- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Recommended Places to Exchange USD to HKD in Hong Kong and Latest Exchange Rate Analysis

Image Source: pexels

Do you want to know the latest 2025 USD to HKD exchange rate? According to Bank of SinoPac’s exchange rate inquiry platform, the real-time USD to HKD rate is approximately 7.8407. You can also refer to official data from the Hong Kong Monetary Authority to understand market interventions and exchange rate fluctuations. The US dollar index has risen recently, impacting global currency exchange costs. When exchanging USD to HKD in Hong Kong, you should always monitor exchange rate changes and choose the appropriate channel.

Key Points

- Checking the USD to HKD exchange rate in real-time is crucial; you can use official websites and multiple online platforms to track the latest rate movements and choose the best exchange timing.

- Hong Kong exchange offices typically offer more favorable rates with low or no fees, banks provide secure and reliable exchanges but with higher rates, and brokerage platforms are suitable for large transactions; choose a channel based on your needs.

- When exchanging, consider both the exchange rate and fees to avoid overlooking total costs; using rate comparison websites can help save money.

- Pre-booking foreign currency and taking advantage of cash or promotional offers from banks or exchange offices can further reduce exchange costs; planning ahead saves more.

- When exchanging USD, be mindful of legal limits on carrying cash and ID requirements, and avoid exchanging at airports or hotels to minimize unnecessary costs and risks.

Exchange Rates and Inquiry

Image Source: pexels

Real-Time Rates

When you want to exchange USD, the most important thing is to grasp the real-time exchange rate. The latest USD to HKD exchange rate in 2025 is around 7.7807. You can check the latest data on official websites like the Hong Kong Monetary Authority and Bank of SinoPac. These platforms update daily, allowing you to stay informed about market trends. Exchange rates fluctuate due to international economics, interest rate policies, geopolitical factors, and more. You should closely monitor rate trends before exchanging to choose a better timing.

Inquiry Methods

You can use various online tools to check real-time exchange rates. Below is a comparison of commonly used platforms’ inquiry accuracy and user reviews:

| Platform Name | Inquiry Accuracy and Performance | User Reviews and Advantages | Disadvantages and Limitations |

|---|---|---|---|

| Perplexity AI | Fast responses, answers include sources, high transparency | No ads, privacy-friendly, suitable for writing and academic needs | Free version uses GPT-3.5, limited depth, weak multi-turn conversation ability, paid version offers stronger features |

| You.com | Response quality varies, sometimes good, sometimes poor | Diverse functions (search, chat, code, image generation), supports multiple AI mode switching, expandable ecosystem | Result pages are cluttered with ads, limited free usage, ads affect user experience |

| Andi | High response accuracy, presented with images and text | No ads, no tracking, strong privacy protection, interface displays key information at once | Unique interface design, new users need time to adapt, features still in testing, limited community and mobile resources |

| iAsk | Strong performance on MMLU benchmarks, ideal for quick fact-checking and popular science | No question storage, good privacy protection, efficient one-question-one-answer format | Provides single answers, lacks multi-perspective views, weak creative functions, no extended services |

| Brave Search | Optional AI responses, prioritizes privacy, zero tracking, no data leaks | Self-built index and open-source models, aims for independent ecosystem | Limited coverage for niche queries, AI responses less deep than GPT-4, weak multi-turn conversation ability, low market share |

| Komo | Good response accuracy, supports multiple languages | No ads, clean interface, combines chat, search, and exploration | N/A |

You can choose a platform based on your needs. Most platforms support real-time inquiries, and some offer rate trend charts and calculators to help compare rates across different periods.

