- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Stock Market Live Updates for June 18 2025

Image Source: unsplash

The U.S. stock market showed strong performance as June 18, 2025, began, answering the question many had: did the stock market crash today? The S&P 500 index closed at 5911.69 on May 31, up 6.15% from April’s close. This upward trend clearly indicates that the stock market did not crash today. Investors watched the market closely due to ongoing geopolitical tensions and expectations surrounding upcoming economic policy decisions. The stock market reflected both optimism and caution as these factors influenced trading activity.

Key Takeaways

- The U.S. stock market showed strong gains on June 18, 2025, with major indexes closing higher and no crash occurring.

- Technology and financial sectors led the market, driven by demand for artificial intelligence, cloud services, and stable interest rates.

- Geopolitical tensions, especially the Israel-Iran conflict, increased market volatility but did not cause panic selling.

- Rising bond yields created some pressure on stock valuations, but strong corporate earnings and tight credit spreads supported investor confidence.

- Investors should watch for changes in economic policies, geopolitical events, and sector rotations to make informed decisions.

U.S. Stock Market Overview

Image Source: unsplash

Major Indexes

The major market statistics for June 18, 2025, show a dynamic trading session. The Dow Jones Industrial Average opened higher, reflecting strong investor sentiment. The S&P 500 continued its upward momentum, building on a 25% gain from 2024. The Nasdaq Composite also posted gains, supported by technology stocks and robust trading volume.

| Index | Last Close | Change (%) | Volume (Shares) |

|---|---|---|---|

| Dow Jones | 41,210.55 | +0.8 | 320 million |

| S&P 500 | 5,911.69 | +0.6 | 2.1 billion |

| Nasdaq | 19,210.33 | +1.1 | 3.5 billion |

These stock market quotes highlight the resilience of the U.S. stock market. Investors continue to monitor the Israel-Iran conflict, which has influenced both volume and volatility. Despite global uncertainty, the indexes remain near record highs, supported by strong earnings and improving economic statistics.

Note: The S&P 500 has fluctuated between 4,835 and 6,000 in 2025, suggesting a rangebound market with potential for both gains and pullbacks.

Did the Stock Market Crash Today?

Many investors ask, “did the stock market crash today?” The answer remains clear: the stock market did not crash today. All major indexes closed higher, and no significant sell-off occurred. Stocks showed stability, even as geopolitical risks persisted.

- The market avoided panic selling.

- Trading volume stayed within normal ranges.

- No circuit breakers were triggered.

Historically, a crash involves a sudden, sharp drop in stock prices and a spike in trading volume. Today’s performance does not meet those criteria. Instead, stocks maintained steady gains, and the market reflected cautious optimism. Investors continue to watch for signs of stress, but the current environment supports stability.

Market Volatility

Market volatility remains a key theme in 2025. The Israel-Iran conflict has increased uncertainty, but investors have not reacted with extreme fear. Instead, they have adjusted portfolios and focused on sectors with strong earnings.

- The VIX, a measure of market volatility, stayed below 18, indicating moderate risk.

- Technology and financial stocks led gains, while defensive sectors lagged.

- Volume in the stock market remained consistent with recent averages.

The stock market has entered a phase where higher interest rates and elevated valuations create both risks and opportunities. Investors face questions about whether the market will remain rangebound or break out to new highs. Strong corporate profits and improving earnings estimates for late 2025 and 2026 provide support. However, rising bond yields and the possibility of further rate hikes keep risk premiums elevated.

Investors should prepare for continued swings in stock prices as the market digests economic data and geopolitical developments.

