- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Key Updates on Hong Kong to Taiwan Remittance Policies in 2025

Image Source: pexels

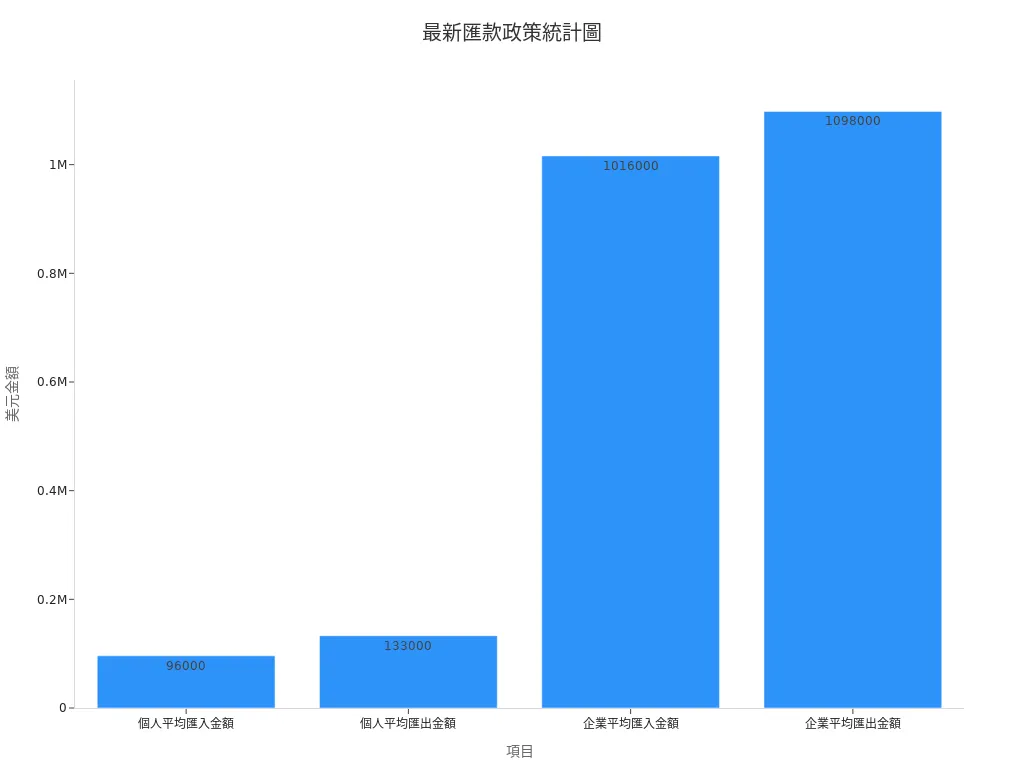

When you conduct remittances from Hong Kong to Taiwan in 2025, you must pay attention to new policy regulations. Hong Kong banks no longer accept electronic remittances in New Taiwan Dollars (TWD), and you can only use Hong Kong Dollars (HKD) or U.S. Dollars (USD). Single transactions exceeding 50,000 USD require declaration and preparation of identity proof and source of funds documents. The table below shows average individual and corporate inbound and outbound remittance amounts:

| Item | Individual Average Inbound Amount | Individual Average Outbound Amount | Corporate Average Inbound Amount | Corporate Average Outbound Amount |

|---|---|---|---|---|

| Amount (USD) | 96,000 | 133,000 | 1,016,000 | 1,098,000 |

You should pay special attention to TWD remittance restrictions and the latest declaration rules to avoid delays due to incomplete documentation.

Key Points

- Starting in 2025, Hong Kong banks have stopped electronic TWD remittances, allowing only HKD or USD for remittances to Taiwan.

- Single remittances exceeding 50,000 USD require declaration of the source of funds, along with identity proof and related documents.

- The daily remittance limit is approximately 62,500 USD, with lower limits for non-registered accounts; confirm bank regulations in advance.

- Before remitting, compare fees and exchange rates across banks and platforms to choose the most cost-effective option.

- Preparing complete remittance details and supporting documents can expedite reviews and prevent delays or rejections.

Policy Updates

TWD Remittance Restrictions

Starting in March 2025, you can no longer use TWD for electronic remittances. Hong Kong banks have completely ceased TWD electronic remittance services. This policy change is primarily due to Taiwan’s financial regulators strengthening foreign exchange controls. If you want to remit from Hong Kong to Taiwan, you must choose HKD or USD as the remittance currency.

You may wonder why this change was made. The Taiwan government aims to reduce TWD circulation internationally and enhance oversight of fund flows. This helps prevent money laundering and illicit fund movements. When remitting from Hong Kong to Taiwan, you can no longer directly select TWD as before, which will affect your remittance process and costs.

