- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Why is the Dow going down today and what you need to know

Image Source: pexels

You might wonder why is the dow going down today. The dow jones industrial average dropped after the fed kept rates steady. Powell’s comments signaled caution, which made investors nervous. Rising inflation and higher jobless claims added to the pressure on the index. Geopolitical risks also weighed on major stock indexes. You can see the market reacting fast to every fed decision and new data. If you follow why is the dow going down today, you notice these factors move the dow and other indexes quickly. Why is the dow going down today often comes down to these key events.

Key Takeaways

- The Dow dropped today mainly because the Federal Reserve kept interest rates steady and signaled caution about the future economy.

- Rising inflation and higher jobless claims make investors worry, causing the stock market to fall.

- Geopolitical tensions and global risks add uncertainty and can quickly affect stock prices and market stability.

- Investors closely watch Fed announcements, inflation data, and jobless claims to predict market moves and adjust their strategies.

- Tracking economic indicators like the Producer Price Index, jobless claims, and Fed statements helps you stay prepared for market changes.

Why is the Dow Going Down Today

Image Source: pexels

Fed Rate Decision Impact

You see the Dow drop today because the Federal Reserve kept rates steady at 4.50%. This decision matched what most experts expected, but it did not calm investors. When the Fed holds rates high, it signals that borrowing money will stay expensive. You might notice that this makes companies and people more careful with spending. The Dow Jones Industrial Average fell by 0.70% after the announcement. Investors felt cautious, waiting to see if the Fed would give any hint about future rate cuts.

The market often reacts quickly to any news from the Fed. Studies show that stock prices can change within minutes of a Fed announcement. When the Fed surprises investors, you see big moves in the index. Today, the Fed did not surprise anyone, but the steady rates and careful comments from Chair Powell made investors nervous about the future.

You may wonder why is the dow going down today even when the Fed did not raise rates. The answer lies in the details of their message. The Fed signaled that they want to see more progress on inflation before lowering rates. This means you might have to wait longer for lower interest costs. Investors worry that high rates could slow down the economy and hurt company profits.

The market also looks at history. Most of the time, after the Fed starts cutting rates, the market recovers within a year. But in rare cases, like during the 2001 dot-com bubble or the 2007 subprime crisis, the market kept falling. Today, the Fed seems to be moving slowly, which adds to the uncertainty.

