- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Top Free Stock Trading Apps with No Commission Fees for 2025

Image Source: unsplash

Looking for the best stock trading apps on your mobile in 2025? You have great options like Fidelity, Charles Schwab, Interactive Brokers (IBKR Lite), Moomoo, Public, Robinhood, Webull, E*TRADE, and Firstrade. Each one gives you free stock trading with no commission. Robinhood stands out for its easy-to-use app and beginner focus, while Fidelity shines with research tools and education. Here’s a quick look at some numbers:

| App | Active Users (Millions) | What Makes It Stand Out |

|---|---|---|

| Robinhood | 10.8 | Beginner-friendly, simple mobile design |

| Webull | 2 | Advanced charting, free Level 2 data |

| Fidelity | 6.5 | Strong research, live Bloomberg TV |

You’ll find commission-free trading, powerful mobile features, and unique benefits for all kinds of investments. Ready to find the best stock market app for your trading style?

Key Takeaways

- Many top stock trading apps in 2025 offer commission-free trading with no account minimums, making investing accessible to everyone.

- Each app has unique strengths, such as strong research tools, easy mobile use, advanced trading features, or social investing communities.

- Beginners should choose apps with simple interfaces and educational resources, while active traders benefit from platforms with advanced tools and fast order execution.

- Always check for hidden fees, security features, and user reviews before picking an app to ensure a safe and cost-effective trading experience.

- Trying multiple apps can help you find the best fit for your trading style and goals, so start small and keep learning to invest smartly.

Best Free Stock Trading Apps

Image Source: unsplash

Top Picks for 2025

You want to find the best stock market app for your needs. In 2025, you have many choices for commission-free trading. Here are the top picks that stand out for different reasons:

- Fidelity – You get strong research tools and a reliable mobile experience. Many people call it the best stock market app for research and education.

- Charles Schwab – This app gives you commission-free trading and a wide range of investments. You can use it for both stocks and ETFs.

- Interactive Brokers (IBKR Lite) – If you want advanced trading platforms, this one is for you. You get free stock trading and powerful tools.

- Robinhood – This mobile trading platform is easy to use. Many beginners start here because the app makes online stock trading simple.

- Webull – You get advanced charting and free stock trading. Webull is great for active traders who want more data.

- E*TRADE – This app offers commission-free trading and strong mobile features. You can trade stocks, ETFs, and more.

- Moomoo – You get free stock trading and advanced trading platforms. Moomoo is popular for its real-time data.

- Public – This app focuses on community and education. You can join group chats and learn about trading.

- Firstrade – You get commission-free trading and a simple mobile app. Firstrade is good for beginners who want easy online stock trading.

Tip: Try a few trading platforms before you decide which one fits your style. Many apps let you open an account with no minimum deposit.

Standout Features

Each of these free stock trading apps brings something special to the table. You might want strong research, or maybe you care about a smooth mobile experience. Here’s a quick look at what makes these trading platforms unique:

| App | Standout Feature |

|---|---|

| Fidelity | Best research and education |

| Schwab | Wide investment choices |

| IBKR Lite | Advanced trading tools |

| Robinhood | Simple mobile design |

| Webull | Free Level 2 market data |

| E*TRADE | Great mobile trading platform |

| Moomoo | Real-time global data |

| Public | Social trading and education |

| Firstrade | Easy-to-use trading platforms |

You can see that each app offers commission-free trading and a strong mobile focus. Some trading platforms give you more research, while others make trading easy for beginners. If you want the best stock market app, think about what matters most to you—research, mobile features, or community.

