- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Complete Guide to Bank of China Code and Branch Code Lookup

Image Source: unsplash

If you want to quickly find the Bank of China code and branch code, you can directly visit the Bank of China (Hong Kong) official website or log into the Hong Kong Interbank Clearing website. You can also call the Bank of China (Hong Kong) customer service hotline. Please ensure to rely on official information to avoid trusting unverified information circulating online.

Key Points

- Use the Bank of China (Hong Kong) official website or the Hong Kong Interbank Clearing website to look up bank and branch codes, ensuring accurate and reliable information.

- Both bank codes and branch codes are three-digit numbers, representing the bank and specific branch, respectively, and must be used correctly when filling out transfer or remittance forms.

- If accessing the internet is inconvenient, you can call the Bank of China (Hong Kong) customer service hotline or visit a branch in person to inquire, avoiding reliance on unofficial sources to prevent errors.

Looking Up Bank of China Code and Branch Code

Official Website Lookup

You can directly visit the Bank of China (Hong Kong) official website to look up the Bank of China code and branch code. This is the most reliable method. You only need to follow these steps:

- Open the Bank of China (Hong Kong) official website (https://www.bochk.com).

- On the homepage, look for the “Branch Network” or “Service Outlets” option.

- After clicking, you will see a list of all branches in Hong Kong. Each branch will display its name, address, and branch code next to it.

- If you need the bank code, you can find relevant information on the “FAQs” or “Customer Service” page.

You can also use the Hong Kong Interbank Clearing website (https://www.hkicl.com.hk) for lookup. After entering the website, select the “Bank Code and Branch Code Lookup” function, enter the bank name or branch name, and you can find the required information.

Tip: You should rely on the Bank of China code and branch code provided by the official website. Information circulating online may be outdated or incorrect.

Customer Service and Other Channels

If accessing the internet is inconvenient, you can call the Bank of China (Hong Kong) customer service hotline (+852 3988 2388) to inquire. You only need to provide the branch name or address to the customer service representative, and they will immediately look up the correct Bank of China code and branch code for you.

You can also visit any Bank of China (Hong Kong) branch in person to ask. Counter staff will assist you in finding the relevant codes.

Sometimes, you can find the branch code on your checkbook, debit card, or bank statement. However, this information may vary depending on the account type or branch adjustments. It is recommended to primarily rely on official channels for inquiries to ensure accuracy.

Note: You should avoid relying on unofficial websites or social media information. Only official channels can provide the latest and most accurate Bank of China code and branch code.

Code Definition and Structure

Image Source: unsplash

Bank Code

When handling banking transactions, you often encounter the “bank code.” The bank code is typically a three-digit number used to identify different banks. For example, the bank code for Bank of China (Hong Kong) is “012.” This code is crucial for transfers, remittances, or filling out forms. As long as you enter the correct bank code, the system can automatically identify which bank it is.

Tip: You can find the official bank codes for all Hong Kong banks on the Hong Kong Interbank Clearing website.

Branch Code

The branch code is also a three-digit number used to distinguish different branches within the same bank. Each branch has a unique branch code. For example, the branch code for the Central branch of Bank of China (Hong Kong) might be “012,” while the Mong Kok branch might be “543.” When conducting local transfers or check deposits, you must enter the correct branch code; otherwise, funds may not be credited correctly.

You can find the bank code and branch code in the following places:

- Check: The bank code and branch code are printed in the bottom left corner of the check.

- Debit Card: Sometimes, the branch code is printed on the front or back of the card.

- Bank Statement: The account details section typically lists the bank and branch codes.

| Document Type | Bank Code Location | Branch Code Location |

|---|---|---|

| Check | Bottom Left | Bottom Left |

| Debit Card | Front/Back | Front/Back |

| Bank Statement | Details Section | Details Section |

Note: You should rely on official information to avoid transaction issues due to incorrect data.

