- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Emerging features shaping the best share trading app experience

Image Source: pexels

The best share trading app in 2025 gives you fast, secure, and flexible options for investing. Whether you use a beginner stock trading app or advanced platforms, new features matter. For example, Charles Schwab holds a 4.8/5 rating on the Apple Store and offers over 8,000 no-transaction-fee mutual funds, which shows strong appeal for both new and experienced traders. As trading volume rises and technology improves, apps now use AI and real-time analytics to help you make smarter investing decisions. These changes make trading and investing more efficient for everyone.

Key Takeaways

- The best share trading apps offer fast trade execution and low fees to help you trade quickly and keep more profits.

- Strong security features like biometric login and data encryption protect your personal and financial information.

- AI-powered tools provide smart insights, predictive analytics, and robo-advisory services to improve your investing decisions.

- User-friendly design with easy onboarding and intuitive navigation makes trading simple and enjoyable for beginners and experts.

- Instant fund management and cross-platform access let you deposit, withdraw, and trade smoothly on any device.

Best Share Trading App Features

Fast Execution

You want your trades to happen quickly. The best share trading app gives you fast execution, which means your orders go through almost instantly. This speed helps you get the price you see, not a worse one. Many stock trading apps use smart order routing and low latency systems. These features help you avoid missing out on good deals. For example, 85% of users report faster trade execution with top investment platforms, and 78% say they miss fewer opportunities.

| Performance Metric | Percentage of Users Reporting |

|---|---|

| Faster trade execution | 85% |

| Reduced missed opportunities | 78% |

Some apps also offer real-time dashboards. These dashboards let you track your trades and make quick changes. You can use different order types, like limit or stop-loss, to control your trades. Fast and reliable execution is key for both beginners and advanced traders.

Low Fees

Low fees make a big difference in your trading results. The best share trading app often offers commission-free trading, which means you do not pay extra when you buy or sell stocks. Many platforms now provide free trading for stocks and ETFs. This helps you keep more of your profits.

Tip: Always check if the app charges hidden fees for withdrawals or special services.

A lot of stock trading apps compete by offering commission-free stocks and low fees. For example, some platforms let you trade with no minimum balance. Others give you free trading on options or mutual funds. These features help you start investing with less money and less risk.

Trust and Security

Trust and security are the foundation of any good investment platform. You need to feel safe when you use stock trading apps. The best share trading app uses strong security features, like two-factor authentication and data encryption. These tools protect your personal and financial information.

Research shows that security features and privacy assurance are the top reasons users stay loyal to a platform. Good customer support and a strong reputation also build trust.

| Factor / Aspect | Influence on Continuous Trust and User Retention | Notes |

|---|---|---|

| Security Features | Direct antecedent of continuous trust | Most important for protecting personal data and reinforcing loyalty |

| Privacy Assurance | Direct antecedent of continuous trust | Critical for protecting sensitive financial information |

| Organisation Reputation | Strong influence on trust and perception of app | High reputation signals fairness and reliability, indirectly boosts perceived security |

| Customer Support | Strong influence on trust and retention | Timely, responsive support enhances trust; poor support damages trust |

You can see that the best share trading app stands out by offering a mix of free trading, commission-free stocks, and strong security. Each platform tries to attract you with unique features.

