- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Essential Guide for Entrepreneurs: Steps and Document Checklist for Opening a Company Bank Account

Image Source: pexels

If you want to open a company bank account, you can follow these steps to prepare:

- Choose a suitable bank

- Schedule an appointment and submit the account opening application

- Prepare required documents, including company registration certificate, business registration certificate, articles of association, identity proofs for directors and shareholders, address proof, and business proof

- Undergo KYC review and interview

- Deposit the required amount to activate the account

In 2020, Taiwan saw over 100,000 newly established companies, with an annual growth rate of 11.35%, of which small and micro-enterprises accounted for over 40%, reflecting the rising demand for bank accounts.

Key Points

- Before opening a company bank account, you must prepare complete documents such as company registration certificate, business registration certificate, articles of association, and identity proofs for directors and shareholders to ensure a smooth application process.

- A bank account helps separate company and personal funds, facilitating financial management, tax filing, and enhancing the company’s professional image, increasing trust from clients and partners.

- When choosing a suitable bank, compare service fees, minimum deposit requirements, and online banking functions, and make the best decision based on your company’s business needs.

- Cooperating with the bank’s KYC review and interview by providing accurate and complete information can effectively mitigate risks and significantly improve the success rate of account opening.

- Understanding bank requirements and processes in advance and proactively preparing business proofs and tax documents can shorten the review time and quickly activate the bank account.

Why Open a Bank Account

Legal Compliance

After establishing a company, you must comply with legal regulations in Hong Kong and China. According to the Hong Kong Companies Ordinance, you need to set up a separate bank account for the company. This ensures that company funds are separated from personal funds, facilitating tax filing and audits. If you do not have a separate account, the tax authority may question the authenticity of your company’s operations. Some banks, such as HSBC and Standard Chartered, will require you to provide detailed company registration information to ensure compliance with anti-money laundering and anti-terrorism financing regulations.

Financial Management

After opening a company bank account, you can manage company funds more effectively. You can clearly record every income and expense, making it easier to prepare financial statements later. If you need to apply for loans or attract investors, the transaction records of the bank account serve as important proof. You can also use online banking services to check account balances and transaction records anytime. For example, with HSBC, you can manage multiple currency accounts through its online banking platform, facilitating international business. When handling foreign currencies, the bank will automatically convert based on the daily exchange rate, such as approximately 7.8 HKD for 1 USD (subject to the daily rate).

Professional Image

After opening a company bank account, you can enhance your company’s professional image. When issuing invoices to clients, receiving payments through a company account will make clients trust your business more. When collaborating with suppliers, paying through a company account makes your company appear more standardized. If you only use a personal account for company funds, it may raise doubts about your company’s scale and integrity. The existence of a bank account can make you more competitive in business collaborations.

Documents Required for a Bank Account

Image Source: unsplash

When preparing to open a bank account, you must organize a series of documents in advance. These documents are not only the basic requirements for bank review but also significantly improve account opening efficiency. Based on the practical experience of multiple Hong Kong banks, the completeness of documents directly affects the review speed. Automated KYC systems have become widespread, capable of quickly integrating and analyzing data, reducing review time from weeks to days or even hours. By preparing the following documents, you can greatly increase the success rate of account opening.

Company Registration Certificate

You need to provide the Certificate of Incorporation. This document proves that your company has been officially registered in Hong Kong or China. The bank will verify the company’s identity based on this certificate to ensure its legal existence. If you omit this document, your bank account application is likely to be delayed.

Business Registration Certificate

You also need to prepare the Business Registration Certificate. This is a statutory proof of a company’s operations in Hong Kong. The bank will check the validity and details of the certificate to ensure the company is still operational. You must renew this certificate annually for the bank to accept your application.

Articles of Association

The Articles of Association are a key basis for the bank to review the company’s structure and operational rules. You need to submit the complete articles to allow the bank to understand the company’s business scope, directors’ authority, and shareholders’ rights. This document helps the bank determine whether the company meets compliance requirements.

Directors and Shareholders Proof

The bank will require you to provide identity proof documents for all directors, shareholders, authorized signatories, and ultimate beneficial owners. You can prepare copies of passports or Hong Kong ID cards. The bank will also require address proof, such as utility bills or bank statements from the past three months. These documents assist the bank in conducting KYC (Know Your Customer) reviews to ensure the company structure is transparent and reduce money laundering risks. AI technology and automated systems can improve data processing accuracy, reducing human errors and making the review process faster and more precise.

