- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

[2025 Latest] USD Fixed Deposit Rate Comparison and Smart Financial Tips

Image Source: unsplash

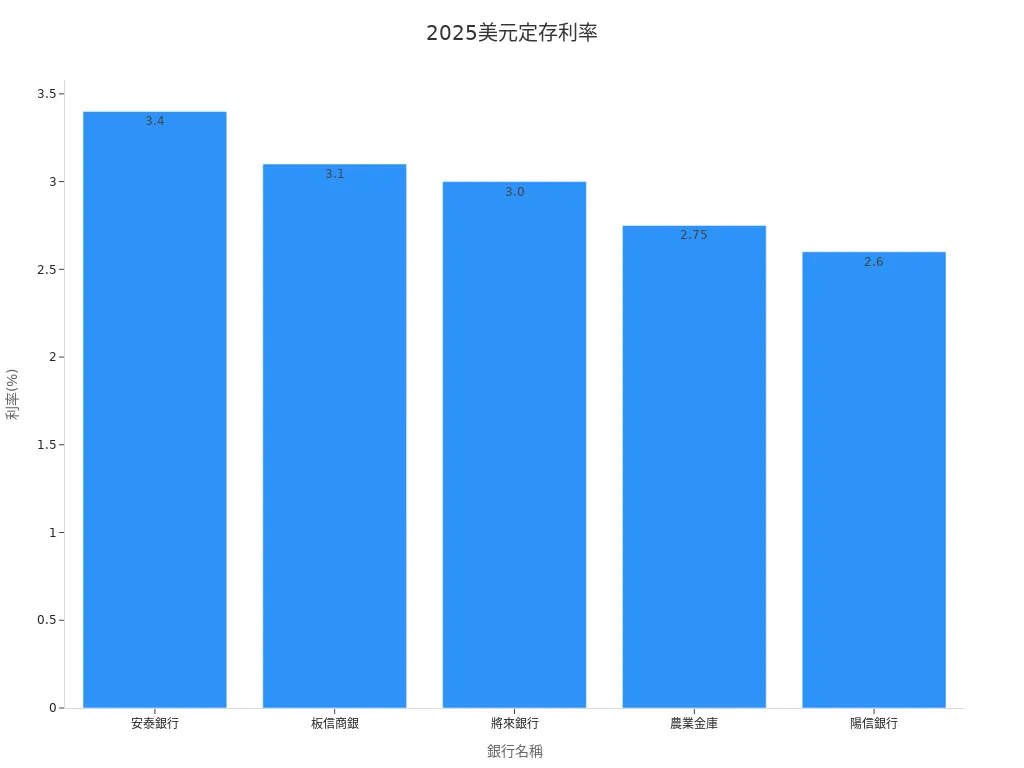

Do you want to know the 2025 USD fixed deposit rate comparison? I’ve compiled the latest data for you. Antai Bank offers 3.40% (6 months), making it the highest rate among regular banks. If you have new funds, some banks offer even higher limited-time promotional rates, such as HSBC’s up to 6.6% for high-net-worth clients. You can refer to the table below:

| Bank Name | 6-Month USD Fixed Deposit Rate (%) | Remarks |

|---|---|---|

| Antai Bank | 3.40 | Highest rate among regular banks |

| Banchin Commercial Bank | 3.10 | Among the top ranks |

| Future Bank | 3.00 | Among the top ranks |

| Agricultural Finance | 2.75 | Lower among regular banks |

| Yangxin Bank | 2.60 | Lower among regular banks |

USD fixed deposit rates are generally higher, and with the HKD pegged to the USD, exchange rate fluctuation risks are minimized. If you’re seeking stable returns, this product is very suitable for you.

Key Points

- In 2025, USD fixed deposit rates vary significantly, with virtual banks offering up to 10% for new clients’ savings accounts, often with caps and new fund requirements.

- When choosing USD fixed deposits, consider deposit terms, minimum deposit amounts, and eligibility for new fund promotions; flexibly combining short- and long-term deposits can enhance returns and liquidity.