Exchange Rate Fluctuations

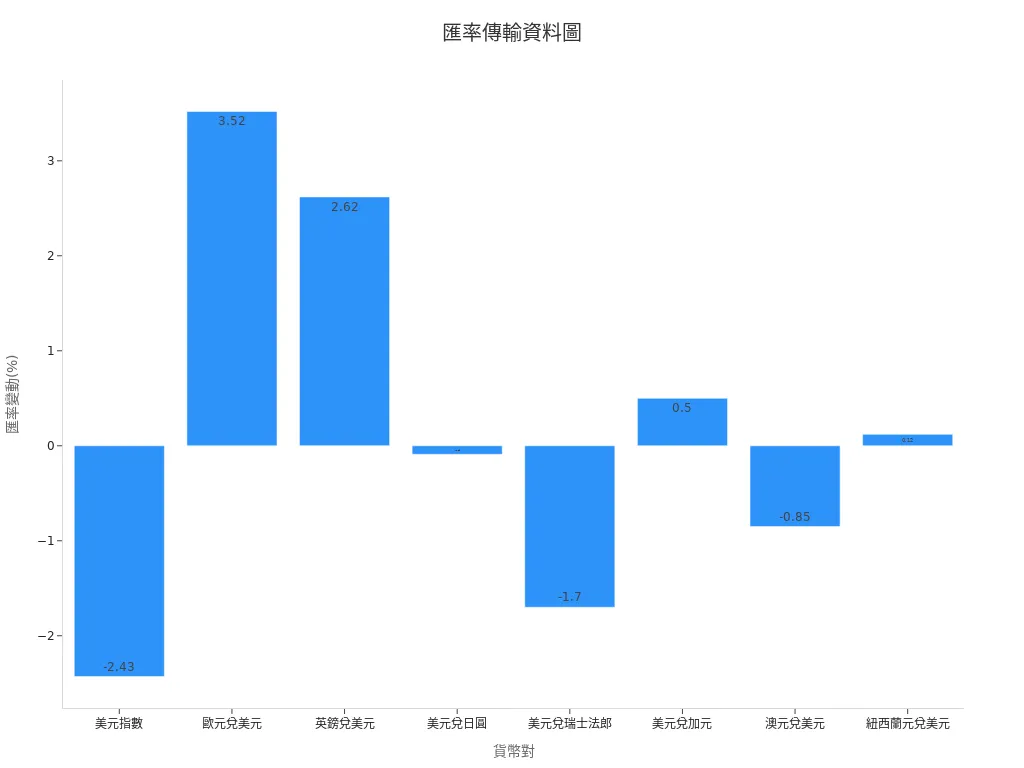

Exchange rate fluctuations directly affect your USD exchange costs. The US dollar index and major currencies’ rates against the USD often change. The table below shows short-term fluctuations of major currencies against the USD in early 2025:

| Currency Pair | Period | Rate Change (%) | Spot Price | 200-Day Moving Average | Support Level | Resistance Level |

|---|---|---|---|---|---|---|

| US Dollar Index | 2025/2/22-3/24 | -2.43% | 104.00 | 104.95 | 102.00 | 105.42 |

| EUR/USD | 2025/2/22-3/24 | +3.52% | 1.0836 | 1.0726 | 1.0730 | 1.0950 |

| GBP/USD | 2025/2/22-3/24 | +2.62% | 1.2956 | 1.2800 | 1.2800 | 1.3050 |

| USD/JPY | 2025/2/22-3/24 | -0.09% | 149.59 | 151.78 | 146.50 | 151.96 |

| USD/CHF | 2025/2/22-3/24 | -1.70% | 0.8818 | 0.8813 | 0.8750 | 0.8910 |

| USD/CAD | 2025/2/22-3/24 | +0.50% | 1.4330 | 1.3969 | 1.4150 | 1.4540 |

| AUD/USD | 2025/2/22-3/24 | -0.85% | 0.6296 | 0.6514 | 0.6200 | 0.6400 |

| NZD/USD | 2025/2/22-3/24 | +0.12% | 0.5740 | 0.5917 | 0.5680 | 0.5800 |

You can see from the chart that fluctuations in the US dollar index and other currencies affect the actual cost of exchanging. When the US dollar index falls, other currencies may appreciate against the USD, altering your USD exchange costs.

Tip: You should compare rates across different periods and exchange when fluctuations are minimal or the USD is weaker to reduce exchange costs.

Places to Exchange USD to HKD in Hong Kong

Image Source: unsplash

When exchanging USD to HKD in Hong Kong, you can choose from various locations and channels. Each location differs in exchange rates, fees, and convenience. You should select the most suitable method based on your needs and amount.

Exchange Offices

When you want to exchange cash, exchange offices typically offer the most favorable rates. Downtown exchange offices face fierce competition, update rates quickly, and charge low or no fees. You can refer to the table below for details of highly rated exchange offices in different areas:

| Area | Exchange Office Name | Location Description | Fee Status | Notes |

|---|---|---|---|---|

| Tsim Sha Tsui | Kin Shing Exchange | Inside Chungking Mansions | No fees | Established name, rates updated daily |

| Tsim Sha Tsui | Eternity Exchange | 17 Hankow Road | No fees | Supports FPS payments, offers niche currencies |

| Kwun Tong | To Fuk Exchange | Multiple branches in Kwun Tong, Tsim Sha Tsui, Lai Chi Kok, Kowloon Bay | Fees not explicitly waived, check by phone | Multiple branches, convenient for industrial areas |

| Sha Tin | Sang Sang Exchange | 3/F, Sha Tin Centre | Fees not explicitly waived | Offers rate comparisons for multiple HK exchange offices |

You can use platforms like YoYoRate.com for real-time rate comparisons to quickly check the latest rates from multiple exchange offices and banks. These platforms update data daily, letting you choose flexibly based on location and rates. You should avoid exchanging on weekends or holidays, as rates fluctuate more during these times.