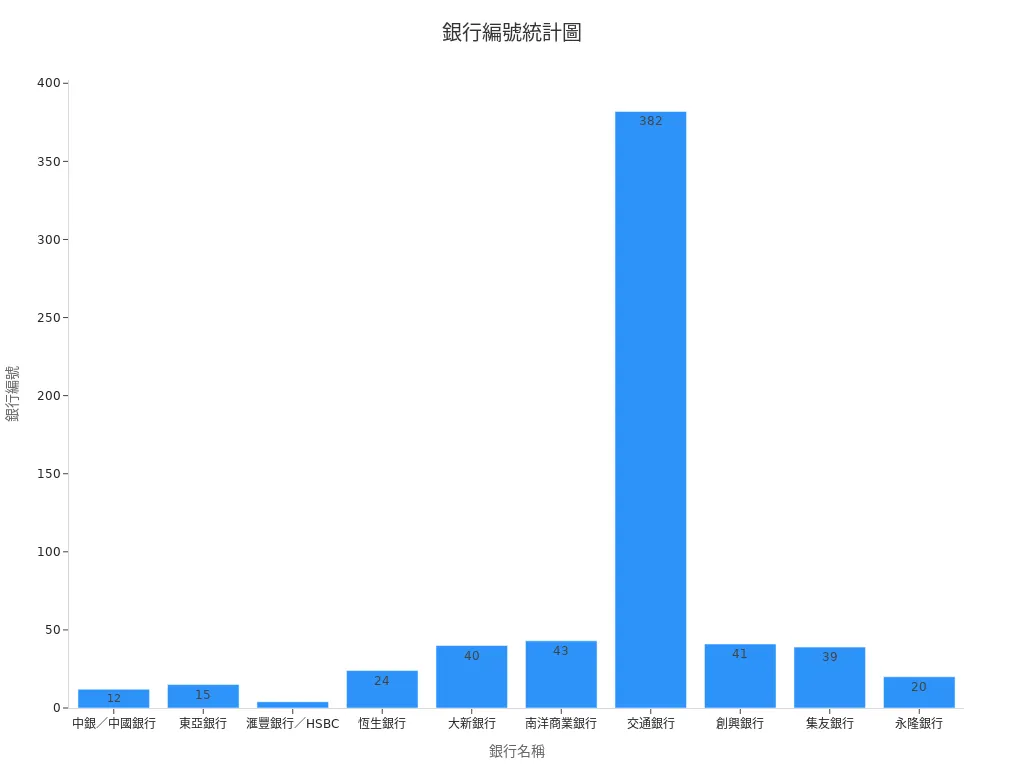

Common Bank of China (Hong Kong) Codes

Image Source: unsplash

Head Office Code

When processing transfers or filling out forms, you often need to enter the head office code for Bank of China (Hong Kong). The most commonly used head office code for Bank of China (Hong Kong) is “012.” Sometimes, you may also see “014” or “019,” which are official bank codes for Bank of China (Hong Kong) under different systems. You can refer to the table below to understand the codes for major Hong Kong banks:

| Bank Name | Bank Code |

|---|---|

| Bank of China (Hong Kong) (BOCHK) | 012, 014, 019 |

| The Hongkong and Shanghai Banking Corporation (HSBC) | 004 |

| Hang Seng Bank | 024 |

| Standard Chartered Bank | 003 |

| Citibank | 006 |

Tip: You can find the latest bank codes and branch codes on the “Branch Network” page of the Bank of China (Hong Kong) official website.

Common Branch Codes

If you need to look up the code for a specific branch, you can directly visit the Bank of China (Hong Kong) official website. The website lists the names, addresses, and branch codes for all branches in Hong Kong. You can also call the bank’s customer service, provide the branch name or address, and the representative will immediately look up the correct branch code for you. Some online payment platforms automatically display the Bank of China code and branch code during electronic transfers, making it convenient for you to select.

Examples of common branch codes include:

- Central Branch: Branch Code 012

- Mong Kok Branch: Branch Code 543

- Causeway Bay Branch: Branch Code 501

- Sha Tin Branch: Branch Code 613

You can find the relevant branch code on your bank statement, checkbook, or debit card. However, it is recommended to primarily rely on the official website or customer service for inquiries to ensure accuracy.

Note: Although third-party websites like HongKongCard offer branch code lookup functions, these are not official sources. Always rely on the Bank of China (Hong Kong) official website for inquiries.

Lookup Methods

Check

You can directly find the Bank of China code and branch code in the bottom left corner of a check. Checks typically print a series of numbers, such as “012-543-123456.” Here, “012” represents the bank code, “543” is the branch code, and “123456” is your account number. You can refer to these numbers when filling out transfer or deposit forms.

