- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Bank Fixed Deposit Interest Rate Comparison | June 2025 Latest High-Yield Deposit Recommendations

Image Source: pexels

You want to compare the fixed deposit interest rates of major banks in June 2025? When comparing bank fixed deposit interest rates, you will find that different banks offer varying rates. Digital banks typically provide higher rates, while traditional banks attract new funds with promotional offers. The table below shows the fixed deposit rates and features of major banks, helping you quickly grasp market trends:

| Deposit Type | Bank Category | Highest Rate Range | Key Features |

|---|---|---|---|

| USD Fixed Deposit | Traditional/Emerging Banks | 3.00%~3.40%, promotional rates up to 6.6% | Higher rates for new fund programs |

| TWD Fixed Deposit | Digital/Traditional Banks | 1.71%~1.81% | Digital banks offer higher rates |

Key Points

- Fixed deposit interest rates vary significantly across banks and currencies, with USD fixed deposits generally offering higher rates, especially for short- and medium-term deposits.

- The longer the deposit term, the higher the interest rate typically is, but liquidity decreases, so you should align your choice with personal financial planning.

- Minimum deposit amounts and new fund requirements affect eligibility for high-yield promotions, with some banks restricting applications to online or specific channels.

- High-yield fixed deposit promotions are mostly targeted at new funds or new clients, so you should carefully read terms before applying to avoid missing or misusing offers.

- Interest calculation methods include simple and compound interest, with compound interest offering higher returns; early withdrawal may incur penalties, so you need to note relevant rules.

Bank Fixed Deposit Interest Rate Comparison

Image Source: unsplash

Rate Overview

You want to understand the fixed deposit interest rates of major Hong Kong banks in June 2025, so you must first grasp the rate differences across various deposit terms. When comparing bank fixed deposit interest rates, you will find that longer deposit terms typically offer higher rates. The table below summarizes the main rate trends for HKD, USD, and RMB for 1-month, 3-month, 6-month, and 12-month terms:

| Deposit Term | HKD Rate Range | USD Rate Range | RMB Rate Range | Remarks |

|---|---|---|---|---|

| 1 Month | 1.10%~1.25% | 1.15%~1.30% | 1.50%~1.70% | Lowest rates, fewer options |

| 3 Months | 1.25%~1.40% | 2.50%~2.70% | 1.70%~1.90% | Little difference between 3 and 6 months |

| 6 Months | 1.45%~1.60% | 2.60%~3.00% | 1.90%~2.10% | Some banks offer high-yield promotions |

| 12 Months | 1.70%~1.81% | 3.00%~3.40% | 2.20%~2.50% | Highest rates, suitable for long-term funds |

You can see that when comparing bank fixed deposit interest rates, 12-month terms clearly offer higher rates than short-term deposits. USD fixed deposit rates are generally higher than HKD and RMB, especially for 3-month and 6-month terms, with some banks launching high-yield programs for new funds. These rate data are sourced from official bank websites and central bank statistics, reflecting market demand for different currencies and terms.

Tip: When you choose a longer deposit term, you can usually get higher rates, but liquidity will decrease. When comparing bank fixed deposit interest rates, it’s recommended to select a suitable term based on your financial planning.

