- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

What Investors Need to Know About 2025 Stock Market Regulations

Image Source: pexels

Major regulatory shifts in 2025 have started to reshape the gov stock landscape, directly influencing investment decisions and the financial future of investors. The Project 2025 policy agenda proposes weaker financial oversight, which may cause more market instability and higher risks for investments. New SEC staff reductions—such as a nearly 20% cut in Chicago and Denver offices—signal less oversight, creating a riskier environment for financial investments. The urgency to understand the 2025 tax cliff has grown, as potential changes in tax policy could dramatically impact both current and future investment strategies.

Key Takeaways

- New 2025 regulations reduce government oversight, increasing risks for investors and making company compliance more important than ever.

- Tax reforms keep capital gains rates mostly stable but require investors to watch income thresholds and plan asset sales carefully.

- The 2025 tax cliff will end key tax breaks, possibly raising taxes for many investors and businesses, so early planning is crucial.

- Investors should adjust portfolios to manage rising loan risks and use technology to improve tax and compliance strategies.

- Staying informed about legislative and judicial changes helps investors protect their money and find new growth opportunities.

Gov Stock Rules 2025

Image Source: pexels

New Market Regulations

The 2025 policy changes have introduced sweeping updates to the gov stock environment. Lawmakers have enacted new legislation that reduces oversight by regulatory agencies, including the SEC. These changes have led to fewer staff in key offices and a shift in how organizations approach compliance. Companies now face a more complex landscape, with less direct supervision but higher expectations for self-regulation.

Note: The regulatory compliance market has grown from $21.16 billion in 2024 to an expected $23.18 billion in 2025, reflecting the increased demand for advanced compliance solutions and transparent governance.

Many organizations have responded by investing in new technologies. They use AI-powered compliance monitoring and supply chain software to meet evolving requirements. The rise in fraudulent activities, such as a 72% increase in publicly reported data compromises in 2023, has made compliance even more critical. Companies must now demonstrate compliance with multiple frameworks, especially in information security and data privacy.

A recent survey highlights these trends:

- 70% of corporate risk and compliance professionals have shifted from checkbox compliance to a strategic approach in the past two to three years.

- 47% focus on easing legal compliance burdens, while only 16% take a strategic approach.

- 83% consider maintaining compliance with laws and regulations as very or absolutely essential in decision-making.

- 80% agree that risk and compliance functions add business value, with 74% stating these requirements support and enhance business activities.

- Nearly 70% of service organizations must show compliance with at least six frameworks.

- 59% of security and IT leaders report multiple systems requiring compliance adherence.

- 40% of business and risk leaders say their organizations improved risk approaches to achieve stronger regulatory compliance in the past year; this rises to 81% among top-performing organizations.

- 73% of organization leaders agree cyber and privacy regulations effectively reduce cyber risks, up from 39% in the previous year.

- 80% of compliance professionals in strategic roles focus on identifying appropriate risks, and 79% aim to provide greater visibility to senior management.

- The average US firm spends between 1.3% and 3.3% of its total wage bill on regulatory compliance.

These statistics show that compliance now plays a central role in investment management. Investors must pay close attention to how companies handle compliance and reporting. The cost of compliance continues to rise, and organizations that fail to adapt may face higher risks and lower returns on their investments.

Political and Judicial Shifts

Political reversals and judicial decisions have also shaped the gov stock landscape in 2025. Changes in legislation have altered the rules for tax reporting and investment transparency. Courts have issued rulings that affect how companies disclose financial information and manage risk. These shifts have created uncertainty for investors, who must now track both legislative updates and judicial interpretations.

Tip: Investors should monitor new legislation and court decisions closely, as these can change compliance requirements overnight.

The impact of these shifts extends to tax policy as well. New laws have changed the way companies calculate and report tax liabilities. Investors must understand how these changes affect their investments and adjust their strategies accordingly. The growing complexity of compliance means that investors need to stay informed and work with professionals who understand the latest regulations.

A table below summarizes the main areas affected by political and judicial changes:

| Area | 2025 Changes | Investor Considerations |

|---|---|---|

| Legislation | Reduced oversight, new tax laws | Increased self-regulation, higher compliance costs |

| Judicial Decisions | New disclosure requirements | Need for updated reporting and risk management |

| Compliance | Multiple frameworks, tech adoption | Investment in compliance technology, higher transparency |

The evolving gov stock rules in 2025 require investors to remain vigilant. They must evaluate how companies respond to new compliance demands and legislative changes. By understanding these shifts, investors can better protect their portfolios and make informed decisions in a changing market.

