- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Hong Kong Bank Branch Code Quick Reference Table: Essential for Transfers and Cheque Processing

Image Source: unsplash

Do you frequently handle transfers or deposit cheques? Bank branch codes can help you correctly identify each Hong Kong bank branch, ensuring funds are securely received. The quick reference table below allows you to find the necessary information quickly, improving processing efficiency. By entering the correct branch code, you can reduce errors and easily complete daily banking operations.

Key Points

- The bank branch code is an important three-digit number used to identify different branches of Hong Kong banks, ensuring smooth completion of transfers and cheque processing when filled out correctly.

- You can find branch codes through bank official websites, bank statements, chequebooks, or mobile apps, or confirm with bank customer service, always relying on official sources.

- Be extra careful when filling out bank codes and branch codes to avoid transcription errors or confusion, as mistakes may lead to delayed or returned funds.

- Local transfers and electronic payments require both bank codes and branch codes, while international remittances require SWIFT codes, as their purposes differ.

- Regularly verify branch code information to keep it up-to-date, helping to enhance fund security and banking operation efficiency.

Bank Branch Code Quick Reference Table

Image Source: pexels

When handling transfers or cheques, you often need to accurately fill out the bank branch code. This code helps you correctly identify the recipient’s bank branch, ensuring funds are successfully received. Although many websites compile bank branch codes, there is currently no official body that regularly publishes a complete reference table. When looking up, you should cross-reference multiple sources and rely on official bank data.

Tip: The table below lists only some common branch codes; for actual operations, it’s recommended to double-check with the bank’s official website or contact customer service.

HSBC

| Bank Code | Branch Code | Branch Name |

|---|---|---|

| 004 | 123 | Central Head Office |

| 004 | 128 | Mong Kok Branch |

| 004 | 143 | Causeway Bay Branch |

| 004 | 157 | Sha Tin Branch |

When opening an account or processing transfers with HSBC, you often see the bank code “004.” The branch code varies by region. By entering the correct bank branch code, you can ensure funds reach the designated branch accurately.

Bank of China (Hong Kong)

| Bank Code | Branch Code | Branch Name |

|---|---|---|

| 012 | 491 | Central Branch |

| 012 | 494 | Mong Kok Branch |

| 012 | 498 | Kowloon Bay Branch |

| 012 | 502 | Sha Tin Branch |

Bank of China (Hong Kong)’s bank code is “012.” When filling out cheques or making local transfers, you must include both the bank code and branch code to avoid errors.

Hang Seng Bank

| Bank Code | Branch Code | Branch Name |

|---|---|---|

| 024 | 382 | Central Head Office |

| 024 | 385 | Mong Kok Branch |

| 024 | 388 | Kwun Tong Branch |

| 024 | 391 | Sha Tin Branch |

Hang Seng Bank’s bank code is “024.” When transferring via online banking or mobile apps, the system requires you to enter the bank branch code. This step helps reduce the risk of funds being sent to the wrong branch.

Bank of East Asia

| Bank Code | Branch Code | Branch Name |

|---|---|---|

| 015 | 201 | Central Branch |

| 015 | 203 | Mong Kok Branch |

| 015 | 205 | Kowloon Bay Branch |

| 015 | 207 | Sha Tin Branch |

Bank of East Asia’s bank code is “015.” When processing cheques or electronic payments, make sure to check the branch code to avoid delays in crediting.

Other Major Banks

| Bank Name | Bank Code | Common Branch Codes | Branch Name |

|---|---|---|---|

| Standard Chartered Bank | 003 | 401 | Central Branch |

| CITIC Bank International | 250 | 701 | Mong Kok Branch |

| Dah Sing Bank | 040 | 601 | Kowloon Branch |

| DBS Bank | 185 | 801 | Sha Tin Branch |

When choosing different Hong Kong banks, the combination of branch codes and bank codes varies. You should check the relevant bank’s official information based on your needs to ensure accuracy.

Note: Many online bank branch code reference tables come from third-party platforms like Wise. These may not be updated promptly, so rely on information from bank official websites or customer service.

Uses of Bank Branch Codes

Local Transfers

When making local transfers in Hong Kong banks, the bank branch code helps you accurately identify the recipient’s branch. When filling out transfer forms or using online banking services, the system requires you to enter the bank code and branch code. This allows the bank to transfer funds correctly to the recipient’s designated branch based on this information. By entering the correct codes, funds can be securely received, reducing the chance of errors.

Cheque Processing

When depositing cheques, you also need to fill out the bank branch code. The account number on a cheque typically includes the bank code, branch code, and personal account number. For example, in the account number “004-123-456789,” “004” is the bank code, “123” is the branch code, and “456789” is your account number. By correctly filling out these details, the bank can process the cheque smoothly, ensuring funds are credited on time.

Electronic Payments

When using electronic payment platforms (e.g., FPS, PayMe), the system sometimes requires you to enter the bank branch code. This step helps the platform accurately identify your bank branch, ensuring funds are correctly transferred to your account. When setting up electronic payments, it’s recommended to check your branch code first to avoid delays or transfers to the wrong account.

