- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Implications of Hong Kong Fixed Deposit Rate Changes for Investors

Image Source: pexels

In 2025, Hong Kong fixed deposit rates have seen a significant decline, with intensified competition among banks. Some banks are launching high-interest promotions to attract customers, and investors are starting to focus on income-generating assets. The dividend yield of several Hong Kong banks reaches 6%, far exceeding the global average, with a capital adequacy ratio as high as 19%. Citibank’s fixed deposit rates have also become a market focus. Investors are gradually shifting from traditional fixed deposits to bank stocks and income-generating products, flexibly adjusting their wealth management strategies.

Key Points

- In 2025, Hong Kong fixed deposit rates have significantly declined, and investors should closely monitor market rate changes and flexibly adjust wealth management strategies.

- Intense bank competition has led some banks to offer high-interest promotions, allowing investors to choose suitable fixed deposit products based on fund size and liquidity needs.

- The decline in rates reduces the appeal of fixed deposits, prompting investors to consider diversified asset allocation, such as bonds and ETFs, to spread risk and enhance returns.

- The focus of asset allocation is risk diversification, with long-term holding and periodic rebalancing helping to achieve stable growth, suitable for investors with varying risk tolerances.

- Citibank’s fixed deposit rates are competitive and flexible, ideal for medium-sized investors seeking stable income, and worth comparing and considering regularly.

Rate Forecast

Image Source: pexels

Recent Trends

Since May 2025, HKD fixed deposit rates at many Hong Kong banks have noticeably declined. For one-year fixed deposits, some major banks’ annual rates have dropped from 3.5% to 2.2%. During the same period, the Hong Kong Interbank Offered Rate (HIBOR) also fell, reflecting ample market liquidity. Based on the latest exchange rate, 1 USD is approximately 7.8 HKD. Investors have noticed that interest income from a USD 10,000 (approximately HKD 78,000) fixed deposit has significantly decreased. To attract funds, banks have started offering short-term high-interest promotions, but the overall rate trend remains downward.

Influencing Factors

Multiple factors affect Hong Kong fixed deposit rates.

- First, the pace of U.S. Federal Reserve rate cuts directly impacts Hong Kong rates. As the U.S. cuts rates, Hong Kong banks follow suit.

- Second, China’s economic growth slowdown directs funds toward more stable markets.

- Third, local Hong Kong policies, such as property market regulations and capital flow oversight, also affect banks’ funding costs.

- Finally, intense competition among banks leads some to temporarily raise fixed deposit rates to attract new funds.

Investors should closely monitor global economic and local policy changes, as these factors impact fixed deposit returns.

Future Scenarios

Looking ahead to the second half of 2025, the market generally expects the U.S. to continue cutting rates. Hong Kong banks’ fixed deposit rates may decline further. If U.S. rate cuts exceed expectations, Hong Kong’s one-year fixed deposit rates could fall below 2%. Some banks may launch short-term high-interest products to attract funds, but in the long term, fixed deposit rates are unlikely to return to 2024 highs. Investors need to consider the risk of falling rates, flexibly adjust asset allocation, and seek more suitable wealth management solutions.

Bank Competition

High-Interest Promotions

Competition among Hong Kong banks is fierce. Hang Seng Bank, Bank of China Hong Kong, China Construction Bank (Asia), Fubon Bank, and others frequently launch high-interest fixed deposit promotions. Some banks offer short-term rates above the market average for new customers or large deposits. For example, certain banks provide one-year rates up to 2.5% for new funds. Depositing USD 10,000 (approximately HKD 78,000) could yield significantly higher interest than standard fixed deposits. However, these high-interest promotions often have quotas or apply only to specific terms. Banks aim to attract more fund inflows through these offers.

