 3.40% | 3.20% | Some rates require higher deposit amounts |

| Pan Asia Commercial Bank | 3.00% | 3.10% | 3.30% | Some rates require higher deposit amounts |

You will find that longer deposit terms generally offer higher interest rates. However, some banks offer higher rates for specific deposit amounts or new funds. When conducting a USD time deposit comparison, you should choose the most suitable deposit term based on your liquidity needs and interest rate expectations.

Note: Some banks’ high interest rates apply only to new funds or specific customer categories. When comparing USD time deposits, make sure to carefully review the bank’s terms to avoid missing out on offers.

You can use the above information to flexibly choose the right bank and product based on your capital size, financial goals, and liquidity needs. USD time deposit comparisons should not only focus on interest rates but also consider minimum deposit amounts, deposit term options, and related restrictions to find the most suitable USD time deposit plan for you.

Eligibility Criteria

Age and Identification

To apply for a USD time deposit, you first need to meet the age requirements. Most Hong Kong banks stipulate that applicants must be at least 18 years old. Some banks accept applicants aged 16 and above, but they require a parent or guardian to accompany them. You should check the bank’s official website for the latest requirements before applying.

You also need to prepare identification documents. Generally, banks require the following documents:

- Hong Kong ID card or valid passport

- Proof of address (e.g., utility bill or bank statement from the last three months)

Tip: Some banks require in-person identity verification at a branch. You should call the bank in advance to confirm the required documents to avoid omissions.

Account Requirements

To open a USD time deposit, you usually need to have an existing current or savings account with the bank. This allows the bank to deposit the interest and principal of your USD time deposit into your account. You can choose to open both HKD and USD accounts at the same bank for easier future fund transfers.

Below are common account requirements:

| Bank Name | Existing Account Required | Acceptable Account Types |

|---|---|---|

| HSBC | Yes | HKD or USD current/savings account |

| Standard Chartered Bank | Yes | HKD or USD account |

| O-Bank | Yes | USD current account |

You should note that different banks have different requirements for account types. Some banks only accept USD accounts, while others accept HKD or multi-currency accounts. You should inquire with the bank before applying to ensure all account opening conditions are met.

Note: Some banks may charge account management fees or minimum balance fees. You should calculate related costs to avoid additional fees due to insufficient account balances.

Application Process

Image Source: pexels

Online Application

You can choose to apply for a USD time deposit online. Most Hong Kong banks offer online banking or mobile apps. You only need to log into your personal online banking account, select the “time deposit” service, then enter the deposit amount, choose the deposit term, and confirm the interest rate.

The entire process is simple and fast, usually completed in just a few minutes. You can check the deposit status anytime and set up automatic renewal or transfer instructions upon maturity.

Benefits of online applications include:

- Convenient and fast, no need to visit a branch

- 24-hour access to operations

- Instant access to the latest rates and offers

Tip: Some banks offer additional interest rate benefits for online new fund deposits. You can pay attention to the latest promotional information on the bank’s website.

Branch Application

If you value face-to-face service, you can visit a bank branch to apply for a USD time deposit. You only need to bring identification documents and relevant account information, inform the counter staff of your intention to apply, and they will assist you in completing the application form and explaining product details. Some banks verify information on the spot to ensure a smooth application process.

According to First Bank’s “mystery shopper survey” conducted by external consultants, banks regularly review branch service efficiency and environment, continuously optimizing processes. Hua Nan Bank, through its digital management system, controls customer waiting times to within five minutes and uses customer satisfaction surveys as a service quality standard.

When choosing a branch application, you can refer to these banks’ service commitments to select branches with shorter waiting times and better service.

Note: Some popular branches may have longer waiting times during peak hours. You can call in advance to inquire or book an appointment to save time.

Key Notes

Interest Rates and Penalties

When choosing a USD time deposit, you should carefully compare the interest rates and penalties of different banks. Each bank’s time deposit rates vary based on the deposit term and amount. Some banks offer higher rates for new funds or large deposits. You should note that high interest rates may not always be the most suitable, as some banks impose stricter early withdrawal penalties.

