- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Your Go-To List of All Banks in America

Image Source: unsplash

You want the latest, official list of banks in the United States for 2025. You can trust this guide because it uses data from the OCC, FDIC, and the Federal Reserve. These trusted financial institutions track every bank name and update their numbers often. For example, FDIC reports show that banks reached a return on assets (ROA) of 1.16% in Q1 2025. You get easy tables that help you compare banks by type, size, and special features. Find the right fit by scanning categories and seeing what each bank offers in financial services.

| Time Period | Return on Assets (ROA) | Net Income (USD Billions) |

|---|---|---|

| Q4 2024 | 1.11% | N/A |

| Q1 2025 | 1.16% | N/A |

| Q3 2024 | N/A | 65.4 |

| Q2 2024 | N/A | 71.5 |

Key Takeaways

- Use trusted sources like the OCC, FDIC, and Federal Reserve to find the most current list of U.S. banks and compare their services easily.

- The largest banks hold the most assets and offer many services, but regional banks provide local knowledge and better customer service.

- National banks follow strict rules to keep your money safe and offer strong protections and wide services.

- Credit unions often offer better rates, fewer fees, and a community feel, making them a great choice for many people.

- Online banks provide convenience, lower fees, and strong digital tools, perfect for managing money anytime, anywhere.

All Banks in the US

Bank Name & Headquarters

You might wonder how many banks operate in the United States. The answer changes every year, but you can always find the most current list from trusted sources like the OCC and FDIC. These organizations track every bank name and update their records often. When you look for a bank, you probably want to know where it is based. The headquarters location tells you a lot about the bank’s reach and focus. Some banks have a national presence, while others serve only certain regions.

You can use the official OCC list as of May 31, 2025, to see every bank name and its headquarters. This list helps you compare banks quickly. If you want to check a specific bank name, you can use the FDIC BankFind Suite. This tool lets you search for banks by name, city, or state. You get up-to-date information about each bank’s location and charter type. Many financial institutions also share this data with the public, so you can trust what you find.

Quick Reference Table

You do not have to scroll through long lists to find the details you need. The quick reference table below gives you a snapshot of the most important information. You see the bank name, headquarters, and charter type all in one place. This makes it easy to compare banks side by side.

| Bank Name | Headquarters | Charter Type |

|---|---|---|

| JPMorgan Chase Bank | New York, NY | National Bank |

| Bank of America | Charlotte, NC | National Bank |

| Wells Fargo Bank | San Francisco, CA | National Bank |

| Citibank | Sioux Falls, SD | National Bank |

| U.S. Bank | Cincinnati, OH | National Bank |

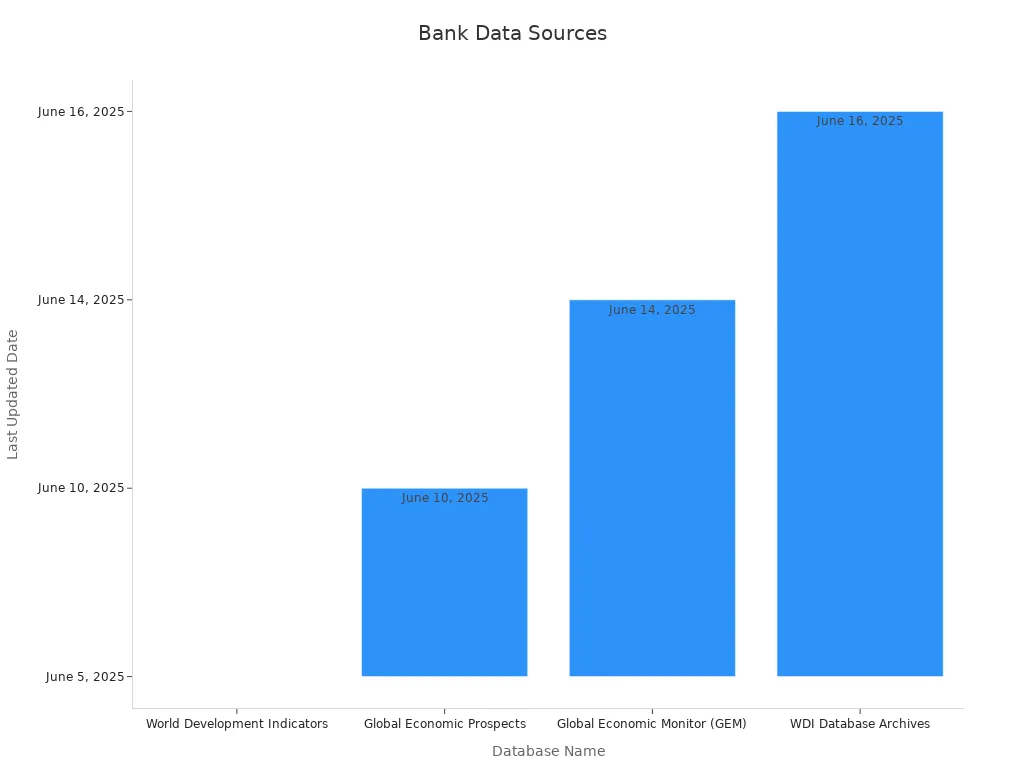

Note: The data in this table comes from the OCC’s official list and the FDIC BankFind Suite. For more detailed numbers, the World Bank’s DataBank platform also supports this section. Their databases, like World Development Indicators and Global Economic Prospects, update regularly to keep your information fresh.