Best Stock Market App Comparison

Image Source: pexels

Key Features Table

You want to see how the best online brokers stack up side by side. Here’s a quick table to help you compare the top stock trading platforms for 2025. This table shows you the main features you get with each brokerage account.

| App | Commission-Free Trading | Fractional Shares | Advanced Tools | Paper Trading | Social Features | Research & Education | Asset Variety |

|---|---|---|---|---|---|---|---|

| Fidelity | Yes | Yes | Yes | No | No | Yes | High |

| Schwab | Yes | Yes | Yes | No | No | Yes | High |

| IBKR Lite | Yes | Yes | Yes | Yes | No | Yes | High |

| Robinhood | Yes | Yes | No | No | No | Basic | Medium |

| Webull | Yes | No | Yes | Yes | No | Limited | Medium |

| E*TRADE | Yes | Yes | Yes | No | No | Yes | High |

| Moomoo | Yes | No | Yes | Yes | No | Yes | High |

| Public | Yes | Yes | No | No | Yes | Yes | Medium |

| Firstrade | Yes | No | No | No | No | Basic | Medium |

You can see that most trading platforms offer commission-free trading and strong research tools. Some, like Public, focus on social features, while others, like Webull and Moomoo, give you advanced tools and paper trading.

Fees and Minimums

When you look for the best brokerage accounts, you want low costs and simple rules. Most of these stock trading platforms have no account minimums. You can open a brokerage account with as little as $0.00. For example, Interactive Brokers and Webull both let you start with no minimum deposit. They also offer commission-free trading on stocks and ETFs. Some platforms, like Webull, even give you free options trading, which helps you keep your trading costs low.

Interactive Brokers stands out for low fees on margin rates, especially if you keep a balance under $100,000. Webull charges a $75 fee if you transfer your account out, but most other best online brokers do not. You should always check the fee schedule before you open a brokerage account, so you know what to expect.

Unique Benefits

Each of the best stock market app choices brings something special. Fidelity gives you top research and education, making it one of the best brokerage accounts for learning. Schwab offers a wide range of investments, so you get more choices. IBKR Lite gives you advanced trading platforms and paper trading, which helps you practice before you risk real money. Robinhood keeps things simple, so you can start trading fast. Webull and Moomoo focus on advanced tools and real-time data, perfect for active traders who want low costs. Public lets you join group chats and learn from others, while Firstrade keeps things easy for beginners.

Tip: If you want the best online brokers for low costs, look for commission-free brokers with no account minimums and strong trading platforms. This way, you can keep more of your money and focus on your trading goals.

Selection Criteria

How We Chose

You want a trading app that helps you keep more of your money. That’s why we focused on platforms with low costs and zero commissions. We looked for apps that make it easy to start, with no account minimums and simple sign-up steps. We also checked if you get a user-friendly trading platform, so you don’t feel lost when you open the app. We picked apps that offer strong research and trading tools, so you can make smart choices. Product variety matters too. You might want to trade stocks, ETFs, or even crypto assets. We made sure each app gives you plenty of options. We also checked for quality customer support, because you need help fast if something goes wrong. Our goal is to help you find an app that fits your style and keeps your trading costs low.

Security and Regulation

You need to know your money and data stay safe. We only chose apps that follow strict rules set by regulators. These platforms must show they can track trades for at least 72 hours and provide proof of their claims with real documents. Many apps hold security certifications like SOC 2 or ISO 27001, which means they meet high standards. Some countries still struggle with monitoring all trades, especially with new things like crypto or high-frequency trading. That’s why we checked if each app has strong systems for cross-market monitoring and risk alerts. The best apps also tell you about risks, like the ups and downs of crypto or trading after hours. They must give you clear info about how your orders get routed and make sure all promotions are honest and easy to understand. This way, you can trust the app to protect you and follow the rules.

User Experience

You want trading to feel simple, not stressful. That’s why we picked apps with a user-friendly trading platform. You can find what you need fast, even if you’re new to investing. The best apps let you trade with just a few taps and offer clear charts and trading tools. If you have a question, you can reach out to quality customer support and get answers quickly. We also looked for apps that keep your costs low, so you don’t lose money on hidden fees. A good user experience means you can focus on your trades, not on figuring out how the app works. When you use an app that puts you first, you can trade with confidence and keep your low costs in check.

App Reviews – Best Free Trading Platforms

Fidelity

You want a platform that gives you strong research and education. Fidelity stands out as one of the best brokerage accounts for both new and experienced investors. You get commission-free trading on stocks, ETFs, and options. There are no account minimums, so you can start with any amount. The mobile app is easy to use and gives you access to live Bloomberg TV, stock screeners, and detailed research reports.