Address Proof

You need to provide address proof for the company and all key personnel. Common address proofs include utility bills, bank statements, or government letters from the past three months. The bank will use these documents to verify the actual residence of you and the company’s key personnel, a critical part of anti-money laundering regulations.

Business Proof

The bank places great importance on business proof. You can prepare contracts, invoices, business plans, company website screenshots, or past bank statements. The bank will analyze your corporate shareholder structure, fund sources, operational model, and transaction behavior through the Customer Due Diligence (CDD) process. These documents help the bank assess the nature of your business and the purpose of funds, identifying potential risks. If your business is new or in a high-risk industry, the bank may require more detailed business information. Using professional tools to integrate scattered data can improve investigation efficiency and review accuracy. Manual checks are prone to missing details, while system integration can quickly generate comprehensive reports, ensuring thorough reviews.

Tip: The more business proof you prepare, the higher the success rate of opening a bank account, and the review time will be significantly reduced.

Tax Identity Documents

You also need to provide tax identity proof, such as a Tax Identification Number (TIN) or related tax documents. The bank will use these documents to ensure that the company and its key personnel comply with tax regulations in Hong Kong and China. These documents help the bank fulfill international tax information exchange requirements (e.g., CRS, FATCA), reducing tax risks.

Other Supplementary Documents

Some banks may require additional documents based on your company’s nature or business model, such as the Incorporation Form (NNC1), Annual Return (NAR1), company structure chart, authorization letter, or lease agreement copies. You should proactively inquire about the bank’s latest requirements and prepare all possible documents in advance. The completeness and accuracy of documents directly affect the bank account review speed. Automated integration of multi-source information can improve operational efficiency and optimize customer experience, allowing you to open a bank account faster.

Bank Account Opening Process

Image Source: unsplash

To successfully open a bank account, you can follow these steps:

Choose a Bank

You first need to choose a suitable bank based on your company’s business needs. Hong Kong has multiple banks offering company account services, such as HSBC, Bank of China, and Standard Chartered. You can compare different banks’ service fees, minimum deposit requirements, online banking functions, and branch networks. Some new online financial platforms (e.g., Airwallex) support fully online account opening, making the process simpler. You should choose the most suitable bank account plan based on your company’s size, business scope, and budget.

Schedule and Apply

After selecting a bank, you need to schedule an account opening appointment in advance. Most banks require you to fill out an application form online, and some support remote account opening and electronic identity verification. During scheduling, you need to prepare basic company information, including company name, registration number, business nature, and contact details. The bank will arrange an interview or document submission time based on your application.

Document Submission

You need to submit all required documents as per the bank’s requirements. These documents include company registration certificate, business registration certificate, articles of association, identity proofs for directors and shareholders, address proof, business proof, and tax identity documents. Ensure the documents are complete and accurate to speed up the review process. Some banks support online document uploads, saving you time from visiting a branch.

KYC Review

The bank will conduct a KYC (Know Your Customer) review based on the documents you provide. This step is crucial for preventing money laundering and fraud risks. You must cooperate with the bank to verify the company structure, fund sources, and business model.

Inadequate KYC reviews can lead to serious consequences, such as:

- Some companies failed to implement KYC, resulting in multiple sellers using the same address with large and frequent transactions.

- Within a week, payments collected reached millions of USD, with each transaction under 2,600 USD (calculated at 1 USD to 7.8 HKD).

- These sellers had annual sales exceeding a million USD, but the company could not provide reasonable explanations or transaction evidence.

- Due to inadequate KYC reviews, high-risk clients could not be identified, leading to government investigations and reputational damage.

The Digital Industry Agency emphasizes that KYC must substantively verify customer identity, enhance monitoring of high-risk clients, require transaction evidence, and report suspicious transactions promptly to effectively prevent money laundering and fraud risks.

Interview and Verification

The bank will arrange an interview with you and the company’s key personnel. You need to visit a branch in person or participate via video conference to answer questions about the company’s business, fund sources, and future development. The bank will verify the submitted documents to ensure all information is accurate. Some banks may request additional business proof or supplementary documents. During the interview, present yourself professionally and clearly explain the company’s operations to increase the success rate of account opening.

