- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Exploring Financial Markets with a Practical Guide

Image Source: pexels

You face a world where financial markets can shift quickly. Persistent inflation, with rates like 3.24% for most items and even 10.19% for utility gas, puts pressure on your daily life and investments. Market downturns happen often—history shows 11 bear markets and 5 major declines since 1950, with recoveries taking about 30 months. Decoding financial jargon and understanding what drives markets help you make smarter choices. Practical steps and a clear guide to the markets give you the confidence to explore stocks, bonds, and even futures. You can start building your financial knowledge today.

Key Takeaways

- Financial markets connect people, companies, and governments, helping grow the economy and create jobs.

- Understanding how markets work, including stocks, bonds, futures, and currencies, helps you make smarter investment choices.

- Key trends in 2025 include economic growth, geopolitical risks, technology advances like AI, and growing focus on sustainable investing.

- Using research tools, trading apps, and news analysis improves your ability to track markets and manage risks effectively.

- Start investing with clear goals, small amounts, and simple strategies like index funds; avoid common mistakes by staying informed and diversifying your portfolio.

Guide to the Markets

Image Source: pexels

Why Financial Markets Matter

You interact with financial markets every day, even if you do not realize it. When you save money, invest in stocks, or buy goods, you take part in a system that connects people, companies, and governments. The guide to the markets helps you see why these systems matter for your life and for society.

Financial markets play a key role in the economy. They help move money from people who save to those who need funds to grow businesses or build new products. When you invest, you help companies expand and create jobs. This process supports economic growth and helps everyone benefit.

Research shows that your social network can influence your participation in financial markets. If you have friends or family who invest, you are more likely to join in. A study found that a one standard-deviation increase in Economic Connectedness leads to a 9.5% rise in stock market participation and an 8.0% increase in saving participation. This means that markets do not just affect the economy—they shape how people connect and build wealth.

You also see the impact of markets in your daily life. When markets perform well, companies can hire more workers and pay higher wages. When markets struggle, you may notice fewer job openings or slower wage growth. The guide to the markets gives you the tools to understand these changes and make better decisions.

How Markets Work

Markets bring together buyers and sellers. You can trade stocks, bonds, futures, currencies, and commodities. Each market has its own rules and ways of working. The guide to the markets explains these systems so you can take part with confidence.

You might wonder how the stock market works. It matches people who want to buy shares with those who want to sell. Prices change based on supply and demand. If more people want to buy a stock, the price goes up. If more want to sell, the price drops. This simple rule applies to many markets, including futures and currencies.

Futures markets let you agree to buy or sell something at a set price on a future date. You can use futures to manage risk or try to profit from price changes. For example, a farmer might use futures to lock in a price for crops, while an investor might use them to bet on oil prices. The guide to the markets covers how futures work and why they matter.

Innovation drives change in markets. Companies that create new products or improve old ones can shift how markets operate. Studies show that both radical and small changes can shape market structure and behavior. When firms innovate, they often gain a competitive edge and improve their financial results. This process keeps markets dynamic and helps you find new opportunities.

Financial systems like stock markets and banks help economies grow. They make it easier for businesses to get funding and for people to invest. Research shows that strong financial markets support economic growth by improving how money moves and gets used. However, high inflation can hurt markets. When inflation rises above certain levels, such as 15%, both banking and equity market activity can drop sharply. The guide to the markets helps you watch these trends and adjust your plans.

You can use a comprehensive guide, such as those from J.P. Morgan or SIFMA, to learn market basics. These guides save you time and give you a full view of the market. They help you check your own research, compare your ideas with industry standards, and make better choices. Here are some benefits of using a comprehensive guide:

- You gather important information quickly, saving time.

- You validate your own research with outside insights.

- You see the whole market, not just one part.

- You use unbiased data to make smart decisions.

- You build credibility by backing your choices with solid evidence.

Tip: Use a guide to the markets to spot new trends, understand futures, and make informed decisions.