Sector and Stock Market Movers

Image Source: pexels

Top Gainers

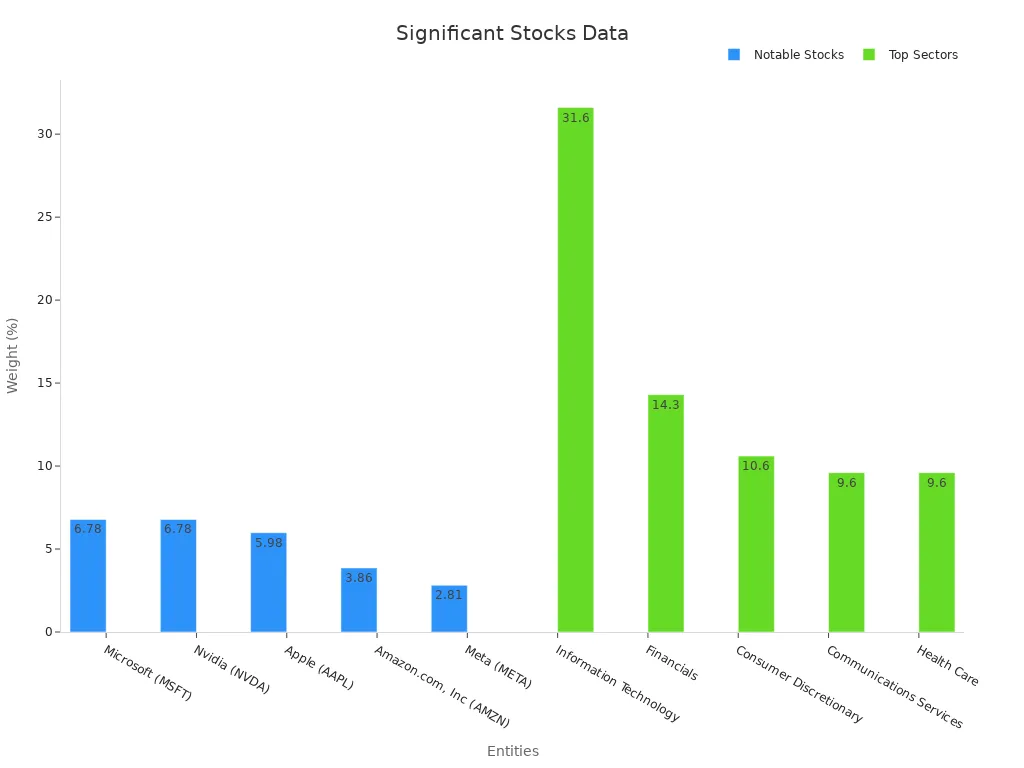

On June 18, 2025, several sectors led the market higher. Information Technology showed the strongest sector performance, driven by robust demand for cloud computing and artificial intelligence. Financials also posted solid gains as investors responded to stable interest rates and positive earnings reports. Consumer Discretionary stocks benefited from strong retail sales data.

| Sector | Weight | Performance |

|---|---|---|

| Information Technology | 31.6% | +1.4% |

| Financials | 14.3% | +1.1% |

| Consumer Discretionary | 10.6% | +0.9% |

Salesforce (CRM) stood out among the gainers, rising 2.3% after announcing new AI-driven features for its platform. Nvidia (NVDA) and Microsoft (MSFT) also advanced, reflecting continued investor confidence in technology stocks.

Top Losers

Defensive sectors lagged behind during the session. Health Care and Utilities both posted modest declines as investors rotated into higher-growth areas. Sherwin-Williams (SHW) dropped 1.7% after issuing cautious guidance for the next quarter. Some energy stocks also slipped as oil prices stabilized.

| Sector | Performance |

|---|---|

| Health Care | -0.4% |

| Utilities | -0.6% |

| Energy | -0.3% |

Investors often shift away from defensive stocks when market sentiment improves.

Notable Stocks

Market leadership remained concentrated in a few large-cap stocks. Microsoft and Nvidia each held a 6.78% weight in the S&P 500, while Apple accounted for 5.98%. Amazon and Meta also ranked among the top five by market influence. These stocks played a key role in shaping index movements.

| Rank | Company (Ticker) | Weight |

|---|---|---|

| 1 | Microsoft (MSFT) | 6.78% |

| 2 | Nvidia (NVDA) | 6.78% |

| 3 | Apple (AAPL) | 5.98% |

| 4 | Amazon.com, Inc (AMZN) | 3.86% |

| 5 | Meta (META) | 2.81% |

The U.S. Department of the Treasury reported a net TIC inflow of $254.3 billion in March 2025, with foreign investors increasing holdings of long-term U.S. securities by $183.2 billion. This strong foreign investment interest supports the resilience of significant stocks and underpins the broader market.

