- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

2025 Hong Kong Bank Prime Rate Comparison: How Does Bank of Communications Perform?

Image Source: pexels

When you choose a Hong Kong bank, time deposit rates and prime rates are key considerations. According to June 2025 data, traditional banks like Fubon Bank offer a 1-year time deposit rate of 2.10%, while Bank of Communications’ prime rate is only 5.5%, with time deposit rates ranging from 0.10% to 0.40%, which is at a mid-to-low level. Virtual banks like ZA Bank offer a 1-year time deposit rate as high as 2.31%, with a minimum deposit amount far lower than traditional banks. You can refer to the table below to quickly compare the rate performance of major banks:

| Bank Name | 1-Month Rate | 3-Month Rate | 6-Month Rate | 1-Year Rate | Minimum Deposit (USD) |

|---|---|---|---|---|---|

| Bank of Communications | 0.40% | 0.10% | N/A | N/A | ~64,000 |

| Fubon Bank | 0.60% | 1.10% | 1.60% | 2.10% | ~128,000 |

| ZA Bank | 0.10% | 0.51% | 1.61% | 2.31% | 0.13 |

Bank of Communications’ prime rate and time deposit rates are in the mid-to-lower range in the market. If you seek high returns, virtual banks or other traditional banks offer more options.

Key Points

- Bank of Communications’ prime rate in 2025 is 5.5%, with time deposit rates ranging from 0.10% to 0.40%, among the lower levels for traditional banks.

- Virtual banks like Fusion Bank and Mox Bank offer higher rates (up to 6.00%) and lower deposit thresholds, suitable for those seeking high returns and flexible funds.

- When choosing a bank, pay attention to rate announcements, minimum deposit amounts, and early withdrawal penalties to avoid losing interest due to restrictive terms.

- Bank of Communications’ strengths lie in its extensive branch network and stable services, ideal for those who value brand and service reliability.

- Based on your capital size and financial goals, rationally compare different bank products, allocate assets flexibly, and enhance financial returns.

Rate Comparison

Image Source: pexels

Bank Rankings

When you choose a bank, the prime rate (P-prime, Big P, Small P) directly affects mortgage interest expenses. In 2025, the prime rates of major Hong Kong banks are as follows:

| Bank Name | Big P (%) | Small P (%) | P-Prime (%) |

|---|---|---|---|

| HSBC | 5.875 | 5.625 | 5.625 |

| Hang Seng Bank | 5.875 | 5.625 | 5.625 |

| Bank of China Hong Kong | 5.875 | 5.625 | 5.625 |

| Standard Chartered Bank | 5.875 | 5.625 | 5.625 |

| Bank of Communications | 5.50 | 5.50 | 5.50 |

| Fusion Bank | 6.00 | 6.00 | 6.00 |

| Mox Bank | 6.00 | 6.00 | 6.00 |

You can see that Bank of Communications’ prime rate is 5.5%, among the lower levels for traditional banks. Fusion Bank and Mox Bank offer a high P-prime of 6.00%, more attractive for those seeking high returns.