Tip: When handling any banking operations, remember to verify the bank code and branch code to enhance fund security and processing efficiency.

Methods to Look Up Branch Codes

Image Source: unsplash

When performing daily banking operations, you often need to look up branch codes. In fact, you can easily obtain accurate information through various methods. Below are three of the most common lookup methods:

Official Website

You can directly visit the official websites of major Hong Kong banks to look up branch codes. Most banks provide branch lists and code reference tables on their websites. By selecting your bank name and branch location, you can find the correct branch code.

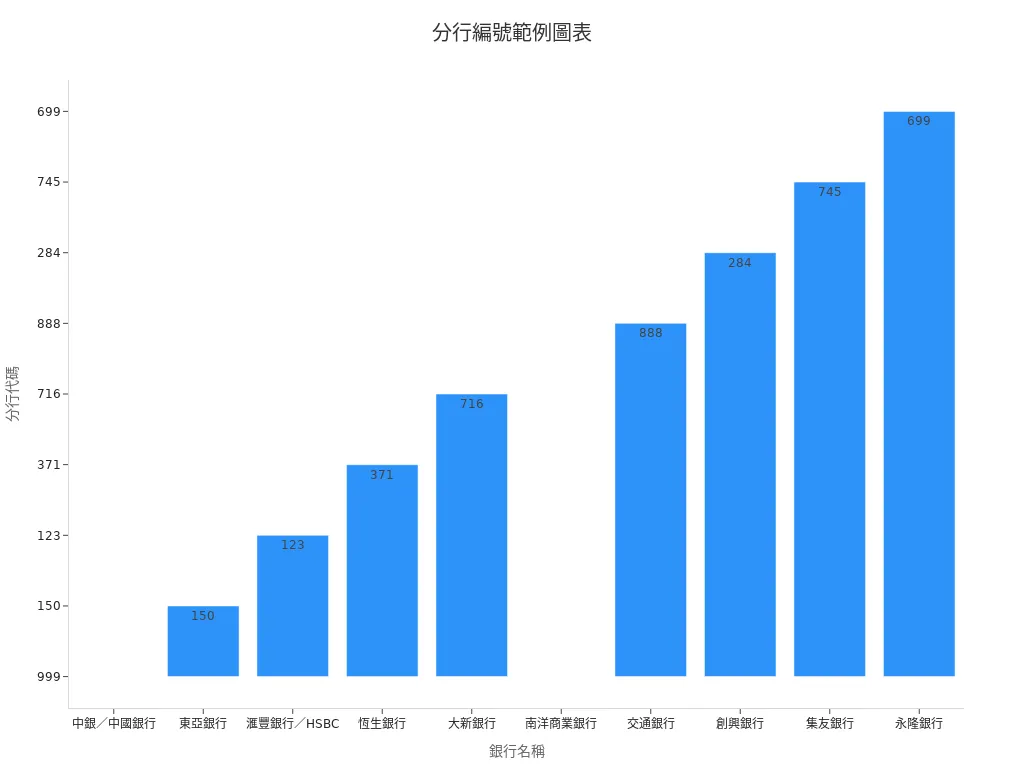

The table below shows examples of bank codes, branch codes, and account numbers for common banks:

| Bank Name | Bank Code | Branch Code Example | Account Number Example |

|---|---|---|---|

| Bank of China | 012 | 999 | 999999999 |

| Bank of East Asia | 015 | 150 | 889999999 |

| HSBC | 004 | 123 | 45678900 |

| Hang Seng Bank | 024 | 371 | 333336668 |

| Dah Sing Bank | 040 | 716 | 88888888 |

| Nanyang Commercial Bank | 043 | 999 | 99999999 |

| Bank of Communications | 382 | 888 | 888888888 |

| Chiyu Banking Corporation | 039 | 745 | 00088000 |

| Wing Lung Bank | 020 | 699 | 12345678 |

You can refer to the chart below to understand the distribution of branch codes across banks:

On your debit card or online banking page, you typically see a set of numbers. These numbers are generally divided into three parts: bank code (3 digits), branch code (3 digits), and account number (8 or 9 digits). By referencing these details, you can accurately find the branch code for your account.

Bank Statements and Cheques

Your monthly bank statements and chequebooks are also great tools for finding branch codes. You can find the complete bank code and branch code in the account details section of your bank statement. Cheques usually have a string of numbers printed on them, including the bank code, branch code, and account number. By cross-referencing these numbers, you can confirm your branch code.

Tip: When filling out cheques or transfer forms, check the numbers on your bank statement or cheque to ensure accuracy.

Customer Service and Apps

If you have questions about branch codes, you can call the bank’s customer service hotline. Customer service staff will help you confirm the correct branch code based on your account details. You can also use the bank’s mobile app; after logging in, check the account details page for the branch code. Some apps even offer a branch search function, allowing you to enter a region or branch name to instantly find the relevant code.

Reminder: When using apps or calling customer service, have your account number and personal details ready to expedite identity verification and branch code inquiries.

