- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Best Ways to Exchange HKD to JPY at Banks: Fee Comparison and Offers Overview

Image Source: unsplash

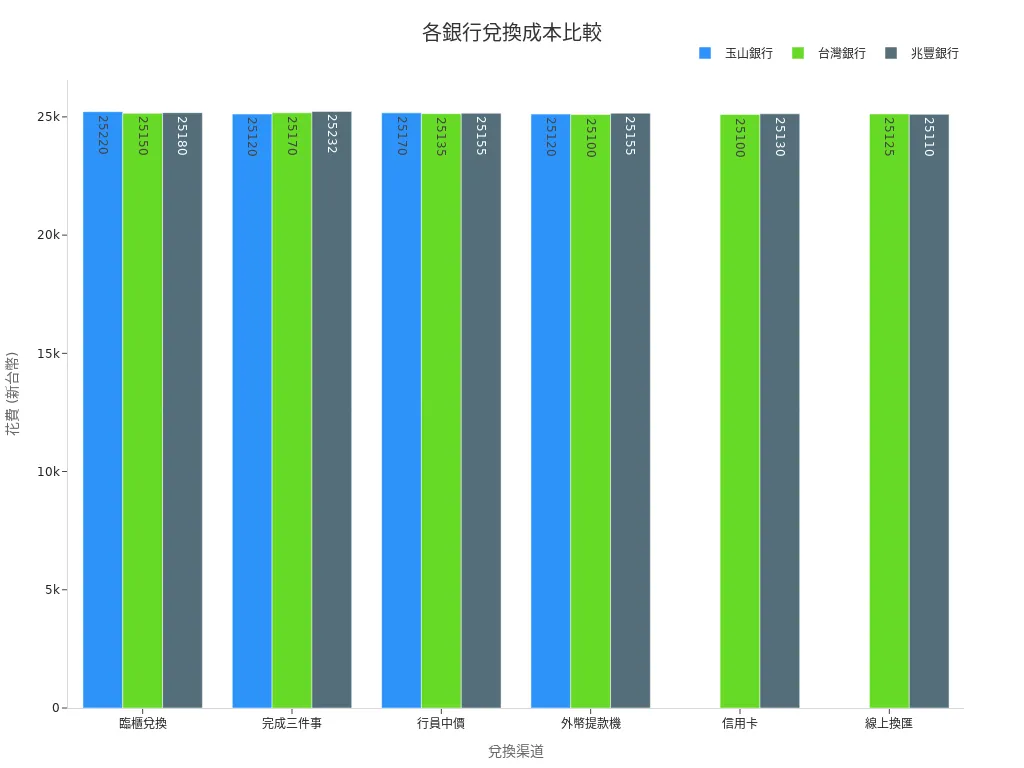

Do you want to exchange HKD to JPY in the most cost-effective way? Banks’ HKD to JPY services, money changers, and online forex platforms each have different fees and exchange rates. According to statistics, exchanging the same amount through different channels can result in a total cost difference of over USD 10. The chart below clearly shows the actual cost differences across major channels:

Key Points

- Money changers often waive fees and offer better rates, suitable for those needing cash and seeking low costs; remember to choose reputable shops and ensure cash safety.

- Bank exchanges are safe and reliable, ideal for large transactions; using online banking or mobile apps is recommended to enjoy fee waivers and better rates, and you should note different banks’ member offers.

- Online forex is convenient and fast, requiring no foreign currency account, suitable for those without time to visit banks or wanting to pick up cash at airports; remember to book in advance and prepare identification documents.

Exchange Method Comparison

Image Source: pexels

If you want to exchange HKD to JPY, there are three main channels available: bank HKD to JPY, money changers, and online forex. Each method has different costs, rates, and convenience levels. You can choose the most suitable method based on your needs.

Bank HKD to JPY

If you choose bank HKD to JPY, you can usually enjoy higher safety and confidence. Major Hong Kong banks such as HSBC, Bank of China Hong Kong, Hang Seng, and Standard Chartered all offer HKD to JPY services. You can operate at bank counters, through online banking, or via mobile apps.

Note: Counter exchanges at banks usually require a handling fee, and the exchange rate may not be the most favorable. Some banks offer exclusive benefits for online exchanges or premium members, such as fee waivers or enhanced rate discounts.

If you prioritize convenience and safety, and the amount is large, bank HKD to JPY is more suitable for you. However, you should be aware of bank operating hours and potential fees. According to real-time data from YoYoRate.com, the exchange rates and fees vary significantly among banks, with the total cost for exchanging the same amount potentially differing by over USD 10.

Money Changers

If you choose money changers to exchange HKD to JPY, you can usually enjoy better rates and no handling fees. Hong Kong has several well-known money changers, such as Kin Shing Money Exchange, Little Girl Money Exchange, and Birdy Exchange. These money changers provide real-time quotes, allowing you to instantly compare rates across different shops.