Tip: Positive reviews and behavioral data from internet-era consumers have become key for building exchange office brands. You can check reviews on online media, self-media, and social platforms to choose reputable exchange offices.

Banks

If you prioritize safety and stability, you can exchange USD at Hong Kong bank counters or through online banking services. Major Hong Kong banks like HSBC, Bank of China Hong Kong, and Hang Seng Bank offer USD to HKD exchange services. You can visit a branch counter in person or use online banking or mobile apps for currency exchange.

The advantage of bank exchanges is safety and reliability, ideal for large transactions. Some banks support instant transfers and pre-booked exchanges, letting you lock in rates. The downside is that rates are often less favorable than exchange offices, and some banks charge fees or set minimum exchange amounts. You should check your bank’s latest rate and fee policies in advance.

Note: Bank counters at airports and hotels offer poor rates and high fees. You should exchange at downtown banks or exchange offices to minimize costs.

Foreign Currency ATMs

If you need cash immediately, consider using foreign currency ATMs. Hang Seng Bank, HSBC, and others have foreign currency ATMs at major malls and MTR stations, supporting USD, HKD, and other currencies. You simply insert your bank card, select USD or HKD withdrawal, and complete the exchange.

The advantage of foreign currency ATMs is 24-hour service, convenience, and speed. You don’t need to queue, making it ideal for urgent cash needs. The downside is that rates are often less favorable than exchange offices, and some ATMs charge fees. You should review your bank’s ATM network and fee details to avoid extra costs.

Brokerage Platforms

If you need to exchange large amounts of USD, brokerage platforms like IBKR (Interactive Brokers) are efficient and cost-effective. These platforms support multiple currency exchanges with rates close to the market mid-rate and fees much lower than traditional banks. You can refer to the table below for IBKR’s key features:

| Item | Details |

|---|---|

| Fee Structure | Manual exchange: USD 2 per trade or 0.002% of trade amount (whichever is higher); Auto-exchange: 0.03% fee. |

| Rate Advantage | Rates close to market mid-rate, typically more favorable than local banks, ideal for large traders. |

| Transaction Flexibility | Supports manual and auto-exchange; auto-exchange recommended for amounts below USD 6,666, manual for larger amounts to reduce costs. |

| Currency Support | Supports 24 currencies, including USD, HKD, EUR, GBP, JPY, offering diverse trading options. |

| User Transaction Volume | No specific data, but tiered fees and near-market rates reflect cost optimization for users with varying trade sizes. |

When exchanging USD on brokerage platforms, the process is entirely online, suitable for users with investment or wealth management needs. You can choose the most cost-effective method based on the exchange amount, flexibly managing funds.

Tip: Brokerage platforms are ideal for large exchanges with low fees and near-market rates. For small cash amounts, choose exchange offices or banks.

When choosing where to exchange USD to HKD in Hong Kong, compare rates and fees across channels. Downtown exchange offices are usually the most cost-effective, while banks and foreign currency ATMs are safer and more convenient. Brokerage platforms suit large-scale users, effectively reducing costs. You should choose flexibly based on your needs, using real-time rate comparison tools to secure the best exchange terms.

Channel Comparison

Rate Differences

When exchanging USD to HKD in Hong Kong, your primary concern is the exchange rate. Rate differences across channels can be significant. You can refer to the table below to quickly compare the rate features of major channels:

| Exchange Channel | Rate Features | Notes |

|---|---|---|

| Hong Kong Banks | Telegraphic transfer rates more favorable, cash rates higher | Online banking rates close to market mid-rate |

| HSBC Mastercard Debit Card | Rates include markup | Rates differ from market price |

| Citi Plus Debit Card | Rates include markup up to 2.4% | Supports 12 currencies |

| Local Exchange Offices | Cash rates more expensive than banks and remittance platforms | Convenient, ideal for short-term travelers |

| Wise Remittance Platform | Close to market mid-rate (zero spread) | Fast remittance |

| TorFX Remittance Platform | Rates include small margin | Offers dedicated account manager |

| Revolut Debit Card | Rates close to market mid-rate | Not available for Hong Kong residents |

If you seek rates closest to the market, consider online platforms like Wise or Revolut. For cash, exchange offices are convenient but often have higher rates. Exchanging via Hong Kong banks’ online banking offers better rates than cash at counters. You should choose the channel based on your needs and amount.