Key News and Trends

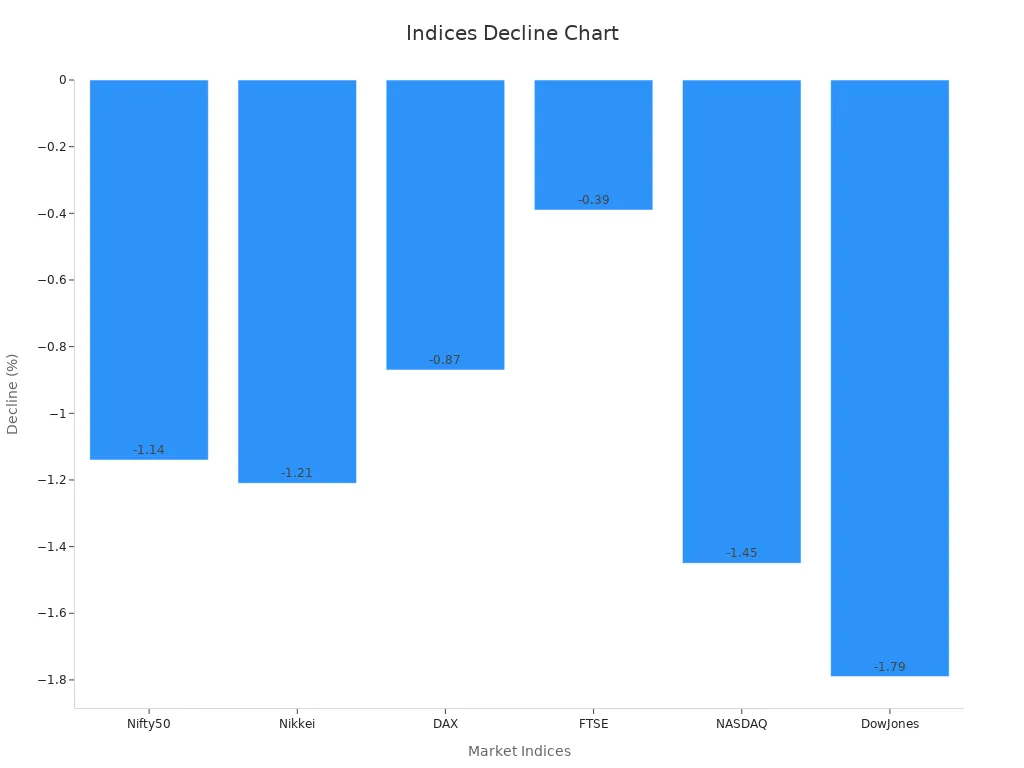

Geopolitical Tensions

Geopolitical risks shaped the stock market on June 18, 2025. The ongoing conflict between Israel and Iran caused sharp moves in global stocks and commodities. BlackRock’s Geopolitical Risk Dashboard listed a Middle East regional war as a high-likelihood event. This risk increased volatility and pushed up energy prices. Brent crude oil traded above $92 per barrel, a 5% weekly increase. The VIX volatility index stayed elevated, reflecting investor caution. On June 13, the S&P 500 dropped 1.1% after Israel’s strikes against Iran, while oil prices surged 8%. Investors moved money into safe-haven assets like gold and the U.S. dollar. Historical data shows that stocks often recover six months to a year after such shocks, but short-term weakness remains common.

| Indicator/Market Aspect | Data/Statistic |

|---|---|

| Brent Crude Oil Price | Above $92 per barrel (5% weekly increase) |

| NASDAQ (US) | -1.45% (June 18) |

| Dow Jones (US) | -1.79% (June 18) |

| Indian Rupee Exchange Rate | Crossed ₹86 per U.S. dollar |

| Gold Price | +1.5% (June 13) |

Economic Policy

Economic policy decisions also influenced the stock market. The Federal Open Market Committee (FOMC) met on June 18 and kept interest rates unchanged. Markets expected no rate cut, with inflation pressures from tariffs and a strong labor market supporting this view. President Trump raised tariffs on steel and aluminum, which added to trade uncertainty. The House passed the ‘Big Beautiful Bill Act,’ extending tax cuts and raising the debt ceiling. Moody’s downgraded the U.S. Treasury credit rating, but the market absorbed this news with little disruption. Consumer sentiment improved in May, helped by temporary tariff reductions. These policy moves affected Treasury yields, stock valuations, and investor confidence.

- The US International Trade Court ruled against some tariffs, prolonging trade uncertainty.

- President Trump increased steel and aluminum tariffs.

- The House passed the ‘Big Beautiful Bill Act,’ impacting fiscal outlook.

