- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Comparison of Transfer Fees from Major Hong Kong Banks to Taiwan and Money-Saving Tips

Image Source: unsplash

When you want to compare transfer fees from Hong Kong banks to Taiwan, you can first take a look at the following key points:

- Many Hong Kong banks (such as Bank of East Asia, Standard Chartered, HSBC) have transfer fees ranging from approximately USD 13-116 (based on 1 USD ≈ 7.8 HKD), with telegraph fees around USD 26-65.

- Some banks charge a fixed amount, for example, Bank of East Asia charges USD 52 (handling fee) + USD 52 (telegraph fee); Mizuho Bank’s total fees can reach up to USD 129.

- Standard Chartered calculates fees based on a percentage of the amount, with a minimum of USD 26 and a maximum of USD 104.

- While transferring to Taiwan via Hong Kong ATMs is convenient, you should pay special attention to the fees and restrictions.

Key Points

- Online transfer fees are usually lower than in-branch fees, and choosing online operations can save both money and time.

- Third-party platforms like Wise and Airwallex have low fees, with exchange rates close to market rates, resulting in higher received amounts.

- Traditional bank transfers incur exchange rate differences and correspondent bank fees, which are hidden costs that increase the total cost.

- Transfer speed is generally 1 to 3 working days, and avoiding holidays or cutoff times can speed up the receipt time.

- When choosing a transfer method, you should balance fees, speed, and convenience. For frequent large transfers, consider third-party platforms.

Fee Comparison

Image Source: unsplash

Fee Overview

When choosing a Hong Kong bank or third-party platform to transfer to Taiwan, your primary concern is the handling fees and total cost. The following table summarizes the basic fees of major banks and platforms (based on 1 USD ≈ 7.8 HKD):

| Bank/Platform | Online Transfer Fee (USD) | In-Branch Transfer Fee (USD) | Exchange Rate Difference (Approx.) | Correspondent Bank Fee (USD) | Receiving Bank Fee (USD) | Remarks |

|---|---|---|---|---|---|---|

| Bank of China (Hong Kong) | 15.4 | 33.3 | 1-2% | 10-30 | 7.7-13 | No inbound fee for amounts below 500 HKD |

| HSBC | 16.0 | 4.5 | 1-2% | 10-30 | 8.3 | Inbound fee around 8.3 USD |

| Standard Chartered | 15.4-25.6 | 15.4-25.6 | 1-2% | 10-30 | 0-13 | Priority banking clients may be exempt |

| Citibank | 0 | 12.8-28.2 | 1-2% | 10-30 | 0 | Online transfers are free |

| Hang Seng Bank | 10.9-16.0 | 24.4-34.6 | 1-2% | 10-30 | 0.6 | Very low inbound fees |

| China CITIC Bank | 15.4-25.6 | 15.4-25.6 | 1-2% | 10-30 | 7.7-13 | |

| Wise | 6.4 | Not applicable | 0.4-0.6% | 0 | 0 | Exchange rate close to market rate |

| Airwallex | 0.6-1.3 | Not applicable | 0.2% | 0 | 0 | Primarily for business users |

Tip: When you choose online transfers, the fees are usually lower than in-branch. Some banks, like Citibank, offer free online transfers. Third-party platforms like Wise and Airwallex have significantly lower fees and exchange rate differences, making them suitable for cost-conscious users.

Exchange Rates and Other Fees

In addition to obvious handling fees, you should also pay attention to exchange rate differences and hidden fees. Traditional banks typically add a 1-2% markup to the exchange rate, which, although not listed in the fee table, directly affects the amount received. Correspondent bank fees and receiving bank fees are also hidden costs, especially when your transfer passes through multiple intermediary banks, each of which may charge USD 10-30.

Note: If you choose in-branch transfers, some banks charge higher fees. For example, Bank of China (Hong Kong) charges about USD 33.3 for in-branch transfers, while online transfers cost only USD 15.4. While ATM or postal transfers are convenient, their fees and exchange rates are usually less favorable than online transfers, and there are amount limits.

