- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

4 Key Factors Behind High or Low GBP Time Deposit Interest Rates

Image Source: pexels

When you choose a GBP time deposit, you cannot focus solely on the surface interest rate. Actual returns are influenced by multiple factors, including market interest rates, central bank policies, exchange rate fluctuations, bank product terms, and fees. Recently, the Bank of England significantly cut interest rates, causing an immediate drop in the GBP to USD exchange rate, demonstrating that interest rate adjustments directly impact the actual returns of GBP time deposits. You should compare based on the following four key factors:

- Market interest rates and central bank policies

- Exchange rate fluctuations

- Bank and product terms

- Fees and related costs

Each factor will be discussed in detail below with specific recommendations to help you compare and choose more comprehensively.

Key Points

- When choosing a GBP time deposit, you should focus on market interest rates and Bank of England policies, as higher rates can yield better returns when opening an account.

- Exchange rate fluctuations affect actual returns, so assess your ability to bear exchange rate risks before depositing, especially for short-term funds.

- Compare deposit terms, minimum deposit amounts, and promotional offers across banks to select the product best suited to your funds and needs.

- Currency conversion fees and handling charges reduce actual returns, so choose banks with low spreads and fees to minimize costs.

- Early withdrawal may result in loss of interest or penalties, so select an appropriate deposit term based on liquidity needs to avoid unnecessary losses.

Market Interest Rates and Central Bank Policies

Image Source: pexels

Market Interest Rates

When choosing a GBP time deposit, you should first understand changes in market interest rates. Market interest rates directly affect the deposit rates offered by banks. Over the past decade, market interest rates have experienced significant fluctuations. You can refer to the table below to understand market interest rate trends over the past decade:

| Year/Date | Interest Rate Range (%) | Trend Description |

|---|---|---|

| Approx. Year 104 (10 years ago) | Approx. 1.5% or higher | Rates were high, at a relative peak |

| Approx. Years 106-107 | Approx. 0.4% to 0.5% | Downward trend in rates began to emerge |

| Approx. Years 108-109 | Approx. 0.5% to 0.6% | Rates remained low and stable |

| Approx. Year 110 | Approx. 0.2% to 0.3% | Rates hit a decade low |

| Approx. Year 111 | Approx. 0.36% to 1.13% | Rates started to recover, showing an upward trend |

| Approx. Years 112-113 | Approx. 1.23% to 1.7% | Rates continued to rise, nearing 1.5% or higher |

| Year 114 (2025) | Approx. 1.6% to 1.9% | Rates rose to a decade high, showing a clear rebound trend |

You will notice that rates sometimes drop significantly and at other times recover quickly. These changes affect the actual returns you get from choosing a GBP time deposit. When market interest rates are high, opening a GBP time deposit typically yields higher interest.

Central Bank Policies

The Bank of England’s policies significantly influence GBP time deposit interest rates. When the Bank of England adjusts its base rate, banks adjust deposit rates based on this benchmark. If the central bank cuts rates, banks usually lower GBP time deposit rates; if it raises rates, banks increase rates. You should also pay attention to policies of major global central banks, such as the U.S. Federal Reserve’s rate decisions, as these indirectly affect GBP market interest rates and exchange rates.

Tip: You should regularly follow market news and central bank announcements, choosing to open a GBP time deposit when rates are higher to boost your deposit returns.

Exchange Rate Fluctuations

Image Source: pexels

Exchange Rate Risks

When considering a GBP time deposit, you must understand exchange rate risks. The GBP often experiences significant fluctuations against other major currencies (e.g., USD, HKD). These fluctuations are influenced by various factors, including UK political events and economic policies. For example, after the 2016 Brexit referendum, the GBP to USD exchange rate fell sharply from about 1.50 to 1.20, a 20% drop. Meanwhile, UK stock markets also saw sharp volatility, reflecting the real impact of exchange rate risks. You can refer to the table below to understand short-term GBP volatility against major currencies:

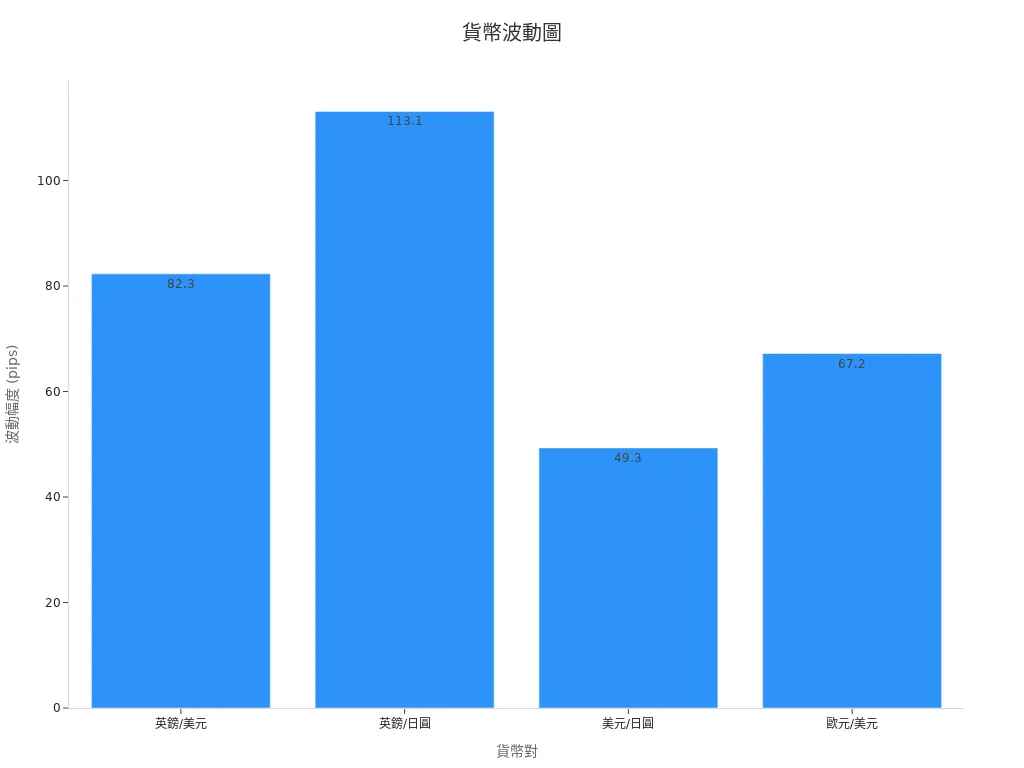

| Currency Pair | Volatility (Dec 6, 2021 - Jan 4, 2022) | Trading Volume (2022, Billion USD) | Trading Volume Share (2022) |

|---|---|---|---|

| GBP/USD | Approx. 82.3 pips | 714 | Approx. 9.5% |

| GBP/JPY | Approx. 113.1 pips | N/A | N/A |

| USD/JPY | Approx. 49.3 pips | 1013 | 13.5% |

| EUR/USD | Approx. 67.2 pips | 1705 | 22.7% |

You will notice that GBP ranks fourth in global forex market trading volume, with significant volatility. This means that when choosing a GBP time deposit, you must assess your ability to bear the risks of substantial exchange rate fluctuations.

Actual Returns

Exchange rate movements directly affect your actual returns when converting back to HKD or USD. Even if you earn high interest on a GBP time deposit, if the GBP depreciates during the deposit period, the HKD or USD you convert back to may decrease. For example, if you deposit at a GBP high and it later falls, your actual returns may be offset by exchange rate losses. Conversely, if the GBP appreciates, your returns increase.

Tip: If you have short-term funding needs, pay special attention to exchange rate fluctuations. You can set a target exchange rate or convert in batches to reduce risks from single-point volatility.

When choosing a GBP time deposit, it’s advisable to first assess your risk tolerance. If you don’t want to bear significant exchange rate risks, consider shorter deposit terms or depositing when rates are relatively stable.

GBP Time Deposit Product Terms

Deposit Terms

When choosing a GBP time deposit, you should first understand the deposit terms offered by different banks. Common terms include 1 month, 3 months, 6 months, and 12 months. Some Hong Kong banks also offer 18 months or longer options. Longer terms typically offer higher interest rates. However, if you anticipate needing funds in the short term, opt for shorter terms to minimize losses from early withdrawal.

Minimum Deposit Amount

Each bank has different minimum deposit requirements for GBP time deposits. Generally, the minimum is around 2,000 GBP, equivalent to about 2,500 USD based on current exchange rates. Some banks require higher minimums, such as 5,000 GBP or 10,000 GBP. You should choose a product based on your available funds. If funds are limited, select a bank with a lower minimum deposit.

Promotional Offers

Many banks periodically launch promotional offers for GBP time deposits. For example, some Hong Kong banks offer higher rates or cash rebates for new funds. You can check bank websites or flyers for the latest promotions. Some banks have no cooling-off period, with interest starting immediately upon account opening, which is beneficial if you want quick returns. However, promotional rates often come with conditions, such as applying only to new funds or specific terms.