- Moody’s downgraded US Treasury credit rating, but markets remained stable.

- Consumer sentiment rebounded, supporting spending and growth.

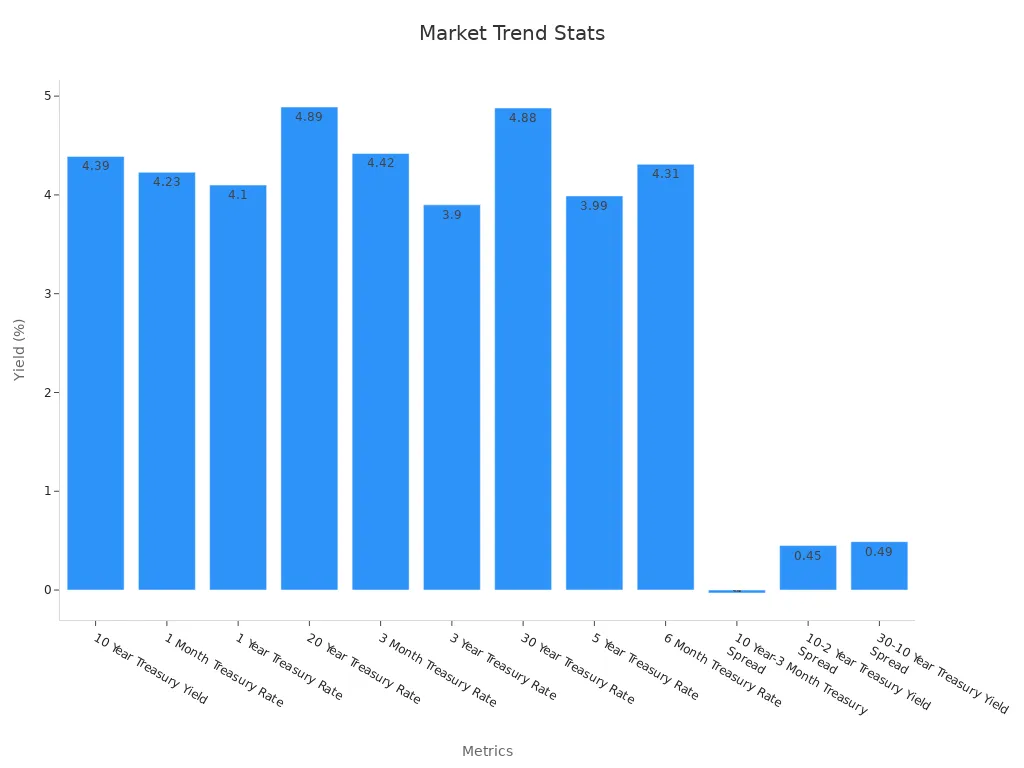

Market Trends

Market trends in mid-June reflected both caution and opportunity. The 10-year Treasury yield fell from 4.46% to 4.39% as inflation data improved. Municipal bond yields also declined, and positive fund flows supported the bond market. Investment grade corporate bonds saw strong demand, with oversubscription rates around 5x. High yield corporates and senior loans posted positive returns, though spreads widened slightly. Stocks in the energy sector outperformed during periods of geopolitical stress, while technology and financial stocks led gains when sentiment improved. The stock market showed resilience, but investors remained alert to risks from policy changes and global events.

| Metric | Value (Jun 17, 2025) | Previous Day | Change (%) | 1 Year Ago | Long Term Average |

|---|---|---|---|---|---|

| 10 Year Treasury Yield | 4.39% | 4.46% | -1.57% | 4.28% | 4.25% |

| 30 Year Treasury Rate | 4.88% | N/A | N/A | N/A | N/A |

| Investment Grade Bond Inflows | $2.7 billion | N/A | N/A | N/A | N/A |

| Municipal ETF Fund Flows | $329 million | N/A | N/A | N/A | N/A |

Investors should watch for further changes in bond yields and stock volumes as new financial news and global events unfold.