Tip: Before exchanging, use platforms like YoYoRate.com to compare rates across multiple exchange offices and banks in real-time to minimize losses.

Fees

When exchanging, besides rates, you should note fees. Fee structures vary across channels, and some with good rates may have high fees, increasing overall costs. You can refer to the table below:

| Exchange Channel | Fee Status | Notes |

|---|---|---|

| Hong Kong Banks | Most don’t charge fixed fees, profit via rate spread | Online banking exchanges closer to market rate |

| HSBC Mastercard Debit Card | No fees for HSBC ATM withdrawals, fees for non-HSBC ATMs | Rates include markup |

| Citi Plus Debit Card | No fees for overseas withdrawals, 1.95% fee for non-supported currency transactions | Rates include markup up to 2.4% |

| Local Exchange Offices | High fees and rate spreads | Check in advance |

| Wise Remittance Platform | Fees based on remittance amount, starting at ~0.43% | Fast remittance |

| TorFX Remittance Platform | No remittance fees | Rates include small margin |

| Revolut Debit Card | Free account has GBP 1,000 monthly fee-free limit, 1% spread for excess or weekends | Not available for Hong Kong residents |

For small cash exchanges, exchange offices often waive fees but have large rate spreads. Using platforms like Wise, which have clear fees but near-market rates, can lower total costs. Online banking with Hong Kong banks has low fees but less optimal rates. You should calculate total costs, not just focus on one aspect.

Note: Exchanging at airports or hotels has the highest fees and worst rates; avoid if possible.

Cash Rewards

You can sometimes use cash rewards or promotions from banks or exchange offices to further reduce exchange costs. Some Hong Kong banks offer cashback during promotional periods, such as:

- Some Hong Kong banks launch “exchange USD 1,000, get USD 10 cash voucher” campaigns.

- Certain exchange offices offer “exchange USD, get small gifts” or “cumulative exchange extra cashback” during specific holidays.

- Some online platforms provide fee waivers or cashback for new users’ first transactions.

Before exchanging, check the latest offers from banks, exchange offices, and online platforms. By leveraging these rewards, you can receive more HKD in hand.

Tip: Follow bank apps, exchange office social media, or real-time rate comparison websites to stay updated on the latest promotions.

By comparing and staying alert to offers, you can exchange USD to HKD in Hong Kong more cost-effectively.

Money-Saving Tips

Compare Rates

To save money when exchanging USD to HKD in Hong Kong, the first step is to compare rates across multiple exchange offices and banks in real-time. You can use rate comparison websites like YoYoRate.com or MoneyHero to quickly check the latest rates from different channels. Enter the amount, and the system automatically displays exchange prices from various offices and banks. You can also check rates directly on major banks’ official websites or apps. This gives you a clear overview, allowing you to choose the most favorable exchange point. You should monitor rate fluctuations and avoid peak periods or holidays, as rates are typically worse then.

Pre-Book Currency

To lock in rates further, consider pre-booking currency. Many Hong Kong banks and exchange offices offer online pre-booking services. You can select the amount and rate in advance, avoiding temporary rate changes when collecting cash. According to public data from the central bank’s website, you can refer to the following statistics when pre-booking currency:

- Import-export foreign exchange balance statistics to understand market transaction flows and costs

- Foreign currency settlement platform providing transaction records and settlement information

- Exchange transaction balances and foreign currency liquidity statistics reflecting market fund conditions

- Detailed statistical database and release schedule for easy access to latest and historical data

These data come from the central bank’s official website and are authoritative. You can analyze pre-booking costs and market trends based on this data to choose the best timing.

Avoid Fees

When exchanging, pay special attention to fees. Some exchange offices offer good rates but charge extra fees. You should inquire in advance and choose fee-free channels. For large USD exchanges, online platforms like Wise or brokerage platforms have clear fees but lower total costs than banks. Avoid last-minute exchanges, as they often result in high fees or unfavorable rates. Plan ahead and use account benefits or promotions to further reduce costs.

Tip: Always calculate total costs, including rates and fees, before each exchange to ensure smart spending.