- A laddering strategy can increase fund flexibility, splitting large sums into multiple deposit certificates to avoid interest losses from early termination.

- Exchange rate fluctuations and fees can affect actual returns; those with USD income or expenses should prioritize USD fixed deposits to reduce exchange costs.

- For smart financial management, watch for early termination penalties and hidden fees, diversify funds across banks and terms, and regularly review your portfolio.

Rate Comparison

Image Source: pexels

USD Fixed Deposit Rate Comparison

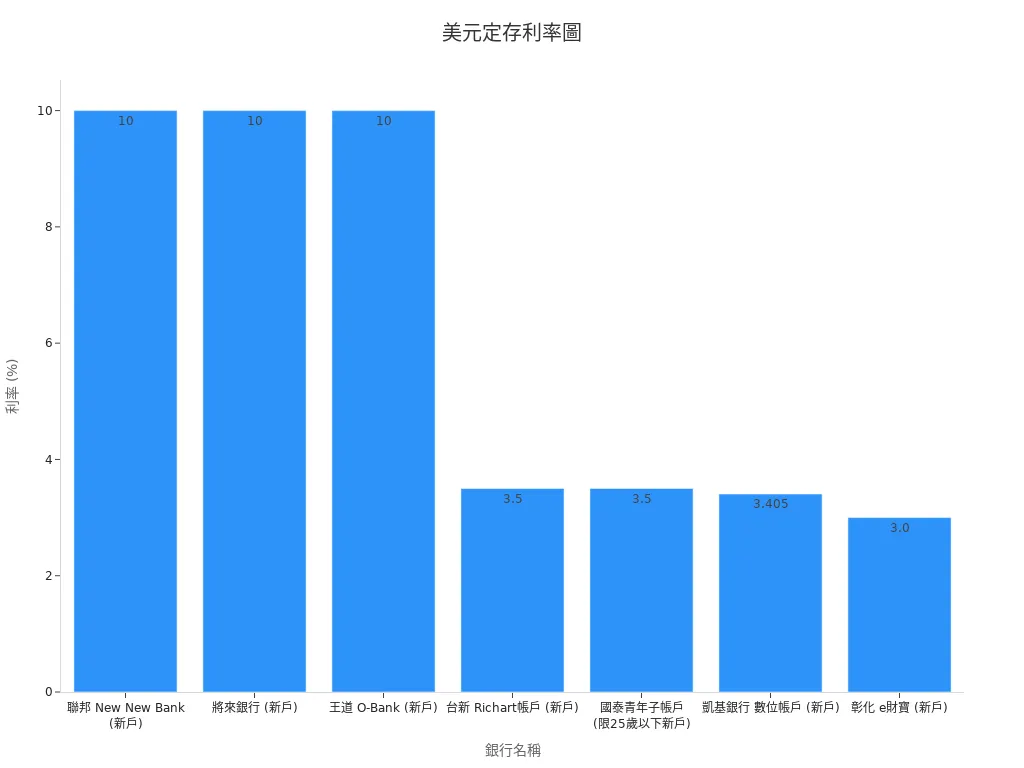

Do you want to know which bank offers the highest USD fixed deposit rate comparison in 2025? I’ve prepared a latest comparison table to make it clear at a glance. You’ll find that virtual banks’ new client savings rates are very attractive, reaching up to 10%. However, these high rates usually have amount caps and new fund requirements. You can refer to the table below to quickly grasp the USD fixed deposit rate comparison of major banks:

| Bank Name | Rate | Rate Cap | Minimum New Fund Amount | Remarks |

|---|---|---|---|---|

| Federal New New Bank (New Clients) | 10% | 150,000 USD | 100 USD | Highest savings rate, new clients only |

| Future Bank (New Clients) | 10% | 50,000 USD | 1 USD | Highest savings rate, new clients only |

| O-Bank (New Clients) | 10% | 50,000 USD | 1 USD | Highest savings rate, new clients only |

| Fubon Digital Account | 2.0%-5.0% | 100,000 USD | 5,000 USD | Requires completing specific tasks |

| Taishin Richart Account (New Clients) | 3.5% | 100,000 USD | 1 USD | New fund requirement |

| Cathay Youth Sub-Account (New Clients Under 25) | 3.5% | 100,000 USD | 5,000 USD | New fund requirement |

| KGI Bank Digital Account (New Clients) | 3.405% | 50,000 USD | 10,000 USD | New fund requirement |

| Changhua e-Caibao (New Clients) | 3.0% | 100,000 USD | 10,000 USD | New fund requirement |

