- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

How Do Electronic Stocks Operate in the Digital Age

Image Source: pexels

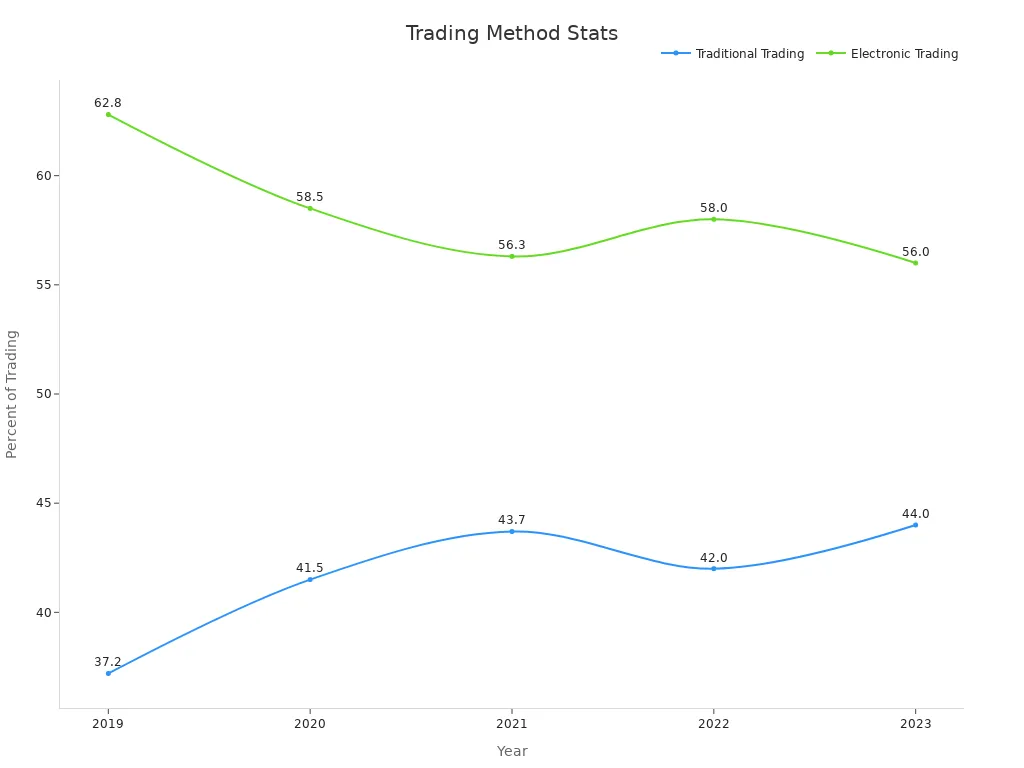

You now buy and sell electronic stocks with just a few clicks, thanks to digital systems that replaced old paper certificates. This shift changed how you invest, making stock ownership faster and easier to track. Most stock trading now happens online. For example, in 2023, about 56% to 63% of stock trades used electronic trading on exchanges or special trading platforms. The table below shows recent trading volumes:

| Year | Total Shares Volume (NMS Stocks) | OTC Shares Volume | % OTC (Traditional) |

|---|---|---|---|

| 2019 | 1.77 trillion | 659 billion | 37.2% |

| 2020 | 2.77 trillion | 1.15 trillion | 41.5% |

| 2021 | 2.87 trillion | 1.26 trillion | 43.7% |

| 2022 | 2.98 trillion | 1.25 trillion | 42.0% |

| 2023 | 2.76 trillion | 1.21 trillion | 44.0% |

Today, electronic trading platforms help you access stock markets quickly and securely.

Key Takeaways

- Electronic stocks exist as digital records, making buying, selling, and tracking faster and safer than paper certificates.

- You can trade stocks online anytime through brokerage accounts, with instant ownership updates and easy access to market data.

- Digital systems reduce errors and costs while improving transparency, helping you make smarter investment decisions.

- High-frequency trading and automated tools increase market speed and liquidity but require awareness of potential risks.