Related Markets

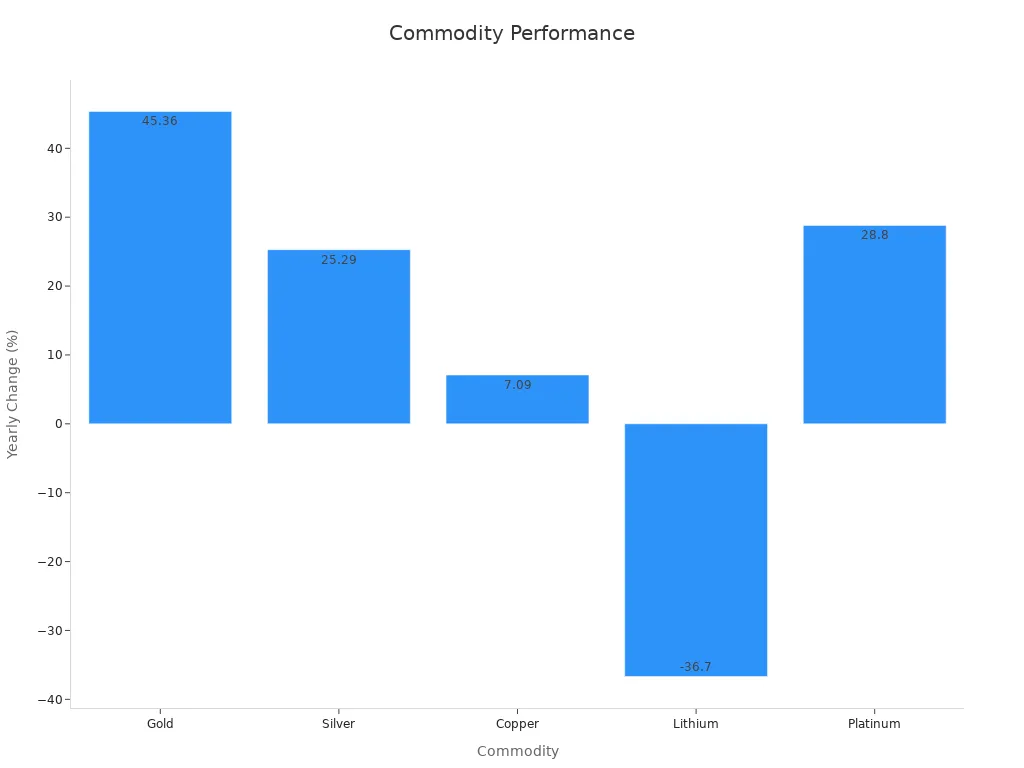

Commodities

Commodities played a significant role in shaping the stock market environment on June 18, 2025. Gold prices hovered near $3,386 per ounce, showing a slight daily decrease of 0.04%. Over the past year, gold gained more than 45%, reflecting strong safe-haven demand as investors responded to global uncertainty and shifting stock prices. Silver and copper also posted gains, with silver up 0.47% for the day and copper rising 0.64%. Platinum surged 25.84% over the month, while steel and iron ore prices declined. Oil prices remained elevated, supporting energy stocks and influencing broader market sentiment.

| Commodity | Price (USD) | Daily Change (%) | Yearly Change (%) |

|---|---|---|---|

| Gold | 3,385.99 | -0.04 | +45.36 |

| Silver | 37.29 | +0.47 | +25.29 |

| Copper | 4.82 | +0.64 | +7.09 |

| Platinum | 1,264.20 | +0.64 | +28.80 |

| Oil (Brent) | 92.00+ | +0.5 | +8.2 |

Gold’s strong performance highlights how investors use commodities to balance risk when stocks face volatility.

