- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

HSBC English Name and Hong Kong Major Bank Codes at a Glance

Image Source: unsplash

Do you often need to look up HSBC’s English name? The Hongkong and Shanghai Banking Corporation (HSBC) has a bank code of 004. The table below clearly displays the Chinese and English names and codes of major Hong Kong banks, helping you verify information quickly and accurately.

Key Points

- Correctly filling out HSBC’s English name, bank code (004), and SWIFT Code (HSBCHKHHHKH) ensures smooth completion of local and international transfers.

- The bank code is used for local transfers in Hong Kong, while the SWIFT Code is used for international transfers; their purposes differ, so don’t confuse them.

- You can find bank details through bank statements, official websites, or customer service; always double-check before filling out to avoid spelling errors and inaccuracies, ensuring fund safety.

HSBC English Name

English Name

When you handle bank documents or cross-border transfers, you often need to accurately fill out HSBC’s English name. HSBC’s official English name is “The Hongkong and Shanghai Banking Corporation Limited”. This name is crucial in international financial transactions. You must ensure the spelling is correct, or it could lead to transfer failures.

Tip: You can find the correct English name on HSBC’s official website or bank statements.

Bank Code

The bank code (Bank Code) is a three-digit number used within Hong Kong’s banking system to identify different banks. HSBC’s bank code is “004”. You must enter the correct bank code for local transfers, bill payments, or setting up automatic transfers.

- The bank code is only used for transactions between banks in Hong Kong.

- You can check the bank code on bank statements, online banking platforms, or by calling customer service.

SWIFT Code

The SWIFT Code is an 8-to-11-character code of letters and numbers used for international bank identification. HSBC’s SWIFT Code is “HSBCHKHHHKH”. You must provide the correct SWIFT Code for international transfers to ensure funds reach the recipient bank accurately.

| Bank Name (English) | Bank Code | SWIFT Code |

|---|---|---|

| The Hongkong and Shanghai Banking Corporation Limited | 004 | HSBCHKHHHKH |

- The SWIFT Code differs from the bank code. The bank code is for local transactions, while the SWIFT Code is for international transfers.

- The SWIFT Code allows the global banking system to quickly identify your recipient bank, reducing transfer errors.

According to the Hong Kong Monetary Authority and HSBC’s official data, correctly filling out HSBC’s English name, bank code, and SWIFT Code significantly enhances transaction safety and efficiency. You must double-check these details when handling cross-border transfers.

Bank Names and Codes

Image Source: pexels

Major Banks Overview

When you handle bank transfers, set up automatic transfers, or fill out financial documents, you often need to look up the Chinese and English names, bank codes, and SWIFT Codes of different banks. These details are critical to ensuring funds are credited accurately.

You can refer to the table below to quickly find information on major Hong Kong banks. This table is compiled based on the Hong Kong Monetary Authority and official bank websites, ensuring accurate and reliable content.

| Bank Name (Chinese) | Bank Name (English) | Bank Code | SWIFT Code |

|---|---|---|---|

| 香港上海滙豐銀行 | The Hongkong and Shanghai Banking Corporation Ltd. | 004 | HSBCHKHHHKH |

| 渣打銀行 | Standard Chartered Bank (Hong Kong) Ltd. | 003 | SCBLHKHH |

| 恒生銀行 | Hang Seng Bank Ltd. | 024 | HASEHKHH |

| 中國銀行(香港) | Bank of China (Hong Kong) Ltd. | 012 | BKCHHKHH |

| 招商永隆銀行 | CMB Wing Lung Bank Ltd. | 020 | WUBAHKHH |

| 上海商業銀行 | Shanghai Commercial Bank Ltd. | 025 | SCBLHKHH |

| 花旗銀行 | Citibank (Hong Kong) Ltd. | 250 | CITIHKAX |

| 東方匯理銀行 | BNP Paribas | N/A | BNPAPHMM |

Tip: When filling out HSBC’s English name, always verify the official name and bank code to avoid transfer failures due to errors.