Pros:

- No commissions on stocks, ETFs, and options

- No account minimums

- Top-rated research tools and educational content

- Fractional shares available

- Reliable customer support

Cons:

- No paper trading feature

- Advanced traders may want more charting tools

Best for:

You should choose Fidelity if you want the best free trading platforms for research and education. It’s also great if you want a brokerage account with strong customer service and a simple mobile experience.

Unique Features:

Fidelity gives you commission-free ETF trading, a wide range of investment choices, and strong security. You can use the app to learn about investing and make smart decisions.

Charles Schwab

Charles Schwab is one of the best online brokers for people who want a wide range of investments. You get commission-free trading on stocks, ETFs, and options. There are no account minimums, so you can open a brokerage account with $0. The mobile app is user-friendly and gives you access to research, news, and advanced order types.

Pros:

- Commission-free trading on stocks, ETFs, and options

- No account minimums

- Wide selection of mutual funds and ETFs

- Strong research and educational resources

Cons:

- Some advanced tools only available on desktop

- Fractional shares limited to S&P 500 stocks

Best for:

You should pick Schwab if you want asset variety and commission-free ETF trading. It’s a good choice for both beginners and experienced investors who want a trusted name.

Unique Features:

Schwab offers a wide range of investment products, including international stocks and bonds. You get access to Schwab’s own mutual funds and commission-free options trading.

Interactive Brokers (IBKR Lite)

Interactive Brokers (IBKR Lite) is a top pick for active traders who want cost efficiency and advanced tools. You get commission-free trading on U.S. stocks and ETFs. There are no inactivity fees for most users, and you can open a brokerage account with no minimum deposit. IBKR Lite also gives you access to advanced trading platforms and paper trading.

- IBKR Lite offers commission-free trading on U.S. stocks and ETFs, helping you save on costs.

- IBKR Pro users pay as little as $0.0005 per share, with discounts for high trading volume.

- Inactivity fees have been removed for most users, so you avoid hidden costs.

- Margin rates start at 5.83% for IBKR Lite, which is competitive for borrowing.

Pros:

- Commission-free trading on U.S. stocks and ETFs

- No account minimums or inactivity fees

- Advanced trading platforms and paper trading

- Volume-based discounts for active traders

Cons:

- The mobile app can feel complex for beginners

- Some research tools require a paid subscription

Best for:

You should use IBKR Lite if you want the best brokerage accounts for active trading and low costs. It’s also a strong choice if you want commission-free ETF trading and advanced order types.

Unique Features:

IBKR Lite stands out for its cost efficiency, advanced trading platforms, and paper trading feature. You can practice strategies before risking real money.

Robinhood

Robinhood changed the game with commission-free trading and a simple mobile app. You can open a brokerage account with no minimum deposit. The app is easy to use, making it a favorite for beginners. Robinhood offers commission-free ETF trading, stocks, options, and even crypto.

- Robinhood’s user base has grown to over 23 million, showing strong market adoption.

- The commission-free trading model pushed other brokers to drop their fees.

- Robinhood offers an IRA match program, with a 1% match for standard users and up to 3% for Gold subscribers. Over 30 years, this could add up to $63,155 in extra retirement savings.

- No account minimums and fractional shares make investing easy for everyone.

- Robinhood Gold gives you interest on uninvested cash and better IRA matching.

- Safety features include SIPC protection up to $500,000 and two-factor authentication.

- Users like the app’s ease of use and accessibility.

Pros:

- Commission-free trading on stocks, ETFs, and options

- No account minimums

- Fractional shares and crypto trading

- Simple mobile design

Cons:

- Limited research and educational tools

- No paper trading feature

Best for:

You should try Robinhood if you’re a beginner or want a simple mobile experience. It’s also good for those who want commission-free options trading and easy access to crypto.

Unique Features:

Robinhood’s IRA match program and simple interface make it stand out. You can start investing with just a few dollars.

Webull

Webull is a favorite for intermediate and active traders who want advanced tools and commission-free trading. You get commission-free ETF trading, stocks, and options. There are no inactivity fees or account maintenance charges. The mobile app is highly rated and gives you advanced scanning tools and an intuitive interface.