Time Deposit Rates

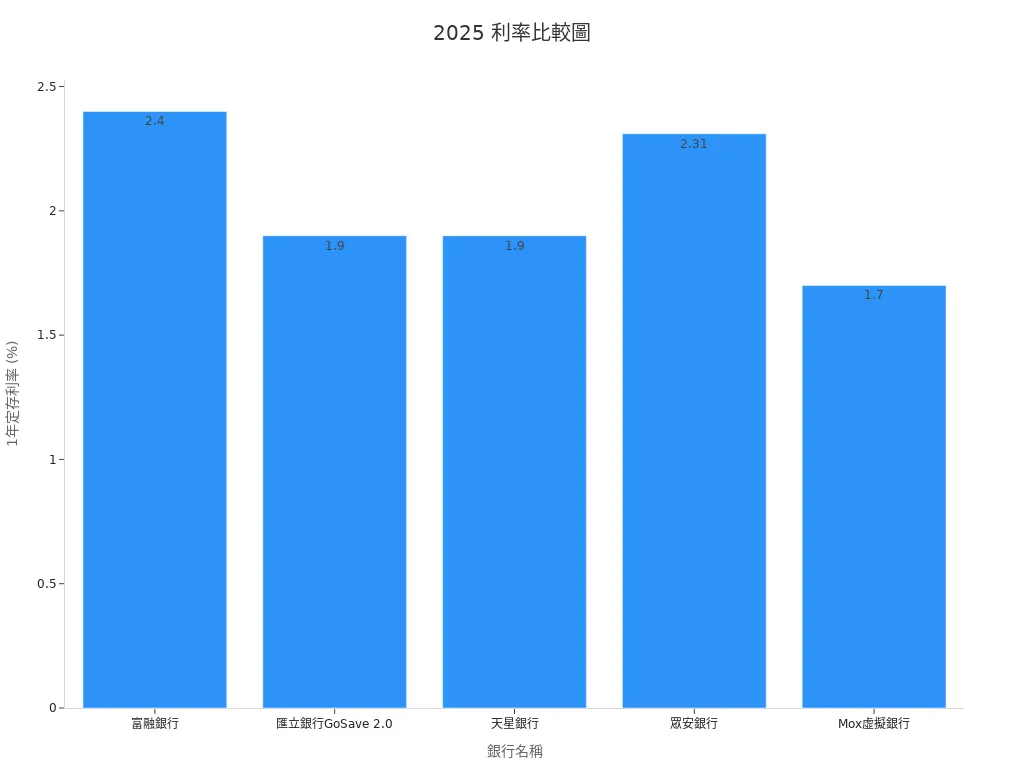

Time deposit rates directly impact your savings returns. You can refer to the table below to understand the time deposit rates of major banks in 2025:

| Bank Name | 1-Month Rate | 3-Month Rate | 6-Month Rate | 1-Year Rate | Minimum Deposit (USD) |

|---|---|---|---|---|---|

| Bank of Communications | 0.40% | 0.10% | N/A | N/A | ~64,000 |

| Fubon Bank | 0.60% | 1.10% | 1.60% | 2.10% | ~128,000 |

| ZA Bank | 0.10% | 0.51% | 1.61% | 2.31% | 0.13 |

| Fusion Bank | 1.20% | 1.80% | 2.00% | 2.50% | 0.13 |

| Mox Bank | 1.10% | 1.70% | 2.00% | 2.40% | 0.13 |

- You will notice that Bank of Communications’ time deposit rates range from 0.10% to 0.40%, far lower than virtual banks like Fusion Bank and Mox Bank. These virtual banks not only offer higher rates but also have extremely low minimum deposit amounts, suitable for those with limited fund flexibility.

- When choosing a bank, you should note that rate announcements come from official bank websites, with highly reliable data. Banks detail rate calculation methods, applicable conditions, fund source restrictions, and total promotional quotas in their announcements. These regulations ensure the information you receive is transparent and compliant with legal requirements.

- Banks also clearly specify the rate application period, interest calculation method, tax withholding, and promotion termination conditions. You can confidently use this data to make financial decisions.

Pro Tip: New fund definitions and fund flows have strict restrictions, and banks limit total promotional quotas and transaction counts, potentially terminating promotions early if limits are reached. You should closely monitor bank announcements to avoid missing high-rate offers.

Bank of Communications Prime Rate

Rate Details

When choosing a bank, prime rates and time deposit rates are important reference points. In 2025, Bank of Communications’ prime rate (P-prime) is 5.5%, among the lower levels for traditional banks. For time deposit rates, Bank of Communications offers 0.10% to 0.40%, significantly below the market average. You need to note that Bank of Communications’ minimum deposit threshold is approximately USD 64,000, which may pose a higher barrier for those with smaller capital.

| Year | Bank Code | Rate (%) | Rate Change (%) | Rate Difference | Market Performance Index |