Quick Code Lookup

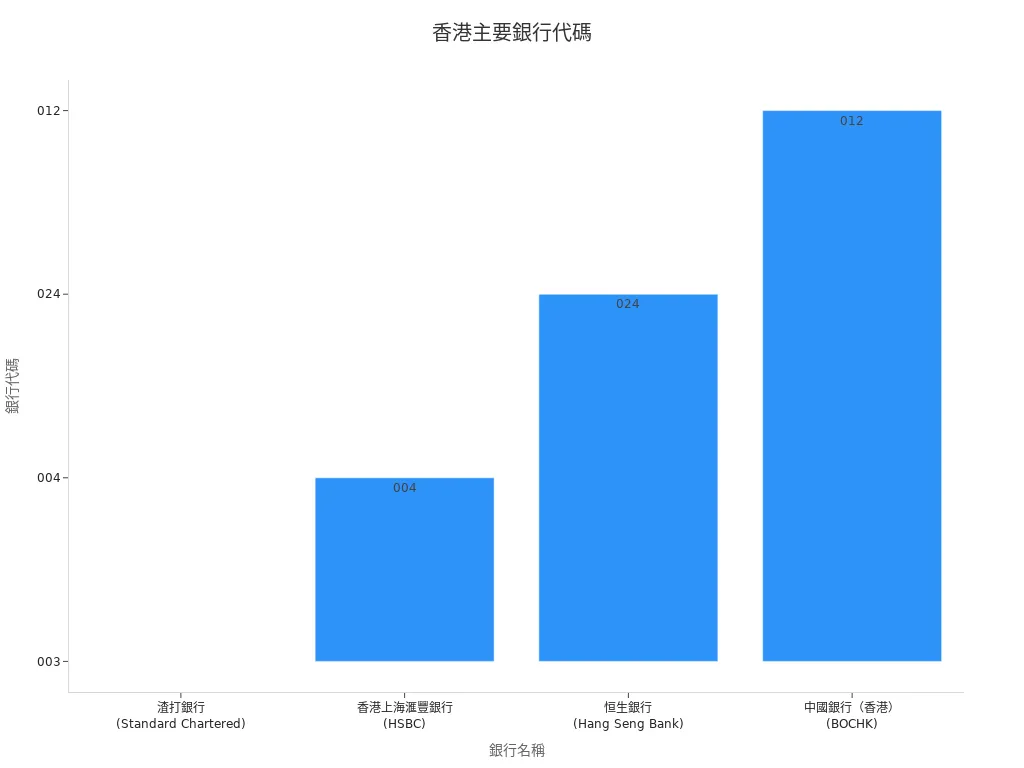

When you want to look up bank codes quickly, charts can help. The bar chart below shows the distribution of bank codes for major Hong Kong banks, making it clear at a glance:

You can see that different banks have distinct codes. You must enter the correct bank code when setting up automatic transfers, local transfers, or online banking.

Combining tables and charts helps you quickly verify information and reduce errors.

You should frequently refer to the Hong Kong Monetary Authority and bank official websites to ensure the data is up-to-date and accurate.

Finding Bank Codes

Statement Lookup

You can find the bank code on your bank statement. The monthly paper or electronic statement typically displays the bank name, branch name, and bank code in the account details section. You just need to open the statement and check the account details section to find the correct bank code. For example, HSBC’s statement will clearly list the code “004”. This method is simple and straightforward, ideal for daily verification.

Official Inquiry

You can also check bank codes through the bank’s official website or by calling the customer service hotline. Most Hong Kong banks list bank codes and SWIFT Codes on their “FAQ” or “Service Guide” pages. You just need to visit the relevant page and search for “bank code”. If you can’t access the internet, you can call customer service and ask staff directly. This ensures accurate information.

Filling Precautions

When filling out bank details, you must pay special attention to the accuracy of the bank code and bank name. Common errors include confusing the bank code with the branch code or misspelling the English name. You should double-check all details before submission, especially for international transfers, ensuring the SWIFT Code is correct. Accurate bank details prevent transfer failures or delays, safeguarding your funds. For large amounts, such as over USD 1,000, it’s advisable to verify through official channels to minimize risks.