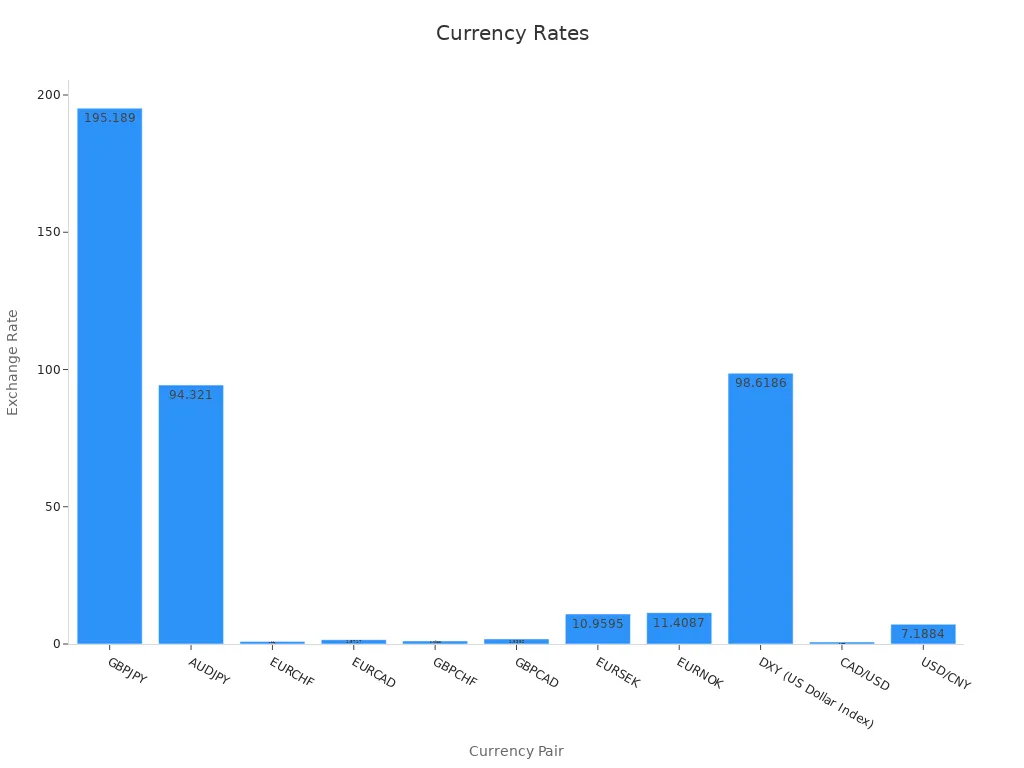

Currencies

Currency movements influenced both the stock and bond markets. The U.S. dollar index slipped by 0.20% to 98.62, reflecting a mild depreciation against a basket of global currencies. The USD/CNY rate stood at 7.1884, down 0.05% from the previous session. Over the past year, the Chinese yuan appreciated by 1.25% against the dollar. The Canadian dollar traded at 0.7321 USD, showing a daily decrease of 0.60%. These shifts affected multinational stocks and companies with global exposure.

| Currency Pair | Exchange Rate | Daily % Change | Yearly % Change |

|---|---|---|---|

| USD/CNY | 7.1884 | -0.05 | +1.25 |

| DXY Index | 98.62 | -0.20 | -6.27 |

| CAD/USD | 0.7321 | -0.60 | N/A |

| EURCAD | 1.5717 | +0.09 | +6.70 |

Currency fluctuations can impact the earnings of U.S.-listed stocks with international operations.

