- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Bank of China Online Account Opening Guide and Precautions

Image Source: pexels

When you plan to apply for a Bank of China account, please prepare a valid ID, proof of address, and a mobile phone in advance. The account opening process includes:

- Downloading the “Bank of China Hong Kong Mobile Banking” App

- Preparing the required documents

- Completing identity verification and facial recognition

- Filling in personal information

- Setting a login password

You can choose to open an account online or in person at a branch, accommodating students, working professionals, or mainland Chinese residents flexibly. It is recommended to check the accuracy of your information in advance to avoid delays.

Key Points

- Before applying for a Bank of China account, prepare a valid ID, proof of address, and a mobile phone, ensuring the information is clear and valid to avoid application delays.

- The online account opening process is simple and fast; just download the Bank of China Hong Kong Mobile Banking App, complete identity verification, facial recognition, and information filling, with approval typically completed within 1 to 3 working days.

- When logging into online banking for the first time, set a strong password and security questions, and enable mobile authentication to protect account security and prevent personal information leaks.

- Some accounts have minimum deposit requirements; check and prepare sufficient funds in advance to ensure a smooth account opening process.

- When using online banking, change passwords regularly, enable two-factor authentication, and monitor account anomalies to enhance fund security and user experience.

Account Opening Eligibility

Age Requirement

You must be at least 18 years old to apply for a Bank of China account. This is a basic requirement for most Hong Kong banks. If you are under 18, you can consider visiting a branch with a parent to inquire about special youth account options. The age restriction helps the bank ensure account security and confirms your ability to manage your finances.

Identity Proof

You need to prepare valid identity proof documents. Hong Kong residents typically need to provide a Hong Kong ID card. Mainland Chinese residents need to provide a Chinese resident ID card. In some cases, the bank may require you to present a passport or other supplementary proof. You should ensure all documents are within their validity period and the information is clear and legible.

Tip: If you hold multiple identity proof documents, it’s recommended to bring them all to facilitate bank verification.

Proof of Address

You must provide proof of address issued within the last three months. Common proof of address includes utility bills (water or electricity), bank statements, or letters from government departments. These documents must display your name and current address. Some banks may require you to provide additional occupational or income proof for further review.

- Examples of proof of address documents:

- Bank statements

- Utility bills

- Government letters

If you don’t have the above documents, you can inquire with the bank about other acceptable proof methods. You should ensure all information is accurate to expedite the account opening approval process.

Bank of China Account Opening Process

Image Source: pexels

Online Account Opening

You can choose to apply for a Bank of China account online. This method is suitable for those seeking convenience and speed. You only need to download the “Bank of China Hong Kong Mobile Banking” App and follow the instructions to complete the following steps:

- Open the app and select “Open a New Account.”

- Upload valid identity proof documents, such as a Hong Kong ID card or Chinese resident ID card.

- Perform facial recognition to verify your identity.

- Fill in personal information, including name, date of birth, contact phone number, and email address.

- Upload proof of address issued within the last three months, such as a bank statement or utility bill.

- Set a login password and security questions.

After completing these steps, the system will automatically review your information. Generally, you will receive the account opening result notification within one to three working days. You don’t need to visit a branch, saving significant time. This process is particularly suitable for students, working professionals, or those needing flexible scheduling.

Tip: Ensure the uploaded documents and proof of address are clear and legible, as unclear submissions may delay the Bank of China account opening process.

In-Branch Account Opening

If you prefer to handle the Bank of China account opening in person, you can visit a branch. You need to bring the following documents:

- Valid identity proof documents (e.g., Hong Kong ID card or Chinese resident ID card)

- Proof of address issued within the last three months

- Mobile phone and email address (for receiving notifications)

Upon arriving at the branch, staff will assist you in filling out the application form and verify your documents on the spot. Some branches support online appointment booking, allowing you to reserve a time slot in advance to reduce waiting. In-branch account opening is suitable for those needing immediate consultation or with special requirements, such as opening a foreign currency account or inquiring about wealth management products.