Deposit and Activation

After the bank approves your application, you need to deposit the specified minimum amount to formally activate the bank account. Minimum deposit requirements and activation times vary by bank and platform. You can refer to the table below:

| Bank/Platform | Account Opening Time | Minimum Deposit Requirement Impact |

|---|---|---|

| Traditional Banks (e.g., HSBC, Bank of China) | As fast as three working days, document review and supplementation may extend the time | Higher or stricter minimum deposit requirements may lead to longer review times, delaying account activation |

| Airwallex (Online Financial Platform) | Account opening completed in minutes, 24-hour online service | More flexible minimum deposit requirements, combined with online processes, significantly shorten account activation time |

If you choose traditional banks, it may take days to weeks to activate the account. If you choose online financial platforms, the account opening and activation process is faster. You should choose the most suitable bank account plan based on your company’s cash flow and business needs.

Precautions

KYC Focus

When opening an account, the bank will place special emphasis on the KYC (Know Your Customer) process. You must provide accurate and complete information about the company and its key personnel. Hong Kong banks integrate multiple data sources, including company registration, shareholding structure, historical records, financial status, transaction behavior, compliance reputation, related party information, and additional risk indicators. These data help the bank comprehensively assess your risk profile. Many banks now use automated data matching, AI analysis, and text mining technologies to quickly identify potential risks and unusual transactions. If you regularly update your information, the bank can promptly detect anomalies and initiate enhanced due diligence. These measures effectively prevent money laundering and fraud, significantly reducing bank risks.

Minimum Deposit

When opening an account, pay attention to the minimum deposit requirements of different banks. Some Hong Kong banks require you to deposit a specified amount, such as USD 1,000 or more (approximately HKD 7,800 at 1 USD to 7.8 HKD). If you fail to meet the minimum deposit, the bank may not formally activate the account. You should inquire about the target bank’s requirements in advance to ensure sufficient funds and avoid delays due to insufficient amounts.

Account Opening Challenges

When opening a company account, you may encounter issues like incomplete documents or discrepancies in information. The bank may delay the review or reject your application due to incomplete or inconsistent data. For startups lacking business records, the bank may require more detailed business plans, budgets, and business proofs. You should proactively prepare all relevant documents and ensure their accuracy to reduce account opening challenges.

Success Rate Improvement

To improve the success rate of account opening, you can take multiple approaches. You should prepare all necessary documents in advance, including company registration certificate, business registration certificate, articles of association, directors and shareholders proofs, address proof, and business proof. You can prepare a detailed business plan and budget to help the bank clearly understand your business model and fund sources. If you proactively cooperate with the bank’s KYC and anti-money laundering requirements and regularly update information, the success rate of opening a bank account will significantly increase.