Tax Reform 2025 Changes

Capital Gains Tax Rates

The 2025 tax reform brings important updates for investors who realize capital gains. Short-term capital gains continue to face ordinary income tax rates, which can reach up to 37%. Long-term capital gains receive more favorable treatment, with rates set at 0%, 15%, or 20%. These rates depend on the investor’s income and filing status. Special asset categories, such as collectibles and qualified small business stock, have a maximum rate of 28%. Unrecaptured Section 1250 gains are taxed up to 25%. The Net Investment Income Tax of 3.8% still applies to certain investment income, increasing the effective tax rate for high earners.

| Asset Type | Maximum Rate (2025) |

|---|---|

| Short-Term Capital Gains | 37% |

| Long-Term Capital Gains | 0%, 15%, 20% |

| Collectibles/Qualified Small Business Stock | 28% |

| Unrecaptured Section 1250 Gains | 25% |

| Net Investment Income Tax (additional) | 3.8% |

Investors must pay close attention to these tax policies when planning asset sales. The structure of capital gains taxes can influence the timing of transactions and overall investment returns. Tax reform 2025 does not change the statutory rates, but inflation adjustments to income thresholds may affect which rate applies to each taxpayer. This detail highlights the importance of reviewing annual tax bracket updates.

Standard Deduction Updates

The standard deduction for 2025 reflects modest increases due to lower inflation in the previous year. The Bureau of Labor Statistics provided the August 2024 CPI data, which guided the new deduction amounts. Since 2018, the IRS has used the Chained Consumer Price Index (C-CPI-U) to calculate inflation adjustments. This method results in smaller increases compared to the traditional CPI. After several years of high inflation, the 2025 update brings only a slight rise in the standard deduction.

Note: The use of C-CPI-U means taxpayers see less dramatic changes in their deductions, which can affect tax planning and after-tax income.

The seven federal tax brackets remain at 10%, 12%, 22%, 24%, 32%, 35%, and 37%. Only the income thresholds for these brackets change, not the rates themselves. This approach keeps the tax system stable while allowing for minor adjustments based on economic conditions.

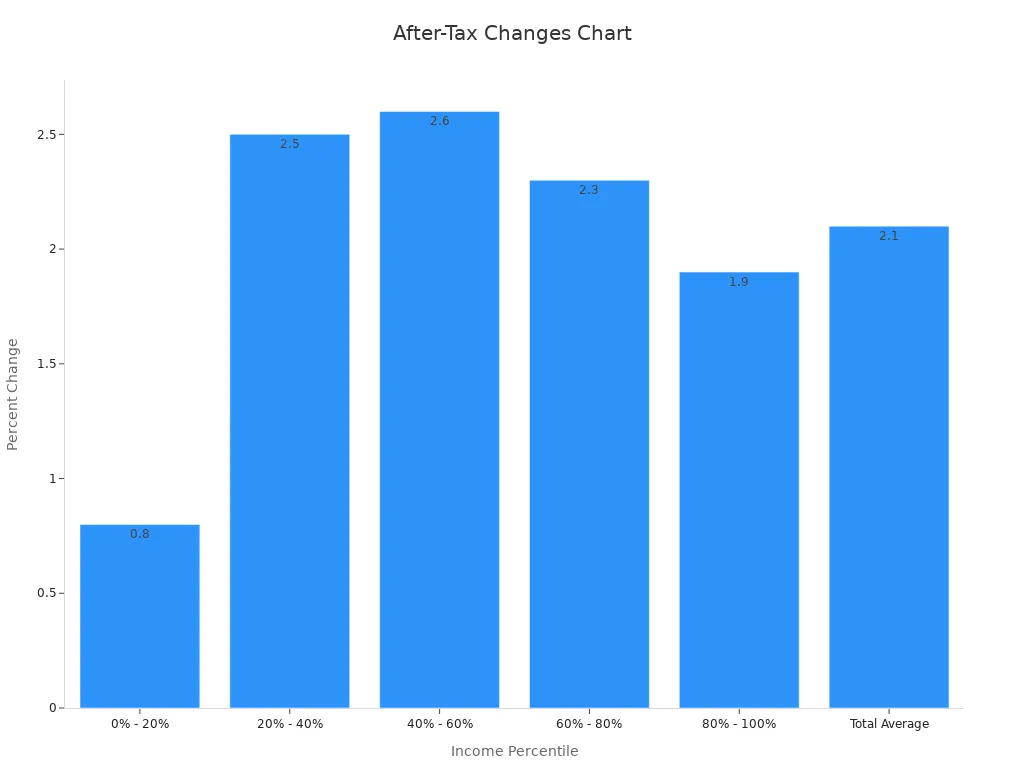

The projected changes in after-tax income for 2025 show small but positive effects across all income groups. The table below summarizes these changes:

| Income Percentile | After-Tax Income Change 2025 |

|---|---|

| 0% - 20% | +0.8% |

| 20% - 40% | +2.5% |

| 40% - 60% | +2.6% |

| 60% - 80% | +2.3% |

| 80% - 100% | +1.9% |

| Total Average | +2.1% |

These figures demonstrate that tax policies in 2025 aim to provide modest relief for most taxpayers. Investors should review their tax situation each year to maximize deductions and minimize taxes owed.

Corporate Tax Proposals

Corporate tax proposals for 2025 introduce significant changes at both the federal and state levels. Thirty-nine states plan to implement new corporate income tax rules, and nine states will reduce individual income taxes. These changes reflect a broader movement toward pro-growth tax policy, which seeks to stimulate investment and economic activity.

The federal government projects that a corporate tax rate increase could raise $1.4 trillion in revenue over ten years. The Tax Foundation estimates a $1.0 trillion increase from the same proposal. On the other hand, a 15% corporate tax cut would reduce revenues by $596 billion to $673 billion over a decade, depending on the model used. Corporate tax expenditures in 2024 are estimated at $188 billion, about one-third of total corporate income tax revenues.

Key corporate tax policy changes for 2025 include:

- BEAT tax rate increase from 10% to 12.5% for certain corporations.

- Expansion of BEAT applicability to corporations more than 50% owned by applicable persons, regardless of gross receipts or erosion thresholds.

- Introduction of a quarterly published list of discriminatory jurisdictions affecting withholding tax rates.

- Opportunity zones program revisions:

- New designations allowed from 2027 to 2033 with stricter low-income community definitions.

- A minimum share of new opportunity zones must be in rural areas.

- Annual reporting requirements for Qualified Opportunity Funds and opportunity zone businesses.

- Reinstatement of a 10% gain exclusion for investments held five years.

- Enhanced 30% gain exclusion for investments in Qualified Rural Opportunity Funds.

- New provision allowing up to $10,000 ordinary income investment with future gains excluded if held ten years.

- REIT taxable subsidiary stock holding limit increased from 20% to 25%.

These proposals support a pro-growth tax policy by encouraging investment in opportunity zones and rural communities. Investors should monitor these tax policies closely, as they can affect both corporate profits and individual investment strategies. The opportunity zones program, in particular, offers new incentives for long-term investments in designated areas.

Tip: Investors who participate in opportunity zones may benefit from significant tax exclusions if they meet the new holding requirements.

Tax reform 2025 brings a mix of stability and targeted changes. By understanding these updates, investors can make informed decisions and optimize their portfolios for the evolving tax landscape.

2025 Tax Cliff Impact

Image Source: pexels

Expiring TCJA Provisions

The 2025 tax cliff brings major uncertainty for investors. Many key tax provisions from the Tax Cuts and Jobs Act (TCJA) will expire at the end of 2025. This expiration could lead to higher taxes for both individuals and businesses. Investors must prepare for changes that may increase their tax liabilities and alter their investment strategies.

- The 20% Qualified Business Income deduction for pass-through entities will end, raising taxes for many small businesses.

- Interest expense deduction limits will tighten, especially for industries with high debt like manufacturing and real estate.

- The 100% bonus depreciation benefit is being phased out and will disappear by 2027, reducing immediate asset cost deductions.

- Global tax provisions will see rate increases:

- GILTI tax rate will rise from 10.5% to 13.125%.

- FDII tax rate will increase from 13.125% to 16.4%.

- BEAT tax rate will jump from 10% to 12.5%, with fewer offsetting credits.

- The state and local tax (SALT) deduction cap of $10,000 may be repealed or changed, affecting tax strategies for partnerships and pass-through entities.

- Individual income tax rates are expected to return to pre-TCJA levels, which means higher taxes for many investors.

These changes could lead to a significant impact on investor tax bills. The Congressional Budget Office projects that keeping current global tax rates would reduce federal revenue by $120 billion for GILTI and FDII, and $21 billion for BEAT. The main street tax certainty act and other small business tax provisions may also change, adding to the uncertainty.