Note: Some Bank of China account types may have minimum deposit requirements, such as USD 100 (approximately HKD 780 based on the daily exchange rate), so check the details in advance.

Joint Account

If you want to manage funds with family or friends, you can consider applying for a joint account. For a Bank of China joint account, all applicants must visit the branch in person. Each applicant needs to bring:

- Valid identity proof documents

- Proof of address

- Contact information

At the branch, staff will verify everyone’s information and explain the joint account’s operation methods. For example, some joint accounts require all holders’ consent for withdrawals or transfers. This account type is suitable for family financial management or co-managing small businesses.

Tip: Before opening a joint account, discuss fund management agreements with other applicants to avoid future misunderstandings.

Activation and Login

Activating Online Banking

After receiving the Bank of China account opening success notification, you can follow the bank’s instructions to activate online banking services. You need to download the “Bank of China Hong Kong Mobile Banking” App first. If you’ve already downloaded it, open the app directly. You will see the “Activate Online Banking” option. Follow the on-screen steps:

- Enter your account number and ID number.

- Set up mobile authentication, ensuring your phone number is correct.

- After receiving a one-time password (OTP), enter the code to complete authentication.

Tip: Ensure your phone has a stable signal and the registered phone number matches the bank’s records to avoid issues during activation.

After activation, you can use the mobile app to check account details, transfer funds, or pay bills anytime. This step is crucial, as only by activating online banking can you access most electronic banking services.

First Login

When logging into online banking for the first time, you need to set a login password and security questions. This helps protect your account security. Follow these steps:

- Enter your account number and mobile authentication details.

- Set a strong password, preferably including letters, numbers, and symbols.

- Select and answer security questions to assist with password recovery in the future.

After completing these steps, you can officially log into online banking. You can check account balances, transfer funds, pay bills, and even apply for e-statements. During each login, pay attention to any suspicious messages or anomaly alerts to ensure personal information security.

Note: Do not disclose your password or security question answers to others. If you notice suspicious activity, contact Bank of China customer service immediately.

Precautions

Document Requirements

When applying for a Bank of China account, you must prepare genuine and valid documents. The bank will verify your identity proof and proof of address. If documents are expired or unclear, the bank may reject your application. You should check all documents in advance to ensure clarity. The bank does not accept applications on behalf of others; all applicants must apply in person.

Tip: If you have more than one identity proof document, bring them all to facilitate bank verification.

Data Accuracy

All information you provide must be accurate. The bank will review your application based on the submitted data. Errors or omissions can delay the account opening process. You should double-check key information such as name, date of birth, and contact phone number. Discrepancies may require you to submit additional documents or lead to application rejection.

- Common data errors include:

- Inconsistent name spelling

- Incorrect contact phone number

- Address not matching proof documents

Deposit Requirements

Some Bank of China account types have minimum deposit requirements. You need to deposit a specified amount during account opening. For example, certain accounts may require a deposit of at least USD 100 (approximately HKD 780, depending on the daily exchange rate). You should check these requirements in advance to avoid delays due to insufficient deposits.

Note: Minimum deposit amounts may vary by account type; consult bank staff for the latest information.

Risk Warnings

When using online banking services, you must pay attention to personal information security. Do not disclose passwords, verification codes, or personal details to others. If you receive suspicious calls or messages, contact the bank immediately to verify. You should change passwords regularly and monitor account activity to prevent fraud risks.

- Security recommendations:

- Use strong passwords

- Enable two-factor authentication

- Regularly check account records

Online Banking and Payment Features

Image Source: pexels

Binding Alipay/WeChat

You can bind your account to Alipay or WeChat within the Bank of China online banking or mobile app. This allows you to transfer funds, pay bills, or shop online across platforms anytime, anywhere. The binding process typically involves a few steps:

- Log into the Bank of China mobile app

- Select the “Alipay/WeChat Binding” function

- Enter the relevant account details and verify your identity

- After binding, you can transfer or receive funds directly

Tip: Ensure your Alipay or WeChat account details match the bank’s registered information to reduce the chance of authentication failure.