A guide to the markets also helps you minimize uncertainty. It shows you how to spot new opportunities, avoid risks, and respond to changes. You can follow a simple process:

- Define your goals and what you want to learn.

- Choose the right research methods.

- Collect and review data from trusted sources.

- Analyze the information to find key insights.

- Use your findings to make clear, confident decisions.

When you use a guide to the markets, you gain the knowledge to take part in stocks, bonds, futures, and other markets. You learn how trends shape the market and how to use futures to manage risk or seek profit. This knowledge helps you build a strong foundation for your financial journey.

Financial Market Trends 2025

You see many changes shaping financial market trends in 2025. Understanding these trends helps you spot opportunities and manage risks. You need to look at economic drivers, geopolitical factors, technology shifts, and sustainability. These areas influence how markets move and how you can make smart decisions.

Economic Drivers

Economic drivers set the pace for stock market trends and other asset classes. In 2025, you notice moderate growth. The US Leading Economic Index predicts about 2% GDP growth. The Coincident Economic Index rose by 0.3% in February and 1.2% over the last six months. Payroll employment, personal income, and industrial production also increased. These numbers show that the global economic recovery continues, even with some volatility.

Central bank policies play a big role. When central banks adjust interest rates, you see changes in inflation and market behavior. For example, if the Federal Reserve raises rates, borrowing costs go up. This can slow economic growth but may help control inflation. In 2025, central bank policies remain a key focus for investors. You watch for signals about future rate changes because they affect stocks, bonds, and futures.

You also see policy changes in taxes and trade. Individual tax cuts can boost consumer spending and inflation. Business tax changes may raise GDP and inflation. Immigration policy changes could reduce consumer spending and GDP but might increase inflation. Proposed tariffs can decrease spending and GDP while raising inflation. These shifts create both risks and opportunities in markets.

You find that market volatility often comes from uncertainty, not from weak fundamentals. Equity market breadth is growing beyond just top technology stocks. This broadening base gives you more opportunities to invest in different sectors. You also see growth in healthcare and technology, mixed results in energy, and new opportunities in emerging markets. Currency and commodity markets respond to interest rate differences and global events. Gold and oil prices often rise when uncertainty grows.

Note: Historical data shows that after two years of strong stock market returns, a new technology catalyst like AI can drive further gains. In the late 1990s, the S&P 500 rose 33% in 1997, 29% in 1998, and 21% in 1999 after two years of 20%+ returns. Today, valuation multiples for major tech companies are about half of what they were during the dotcom bubble, suggesting more room for growth.

Geopolitical Factors

Geopolitical factors shape market trends and risk. In 2025, you face rising tensions between the US and China. These tensions increase market volatility, just as past events have done. Conflicts in the Middle East and Ukraine also affect energy and food prices. Higher prices can keep inflation elevated and interest rates high.

You see five main geopolitical trends changing markets:

- Shifts in global power and trade alliances.

- Fragmented regulatory and tax environments.

- Fast-changing technology landscapes shaped by politics.

- Threats to supply chains and infrastructure.

- Demographic and cultural pressures on workforces.

These trends force you to rethink your investment strategies. BlackRock’s Geopolitical Risk Dashboard shows that regional conflicts, trade protectionism, and technology decoupling can move asset prices and increase volatility. The IMF Global Financial Stability Report finds that major geopolitical events can cause sharp drops in stock prices and higher risk premiums, especially in emerging markets. You need to watch these risks and use tools like stress testing to protect your investments.

EY’s 2025 Geostrategic Outlook lists ten high-impact geopolitical developments. These include populist policies, tax challenges, demographic divides, digital sovereignty, climate competition, geo-energy dynamics, and astro-politics. Each one can change how you view opportunities and risks in markets.

Technology Shifts

Technology changes how you invest and manage risk. In 2025, you see rapid growth in AI, fintech, and digital banking. These shifts create new opportunities and challenges in financial markets.