Webull offers commission-free trading on stocks, ETFs, and options, with no inactivity fees or account maintenance charges. Margin financing rates are about 7% per year, and rates drop as you borrow more. Options trading is commission-free, but you pay small regulatory fees. The app supports a mobile-first approach and has advanced scanning tools. However, withdrawals are only through bank transfers, and wire transfer fees are high. Customer service can be slow, with no live chat and long phone wait times.

- Withdrawals over $25,000 may take 5–15 business days, sometimes longer during busy markets.

- Dormant accounts face extra verification steps.

- Cross-currency withdrawals can take up to 14 days and may have hidden conversion fees.

- Withdrawal requests before weekends or holidays take longer to process.

- Promotional bonuses require you to meet trading volume rules before withdrawing.

Comparing demo and live accounts, long-term strategies perform similarly, but short-term scalping does much better in demo mode. You should adjust your expectations by 15–20% when moving from demo to live trading.

Pros:

- Commission-free trading on stocks, ETFs, and options

- No account minimums or inactivity fees

- Advanced charting and scanning tools

- Paper trading available

Cons:

- Limited withdrawal options and slow processing

- Customer service can be slow

Best for:

You should use Webull if you want the best brokerage accounts for active trading and advanced tools. It’s also a good choice for commission-free options trading and mobile-first trading platforms.

Unique Features:

Webull gives you free Level 2 market data and a strong mobile app. You can practice with paper trading before using real money.

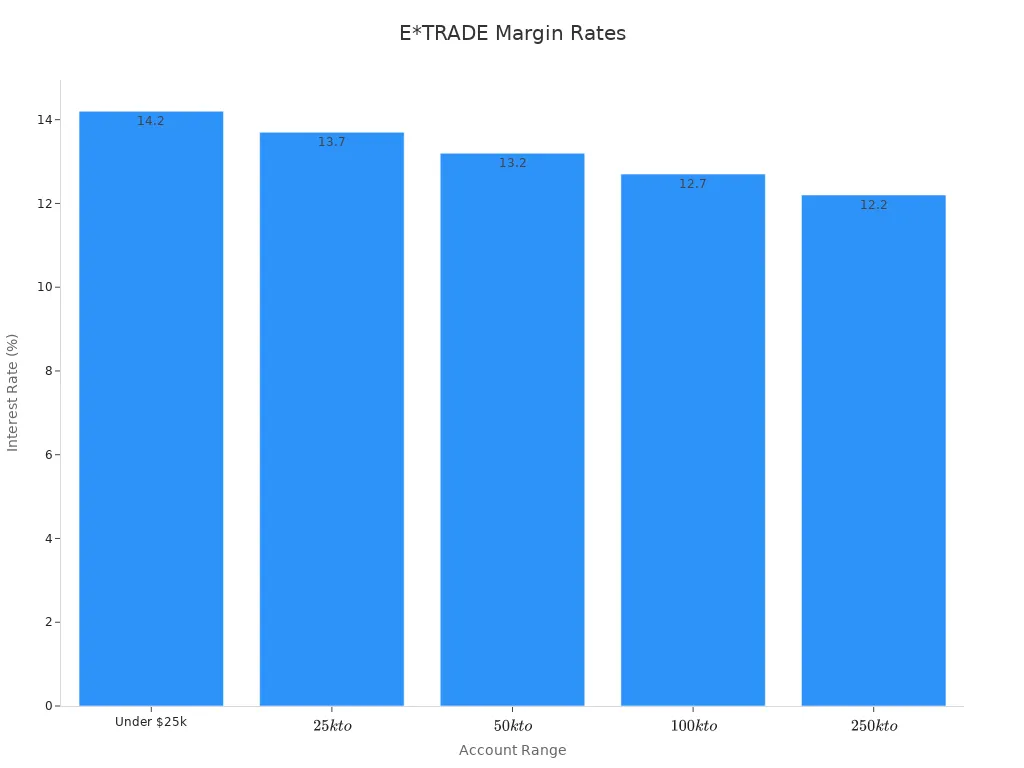

E*TRADE

E*TRADE is one of the best online brokers for people who want a strong mobile app and a wide range of investments. You get commission-free trading on stocks, ETFs, and mutual funds. Options contracts cost $0.65 each, but if you trade more than 30 times per quarter, the fee drops to $0.50. Margin rates range from 13.20% for balances under $10,000 to 11.20% for balances of $250,000 or more.