|---|---|---|---|---|---|

| 2001 | 2801 (Other Bank) | ~4.06 | -43.49 | 47.55 | 5.95 |

| 2001 | 2802 (Other Bank) | ~4.86 | -47.95 | 52.81 | 3.76 |

| 2001 | 2803 (Bank of Communications) | ~6.52 | -19.50 | 26.02 | 3.90 |

| 2002 | 2801 (Other Bank) | ~-68.69 | -99.88 | 31.19 | 4.32 |

| 2002 | 2802 (Other Bank) | ~-61.35 | 8.40 | -69.75 | 2.28 |

| 2002 | 2803 (Bank of Communications) | ~-74.01 | -48.89 | -25.12 | 1.97 |

| 2003 | 2801 (Other Bank) | ~9.13 | -20.43 | 29.56 | 3.95 |

| 2003 | 2802 (Other Bank) | ~-40.41 | 5.67 | -46.08 | 0.91 |

| 2003 | 2803 (Bank of Communications) | ~28.15 | 29.12 | -0.97 | 1.16 |

You will notice that Bank of Communications’ prime rate has fluctuated significantly across years, with varying market performance indices. In 2025, Bank of Communications has not launched particularly high-rate promotional activities, maintaining time deposit rates at a lower level. If you seek high returns, you may consider virtual banks like Fusion Bank or Mox Bank, which generally offer time deposit rates above 2% with minimum deposits as low as USD 0.13, providing greater flexibility.

Pro Tip: When choosing Bank of Communications, pay special attention to its rate announcements and promotional activities, as rate changes directly impact your financial returns.

Strengths and Weaknesses

When you choose Bank of Communications, you can benefit from its extensive branch network and well-established service system. Bank of Communications has multiple branches in Hong Kong, offering multilingual customer service to facilitate your daily banking needs. You can also use online banking and mobile apps to check account information and make transfers anytime, improving financial efficiency.

However, Bank of Communications’ prime rate and time deposit rates are relatively low, a key drawback you need to consider. If you aim for higher deposit returns, Bank of Communications may not be the best choice. In recent years, virtual banks like Fusion Bank and Mox Bank offer higher time deposit rates and lower deposit thresholds, making them more attractive for those with limited fund flexibility. Additionally, Bank of Communications lacks high-rate promotional activities, resulting in weaker market competitiveness.

- Strengths of choosing Bank of Communications:

- Extensive branch network, stable services

- Multilingual customer service, high support level

- Convenient online and mobile banking platforms

- Weaknesses to note:

- Bank of Communications’ prime rate and time deposit rates are below market average

- Limited high-rate promotions, modest returns

- High deposit threshold, less suitable for those with smaller, flexible funds

Tip: When choosing a bank, evaluate whether Bank of Communications’ prime rate meets your needs based on your capital size and financial goals. If you seek high returns and flexibility, compare products from different banks.

