- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Dow Jones Weekend Effect in 2025 and What It Means

Image Source: pexels

The Dow Jones continues to show a weekend effect in 2025. Data reveals that Monday returns often react to news and events from the weekend dow period. Investors see increased volatility on Mondays, which can present both risks and opportunities. Traders watch these patterns closely. Understanding these shifts helps investors make informed choices and manage their portfolios more effectively.

Key Takeaways

- The weekend effect means the stock market often shows weaker returns on Mondays compared to Fridays, driven by investor emotions and news over the weekend.

- In 2025, the Dow Jones shows increased Monday volatility, creating both risks and opportunities for investors who watch these patterns closely.

- Trading strategies based solely on the weekend effect rarely produce consistent profits, so investors should combine them with other analysis and risk controls.

- Effective risk management includes reviewing positions on Fridays, using stop-loss orders, monitoring weekend news, and diversifying portfolios to protect against Monday market swings.

- The weekend effect appears in many markets worldwide but can change over time and varies by company size and sector, so investors should stay informed and flexible.

Weekend Effect

What Is the Weekend Effect

The weekend effect describes a pattern where the market shows different returns on Mondays compared to Fridays. In the stock market, this means that prices often drop or show weaker gains at the start of the week. Researchers first noticed this pattern in the early 1970s. Frank Cross documented that the stock market often had higher returns on Fridays and lower or negative returns on Mondays. This pattern became known as the weekend effect in stocks.

The weekend effect in stocks has drawn attention because it challenges the idea that markets always act efficiently. Investors and analysts have studied this effect for decades. They found that the weekend effect in stocks appears in many markets, including the Dow Jones Industrial Average. The effect was strong before 1987, faded for a while, and then returned with more volatility after 1998. Some experts believe that company news released after the market closes on Fridays and changes in investor mood over the weekend play a role.

Weekend Effect in Stocks

The weekend effect in stocks has a long history. Many studies have confirmed its presence in the Dow Jones Industrial Average and other major indices. The pattern shows that the market tends to perform better on Fridays and worse on Mondays. This trend has appeared in both large and small companies. Researchers like K.R. French and Keim found that the weekend effect in stocks is not limited to one market or time period. They used new methods to measure the effect and found it in different sectors.

- Key findings about the weekend effect in stocks:

- The weekend effect in stocks was first studied in detail by K.R. French in 1980.

- Later studies confirmed that the effect appears in both large and small companies.

- The weekend effect in stocks has been tested using advanced statistical tools to ensure it is not random.

- Sector studies show that the weekend effect in stocks can impact the entire market structure.

Historical data shows that the weekend effect in stocks has real impacts. The Dow Jones Industrial Average often sees lower returns on Mondays after gains on Fridays. This pattern affects how investors plan their trades and manage risk. The weekend effect in stocks remains a key topic for anyone interested in understanding market behavior.

Weekend Dow Patterns

Image Source: unsplash

Monday Returns

The weekend dow effect remains a key focus for analysts in 2025. Monday returns on the Dow Jones have shown a consistent pattern this year. The index often opens with higher volatility after the weekend, reflecting the impact of news and investor sentiment. In 2025, the monday effect has become more pronounced. Analysts observe that the market returns on Mondays frequently differ from other weekdays. This trend aligns with the historical monday effect, where returns on the first trading day often lag behind those of Fridays.

A review of recent data shows that the Dow Jones Industrial Average trades around $42,211.7 as of mid-2025. The index reached an all-time high of $45,067.3 in November 2024. Since January 2025, the Dow has delivered a bullish return between 6% and 8%. This performance signals a continuation of the upward trend, even as the monday effect persists. Technical indicators such as MACD and volume surges confirm these patterns. The monday effect in 2025 does not always mean negative monday returns, but it does highlight increased risk and opportunity at the start of each week.

Note: The monday effect can create both challenges and advantages for investors. Those who monitor weekend dow patterns closely can adjust their strategies to capture gains or avoid losses.

Friday to Monday Gaps

Friday to Monday gaps in the weekend dow have drawn attention in 2025. These gaps occur when the opening price on Monday differs sharply from Friday’s close. The gaps often reflect news released over the weekend or changes in global sentiment. In 2025, the performance of the Dow Jones from Friday to Monday shows both upward and downward gaps, but the overall trend remains positive.