Transfers and Withdrawals

You can perform local and cross-border transfers anytime via the Bank of China online banking or mobile app. For withdrawals, you can choose to withdraw cash at ATMs or use the app to apply for cardless withdrawal services. Bank of China employs multi-factor authentication and facial recognition technology, significantly enhancing transaction security. According to public data, the misjudgment rate has dropped to one in a million. The bank also integrates smart ATMs with AI anti-fraud systems, detecting abnormal transactions instantly and alerting you, further safeguarding funds. These measures greatly improve transaction success rates, allowing you to use services with peace of mind.

E-Statements

You can opt for e-statement services. This way, you receive monthly email notifications to view PDF bank statements directly. E-statements are environmentally friendly and allow you to access past transaction records anytime. You only need to set up e-statements in online banking or the app to stop paper mailings, reducing the risk of loss.

Note: Regularly download and back up e-statements for future reference or tax purposes.

Mobile App Features

The Bank of China mobile app is feature-rich, supporting various operations, including checking account balances, transfers, bill payments, wealth management, and credit card applications. You can log in using fingerprint or facial recognition for enhanced security. According to multiple media tests, some bank apps may face compatibility issues across different devices or network environments, such as system lags, crashes, or CAPTCHA recognition errors. Large banks like Bank of China have relatively comprehensive app features with lower error rates, but there’s still room for improvement. You should update the app regularly and monitor official announcements to ensure a smooth experience.

- Common mobile app features:

- Check account balances

- Transfers and bill payments

- Investment and forex trading

- E-statement viewing

- Online customer support

Tip: If the app crashes or operations fail, try restarting your phone or reinstalling the app. If issues persist, contact bank customer service.

Mainland China and Greater Bay Area Account Opening

Mainland China Account Opening Requirements

If you plan to open a Bank of China account in mainland China, you must prepare the following documents:

- Valid Hong Kong ID card

- Mainland Travel Permit for Hong Kong and Macau Residents (Home Return Permit)

- Mainland mobile phone number (must be real-name registered)

- Proof of address issued within the last three months

When visiting a Bank of China branch, staff will require you to present these documents. You need to fill out an application form and undergo identity verification. Some branches may request occupational or income proof. You should check the required documents in advance to avoid delays due to missing materials.

Note: Some Bank of China accounts in mainland China have minimum deposit requirements, such as USD 100 (approximately HKD 780, depending on the daily exchange rate). Prepare sufficient funds in advance.

After completing the account opening, you can apply for online banking services to manage funds in both Hong Kong and mainland China conveniently. You can also use the Bank of China mobile app to check accounts, transfer funds, and pay bills.

“Easy Account Opening” Service

If you already hold a Bank of China Hong Kong account, you can consider using the “Easy Account Opening” service. This service is designed for Hong Kong residents, allowing you to apply for a mainland China personal Bank of China account online without visiting a branch in mainland China.

Simply log into the Bank of China Hong Kong mobile app, select the “Easy Account Opening” function, and upload your identity proof, Home Return Permit, and proof of address as instructed. The system will automatically verify the information and arrange a simple video authentication. Generally, you will receive the account opening result within three to five working days.

The “Easy Account Opening” service supports binding your account to mainland China’s mainstream electronic payment platforms like Alipay and WeChat. You can perform cross-border transfers, bill payments, or shopping directly in the app without exchanging cash or visiting a branch.

Tip: Ensure all uploaded documents are clear and legible, and regularly check the app for account opening progress updates. If you have questions, contact Bank of China customer service.