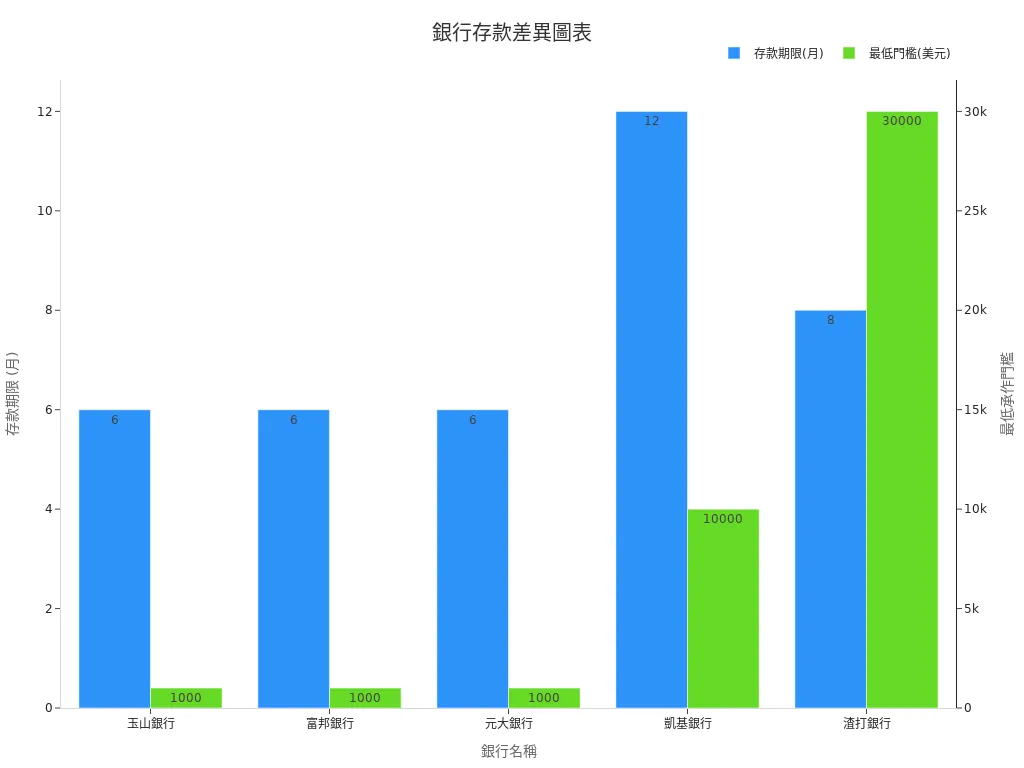

Deposit Terms and Requirements

Comparing bank fixed deposit interest rates involves not only rates but also minimum deposit amounts and requirements. These factors reflect banks’ strategies for different client groups. You will find that higher minimum deposits often come with higher rates. Below is a comparison of fixed deposit requirements for major Hong Kong banks in June 2025:

| Bank Name | Deposit Term | Rate Range (%) | Minimum Deposit Threshold (USD) | Restrictions |

|---|---|---|---|---|

| E.Sun Bank | 6 Months | 4.3 | 1,000 | Limited to individual accounts, new funds via online/mobile banking |

| Fubon Bank | 6 Months | 4.0~4.2 | 1,000 | Limited to individual accounts, new funds |

| Yuanta Bank | 6 Months | 4.0 | 1,000 | Limited to individual accounts, new funds at branch |

| KGI Bank | 12 Months | 4.15~4.2 | 10,000 | Limited to individual accounts, new funds |

| Standard Chartered | 8 Months | 4.7 | 30,000 | Limited to individual accounts, new funds |

You can see that minimum deposit thresholds vary significantly, ranging from USD 1,000 to USD 30,000. When comparing bank fixed deposit interest rates, these thresholds directly affect your eligibility for high-yield promotions. Some banks also require new funds or specific channels (e.g., online or mobile banking) to access high rates.

- Minimum deposit requirements are a key factor in comparing bank fixed deposit interest rates. Since 2018, banks have gradually raised large-amount certificate of deposit thresholds from USD 20,000 to USD 50,000, 80,000, or even 100,000, with higher tiers offering higher rates, indicating differentiated rate strategies.

- Rates fluctuate noticeably, especially for 6-month and 12-month terms, as banks adjust rates based on market funding needs to attract different depositors.

- Payment methods are diverse, including monthly interest payments and fixed interest payments, with some banks offering early withdrawal or transferable options for added flexibility.

- The number of banks issuing large-amount certificates of deposit continues to grow, reflecting strong market demand for high-yield fixed deposit products.

When comparing bank fixed deposit interest rates, you should consider rates, deposit terms, minimum deposits, and product flexibility simultaneously. In June 2025, overall rates show a mild upward trend, mainly influenced by HIBOR (Hong Kong Interbank Offered Rate) fluctuations. When HIBOR rises, banks increase fixed deposit rates to attract funds. You should closely monitor market dynamics and flexibly adjust fund allocation to seize the best returns.