Deductions and Credits

Deductions and credits play a key role in shaping investor behavior. Recent policy changes have already affected how companies claim deductions for research and development (R&D). Before 2022, U.S. companies could deduct 100% of R&D costs right away. Now, they must spread these deductions over five years, which has led to an 11.6% drop in R&D spending among the most research-focused public companies. The R&D tax credit still encourages innovation, but only profitable firms can use it, leaving out many small businesses.

Research shows that tax credits and deductions have a strong impact on corporate investment. For example, a 5% reduction in after-tax R&D costs increased R&D spending by up to 13% after two years. Each dollar of R&D tax credit has generated up to $1.80 in new R&D spending. These findings suggest that changes in tax policies, deductions, and credits in 2025 will directly affect how companies invest and grow.

Investors should watch for updates to tax relief programs and credits, as these can change the after-tax returns on their investments. The 2025 tax cliff will likely bring new rules for deductions and credits, making it important to review tax strategies each year.

Protecting Your Financial Future

Portfolio Adjustments

Investors face a changing landscape in 2025. New regulations and economic pressures require careful review of portfolios. Data shows that auto loan delinquencies have reached their highest levels since the 1990s, and credit card defaults are rising. Mortgages show smaller increases in risk, but still need attention. The table below highlights these trends:

| Loan Category | Quantitative Evidence of Increased Risk | Implication for Portfolio Adjustments |

|---|---|---|

| Auto Loans | Delinquencies of 60+ days at highest since 1990s; 15 basis points increase in delinquencies; 19 basis points increase in charge-offs | Indicates need for portfolio risk adjustments due to rising defaults and economic pressures |

| Credit Cards | Credit card payments deprioritized by consumers; majority of 90+ day delinquencies are credit cards | Suggests increased risk requiring portfolio recalibration to mitigate losses |

| Mortgages | Smaller increase in delinquencies (1 basis point for conventional, higher for FHA and VA loans) | Lower risk relative to other loans but still requires monitoring |

A recent study found that quantitative investors experienced a temporary performance decline of up to 2.4% annually after regulatory changes. This drop resulted from increased portfolio turnover and transaction costs. However, these investors adapted within two months, showing that timely portfolio adjustments help manage new risks and uncover strategic investment opportunities.