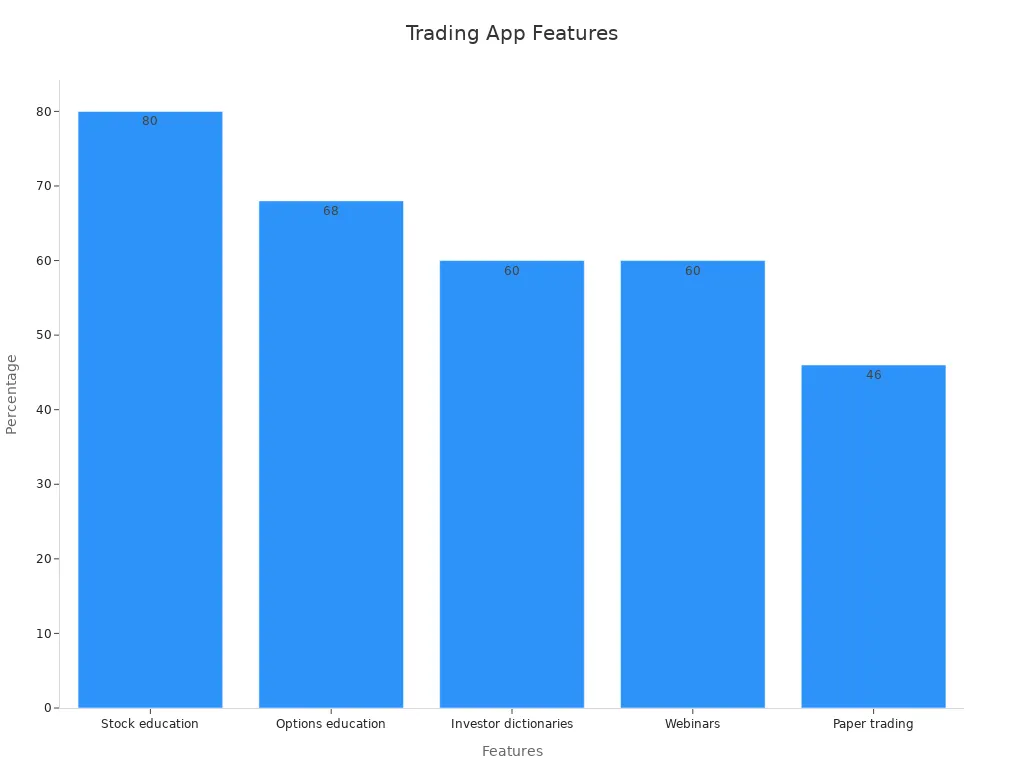

This chart shows how different platforms offer features like stock education, webinars, and paper trading. You should look for the features that matter most to you when choosing an app.

AI Insights

Image Source: pexels

Artificial intelligence now shapes how you approach trading and investing. Many trading apps use AI to help you make better decisions. You see this trend as more platforms add machine learning and real-time data analysis. These tools scan thousands of stocks and provide insights that help you act quickly. AI models like GPT-4 even process news and social media to predict market moves. This shift means you get more accurate information and faster alerts, making your trading experience smarter and more efficient.

Predictive Analytics

Predictive analytics uses AI to forecast market trends. You benefit from these tools because they analyze huge amounts of data, including price history, financial news, and even social media sentiment. Many trading apps now offer AI-powered scores and alerts. For example:

- Some platforms assign AI scores by combining traditional and alternative data, such as job postings and employee satisfaction.

- Others use a 1–10 AI score based on technical, fundamental, and sentiment analysis, giving you clear price targets.

- Advanced trading tools monitor the market in real time and adapt their analysis as conditions change.

- You receive streaming alerts, dynamic top 10 lists, and backtesting features to test your strategies.

These features help you spot trends and make informed investments. You can react faster to market changes and improve your trading results.

Robo-Advisory

Robo-advisory services use AI to manage your investments automatically. You answer a few questions about your goals, and the app builds a portfolio for you. These services offer broad investment options, including low-cost ETFs, international stocks, and even SRI/ESG themes. Many trading apps now combine self-driven trading with robo-advisory, so you can choose your level of control.

| Evaluation Metric Category | Specific Metrics | Purpose |

|---|---|---|

| Asset Classes Availability | Fractional shares, SRI/ESG, international stocks | Measures diversity |

| Fees and Commissions | Trading fees, monthly costs, ETF fees | Quantifies cost efficiency |

| Account Services | Cash management, banking, robo-advisor integration | Assesses service quality |

Studies show that robo-advisors often outperform traditional funds on risk-adjusted metrics like the Sharpe Ratio and Jensen’s Alpha. You get better risk management and higher returns, all with lower fees. Many apps also offer real-time updates, financial planning tools, and high security standards. This makes investing easier and safer for you.

User-Friendly Design

Image Source: pexels

Seamless Onboarding

You want to start trading quickly and easily. A seamless onboarding process helps you do just that. Many trading apps now use a user-friendly interface that guides you step by step. You see clear instructions, helpful tips, and simple forms. This approach removes confusion and helps you feel confident from the start.

The guide on attracting new traders to crypto exchanges shows that a simple onboarding process with guided tutorials and efficient KYC/AML checks lowers barriers for beginners. For example, Coinbase’s easy KYC process brought in millions of users. Trial accounts let you explore the app without risk, making it easier to get started. Trade 350 highlights that a frictionless onboarding process builds trust and confidence. Removing confusing steps and hidden fees helps you focus on trading, not paperwork. The Syntellicore mobile app proves that a quick sign-up and integrated KYC uploads let you pre-register in minutes. This boosts conversion rates and keeps you engaged.