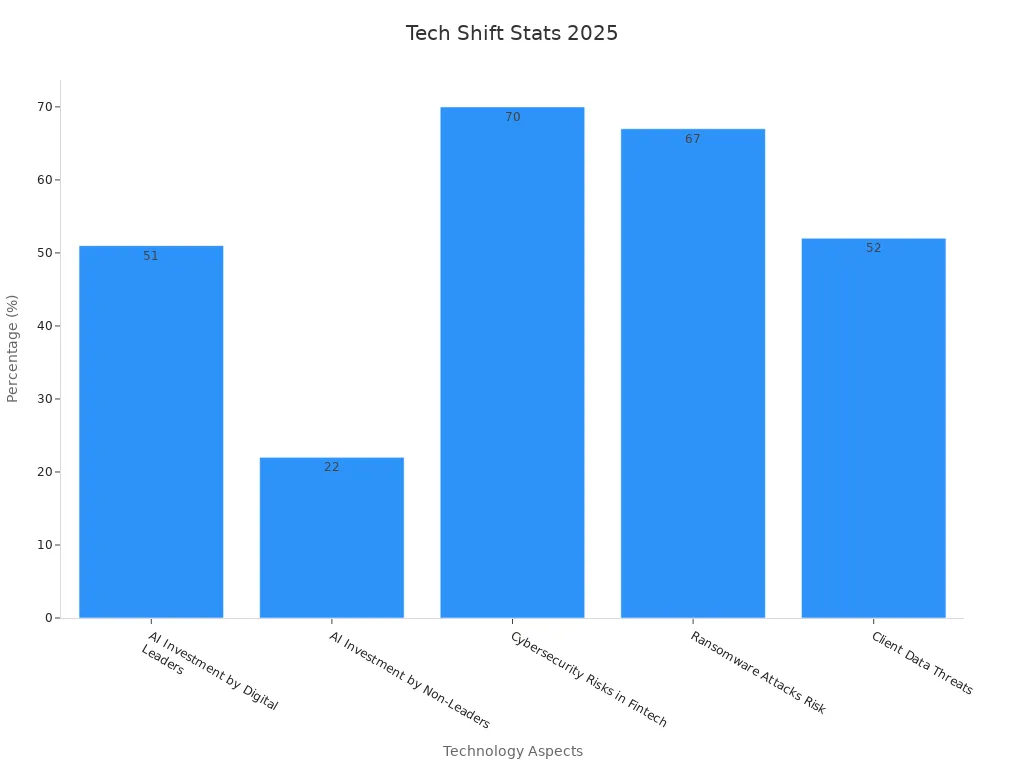

| Technology Area | Statistic / Projection | Year / Period |

|---|---|---|

| AI in Fintech | Valued at $115.4 billion | 2025 |

| AI in Fintech | Projected to reach $250.98 billion | 2029 |

| Embedded Finance Market | Expected growth of 148% | By 2028 |

| Neobanking Market | Projected to reach 386.30 million users | By 2028 |

| Sustainable Finance Market | Expected to reach $18.8 trillion with a CAGR of 22.8% | By 2029 |

| Open Banking API Calls | Over 100 billion API calls globally | 2024 |

| Cybersecurity Risks | 70% of fintech businesses cite payment fraud and email compromise as major risks | 2024 Survey |

| AI Adoption in Firms | 51% of digital leader firms invest in AI vs. 22% of non-leaders | Recent Study |

You see that 51% of digital leader firms invest in AI, compared to 22% of non-leaders. AI boosts productivity and can drive higher market returns. The embedded finance market is growing fast, and neobanking attracts millions of users. Hong Kong banks and others use open banking APIs to improve services. You also need to watch for cybersecurity risks. About 70% of fintech businesses worry about payment fraud and email compromise.

Technology also changes how you trade futures, manage portfolios, and access research. AI and big data help you spot trends and make better decisions. You can use trading apps and research platforms to track stock market trends and futures prices in real time. These tools give you more control and help you find new opportunities.