Actual Transfer Cost Comparison for 10,000 HKD

Assuming you transfer 10,000 HKD (approximately USD 1,282) from Hong Kong, the following is an estimate of the total cost across different channels:

| Channel | Handling Fee (USD) | Exchange Rate Difference (USD) | Correspondent/Receiving Bank Fee (USD) | Total Cost (USD) | Received Amount (USD) |

|---|---|---|---|---|---|

| Bank of China (Hong Kong) Online | 15.4 | 12.8 | 20 | 48.2 | 1,233.8 |

| HSBC Online | 16.0 | 12.8 | 18.3 | 47.1 | 1,234.9 |

| Citibank Online | 0 | 12.8 | 10 | 22.8 | 1,259.2 |

| Hang Seng Online | 10.9 | 12.8 | 10 | 33.7 | 1,248.3 |

| Wise | 6.4 | 5.1 | 0 | 11.5 | 1,270.5 |

| Airwallex | 1.3 | 2.6 | 0 | 3.9 | 1,278.1 |

You can see that the total cost of traditional banks is generally higher than third-party platforms. Wise and Airwallex have minimal exchange rate differences and no intermediary bank fees, resulting in the highest received amounts. If you frequently make cross-border transfers, choosing these platforms will save you money.

Tip: Traditional bank transfers are limited by office hours and cutoff times, which can delay receipt if missed. Third-party platforms like Airwallex use local currency accounts for direct transactions, eliminating intermediary steps, offering faster transfers and lower fees, especially for businesses or frequent transfers.

When choosing a transfer channel, you should make the most suitable choice based on your needs (e.g., fees, speed, convenience). The next section will further break down the fee structures of banks and platforms to help you manage your finances wisely.

Fee Structure

Handling Fees

When transferring to Taiwan through Hong Kong banks or third-party platforms, the first fee you encounter is the handling fee. This fee covers the bank’s operational costs, mainly for office, personnel, and system maintenance. According to market data, the operational expense ratio is about 10%, which is reflected in the fixed or proportional handling fees you pay for each transfer.

Some banks charge different amounts based on the channel you choose (e.g., online, in-branch, ATM). For example, online transfers are usually cheaper, while in-branch transfers are more expensive due to manual services. If you are a high-net-worth client, you may be eligible for fee waivers or discounts.

Tip: Choosing online transfers offers the most cost-effective fees. Some banks, like Citibank, even offer free online transfer fees.

Exchange Rate Differences

When you transfer money, the bank converts HKD to TWD based on the daily exchange rate. Banks typically add a 1-3% markup to the market rate, which is a currency conversion fee. This fee is not explicitly shown in the fee column but affects the amount received.

For example, when transferring 10,000 HKD, the bank may use a lower exchange rate, resulting in fewer TWD than expected. This exchange rate difference is part of the bank’s administrative costs, with data showing an administrative expense ratio of about 2.14% to 3.11%, meaning banks pass some operational costs to you.

Note: Third-party platforms like Wise and Airwallex have lower exchange rate differences, closer to market rates, resulting in higher received amounts.

Correspondent and Receiving Bank Fees

When using traditional banks for cross-border transfers, funds often pass through one or more correspondent banks. Each correspondent bank may charge USD 10-30. The receiving bank may also charge an inbound fee of USD 7.7-13. These fees are indirect costs, similar to operational and administrative expenses.

If you choose third-party platforms, you can usually avoid these intermediary bank fees, saving significant costs.

| Fee Type | Fee Range | Description |

|---|---|---|

| Operational Expense Ratio | Approx. 10% | Includes handling fees and indirect costs |

| Administrative Expense Ratio | 2.14% to 3.11% | Reflected in exchange rate differences |

| Correspondent Bank Fee | USD 10-30 per transaction | May be charged by each intermediary bank |

| Receiving Bank Fee | USD 7.7-13 per transaction | Charged by the receiving bank upon deposit |

Tip: For large or frequent transfers, choose platforms with transparent fees and exchange rates close to market rates to reduce intermediary bank fees and improve receipt efficiency.

HSBC

Online and In-Branch Transfers

You can choose HSBC’s online or in-branch services to transfer money to Taiwan. The handling fees for the two methods differ significantly:

- Online transfer fees are approximately USD 6.4 (HKD 50, based on 1 USD ≈ 7.8 HKD).