High-Yield Fixed Deposit Recommendations

Image Source: pexels

Latest Promotions

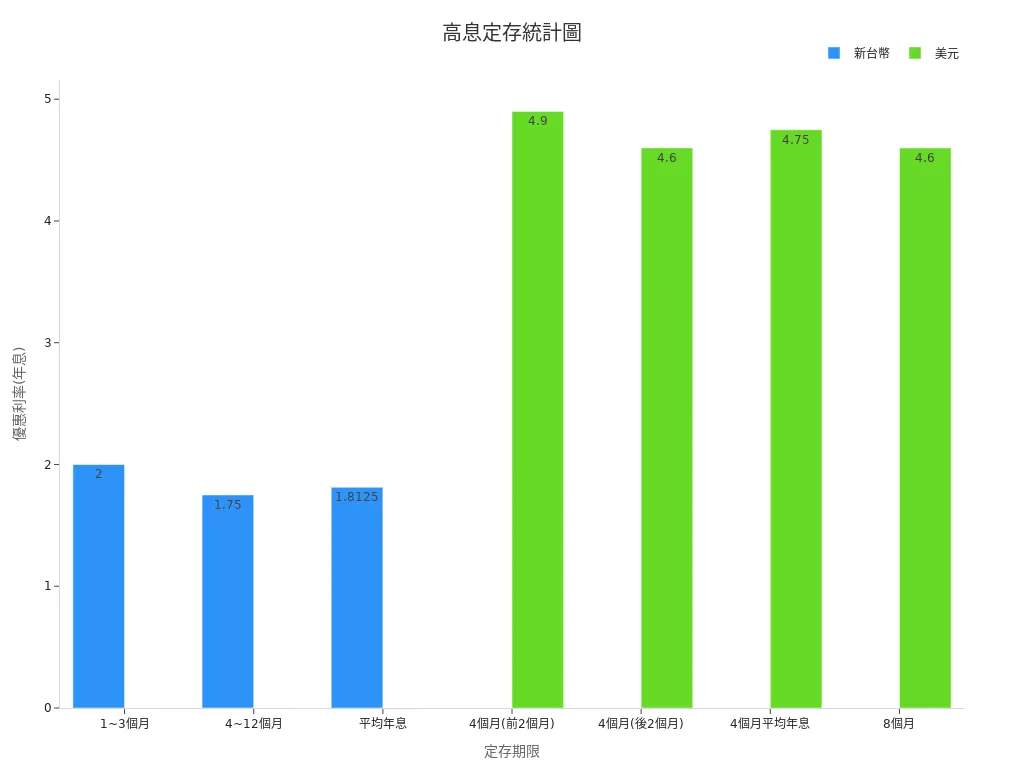

You want to find the latest high-yield fixed deposit promotions in June 2025, so you can pay attention to offers from multiple Hong Kong banks and virtual banks. Different banks provide special annual rates for new funds, specific amounts, or online account openings. You can refer to the table below to quickly compare high-yield fixed deposit plans from various banks:

| Bank | Currency | Deposit Term | Promotional Rate (Annual) | Minimum Deposit Requirement |

|---|---|---|---|---|

| Taishin Bank | HKD | 1~3 Months | 2% | USD 10,000 new funds |

| Taishin Bank | HKD | 4~12 Months | 1.75% | USD 10,000 new funds |

| Taishin Bank | HKD | Average Annual Rate | 1.8125% | USD 10,000 new funds |

| Taishin Bank | USD | 4 Months (First 2 Months) | 4.9% | USD 1,000 |

| Taishin Bank | USD | 4 Months (Last 2 Months) | 4.6% | USD 1,000 |

| Taishin Bank | USD | 4-Month Average Annual Rate | 4.75% | USD 1,000 |

| Taishin Bank | USD | 8 Months | 4.6% | USD 1,000 |

| Taishin Bank | USD/AUD | 14 Days | 6.5% (Above USD 1,000) / 7% (Above USD 8,000) | USD 1,000 / USD 8,000 |

You will find that USD fixed deposit promotional rates are significantly higher than HKD, especially for short-term plans (e.g., 14 days, 4 months). Some banks also offer higher rates for AUD. As long as you meet new fund or specific amount requirements, you can enjoy these high-yield promotions.