Inflation and Jobless Claims

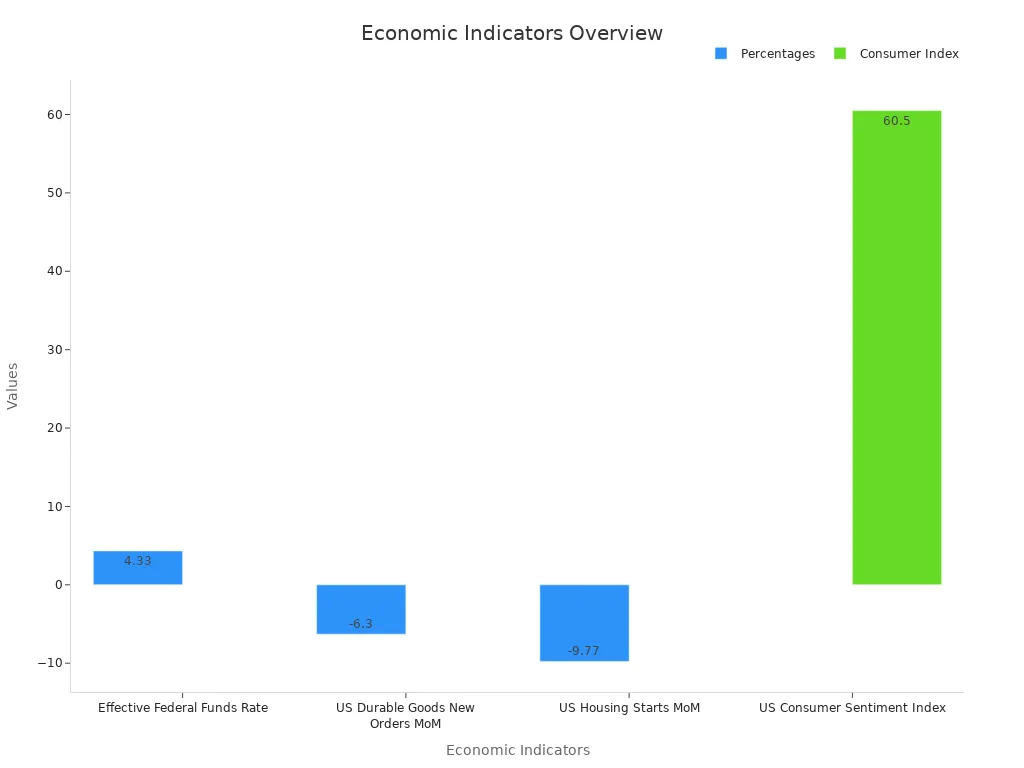

Inflation and jobless claims play a big role in why is the dow going down today. You see higher inflation numbers, and that makes the Fed keep rates high. The Producer Price Index (PPI) rose by 0.1% last month, which is less than expected, but still above the Fed’s target. This tells you that prices are not falling fast enough. The table below shows how recent data affects the Dow and market mood:

| Indicator | Recent Figures / Trend | Implication on Dow and Market Impact |

|---|---|---|

| Initial Jobless Claims | Around 245,000 to 248,000; fifth highest since Aug 2023 and early Oct 2024 | Elevated claims signal softening labor market, contributing to economic uncertainty and downward pressure on the Dow (-225 points pre-market) |

| Four-Week Moving Average | Increased to ~240,000 from ~231,000 | Confirms trend of rising claims, reinforcing concerns about labor market weakening |

| Continuing Claims | Above 1.9 million for several weeks, nearing multi-year high | Indicates sustained unemployment, adding to negative sentiment impacting the Dow |

| Producer Price Index (PPI) | Month-over-month increase +0.1% (below expected +0.2%); core PPI cooling but still above Fed target | Inflation moderating but remains elevated, contributing to economic uncertainty affecting market performance |

| Dow Performance | Down ~225 points in pre-market trading | Reflects combined impact of labor market softness and inflation data on investor sentiment |

| External Factors | Boeing shares down 7% after plane crash | Additional negative sentiment influencing Dow’s decline |

You can see that higher inflation and more jobless claims make investors worry about the economy. When jobless claims rise, it means more people are losing jobs. This weakens the labor market and makes people spend less. The Dow often drops when these numbers go up.

You also need to watch for ongoing geopolitical risks. Tensions in the Middle East, such as the Israel-Iran conflict, keep investors on edge. The Dow futures stayed flat today because of these risks. When you see news about rising oil prices or political statements, it can make the market more volatile. The BlackRock Geopolitical Risk Dashboard tracks these events and shows that market anxiety remains high.

Fed and Federal Reserve Update

Powell’s Comments

You may notice that every word from the Fed chair can move the market. Powell said the current policy stands “well into restrictive territory.” This means the Fed wants to keep financial conditions tight to fight inflation. After Powell spoke, you could see changes in liquidity markets. For example, the Secured Overnight Financing Rate (SOFR) jumped to record highs of 5.39% and 5.40% during key Fed meetings. The spread between SOFR and the effective fed funds rate reached its widest since 2020. Banks responded by borrowing $203 million from the Standing Repo Facility and $136 billion from the Bank Term Funding Program. These numbers show that Powell’s comments made investors worry about funding costs and the strength of the financial system.

Here is a table that helps you understand how investors react to Powell’s statements:

| Quantitative Measure | Description |

|---|---|

| Projected rate cuts in 2025 | 50 basis points total reduction expected by policymakers |

| Probability of rate cuts in 2025 | About 70% chance of at least two cuts |

| GDP growth forecast for 2025 | 1.7% |

| Core PCE inflation forecast for 2025 | 2.8% |

| Investor sentiment | Strong bullish potential for USD if hawkish surprises occur |

You can see that investors pay close attention to Powell’s words. They adjust their strategies based on his outlook for rates, inflation, and the economy.