- In-branch transfer fees range from USD 15.4 to 30.8 (HKD 120 to 240).

- The receiving bank in Taiwan (e.g., CTBC Bank) may charge an inbound fee of up to USD 12.8 (TWD 400).

- Taiwan banks’ transfer fees typically have a cap, ranging from USD 25.6 to 28.2 (TWD 800 to 900).

- You can choose whether the fees are deducted from the transfer amount or paid separately, depending on your agreement with the recipient.

Online operations are more convenient and cost less. In-branch services are suitable if you need face-to-face assistance but are more expensive.

Tip: If you encounter requests to transfer large sums (e.g., USD 30,000 or equivalent TWD), stay vigilant, as this may involve scams. Contact the receiving bank branch directly to verify the transfer’s authenticity.

Receipt Time

When using HSBC to transfer to Taiwan, funds generally arrive within 1 to 3 working days. Online transfers are usually faster, while in-branch transfers may be slightly delayed due to processing or cutoff times. If you complete the transfer before the cutoff time, funds may arrive the same or next day. During holidays or weekends, processing times may be extended.

Note: The actual receipt time depends on the processing speed of intermediary banks and the Taiwan receiving bank. For urgent transfers, use online transfers and avoid holidays.

Pros and Cons

When choosing HSBC to transfer to Taiwan, here are the pros and cons:

| Pros | Cons |

|---|---|

| Low online transfer fees | Higher in-branch transfer fees |

| Simple operation, supports multiple currencies | Exchange rate difference of about 1-2%, affecting received amount |

| High security, strong brand reputation | Correspondent and receiving banks may charge additional fees |

| Stable receipt time | Transfers after cutoff or during holidays may be delayed |

If you value security, stability, and brand reputation, HSBC is a reliable choice. If you prioritize low costs and high efficiency, consider third-party platforms.

Bank of China (Hong Kong)

Online and In-Branch Transfers

You can transfer to Taiwan through Bank of China (Hong Kong)’s online banking or in-branch services. Online transfer fees are lower, about USD 15.4, while in-branch transfers cost around USD 33.3. For online transfers, you only need to log into online banking, select “overseas transfer,” and enter the Taiwan recipient’s details and amount. In-branch transfers require identification documents and recipient details, with staff assistance to complete the process.

Note that both online and in-branch transfers involve a 1-2% exchange rate difference. Additionally, correspondent banks and Taiwan receiving banks may charge additional fees of USD 10-30.

Tip: Choosing online transfers not only saves on fees but also allows you to operate anytime, anywhere, saving time and convenience.

Receipt Time

When using Bank of China (Hong Kong) to transfer to Taiwan, funds generally arrive within 1 to 3 working days. Online transfers are usually faster, while in-branch transfers may be slower due to processing time. If you complete the transfer before the cutoff time, funds may arrive the next day. During weekends or public holidays, processing times will be extended.

Note that the processing speed of intermediary banks and the Taiwan receiving bank will also affect the final receipt time.

Pros and Cons

| Pros | Cons |

|---|---|

| Low online transfer fees | Higher in-branch transfer fees |

| Simple operation, supports multiple currencies | Exchange rate difference of about 1-2%, affecting received amount |

| Secure and reliable, strong brand reputation | Correspondent and receiving banks may charge additional fees |

| Stable receipt time | Transfers after cutoff or during holidays may be delayed |

If you value security and stability, Bank of China (Hong Kong) is a good choice. If you prioritize low costs and high efficiency, consider third-party platforms.

Hang Seng Bank

Handling Fees

When choosing Hang Seng Bank to transfer to Taiwan, you can use online banking or visit a branch. Online transfer fees range from USD 10.9 to 16.0 (approximately HKD 85 to 125), while in-branch transfers cost USD 24.4 to 34.6 (approximately HKD 190 to 270). Online operations have lower fees, making them suitable for cost-conscious users.

Hang Seng Bank’s exchange rate difference is about 1-2%. Note that correspondent bank fees are around USD 10 to 30, while receiving bank fees are very low, about USD 0.6.