Product Variety

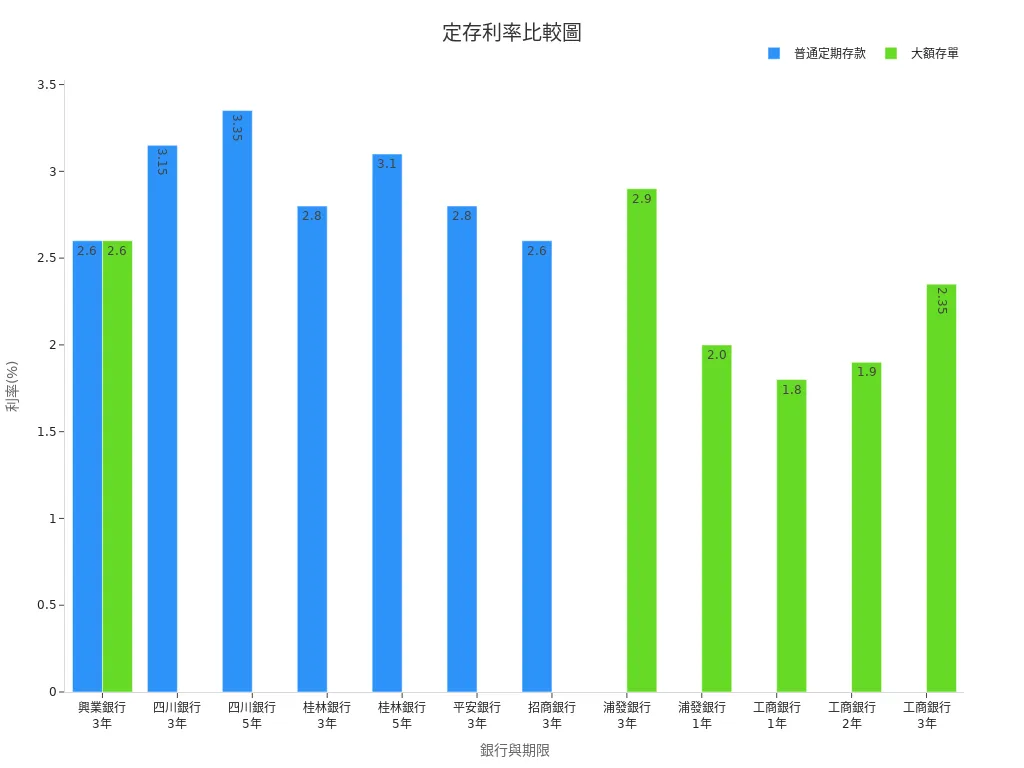

Hong Kong banks offer a variety of fixed deposit products. Products differ in deposit terms, minimum deposit amounts, and rates. Some banks provide options ranging from one month to five years. Minimum deposits range from USD 500 to USD 20,000. In terms of rates, regional banks like Sichuan Bank and Guilin Bank offer three-year fixed deposit rates of 3.15% to 3.35%. Major banks like ICBC and China Merchants Bank offer three-year rates of about 2.35% to 2.6%. Large-denomination certificates of deposit for new customers sometimes have higher rates but stricter conditions. The table below compares fixed deposit products of some banks:

| Bank Name | Deposit Type | Minimum Deposit | Term | Rate (%) | Notes |

|---|---|---|---|---|---|

| Sichuan Bank | Regular Fixed Deposit | N/A | 3-Year | 3.15 | Regional bank, higher rates |

| Sichuan Bank | Regular Fixed Deposit | N/A | 5-Year | 3.35 | Regional bank, higher rates |

| Guilin Bank | Regular Fixed Deposit | N/A | 3-Year | 2.8 | Regional bank |

| Guilin Bank | Regular Fixed Deposit | N/A | 5-Year | 3.1 | Regional bank |

| ICBC | Large-Denomination CD | USD 20,000+ | 3-Year | 2.35 | CD rates close to regular fixed deposits |

| China Merchants Bank | Regular Fixed Deposit | N/A | 3-Year | 2.6 | No 3-year large-denomination CD available |

Investors should choose suitable fixed deposit products based on their fund size and liquidity needs.

Citibank Fixed Deposit Rates

Citibank’s fixed deposit rates are notably attractive in the Hong Kong market. The bank frequently adjusts rates based on market changes and designs diverse products for different customer groups. At certain times, Citibank’s fixed deposit rates surpass those of local major banks, especially during new customer promotions. For example, in May 2025, Citibank’s one-year fixed deposit rate is around 2.3%, and three-year rates reach 2.6%. The minimum deposit is typically USD 10,000, suitable for medium-sized investors. Citibank’s fixed deposit products are flexible, with some supporting online account opening and automatic renewal, making fund management convenient. Investors seeking stable income can consider Citibank’s fixed deposit rates as part of their asset allocation. Compared to other banks, Citibank’s fixed deposit rates remain competitive during market fluctuations, attracting many conservative investors. Some high-interest products are paired with wealth management account benefits, enhancing overall returns. Investors should regularly compare Citibank’s fixed deposit rates with other banks’ products and flexibly adjust deposit strategies.