Bank Code vs SWIFT Code

Image Source: unsplash

Bank Code

When you perform local bank transfers in Hong Kong, you often use the Bank Code. The Bank Code is the bank code, typically three digits. For example, HSBC’s Bank Code is 004, and Standard Chartered’s is 003. You must enter the correct Bank Code for automatic transfers, bill payments, or local transfers. This code is only used for transactions between banks in Hong Kong. You can find the correct Bank Code on bank statements, official websites, or through customer service.

Tip: The Bank Code is only for fund transfers between banks in Hong Kong and cannot be used for international transfers.

SWIFT Code

You must use the SWIFT Code for international transfers. The SWIFT Code is an 8-to-11-character code of letters and numbers used to identify banks globally. Each bank has a unique SWIFT Code. For example, HSBC’s SWIFT Code is HSBCHKHHHKH. When transferring funds from the US or other countries to Hong Kong, you must provide the correct SWIFT Code to ensure funds reach the recipient bank accurately.

Note: The SWIFT Code is for international transfers and differs from the Bank Code.

Key Differences

You need to distinguish between Bank Code and SWIFT Code, as their purposes are entirely different. The table below helps you compare them quickly:

| Item | Bank Code | SWIFT Code |

|---|---|---|

| Purpose | Local bank transfers in Hong Kong | International transfers |

| Format | 3-digit number | 8-11 alphanumeric characters |

| Example | 004 (HSBC) | HSBCHKHHHKH (HSBC) |

You must not confuse Bank Code and SWIFT Code when filling out bank details. For example, to transfer USD 1,000 from the US to HSBC in Hong Kong, you must use the SWIFT Code, not the Bank Code. Choosing correctly ensures funds are safely credited.

Filling Tips

Common Errors

When filling out bank details, you often encounter the following errors:

- Confusing the bank code (Bank Code) with the branch code (Branch Code). For example, HSBC’s Bank Code is 004, but the branch code varies by branch.

- Misspelling the bank’s English name during transcription. You should refer to bank statements or official websites.

- Entering the wrong SWIFT Code, causing international transfer failures. For example, HSBC’s correct SWIFT Code is HSBCHKHHHKH.

- Incorrect spelling of the recipient’s account name. This can affect fund crediting.

- Entering the wrong account number, potentially transferring funds to another account.

Tip: Each time you fill out bank details, verify with official data to reduce errors.

Verification Checklist

Before submitting bank details, please follow this checklist to verify each item:

- Confirm the bank’s English name matches official data.

- Check if the bank code (Bank Code) is correct, e.g., 004 for HSBC.

- For international transfers, verify the SWIFT Code, e.g., HSBCHKHHHKH.

- Check the spelling of the recipient’s account name.

- Confirm the account number is accurate.

- For amounts exceeding USD 1,000, re-verify all details.

By following the checklist step-by-step, you can significantly reduce transfer errors and ensure fund safety.

You need to accurately look up and fill out bank details to ensure fund safety. You should frequently use official websites or bank statements to verify HSBC’s English name and bank code. Common errors include misspellings or incorrect codes. By checking carefully, you can improve efficiency in handling banking tasks.

FAQ

How can I find the correct bank code for Hong Kong banks?

You can check bank statements, official websites, or call customer service. These methods help you find the correct bank code.

What’s the difference between SWIFT Code and Bank Code?

| Item | SWIFT Code | Bank Code |

|---|---|---|

| Purpose | International transfers | Local transfers |

| Format | 8-11 alphanumeric characters | 3-digit number |

What should I pay attention to when filling out bank details?

You must verify the bank’s English name, bank code, and SWIFT Code. Errors can lead to transfer failures or delays.

HSBC transfers and remittances require precise entry of bank codes and SWIFT Codes, where errors may cause delays or failures, while high cross-border remittance fees, complex currency exchanges, and limited flexible savings options independently constrain fund efficiency. BiyaPay, as an all-in-one financial platform, enables real-time US and HK stock trading without cumbersome data entry, simplifying global fund management. Platform remittance fees are as low as 0.5%, covering 190+ countries with same-day transfers. Its flexible savings product offers a 5.48% annualized return, with daily interest credited automatically and withdrawals anytime, supporting 30+ fiat and 200+ cryptocurrencies, secured by KYC.

Try BiyaPay now to start your global investment journey! Join BiyaPay for efficient fund management!

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.