Code Comparison

When handling banking tasks, you encounter different types of identification codes. Each code has distinct uses and formats. The table below helps you quickly understand the main differences between bank branch codes, bank codes, SWIFT, and IBAN:

| Code Type | Purpose | Format Example | Scope |

|---|---|---|---|

| Bank Branch Code | Local transfers, cheque processing | 123 | Hong Kong local banks |

| Bank Code | Identify banking institutions | 004 | Hong Kong local banks |

| SWIFT | International remittances | HSBCHKHHXXX | Global banks |

| IBAN | International remittances (used in some regions) | GB29NWBK60161331926819 | Europe and other regions |

Bank Branch Code

When making local transfers or depositing cheques in Hong Kong, you must fill out the bank branch code. This code helps the bank accurately identify the recipient’s branch. By entering the correct branch code, funds can be securely received. The bank branch code is typically three digits, forming part of the complete account identification alongside the bank code.

Bank Code

The bank code is used to identify different banking institutions. You see the bank code when filling out transfer forms or cheques. Each Hong Kong bank has a unique three-digit bank code, such as 004 for HSBC and 012 for Bank of China (Hong Kong). Used together with the branch code, the bank code ensures funds are directed to the correct bank and branch.

SWIFT/IBAN

When making international remittances, banks require you to provide a SWIFT code. SWIFT is a unique combination of letters and numbers used to identify banks worldwide. IBAN, or International Bank Account Number, is mainly used in Europe and some regions. Hong Kong banks typically only require SWIFT codes, not IBAN.

Fact: The Hong Kong Interbank Clearing Limited (HKICL) coordinates settlement and transfers between local banks. When transferring between local banks, HKICL uses bank codes and branch codes to facilitate secure and efficient fund flows.

Considerations

Common Errors

When filling out bank branch codes, you are most likely to make the following errors:

- Confusing bank codes with branch codes, leading to funds being sent to the wrong bank or branch.

- Making transcription errors when copying branch codes, such as adding or omitting a digit.

- Using outdated branch codes, as some banks may adjust branch structures.

- Failing to verify recipient details, resulting in funds not being credited correctly.

Tip: Before each transfer or cheque deposit, double-check the bank branch code and refer to the latest information on the bank’s official website or bank statement.

International Remittances

When making international remittances, Hong Kong banks typically require you to provide a SWIFT code. Some countries also require an IBAN. You don’t need to fill out the bank branch code but must ensure the recipient’s account details are correct. You should:

- Check the recipient bank’s SWIFT code.

- Confirm the recipient’s account number and name are accurate.

- If needed, contact the recipient bank to inquire about special requirements.

Note: Requirements for international remittances vary by country. You should understand the relevant regulations in advance to avoid delays due to incorrect information.

User Questions

You may have the following common questions:

- “Can I fill out only the bank code without the branch code?”

No. You must fill out both the bank code and branch code to ensure the bank processes your transaction accurately. - “Do branch codes change frequently?”

Branch codes may change occasionally due to bank restructuring or branch relocations. You should regularly check official sources. - “What happens if I enter the wrong branch code?”

Funds may be delayed or returned. You should contact bank customer service immediately for assistance.

Suggestion: If you have any questions, proactively contact bank customer service or check the official website to ensure all information is accurate.

When performing daily banking operations, bank branch codes help you accurately process transfers and cheques. This quick reference table allows you to find needed information quickly, improving efficiency. You can bookmark this article or share it with friends. You should regularly check the latest branch code information to avoid errors due to outdated data.

FAQ

What is a bank branch code?

A bank branch code is a three-digit number. You use it to identify branches of Hong Kong banks. You must fill it out correctly for transfers or cheque deposits.

Where can I find a branch code?

You can find branch codes on bank official websites, bank statements, chequebooks, or mobile apps. You can also call bank customer service to inquire.

What happens if I enter the wrong branch code?

If you enter the wrong branch code, funds may be delayed or returned. You should contact bank customer service immediately for assistance.

What’s the difference between a branch code and a bank code?

A branch code identifies a branch. A bank code identifies a bank. You need to fill out both for local transfers.

Do I need to provide a SWIFT code for transfers to Bank of China (Hong Kong)?

You don’t need a SWIFT code for local transfers. You only need the bank code and branch code. SWIFT codes are required for international remittances.

Accurate bank branch codes are essential for seamless local transfers and cheque processing in Hong Kong, ensuring funds reach the correct account efficiently. However, cross-border remittances often face high fees and complex overseas account requirements, particularly for PST users navigating time zone differences. BiyaPay streamlines global remittances with real-time, fee-free conversion of over 200 digital currencies, including USDT, into 30+ fiat currencies like USD and HKD, and cross-border remittance fees as low as 0.5%, supporting transactions across 190+ countries. A 1-minute BiyaPay account registration provides fast, secure access, complementing local bank code usage with simplified, cost-effective cross-border transfers in 2025.

Enhance your global remittances! Join BiyaPay.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.