Investment Impact

Attractiveness Changes

Since the significant decline in Hong Kong fixed deposit rates in 2025, their appeal to investors has noticeably diminished. For a one-year fixed deposit, rates have dropped from 3.5% to 2.2%, reducing interest income on a USD 10,000 (approximately HKD 78,000) deposit by over a third. The primary advantage of fixed deposits lies in capital safety and stable returns, but as rates fall, investors are more inclined to seek higher-yield products.

Fixed deposits carry extremely low risk with relatively stable returns. According to statistics, their volatility (standard deviation) is minimal, and their Sharpe ratio is low, indicating limited returns under low risk. The risk-free rate is often referenced by one-year fixed deposits, highlighting their stability.

As rates decline, some investors shift funds to high-yield bonds, stocks, or funds to pursue higher returns. This capital flow further depresses fixed deposit rates, creating a market cycle. Overall, the appeal of fixed deposits is closely tied to market rates, naturally weakening as rates fall.

Other Products

Falling rates not only affect fixed deposits but also significantly impact other investment products. Below is the performance of major investment products in a low-rate environment:

- Safe-haven long-term government bonds and investment-grade bonds perform better, with rising prices and stable returns.

- Riskier bonds (e.g., non-investment-grade bonds, emerging market bonds) perform similarly to stock market trends but with shallower declines.

- Stock markets are more volatile, offering no fixed returns, requiring investors to bear higher risks.

- Short-term government bonds have smaller price fluctuations and low sensitivity to rates and market volatility.

- Fund performance varies by portfolio and risk attributes, with demand for fixed-income funds rising in low-rate environments.

Based on past data, from 2007 to 2016, global high-yield bond funds achieved a cumulative return of 57.2%, significantly higher than the 26.4% for savings-type insurance policies and about 1% higher than fixed deposits. U.S. 10-year Treasury yields ranged from 2.9% to 3.1%, and investment-grade bond ETFs yielded around 3.6%. However, higher-return products carry greater risks, and investors must choose based on their risk tolerance.

| Investment Product Type | Return Range/Data |

|---|---|

| Bank Demand Deposit | Approx. 0.2% |

| Bank Fixed Deposit | Approx. 1.0% |

| Foreign Currency Fixed Deposit (USD) | Approx. 2.0% - 2.5% |

| U.S. 10-Year Treasury Yield | Approx. 2.9% - 3.1% |

| U.S. Investment-Grade Bond ETF | Approx. 3.6% |

| Global High-Yield Bond Fund (2007-2016) | 57.2% (Cumulative) |

| Savings-Type Insurance Policy (2007-2016) | 26.4% (Cumulative) |

Investors should note that past returns do not guarantee future performance, and changes in the rate environment affect the yields of bonds, fixed deposits, and similar products.

Investment Recommendations

Different investors should flexibly adjust asset allocation based on their risk tolerance and funding needs. Below are recommendations for conservative and aggressive investors:

| Investment Tool | Risk Level | Return Level | Liquidity | Suitable Group |

|---|---|---|---|---|

| Fixed Deposit | Very Low | Very Low | Good | Extremely conservative retirees, short-term liquidity needs |

| Savings Insurance | Low | Low | Poor | Wealth inheritance planners, those with surplus funds |

- Conservative investors can continue using fixed deposits as a primary tool for capital preservation and short-term liquidity needs. Foreign currency fixed deposits (e.g., USD) offer higher rates but involve exchange rate risks. Early withdrawal may forfeit interest, but principal is safe.

- Aggressive investors can adopt a diversified asset allocation strategy:

- Choose asset classes based on risk tolerance, such as ETFs, stocks, bonds, or funds.

- Adjust portfolio proportions based on income, savings, and future financial needs to diversify risks.

- Periodically review investment performance, cutting losses or taking profits when necessary to ensure stable asset growth.