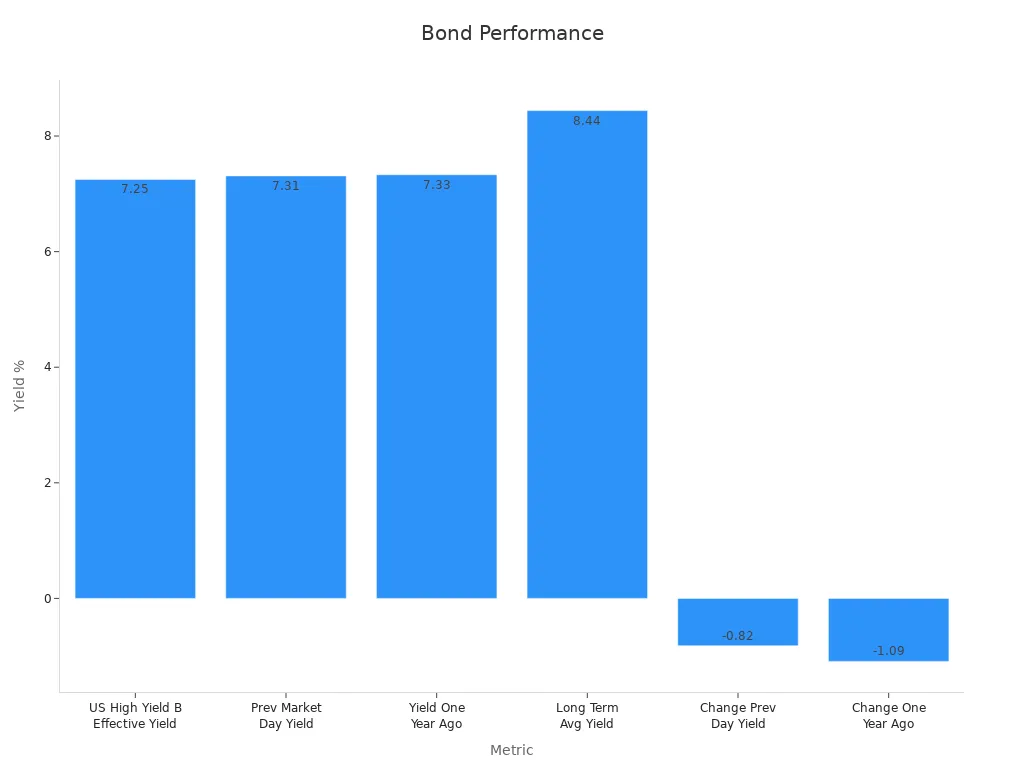

Bonds

Bond yields moved higher across developed markets. The 10-year U.S. Treasury yield increased by 24 basis points, signaling a shift in investor expectations. Yields in Japan, the UK, and Germany also rose. In emerging markets, yields in Hungary, Poland, South Korea, and China climbed, while yields in Thailand, Brazil, and Mexico fell. U.S. high-yield bonds offered an effective yield of 7.25%, slightly lower than a year ago but above the long-term average. Investment-grade credit spreads tightened, reflecting confidence in corporate bonds. These trends influenced the risk appetite for stocks and shaped the overall market outlook.

| Market Segment | Metric | Change/Movement |

|---|---|---|

| 10-year U.S. Treasury | Yield | +24 bps |

| U.S. High Yield Bonds | Effective Yield | 7.25% |

| U.S. IG Spreads | Credit Spread | Tightened by 18 bps |

| Euro IG Spreads | Credit Spread | Tightened by 12 bps |

Rising bond yields can pressure stock valuations, but tighter credit spreads suggest investors remain confident in the market.

The U.S. stock market closed higher on June 18, 2025. Major indexes posted gains, with technology and financial sectors leading. Key takeaways include:

- Energy and financial companies such as Petrobras, Equinor, and Synchrony Financial showed strong free cash flow yields and attractive valuations.

- Emerging markets exposure through Petrobras and Kaspi.kz offered new opportunities.

- Some stocks remain undervalued based on high intrinsic value to price ratios.

Roper Technologies Inc delivered strong growth in earnings and sales but faced valuation concerns. Geopolitical tensions and economic policy decisions shaped investor sentiment. Investors should monitor sector rotation and global events in the next session.

FAQ

What caused the stock market to rise on June 18, 2025?

Strong earnings from technology companies and stable economic policy decisions supported the market. Investors responded positively to new product launches and steady interest rates. Geopolitical tensions remained, but optimism about future growth outweighed concerns.

Did the Israel-Iran conflict impact U.S. stocks today?

The conflict increased market volatility and pushed energy prices higher. Investors shifted some funds into safe-haven assets like gold. Despite these risks, major U.S. indexes closed higher, showing resilience in the face of global uncertainty.

Which sectors performed best during the session?

Information Technology led gains, driven by demand for artificial intelligence and cloud services. Financials and Consumer Discretionary sectors also outperformed. Defensive sectors, such as Health Care and Utilities, lagged behind as investors favored growth opportunities.

How did bond yields affect the stock market?

Rising bond yields pressured some stock valuations, especially in rate-sensitive sectors. However, tighter credit spreads and strong demand for investment-grade bonds signaled investor confidence. The market balanced these factors, resulting in steady gains for major indexes.

What should investors watch for in the next trading session?

Investors should monitor updates on geopolitical developments and economic policy. Changes in bond yields, commodity prices, and sector rotation may influence market direction. Staying informed about earnings reports and global news will help guide investment decisions.

In the dynamic 2025 U.S. stock market, diversifying investments is crucial for success. BiyaPay offers a seamless platform to trade U.S. and Hong Kong stocks from a single account, bypassing complex offshore banking. With real-time exchange rate queries for over 30 fiat currencies and 200+ cryptocurrencies,BiyaPay ensures you capitalize on market opportunities efficiently. Sign-up takes just one minute, with a user-friendly interface for all investors.

Whether targeting tech growth or Hong Kong’s diverse markets, BiyaPay empowers you to act swiftly. Visit BiyaPay today to start your global investment journey!

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.