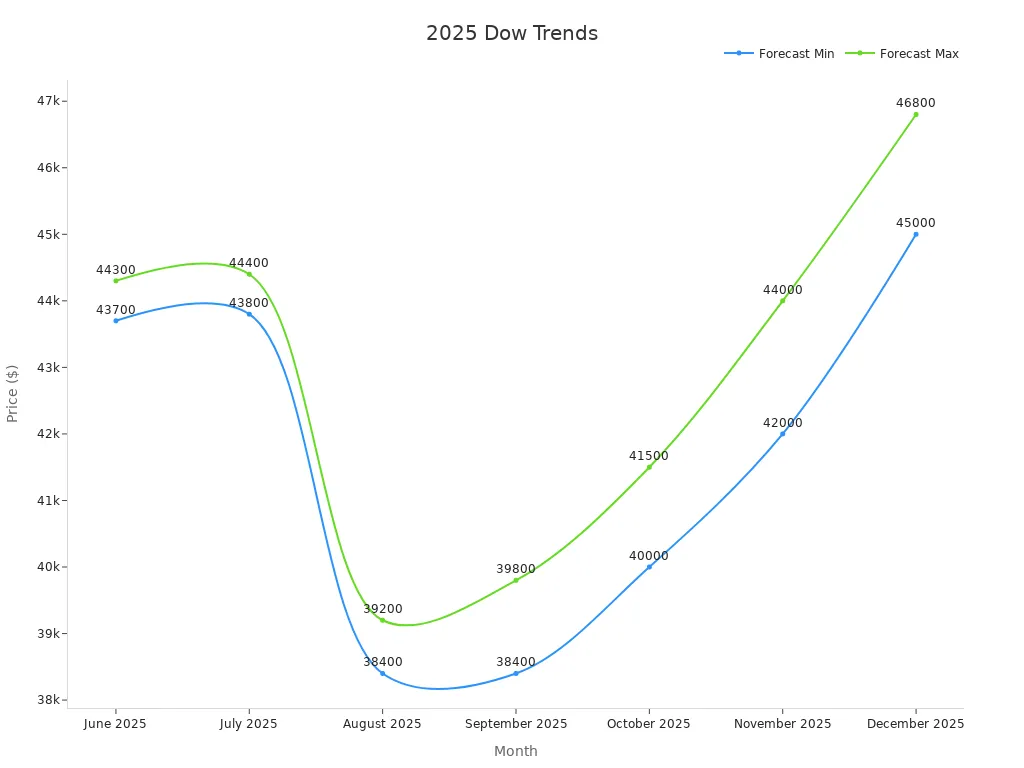

The following table summarizes forecasted minimum and maximum Dow Jones prices for the second half of 2025:

| Month | Forecasted Minimum Price ($) | Forecasted Maximum Price ($) |

|---|---|---|

| June 2025 | 43,700 | 44,300 |

| July 2025 | 43,800 | 44,400 |

| August 2025 | 38,400 | 39,200 |

| September 2025 | 38,400 | 39,800 |

| October 2025 | 40,000 | 41,500 |

| November 2025 | 42,000 | 44,000 |

| December 2025 | 45,000 | 46,800 |

The chart above illustrates the forecasted price range for the Dow Jones through the end of 2025. The weekend dow pattern shows that after periods of correction, the index often rebounds, especially near strong support levels around $38,400. Analysts recommend profit-taking near highs up to $46,800, which matches the forecasted price movements. The monday effect continues to influence returns, but the overall performance remains strong.

- Key points about weekend dow patterns in 2025:

- The monday effect appears more frequently, with both positive and negative monday returns.

- Technical signals such as MACD and volume surges help confirm trend reversals.

- Fundamental factors like US macroeconomic policies and corporate earnings support the market’s stability.

- Analysts do not expect major declines, reinforcing the long-term upward trend in performance.

Market returns in 2025 show that the weekend dow effect still matters. Investors who understand these patterns can better manage risk and improve their performance. The monday effect, with its frequent gaps and volatility, remains a central feature of the Dow Jones trading week.

Causes of the Weekend Effect

Market Psychology

Market psychology plays a central role in the weekend effect and the monday effect. Investors often react emotionally to news and uncertainty that builds up when the market closes on Friday. Over the weekend, they have more time to process information, which can lead to anxiety or optimism. When the market opens on Monday, this pent-up emotion often results in higher volatility and unusual price movements. The monday effect becomes more visible as traders respond to their feelings rather than just facts.