E*TRADE also makes money through payment for order flow, stock loan programs, and margin interest. This helps keep commission-free trading available for everyone.

| Fee/Rate Type | E*TRADE Details |

|---|---|

| Stock Trades Commission | $0.00 per trade |

| Mutual Fund Trade Fee | $0.00 |

| Options Contract Fee | $0.65 per contract (drops to $0.50 for high volume) |

| Margin Interest Rate (Under $25k) | 14.2% |

| Margin Interest Rate ($25k-$49,999.99) | 13.7% |

| Margin Interest Rate ($50k-$99,999.99) | 13.2% |

| Margin Interest Rate ($100k-$249,999.99) | 12.7% |

| Margin Interest Rate ($250k-$499,999.99) | 12.2% |

| Margin Interest Rate (Above $500k) | Varies |

Pros:

- Commission-free trading on stocks, ETFs, and mutual funds

- No account minimums

- Advanced mobile trading platform

- Wide range of investment choices

Cons:

- Options contracts have a small fee

- Margin rates are higher for small balances

Best for:

You should pick E*TRADE if you want a strong mobile app and commission-free ETF trading. It’s also a good choice for people who want a wide range of investments.

Unique Features:

E*TRADE gives you access to commission-free options trading, mutual funds, and advanced mobile features.

Moomoo

Moomoo is a great choice if you want commission-free trading and access to global markets. You get free trades on U.S. stocks, ETFs, and equity options. Index options have a small fee, and margin rates are about 6.8% APR for U.S. markets. You can also trade stocks in China and Hong Kong, which is rare among the best free trading platforms.

- Moomoo offers $0 commissions on U.S. stocks, ETFs, and equity options.

- Margin rates are competitive at 6.8%, with a tiered structure for high-volume traders.

- Index options have a $0.50 per contract fee.

- No deposit, withdrawal, or account maintenance fees.

- Users like the commission-free model and advanced tools like Level II data and technical indicators.

- Some users find the interface complex, and there can be delays in deposits or withdrawals.

Pros:

- Commission-free trading on U.S. stocks, ETFs, and options

- Access to Chinese and Hong Kong stock markets

- No account minimums or maintenance fees

- Advanced charting and educational content

Cons:

- Interface can be hard for beginners

- Mutual fund fees vary by provider

Best for:

You should use Moomoo if you want global asset variety and commission-free options trading. It’s also a good pick for active traders who want advanced tools.

Unique Features:

Moomoo stands out for access to Chinese markets and real-time global data. You get strong regulatory protection and lots of educational resources.

Public

Public is a social investing app that focuses on community and education. You get commission-free trading on stocks, ETFs, and crypto. The mobile app lets you join group chats, follow other investors, and learn from the community. You can open a brokerage account with no minimum deposit.

Pros:

- Commission-free trading on stocks, ETFs, and crypto

- No account minimums

- Social features and group chats

- Fractional shares available

Cons:

- Limited advanced trading tools

- No options trading

Best for:

You should try Public if you want to learn from others and join a community. It’s a good choice for beginners who want commission-free ETF trading and a social experience.

Unique Features:

Public lets you follow other investors, join discussions, and learn as you trade. The focus on education and community makes it unique among the best brokerage accounts.