- Most money changers waive handling fees, offering more attractive rates than banks.

- You can inquire about quotes via WhatsApp or even reserve foreign currency, which is convenient and fast.

- Money changers are suitable for those needing cash, seeking low costs, and requiring immediate exchanges.

Tip: You should choose reputable money changers and ensure cash safety. According to YoYoRate.com’s rate comparisons, money changers generally have an edge over banks in terms of cost and benefits.

Online Forex

If you find it inconvenient to visit banks or money changers in person, you can consider online forex. This method allows you to book exchanges online, selecting the currency, amount, and cash pickup location. After completing payment, you can collect cash at designated branches or airports.

| Exchange Method | Rate Basis | Rate Discount | Handling Fee | Convenience | Foreign Currency Account Required | Recommendation Level | Suitable Audience |

|---|---|---|---|---|---|---|---|

| Bank Counter Exchange | Cash Sell Rate | None | Usually Yes | Limited to bank hours | No | Least Recommended | Those who avoid hassle or don’t use online platforms |

| Online Exchange with Counter Pickup | Spot Sell Rate | Usually Yes | Yes | Limited to bank hours | Yes | Most Recommended | Cost-conscious users with foreign currency accounts who monitor rates |

| Online Forex with Counter Pickup | Cash Sell Rate | Usually Yes | None | Limited to bank hours | No | Second Recommended | Those too busy to visit banks but want airport cash pickup |

| Foreign Currency ATM Withdrawal | Cash Sell Rate | Usually Yes | None | 24-hour access | No | Second Recommended | Those unable to visit banks during working hours for cash pickup |

The advantage of online forex is that rates often come with discounts, and fees are low or even waived. You don’t need a foreign currency account; you only need to book and pay online. This method is suitable for those too busy to visit banks or wanting to pick up cash at airports. However, you must book in advance, and once the pickup location and time are set, they cannot be changed.

According to market research, foreign currency ATM services are offered by multiple banks, supporting 24-hour withdrawals, suitable for working professionals or those unable to visit bank counters for cash. You can flexibly choose the most convenient method.

You can use websites like YoYoRate.com to compare real-time exchange rates and fees for bank HKD to JPY, money changers, and online forex, quickly identifying the best exchange option.

Bank Fee Comparison

Image Source: unsplash

If you want to use bank HKD to JPY, the most important thing is to compare fees, rates, and offers across different banks. Each bank has different charges and benefits. You should choose the bank that best suits your needs. Below is a detailed comparison of five major Hong Kong banks:

Hang Seng

Hang Seng Bank offers multiple methods for exchanging HKD to JPY. You can choose to exchange at branch counters, through online banking, or via the mobile app.

- Handling Fee: If you exchange at a branch counter, you typically pay a fee of about USD 3. Online banking or app exchanges may have fee waivers.

- Exchange Rate: Online exchange rates are generally more favorable than counter rates. You can check real-time rates on the Hang Seng website.

- Offers: Premium accounts (e.g., Prestige Banking) or forex members may enjoy lower fees or cash rebates. For example, some members can enjoy one free exchange per month.

Tip: You can check real-time rates on Hang Seng online banking before deciding whether to exchange.

HSBC

HSBC Bank offers multiple options for bank HKD to JPY services. You can operate at branches, through online banking, or via the mobile app.

- Handling Fee: Branch counter exchanges typically charge about USD 3. Online banking or app exchanges sometimes offer fee waivers during promotions.

- Exchange Rate: HSBC online banking rates are usually more favorable than counter rates. You can check real-time rates on the HSBC website.

- Offers: Premium accounts (e.g., Premier) or forex members can enjoy exclusive benefits, including fee waivers, cash rebates, or points rewards. Some periods feature limited-time rate enhancement promotions.

Note: If you frequently exchange large amounts of JPY, consider upgrading your account to enjoy more benefits.

Standard Chartered

Standard Chartered Bank also offers multiple channels for bank HKD to JPY. You can choose branches, online banking, or the app.

- Handling Fee: Branch exchanges charge about USD 3. Online banking or app exchanges may waive fees entirely, especially during promotions.

- Exchange Rate: Online exchange rates are more favorable than counter rates. You can check real-time rates on Standard Chartered online banking.

- Offers: Priority Banking or Premium account holders can enjoy fee waivers and exclusive rates. Some promotional periods offer cash rebates or points rewards.

Tip: You can watch for limited-time offers on the Standard Chartered app to exchange at the most cost-effective time.

Bank of China

Bank of China Hong Kong’s bank HKD to JPY services cater to various needs. You can exchange at branches, through online banking, or via the app.

- Handling Fee: Branch exchanges generally charge about USD 3. Online banking or app exchanges often enjoy fee waivers.

