- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

How to Choose Bank Interest Rate Products? 3 Minutes to Master Bank of Communications’ Best Preferential Rate Secrets

Image Source: pexels

Do you want to find Bank of Communications’ best preferential rates in the shortest time? Just three steps: first, clarify how you want to use your money, then compare the rates of time and demand deposits, and finally, remember to stay updated on the latest offers. You don’t need professional knowledge or worry about complex terms. This method is simple and straightforward, allowing anyone to learn and apply it immediately to master Bank of Communications’ best preferential rates.

Key Points

- Understand the features of different deposit products; time deposits offer higher rates but require locked funds, while demand deposits provide high liquidity but lower rates.

- Pay attention to Bank of Communications’ latest offers and new fund programs to enjoy returns higher than standard rates.

- Choose suitable products based on personal financial needs and risk tolerance, flexibly utilizing demand, time, and foreign currency deposits.

- Carefully read terms before applying, especially regarding early withdrawal penalties and minimum deposit requirements, to avoid unnecessary losses.

- Stay informed about market rate changes and bank announcements, regularly adjusting financial strategies to maximize fund efficiency.

Product Type Comparison

Image Source: pexels

When choosing bank deposit products, you may find too many options and not know where to start. Don’t worry, below we will introduce five common deposit products one by one to help you quickly understand their features and suitable uses.

Time Deposits

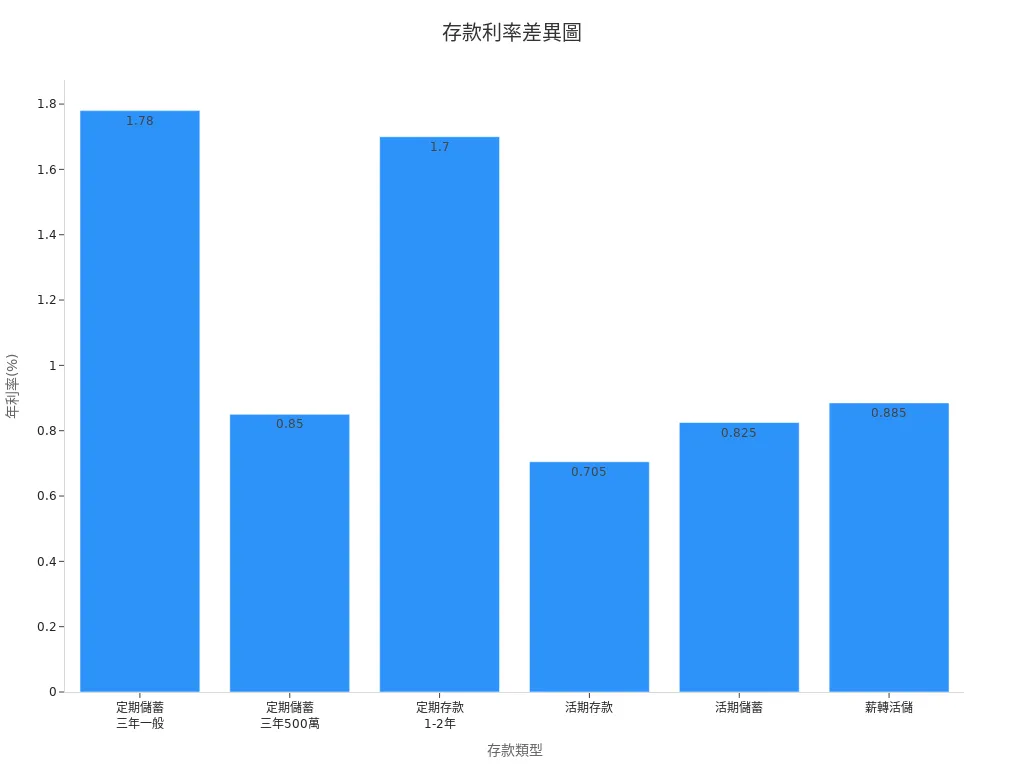

Time deposits are suitable if you have idle funds that you don’t need to use in the short term. Their rates are usually higher than demand deposits, but funds must be locked for a period. Below are some common rates and deposit thresholds:

| Deposit Type | Term | Deposit Amount | Annual Rate (%) | Deposit Threshold |

|---|---|---|---|---|

| Time Savings Deposit | 3 years | General | ~1.78 | No special restrictions |

| Time Deposit | 1 year ~ less than 2 years | General | ~1.70 | No special restrictions |

If you can accept locked funds, time deposits are a stable choice.