Tip: For frequent transfers, choose online banking to save on fees.

Receipt Time

When using Hang Seng Bank to transfer to Taiwan, funds generally arrive within 1 to 3 working days. Online transfers are usually faster, while in-branch transfers may be slower due to processing time. If you complete the transfer before the cutoff time, funds may arrive the next day. During weekends or public holidays, processing times will be extended.

Note: The processing speed of correspondent banks and the Taiwan receiving bank will affect the final receipt time.

Pros and Cons

| Pros | Cons |

|---|---|

| Low online transfer fees | Higher in-branch transfer fees |

| Very low receiving bank fees | Exchange rate difference of about 1-2%, affecting received amount |

| Simple operation, supports multiple currencies | Correspondent banks may charge additional fees |

| Stable receipt time | Transfers after cutoff or during holidays may be delayed |

If you value low receiving bank fees and online convenience, Hang Seng Bank is a good choice. If you seek minimal total costs, compare third-party platform options.

Citibank

Handling Fees

When choosing Citibank to transfer to Taiwan, online transfer fees are USD 0, a major advantage. In-branch transfers cost USD 12.8 to 28.2 (based on 1 USD ≈ 7.8 HKD). Note that the bank adds a 1-2% exchange rate difference. Correspondent bank fees are around USD 10 to 30, while receiving bank fees are typically USD 0. Frequent use of online banking can significantly save costs.

| Transfer Method | Handling Fee (USD) | Exchange Rate Difference | Correspondent Bank Fee (USD) | Receiving Bank Fee (USD) |

|---|---|---|---|---|

| Online Transfer | 0 | 1-2% | 10-30 | 0 |

| In-Branch Transfer | 12.8-28.2 | 1-2% | 10-30 | 0 |

Tip: Choosing online transfers with no fees is ideal for cost-conscious users.

Receipt Time

When using Citibank’s online transfers, funds generally arrive within 1 to 3 working days. If you operate before the cutoff time, funds may arrive the next day. In-branch transfers have similar processing times but may be delayed during holidays or weekends. Note that the processing speed of correspondent banks and the Taiwan receiving bank will affect the final receipt time.

- Online Transfer: 1-3 working days

- In-Branch Transfer: 1-3 working days

- Holidays or Weekends: Processing time will be extended

Note: For urgent transfers, avoid holidays and post-cutoff times.

Pros and Cons

When choosing Citibank to transfer to Taiwan, here are the pros and cons:

| Pros | Cons |

|---|---|

| No online transfer fees | Higher in-branch transfer fees |

| Simple operation, supports multiple currencies | Exchange rate difference of about 1-2%, affecting received amount |

| Stable receipt time | Correspondent banks may charge additional fees |

| Strong brand reputation, secure and reliable | Transfers after cutoff or during holidays may be delayed |

If you value low costs and online convenience, Citibank is an ideal choice. If you need in-person services, consider the higher in-branch fees.

Standard Chartered

Handling Fees

When choosing Standard Chartered to transfer to Taiwan, you can use online banking or visit a branch. Online transfer fees range from USD 15.4 to 25.6 (based on 1 USD ≈ 7.8 HKD), with in-branch fees being the same. Standard Chartered charges proportional fees based on the transfer amount, with a minimum of USD 26 and a maximum of USD 104. Note that the bank adds a 1-2% exchange rate difference. Correspondent bank fees are around USD 10 to 30, while receiving bank fees range from USD 0 to 13. As a priority banking client, you may be eligible for fee exemptions.

Tip: For frequent transfers, check if you qualify for priority banking to save on fees.

Receipt Time

When using Standard Chartered to transfer to Taiwan, funds generally arrive within 1 to 3 working days. Online transfers are usually faster, while in-branch transfers may be slower due to processing time. If you complete the transfer before the cutoff time, funds may arrive the next day. During weekends or public holidays, processing times will be extended. The processing speed of correspondent banks and the Taiwan receiving bank will also affect the final receipt time.