You can see from the chart that rate differences across currencies and terms are significant. USD short-term fixed deposits offer the highest rates, suitable for flexible short-term fund use. HKD fixed deposits are suitable for stable wealth management.

Some banks, like Standard Chartered, offer currency exchange preferential fixed deposit promotions, with annual rates up to 8.88%. These promotions often target specific channels for foreign currency conversions, combined with discounts on currency exchange and fund subscription fees. You need to note that these promotions may not have clear fixed deposit rate details, and minimum deposit amounts and application methods may have special requirements.

Tip: When applying for high-yield fixed deposits, remember to read the terms carefully. Some promotions are limited to new funds, online account openings, or new clients and may not apply to all users.

Limited-Time Events

You want to seize banks’ limited-time high-yield fixed deposit events, so you need to pay attention to promotion periods, promo codes, and real-time data. Banks use limited-time events to attract new clients or encourage existing clients to deposit more. You can refer to the following points to effectively compare limited-time promotions from different banks:

- During the event period, banks will publish real-time visitor numbers and promo code usage status. You can judge the popularity of promotions based on this data.

- Banks track promotion click-through rates (CTR) and conversion rates (CVR) to help you understand the actual appeal of promotions.

- You can use automated dashboards (e.g., GA4 Dashboard or Looker Studio) to observe promotion performance in real-time, making it easy to compare the effectiveness of different banks’ events.

- Some banks include countdown timers or limited-quantity settings to remind you that promotions are ending, creating urgency.

- If you want to precisely compare limited-time events across banks, it’s recommended to note event terms, minimum deposit amounts, promo code validity periods, and whether they are limited to new clients.

Note: Limited-time high-yield fixed deposit events usually have strict conditions, such as completing account opening, deposits, or using invitation codes within a specified period. You should read the fine print to avoid missing promotions.

When choosing high-yield fixed deposits, it’s recommended to consider rates, deposit terms, minimum deposit amounts, and event conditions simultaneously. Some promotions are limited to new clients or new funds, suitable for you when opening an account for the first time or with extra funds. If you frequently check bank websites or mobile apps, you can stay updated on the latest high-yield fixed deposit recommendations and seize the best return opportunities in the market.

Interest Calculation and Examples

Calculation Methods

You want to calculate fixed deposit interest, so you can choose the appropriate formula based on different deposit methods. The most common methods are simple and compound interest:

- Simple Interest Calculation: Interest is calculated only on the principal, without reinvesting interest into the principal.

- Formula: Interest = Principal × Annual Rate × Deposit Years

- Compound Interest Calculation: Interest from each period is rolled into the principal, creating a “profit-on-profit” effect.

- Formula: Final Principal and Interest = Principal × (1 + Rate)^Number of Periods

- You can use Excel’s FV (Future Value) function to calculate compound interest by inputting annual rate, deposit periods, principal, and other data to quickly obtain results.

- Rate and term data are generally sourced from bank announcements, such as Hong Kong bank websites or financial websites’ calculators.

Tip: If you choose “whole deposit, whole payment,” compound interest is typically used; “principal retained, interest withdrawn” uses simple interest. Deposit periods and rates affect final returns.

Return Examples

You can refer to the following simple examples to understand actual returns under different calculation methods:

| Deposit Method | Principal (USD) | Annual Rate (%) | Term (Years) | Calculation Method | Final Principal and Interest (USD) |

|---|---|---|---|---|---|

| Simple Interest | 10,000 | 3.0 | 1 | Simple Interest | 10,300 |

| Compound Interest | 10,000 | 3.0 | 1 | Compound Interest | 10,300 |

| Compound Interest | 10,000 | 3.0 | 3 | Compound Interest | 10,927 |

If you deposit USD 10,000 at a 3% annual rate for 1 year, both simple and compound interest yield the same result: USD 10,300. If you deposit for 3 years using compound interest, the final principal and interest increase to USD 10,927. This is the effect of “profit-on-profit.”

