- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

How to Strategize a $1 Million Time Deposit to Maximize Bank Benefits

Image Source: pexels

Do you want to use a $1 million time deposit to maximize bank benefits? Banks currently offer many high-interest promotions, with interest rates ranging from 1.6% to 2.2%, but most come with thresholds such as new funds or customer tier requirements.

The market is highly competitive. The following table shows the interest rates and restrictions of different Hong Kong banks for a $1 million time deposit:

| Bank Name | Promotional Rate Range (%) | Tenor | Application Restrictions and Thresholds |

|---|---|---|---|

| HSBC | 2.0 ~ 2.2 | 3~9 months | Limited to Premier clients, minimum $1 million USD, cap at $15 million USD |

| O-Bank | 2.0 | 6 months | Individual clients, minimum $20,000 USD |

| Yang Hsin Bank | 1.8 | 12 months | Limited to individuals, new funds, no minimum threshold, cap at $24 million USD |

You should diversify your funds, flexibly choose tenors, and make full use of new customer and online-exclusive offers to boost your total interest returns.

Key Points

- Diversify funds across multiple banks to avoid exceeding a single bank’s protection limit, enhancing fund safety and interest returns.

- Leverage new customer, new fund, and online-exclusive offers to enjoy higher rates and additional rewards, increasing total interest income.

- Flexibly choose time deposit tenors, combining short- and long-term strategies to adapt to market rate fluctuations, balancing interest and liquidity.

- Regularly check bank offers and market rates, promptly adjust fund allocation to ensure every dollar maximizes interest.

- Be mindful of early withdrawal penalty risks, plan fund liquidity rationally to avoid losing interest, and maximize fund efficiency.

Strategy Plan

Fund Diversification

If you want to maximize interest on a $1 million time deposit, the first step is to diversify your funds. Don’t place all your funds in a single bank. This approach avoids a single bank’s deposit protection limit and reduces risk.

- You can split the $1 million time deposit into three or four portions, depositing them in different Hong Kong banks, such as HSBC, Fubon Bank, Airstar Bank, and PAObank.

- Each bank’s high-interest offers and deposit limits vary. Diversifying funds allows you to simultaneously benefit from multiple banks’ new customer or new fund promotions.

- Market research shows that global economic uncertainty is high, and diversifying assets with flexible tenor allocation can effectively reduce risk and enhance overall returns.

- For example, some virtual banks like PAObank and Airstar Bank offer higher rates for new funds but have quotas or amount caps. By splitting funds, you can apply for high-interest time deposits at multiple banks, boosting total interest.

Tip: Diversifying funds not only increases interest but also enhances fund safety. Hong Kong’s Deposit Protection Scheme provides up to HK$500,000 (~USD 64,000, based on 1 USD = 7.8 HKD) per bank, so splitting deposits ensures maximum protection for your funds in case of individual bank issues.

Leveraging Offers

To maximize interest on a $1 million time deposit, you must make full use of new customer, online-exclusive, and new fund offers.

- Many Hong Kong banks offer rates higher than standard time deposits for new customers or new funds. For example, virtual banks like Airstar Bank and PAObank often launch exclusive high-interest time deposits for new clients, with rates 0.5% to 1% higher than traditional banks.

- A survey by InsightX Market Research found that over half of respondents opened accounts with online-only banks due to high interest rates and reward points. Young people aged 25-29 are most interested in such offers.

- You can apply online to enjoy exclusive online rates, and some banks even offer additional cash rebates or lucky draws.

- International financial institutions like PayPal also tailor personalized offers based on user behavior to boost engagement and retention. Similarly, banks analyze new customer behavior and proactively offer high-interest time deposits or cash rewards to encourage early deposits.

Note: New customer offers are typically limited to first-time account holders or new funds, so carefully review terms to avoid missing offer periods or amount caps.

Flexible Tenors

You need to flexibly choose time deposit tenors to adapt to market rate changes and maximize interest on a $1 million time deposit.

- Market reports indicate that 2025 will see significant volatility in interest rates and bond markets, making flexible tenor adjustments an effective strategy.

- You can opt for short-term (e.g., 1-3 months) or rolling time deposits, allowing you to switch to higher-rate products when market rates rise.