Bank Comparison

Document Requirements

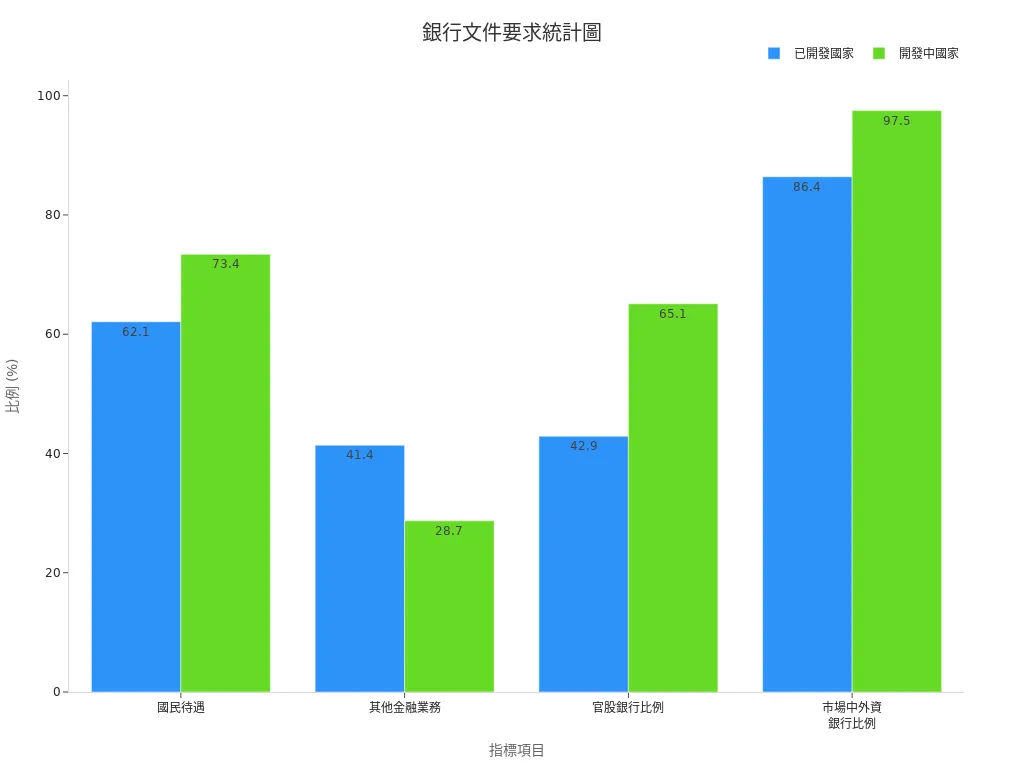

When choosing a bank, you should first understand the document requirements of different banks. Hong Kong banks typically require company registration certificate, business registration certificate, articles of association, identity proofs for directors and shareholders, address proof, and business proof. However, banks vary in their requirements for document details and supplementary information. Some banks may require additional documents like company structure charts, authorization letters, or lease agreement copies. You can refer to the table below to compare document and capital requirements for foreign and local banks in different countries:

| Indicator | Developed Countries Proportion | Developing Countries Proportion | Difference Explanation |

|---|---|---|---|

| National Treatment (Minimum Capital Requirement) | 62.1% apply similar requirements to foreign and local banks | 73.4% apply similar requirements to foreign and local banks | Most countries have similar capital requirements for foreign and local banks |

| Proportion of Foreign Banks in the Market | 86.4% | 97.5% | Developing countries have a higher proportion of foreign banks in the market |

| Proportion of State-Owned Banks | 42.9% | 65.1% | Developing countries have a higher proportion of state-owned banks |

You can see that document and capital requirements vary significantly across regions. When preparing documents, you should proactively inquire about the target bank’s latest requirements to avoid delays due to insufficient information.

Fees and Balances

When choosing a bank, you should also compare service fees and minimum balance requirements of different banks. Hong Kong banks generally charge account opening fees, monthly fees, and transfer fees. For example, with HSBC, the account opening fee is approximately USD 100 (about HKD 780 at 1 USD to 7.8 HKD), and the monthly minimum balance requirement is around USD 1,000 (about HKD 7,800). If you fail to maintain the minimum balance, the bank may charge additional fees. Some online financial platforms like Airwallex have lower account opening fees and more flexible balance requirements, suitable for startups. You should choose the most suitable bank plan based on your company’s cash flow and business scale.

Tip: When choosing a bank, consider both document requirements and fee structures to reduce future operational pressure.

When opening a company bank account, you should prepare according to these steps:

- Organize key documents such as company registration certificate, business registration certificate, and articles of association.

- Prepare identity proofs for directors and shareholders and business proof.

- Submit the application form and cooperate with the bank’s interview and KYC review.

If you prepare carefully, the bank will find it easier to understand your business model and fund sources. Based on practical experience, over 2,000 companies have improved account opening efficiency due to standardized processes. It is recommended to regularly check the target bank’s latest requirements, as professional preparation can significantly increase success rates.

FAQ

How long does it take to open an account?

After preparing complete documents, Hong Kong banks generally take 3 to 14 working days to complete the review. Some online financial platforms can open accounts on the same day. Incomplete documents will delay approval.

Can a company without a physical office open an account?

You can apply using a registered address or virtual office address. However, the bank may require lease agreements or business proofs to ensure the company’s operations are genuine.

What is the minimum deposit requirement for account opening?

Most Hong Kong banks require a minimum deposit of USD 1,000 (approximately HKD 7,800 at 1 USD to 7.8 HKD). Some online platforms have lower requirements; check with individual banks.

Can a startup without business records open an account?

You can open an account but need to prepare a detailed business plan, budget, and business proof. The bank will closely review your business model and fund sources.

Can you reapply if your account opening is rejected?

You can reapply. It is recommended to complete missing documents, improve business proofs, and proactively explain company operations. Choosing a different bank or platform can also help increase success rates.

Opening a company bank account in 2025 is slow (3–14 days) and costly (USD 100 fees, USD 1,000 minimum balance), with complex KYC and documentation challenges for startups. BiyaPay streamlines your setup with online account opening in minutes, bypassing lengthy reviews. Enjoy low or zero fees and flexible balance requirements. Complete HKD-to-USD conversion at the real - time market exchange rate, supporting HKD, USD, and crypto for global business.

Compliance-registered as FSP (New Zealand) and MSB (the US), regulated by regulatory authorities of both regions, it ensures compliance. Join BiyaPay now to simplify finances! Sign up today to grow your business in 2025!

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.