Tax Planning Strategies

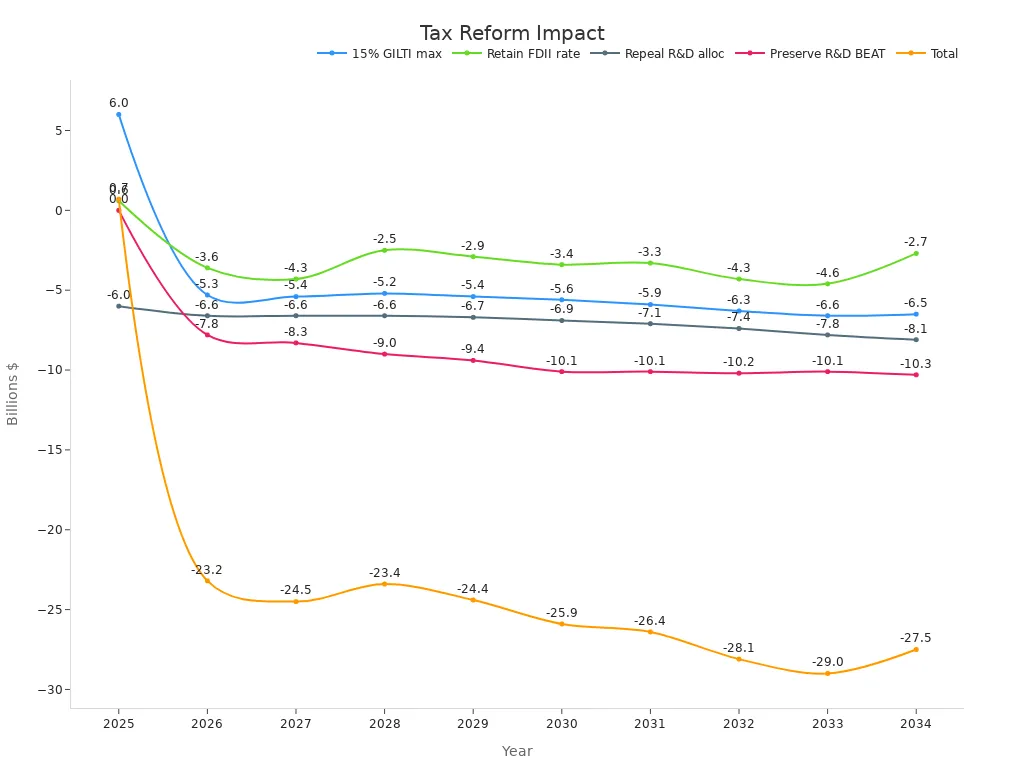

Tax reform in 2025 brings both challenges and opportunities. Investors should build resilient compliance frameworks and invest in technology to streamline tax processes. Integrating tax strategy into business planning, including mergers and acquisitions, can improve outcomes. The chart below shows the projected impact of key tax provisions over the next decade:

Key strategies include:

- Maximizing R&D tax credits by improving documentation and tracking innovation.

- Monitoring legislative changes, such as estate and gift tax exemptions, to adjust retirement and financial plans.

- Modeling tax impacts and considering restructuring options, like choosing between pass-through entities and C corporations, to optimize tax efficiency.

These steps help investors protect after-tax returns and support long-term retirement goals.

Managing Risk

Effective risk management remains essential during regulatory shifts. Organizations now use enhanced risk appetite tools and key risk indicators to monitor threats. AuditBoard reports that 83% of businesses found their risk controls at least partially effective in 2025, up from 79% the previous year. Leadership now plays a larger role in risk oversight, embedding risk management into strategic planning and financial planning strategies.

FIS Global notes that regions with strong regulatory frameworks, such as Hong Kong and Singapore, report higher confidence in managing business risks. Technology and automation help organizations turn data into actionable insights, supporting a forward-looking approach. Investors should maintain compliance readiness, adapt to policy changes, and regularly review retirement plans to ensure financial security.

Tip: Proactive evaluation of entity structures, maximizing credits, and monitoring legislative developments can help investors manage risk and secure their financial future.

Investors face a rapidly changing environment in 2025. They must stay alert to new regulations and tax reforms to protect their financial interests. The April 2025 Global Financial Stability Report highlights several risks:

- Persistently high valuations in key stock markets.

- Highly leveraged financial institutions connected to banking systems.

- Elevated risks of market turmoil and debt sustainability challenges.

Ongoing monitoring and proactive planning help investors secure their future. Seeking professional advice supports better decisions for long-term financial stability and retirement goals.

FAQ

What is the 2025 tax cliff, and why does it matter for investors?

The 2025 tax cliff refers to the expiration of key tax cuts from the Tax Cuts and Jobs Act. Investors may face higher taxes on income, capital gains, and business profits. Planning ahead helps reduce unexpected tax bills.

How do new SEC staff reductions affect investment risk?

SEC staff reductions mean less oversight of financial markets. Companies must self-regulate more. Investors should review company compliance practices and consider higher risks when making decisions.

Will capital gains tax rates change in 2025?

Current law keeps long-term capital gains rates at 0%, 15%, or 20%, depending on income. Short-term gains remain taxed as ordinary income. Investors should monitor for updates, as Congress may change these rates.

How can investors protect portfolios from regulatory changes?

Investors can diversify holdings, use technology for compliance tracking, and consult financial professionals. Regular reviews of tax strategies and risk management plans help protect against sudden regulatory shifts.

What are opportunity zones, and how do they benefit investors?

Opportunity zones are designated areas that offer tax incentives for long-term investments. Investors who hold qualifying assets for five or ten years may exclude some or all gains from taxes, supporting both growth and community development.

The 2025 regulatory and tax reforms reshape stock trading, with reduced SEC oversight and expiring TCJA provisions increasing market volatility and compliance demands.BiyaPay enables you to seamlessly trade US stocks, HK stocks, and cryptocurrencies with just one account, offering unmatched flexibility to navigate these challenges. Convert USDT to USD or HKD at real-time rates to minimize exchange costs, and benefit from rapid deposits to brokers like Charles Schwab.

Backed by FinCEN, FINTRAC MSB licenses, and SEC RIA registration, BiyaPay ensures secure, compliant transactions. Sign up in minutes to build a resilient portfolio and optimize returns in a complex regulatory landscape. Join BiyaPay now to thrive in 2025’s dynamic markets! Trade with BiyaPay today to seize opportunities amid regulatory shifts!

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.