Notes

Cash vs. Telegraphic Transfer

When exchanging USD to HKD in Hong Kong, understand the cost differences between cash and telegraphic transfers. According to statistics, the spread for cash exchanges is about 2.27%, while the spot rate spread is only 0.326%. Cash exchange costs are roughly seven times higher than spot rates. If you don’t need cash for travel, opt for telegraphic transfers or foreign currency account conversions to significantly reduce costs. Telegraphic transfer fees and cable fees vary by bank, as shown below:

| Bank Name | Telegraphic Transfer Fee Range | Cable Fee | Total Cost for USD 30,000 Transfer (OUR Full Amount) |

|---|---|---|---|

| Mega Bank | 0.05% (min USD 4, max USD 27) | USD 10 | ~USD 25 |

| Cathay United | Fixed USD 7 | USD 10-13 | Counter: ~USD 38, Online: ~USD 27 |

| E.Sun Bank | 0.05% (min USD 3.5, max USD 27) | USD 10 | ~USD 46 |

| Taipei Fubon | 0.05% (min USD 3.5, max USD 27) | USD 10 | ~USD 41 |

| Bank of Taiwan | N/A | N/A | ~USD 41 |

Tip: Unless necessary, avoid cash exchanges; opt for telegraphic transfers or online transfers to save money.

Carrying Limits

When carrying large amounts of cash in or out of Hong Kong, you must comply with legal requirements. Under Hong Kong law, anyone entering or leaving with over HKD 120,000 (approximately USD 15,300) must declare to customs. Failure to declare is illegal and may result in fines or prosecution. You should calculate your cash needs in advance to avoid unnecessary trouble.

Exchange Limits

When exchanging USD to HKD in Hong Kong, different channels impose varying limits on amounts. Exchange offices are generally lenient with small exchanges, but large amounts (e.g., over USD 10,000) may require pre-booking. Banks set daily or per-transaction limits based on your account level and transaction history. For large exchanges, contact the relevant institution in advance to ensure smooth fund arrangements.

ID Requirements

When exchanging USD, banks and some exchange offices require valid identification, such as a Hong Kong ID or passport. For large transactions, you may need to provide a source of funds statement or proof of address. These measures prevent money laundering and ensure transaction security. You should bring the required documents and follow staff instructions.

Note: Exchange rate fluctuations affect your exchange costs. Monitor market trends and choose optimal timing to minimize losses.

When exchanging USD to HKD in Hong Kong, compare rates and fees across exchange offices, banks, online platforms, and brokers. The table below shows that USD cash transaction costs are around 1.5%, a high proportion of total costs:

| Product Category | Average Volatility | Transaction Cost Proportion |

|---|---|---|

| USD Cash | ~0.95% | ~1.5% |

Exchanging when rates are lower can effectively save costs. Rate differences across channels can reach 2%, so compare and choose the most favorable timing and location. Always calculate total costs to avoid unnecessary expenses.

FAQ

1. What IDs can you use to exchange USD in Hong Kong?

You can use a Hong Kong ID or passport. For large exchanges, some exchange offices or banks may require proof of address.

2. Is it cost-effective to exchange USD at Hong Kong airports?

Exchanging USD at airports is usually not cost-effective. Rates are poor, and fees are high. Choose downtown exchange offices or banks instead.

3. How can you check USD to HKD rates in real-time?

You can use YoYoRate.com, the Hong Kong Monetary Authority website, or bank apps. These platforms show the latest rates and trend charts.

4. Are there minimum or maximum limits for exchanging USD?

Exchange offices have fewer restrictions on small amounts. Large exchanges (e.g., over USD 10,000) may require pre-booking. Banks set limits based on account levels.

5. What safety precautions should you take when exchanging USD?

Avoid carrying large amounts of cash. Deposit funds immediately or take in batches. Choose reputable exchange offices or banks for safety.

With USD to HKD rates around 7.8487, Hong Kong’s money changers offer competitive rates but high cash costs, while banks ensure safety yet charge higher fees, and PST users face cross-border timing challenges. BiyaPay delivers a cost-effective solution with remittance fees as low as 0.5%, covering 190+ countries for rapid transfers, and fee-free conversion of over 200 digital currencies (like USDT) to fiat currencies like USD and HKD. A 1-minute BiyaPay account registration simplifies global fund management without complex overseas accounts, while supporting U.S. and Hong Kong stock investments, empowering you to mitigate exchange rate risks and optimize finances in 2025.

Minimize your exchange costs! Join BiyaPay.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.