Sustainability and ESG

Sustainability and ESG (Environmental, Social, and Governance) factors now shape investment strategies. In 2025, you see more investors choosing sustainable investments. Global ESG reporting standards, such as GRI and SASB, make it easier to compare companies. About 80% of investors now consider climate risk in their decisions.

- ESG integration is part of corporate strategy and operations.

- Mandatory ESG disclosures, like the EU CSRD and U.S. SEC guidelines, increase transparency.

- AI and blockchain improve ESG data quality and risk prediction.

- Companies with high ESG scores often have lower capital costs and better long-term results.

- By 2025, ESG-mandated assets are expected to reach $35 trillion, about half of all professionally managed investments.

- 90% of public companies now report on sustainability to build investor confidence.

- Younger investors drive demand for sustainable finance products.

- Social and environmental actions improve brand loyalty and reduce risks.

You see that sustainable investments offer both financial returns and positive social impact. Tools like Carbon Trail and SimaPro help you measure emissions and make better choices. Companies like Unilever and Patagonia show that strong ESG performance can lead to faster growth and higher profits. BlackRock’s ESG-integrated portfolios often match or beat benchmarks with less volatility.

Tip: You can use ESG ratings, green bonds, and AI-driven analytics to find new opportunities in sustainable investments. These tools help you manage risk and support long-term growth.

You need to keep up with market trends and decode financial jargon. By understanding economic, geopolitical, technology, and sustainability trends, you can spot opportunities in emerging markets, trade futures with confidence, and build a strong investment plan for 2025.

Market Types

Stocks and Bonds

You see stocks and bonds as the foundation of most investment portfolios. Stocks give you ownership in companies, while bonds represent loans to governments or businesses. These two types of assets help you balance risk and reward. The relationship between stocks and bonds changes over time. When inflation and interest rates rise, stocks and bonds often move together, which can reduce the benefits of diversification. In the last 20 years, US stocks and bonds usually moved in opposite directions, helping you lower risk during market downturns. This pattern can shift in countries with lower credit ratings or during periods of high inflation.

Here is a snapshot of recent market data:

| Market Type | Metric | Value (Monthly Average) | Month-over-Month Change | Year-over-Year Change |

|---|---|---|---|---|

| Equities | Volatility (VIX) | 20.46 | -36.0% | +56.3% |

| Equities | S&P 500 Price Level | 5,810.92 | +8.2% | +11.0% |

| Equities | Equity Avg Daily Volume | 17.6 billion shares | -9.0% | +41.2% |

| Options | Options Avg Daily Volume | 54.3 million contracts | -33.1% | +25.6% |

| Sector Performance | Best Sectors | Tech/Industrials | +10.8% (month), +8.2% (year) | N/A |

| Sector Performance | Worst Sectors | Healthcare/Consumer Discretionary | -5.7% (month), -6.2% (year) | N/A |

SIFMA tracks the US fixed income markets, giving you data on Treasuries, mortgage-backed securities, and municipal bonds. This information helps you understand the size and activity of these markets.

- When you invest in stocks and bonds, you can use their different behaviors to manage risk.

- Central bank policies and inflation can change how these assets perform together.

Futures Trading

Futures trading lets you buy or sell assets at a set price on a future date. You use futures contracts to manage risk or try to make a profit from price changes. These contracts cover many assets, such as oil, gold, or agricultural products. In futures trading, you agree to the terms now, but the actual exchange happens later.

Futures trading involves risk and reward. You measure risk using tools like standard deviation, beta, and Value-at-Risk. Leverage plays a big role in futures trading. It can increase both your gains and your losses. The formula P = L × ΔPrice shows how leverage affects your potential profit or loss. You also use reward-to-risk ratios to decide if a trade is worth it. For example, a ratio of 3.0 means you expect three times more reward than risk.