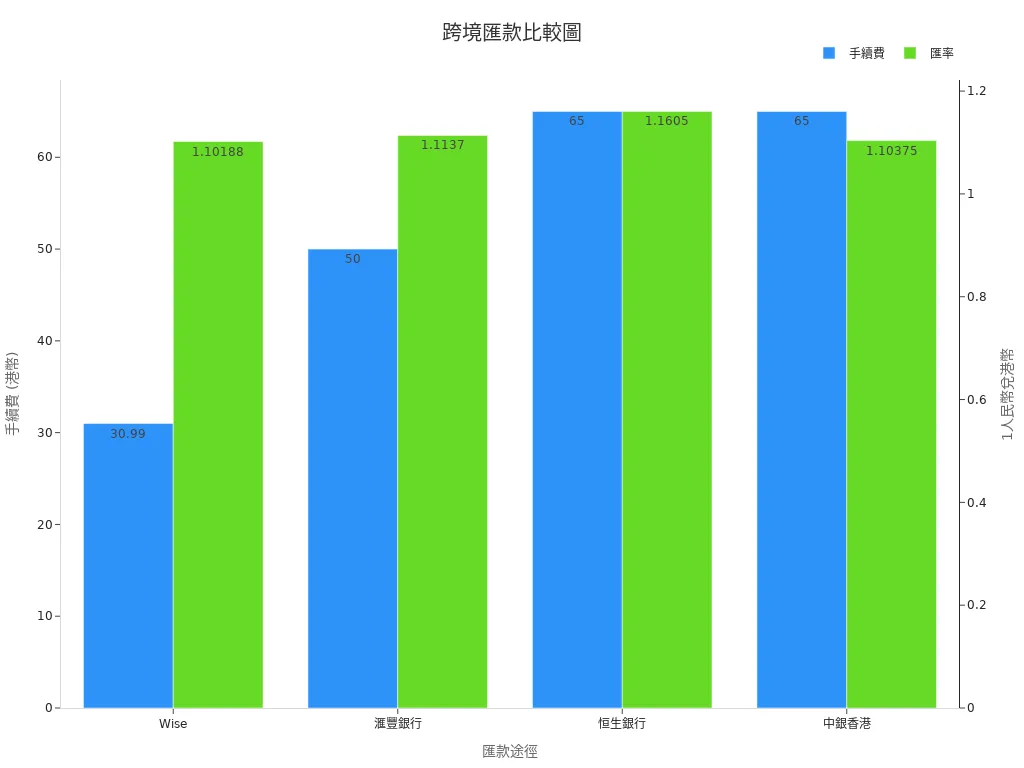

By choosing a Bank of China account, you can enjoy an efficient and transparent process. According to official information, you only need to prepare ID and proof of address to complete the application easily. Bank of China offers multiple remittance methods with clear fees and exchange rates, making it easier to compare services across banks.

Tip: Set a strong password, regularly monitor account activity, and refer to official tutorials when using online banking for the first time to protect personal information.

FAQ

How long does it take to apply for a Bank of China online account?

You generally receive the account opening result notification within 1 to 3 working days. Complete documentation speeds up approval.

Tip: Uploading clear documents can reduce review time.

What is the minimum deposit amount for account opening?

For some accounts, you need to deposit at least USD 100 (approximately HKD 780, depending on the daily exchange rate).

Can I correct errors in submitted information?

If you find errors in your information, contact Bank of China customer service promptly. The bank will guide you to submit or correct documents.

Can I open an account with a foreign passport?

If you hold a foreign passport, some Hong Kong banks accept applications. You need to provide proof of address and other identity documents.

What security measures does online banking have?

When using online banking, the system requires multi-factor authentication, including facial recognition and one-time passwords, to protect your funds.

In 2025, Bank of China (Hong Kong) offers streamlined online account opening, with approvals in 1-3 days, but cross-border remittances carry high fees (7-10%), and PST users face timing challenges. BiyaPay provides a superior solution with remittance fees as low as 0.5%, covering 190+ countries for swift transfers, and supports fee-free conversion of 200+ digital currencies (like USDT) to USD, HKD, and JPY, alongside U.S. and Hong Kong stock investments. A 1-minute BiyaPay registration simplifies global fund management, minimizing costs and exchange risks.

Streamline your remittances and investments! Join BiyaPay.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.