- Strong cybersecurity and regulatory rules protect your electronic shares, so always monitor your accounts and choose trusted platforms.

What Are Electronic Shares?

Image Source: pexels

Definition of Electronic Shares

You now own stocks in a new way. Electronic shares exist as records in a digital system, not as pieces of paper. When you buy electronic shares, your ownership appears in a secure online account. You do not receive a physical certificate. Instead, you see your holdings as digital shares in your brokerage account. These shares are also called uncertificated shares. You can manage, transfer, or sell them online at any time.

Uncertificated shares use book entry systems. This means your shares are tracked in a database. You get notifications and updates through email or your trading platform. You do not need to worry about losing a certificate or proving your ownership. All 50 U.S. states recognize uncertificated shares as legal proof of ownership. Many companies now issue only electronic shares. This trend continues to grow as more investors prefer digital shares for their speed and safety.

Note: Electronic shares and digital shares both refer to stocks you hold without paper certificates. You may also hear the term paperless shares, which means the same thing.

Electronic Shares vs. Paper Certificates

You might wonder how electronic shares compare to old paper certificates. In the past, companies gave you a paper certificate when you bought stock. These certificates had fancy designs and showed your name, the number of shares, and the company’s name. They looked impressive, but they caused problems.

- Paper certificates could get lost or stolen.

- Transferring ownership took a long time and required mailing documents.

- Tracking your shares was hard, especially if you owned stocks in many companies.

With electronic shares, you avoid these issues. Uncertificated shares make it easy to buy, sell, and track your investments. You can see all your digital shares in one place. The system records important details like the number of shares, face value, dividend rate, and voting rights. This digital record keeps your investments safe and easy to manage.

Today, most companies have moved to uncertificated shares. You benefit from lower costs, better security, and faster transactions. The shift to electronic shares marks a big step forward in how you invest.

How Electronic Stocks Work

Issuance and Recordkeeping

When a company wants to raise money, it starts by issuing electronic shares. You do not receive a paper certificate. Instead, the company creates a digital record of your ownership. This process is called issuing uncertificated shares. The company or its transfer agent enters your name and the number of shares you own into a secure online system. This system keeps track of all electronic certificated shares and updates your account in real time.

Modern recordkeeping uses advanced software. These systems offer real-time electronic delivery of reports and information. You can search, sort, and monitor your holdings with just a few clicks. Automated alerts notify you about important changes. Many global investment firms use intranets to share research, trading data, and compliance records. Portfolio accounting systems and online pricing services automate recordkeeping and accounting. You benefit from accurate, up-to-date information.

Here is a table showing the main digital processes used for issuing and tracking electronic shares:

| Digital Process Category | Description | Supporting Evidence Type |

|---|---|---|

| Real-time Electronic Delivery | Electronic delivery of broker-dealers’ reports and information, eliminating mailing delays and enabling timely use. | Case study examples of implementation |

| Electronic Searching & Monitoring | Systems with search, sorting, monitoring, and automated alert functions for tracking relevant issuer information. | Practical implementations and user alerts |

| Statistical Services | Software services that calculate and process investment criteria and provide sorting capabilities for securities. | Statistical data and software vendor services |

| Information Management | Use of intranets in global investment firms to share research, trading data, and compliance records. | Case examples from global firms |

| Automated Administrative Services | Portfolio accounting systems and online real-time pricing services automating recordkeeping and accounting. | Case study data on adviser usage |

| Accounting and Recordkeeping Systems | Computer software and online systems with audit trails, automated ledger updates, and regulatory record retention. | Practical software implementations |

Digital systems make recordkeeping more accurate than paper-based methods. Data discrepancy rates drop from 7% with paper to just 1% with digital systems. You also save money because digital recordkeeping costs 25% to 62% less than paper. Digital data capture reduces transcription errors and provides real-time validation. You get reliable, timely updates that help you make better decisions.

Transfer and Trading

You can transfer or trade electronic stocks quickly and easily. When you want to sell your electronic shares, you place an order through your brokerage account. The system matches your order with a buyer. The transfer of ownership happens almost instantly. You do not need to sign or mail any documents. The system updates the records and notifies both you and the buyer.