Tip: Pay special attention to the “Minimum New Fund Amount” column. Some banks require new funds to qualify for high rates. New clients often receive additional benefits.

You can see from the chart that the USD fixed deposit rate comparison varies greatly among banks. Virtual banks’ new client promotional rates are significantly higher than traditional banks. However, these high rates typically have amount caps, with rates dropping beyond the limit.

Recommended Banks

If you want to choose USD fixed deposits wisely, first select the most suitable bank based on your fund size and deposit needs. Below are a few recommended banks worth noting, along with their USD fixed deposit rate comparison:

- Federal New New Bank, Future Bank, O-Bank: These three virtual banks offer new client savings rates up to 10%, with caps (50,000 to 150,000 USD), ideal for those with smaller funds seeking short-term high interest.

- Fubon Digital Account, Taishin Richart Account, Cathay Youth Sub-Account: These banks offer rates from 3.5% to 5%, some requiring specific tasks or new funds, suitable for those wanting stable returns with fewer restrictions.

- KGI Bank, Changhua Bank: These banks’ digital accounts offer rates around 3% to 3.4%, with new clients potentially enjoying higher rates, ideal for long-term USD asset allocation.

Note: When choosing a bank, besides the USD fixed deposit rate comparison, consider minimum deposit amounts, term options, and promotional terms. Some banks limit benefits to new clients or new funds, and longer terms don’t always mean higher rates; flexibility is key.

If you want to apply for high-rate fixed deposits, check the bank’s latest promotions and terms first. Some banks periodically offer limited-time high-interest activities, such as:

| Item | Term | Promotional Rate (Annual) | Minimum Amount | New Fund Requirements & Conditions |

|---|---|---|---|---|

| USD High-Interest Fixed Deposit | 3 Months | Up to 5.3% (New Client Bonus) | 5,000 USD | Limited time and quantity, apply via customer service or branch |

| USD High-Interest Fixed Deposit | 6 Months | Up to 4.2% | 5,000 USD | Limited time and quantity, apply via mobile banking app |

| USD High-Interest Fixed Deposit | 12 Months | Approx. 4.2% | 5,000 USD | New client bonus, suitable for long-term fund allocation |

You can flexibly choose terms and banks based on your liquidity needs. The USD fixed deposit rate comparison isn’t just about numbers; check if you qualify for promotions. Compare multiple banks, leverage new client or new fund benefits, and boost your interest returns.

Basic Concepts

What is a USD Fixed Deposit

You may have heard of USD fixed deposits but might not fully understand how they work. In fact, a USD fixed deposit involves depositing USD into a bank for a fixed term (e.g., 3 months, 6 months, or 12 months), and the bank offers a fixed interest rate based on the term. At maturity, you can withdraw the principal and interest. This method is ideal for those seeking stable returns without taking significant risks.

Tip: If you have idle USD funds, consider USD fixed deposits. Use the USD fixed deposit rate comparison to choose the best bank and term to earn more interest.

Who are USD fixed deposits suitable for? If you have USD income, frequently need USD, or want to diversify asset risks, this product is a good fit. You don’t need to worry about market fluctuations, as the rate remains fixed during the term.

USD Fixed Deposit vs. HKD Fixed Deposit

You might wonder, what’s the difference between USD fixed deposits and HKD fixed deposits? The most obvious differences are the interest rates and exchange rate risks. Generally, USD fixed deposit rates are higher than HKD fixed deposits. If you’re seeking higher returns, USD fixed deposits are a better choice.