Demand Deposits

Demand deposits are suitable if you need to withdraw funds anytime. Their rates are lower, but liquidity is high, ideal for daily expenses or short-term savings. Below is an example of demand deposit rates:

| Deposit Type | Annual Rate (%) | Deposit Threshold |

|---|---|---|

| Demand Deposit | ~0.705 | No special restrictions |

| Demand Savings Deposit | ~0.825 | No special restrictions |

If you need flexible fund access, demand deposits are the best choice.

Digital Accounts

Digital accounts combine high rates with convenience, especially suitable for young people or those accustomed to online banking. For example, some digital accounts offer a 0.36% rate increase for 1-year time deposits, but the deposit amount must be within USD 1,250 (HK$10,000). These products are ideal for small-scale savings and are easy to operate.

Foreign Currency Time Deposits

If you have foreign currency needs or want to diversify investment risks, foreign currency time deposits are worth considering. Their rates are tied to exchange rate fluctuations, suitable for those who can tolerate some risk. For example, USD time deposit rates may be higher than local currency, but you need to be aware of the impact of exchange rate changes.

Installment Savings

Installment savings are suitable if you have a steady income and want to gradually accumulate funds. The minimum deduction amount is USD 125 (~HK$1,000), with a minimum deposit term of 1 year. This method is ideal for those with savings goals but unable to deposit large sums at once.

Each product has its advantages, and the key lies in your fund usage and savings goals. Choosing the right product for you will maximize your funds’ efficiency.

Bank of Communications Best Preferential Rate Selection

Image Source: pexels

Latest Promotional Activities

Do you want to seize Bank of Communications’ best preferential rates? You can start by paying attention to the bank’s quarterly limited-time offers. Recently, Bank of Communications has frequently offered rate increases for time deposits for new accounts or new funds. For example, digital accounts offer a 0.36% rate increase for 1-year time deposits if you deposit within USD 1,250 (~HK$10,000), providing a higher annual rate than standard time deposits. These offers typically have quotas or time limits, so it’s recommended to regularly check the official website or use the online banking platform to stay updated.

Tip: You can subscribe to Bank of Communications’ newsletter or follow their official social media to avoid missing any latest offers.

Fixed vs Floating Rates

When choosing Bank of Communications’ best preferential rate products, you often face the choice between “fixed rates” and “floating rates”. How should you decide which is more suitable for you?

- Fixed Rates: If you choose fixed rates, your rate remains unchanged during the deposit term. This is suitable if you want stable returns and don’t want to bear market fluctuation risks.

- Floating Rates: If you choose floating rates, the rate adjusts with market changes. If you expect rates to rise in the future or are willing to take some risk, floating rates may be more suitable.

You can refer to the following market indicators to analyze the performance of fixed and floating rates in different environments:

- Effective Federal Funds Rate (EFFR): Reflects market liquidity and interbank funding costs.

- Secured Overnight Financing Rate (SOFR): Reflects secured overnight borrowing costs.

- Federal Funds Rate Target Range (FFR): The US central bank’s policy rate target, guiding market rate trends.

- Interest on Reserve Balances (IORB): The rate paid by the central bank on bank reserves, affecting banks’ funding cost structures.

- Overnight Reverse Repurchase Rate (ON RRP Rate): Maintains the market rate floor.

- Federal Discount Rate: Reflects central bank monetary policy operations.

- Central Bank Open Market Operations and Reserve Ratios: Affect market fund supply and rate levels.

By observing these indicators, you can predict rate trends and choose the most suitable Bank of Communications preferential rate product for you.

New Fund Programs

If you have new funds to deposit with Bank of Communications, don’t miss their new fund programs. These programs typically offer higher rates than standard time deposits for first-time deposits or new accounts. To participate, the bank may require you to meet certain conditions, such as:

- Your asset size, capital, and risk-weighted asset ratio must meet standards.

- Your after-tax net profit for the past year must be positive, indicating financial health.