Firstrade

Firstrade is a simple and cost-effective choice for commission-free trading. You get commission-free trading on stocks, options, and mutual funds within IRAs. There are no annual, setup, or maintenance fees. You can open a brokerage account with $0, making it easy for first-time investors.

| Feature | Firstrade Details |

|---|---|

| Annual Fees | None |

| Account Setup Charges | None |

| Maintenance Fees | None |

| Commission on Trades | Commission-free on stocks, options, and mutual funds within IRA |

| Customer Support | Business hours, 24/7 live representatives, online support |

| Trading Platforms | Desktop, iPad, smartphone |

| Feature | Details |

|---|---|

| Platform Support | Windows, Mac, Linux, Cloud, On-Premises, iPhone, iPad, Android, Chromebook |

| Customer Support | Phone support, 24/7 live support, online support |

| Training | Documentation, webinars, live online, in person |

| API | Available |

| Feature | Details |

|---|---|

| Account Opening Fee | None |

| Account Maintenance Fee | None |

| Commission on Trades | Commission-free on stocks, options, and mutual funds within IRAs |

| Broker-Assisted Trade Fee | $19.95 flat fee + $0.50 per contract |

| Customer Service Availability | 24/7 live representatives, business hours support, and online support |

| Platform | User-friendly, supports desktop and mobile devices |

| Educational Materials | Extensive resources including research tools, stock simulator, stock screener, and news |

| Account Minimum | $0, suitable for first-time investors |

Pros:

- Commission-free trading on stocks, options, and mutual funds

- No account minimums or maintenance fees

- User-friendly mobile and desktop platforms

- Strong customer support and educational resources

Cons:

- Broker-assisted trades have a fee

- Fewer advanced trading tools

Best for:

You should choose Firstrade if you want a simple, low-cost brokerage account. It’s great for beginners and those who want commission-free options trading and mutual funds.

Unique Features:

Firstrade offers strong customer support, a user-friendly platform, and lots of educational materials. You can trade on any device, making it easy to manage your investments.

How to Choose a Commission-Free Stock Trading App

Key Factors

When you pick a commission-free trading app, you want to make sure it fits your needs. Here are some things you should look for:

- User reviews help you see if the app has a good reputation and strong customer service.

- Security is important. Look for apps with data encryption, two-factor authentication, and account protection.

- You want a mobile app that works smoothly. Check if the platform is stable and gives you real-time data.

- Some apps offer personalized financial advice. This can help you make better decisions.

- Make sure the app matches your trading goals and risk level.

- Always check the fee structure. Some apps have hidden costs.

- A user-friendly trading platform makes it easy to find what you need.

- Market research can show you which apps meet the needs of different investors.

Tip: Try out the mobile app before you open a brokerage account. You want an easy-to-use app that feels right for you.

For Beginners

If you are new to investing, you want a simple start. Many commission-free trading apps focus on beginners. You should look for:

- Beginner-friendly interfaces like Robinhood or SoFi Invest®.

- Commission-free stock trading and fractional shares, so you can start small.

- Free investment research and educational content to help you learn.

- Security features like SIPC or FDIC insurance for your funds.

- Robo-advisor portfolios that automate your investments.

- Clear risk disclosures, especially if you want to try crypto.

A user-friendly trading platform helps you avoid mistakes. You can also find apps that offer checking or savings accounts, making it easy to manage your money.

For Active Traders

Active traders need more than just commission-free trading. You want fast order execution and advanced tools. Here’s what to look for:

- Platforms like E*TRADE, Robinhood, and TD Ameritrade offer commission-free ETF trading and commission-free options trading.

- Look for mobile apps with direct market access and low latency.

- Advanced charting and analysis tools help you spot trends.

- Fast order fill times mean you never miss a trade.

- Some apps let you trade crypto and fractional shares, giving you more choices.

You want a mobile trading platform that keeps up with your pace and supports high trade volume.

For Research and Education

If you want to learn more about investments, choose an app with strong research tools. Fidelity and Schwab offer free investment research, live news, and educational videos. You can use these features to build your skills and make smarter trades. Many apps also have webinars and tutorials right in the mobile app.

For Asset Variety

You may want to diversify your investments. Some commission-free trading apps give you access to many asset classes. For example:

- Fidelity and Schwab offer stocks, ETFs, mutual funds, and more.

- Robinhood lets you trade stocks, ETFs, options, and crypto.

- Moomoo gives you access to U.S., China, and Hong Kong markets.

A good brokerage account should let you try different investments and build a strong portfolio. You can find apps that support global trading and offer commission-free ETF trading, so you never feel limited.