- Exchange Rate: Online exchange rates are more favorable than counter rates. You can check real-time rates on the Bank of China app.

- Offers: Premium accounts (e.g., BOC Wealth Management) or forex members can enjoy exclusive rates and fee benefits. Some periods offer cash rebates or points rewards.

Note: If you travel frequently or need large amounts of JPY, consider applying for a foreign currency debit card to reduce exchange costs.

Bank of East Asia

Bank of East Asia also offers multiple ways for bank HKD to JPY. You can choose branches, online banking, or the app.

- Handling Fee: Branch exchanges charge about USD 3. Online banking or app exchanges may waive fees entirely at times.

- Exchange Rate: Online exchange rates are more favorable than counter rates. You can check real-time rates on Bank of East Asia online banking.

- Offers: Premium accounts (e.g., SupremeGold) or forex members can enjoy fee waivers and exclusive rates. Some promotional periods offer cash rebates.

Tip: You can compare rates across different times to exchange at the most cost-effective moment.

| Bank | Branch Fee (USD) | Online/App Fee | Rate Discount | Premium Account/Member Offers | Cash Rebate/Points |

|---|---|---|---|---|---|

| Hang Seng | ~3 | May be waived | Yes | Yes | Yes |

| HSBC | ~3 | May be waived | Yes | Yes | Yes |

| Standard Chartered | ~3 | May be fully waived | Yes | Yes | Yes |

| Bank of China | ~3 | May be waived | Yes | Yes | Yes |

| Bank of East Asia | ~3 | May be fully waived | Yes | Yes | Yes |

Reminder: Before exchanging, you should check real-time rates and fees. You can use bank online platforms or apps to stay updated on the latest offers. The cost of bank HKD to JPY varies with exchange rate fluctuations. To save the most, it’s recommended to compare real-time quotes from different banks.

Money Changer Advantages

No Handling Fees

If you choose money changers to exchange HKD to JPY, the biggest attraction is that most advertise “no handling fees”. This fee-free strategy is highly appealing to customers, allowing you to directly calculate exchange costs without worrying about additional charges.

- Many market reports note that money changers typically display “no handling fees” clearly at entrances or counters to attract more customers.

- No handling fees have become one of the main reasons for attracting consumers.

Note: Although there are no handling fees, some money changers may adjust rates, and the actual cost may not necessarily be lower than banks. You should compare rates across different shops in real time.

Better Rates

When you exchange HKD to JPY at money changers, you can usually enjoy more flexible and real-time rates.

- Money changer rates are more flexible than banks, sometimes even more favorable during certain periods.

- Money changers have long operating hours and convenient locations, suitable for temporary or urgent foreign currency exchanges.

You can instantly compare rates across multiple money changers to choose the most cost-effective one, further reducing exchange costs.

WhatsApp Quotes

If you want to save time, you can use WhatsApp to inquire about real-time quotes from money changers.

- Many well-known money changers offer WhatsApp quote services, allowing you to check the latest rates anytime.

- You can reserve foreign currency to ensure sufficient cash is available when you visit the shop.

Tip: You should choose reputable money changers and ensure the safety of carrying cash. For large cash exchanges, it’s recommended to go with a companion or choose locations with high foot traffic.

Online Forex and Debit Cards

Online Forex Services

If you choose online forex services, you can enjoy greater flexibility and convenience. You don’t need a foreign currency account; you can place orders anytime online.

- Online forex services operate 24/7 year-round, allowing you to exchange currency anytime without being limited to bank hours.

- You can complete applications online and pick up cash at airports or designated branches, saving queuing time.

- Most online forex services waive handling fees, with some currencies like USD and EUR traveler’s checks completely fee-free, and other currencies having low fees (around USD 3).

- The operation steps are simple, with clear instructions, suitable for first-time users.

Tip: If you want to save time and fees, online forex is a great choice.

Foreign Currency Debit Cards

If you use a foreign currency debit card, you can settle transactions directly in foreign currency, avoiding credit card foreign transaction fees. When spending overseas or shopping online, funds are deducted directly from your foreign currency account, reducing exchange losses.

- Foreign currency debit cards are suitable for those who frequently travel or shop online with foreign currency.

- You can flexibly manage multiple currencies, reducing unnecessary exchange costs.

Note: You need to ensure sufficient foreign currency deposits in your account, or automatic exchanges may incur additional fees.

Credit Cards and ATM Considerations

When using credit cards or ATMs for withdrawals, banks charge additional fees. You should check the relevant fees in advance to avoid unnecessary expenses.

| Card Type | Fee Description |

|---|---|

| General Debit Card | ~USD 2 foreign withdrawal fee per transaction + 1% foreign transaction fee on withdrawal amount |

| Signature Debit Card | ~USD 2 foreign withdrawal fee per transaction + 1.5% foreign transaction fee on withdrawal amount |

Reminder: When spending or withdrawing overseas, you should use foreign currency debit cards or online forex to minimize fees. Credit card transactions incur an additional 1.5% foreign transaction fee, which is costly in the long run.