- The average non-performing loan ratio over the past three years must be below 4%, reflecting risk management capability.

- You must not have violated financial policies or be deemed unfit.

- Some programs prioritize attracting foreign funds or corporate investments, aligning with government policies.

These new fund programs not only enhance the appeal of Bank of Communications’ best preferential rates but also allow you to enjoy high rates with lower thresholds. By staying updated on program announcements and preparing required documents, you can easily participate.

Note: New fund programs typically have deposit thresholds and term limits, so carefully review terms before applying to avoid missing offers.

By mastering these three key points, whether you seek stability or high returns, you can find the most suitable Bank of Communications preferential rate product for you.

Choosing Based on Needs

To choose the most suitable bank interest rate product, you first need to decide based on your financial needs. Everyone’s financial goals differ; some want flexible fund access, while others aim for long-term wealth accumulation. You can refer to the following common scenarios to quickly find the most suitable product.

Short-Term Funds

If you only want to park funds for a few months or may need money anytime, liquidity becomes crucial. You can choose demand deposits or digital accounts. These products allow you to withdraw funds anytime without penalty issues. Though rates are lower, you don’t need to worry about locked funds.

Tip: You can use Bank of Communications’ digital accounts to enjoy higher rates than traditional demand deposits while retaining fund flexibility.

| Product Type | Liquidity | Annual Rate (%) | Suitable For |

|---|---|---|---|

| Demand Deposit | High | ~0.705 | Daily expenses, short-term savings |

| Digital Account | High | ~1.1 | Small short-term funds |

By keeping funds in these accounts, you can handle unexpected needs anytime.

Long-Term Savings

Do you have long-term savings goals, such as buying a property, funding education, or retirement planning? You can consider time deposits or installment savings. These products offer higher rates, suitable if you’re willing to lock funds for over a year. You deposit a fixed amount monthly, gradually accumulating principal and interest to reach your goal.

-

Time Deposits: You deposit a lump sum and choose a 1-, 2-, or 3-year term, enjoying stable rates.

-

Installment Savings: You deposit a fixed amount monthly, receiving principal and interest at maturity, ideal for those with steady income.

Note: Early withdrawal incurs penalties, so reserve some funds for emergencies.

Seeking High Rates

Do you want your funds to earn higher returns? You can pay attention to Bank of Communications’ limited-time preferential rate activities or join new fund programs. These programs often target new accounts or new funds, offering rates higher than standard time deposits. You can also consider foreign currency time deposits, especially USD deposits, which sometimes have higher rates than HKD. However, foreign currency deposits are subject to exchange rate fluctuations, suitable if you’re willing to take some risk.

| Product Type | Annual Rate (%) | Risk | Suitable For |

|---|---|---|---|

| New Fund Programs | ~2.0-2.5 | Low | Seeking high rates, ample funds |

| Foreign Currency Deposit (USD) | ~3.0-4.0 | Exchange rate fluctuations | Those who can tolerate exchange rate risks |

Tip: Before joining high-rate programs, carefully read terms to ensure you qualify.

Risk Tolerance

When choosing products, besides rates, consider your risk tolerance. If you prefer no risk, opt for local currency time or demand deposits, which are low-risk with stable returns. If you’re willing to bear exchange rate fluctuation risks, consider foreign currency time deposits for higher rates, but principal may decrease due to exchange rate changes.

You can ask yourself a few questions:

- Can you accept funds being locked for a period?

- Would you feel uneasy about exchange rate declines?

- Do you need immediate access to these funds?

By choosing products based on your needs and risk preferences, you can maximize your funds’ efficiency.

Recommendation: Regularly review your financial goals and market conditions, flexibly adjusting your product mix to enjoy long-term benefits from Bank of Communications’ best preferential rates.

Application and Precautions

Application Process

Applying for Bank of Communications’ interest rate products is straightforward. You only need to prepare identification, proof of address, and the deposit amount. Then, you can choose to apply in person at a branch or directly through the online banking platform. Most Hong Kong banks provide clear application process charts online, making each step easy to follow. These charts and statistical data help banks identify common issues in the application process, such as data entry errors or long wait times. Banks optimize processes based on this data to make your application smoother.

Tip: Check the application guide on the official website first to reduce in-person wait times.