High-frequency trading plays a big role in today’s markets. In the United States, about 50% of equity trading volume comes from high-frequency trading. This method uses computers to buy and sell stocks in milliseconds. High-frequency trading improves price efficiency and provides liquidity. You benefit from faster trades and better prices. However, this speed can also cause sudden changes in prices, known as flash crashes.

- High-frequency trading acts as a market maker, offering continuous liquidity.

- It helps new information reach market prices quickly.

- The speed of trading reduces the time for informed traders to act.

- Some experts worry that the race for faster trading may not always help the market.

Digital systems also improve tracking. You can see your electronic certificated shares and uncertificated shares in your account at any time. Automated alerts keep you informed about trades and transfers. This transparency helps you manage your investments with confidence.

Electronic Stock Certificates

Electronic stock certificates replace traditional paper certificates. When you buy electronic certificated shares, you receive a digital proof of ownership. This certificate appears in your online account. You do not need to worry about losing or damaging a paper document. The system stores your electronic stock certificates securely.

Electronic stock certificates offer several advantages over paper certificates:

- You can access your certificates anytime through your brokerage account.

- Transfers happen instantly, without paperwork.

- The system keeps a complete history of your electronic certificated shares and uncertificated shares.

- You get automated updates and alerts about your holdings.

Issuing electronic shares and electronic certificated shares makes investing safer and more efficient. You avoid the risks of lost or stolen certificates. The digital system ensures that your records stay accurate and up to date. Issuing uncertificated shares also reduces costs for companies and investors.

Tip: Always check your account regularly to review your electronic stock certificates and track your holdings. This habit helps you spot any errors or unauthorized activity quickly.

Electronic Stock Exchange

Image Source: unsplash

How Electronic Trading Platforms Operate

You now access stock markets through electronic stock exchanges. These digital marketplaces connect buyers and sellers using advanced trading platforms. You do not need to visit a physical location. Instead, you log in to your account and place orders online. The electronic trading system matches your order with someone who wants to buy or sell the same stock. This process happens in seconds.

Electronic stock exchanges replaced the old open outcry method. You no longer see traders shouting on the floor. The new system uses computers to handle every step. This change brings many benefits. You get faster trades, more accurate prices, and lower costs. You can join the market from anywhere in the world.

| Metric | What It Means | Why It Matters for You |

|---|---|---|

| Gross Merchandise Value | Total value of all trades on the platform | Shows how active and liquid the market is |

| Customer Acquisition Cost | How much it costs to bring in a new trader | Affects fees and platform growth |

| Revenue Per Transaction | Average money made from each trade | Helps platforms set fair prices |

| Cost Per Transaction | Average cost to process each trade | Lower costs mean better deals for you |

| Customer Lifetime Value | Total value a customer brings over time | Encourages platforms to offer better service |

Setting Up Brokerage Accounts

You need a brokerage account to use electronic trading platforms. Setting up an account is simple. You choose a broker, fill out an online form, and provide your ID. Most brokers approve your account in less than a day. Once you fund your account, you can start trading stocks right away.

Many brokers offer tools to help you learn about the stock market. You can use real-time data, research reports, and trading simulators. These features make e-trading easy for beginners and experts. You control your investments and track your trades in one place.

Tip: Always compare fees and services before choosing a broker. Some platforms offer lower costs or better research tools.

Market Efficiency and Transparency

Electronic trading platforms make stock markets more efficient and transparent. You see real-time prices and trade data. This helps you make better decisions. Studies show that after electronic trading systems started, most stocks saw higher trading volumes and better liquidity. For example, one market showed an 85% increase in stocks with improved liquidity after switching to electronic trading.

- Electronic trading increases liquidity and transparency.

- Real-time analytics and AI tools help you trade faster.

- Digital systems reduce the chance of unfair trading and market manipulation.

Research shows that digital trading practices help everyone get the same information. This reduces the advantage of insiders and makes the market fairer. You benefit from better price discovery and fewer hidden risks. Electronic stock exchanges continue to improve, making trading safer and more accessible for all.