Money-Saving Tips

Online Banking/Mobile Apps

You can make good use of online banking or mobile apps for bank HKD to JPY exchanges. These platforms are not only convenient but also offer higher transaction limits and flexibility.

- When combining online banking and mobile apps, the daily cumulative limit for foreign currency transfers and remittances can reach up to TWD 3 million equivalent, offering high transaction flexibility.

- Single and daily cumulative exchange transaction limits are up to TWD 500,000 equivalent, suitable for large exchanges.

- There are no limits on exchanges between foreign currencies, offering high flexibility.

- Foreign currency fixed deposits have clear minimum investment amounts, with terms ranging from 1 week to 1 year, facilitating flexible wealth management.

Tip: For large exchanges, it’s recommended to complete branch account opening and counter applications in advance to ensure security.

Rate Alerts

You can set rate alerts, and when bank HKD to JPY rates reach your desired level, the system will notify you instantly. This allows you to seize the best timing and reduce exchange costs.

Split Exchanges

You don’t need to exchange the entire amount at once. You can split exchanges to diversify exchange rate fluctuation risks. This method is suitable for those with long-term JPY needs.

Compare Multiple Services

You should compare real-time rates and fees across different banks, money changers, and online forex services. You can use comparison websites or apps to quickly find the most cost-effective exchange channel.

Reminder: Watch for limited-time offers, cash rebates, and membership programs, which can further help you save.

Considerations

Hidden Fees

When exchanging HKD to JPY, you must be aware of all potential fees. Some banks or money changers may hide costs in exchange rates or charge additional fees after transactions.

Reminder: You should check the official websites of banks or money changers for details on all fees and rates. When using credit cards or ATMs for exchanges, banks typically charge an additional 1% to 1.5% fee. For example, Hong Kong banks’ credit card foreign transaction fees are about 1.5% (calculated at real-time rates).

Exchange Process

You need to understand the operational steps for each exchange channel. Banks usually require you to open a foreign currency account first, then exchange via online banking or apps. Money changers require in-person visits for cash exchanges. Online forex services require online booking, with cash pickup at designated locations.

- You should prepare identification documents and required cash or bank cards in advance.

Amount Limits

When exchanging at banks or money changers, you may encounter minimum or maximum amount restrictions. Hong Kong banks generally require a minimum exchange of USD 100, while some money changers set maximum exchange limits.

| Channel | Minimum Exchange Amount | Maximum Exchange Amount |

|---|---|---|

| Banks | USD 100 | Depends on account type |

| Money Changers | USD 50 | USD 10,000 |

| Online Forex | USD 100 | Depends on platform rules |

Safety Tips

You should be especially careful when carrying large amounts of cash. You can choose locations with high foot traffic for exchanges or go with a companion.

Tip: You should avoid large exchanges in remote locations and securely store cash and documents. Choosing online forex or foreign currency debit cards can reduce the risks of carrying cash.

| Exchange Channel | Advantages | Disadvantages | Usage Recommendations |

|---|---|---|---|

| Bank HKD to JPY | Rates can be locked, suitable for large amounts | May charge fees | Large exchanges, use online banking |

| Credit Card Overseas Spending | Convenient, offers rebates | Foreign transaction fees | Daily spending, check fees first |

| Foreign Currency Money Changers | Friendly service, long hours | Rates may not be optimal | Small cash amounts, compare multiple shops |

You should compare fees, rates, and offers, use rate tools, watch for hidden fees and safety, and choose the exchange method that best suits you.

FAQ

Which channel is the most cost-effective for exchanging HKD to JPY?

You should compare banks, money changers, and online forex. Money changers often waive fees and offer better rates, typically having the lowest costs.

Is there a minimum amount restriction for bank JPY exchanges?

Most Hong Kong banks require you to exchange at least USD 100 per transaction. You should check the specific bank’s regulations.

What are the considerations for online forex cash pickup?

You need to book in advance and collect cash at designated locations. Please bring identification documents and exchange vouchers.

Converting HKD to JPY can be costly due to bank fees (~USD 3) and fluctuating exchange rates, challenging for beginners. BiyaPay offers a cost-effective solution, enabling seamless HKD-to-JPY exchanges with real-time rates and remittance fees as low as 0.5%, beating typical bank charges. Supporting HKD, USD, JPY, and crypto conversions, it suits travel or investment needs.

Compliance-registered as FSP (New Zealand) and MSB (the US), regulated by regulatory authorities of both regions, BiyaPay ensures secure transactions. Set up in minutes for fast, hassle-free exchanges. Join BiyaPay now to save on conversion costs! Sign up today to manage your currencies effortlessly in 2025!

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.