However, USD fixed deposits involve exchange rate risks. If you need to convert USD to HKD later, exchange rate changes may affect your actual returns. But don’t worry too much, as the HKD is pegged to the USD, keeping exchange rate fluctuations relatively small. For Hong Kong residents, the exchange rate risk of USD fixed deposits is much lower than other foreign currencies.

Note: Before choosing a USD fixed deposit, consider your fund usage and whether you’ll need HKD in the future to minimize unnecessary exchange losses.

Rate Factors

Market Trends

Have you noticed that USD fixed deposit rates often fluctuate with US economic data and rate hike cycles? US inflation data and employment conditions directly influence the Federal Reserve’s rate hike pace, affecting the USD fixed deposit rates you see at Hong Kong banks. For example:

- In January this year, the US core CPI annual rate was 5.6%, slightly above expectations but lower than last year, indicating easing inflation.

- The US 2-year Treasury yield rose from 4.43% to 4.64%, reflecting market expectations of continued Fed rate hikes.

- August non-farm payrolls added 187,000 jobs, with unemployment rising to 3.8%, showing a robust labor market.

When markets expect Fed rate hikes, banks raise USD fixed deposit rates to attract your funds. Stay informed about US economic news to gauge rate trends and choose the right timing to enter.

Bank Promotions

Want to earn higher interest? Pay attention to promotional activities from Hong Kong and virtual banks. Many banks offer limited-time high-rate promotions for new clients, new funds, or online account openings. For example:

- Some virtual banks offer new client savings rates up to 10%, typically with amount caps.

- Traditional banks periodically offer rate boosts for new fund fixed deposits or extra rates for mobile banking applications.

Tip: Compare multiple banks’ promotions to flexibly allocate funds and maximize returns.

Deposit Requirements

Different banks have varying requirements for USD fixed deposits. Pay special attention to:

- Minimum deposit amounts: Some banks require at least 5,000 USD for high rates.

- Deposit terms: Rates for 3, 6, or 12 months vary, and short- and long-term rates may not always align.

- New fund requirements: Some promotions apply only to new funds, not existing funds.

When choosing, select a plan based on your liquidity and financial goals to fully leverage USD fixed deposit benefits.

Financial Tips

Image Source: pexels

Deposit Terms

When choosing a USD fixed deposit, the deposit term is crucial. Short-term deposits (e.g., 3 or 6 months) allow quicker access to funds, ideal for those needing cash flexibility. Long-term deposits (e.g., 12 months or more) often offer higher rates but lock funds for longer. If you expect to need the funds soon, opt for short-term deposits. You can also split funds, allocating some to short-term and some to long-term deposits to balance returns and liquidity.

Tip: Some banks have minimal rate differences between short- and long-term deposits; compare rate tables to choose the best term.

Laddering Strategy

Have a large USD fund and want more flexibility? Consider the “laddering strategy.” This involves splitting a large sum into multiple smaller deposit certificates with staggered maturity dates. For example, with 100,000 USD, you can create five 20,000 USD or ten 10,000 USD certificates. What’s the benefit? If you urgently need funds, you only need to terminate some certificates early, while others continue earning interest. You avoid losing high interest on the entire deposit for small cash needs. While no specific statistics support this, many savvy investors use this strategy to reduce interest losses and enhance fund flexibility.

The laddering strategy is ideal for those with larger funds seeking both returns and flexibility; give it a try.

Exchange Rates and Fees

When doing USD fixed deposits, exchange rates and fees affect actual returns. When depositing USD, banks may charge exchange fees. Converting USD to HKD later incurs spreads and fees, which can offset some interest gains. Pay attention to banks’ exchange rate quotes and fee standards. Some banks offer lower fees for online exchanges. Compare multiple banks to choose the most cost-effective exchange plan.

Tip: If you have USD income or assets, use USD directly for fixed deposits to minimize exchange costs.