Benefits and Challenges

Advantages of Electronic Stocks

You gain many benefits when you invest in electronic shares. Digital systems make it easy for you to buy, sell, and track your stock. You can see your holdings in real time and receive instant updates. Transparency and traceability help you trust each transaction. Blockchain technology keeps records tamper-proof, which reduces fraud and increases your confidence as an investor.

Fractional ownership lets you buy small portions of a stock. This feature opens the door for more people to invest, even if you have a limited budget. You can build a diverse portfolio without needing large amounts of money. Decentralized systems remove the need for middlemen, which lowers costs and speeds up settlement times. Algorithmic trading adds more buy and sell orders, making it easier for you to find a match and pay lower transaction fees.

Note: Automatic compliance tools, such as smart contracts, help reduce manual errors and legal risks. These tools make it easier for you to follow the rules and protect your investments.

Security and Cyber Risks

You also face new risks with electronic shares. Cybersecurity threats can affect your investments. The average cost of a data breach is $3.86 million USD, which shows how serious these attacks can be. Hackers use ransomware, phishing, and DDoS attacks to target digital stock platforms. The 2017 WannaCry ransomware attack caused major disruptions worldwide. Companies with strong cybersecurity could limit the damage, but others suffered losses.

Cybersecurity startups now use machine learning to spot threats in real time. These tools help protect your electronic shares, but you must stay alert. Market volatility can also increase with fast trading systems. Smaller traders may struggle to keep up with the latest technology and high-speed connections.

Regulatory Considerations

You need to know about new rules for digital stock markets. The U.S. Securities and Exchange Commission (SEC) now requires companies to report major cybersecurity incidents. Starting December 15, 2023, companies must share details about their cybersecurity risk management and governance in annual reports. Independent data, such as Bitsight security ratings, help companies measure and report their cybersecurity strength. These ratings use over 120 data sources and update daily. They track issues like compromised systems and risky behavior, giving you more information about the safety of your investments.

Tip: Always check if a company follows these rules before you invest. Strong compliance means better protection for your electronic shares.

You have seen how electronic stocks changed investing. The move from paper to digital records brought faster trades, better accuracy, and real-time data. Today, you benefit from high order accuracy, instant trade speed, and easy access to market trends.

- Systems now process millions of records each year, using big data and AI to predict stock values.

- Digital trading opens new markets and lets you own fractions of assets.

- Forecasting tools keep improving, making stock systems smarter and more reliable.

Stay informed about digital trends. New technology will keep shaping how you invest and manage your portfolio.

FAQ

What is the main difference between electronic shares and paper shares?

You hold electronic shares in a digital account. You do not need to keep a paper certificate. This makes it easier for you to manage your investments and track your shares online.

How do you start trading electronic stocks?

You open a brokerage account online. After you add money, you can begin trading. You place buy or sell orders through the platform. The system matches your order with another trader.

Are electronic shares safe from hackers?

Most platforms use strong security tools to protect your shares. You should use two-factor authentication and keep your passwords safe. Always check your account for any unusual activity.

Can you trade stocks from anywhere?

You can trade stocks from any place with internet access. You only need a device and a secure connection. This gives you more freedom and flexibility in managing your investments.

The digital age has revolutionized stock trading with electronic shares, offering speed, transparency, and accessibility, but high-frequency trading and cybersecurity risks highlight the need for robust risk management. BiyaPay enables you to seamlessly trade US stocks, HK stocks, and cryptocurrencies with just one account, providing unmatched flexibility compared to traditional brokers. Convert USDT to USD or HKD at real-time rates to minimize exchange costs for global trading.

Backed by FinCEN, FINTRAC MSB licenses, and SEC RIA registration, BiyaPay ensures secure, transparent transactions with rapid deposits to brokers like Charles Schwab. Sign up in minutes to build a resilient portfolio, whether you’re a beginner or seasoned trader. Join BiyaPay now to thrive in the digital trading era! Trade with BiyaPay today to seize opportunities in dynamic markets!

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.