- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

2025 Hong Kong Standard Chartered and Major Bank Codes Quick Reference

Image Source: pexels

When you make transfers or remittances, the bank code helps you process each transaction accurately. The Standard Chartered bank code is a three-digit number, commonly used for fund transfers between major banks. The following quick reference table allows you to instantly find the Standard Chartered bank code and other major Hong Kong bank codes:

| Bank Name | Official Name | Bank Code |

|---|---|---|

| Standard Chartered Bank | Standard Chartered Bank (Hong Kong) Limited | 003 |

| HSBC | The Hongkong and Shanghai Banking Corporation Limited | 004 |

| Hang Seng Bank | Hang Seng Bank Limited | 024 |

| Citibank | Citibank (Citibank Hong Kong Limited) | 006 (250) |

| CITIC Bank | CITIC Bank International Limited | 018 |

You can use this quick reference table to quickly find the correct Standard Chartered bank code, reducing the chance of filling in errors.

Key Points

- The bank codes of major Hong Kong banks are all three-digit numbers, with Standard Chartered’s code being 003, making it easy for you to verify and fill in transfer details.

- Bank codes identify banks, branch codes distinguish different branches, and together with account numbers, they ensure funds reach the recipient accurately.

- You can check the latest bank and branch codes through the bank’s official website, online banking platform, or customer service to avoid transfer failures due to incorrect information.

- For international remittances, use the correct SWIFT code to ensure funds safely reach overseas banks, and select the appropriate remittance code based on the region.

- Using the quick reference table and inquiry methods provided in this article can effectively reduce transfer errors, ensuring your funds’ safety and financial efficiency.

Bank Code Quick Reference

Image Source: pexels

Standard Chartered Bank Code and Major Bank Codes

When you handle bank transfers, you often need to enter the correct bank code. The Standard Chartered bank code (003) is one of the commonly used three-digit bank codes in Hong Kong. You can use these codes directly for transfers, payments, or collections between different banks, ensuring funds arrive safely.

You may wonder, where can you find the official source of these bank codes? Here are some reliable inquiry methods:

- hongkongcard.com provides official bank codes and branch codes for multiple Hong Kong banks, including Standard Chartered, HSBC, Hang Seng, BOC, and Bank of East Asia.

- The website was updated on April 21, 2025, with detailed and authoritative content.

- You can find codes such as BOC (012), HSBC (004), Hang Seng (039), and Bank of East Asia (015) on the website.

- The article also explains the structure of branch codes and account numbers, making it easy for you to check and verify.

You only need to remember that the Standard Chartered bank code and other major bank codes are three-digit numbers. This rule makes it easier for you to verify when filling out forms or using online banking, reducing the chance of errors.

Quick Reference Table Highlights

When you use the quick reference table, you’ll notice that all major Hong Kong bank codes are three-digit numbers. This design helps you quickly distinguish different banks, whether it’s the Standard Chartered bank code or others, making them clear at a glance.

| Bank Name | Bank Code |

|---|---|

| CITIC Bank | 018 |

| Bank of China | 012 |

| Chong Hing Bank | 041 |

| Dah Sing Bank | 040 |

| ICBC Asia | 072 |

| DBS Bank | 016 |

| Bank of East Asia | 015 |

| OCBC Wing Hang Bank | 035 |

| Mox Bank | 389 |

| Welab Bank | 390 |

| Shanghai Commercial Bank | 025 |

| China Construction Bank | 009 |

| Nanyang Commercial Bank | 043 |

| Fubon Bank | 128 |

| China Merchants Wing Lung Bank | 020 |

| O-Bank | 274 |

| ZA Bank | 387 |

| First Bank | 203 |

| Standard Chartered Bank | 003 |

| HSBC | 004 |

| Hang Seng Bank | 024 |

| Citibank | 006 |

You can see from the table above that whether it’s the Standard Chartered bank code or other bank codes, they are all three-digit numbers. This rule gives you confidence when filling out bank details, making errors less likely.

Tip: When entering bank codes in online banking, mobile apps, or ATMs, you only need to input the three-digit number. For example, the Standard Chartered bank code is 003, HSBC is 004, and Hang Seng is 024.