Empirical studies show that the weekend effect shifted over time. From 1963 to 1983, negative returns moved from active Monday trading hours to the period between Friday’s close and Monday’s open. This shift suggests that the weekend effect links closely to how investors behave when the market is closed. The monday effect often appears because traders anticipate changes or react to rumors and news that surface during the break. The market does not always act rationally, and the monday effect highlights how psychology can drive returns.

Note: The weekend effect and monday effect both show that investor mood and behavior can shape the market, especially after a pause in trading.

News and Events

News and events released during the weekend also drive the weekend effect and the monday effect. Important announcements, such as changes in government policy or unexpected company news, often come out when the market is closed. Investors cannot react until Monday, so the market may open with sharp moves. The monday effect becomes stronger when major news stories break over the weekend.

Research using GARCH and EGARCH models finds that the market shows lower returns and higher volatility on Mondays. This pattern links to the monday effect and the weekend effect, as investors digest news and adjust their positions. A study in Nature found a strong positive correlation between the volume of financial news and trading activity. Financial Times issues are longer on Saturdays and Mondays, which means more news for investors to process before the market opens. This extra information can make the monday effect more pronounced.

Long-term studies using advanced econometric tests confirm that the weekend effect and monday effect are not constant. They change as market dynamics shift. The market sometimes adapts, and the monday effect may fade or return, depending on how investors and news interact. The weekend effect remains a key feature of the market, shaped by both psychology and events.

Impact on Investors

Image Source: pexels

Trading Strategies

Investors often look for patterns in the market to improve their trading results. The weekend effect, especially the Monday effect, has attracted attention for decades. Many traders have tried to build strategies around this pattern. Some choose to sell stocks on Friday and buy them back on Monday, hoping to avoid negative Monday returns. Others watch for price gaps at the start of the week to find short-term opportunities.

However, advanced volatility models such as EGARCH show that the weekend effect does not always create reliable trading opportunities. Backtesting on major indices like the S&P 500 reveals that buying at Friday’s close and selling at Monday’s open does not consistently produce profits. The average return for this strategy has been negative since 2001. No strong link exists between Friday’s performance and Monday’s returns, so traders cannot count on a spillover effect.

Note: While calendar effects like Turnaround Tuesday or the Turn of the Month offer more robust patterns, the weekend effect remains inconsistent. Investors should not rely on it as their main trading strategy.

Academic research supports the idea that the weekend effect exists in some markets, but practical trading strategies based on this effect often fail to deliver steady gains. Behavioral factors, such as investor sentiment and overreaction, can influence short-term price moves. Still, these moves are hard to predict and exploit. Traders who use seasonality strategies, including the weekend effect, may see some benefits, such as less need for constant monitoring and the chance for quick gains. Yet, these strategies also carry risks, like crowded trades and the possibility that old patterns may not continue.

- Pros of seasonality trading strategies:

- Predictable market movements can offer more certainty.

- Potential for high returns in a short period.

- Less need for constant market monitoring.

- Cons of seasonality trading strategies:

- Effectiveness may be limited to certain time frames.

- Overcrowded trades can reduce profits.

- No guarantee that past patterns will repeat.

Investors should combine any weekend effect strategy with other forms of analysis and risk controls. They should avoid relying on the weekend effect alone for trading decisions.

Risk Management

Risk management remains a top priority for investors, especially when facing calendar anomalies like the weekend effect. Historical data shows that Monday returns can be negative, while other weekdays often see positive results. This pattern suggests that investors should pay close attention to their positions before the weekend.

Empirical studies on banks in India, such as HDFC Bank, AXIS Bank, and ICICI Bank, show that returns on Fridays and Mondays can differ significantly. These findings help investors anticipate possible return patterns linked to the weekend effect. By understanding these patterns, investors can adjust their risk management strategies more effectively.

Tip: Investors may consider reducing exposure to risky assets before the weekend or using stop-loss orders to limit potential losses from Monday volatility.

A review of long-term data from 1953 to 1977 on the S&P composite portfolio found that average Monday returns were often negative. This inconsistency with common return models highlights the need for careful risk management. Investors should not ignore the weekend effect, even if it does not always lead to profitable trades.

Practical steps for managing risk around the weekend effect include:

- Reviewing open positions on Fridays and considering whether to hold or reduce exposure.

- Setting stop-loss levels to protect against sharp Monday moves.

- Monitoring news and global events over the weekend that could impact Monday’s market open.

- Diversifying holdings to reduce the impact of any single day’s returns.