Tip: Look for a beginner stock trading app that offers a trial account or demo mode. This lets you practice trading before you use real money.

Design surveys support these findings:

- Onboarding feedback surveys ask users about their first experience, helping developers fix confusing steps.

- Usability feedback surveys check if you can find features easily.

- User journey mapping surveys show where users get stuck, so apps can improve.

- Product-market fit surveys measure how much users value the app, guiding future updates.

Intuitive Navigation

You need to find features and information fast. Intuitive navigation makes this possible. The best trading apps use simple menus, clear icons, and logical categories. This design helps you move from one section to another without getting lost.

Research from trading app case studies shows that clean design and easy navigation make users comfortable. Apps like Binance and Gemini use clear categories and labels, so both new and experienced traders can find what they need. When you use a beginner stock trading app with intuitive navigation, you spend less time searching and more time trading. This reduces confusion and lowers the number of support queries.

User research and UX principles show that intuitive navigation increases your confidence and satisfaction. You feel in control, which keeps you coming back. Beginner-friendly interfaces help you learn faster and avoid mistakes.

| Navigation Feature | Benefit |

|---|---|

| Clear menus | Easy access to features |

| Logical pathways | Faster navigation |

| Simple interfaces | Less confusion |

| Familiar icons | Quick recognition |

A user-friendly design, with seamless onboarding and intuitive navigation, sets the foundation for a great trading experience. You can focus on trading, learning, and growing your investments.

Advanced Trading Tools

Charting and Analytics

You need strong charting and analytics tools to make smart trading decisions. These features help you see price trends, spot patterns, and test your ideas before you invest real money. Many trading apps now offer advanced charting platforms that let you customize your view, use technical indicators, and compare different stocks or markets.

A comparative study shows that using advanced analytics and AI in trading improves your decision-making. AI can process large amounts of data quickly, helping you react to market changes and reduce mistakes. Backtesting software lets you test your strategies with past data, so you can see what works and what does not. Risk-reward tools help you measure possible gains and losses before you make a move. These tools give you more control over your investments and help you trade with confidence.

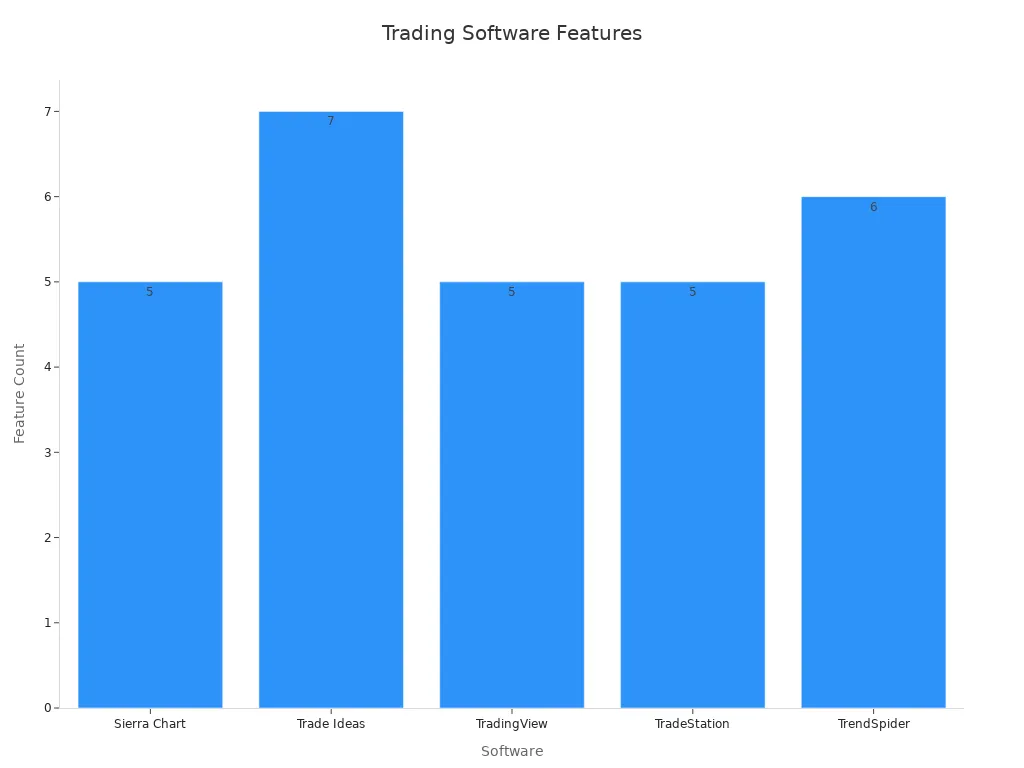

Here is a table showing some top charting and analytics platforms and their features:

| Software | Key Features Supporting Trading Analytics and Charting Effectiveness |

|---|---|

| Sierra Chart | High-performance, customizable charting; real-time and historical data; advanced custom studies; stable and fast; supports multiple markets. |

| Trade Ideas | AI-powered screening; real-time alerts; backtesting; performance tracking; simulated and live trading; cloud storage; real-time stock racing. |

| TradingView | Wide market coverage; extensive charting tools; social network for traders; fundamental and technical screening; free and paid versions. |

| TradeStation | Advanced charting; trading simulation; backtesting tools; supports stocks, ETFs, options, futures, crypto; options strategies. |

| TrendSpider | Automated charting; algorithmic analysis; real-time monitoring; ultra-fast analysis; mobile app available. |

Sierra Chart, for example, is known for its speed and deep analytics. It supports real-time and historical data, which helps you analyze and test your trading ideas across many markets.

Smart Order Types

Smart order types give you more ways to control your trades. You can use limit orders, stop-loss orders, and trailing stops to manage risk and lock in profits. These features help you avoid emotional decisions and stick to your plan. Trading apps now let you set these orders with just a few taps, making it easier to protect your investments.

Studies show that professional traders who use smart order types complete trades faster and get better prices. They often fill orders in under six minutes and reach fill rates close to 99%. These traders also see better results, with more profitable buys and fewer losses on sells. Smart order types help you react quickly to market changes and improve your trading outcomes.

Tip: Use smart order types to set clear entry and exit points. This helps you avoid sudden losses and keeps your investing on track.

Effective trade execution also depends on good risk management. You should review your trades, learn from your results, and adjust your strategies as you gain experience. Trading apps with advanced tools make this process easier, helping you grow your investments over time.

Real-Time Information

Market News

You need access to market news as soon as it happens. Trading apps now deliver real-time market data and news updates directly to your device. This helps you react quickly to changes and make better investing decisions. Platforms like Alpaca Markets use advanced market data feeds with very low latency, sometimes under 20 milliseconds. These feeds give you accurate prices, trade sizes, and order book depth. You can trust that the information you see is current and reliable.

IEX Exchange also provides real-time market data through feeds like TOPS and DEEP. These tools show you top quotes and detailed order book information. You can see how the market moves and spot trends before others do. LSEG offers ultra-low latency feeds and millions of price updates every second. This level of detail supports high-frequency trading and helps you manage risk.

Timely market news boosts your confidence as an investor. Academic research during the COVID-19 pandemic shows that quick access to news increases investor attention and shapes market behavior. Services like the Sevens Report give you early morning analysis, so you never feel caught off guard. You stay informed and ready to adjust your investments.

Note: Staying updated with real-time news helps you avoid surprises and make smarter trading choices.

Integrated Research

Integrated research tools in trading apps help you analyze the market and improve your investing results. You can use AI engines to spot trends and patterns. For example, Trade Ideas uses AI to find opportunities and lets you backtest strategies before you trade. This means you can test your ideas using historical data and see what works best.

Interactive Brokers’ IBot uses natural language processing. You can ask questions or give commands, and the app helps you execute trades faster and with fewer mistakes. TradingView gives you tools to create custom indicators and automate your analysis. These features let you act on real-time information and make decisions with confidence.

- Integrated research tools help you:

- Analyze data quickly

- Reduce errors in trading

- Execute trades efficiently

- Improve your overall trading performance

You get access to investment research resources right inside your app. This makes it easier to compare stocks, review analytics, and plan your next move. When you use these tools, you increase your chances of making successful investments.

Instant Fund Management

Fast Deposits

You want to start trading as soon as you spot an opportunity. Fast deposits make this possible. Many top trading apps now let you add funds instantly using methods like debit cards, e-wallets, or direct bank transfers. When you deposit money, you see it in your account right away. This speed helps you react quickly to market changes and never miss a good trade.

Some platforms even offer instant credit for deposits, so you can begin trading before the bank transfer finishes processing. This feature is especially helpful during high-volatility periods. You stay ready to act, and you do not have to wait for slow banking processes. Fast deposits also reduce stress and make the trading experience smoother for everyone.