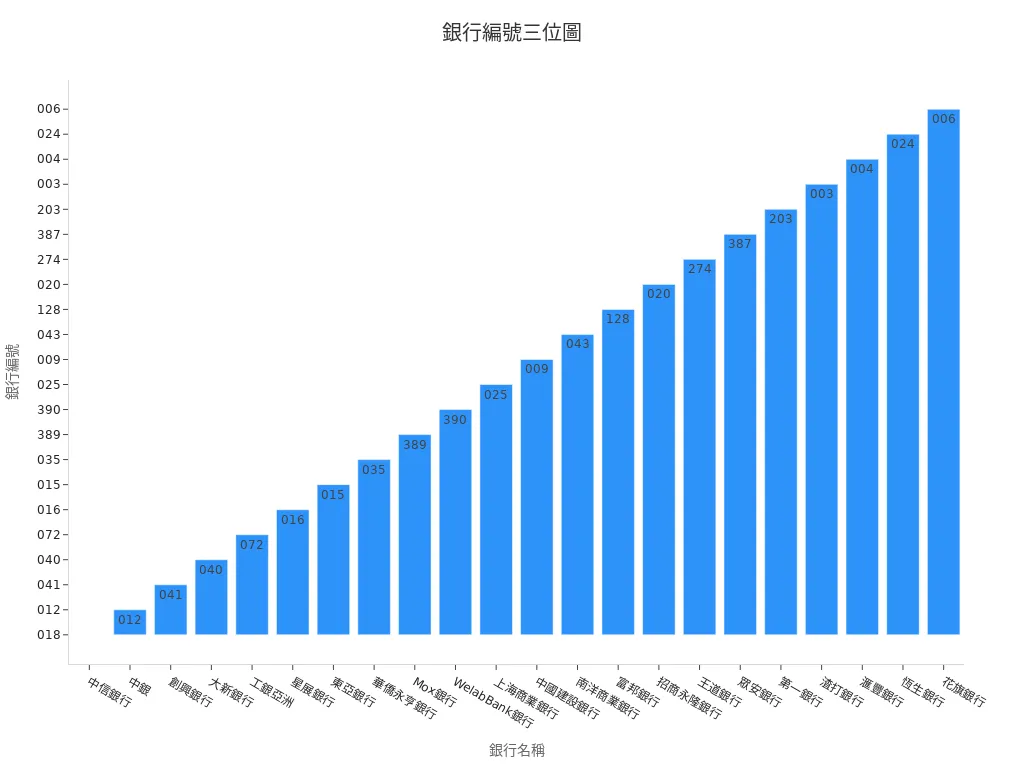

You can also refer to the chart below, which displays all bank codes as three-digit numbers in a bar chart, further proving the practicality of this rule:

As long as you master this three-digit rule, you can easily handle various transfer and remittance scenarios, whether looking up the Standard Chartered bank code or other bank codes.

Code Distinctions

Bank Code Uses

When you process bank transfers, you often encounter three key codes: bank code, branch code, and account number. The bank code is a three-digit number, used to identify each Hong Kong bank. This code ensures your funds reach the correct bank. According to official information, the bank code is a unique identifier for banks. You must enter the correct bank code when using online banking, ATMs, or filling out transfer forms.

Below are some Hong Kong bank codes:

| Bank Code | Bank Name (Chinese) |

|---|---|

| 003 | Standard Chartered Bank (Hong Kong) Limited |

| 004 | The Hongkong and Shanghai Banking Corporation Limited |

| 006 | Citibank |

| 009 | China Construction Bank (Asia) Corporation Limited |

| 012 | Bank of China (Hong Kong) Limited |

| 015 | The Bank of East Asia, Limited |

| 024 | Hang Seng Bank Limited |

| 035 | OCBC Wing Hang Bank Limited |

| 387 | ZA Bank Limited |

| 390 | Welab Bank Limited |

Tip: When filling out transfer details, the bank code requires only the three-digit number to avoid transferring funds to the wrong bank.

Branch and Account Numbers

The branch code distinguishes different branches within the same bank. Each branch has a unique branch code. When transferring funds, you need to enter both the bank code and branch code to ensure the bank directs funds to the correct branch. The account number identifies the recipient’s account. Together, these three codes ensure every transfer reaches its destination accurately.

For example, if you’re transferring USD to Standard Chartered Bank (bank code 003), Mong Kok branch station (branch code 123), with account number 4567890, you should fill out the form as follows:

- Bank code: 003

- Branch code: 123

- Account number: 4567890

As long as you follow this format, the bank can process your transfer accurately. According to official documentation, this classification and usage structure is designed to ensure smooth remittances and minimize errors. In your daily financial management, verify these three codes to ensure accuracy.

Inquiry Methods

Official Inquiries

You can find bank and branch codes through multiple official channels. The most direct method is to visit the official websites of major Hong Kong banks. Most banks list all branch codes and addresses under their “Branch Network” or “FAQ” sections. You can also log into your online banking platform to view your account details, which typically display the bank and branch codes.