Tip: When choosing a remittance currency, you should first check the daily USD-to-TWD and HKD-to-TWD exchange rates. Different exchange rates will affect the actual amount received.

HKD and USD Remittances

Now, you can only use HKD or USD for remittances from Hong Kong to Taiwan. Most Hong Kong banks support international remittances in these two currencies. When you remit, the bank will convert HKD or USD to TWD based on the daily exchange rate, then deposit it into the recipient’s account in Taiwan.

You need to note that USD remittances are typically faster than HKD remittances because USD is a major international currency. Some Hong Kong banks may charge additional fees for HKD remittances or require processing through an intermediary bank, which could increase time and costs. When choosing a remittance currency, you should compare fees and exchange rates across different banks.

- For example: If you want to remit 10,000 USD from Hong Kong to Taiwan, the bank will convert it to TWD based on the daily USD-to-TWD exchange rate. If you choose HKD, the bank will first convert HKD to USD, then to TWD, potentially incurring two exchange rate losses.

You should prepare recipient details and identity proof documents in advance to ensure a smooth remittance process. After the policy adjustment, you should pay special attention to bank announcements, as operational details may vary across banks.

Hong Kong to Taiwan Remittance Amount Regulations

Image Source: pexels

Daily and Annual Limits

When conducting remittances from Hong Kong to Taiwan, you must understand daily and annual amount limits. Different Hong Kong banks set varying remittance limits based on account types and verification methods. Below are common limit standards:

- If you use a registered account for ATM transfers, the single and daily cumulative limit is TWD 2,000,000. Based on the 2024 average exchange rate of 1 USD = 32 TWD, this is approximately 62,500 USD.

- For non-registered accounts (including self and interbank transfers), the single and daily limit is TWD 30,000, approximately 937 USD.

- Different account verification methods or devices result in varying transfer functions and amount limits. You need to check the latest announcements from your Hong Kong bank.

- Currently, some banks do not specify clear annual remittance limits, but for foreign migrant workers, the Financial Supervisory Commission has raised the annual limit from TWD 400,000 to TWD 500,000, approximately 15,625 USD. This adjustment reflects increased remittance demand, and banks may adjust limits based on actual needs.

Note: Before each remittance, you should confirm the latest regulations of your Hong Kong bank to avoid rejections or delays due to exceeding limits.

According to 2024 statistics, remittance demand from foreign migrant workers has significantly increased. The total remittance amount reached TWD 60.7 billion, up 41% year-on-year. This indicates that adjustments to remittance amount limits better accommodate market demand.

Declaration Requirements

When remitting, you must also pay attention to declaration requirements. When a single remittance exceeds TWD 500,000 (approximately 15,625 USD), you must declare the source of funds to the bank. This is a regulation set by Taiwan’s financial authorities to prevent money laundering and illicit fund flows.

- If you make multiple remittances within a year with a cumulative amount reaching TWD 500,000, you also need to declare. Banks will require you to provide identity proof and source of funds documents.

- If you fail to declare in time, the bank may suspend or delay your remittance process.

- When filling out declaration details, you should ensure all information is accurate to avoid delays due to errors.

Reminder: You can prepare relevant supporting documents in advance, such as payslips, contracts, or transaction proofs, to expedite the review process.

When choosing a method for remittances from Hong Kong to Taiwan, you should select appropriate amounts and frequencies based on your actual needs. As long as you comply with daily and annual limits and meet the bank’s declaration requirements, you can smoothly complete cross-border remittances.

Review and Required Documents

Identity and Source of Funds Proof

When remitting from Hong Kong to Taiwan, banks will require you to provide clear identity proof and source of funds. You typically need to prepare the following documents:

- Valid ID or passport

- Proof of funds source, such as payslips, contracts, or investment income proof

- Explanation of remittance purpose, such as tuition, living expenses, property purchase, or investment

Banks will review your documents based on the remittance amount. If a single remittance exceeds 50,000 USD (approximately TWD 1,600,000 at 1 USD = 32 TWD), banks will specifically require a detailed explanation of the funds’ source. If you cannot provide complete documentation, the bank may delay or reject your remittance application. You should note that special accounts, such as those for unregistered organizations or anonymous accounts, are generally not accepted for receiving funds.

Tip: You can prepare all supporting documents in advance to speed up the review process and reduce wait times.

Remittance Details

When filling out remittance details, you will find that requirements across Hong Kong banks are generally similar, but there are slight differences in specifics. Below are common remittance detail requirements:

- Remittance application forms vary slightly by bank; if unsure, you can consult bank staff.

- For example, when using Firstrade, the remarks field must include your English name and account number for the broker to identify.