Rate Cut Outlook

You might wonder when the Fed will lower rates. The Federal Reserve kept interest rates at 4.25%-4.5%. Policymakers expect a total rate cut of 0.5 percentage points in 2025. They also predict unemployment will rise to 4.5% and inflation will stay above the 2% target. Recent jobless claims suggest the Fed may lean toward interest rate cuts, especially if inflation slows down.

JPMorgan expects that if inflation keeps cooling, the Fed could start cutting rates by 25 basis points at each meeting from mid-2024. This would bring the target range down to 4.00%-4.25% by the end of the year. You should watch for changes in treasury yields, as they often signal how soon rate cuts might happen. When yields fall, it usually means investors expect lower rates soon.

- The Fed plans to move slowly with rate cuts because economic data remains strong.

- Powell said you should expect some price increases in the near term.

- Many investors now look for higher yields in short-term U.S. bonds and also invest in places where central banks may cut rates sooner.

You can see that the outlook for interest rate cuts depends on inflation, jobs, and global risks. The Fed will keep watching these numbers before making any big moves.

Economic Data Today

Image Source: unsplash

Inflation Numbers

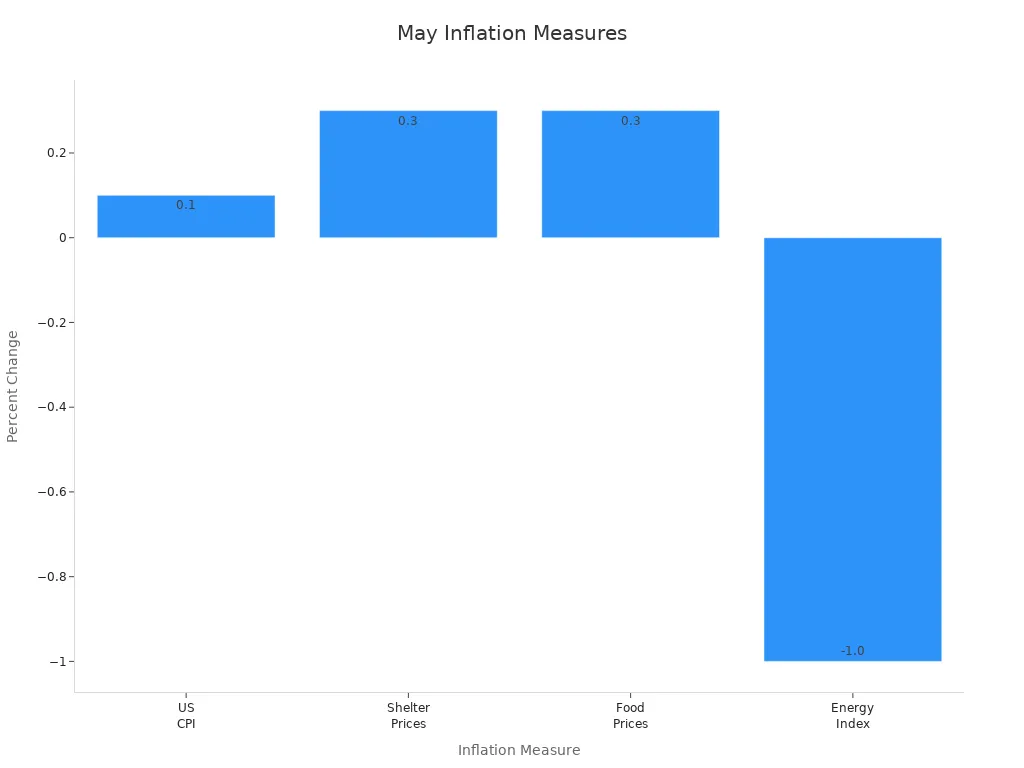

You can see how inflation shapes the market today. The latest inflation data shows that prices are not rising as fast as before. In May 2025, the US Consumer Price Index (CPI) increased by only 0.1%. This is lower than the 0.2% that many experts expected. Shelter and food prices both went up by 0.3%. Energy prices dropped by 1.0%, mostly because gasoline became cheaper. Some costs, like medical care and motor vehicle insurance, also increased, but others, such as airline fares and used cars, went down.