- Many investors split a $1 million time deposit into portions, with some allocated to short-term and others to longer-term (e.g., 6-12 months) to balance interest and liquidity.

- Global asset allocation trends also emphasize flexible tenor adjustments to proactively manage interest rate risks and enhance overall returns.

| Tenor Choice | Advantages | Suitable Scenarios |

|---|---|---|

| Short-term (1-3 months) | Flexible adjustments, quick switch to high rates | High rate volatility, expected rate hikes |

| Medium-term (6-9 months) | Higher rates, moderate liquidity | Stable market rates |

| Long-term (12+ months) | Locks in high rates, ideal for long-term | Expected rate declines |

It’s recommended to regularly review market rates and bank offers, flexibly adjusting the allocation and tenors of your $1 million time deposit to ensure every dollar maximizes interest.

High-Interest Bank Comparison

Image Source: unsplash

Market Rates

To choose a high-interest time deposit, you must first understand the rate differences among banks in the market. Based on the latest data, USD time deposit rates for several Hong Kong banks are as follows:

| Bank Name | USD Time Deposit Rate (6 Months) | USD Time Deposit Rate (12 Months) |

|---|---|---|

| Cathay United Bank | 3.70% | 3.95% |

| Fubon Bank | 3.55% | 3.85% |

| CTBC Bank | 3.55% | 3.85% |

You can see that different banks have noticeable rate gaps. Generally, promotional rates are higher than posted rates but come with more restrictions. When calculating actual interest, remember to note related fees and terms.

Virtual Banks

Virtual banks have recently become a new choice for high-interest time deposits. You can check historical rates on official websites to understand past fluctuations. For example, the Central Bank website publishes interbank rates and rate change information for financial institutions. Virtual banks like PAObank and Airstar Bank frequently offer exclusive high-interest time deposits for new funds or new clients. You can use this data to determine the best time to enter the market.

Offer Terms

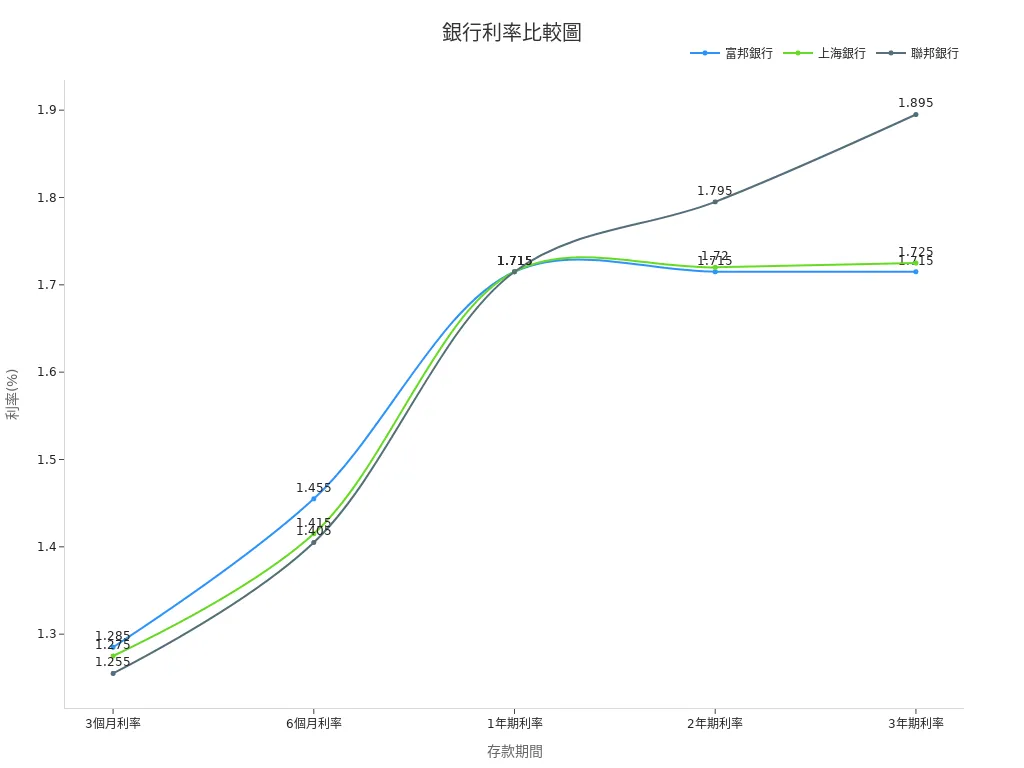

When choosing high-interest banks, besides rates, you must compare the offer terms of different banks. The table below shows TWD time deposit rates for banks like Fubon, Shanghai Commercial, and PAObank:

| Bank Name | 3-Month Rate (%) | 6-Month Rate (%) | 1-Year Rate (%) | 2-Year Rate (%) | 3-Year Rate (%) |

|---|---|---|---|---|---|

| Fubon Bank | 1.285 | 1.455 | 1.715 | 1.715 | 1.715 |

| Shanghai Commercial Bank | 1.275 | 1.415 | 1.715 | 1.720 | 1.725 |

| Union Bank (PAObank) | 1.255 | 1.405 | 1.715 | 1.795 | 1.895 |

| Airstar Bank | No data | No data | No data | No data | No data |

You need to pay special attention to offer quotas, deposit terms, and new fund requirements. Some banks, like Shanghai Commercial Bank, have a clear advantage in USD time deposit rates, but quotas are limited, so you must act quickly when applying. Before choosing, review all terms carefully to ensure you can truly maximize high interest.

$1 Million Time Deposit Allocation Suggestions

Image Source: pexels

Splitting Strategy

To maximize interest on a $1 million time deposit, the key is to split your funds wisely. You can divide the $1 million into three or four portions, depositing them in different Hong Kong banks. This allows you to benefit from multiple banks’ new customer or new fund high-interest offers, while diversifying risk and enhancing fund safety.

For example, you can consider the following allocation:

| Bank Name | Deposit Amount (USD) | Expected Annual Rate (%) | Tenor (Months) | Main Offer Conditions |

|---|---|---|---|---|

| PAObank | 250,000 | 5.00 | 6 | New fund high rate |

| Airstar Bank | 250,000 | 4.80 | 6 | New customer exclusive |

| Fubon Bank | 250,000 | 3.85 | 12 | Online application exclusive |

| Shanghai Commercial Bank | 250,000 | 3.95 | 12 | New fund offer |

This splitting method allows you to lock in multiple high-interest offers without exceeding each bank’s deposit protection limit (HK$500,000, ~USD 64,000). You can adjust the amount and tenor of each portion based on your liquidity needs.

Tip: When splitting a $1 million time deposit, check each bank’s offer terms and quota limits to avoid missing the best rates.

Interest Budget

Want to know how much interest you’ll earn after splitting? You can use a simple formula to calculate the interest for each portion, then sum them for the total return. Many financial platforms like FineReport offer pre-built financial statement templates, such as balance sheets, income statements, and cash flow statements. By entering deposit amounts, rates, and tenors, the system automatically calculates total interest, reducing manual calculation hassles.

Here’s a simple interest budget example (for a 6-month tenor, 5% annual rate):

- Single Bank: 250,000 USD × 5% × (6/12) = 6,250 USD

- Four Banks Combined:

- PAObank: 6,250 USD

- Airstar Bank: 6,000 USD

- Fubon Bank: 4,812.5 USD

- Shanghai Commercial Bank: 4,937.5 USD

- Total Interest: ~22,000 USD (6 months)

You can use tools like FineReport to download free income statement templates, quickly input data, and the system will automatically consolidate calculations, making it easier to compare interest returns across allocation plans.

Using online financial statement tools, you can instantly adjust budget data, and the system will automatically validate and summarize, helping you better grasp the actual returns on a $1 million time deposit.

Tips

To maximize interest on a $1 million time deposit, here are some practical tips:

- When applying for new customer or new fund offers at multiple banks, prepare identification and proof of address to streamline the application process.

- Regularly check the latest high-interest offers from Hong Kong banks, as market rates change frequently, and flexible adjustments can earn more.

- Note each bank’s deposit protection limit to avoid excessive deposits in a single bank, ensuring fund safety.