Tip: If you’re unsure which set of numbers is the branch code, you can cross-reference with the branch list on the Bank of China (Hong Kong) official website.

Debit Card

Sometimes, you can find the branch code on the front or back of a debit card. Some debit cards print the branch code below or beside the card number. You can check for a three-digit number on the card, which is usually the branch code. If it’s not displayed on the card, you can call the Bank of China (Hong Kong) customer service to inquire.

Bank Statement and Online Banking

Your monthly bank statement typically lists the bank code and branch code in the account details section. You can find this information under “Account Details” or “Branch Details.” If you use online banking, log in and go to the “Account Details” page to view the Bank of China code and branch code.

Note: Display formats may vary by account type; always rely on official information.

Considerations

Remittance Applications

When conducting international remittances, you must distinguish between bank codes, SWIFT Codes, and IBANs.

- SWIFT Code (also known as BIC) is a global bank identifier; Hong Kong banks like Bank of China (Hong Kong) have unique SWIFT Codes.

- IBAN is an International Bank Account Number, mainly used in EU countries, with a longer format including country codes and account numbers. Hong Kong banks generally do not use IBAN.

- Others, such as ABA, CHIPS, and Sort Codes, are used in regions like the U.S. and U.K.

When filling out international remittance forms, you should select the correct identifier based on the recipient bank’s location. The bank’s official website will detail the uses of each code. SWIFT Codes apply to most international remittances, while IBANs are common in Europe.

Tip: If remitting USD to Europe, you must provide both the SWIFT Code and IBAN to ensure funds are credited correctly.

Form-Filling Tips

When filling out bank forms, common errors include missing information, duplicate entries, or incorrect formats. You can follow these methods to reduce errors:

- Use Excel’s ISERROR, IF, ISBLANK functions to check data completeness.

- Use the REMOVE DUPLICATES function to delete duplicate data.

- Use VLOOKUP to cross-check data across different tables.

- For formula errors (e.g., #NAME?, #REF!), you can use ChatGPT to troubleshoot.

- Enable Excel’s Protect Sheet function to restrict input ranges and avoid accidental entries.

Note: You should carefully verify the bank code and branch code to avoid delays or losses due to errors. When filling out amounts in USD, pay attention to the day’s exchange rate to ensure accuracy.

You can follow these steps to quickly look up the Bank of China code and branch code:

- Visit the Bank of China (Hong Kong) official website or the Hong Kong Interbank Clearing website.

- Use the branch network function to find branch information.

- If you have questions, call the Bank of China (Hong Kong) customer service.

You should rely on official channels to avoid data errors. Websites like HongKongCard also provide detailed information, making it convenient to compare codes for different Hong Kong banks.

| Bank Name | Bank Code | Branch Code Example | Account Number Example |

|---|---|---|---|

| Bank of China (Hong Kong) | 012 | 999 | 999999999 |

| HSBC | 004 | 123 | 45678900 |

| Hang Seng Bank | 024 | 371 | 333336668 |

If you have any questions, it is recommended to directly contact Bank of China (Hong Kong) customer service to ensure information accuracy.

FAQ

How do I distinguish between a bank code and a branch code?

The bank code is typically three digits, representing the bank itself. The branch code is also three digits, representing a specific branch.

Where can I find the latest branch codes?

You can find the most accurate branch codes on the Bank of China (Hong Kong) official website or the Hong Kong Interbank Clearing website.

What information is needed for remittances to Hong Kong banks?

You need to provide the bank code, branch code, account number, and recipient name. International remittances also require a SWIFT Code.

Accurately retrieving Bank of China (Hong Kong) branch codes through official channels is crucial for seamless transactions, but cross-border remittances often face high fees and complex overseas account requirements, particularly for PST users navigating time zone challenges. BiyaPay simplifies this with fee-free USDT conversion to fiat currencies like USD and HKD, and cross-border remittance fees as low as 0.5%, supporting transfers to over 190 countries for swift fund delivery. A 1-minute BiyaPay account registration enables efficient global fund management without intricate account setups, while also supporting U.S. and Hong Kong stock investments, ensuring smooth cross-border transactions in 2025.

Streamline your global transfers! Join BiyaPay.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.