Here is a table that helps you compare the recent inflation numbers:

| Inflation Measure | April 2025 | May 2025 | Change/Notes |

|---|---|---|---|

| US Consumer Price Index (CPI) | +0.2% | +0.1% | Inflation slowed, below 0.2% expected |

| Shelter Prices | N/A | +0.3% | Increased in May |

| Food Prices | N/A | +0.3% | Both food at home and away increased |

| Energy Index | N/A | -1.0% | Declined mainly due to gasoline |

You notice that the u.s. economy reacts quickly to changes in inflation. Lower inflation can help the market, but steady increases in shelter and food prices keep pressure on families. The data from May suggests that the economy is cooling, but not enough for the Federal Reserve to cut rates soon.

Jobless Claims

Jobless claims give you a clear picture of the labor market’s health. For the week ending June 14, 2025, initial jobless claims reached 245,000. This number fell by 5,000 from the previous week, but it still shows that more people are losing jobs than usual. The four-week moving average rose to 245,500, the highest since August 2023. Continuing claims stayed high at 1.945 million, which means many people are still looking for work.

Here is a summary of the latest jobless claims data:

| Metric | Value | Date/Period | Interpretation/Context |

|---|---|---|---|

| Initial jobless claims | 245,000 (seasonally adjusted) | Week ended June 14, 2025 | Fell by 5,000 but remains elevated, indicating softening labor market |

| Four-week moving average | 245,500 | Week ended June 14, 2025 | Rose by 4,750 to highest since August 2023, suggesting rising layoffs |

| Continuing claims | 1.945 million | Week ended June 7, 2025 | Decreased by 6,000 but still high, showing ongoing unemployment struggles |

| Layoffs reported in industries | Transportation, warehousing, accommodation, food services, agriculture, construction, manufacturing | Prior week | Widespread layoffs across multiple sectors, indicating broad labor market weakness |

| Single-family building permits | Dropped 2.7% | May 2025 | Reflects broader economic challenges impacting housing market |

| Nonfarm payrolls increase | 139,000 jobs | May 2025 | Lower than previous year, indicating tepid hiring amid uncertainty |

You see that layoffs are happening in many industries. The data points to a labor market that is losing strength. This trend can slow down the economy and make investors more cautious. Watching jobless claims each week helps you understand where the market and the economy might go next.

Stock Market Today: Investor Reaction

Sector Movements

You can see that different sectors react in unique ways to the news today. When you look at the stock market today, you notice that some sectors fall more than others. For example, the oil and gas sector shows a strong negative movement, with a significance level of −5.527. Financials also drop, with a significance level of −2.990. These numbers show that not all stocks move together. Some sectors feel more pressure from economic news and policy changes.

- Oil and gas sector: significance level of −5.527

- Financial sector: significance level of −2.990

- Sector volatility measured by special models, showing different reactions across countries

- Sectors respond quickly to uncertainty, such as during the COVID-19 pandemic

You might notice that technology and consumer goods sometimes hold up better when other sectors fall. This happens because investors look for safer places to put their money. The stock market today reflects these shifts as you see some stocks drop sharply while others stay steady.

Tip: Watching sector movements helps you understand where risks and opportunities appear in the market.

Geopolitical and Tariff Risks

Geopolitical tensions and tariff risks add more uncertainty to the stock market today. You see that events like conflicts in Eastern Europe or the Middle East can cause sudden changes in prices. These risks affect not just stocks but also commodities like oil, natural gas, and gold.

- Geopolitical risks can disrupt trade and supply chains, leading to higher costs for companies

- Oil prices react strongly to geopolitical threats, especially in the 0.4–0.8 quantile range

- Natural gas and gold prices also move when tensions rise

- Market volatility increases during major events, such as the Russia-Ukraine conflict

- Energy security becomes a concern when countries rely on imports from unstable regions

You should pay attention to tariff news as well. New tariffs can make imported goods more expensive, which can hurt company profits and push stocks lower. When you track these risks, you get a clearer picture of why the market moves the way it does.