Note: If you withdraw early, banks may deduct part of the interest as a penalty. Some countries or regions may also tax interest income. You should check relevant terms before depositing to avoid affecting returns.

Fixed Deposit Selection Tips

Considerations

When choosing a fixed deposit, you should pay attention to the following key points:

- Deposit Term: Longer deposit terms typically offer higher rates. However, funds will be locked and cannot be withdrawn anytime. You should choose a suitable term based on your financial planning.

- Terms and Conditions: Different banks’ fixed deposit terms may vary. Some require new funds, while others are limited to online account openings. You should read terms carefully to avoid missing promotions.

- Penalty Interest: If you withdraw early, banks generally deduct part of the interest as a penalty. You should understand the penalty calculation method to avoid return losses.

- Hidden Fees: Some banks may charge handling or management fees. You should check all fees to ensure actual returns.

- Liquidity: Fixed deposit funds cannot be accessed anytime. If you have short-term funding needs, consider staggered deposits or short-term products.

Tip: You can use a table to record different banks’ fixed deposit terms for easy comparison and selection.

Product Comparison

When comparing fixed deposit products, you can refer to the following methods:

- Rate Comparison: You can use a table to list each bank’s annual rates, deposit terms, and minimum deposit amounts. For example, a Hong Kong bank offers a 6-month fixed deposit with a 4.2% annual rate and a minimum deposit of USD 1,000 (approximately HKD 7,800, at 1 USD = 7.8 HKD).

- Product Flexibility: Some banks offer early withdrawal, periodic interest payments, or automatic renewal features. You can choose the most suitable product based on your financial goals.

- Other High-Yield Options: Besides traditional fixed deposits, you can consider high-yield savings accounts, money market funds, or structured deposit products. These may offer higher rates but come with different risks and liquidity.

Note: When choosing fixed deposit products, you should make decisions based on your liquidity needs and risk tolerance. Regularly reviewing the latest market promotions helps you flexibly adjust fund allocation.

When comparing bank fixed deposit interest rates, you should focus on major banks’ rates, deposit terms, and promotional terms. You should carefully read penalty interest arrangements and hidden fees to ensure returns meet expectations. You can choose the most suitable fixed deposit product based on your financial goals and liquidity needs. Regularly monitoring the latest market promotions helps you flexibly adjust fund allocation to seize higher return opportunities.

FAQ

Do bank fixed deposits have minimum amount requirements?

When opening a fixed deposit, banks generally set a minimum amount requirement. Common thresholds are USD 1,000 (approximately HKD 7,800, at 1 USD = 7.8 HKD).

Will early withdrawal of a fixed deposit incur penalty interest?

If you withdraw early, most banks deduct part of the interest as a penalty. You should read contract terms carefully to avoid losses.

Is fixed deposit interest taxable?

In Hong Kong, fixed deposit interest is generally not taxable. However, you should note tax regulations in other countries or regions.

Are virtual bank fixed deposit rates higher than traditional banks?

You will find that virtual banks typically offer higher rates. You can compare different banks’ fixed deposit products to choose the most suitable plan.

Can fixed deposits be opened in multiple currencies?

You can open fixed deposits in multiple currencies, such as HKD, USD, or RMB. Rates and minimum deposit amounts vary by currency.

Hong Kong’s high-yield fixed deposits in June 2025 offer rates up to 6.68%, but remittance fees and currency conversion hassles can reduce returns. BiyaPay simplifies funding with a user-friendly platform, enabling real-time USD-to-HKD conversions and remittance fees as low as 0.5%, maximizing your deposit funds. Supporting USD, HKD, and crypto conversions, it meets diverse needs.

Compliance-registered as FSP (New Zealand) and MSB (the US), regulated by regulatory authorities of both regions, BiyaPay ensures secure transactions. Set up in minutes to seize time-sensitive offers. Join BiyaPay now to boost your deposit returns! Sign up today to optimize wealth management in 2025!

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.