Pros and Cons

| Pros | Cons |

|---|---|

| Consistent online and in-branch transfer fees | Exchange rate difference of about 1-2%, affecting received amount |

| Supports multiple currencies, simple operation | Correspondent and receiving banks may charge additional fees |

| Priority banking clients may be exempt from fees | Transfers after cutoff or during holidays may be delayed |

| Strong brand reputation, secure and reliable | Fee structure is complex, requiring careful comparison |

If you value bank branding and security, Standard Chartered is a solid choice. If you prioritize low costs and high efficiency, compare third-party platform options.

China CITIC Bank

Handling Fees

When choosing China CITIC Bank to transfer to Taiwan, you can use online banking or visit a branch. Online transfer fees range from USD 15.4 to 25.6 (based on 1 USD ≈ 7.8 HKD), with in-branch fees being the same. During the operation, the bank adds a 1-2% exchange rate difference. Note that correspondent bank fees are around USD 10 to 30, while receiving bank fees range from USD 7.7 to 13. These fees directly affect the amount received.

Tip: For frequent transfers, check if China CITIC Bank offers fee waivers for high-net-worth clients.

Receipt Time

When using China CITIC Bank to transfer to Taiwan, funds generally arrive within 1 to 3 working days. Online transfers are usually faster, while in-branch transfers may be slower due to processing time. If you complete the transfer before the cutoff time, funds may arrive the next day. During weekends or public holidays, processing times will be extended. Note that the processing speed of correspondent banks and the Taiwan receiving bank will affect the final receipt time.

- Online Transfer: 1-3 working days

- In-Branch Transfer: 1-3 working days

- Holidays or Post-Cutoff: Processing time will be extended

Pros and Cons

When choosing China CITIC Bank to transfer to Taiwan, here are the pros and cons:

| Pros | Cons |

|---|---|

| Consistent online and in-branch transfer fees | Exchange rate difference of about 1-2%, affecting received amount |

| Simple operation, supports multiple currencies | Correspondent and receiving banks may charge additional fees |

| Strong brand reputation, secure and reliable | Transfers after cutoff or during holidays may be delayed |

If you value bank branding and security, China CITIC Bank is a solid choice. If you prioritize low costs and high efficiency, compare third-party platform options.

Hong Kong ATM Transfers to Taiwan

Image Source: unsplash

Operation Process

If you want to use a Hong Kong ATM to transfer to Taiwan, first confirm that your bank card supports cross-border transfer functions. Most Hong Kong bank ATM cards can perform cross-border transfers under the “UnionPay” or “PLUS” networks. However, you need to activate the overseas transfer function through online banking or at a branch first.

You can follow these steps:

- Insert your bank card and select the language.

- Choose “Cross-Border Transfer” or “Overseas Remittance.”

- Enter the Taiwan receiving bank’s branch code, account number, and amount.

- Confirm the details and complete the transfer.

Note that not all Taiwan banks support ATM deposits. It’s best to confirm with the recipient whether their bank accepts Hong Kong ATM transfers to Taiwan.

Tip: Test with a small amount first to ensure the funds arrive smoothly.

Fees and Restrictions

When using a Hong Kong ATM to transfer to Taiwan, the bank charges a fixed handling fee, typically USD 10-30 per transaction (based on 1 USD ≈ 7.8 HKD). Some banks also add a 1-2% exchange rate difference. There is a daily transfer limit, usually not exceeding USD 1,000.

Additionally, the Taiwan receiving bank may charge an inbound fee of about USD 5-10. Funds generally arrive within 1-3 working days, but delays may occur during holidays.

| Item | Fee (USD) | Restriction |

|---|---|---|

| ATM Handling Fee | 10-30 | Daily limit of USD 1,000 |

| Exchange Rate Difference | 1-2% | Based on the bank’s daily rate |

| Receiving Bank Fee | 5-10 | Depends on Taiwan bank policy |

| Receipt Time | None | 1-3 working days, delayed during holidays |

If you consider using Hong Kong Post for transfers to Taiwan, you can visit a post office. Fees are about USD 15-25, but the amount limit is lower, and processing takes longer, typically 3-7 working days. Bring identification and recipient details.

Note: Hong Kong ATM transfers to Taiwan are suitable for small, occasional transfers. For large or frequent transfers, choose online banking or third-party platforms for lower fees and faster speeds.