You can use technical analysis software, Monte Carlo simulations, and stress testing to manage risk in futures trading. Hedge funds showed during the 2008 financial crisis that using diversified futures contracts and hedging can protect your investments. These tools help you make better decisions in futures trading.

Tip: Always check your reward-to-risk ratio before entering any futures trading position.

Currencies

You trade currencies in the foreign exchange market. This market is the largest in the world. Currency values change quickly because of inflation, interest rates, and global events. Recent US inflation data shows the Consumer Price Index rose by 3.1% in February. Central banks, such as the Reserve Bank of Australia and the European Central Bank, have changed interest rates, which affects currency values.

- Currency markets can be unpredictable.

- Companies use hedging to protect against currency swings.

- Geopolitical tensions and supply chain issues add to volatility.

You need to watch interest rate changes and global news to manage risk in currency markets. Many companies review their hedging policies and cash flow forecasts to handle these changes.

Commodities

Commodities include oil, gold, and agricultural products. You can trade these assets using futures contracts. The performance of commodities depends on macroeconomic trends and financial market activity. Monthly commodity returns often follow changes in the economy, while daily returns react to financial news.

Researchers use a 100-year daily commodities data series to study trends. This data combines the Producer Price Index, S&P GSCI Commodity Total Return index, and DBC ETF data. You can use this information to test trading strategies and manage risk. Studies show that dynamic trading strategies in commodity futures markets can lead to profits, but results change over time.

You use futures contracts to lock in prices or speculate on future moves. These contracts help you manage risk in volatile markets. By understanding how commodities react to economic and financial changes, you can make better investment choices.

Tools and Resources

Research Platforms

You need strong research platforms to make smart choices in financial markets. These platforms help you track stocks, bonds, and futures. Many banks and investment firms use digital tools to serve clients better. The 2024 Digital Banking Performance Metrics Report shows that financial institutions with an average asset size of $4.6 billion now rely on digital solutions. These platforms cover 80% of the top 20 investment consultants and serve 50 of the top 100 asset managers. They process over $14 trillion in assets and have more than 25 years of experience in investment technology.

| Metric Description | Value |

|---|---|

| Institutional client base coverage | 80% of top 20 investment consultants |

| Asset manager clients | 50 of top 100 asset managers |

| Assets under advisement processed | Over $14 trillion |

| Years of expertise in institutional investment technology | 25+ years |

You can use stock market research tools to compare companies, study trends, and analyze futures. These tools help you find new opportunities and manage risk.

Trading Apps

Trading apps let you buy and sell stocks, bonds, and futures from your phone or computer. The global online trading platform market reached USD 10.15 billion in 2024 and will likely grow to USD 16.71 billion by 2032. North America leads this growth, with major players like TD Ameritrade and Interactive Brokers. New features include AI trading assistants and cloud-based platforms. These features make it easier for you to trade futures and manage your investments.

In Asia Pacific, trading apps are growing fast. Taiwan’s ETF market grew by 65% in 2024, with over 14 million investors. Australia’s ETF market is also expanding, with daily trading values over USD 400 million (using an exchange rate of 1 AUD ≈ 0.67 USD). Many apps now offer AI-powered portfolio management and regular saving plans. You can use these apps to track futures, set alerts, and automate trades.

News and Analysis

You need timely news and analysis to make good decisions in the futures market. Sentiment analysis helps you understand how news and social media affect prices. This tool lets you spot trends and manage risk. Advances in natural language processing and machine learning give you real-time insights. Moody’s processes over one million news items each day, helping you react quickly to changes in the futures market.

- Sentiment analysis improves your ability to predict market trends.

- It helps you manage risk by spotting negative news early.

- Real-time data lets you adjust your futures positions fast.

- AI tools make these insights available to everyone, not just big firms.

You can use stock market research tools with sentiment analysis to refine your futures strategies.