Major Bank Comparison

Image Source: pexels

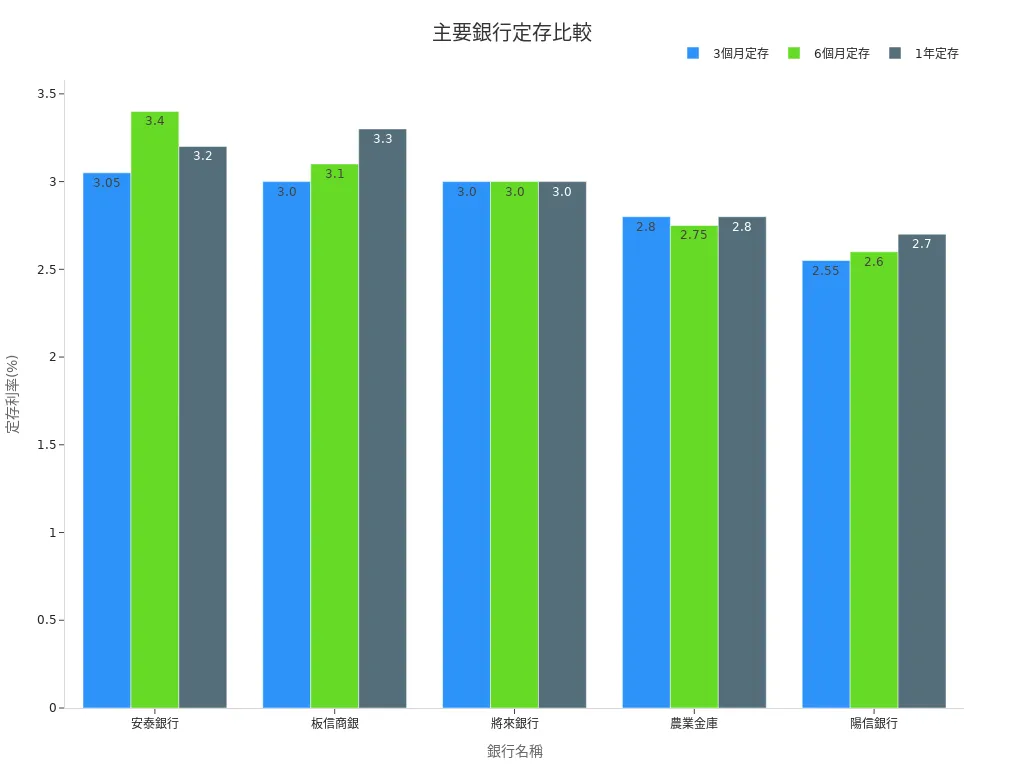

HSBC

When you choose HSBC, you benefit from its stable brand and comprehensive service network. In 2025, HSBC’s prime rate (P-prime) is 5.625%, a mainstream level among traditional banks. For time deposit rates, the 1-year rate is around 1.80%, slightly higher than Bank of Communications. HSBC’s minimum deposit amount is higher, suitable for those with ample funds. HSBC often offers new fund promotions, but rates change quickly, so you need to closely monitor official announcements.

Hang Seng Bank

Hang Seng Bank’s prime rate aligns with HSBC at 5.625%. If you choose Hang Seng, you’ll find its 1-year time deposit rate is about 1.85%, slightly higher than HSBC. Hang Seng has a dense branch network and high service quality. You can easily manage deposits through its online banking platform. Hang Seng occasionally offers short-term high-rate time deposit promotions for new clients, ideal for flexible fund allocation.

Bank of China Hong Kong

Bank of China Hong Kong’s prime rate is also 5.625%. When you open a time deposit with Bank of China, the 1-year rate is around 1.90%, among the higher levels for traditional banks. Bank of China’s minimum deposit threshold is similar to HSBC and Hang Seng. You can leverage Bank of China’s multi-currency services to flexibly allocate USD and HKD assets. Bank of China also periodically launches high-rate time deposit promotions to attract short-term growth.

Standard Chartered Bank

Standard Chartered Bank’s prime rate is 5.625%. When you choose Standard Chartered, you’ll find its 1-year time deposit rate is about 1.95%, among the higher levels for traditional banks. Standard Chartered’s online banking features are robust, allowing you to check rates and manage deposits anytime. Standard Chartered sometimes offers rate-boosting promotions for specific client groups, suitable for flexible fund use.

Fusion Bank and Mox Bank

If you seek high returns, Fusion Bank and Mox Bank are the most noteworthy options in 2025. These virtual banks offer prime rates as high as 6.00%, significantly above traditional banks. Their 1-year time deposit rates are 2.50% and 2.40%, respectively, with minimum deposits as low as USD 0.13, offering high fund flexibility. You can open time deposits anytime via their mobile apps, enjoying instant high returns. Fusion and Mox frequently offer exclusive promotions for new funds, ideal for short-term operations and flexible fund allocation.

You can refer to the table below to quickly compare the time deposit rate differences among major banks:

| Bank Name | 3-Month Time Deposit Rate (%) | 6-Month Time Deposit Rate (%) | 1-Year Time Deposit Rate (%) |

|---|---|---|---|

| HSBC | 1.20 | 1.50 | 1.80 |

| Hang Seng | 1.25 | 1.55 | 1.85 |

| Bank of China | 1.30 | 1.60 | 1.90 |

| Standard Chartered | 1.35 | 1.65 | 1.95 |

| Fusion Bank | 1.80 | 2.00 | 2.50 |

| Mox Bank | 1.70 | 2.00 | 2.40 |

| Bank of Communications | 0.10 | 0.40 | N/A |

You can see that Fusion Bank and Mox Bank’s time deposit rates are significantly higher than traditional banks. If you have limited fund flexibility, these virtual banks are more suitable for you. Traditional banks are better for those seeking stable services and brand reliability.

Selection Tips

Precautions

When choosing a bank, you should first understand all rate details. Prime rates and time deposit rates vary significantly across banks. Pay special attention to the following:

- Banks adjust rates periodically, so check official announcements regularly.

- Some high-rate promotions apply only to new funds or new clients, so review terms carefully.