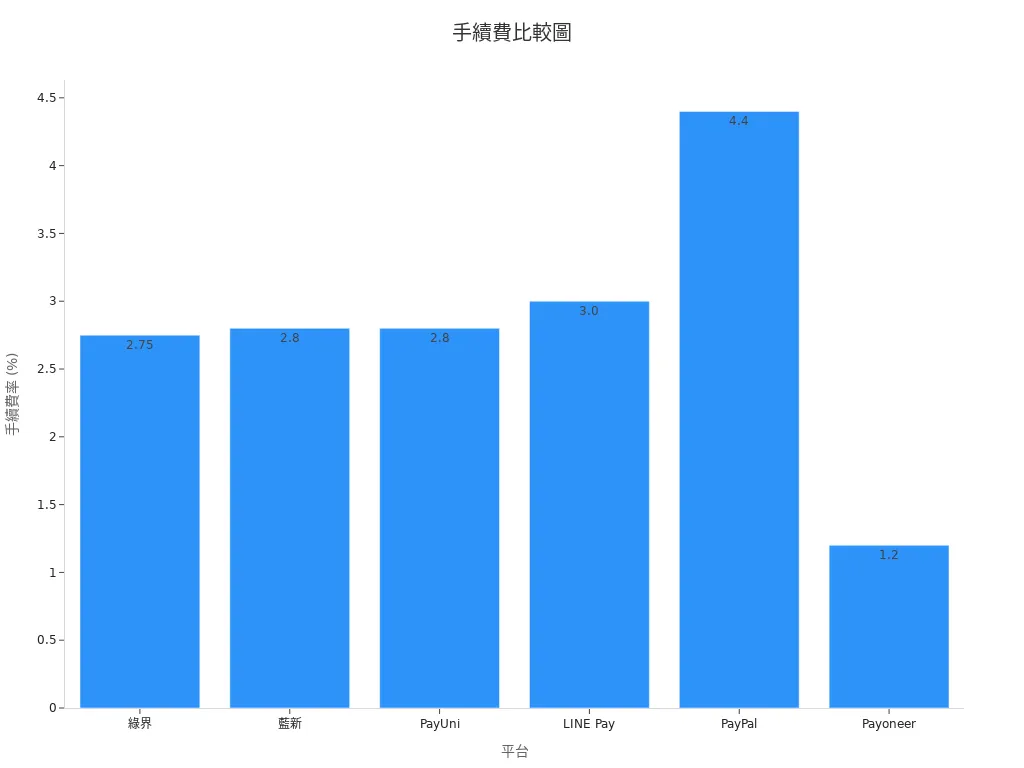

Third-Party Platforms

Wise

If you use Wise to transfer to Taiwan, you can enjoy low fees and exchange rates close to the market rate. Wise transparently displays all fees with no hidden charges. You only need to register an account online, enter the recipient’s details and amount, and the system will instantly calculate the received amount. Wise’s exchange rate difference is typically only 0.4-0.6%, much lower than traditional banks. Transfers are usually completed within 1 to 2 working days, with a simple and quick process. Wise supports multiple currencies, making it suitable for frequent cross-border transfers.

Airwallex

If you are a business user, Airwallex is another efficient option. Airwallex charges no account opening or monthly fees, with handling fees as low as USD 0.6-1.3. You can enjoy interbank exchange rates plus a 0.2% surcharge, saving about 80% compared to traditional banks. Airwallex supports local channel transfers, with 95% of funds arriving on the same day, and at most within 1 working day. You can also process multiple transfers in bulk, saving time and money. Airwallex is ideal for those needing frequent large or multiple international payments.