Mobile Banking

Mobile banking gives you easy access to your accounts and investments. The mobile banking market will grow by USD 8.6 billion from 2025 to 2033, with a CAGR of 20.0%. North America holds 56.7% of the revenue share in 2024. Most users prefer Android devices for mobile banking. You can manage accounts, deposit checks, pay bills, and get alerts. Mobile banking also lets you trade futures and monitor your investments anytime.

| Aspect | Details |

|---|---|

| Market Growth | USD 8.6 billion increase, CAGR 20.0% (2025-2033) |

| Key Use Cases | Account management, mobile deposits, bill payments, alerts |

| Regional Insight | North America: 56.7% revenue share in 2024 |

| Platform | Android leads in revenue share |

| Market Dynamics | Driven by smartphone use and digital transformation |

| Challenges | Security concerns addressed by advanced technologies |

| Transaction Segment | Customer-to-customer transactions grow fastest |

Mobile banking breaks down barriers, especially in rural areas. You can use your phone to access futures markets and other financial services, even if you live far from a bank. This access helps you stay informed and take action quickly.

Investment for Beginners

Image Source: unsplash

Getting Started

You can begin your investment journey with a clear plan. Start by setting specific goals for your investments. Decide if you want to save for college, a home, or retirement. You do not need a lot of money to start investing. Many platforms let you open accounts with small amounts in USD. Focus on learning the basics of stocks, bonds, and futures. Futures give you a way to invest in commodities, currencies, or indexes with a contract to buy or sell at a set price in the future. This can add both risk and opportunity to your portfolio.

A simple strategy works best for most people. Research shows that 85% of large-cap funds have underperformed the market in the last decade. This means that picking individual stocks is hard, even for experts. You can use index funds or exchange-traded funds (ETFs) to match the market’s performance. These funds offer easy access to a wide range of investment opportunities and help you avoid the risks of trying to pick winners.

Tip: Start early and invest regularly. Time in the market often matters more than timing the market.

Small Investments

Small investments can help you build confidence and learn how markets work. You can use small amounts to buy stocks, bonds, or even futures contracts. Many new investors make common mistakes when starting with small investments:

- Undefined investment objectives can lead to unfocused decisions.

- Lack of diversification increases risk.

- Confusing trading with investing may cause you to chase short-term gains.

- Misinformation from unreliable sources can lead to poor choices.

- Overconfidence from early wins can result in risky bets.

- Chasing hyped opportunities, like the GameStop event in January 2021, can cause losses.

- Behavioral biases, such as recency bias, may cloud your judgment.

You should focus on building a diversified portfolio. Use small investments to test different strategies, but always keep your main goals in mind. Futures can offer unique opportunities, but they also carry higher risks. Stay within your knowledge area and avoid investments you do not understand.

Common Mistakes

Many beginners make similar mistakes when entering financial markets. You can avoid these pitfalls by learning from research and expert advice.

- Trying to time the market often leads to missed opportunities.

- Investing in unfamiliar assets can cause losses.

- Choosing investments that do not match your risk tolerance creates stress.

- Neglecting research is like gambling and can result in big losses.

- Overconfidence may lead to reckless decisions.

- Ignoring risk management increases the chance of losing money.

- Focusing only on past performance ignores future risks.

- Copying others without considering your own goals can be risky.

- Delaying your start reduces the benefits of compounding.

- Not reviewing your portfolio can cause your investments to drift from your goals.

You can avoid these mistakes by setting clear goals, doing your research, and reviewing your investments regularly. Futures trading requires extra caution. Always assess your risk and stay informed about market changes. By following these steps, you can find more opportunities and build a strong foundation for your investment for beginners journey.

Strategies for 2025

Risk Management

You face many risks in financial markets. Futures trading brings both rewards and challenges. You need a strong plan to protect your investments. Start by using real-time analytics and automated risk assessments. These tools help you spot problems early. Always check if new risk management systems work with your current technology. Make sure your system can grow as your needs change.

Follow these steps for better risk control:

- Test new systems in a safe setting before using them fully.

- Train everyone who will use the system.