Commission-Free Trading Overview

What It Means

When you hear about commission-free trading, you might wonder what it really means. In simple terms, you can buy and sell stocks, ETFs, and sometimes other assets without paying a fee for each trade. This change has made investing much more accessible. You no longer need to worry about losing money to high trading costs.

Here are some facts that show how popular commission-free trading has become:

- Retail investors now make up almost 20% of all US stock trades, which is double what it was ten years ago.

- Robinhood had over 23 million active users in 2023.

- Mobile trading app downloads jumped by 40% in 2023.

- The average age of investors dropped to 35 years old, with more young people joining the market.

- Women’s participation in investing grew from 26% in 2015 to 38% in 2023.

- 72% of Gen Z investors started before age 25.

You can see that commission-free trading has opened the door for more people to invest, especially younger generations.

How Brokers Make Money

You might ask, “If there are no commission fees, how do brokers stay in business?” Brokers have found new ways to earn money while offering commission-free trades. They collect small fees for things like wire transfers, paper statements, or inactivity. Many brokers also make money by lending you funds for margin trading and charging interest. Some offer premium services with extra tools or research for a monthly fee.

Brokers can lend out your stocks to other traders and earn lending fees. They also work with financial partners to show you ads or sponsored content. Some brokers manage your investments for a small percentage fee. Payment for order flow is another way brokers get paid. They send your trades to certain market makers and receive a rebate. All these methods help brokers keep offering commission-free trading.

Hidden Fees

Even though you get no commission on trades, you should watch out for hidden fees. Some apps charge for wire transfers, paper statements, or account inactivity. Margin loans come with interest rates that can add up if you borrow money to trade. Premium features, like advanced research or faster order execution, may cost extra each month.

Note: Always check the fee schedule before you start trading. This helps you avoid surprises and keeps your costs low.

Commission-free trading gives you a great way to invest, but you need to stay alert for extra charges that can sneak up on you.

You have many strong choices for commission-free stock trading in 2025. Apps like Fidelity, E*TRADE, Schwab, and Webull stand out for safety, low fees, and easy-to-use features. Check out this quick summary:

| App | Strengths | User Base | Security Features |

|---|---|---|---|

| Fidelity | Research, investor protection | ~44.2M | 2FA, SIPC, encryption |

| Schwab | Asset variety, low fees | High | 2FA, SIPC, encryption |

| Webull | Advanced tools, no commissions | Growing | 2FA, SIPC, encryption |

| E*TRADE | Mobile platform, asset variety | Large | 2FA, SIPC, encryption |

Pick the app that matches your goals. Start small, use research tools, and always keep your account secure. Keep learning—smart investing never stops.

FAQ

What is the safest free stock trading app?

You want safety first. Fidelity, Charles Schwab, and E*TRADE all offer strong security. They use two-factor authentication and SIPC insurance. These apps protect your account and personal data.

Can you really trade stocks for free?

Yes, you can. Most top apps let you buy and sell stocks with zero commission. You may still pay small fees for things like wire transfers or premium features. Always check the fee schedule.

Which app is best for beginners?

Robinhood and Public work well for beginners. You get simple interfaces and easy account setup. Both apps offer educational tools. You can start with just a few dollars.

Do these apps support trading international stocks?

Some apps do. Moomoo lets you trade stocks in the U.S., China, and Hong Kong. Interactive Brokers also offers access to global markets. Always check which countries each app supports before you sign up.

Commission-free apps like Robinhood and Moomoo make US/HK stock trading accessible in 2025, but limited advanced tools or global market access can hinder flexibility. BiyaPay empowers you with a single account for commission-free trading of US/HK stocks and cryptocurrencies, outperforming traditional brokers. Convert USDT to USD or HKD at real-time rates to minimize exchange costs for global trading.

Backed by FinCEN and FINTRAC licenses with instant notifications, BiyaPay ensures secure, transparent trades. Sign up in minutes to build a diversified portfolio, whether you’re a beginner or active trader. Join BiyaPay now to boost trading efficiency and returns! Trade with BiyaPay today to seize market opportunities with ease!

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.