If you have paper or electronic statements, the account details section usually includes the bank and branch codes. You can also call the bank’s customer service hotline to inquire with staff. Some banks’ mobile apps offer a QR code for branch inquiries, allowing you to access the latest codes anytime.

Tip: When filling out transfer or remittance forms, verify official information first to ensure the bank and branch codes are correct, avoiding misdirected funds.

Other Apps

Besides official websites and customer service, you can use other authoritative platforms to find bank codes. For example, the Hong Kong Monetary Authority (HKMA) website has a “Bank Directory” where you can view codes for all licensed banks. The Hong Kong Interbank Clearing Limited (HKICL) also publishes updated lists of bank and branch codes for verification.

You can also refer to third-party financial information websites, such as hongkongcard.com or moneyhero.com.hk, which regularly update bank code data. However, verify with official sources, as third-party sites may not always be up-to-date.

Note: When searching for bank codes, rely on official information from the Hong Kong Monetary Authority and bank websites to ensure accuracy.

International Remittance Codes

Image Source: unsplash.com

SWIFT and Other Codes

When you make international remittances, you encounter various bank codes. Each code has different uses and applications. You can refer to the following common international remittance codes:

- SWIFT Code: A set of international standard codes used to identify banks and financial institutions. When you handle international remittances through Hong Kong banks, you must provide the recipient bank’s SWIFT code. SWIFT, also known as BIC, ensures funds reach banks worldwide accurately.

- IBAN (International Bank Account Number): A set of codes used to identify individual bank accounts. You often need to provide IBAN for remittances to Europe. Some Asian and other regional banks offer IBAN as well.

- Clearing Code: A code used in local clearing systems. When you make local transfers in Hong Kong, the Clearing Code links banks for fund transfers.

- Sort Code: A code used in the UK and some regions to identify branches. You typically need a Sort Code for remittances to the UK.

Tip: When handling international transfers, confirm the required codes with the recipient to avoid delays due to incorrect information.

Code Comparison

You may wonder what differentiates these codes. Refer to the table below to quickly understand the main uses of various international remittance codes and related data for Standard Chartered Bank in Hong Kong:

| Code Type | Description | Standard Chartered Hong Kong Example |

|---|---|---|

| SWIFT | Identifies banks for international remittances | SCBLHKHHXXX |

| IBAN | Tracks individual accounts | Not widely used in Hong Kong |

| Clearing | Local interbank clearing for accurate fund flow | 003 (Standard Chartered bank code) |

| Sort Code | UK and some regions’ branch identifier | Not applicable in Hong Kong |

By selecting the correct code based on the remittance region and bank requirements, you can ensure funds reach the recipient’s account safely and on time. For international remittances through Hong Kong banks, the SWIFT code is the most commonly used. To find SWIFT or Clearing Codes for other banks, check bank websites or the Hong Kong Monetary Authority.

You can use the quick reference table to find the correct bank and branch codes quickly, reducing transfer errors. For international remittances, verify SWIFT codes and related details. Three-digit codes like the Standard Chartered bank code make verification easier. Save this article or share it with friends who need it.

Using bank codes and international remittance codes correctly helps ensure your funds’ safety.

FAQ

What’s the difference between bank codes and branch codes?

The bank code identifies the bank, while the branch code identifies the branch. You need to provide both for transfers to ensure funds reach the correct destination.

Where can I find my branch code?

You can find your branch code on bank statements, online banking platforms, or bank websites. You can also call customer service to inquire.

Can I transfer with just the bank code?

Providing only the bank code may prevent funds from reaching the recipient accurately. You must include the branch code and account number.

Is a SWIFT code always required for international remittances?

When making international remittances through Hong Kong banks, you usually need a SWIFT code to ensure funds reach overseas banks safely.

How are bank service fees calculated? Do exchange rates affect them?

Bank service fees are calculated in USD. For cross-border transfers, banks convert amounts based on the day’s exchange rate, resulting in varying fees.

Accurate bank codes (e.g., Standard Chartered 003, HSBC 004) and SWIFT codes are vital for seamless local and international transfers, preventing delays and errors. BiyaPay streamlines your financial management, enabling investment in U.S. and Hong Kong stocks through one account, bypassing complex setups for these markets. Access a wealth management product with up to 5.48% annualized returns, offering flexible withdrawals to meet post-transfer investment needs.

BiyaPay’s real-time currency conversions and rate queries reduce transfer costs to 0.5%, boosting efficiency. Regulated by international financial authorities, it ensures secure transactions. Visit BiyaPay today to manage transfers and investments effortlessly, building a robust financial strategy!

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.