- Most banks deduct earned interest, or pay only partial or no interest, if you withdraw early.

- Some banks charge additional handling fees as penalties.

- In some cases, time deposit interest may be subject to taxation, so you should pay attention to relevant tax regulations.

Tip: You should carefully review the bank’s terms to understand all penalties for early withdrawal to avoid losing interest due to fund transfers.

Exchange Rates and Fees

When applying for a USD time deposit, you must consider exchange rate fluctuations and fees. Different banks have varying fee standards for foreign currency conversions and transfers. If you convert HKD to USD for a deposit or withdraw USD as HKD, the bank will calculate based on the exchange rate at the time and may charge handling fees.

- Banks adjust conversion prices based on market exchange rate fluctuations, which can affect your actual returns.

- Some banks charge fees for USD transfers or cash withdrawals.

- Some banks offer fee waivers for specific accounts or deposit amounts.

You can refer to the bank’s website for comparisons of time deposit rates and fees to comprehensively assess costs and risks. This information helps you understand the differences in exchange rates and fees across banks, aiding you in making informed choices.

Renewal Arrangements

When your USD time deposit matures, you need to decide on the renewal method. Most banks offer options such as automatic renewal, switching to a different term, or withdrawing the principal and interest. You should set this clearly when opening the account to avoid having funds automatically renewed to an unsuitable term or rate upon maturity.

| Renewal Method | Description |

|---|---|

| Automatic Renewal | Principal and interest automatically renew into the same product upon maturity |

| Switch to Another Term | You can choose a different deposit term for renewal |

| Withdraw Principal and Interest | Full amount transferred back to the current account upon maturity |

Note: Renewal arrangements and instruction deadlines may vary across banks. You should regularly check the deposit status and contact the bank before maturity to update renewal instructions to ensure flexible fund utilization.

When choosing a USD time deposit, you should focus on the minimum deposit amount, interest rates, deposit term, early withdrawal penalties, and exchange rate risks. You can conduct more USD time deposit comparisons and choose the right product based on your funds and risk tolerance.

It is recommended that you regularly check the latest information from Hong Kong banks to ensure you get the best rates and offers.

Tip: Comparing USD time deposit plans from different banks can help you maximize fund efficiency.

FAQ

Is there a minimum deposit amount for USD time deposits?

You need to note that different Hong Kong banks have different minimum deposit amounts. For example, HSBC requires at least USD 30,000, while O-Bank requires only USD 300. You should check the bank’s official website first.

Are there penalties for early withdrawal?

If you withdraw early, most banks will deduct earned interest or pay no interest at all. Some banks also charge additional handling fees. You should carefully review the contract terms.

How is interest for USD time deposits calculated?

Banks calculate interest based on the deposit term and amount you choose, using the annual interest rate. You can refer to the bank’s rate table or use an online calculator to estimate returns.

Can you change the deposit term upon renewal?

You can notify the bank before the deposit matures to choose a different deposit term or withdraw the principal and interest. Automatic renewal will proceed under the original terms.

Are there fees for converting to USD?

When converting HKD to USD, banks charge based on the exchange rate at the time. Some banks impose handling fees.

You should compare the exchange rates and fee standards of different banks.

In 2025, Hong Kong banks offer diverse USD fixed deposit options, but high fund management costs and exchange rate risks often deter investors. BiyaPay provides a secure, user-friendly solution to optimize your financial strategy. No need for additional overseas accounts—BiyaPay enables trading in both U.S. and Hong Kong stocks with a single account. Start now at BiyaPay!

BiyaPay supports real-time conversions across multiple fiat and digital currencies with transparent rate queries, ensuring cost clarity. With remittance fees as low as 0.5%, it minimizes expenses. Regulated by international financial authorities, BiyaPay offers a robust platform for secure USD deposit-related investments. Visit BiyaPay today to streamline your wealth management!

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.