- For large remittances, banks will require you to fill out an anti-money laundering declaration form and inquire about the purpose of the funds.

- Some banks require on-site paper form submission, while others have staff assist with filling, the latter usually being faster.

- The bank branch size and whether you are a VIP client will affect remittance processing speed.

When preparing remittance details, you should carefully verify each item to ensure accuracy. This can prevent delays due to incorrect information. If you have questions, it’s recommended to consult bank staff directly to ensure a smooth remittance process.

Hong Kong to Taiwan Remittance Process

Image Source: pexels

Bank and Platform Selection

When choosing a method for remitting from Hong Kong to Taiwan, you can consider traditional banks or third-party payment platforms. Different options have their pros and cons, and the table below helps you compare quickly:

| Item | Bank Payment | Third-Party Payment |

|---|---|---|

| Application Conditions | Strict (requires company registration, years of operation, financial reports, etc.) | More lenient, quick approval |

| Integration | High technical barriers, complex process | Fast and convenient, simple technical integration |

| Fees | Lower (advantageous for large transaction volumes) | Slightly higher than banks |

| Fund Disbursement Time | Faster | Funds processed through the platform before disbursement |

| Additional Features | Limited or require separate application | Integrated payment, logistics, e-invoicing, etc. |

| Suitable For | Large brands or distributors (monthly transaction volume over tens of millions) | SMEs, new e-commerce, individual sellers |

| Main Advantages | Lowest fees for large transactions | Easy application, fast integration, diverse features, time-saving |

| Main Disadvantages | High barriers, complex and costly integration, less flexibility | Slightly higher fees, page redirects may affect experience |

If you are a large enterprise with high transaction volumes, choosing bank payments can reduce fees. If you are an SME or individual seller, third-party platforms like PayPal, Airwallex, or Stripe are more convenient, with easy applications, fast integration, and diverse features.

Operational Steps

The steps for remitting from Hong Kong to Taiwan are straightforward:

- Choose a suitable bank or third-party platform, open an account, and complete verification.

- Prepare recipient details, including bank account number, name, and contact information.

- Fill out the remittance application form, selecting HKD or USD as the remittance currency.

- Upload or submit identity proof and source of funds documents.

- Confirm exchange rates and fees, then complete the payment instructions.

You should note that remittance times vary across banks and platforms. Banks typically complete transfers within 1-3 business days, while third-party platforms may require internal processing, taking slightly longer. For fees, banks are more advantageous for large transactions, while third-party platforms suit small or frequent transactions. Exchange rates also affect the actual amount received, so check the daily rate before remitting. Some banks process through intermediary banks, which may incur additional fees or delays.

Tip: Before remitting, compare fees, exchange rates, and disbursement times across banks and platforms to choose the most suitable option, ensuring secure and efficient fund transfers.

Precautions

Fees and Exchange Rates

When remitting from Hong Kong to Taiwan, you must pay close attention to fees and exchange rate changes. Fee structures vary across banks and platforms, and exchange rate fluctuations directly affect the actual amount received. Based on past statistics, common risks in the remittance process include:

- When remitting in non-base currencies (e.g., HKD or USD), you bear the losses from exchange rate fluctuations.

- Banks’ buy-sell spreads during currency conversion reduce the actual amount received.

- Remittance fee structures vary, with some banks charging different fees based on amount, currency, or method.

- Even hedged transactions cannot fully eliminate exchange rate fluctuation risks.

You can refer to the table below for common fee and exchange rate loss data:

| Item | Value |

|---|---|

| Interactive Brokers Fee Rate | Approx. 0.0007% |

| Single Transaction Cost | Approx. 2.18 USD |

| Contract Value | Approx. 287,590 USD |

| Fee as Percentage of Contract Value | Approx. 0.0007% |

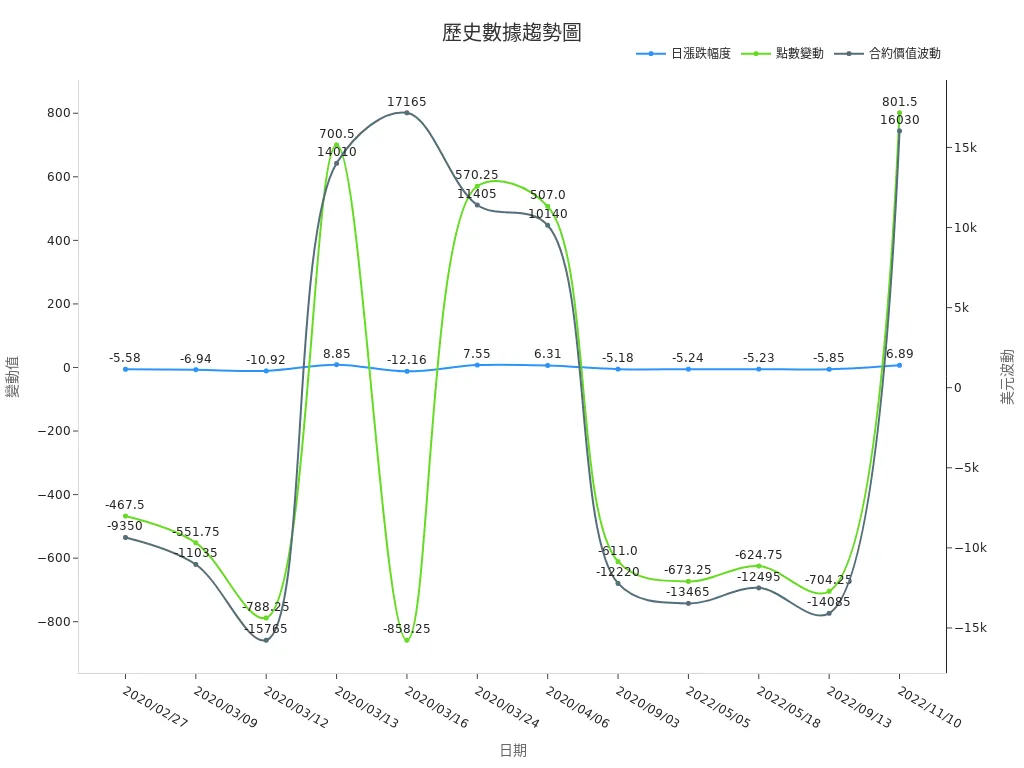

Exchange rate fluctuations can be significant, with daily swings exceeding 5% or even 12%. You can see the contract value fluctuation trends over recent years in the chart below:

Tip: Before remitting, compare bank fees and exchange rates and assess recent exchange rate trends to minimize unnecessary losses.

Common Issues

When remitting, you often encounter the following issues:

- Remittance Delays: Incomplete documentation or exceeding limits can cause delays. You should prepare identity proof and source of funds documents in advance.

- Non-Transparent Fees: Fee structures vary across banks and platforms, so carefully review official announcements to avoid unexpected charges.

- Exchange Rate Losses: Large exchange rate fluctuations may result in receiving less than expected. You can choose to remit when rates are stable.

- Recipient Account Issues: Special accounts (e.g., unregistered organizations) may not be eligible to receive funds. You should confirm the recipient account type meets bank requirements.

It’s recommended to check the latest bank policy announcements and confirm recipient account details before each remittance to significantly reduce risks and ensure funds arrive safely in Taiwan.

When conducting remittances from Hong Kong to Taiwan in 2025, you must note TWD remittance restrictions. Pay attention to daily and annual amount limits and prepare identity proof and source of funds documents. Closely monitor Hong Kong bank announcements and choose the most suitable remittance method to ensure funds reach Taiwan smoothly.

Reminder: If you have questions, proactively consult the bank for the latest policies.

FAQ

How long does it take to remit from Hong Kong to Taiwan?

You can generally complete a remittance within 1 to 3 business days. The choice of bank or third-party platform affects the time. Holidays or reviews may cause delays.

Which currencies can be used for remittances?

You can only choose HKD or USD. Hong Kong banks no longer accept TWD electronic remittances. You should check the daily exchange rate to calculate the actual amount received.

Are there limits on remittance amounts?

Your daily maximum remittance is approximately 62,500 USD (at 1 USD = 32 TWD). Single or cumulative amounts exceeding 50,000 USD require a source of funds declaration.

What documents are needed for remittances?

You need to provide identity proof, source of funds documents, and recipient details. For large remittances, banks require an anti-money laundering declaration.

What to do if there’s an issue with a remittance?

You should first contact the bank’s customer service. Check bank announcements or visit a branch. Preparing all supporting documents helps expedite resolution.

In 2025, new restrictions on New Taiwan Dollar remittances and stricter declaration requirements complicate Hong Kong-to-Taiwan transfers. BiyaPay offers a seamless solution to navigate these changes and minimize costs. No need for additional overseas accounts—BiyaPay enables HKD or USD remittances and trading in U.S. and Hong Kong stocks with a single account, plus a wealth management product with up to 5.48% annualized return, accessible anytime with flexible withdrawals. Start now at BiyaPay!

BiyaPay supports real-time conversions across multiple fiat and digital currencies with transparent rate queries, ensuring cost clarity. With remittance fees as low as 0.5%, it reduces expenses. Regulated by international financial authorities, BiyaPay ensures secure, compliant transfers despite exchange rate volatility and policy constraints. Visit BiyaPay today to streamline your cross-border finances!

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.