Tip: Choose a trading app that supports instant deposits from multiple sources. This flexibility gives you more control over your investments.

Quick Withdrawals

Quick withdrawals are just as important as fast deposits. You want to access your money without delays. Leading trading apps now process withdrawals in seconds, not days. This instant access builds trust and gives you peace of mind. When you know you can get your funds quickly, you feel more confident about using the app for all your trading needs.

User behavior studies in Southeast Asia show that instant withdrawals reduce frustration and increase loyalty. You feel in control when your money is always within reach. Platforms with quick withdrawals see higher repeat usage and better reviews. Many users even refer friends because they trust the platform.

- A 20% drop in support tickets about withdrawals happened after instant payouts started.

- Almost half of investors say withdrawal speed is a key reason for choosing a trading platform.

- More than half of users would switch to an app with instant payouts.

- Instant payouts settle funds in seconds, making the trading experience seamless and secure.

- Automated instant withdrawals also lower costs and reduce fraud risk, helping the platform grow.

You should always look for a trading app that offers both fast deposits and quick withdrawals. These features help you manage your money better and make your trading journey more enjoyable.

Cross-Platform Access

Mobile and Web Sync

You want your trading experience to feel smooth, no matter which device you use. The best platforms now offer seamless mobile and web sync, so you can start a trade on your phone and finish it on your laptop. This feature keeps your data updated in real time. You never have to worry about missing a trade or losing track of your portfolio. Mobile stock trading apps use advanced technology like real-time synchronization and client-side caching. These tools keep your information consistent and reduce errors.

Many investment platforms use performance monitoring tools to track app health and fix issues quickly. For example, developers use Fiddler to optimize API requests and reduce latency. New Relic and Apteligent help monitor errors and crashes, making sure your trading stays reliable. UXCam and Mixpanel analyze how you use the app, so platforms can improve navigation and boost engagement. Companies like Uber and Netflix show that strong sync features lead to fewer errors and happier users.

Note: Real-time sync and offline data updates help you trade even when your internet connection is unstable.

Unified Experience

A unified experience means you get the same features and design on every device. Whether you use a mobile-first platform or switch between desktop and mobile trading platforms, you see the same charts, tools, and order types. This consistency helps you learn faster and avoid mistakes. You do not need to relearn the app when you change devices.

Mobile stock trading platforms now use conflict resolution algorithms to keep your data safe when you update it from different devices. Real-time updates using WebSockets or Server-Sent Events keep your trades and balances current. You can trust that your platform will protect your information and give you a smooth experience.

A unified platform also supports instant notifications and alerts. You get updates about your trades, market news, and account activity right away. This helps you react quickly and make better decisions. Many apps now offer cross-platform access as a standard feature, making trading more flexible and convenient for everyone.

Best Stock Trading Apps Trends

AI Stock Picks

You now see AI stock picks as a core feature in the best stock trading apps. These apps use advanced algorithms to scan the market and suggest stocks with strong growth potential. AI models analyze huge amounts of data, including news, financial reports, and even social media. This helps you spot trends before most investors notice them. Many stock trading apps combine AI with human expertise, which leads to better results.

A recent review of AI stock picking services shows impressive performance. For example, Stock Market Guides reports an average annual return of 79.4% on its stock picks. Trade Ideas uses its Holly AI to run thousands of backtests each night, adapting to changing market conditions. These results show that AI-powered stock picks can help you achieve higher returns compared to traditional strategies.

| AI Stock Picking Service | Performance Data | Key Features |

|---|---|---|

| Stock Market Guides | 79.4% average annual return | AI and extensive backtesting |

| Trade Ideas (Holly AI) | Real-time picks, adapts to market | Proprietary risk management tools |

You can use these tools to make smarter investing decisions and improve your trading outcomes.

Tech-Driven Opportunities

Technology is changing how you find investment opportunities in the market. The best stock trading apps now use AI, 5G, and blockchain to give you faster, safer, and more flexible trading experiences. AI helps you personalize your strategies, analyze market sentiment, and optimize your portfolio. The AI trading market reached $18 billion in 2023 and could grow to $35 billion by 2030.

Blockchain technology brings more transparency and security to trading platforms. It creates a decentralized ledger, which means every transaction is recorded and cannot be changed. This helps you trust the platform and reduces the risk of fraud. The global blockchain market could grow from USD 20.1 billion in 2024 to USD 248.9 billion by 2029. Many platforms now use blockchain for payments, smart contracts, and digital identities.