Comparison with Banks

You can refer to the table below to compare the main differences between traditional bank wire transfers, Airwallex, and Wise:

| Comparison Item | Traditional Bank Wire Transfer | Airwallex | Wise (Indirect Reference) |

|---|---|---|---|

| Handling Fee | Fixed fees + intermediary bank fees, higher | No hidden fees, no account opening or monthly fees | Low fees, no hidden charges |

| Exchange Rate | Higher rates, greater cost | Interbank rate + 0.2% surcharge, saves ~80% | Rates close to market, low difference |

| Receipt Time | 1-5 working days, subject to cutoff restrictions | 95% same-day arrival, fastest 1 working day | Usually 1-2 working days |

| Other Advantages | Secure and reliable | Supports local channels, bulk payments, simple process | Multi-currency, convenient operation |

You’ll find that third-party platforms not only save money but also simplify the process. According to user surveys, 41% of consumers abandon transactions due to hidden fees at checkout, so choosing transparent platforms enhances trust. If you prioritize efficiency and low costs, Wise and Airwallex are more ideal choices.

Money-Saving Tips

Choosing a Transfer Method

To reduce transfer costs, prioritize online operations. Hong Kong banks’ online transfer fees are typically lower than in-branch fees. For example, online transfers to Taiwan cost about USD 6 to 16 (based on 1 USD ≈ 7.8 HKD), while in-branch transfers may exceed USD 30. Choosing third-party platforms like Wise or Airwallex offers even lower fees and smaller exchange rate differences. Transferring larger amounts at once can spread out handling fees, making it more cost-effective overall. Frequent small transfers accumulate higher fees.

Tip: Choosing online transfers and third-party platforms saves time and money while being more convenient.

Avoiding Hidden Fees

Before transferring, review all fee details carefully. Traditional banks charge not only obvious handling fees but also exchange rate differences and correspondent bank fees. These fees are not shown in the fee table but affect the received amount. Choose transparent platforms like Wise, which clearly list all charges. When using Hong Kong banks, inquire about additional correspondent and receiving bank fees, typically USD 10 to 30 per transaction. Ask about all fees to avoid receiving less than expected.

Transfer Timing

Your choice of transfer timing also affects costs. Avoid weekends and public holidays, as bank processing times extend, potentially delaying receipt. Operate on weekday mornings for faster arrivals in Taiwan. Monitor exchange rate fluctuations and transfer when rates are favorable to get more TWD. If not urgent, track market exchange rate trends to choose the most advantageous time.

Tip: Planning transfer timing in advance reduces waiting and unnecessary fees, improving fund efficiency.

If you seek the lowest fees, Wise and Airwallex are the best choices. If you value security and branding, consider Hong Kong banks’ online transfers. For occasional small transfers, Hong Kong ATM transfers to Taiwan are convenient. Compare fees, exchange rates, and receipt times to choose the best method for you. Feel free to share your experiences or ask questions in the comments.

FAQ

How much is the cheapest transfer from a Hong Kong bank to Taiwan?

Using third-party platforms like Wise, fees are as low as USD 6.4 (based on 1 USD ≈ 7.8 HKD), with lower exchange rate differences. Traditional bank online transfers generally cost USD 10.9 to 16.0.

How fast can a transfer to Taiwan arrive?

With Wise or Airwallex, transfers can arrive as fast as 1 working day. Hong Kong bank online transfers typically take 1 to 3 working days. Holidays or weekends may cause delays.

Is there a transfer amount limit?

ATM transfers have a daily limit of about USD 1,000. Online banking or third-party platforms’ single or daily limits depend on bank policies, so check in advance.

How do exchange rate differences affect the received amount?

When transferring, banks use lower exchange rates, reducing the received amount. Third-party platforms’ rates are closer to market rates, allowing you to receive more TWD.

Are third-party platform transfers safe?

Platforms like Wise and Airwallex are internationally regulated with transparent fund flows. You can review transaction records to ensure fund safety.

In 2025, cross-border transfers face high fees and exchange risks, with investments requiring multi-account management and overseas account setups, adding complexity. BiyaPay simplifies transfers and investments with a single account for US and Hong Kong stocks, including ETFs, without needing overseas accounts. International transfers cost just 0.5%, with real-time market rate conversions to minimize losses. Online account opening takes minutes, avoiding high fees.

BiyaPay’s 5.48% annualized return product outperforms bank deposits, boosting idle funds. Compliant in New Zealand (FSP) and U.S. (MSB), supervised by regulators. Join BiyaPay now to optimize transfers and investments! Sign up today to grow your wealth in 2025!

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.