Investors should regularly monitor market dynamics, flexibly adjust asset allocation, and use indicators like standard deviation and Sharpe ratio to assess risk-return balance. Choosing suitable investment products helps achieve capital preservation and growth in a low-rate environment.

Asset Allocation

Image Source: pexels

Risk Diversification

The core of asset allocation lies in risk diversification. Different assets have low correlations, sometimes even negative correlations. When one asset’s price falls, another may rise, offsetting volatility. For example, Benjamin Graham, Warren Buffett’s mentor, suggested investors allocate 50% to stocks and 50% to bonds. This combination leverages their low correlation to effectively reduce overall volatility risk. ETFs are also a popular asset allocation tool due to low fees and minimal human intervention, suitable for long-term holding.

Academic research shows that long-term diversified asset allocation and periodic rebalancing outperform frequent portfolio adjustments in achieving stable profits. This strategy requires no market predictions, only commitment to long-term holding and rebalancing, effectively reducing risk.

Flexible Application

Investors can flexibly use fixed deposits and other wealth management tools based on their goals and risk tolerance. Fixed deposits suit those seeking capital safety and stable returns. Bonds and ETFs are suitable for investors wanting higher returns while tolerating some risk. When market rates fall, investors can shift some funds from fixed deposits to bonds or ETFs to boost overall returns. ETFs, covering multiple assets, further diversify risk and suit investors of various ages and fund sizes.

Strategy Examples

The table below shows the performance of different asset portfolios from 2011 to 2018:

| Investment Period | Investment Tools | Average Annualized Return | Total Return | Portfolio Correlation with U.S. Stock Market |

|---|---|---|---|---|

| 2011-2018 | Corporate Bonds, Developed Market Stocks, Asian Corporate Stocks, European Large and Small Company Stocks | 9.71% | 205.1% | 0.94 |

Classic stock-bond allocation recommendations include:

- Young investors can consider 80% stocks and 20% bonds to pursue capital appreciation.

- Middle-aged or conservative investors can opt for 50% stocks and 50% bonds to balance risk and return.

These strategies leverage low correlations among assets to reduce volatility risk and enhance long-term returns. Long-term holding and periodic rebalancing help investors maintain stable asset growth across economic cycles.

In 2025, Hong Kong fixed deposit rates are declining, and bank competition is intensifying. Investors should continuously monitor market dynamics and flexibly adjust asset allocation. Cathay Intelligent Investment and Multi-Asset Fund dynamic adjustment strategies can help capture growth in sectors like technology and healthcare. Investors are advised to carefully select fixed deposits and other wealth management products based on their goals and risk tolerance, balancing risk and return.

FAQ

Why are Hong Kong fixed deposit rates declining?

Hong Kong fixed deposit rates are influenced by U.S. rate cuts, capital flows, and bank competition. In 2025, U.S. rate cuts prompted Hong Kong banks to adjust, leading to rate declines.

How can investors choose suitable fixed deposit products?

Investors can compare rates, deposit terms, and minimum deposit amounts across Hong Kong banks. For example, a bank offers a one-year fixed deposit rate of 2.2% with a minimum deposit of USD 10,000 (approximately HKD 78,000).

What are the wealth management alternatives when rates fall?

When rates decline, investors can consider bonds, ETFs, or diversified asset funds. These products diversify risk and enhance returns.

What are the features of Citibank’s fixed deposit rates?

Citibank’s fixed deposit rates are flexible, often exceeding local major banks during certain periods. Promotional rates for new customers are particularly attractive, suitable for investors seeking stable income.

How can asset allocation reduce risk?

Investors can allocate funds to fixed deposits, bonds, and stocks. This reduces the impact of single-asset volatility on overall wealth.

Hong Kong’s falling fixed deposit rates reduce returns, and lock-in periods limit fund flexibility, while cumbersome exchange processes and unmet diversification needs independently hinder wealth growth efficiency. BiyaPay, as an all-in-one financial platform, enables real-time US and HK stock trading without complex procedures, simplifying global asset allocation. Platform remittance fees are as low as 0.5%, covering 190+ countries with same-day transfers. Its flexible savings product offers a 5.48% annualized return, with daily interest credited automatically and withdrawals anytime, supporting 30+ fiat and 200+ cryptocurrencies, secured by KYC.

Try BiyaPay now to start your global investment journey! Join BiyaPay for efficient fund management!

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.