What This Means for You

Key Takeaways

You face a market that reacts quickly to news about interest rates, inflation, and global events. The Dow’s drop today shows how sensitive stocks can be to signals from the Federal Reserve and new economic data. You may remember that sudden shocks, like the COVID-19 pandemic, caused major drops in stock prices and led to big changes in investor behavior. These events remind you that markets can move sharply and unpredictably.

- Recession risks often rise before downturns. A small increase in recession odds can lead to a big drop in stock prices.

- Right now, only the Treasury yield curve points to higher recession risk. Other signs, such as company profits and consumer spending, remain steady.

- Bear markets sometimes happen even without a recession. Central bank rate hikes and market fears can trigger these declines.

- Inflation risk today comes more from fiscal and trade policy uncertainty than from weak economic fundamentals.

- The U.S. economy stays strong, but you should watch for challenges like geopolitical conflict and high market valuations.

Tip: Bear markets can happen suddenly and may not always signal a recession. You should keep an eye on policy changes and market sentiment to help protect your investments.

What to Watch Next

You can use several tools and indicators to stay ahead of market changes. Watching the right data helps you make better decisions and avoid surprises.

| Indicator Type | Description | Examples |

|---|---|---|

| Leading Indicators | Signal future economic changes before they happen. | Stock indexes, building permits, consumer confidence |

| Coincident Indicators | Show current economic activity. | GDP, retail sales, personal income |

| Lagging Indicators | Confirm trends after they start. | Unemployment rate, corporate profits, inflation |

You should also track these forward-looking metrics:

- Producer Price Index (PPI) gives early signs of inflation.

- The Federal Reserve’s Beige Book offers updates on economic conditions.

- Watch for changes in GDP, CPI, and interest rates. These numbers shape market direction.

- Monitor company news, supply chain updates, and consumer trends for early warnings.

By following these indicators, you can spot shifts in the market three to twelve months ahead. This helps you adjust your strategy and stay prepared for what comes next.

You saw the Dow slip after the Fed kept rates steady. The table below shows how the Dow, S&P 500, and Nasdaq moved right after the news. This drop links directly to the Fed’s decision and investor caution.

| Stock Index | Change in Points | Percentage Change | Closing Value |

|---|---|---|---|

| Dow Jones Industrial | -44.14 | -0.1% | 42,171.66 |

| S&P 500 | -1.87 | N/A | 5,980.85 |

| Nasdaq Composite | +25.18 | +0.1% | 19,546.27 |

You should watch for new Fed meetings, inflation updates, and global events. Stay alert and avoid quick decisions when markets shift.

FAQ

Why did the Dow drop after the Fed’s rate decision?

You saw the Dow fall because the Fed kept rates steady and signaled caution about the future. Investors worry that high rates could slow the economy. This makes people sell stocks and wait for more positive news.

How do jobless claims affect the stock market?

Jobless claims show how many people lost jobs. When claims rise, you see investors worry about the economy. High claims often lead to lower stock prices because people fear less spending and weaker company profits.

What sectors get hit hardest when the Dow drops?

Oil and gas, financials, and industrials often fall the most when the Dow drops.

Technology and consumer goods sometimes hold up better because investors see them as safer choices.

What should you watch to predict future Dow moves?

- Fed meeting dates and statements

- Inflation reports like CPI and PPI

- Weekly jobless claims

- News about global conflicts or tariffs

These signals help you spot changes before the market reacts.

The Dow’s decline today, driven by steady Fed rates, rising inflation, and geopolitical tensions, highlights the challenges of navigating volatile markets. Investors face uncertainty from jobless claims and global risks, impacting sectors like oil and financials. BiyaPay offers a solution with a single platform to trade US stocks, HK stocks, and cryptocurrencies, enabling diversification to manage risk.

Convert USDT to USD or HKD at real-time rates to cut costs, backed by FinCEN, FINTRAC MSB, and SEC RIA compliance for secure trading. Sign up in minutes to stay agile. Join BiyaPay today to protect your portfolio from market swings! Trade smarter with BiyaPay now to seize opportunities in uncertain times!

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.