- Watch for cyber threats and keep your data safe.

- Work with your team to set clear goals and roles.

- Use scenario analysis to see how futures trading might react to big events.

You can manage risks from economic changes, geopolitical tensions, and new technology. Futures contracts let you lock in prices and reduce surprises. Stay alert to new rules and keep your systems up to date.

Diversification

Diversification helps you lower risk when investing. You spread your money across different assets, such as stocks, bonds, and futures. This way, if one market drops, others may hold steady or rise. Futures trading lets you add more types of assets, like gold or oil, to your portfolio. Adding gold has improved risk-adjusted returns in many studies. Short-term bonds also help because they do not move the same way as stocks.

A diversified plan can look like this:

| Asset Type | Example | Benefit |

|---|---|---|

| Stocks | S&P 500 Index | Growth |

| Bonds | Short-term Bonds | Stability |

| Futures Contracts | Gold, Oil | Hedge against volatility |

| Alternatives | Infrastructure | Lower correlation |

| Cash Equivalents | Money Market | Liquidity |

You can use diversification to find new opportunities and protect your investments during market swings.

Adapting to Change

Markets change fast. Futures trading gives you tools to react quickly. You can use futures contracts to adjust your positions as news breaks or trends shift. Technology helps you track prices and manage trades in real time. Stay flexible and review your strategies often. Use scenario analysis to test how your investments might perform in different situations. This helps you spot risks and find new opportunities.

You should also keep learning. New rules, products, and technologies appear each year. Futures trading requires you to stay informed and ready to act.

Building a Plan

A strong plan guides your investing. Start by setting clear goals. Use data to check how your investments perform. Technology tools, like AI and machine learning, help you see patterns and risks. Advisors use these tools to make better choices and keep your plan on track.

You can use simulations to test your plan. Monte Carlo simulations show how your portfolio might react to thousands of market changes. Scenario analysis helps you see what could happen during a crisis. Review your plan often and adjust as needed. Diversification and futures trading both play a role in building a plan that can handle surprises.

Tip: Work with a trusted advisor to review your goals and update your plan as markets change. This keeps you ready for new opportunities and protects your investments.

You now have practical steps to explore financial markets with confidence. Using high-quality information and clear strategies helps you make better choices and supports success for you and others. Stay informed with research tools and news updates. Review your plan often and use digital platforms to track your progress.

Keep learning and take action. Your journey in financial markets starts with one step—begin today and build your future.

FAQ

What is the best way to start investing in financial markets?

You can start by setting clear goals and learning the basics. Use small amounts of USD to open an account on a trusted platform. Choose simple products like index funds or ETFs. Always check the current USD exchange rate before investing.

How do you manage risk when trading futures?

You can use tools like stop-loss orders and scenario analysis. Always set a limit for your losses. Review your positions often. Use research platforms to track market changes. Stay updated on USD values and related exchange rates.

Why do stocks and bonds sometimes move together?

Stocks and bonds may move together when inflation or interest rates rise. Central bank actions can affect both markets. You need to watch economic news and adjust your investments as needed.

What tools help you track financial market trends?

You can use research platforms, trading apps, and news analysis tools. Many banks, such as Hong Kong banks, offer digital services. These tools help you follow prices, news, and USD exchange rates in real time.

In 2025, financial markets offer opportunities amid challenges like 3.24% inflation, geopolitical risks, and AI-driven shifts. From stocks and bonds to futures, diversification and risk management are vital for success. Ready to dive into the markets? Sign up for a BiyaPay account in just 1 minute to trade U.S. and Hong Kong stocks, navigating volatility with confidence. BiyaPay provides remittance fees as low as 0.5% across 190+ countries and fee-free conversion of 200+ digital currencies (e.g., USDT) to USD, HKD, and JPY, streamlining fund management. Leverage research tools and real-time news to seize economic and sustainable investment trends for a robust portfolio!

Begin your wealth-building journey now! Join BiyaPay.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.