Bank Promotions

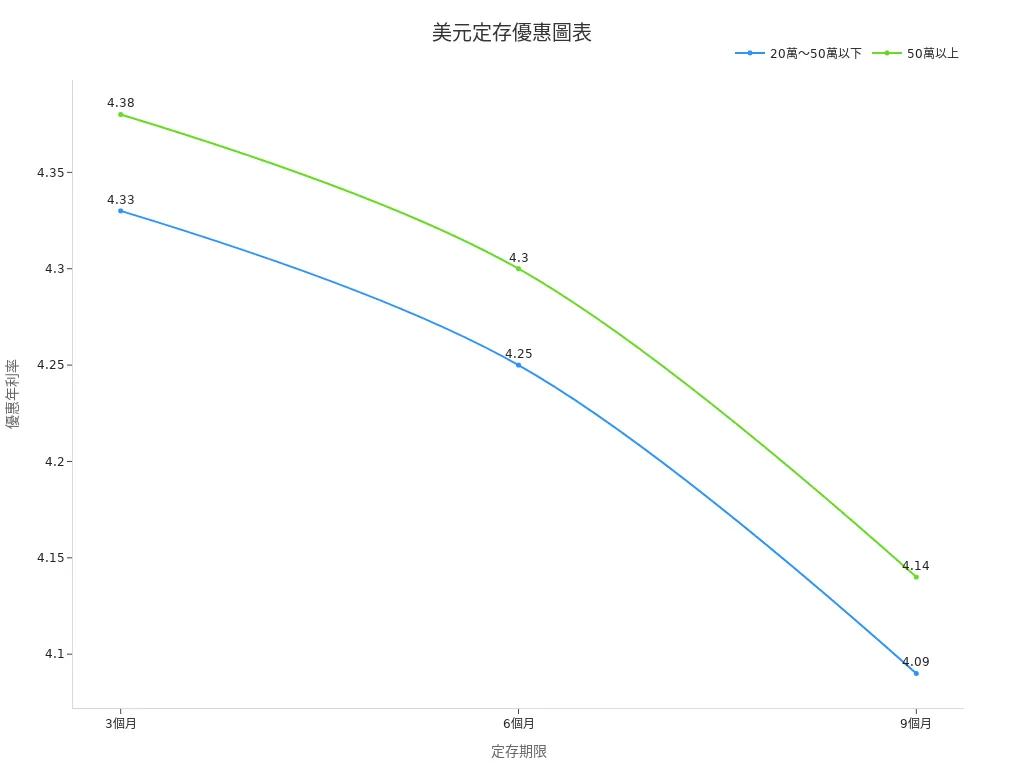

Want higher interest? Make good use of bank deposit promotions. Many Hong Kong banks offer limited-time high-rate activities for new funds, new clients, or online account openings. Different amounts and terms have varying promotional rates. Refer to the table below for promotional annual rates by amount and term:

| Deposit Amount Range | Term | Promotional Annual Rate Range |

|---|---|---|

| 200,000 USD to <500,000 USD | 3 Months | 4.33% |

| 200,000 USD to <500,000 USD | 6 Months | 4.25% |

| 200,000 USD to <500,000 USD | 9 Months | 4.09% |

| 500,000 USD and above | 3 Months | 4.38% |

| 500,000 USD and above | 6 Months | 4.30% |

| 500,000 USD and above | 9 Months | 4.14% |

You’ll notice that larger deposits typically yield higher rates. Some banks offer extra rate boosts for new funds. For example, Huanan Bank’s digital channel program offers new funds 1-month at 4.00%, 3-month at 4.10%, 6-month at 3.95%, and 1-year at 3.35%. Existing clients get 3-month at 3.90%, 6-month at 3.70%, and 1-year at 3.20%. The promotion runs until May 15, 2025.

You can also compare fixed deposit rates from different banks:

| Bank Name | 6-Month Rate | 12-Month Rate |

|---|---|---|

| Cathay United | Approx. 3.70% | Approx. 3.95% |

| Fubon Bank | Approx. 3.55% | Approx. 3.85% |

| CTBC Bank | Approx. 3.55% | Approx. 3.85% |

Note: Most promotions require new funds and have minimum amount thresholds. Promotional periods are usually short, and terms under 3 months yield less interest, so they’re not recommended. Early termination forfeits promotional rates, with interest calculated at 80% of the standard posted rate. Watch for exchange costs and fund transfer fees, which may offset some interest gains.