Early Withdrawal

If you choose time deposits or installment savings, be cautious about early withdrawal. Most banks impose penalties, potentially preventing you from earning the expected interest. For example, if you deposit USD 5,000 and withdraw early, the actual interest received may be significantly reduced. Ask about penalty terms before applying to avoid unnecessary losses.

-

Penalty calculations are typically outlined in the product brochure.

-

Some banks deduct part of the principal or interest as a penalty.

Rate Changes

When choosing floating rate products, rates adjust with market changes, meaning your monthly interest may vary. Banks adjust rates based on market indicators (e.g., SOFR, EFFR). You can regularly check the official website or online banking platform to stay updated on rate information. This allows you to flexibly adjust your financial strategy based on market changes.

Recommendation: Set up rate change notifications to receive the bank’s latest updates instantly and avoid missing important adjustments.

Common Pitfalls

When choosing bank interest rate products, it’s easy to fall into a few common traps. Below are three pitfalls you must watch out for to truly benefit from Bank of Communications’ best preferential rates.

Focusing Only on Rates

Do you only look at annual rate figures? Many people get excited by high rates and rush to apply. But high rates don’t always mean the product suits you. Some high-rate products apply only to specific amounts or short-term promotions, with rates dropping after the offer period. If you don’t read the details, the interest earned may be less than expected. You should first clarify your fund usage and compare the total returns of different products.

Tip: Use a table to record each product’s actual annual rate and applicable conditions for clearer comparisons.

Ignoring Terms

Do you carefully read terms when applying for bank products? Many people only look at promotional flyers, overlooking details like penalties, early withdrawal, and minimum deposit amounts. If you withdraw early, some products may deduct most of the interest or charge a penalty. You must ask about all terms before applying, especially penalties and offer periods, to avoid losses due to oversight.

- Common terms include: early withdrawal penalties, minimum deposit amounts, preferential rate periods, and fund source requirements.

Neglecting Liquidity

Have you considered whether you might suddenly need funds? Some people lock all their money in time or foreign currency deposits for high rates, only to lose more due to early withdrawal penalties when emergencies arise. You should reserve some funds in demand deposits or digital accounts to handle unexpected situations flexibly. Liquidity is as important as rates, so don’t focus on one at the expense of the other.

Recommendation: Split funds into two parts—one for high rates, one for liquidity—for more secure financial planning.

By following the above methods, you can select the most suitable Bank of Communications interest rate product in 3 minutes, easily enjoying the best preferential rates.

It’s recommended to act immediately and regularly stay updated on the bank’s latest offers, flexibly adjusting your financial strategy.

The selection process is simple, fast, and practical, suitable for both beginners and experienced investors to master effortlessly.

FAQ

What is the minimum amount for Bank of Communications’ time deposits?

You only need USD 100 (~HK$780) to open a time deposit. Different products have different thresholds, so check the official website first.

Can I have multiple digital accounts simultaneously?

You can open multiple digital accounts, but each account’s preferential rates and deposit limits vary. Compare terms carefully.

What are the losses from early withdrawal of a time deposit?

If you withdraw early, the bank typically deducts part of the interest or returns only the principal. Ask about penalty details before applying.

Are high-rate foreign currency time deposits always suitable for me?

Foreign currency deposits offer higher rates but carry exchange rate fluctuation risks. If you’re unfamiliar with foreign currency markets, opt for local currency products.

How can I check Bank of Communications’ latest preferential rates?

You can log into the Bank of Communications online banking platform anytime or subscribe to their newsletter. The bank regularly updates offer and activity information.

In 2025, Bank of Communications offers up to 3.4% p.a. on HKD fixed deposits (from HKD 20,000), but choosing products requires balancing rates with liquidity, while forex deposits face exchange rate risks and PST users encounter cross-border challenges. BiyaPay delivers a seamless solution with remittance fees as low as 0.5%, covering 190+ countries for swift transfers. It uses real-time market rates, displayed transparently via the exchange rate calculator, ensuring a convenient experience, and supports fee-free conversion of 200+ digital currencies (like USDT) to USD, HKD, and JPY. A 1-minute BiyaPay registration simplifies global fund management, optimizing returns and flexibility.

Maximize your savings and remittances! Join BiyaPay.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.