- Leverage online applications and automated financial statement tools to reduce manual calculation errors and improve management efficiency.

- Some banks offer cash rebates or lucky draws, so stay alert for promotional periods to secure extra rewards.

By regularly reviewing market rates and bank offers, flexibly allocating your $1 million time deposit and tenors, you can balance high interest and safety, maximizing fund efficiency.

Precautions

Penalty Risks

When choosing a time deposit, pay special attention to early withdrawal penalty risks. Most banks deduct accrued interest if you withdraw principal before maturity, sometimes offering only savings account rates. You should plan fund liquidity in advance to avoid losing interest due to urgent needs.

Tip: Split funds into different tenors so that even if you need to access some funds early, it won’t affect all interest income.

Deposit Protection

Each time you deposit, consider the Deposit Protection Scheme. Hong Kong’s scheme provides up to HK$500,000 (~USD 64,000, based on 1 USD = 7.8 HKD) protection per depositor per bank. By splitting a $1 million deposit across multiple banks, you ensure each portion is within the protection limit. This maximizes principal protection in case of individual bank issues.

- It’s recommended to regularly check each bank’s protection terms to ensure fund safety.

Savings Account Options

Sometimes, high-interest savings account rates exceed certain time deposit rates, which is attractive if you need flexible fund access. Market data shows that some joint-stock and foreign banks’ savings rates are close to the lower end of 3-month time deposits, or even higher in some cases. Refer to the table below:

| Bank Type | Savings Rate | 3-Month Time Deposit Rate | 1-Year Savings Interest (100,000 USD) | 1-Year 3-Month Time Deposit Interest (100,000 USD) |

|---|---|---|---|---|

| State-Owned Commercial Bank | 0.35% | 2.85% | 350 | 712.5 |

| Joint-Stock Bank | 0.385% | 2.86% | 385 | 715 |

| Foreign Bank | 0.385% | 2.86% | 385 | N/A |

When choosing products, compare actual rates for savings and time deposits to allocate funds flexibly.

Note: Some banks’ cash rebates and high-interest offers have caps, so review terms to avoid missing benefits due to exceeding limits.

To maximize interest on a $1 million time deposit, diversify funds, choose high-interest Hong Kong banks, and flexibly allocate tenors. Leverage new customer and online offers, and stay updated with market information. Note each bank’s protection limit and penalty risks to ensure fund safety. Adjust your strategy based on your needs to easily boost returns.

FAQ

1. Can I apply for new customer time deposit offers at multiple Hong Kong banks simultaneously?

You can apply for new customer offers at multiple banks simultaneously. As long as you haven’t opened an account with the bank before, you’re eligible for new customer high-interest time deposits.

2. What are the losses if I withdraw a time deposit early?

Most banks deduct accrued interest or offer only savings account rates. You should plan fund liquidity to avoid losing interest.

3. How to allocate $1 million USD for maximum safety?

| Number of Banks | Deposit per Bank (USD) | Protection Limit (USD) |

|---|---|---|

| 4 | 250,000 | 64,000 |

You split funds across multiple banks, with each portion not exceeding USD 64,000, for maximum safety.

4. Can savings account rates exceed time deposit rates?

Sometimes, certain Hong Kong virtual banks’ savings rates exceed traditional banks’ short-term time deposit rates. You should compare product rates and allocate funds flexibly.

5. What documents are needed to open a time deposit?

You need to prepare identification, proof of address, and bank account details. Some banks may require in-person identity verification at a branch.

Maximizing returns on a $1 million fixed deposit requires strategic allocation to capture high-interest offers while managing risks, but cross-border fund transfers often face high fees and complex overseas account setups, particularly for PST investors navigating time zone challenges. BiyaPay streamlines this by enabling direct trading of U.S. and Hong Kong stocks without overseas accounts, enhancing flexibility for fixed deposit funds. Its multi-asset wallet offers fee-free USDT conversion to fiat currencies like USD and HKD, with cross-border remittance fees as low as 0.5%, minimizing costs. A 1-minute BiyaPay account registration empowers you to optimize global investments, balancing high returns and liquidity in 2025.

Boost your investment returns! Join BiyaPay.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.