Note: Cloud-based blockchain solutions make it easier for trading apps to scale and lower costs, while also improving security.

5G technology also plays a role. It gives you faster data speeds and lower latency, so you can react to market changes in real time. This is important when you want to trade quickly or use advanced features like live charting.

You see more investors using technology-driven strategies to find new investment opportunities. For example, some strategies focus on tech companies with strong growth and solid financials. Backtests show these strategies can deliver an 18% annual return, beating the S&P 500 by 7% each year. The best stock trading apps help you access these opportunities and manage your investments with confidence.

Stock Trading Apps Security

Biometric Login

You want your trading app to keep your account safe. Biometric login uses your fingerprint or face to unlock your account. This method gives you strong protection because only you can access your profile. Many apps combine biometrics with multi-factor authentication, making it even harder for someone else to break in. Liveness detection checks that a real person is logging in, not a photo or video. These steps help stop fraud and spoofing.

Security experts recommend regular risk assessments and audits to keep systems safe. You also benefit when apps teach you about how biometrics work and what privacy means for you. If a problem happens, a good app has a plan to respond quickly to any data breach. Federal guidelines now require strong verification methods, including biometrics, for passwordless systems. These rules help make sure your identity stays protected every time you log in.

Tip: Always use biometric login if your app offers it. This adds an extra layer of security to your trading activities.

Data Encryption

Data encryption keeps your personal and financial information private. When you use a trading app, encryption scrambles your data so no one else can read it. Only you and the app can see your details. This protects your account from hackers and keeps your trades safe.

Apps that follow privacy laws like GDPR and CCPA must store and encrypt your data securely. These rules require your consent before collecting or using your biometric information. Zero Trust security models also help by making sure every access request is checked and encrypted. Real-time monitoring and logging spot threats fast and keep your account safe.

Here are some key security practices that top apps use:

- Verify every login and trade with strong authentication.

- Limit access to only what you need.

- Watch for threats all the time.

- Use micro-segmentation to stop attackers from moving around.

- Encrypt all sensitive data.

A trading app that uses biometric login and strong encryption gives you peace of mind. You know your money and information stay protected every time you trade.

You now know what makes the best share trading app experience in 2025. These features help you manage investing with more confidence. When you compare apps, use a checklist to see which ones offer fast execution, strong security, and smart tools. You get better results when you choose apps that make investing simple and safe. Advanced technology and trust help you grow your investing skills and reach your goals.

FAQ

What features should you look for in a share trading app?

You should look for fast trade execution, low fees, strong security, and easy navigation. AI insights and real-time information help you make better decisions. Instant fund management and cross-platform access also improve your trading experience.

How do trading apps keep your money safe?

Trading apps use data encryption and biometric login to protect your account. Many apps follow strict privacy laws like GDPR and CCPA. Some use Hong Kong banks for secure fund storage. Always check if the app uses strong security features before you start trading.

Can you trade international stocks with these apps?

Yes, many top trading apps let you buy and sell international stocks. You can access markets in the United States, China, and Europe. Some apps show prices in USD and update exchange rates in real time. This helps you track your investments easily.

How fast can you deposit or withdraw money?

Most leading trading apps offer instant deposits and quick withdrawals. You can add funds using debit cards, e-wallets, or direct bank transfers. Some apps process withdrawals in seconds. Always check if your app supports fast transactions and shows fees in USD.

Do you need to pay fees for every trade?

Many trading apps offer commission-free trading for stocks and ETFs. Some may charge fees for special services or withdrawals. Always read the fee schedule. Look for apps that show all costs in USD and update rates based on the latest exchange rates.

In 2025, top share trading apps empower you with fast execution, low fees, and AI-driven insights, making investing seamless for beginners and experts alike. From intuitive designs to biometric logins and data encryption, these features ensure secure and efficient trading. Ready to elevate your investments? Sign up for a BiyaPay account in just 1 minute to trade U.S. and Hong Kong stocks, seizing market opportunities with ease. BiyaPay offers remittance fees as low as 0.5% across 190+ countries and fee-free conversion of 200+ digital currencies (e.g., USDT) to USD, HKD, and JPY, streamlining fund management. Choose apps with instant deposits and cross-platform sync for a confident trading experience!

Start your smart investing journey now! Join BiyaPay.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.