A table below summarizes key risk management actions:

| Action | Purpose |

|---|---|

| Reduce exposure on Fridays | Limit risk from weekend news |

| Use stop-loss orders | Protect against sharp Monday declines |

| Monitor weekend news | Prepare for possible Monday volatility |

| Diversify portfolio | Spread risk across different assets |

Investors who understand the weekend effect and adjust their risk management plans can better protect their portfolios. They can also take advantage of opportunities that arise from increased Monday volatility. However, they should remember that the weekend effect is only one factor among many that influence market returns.

Beyond the Dow

Weekend Effect in Stocks

The weekend effect in stocks extends far beyond the Dow Jones. Researchers have found this pattern in many markets and asset classes. French (1980) showed that negative Monday returns appeared in the S&P 500 from 1953 to 1977, proving that the weekend effect in stocks is not limited to one index. Kamara (1997) observed that while the Monday effect faded in large U.S. stocks after 1982, it continued in smaller stocks through 1993. This persistence highlights how the weekend effect in stocks can vary by company size.

Agrawal and Tandon (1994) documented the weekend effect in stocks across global markets. They found negative Monday returns in nine countries and positive Friday returns in 17 out of 18 countries. Steeley (2001) noted that the weekend effect in stocks disappeared in the UK during the 1990s, showing that the effect can change over time and location. Chang and Pinegar (1986) even found return seasonality in long-term government and corporate bonds, suggesting that the weekend effect in stocks may also influence bond markets.

The weekend effect in stocks remains a global phenomenon. Investors should recognize that this pattern can shift based on market structure, geography, and time period.

- Key findings about the weekend effect in stocks:

- Appears in both large and small companies.

- Exists in many countries and asset classes.

- Can disappear or reappear depending on market conditions.

- May influence bonds as well as equities.

Futures and After-Hours

Futures and after-hours trading play a critical role in how the weekend effect in stocks impacts markets. Futures markets stay open after regular trading hours and during weekends. They react quickly to news released outside normal sessions. When a company announces earnings after the market closes, futures prices adjust right away. This immediate response gives traders early signals about the next trading day’s direction and volatility. The weekend effect in stocks often shows up in these price movements before the official open.

Lyócsa and Molnár (2017) studied the impact of non-trading days on volatility in equity markets like the S&P 500. They found that realized volatility drops on the first trading day after weekends and holidays, but not after long weekends. Their research suggests that volatility models work better when they account for trading days following weekends. This finding supports the idea that the weekend effect in stocks influences both futures and after-hours trading.

Futures and after-hours markets help bridge the information gap during non-trading periods. They allow investors to react to news and adjust positions before the main market opens.

The Dow Jones weekend effect in 2025 remains present but offers little practical advantage for investors. Studies show that day-of-week return differences are very small, often less than 0.01%. Market volatility and trading costs usually outweigh these minor patterns.

- Day-of-week returns differ by only fractions of a percent

- Volatility and transaction costs erase most potential gains

- No weekday offers a clear advantage for positive returns

Investors should focus on broader strategies and risk management rather than relying on the weekend effect for consistent results.

FAQ

What is the main reason for the weekend effect in the Dow Jones?

Investor psychology and weekend news drive the weekend effect. Traders react to new information and emotions after the market closes on Friday. This behavior often leads to higher volatility and price changes when the market opens on Monday.

Can investors profit from the weekend effect in 2025?

Most investors find it difficult to profit from the weekend effect. Day-of-week return differences remain very small. Trading costs and market volatility usually erase any potential gains from this pattern.

Does the weekend effect impact all stocks equally?

No, the weekend effect does not impact all stocks equally. Research shows that smaller companies and certain sectors may experience stronger effects. Large companies in the Dow Jones often show less pronounced changes.

How should investors manage risk related to the weekend effect?

Investors can review open positions on Fridays, set stop-loss orders, and monitor weekend news. Diversifying holdings also helps reduce risk. These steps protect portfolios from unexpected Monday market moves.

The 2025 Dow Jones weekend effect drives Monday volatility (around 0.95% daily), fueled by investor psychology and weekend news, with unreliable trading strategies underscoring the need for robust risk management. To address this, sign up for a BiyaPay account in just 1 minute to invest in U.S. and Hong Kong stocks, adeptly navigating market fluctuations. BiyaPay offers remittance fees as low as 0.5% across 190+ countries and fee-free conversion of 200+ digital currencies (like USDT) to USD, HKD, and JPY, streamlining fund management.

Unlock market opportunities with ease! Join BiyaPay.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.