- Minimum deposit requirements differ, e.g., Bank of Communications requires ~USD 64,000, while virtual banks require as little as USD 0.13.

- When rates are announced, banks specify the applicable period and interest calculation method; ensure you qualify.

Pro Tip: Compare multiple banks’ rates and terms to avoid focusing only on headline figures.

Penalties and Terms

When choosing a time deposit, you must understand early withdrawal penalties and related terms. Different banks handle early termination differently:

- Most banks charge early withdrawal penalties, which may be based on the deposit term or principal proportion.

- Some banks cancel all interest and return only the principal.

- Promotional rates often have total quotas, and banks may terminate offers early if limits are reached.

| Bank Name | Early Withdrawal Penalty | Interest Handling |

|---|---|---|

| Bank of Communications | May charge penalty | Cancels all interest |

| Fusion Bank | Lower penalty | Calculates interest based on actual term |

| Mox Bank | No penalty | Interest calculated daily |

You should carefully read all terms before opening an account to avoid losing interest due to early withdrawal.

Personal Choices

When choosing a bank, make decisions based on your financial goals and risk tolerance. If you value stability and brand reliability, traditional banks like HSBC, Hang Seng, and Bank of China are more suitable. If you seek higher returns and flexible deposits, virtual banks like Fusion Bank and Mox Bank are more appealing.

- Assess your capital size and liquidity needs.

- Choose bank products based on short- or long-term financial goals.

- Consider your risk tolerance to avoid overlooking restrictive terms in pursuit of high returns.

Pro Tip: Adjust asset allocation flexibly based on your situation and choose the bank and product that best suits you.

When choosing a bank, you’ll find that Bank of Communications’ prime rate is among the lower levels for traditional banks. You can enjoy its branch network and stable services, but its rates and flexibility lag behind virtual banks. Make choices based on your needs:

- If you value stability and brand reliability, consider Bank of Communications or other major Hong Kong banks.

- If you have limited fund flexibility or seek high returns, virtual banks like Fusion Bank and Mox Bank are more suitable.

- Assess your risk tolerance, investment horizon, and diversified asset allocation, and make rational judgments based on data.

- Avoid emotional decisions and prepare in advance for market changes.

Choose the bank and product that best aligns with your financial goals and risk preferences to enhance asset returns.

FAQ

What are the features of Bank of Communications’ prime rate?

You will find that Bank of Communications’ prime rate (P-prime) in 2025 is 5.5%. This rate is among the lower levels for traditional Hong Kong banks, suitable for those seeking stability.

Why are Bank of Communications’ time deposit rates low?

When you open a time deposit with Bank of Communications, rates range from 0.10% to 0.40%. This is significantly lower than virtual banks like Fusion Bank and Mox Bank, offering limited returns.

What should you note about deposit thresholds?

When opening a time deposit with Bank of Communications, the minimum deposit is ~USD 64,000. Compared to virtual banks requiring only USD 0.13, Bank of Communications has a higher threshold, suitable for those with more capital.

What are the impacts of early withdrawal?

If you withdraw early, Bank of Communications typically cancels all interest and returns only the principal. You should carefully read terms to avoid losing interest due to urgent fund needs.

How do virtual banks differ from traditional banks?

When choosing virtual banks like Fusion Bank and Mox Bank, you enjoy high rates and low thresholds. Traditional banks like Bank of Communications offer stable services and branch networks, each with distinct advantages.

Fixed deposits offer stable returns, but Bank of Communications’ meager interest rates and early withdrawal restrictions, coupled with high cross-border remittance fees, complex currency exchanges, and time-consuming investment account setups, limit fund flexibility. BiyaPay provides an all-in-one financial platform for flexible fund and investment management! The flexible savings product yields a 5.48% annualized return, with daily interest credited automatically. It supports real-time conversion of 30+ fiat currencies and 200+ cryptocurrencies, secured by KYC verification. Users can trade US and HK stocks in real-time without an overseas bank account, managing global markets with one account.

Remittance fees are as low as 0.5%, covering 190+ countries with same-day fund transfers. Try BiyaPay now to start your global investment journey! Pair with top savings plans and join BiyaPay today at BiyaPay for efficient fund management and steady returns!

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.