Bank Selection

When choosing a GBP time deposit, it’s best to select a bank and currency you’re familiar with. This simplifies account management and reduces currency conversion costs. Hong Kong banks generally support online GBP time deposit opening, allowing you to handle it from home. If you prefer face-to-face service, you can visit a branch. Online processing is typically faster, while branches suit those needing consultation. Choose the method that best fits your needs.

Tip: Compare product terms and promotions across banks to select the GBP time deposit that maximizes your financial efficiency.

Fees and Costs

Currency Conversion Fees

When opening a GBP time deposit, currency conversion fees directly impact your actual returns. Banks typically have a bid and ask price for currency exchange. The bid price is what the bank pays to buy foreign currency from you, and the ask price is what it charges to sell currency to you. The spread between these prices is the bank’s main profit source. Most Hong Kong banks don’t charge additional conversion fees, but the spread affects your final converted amount.

Different banks have varying currency conversion fees and handling charges. Some offer fee-free services, while others charge fixed fees or a percentage of the transaction amount. You can refer to the table below for a snapshot of major banks’ conversion fees (using USD as an example, converted based on prevailing rates):

| Bank Name | Bid Rate Range (USD) | Ask Rate Range (USD) | Fee Type and Rate |

|---|---|---|---|

| Hong Kong Bank A | 1.250 - 1.260 | 1.270 - 1.280 | No handling fee |

| Hong Kong Bank B | 1.255 - 1.265 | 1.275 - 1.285 | USD 3 per transaction |

| Hong Kong Bank C | 1.252 - 1.262 | 1.272 - 1.282 | 0.5% of transaction amount, min. USD 2 |

| Hong Kong Bank D | 1.251 - 1.261 | 1.271 - 1.281 | No fee with account |

Tip: When choosing a bank, compare exchange rates and fees, selecting one with smaller spreads and lower fees to reduce conversion costs and boost GBP time deposit returns.

Early Withdrawal

When opening a GBP time deposit, you must pay attention to early withdrawal rules. Most banks stipulate that withdrawing principal before maturity results in losing all or part of the interest, and some may impose penalties. Certain banks deduct several months’ interest as compensation, significantly reducing your actual returns.

Common early withdrawal costs include:

- Loss of all or part of accrued interest

- Additional penalties (e.g., USD 10-50)

- Requirement for advance notice, with complex procedures

You should choose a deposit term based on your liquidity needs. If you anticipate needing funds soon, avoid overly long terms to prevent losses from early withdrawal.

Note: Early withdrawal significantly reduces your GBP time deposit returns, so carefully read bank terms before opening an account.

When choosing a GBP time deposit, you should evaluate from multiple angles. Market interest rates, exchange rate fluctuations, product terms, and fees all affect your actual returns. Don’t focus only on surface rates. Based on your financial goals, risk tolerance, and liquidity needs, comprehensively compare options to safeguard your interests and achieve optimal returns.

Tip: Do thorough research to choose the best plan for you.

FAQ

Is there a minimum deposit amount for GBP time deposits?

You should note that different Hong Kong banks have varying minimum deposit amounts for GBP time deposits, generally 2,000 GBP, about 2,500 USD, based on the day’s exchange rate.

What are the losses from early withdrawal?

If you withdraw early, you typically lose all or part of the interest. Some banks also charge penalties, ranging from USD 10-50, so review bank terms carefully.

How do exchange rate fluctuations affect actual returns?

When converting GBP back to HKD or USD, if GBP depreciates, your actual returns decrease. Appreciation can boost returns.

How to compare GBP time deposit interest rates?

You can compare rates, promotions, and terms across Hong Kong banks. Also monitor market interest rates and Bank of England policies.

What are the hidden costs of currency conversion?

During conversion, banks have bid-ask spreads. Some also charge handling fees. Compare rates and fees across banks to minimize costs.

GBP fixed deposits in 2025 offer up to 4% rates, but exchange rate volatility and swap fees (USD 2–3) can erode returns. BiyaPay optimizes your investments with a user-friendly platform, offering HKD-to-GBP conversions at just 0.5% remittance fees, beating bank charges. Real-time rates minimize volatility losses, supporting HKD, USD, GBP, and crypto conversions. BiyaPay’s 5.48% annualized return product outpaces standard deposit rates (1.6%–1.9%).

Compliance-registered as FSP (New Zealand) and MSB (the US), regulated by regulatory authorities of both regions, it ensures secure transactions. Set up in minutes to seize high-yield opportunities. Join BiyaPay now to boost your returns! Sign up today to grow your wealth in 2025.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.