Risk Diversification

When doing USD fixed deposits, diversifying risks is crucial. Split funds across different banks to mitigate risks if one bank faces issues, ensuring not all funds are affected. Diversify terms, with some short-term and some long-term, to adapt to market rate changes flexibly. Use online banking for special rates and easier fund management.

Tip: Regularly review your USD fixed deposit portfolio, adjusting allocations based on market changes and personal needs for truly smart financial management.

Precautions

Penalty Clauses

When planning USD fixed deposits, the most overlooked aspect is early withdrawal penalty clauses. Most Hong Kong banks deduct earned interest if you withdraw before maturity, sometimes offering only minimal savings rates. For example, you might earn 4% annually, but early termination could yield just 0.1% savings interest—a significant gap.

Tip: Assess your liquidity needs in advance to avoid early termination and loss of high-interest returns.

Hidden Fees

Think fixed deposits are just about rates? Many banks charge hidden fees, such as account opening fees, management fees, or early termination fees. Some banks also charge above-market exchange rate spreads when converting USD, affecting your actual returns.

Common hidden fees include:

- Exchange fees (e.g., 0.5% per exchange)

- Early termination fees

- Account management fees (some banks charge a few USD monthly)

It’s recommended to carefully read the bank’s fee schedule and terms before opening an account, asking about all potential charges.

Exchange Rate Risks

Although the HKD is pegged to the USD, there are still minor exchange rate fluctuations. If you need to convert USD to HKD later, rate changes may reduce your actual returns. For example, depositing at 1 USD = 7.8 HKD but withdrawing at 7.75 HKD results in a slight loss.

Tip: If you have USD income or future USD expenses, USD fixed deposits are more suitable. Otherwise, consider exchange rate fluctuations to avoid interest losses from poor timing.

Before choosing a USD fixed deposit, assess your liquidity needs and risk tolerance. Don’t focus only on high rates, ignoring penalties, fees, and exchange risks, to achieve truly smart financial management.

To manage finances wisely, first understand the USD fixed deposit rates and promotions of major Hong Kong banks. Choose based on your financial goals, risk tolerance, and liquidity needs. Use online financial tools and regularly review your deposit portfolio to seize market opportunities and boost interest returns.

FAQ

Is there a minimum deposit requirement for USD fixed deposits?

Most Hong Kong banks set a minimum deposit amount, typically 5,000 USD or more. Check the bank’s latest requirements before opening an account.

Are there penalties for early withdrawal?

If you withdraw early, banks generally deduct earned interest or offer only savings rates. Plan your fund usage in advance.

Are USD fixed deposit interest earnings taxable?

In Hong Kong, bank deposit interest is currently tax-exempt. You can collect interest without worrying about tax issues.

Can I convert HKD to USD for a fixed deposit?

You can convert HKD to USD for a fixed deposit, but banks charge exchange spreads and fees. Compare rates and fees across banks.

Can USD fixed deposits auto-renew upon maturity?

Most banks offer auto-renewal services. You can choose to renew or withdraw principal and interest; notify the bank of your decision before maturity.

In 2025, USD fixed deposit rates are highly competitive, with traditional banks like Antai Bank providing a stable 3.40%, though exchange rate fluctuations and hidden fees require careful navigation. BiyaPay offers a seamless solution for savvy wealth management. No need for additional overseas accounts—a single BiyaPay account enables USD fixed deposits, Hong Kong and U.S. stock trading, and a wealth management product with up to 5.48% annualized return, accessible anytime with flexible withdrawals. Start now at BiyaPay!

BiyaPay supports real-time conversions across multiple fiat and digital currencies with transparent rate queries, minimizing exchange costs. With remittance fees as low as 0.5%, it ensures cost efficiency. Regulated by international financial authorities, BiyaPay provides a secure platform to capitalize on high-yield USD deposits while flexibly managing your funds. Visit BiyaPay today to maximize your wealth!

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.