You can use these resources to find the right bank for your needs. Whether you want a big national bank or a smaller local option, this list helps you make a smart choice.

Largest US Banks

Image Source: unsplash

Top 50 by Assets

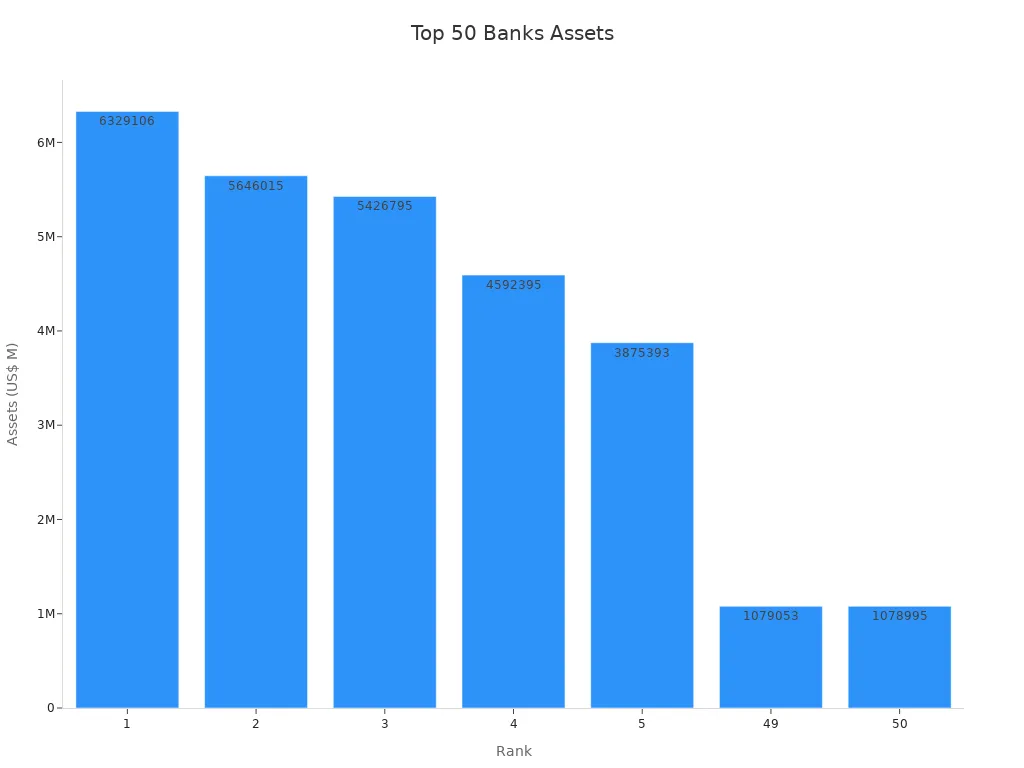

When you look for the largest US banks, you probably want to know which ones have the most total assets. These banks hold a huge share of the country’s money and play a big role in the economy. You might hear people talk about the big four banks. These include JPMorgan Chase, Bank of America, Wells Fargo, and Citibank. They lead the pack in total assets and customer reach.

Here’s a quick look at how the largest US banks stack up by total assets. The table below shows the top five, but the full list covers the top 50. You can see each bank’s rank, name, and total assets in millions of USD. This data comes from trusted sources like S&P Global and the Federal Reserve, so you know it’s accurate.

| Rank | Bank Name | Assets (US$ Millions) | Capital (US$ Millions) | Balance Sheet Date |

|---|---|---|---|---|

| 1 | JPMorgan Chase & Co | 3,875,393 | 31,509 | 31.12.2023 |

| 2 | Bank of America | 3,169,495 | 28,000 | 31.12.2023 |

| 3 | Wells Fargo | 1,886,395 | 19,000 | 31.12.2023 |

| 4 | Citibank | 1,770,000 | 17,500 | 31.12.2023 |

| 5 | U.S. Bank | 669,000 | 9,000 | 31.12.2023 |

You can see that total assets make a big difference in how these financial institutions operate. The largest US banks often offer more services and have more locations.

Comparison Table

You want to compare the largest US banks to find the best banks for your needs. Many people look at total assets, but you might also care about customer satisfaction, deposit market share, and branch locations. Reports from Forbes, U.S. News, and Yahoo Finance help you see which banks stand out.

Here’s a table that shows what data experts use to compare the largest US banks:

| Data Source / Tool | Description / Use Case | Key Metrics Covered |

|---|---|---|

| Reports of Condition and Income (Call Reports) | Banks report assets, liabilities, and income. | Deposits, assets, income, risk profiles |

| Uniform Bank Performance Reports (UBPRs) | Used to benchmark performance among banks. | Financial performance metrics |

| Deposit Market Share Reports | Show deposit percentages in different markets. | Deposit volumes, market share |

| Summary of Deposits | Lists branch locations and deposits. | Branch deposits, geographic distribution |

| Peer Group Comparisons | Groups banks by size or business model for analysis. | Financial trends, benchmarking data |

| FDIC Quarterly Banking Profile & Risk Reviews | Gives detailed statistics on bank performance. | Return on assets, net income, risk metrics |

If you want to find the best banks, you can use these tools to compare total assets, performance, and customer reviews. The largest US banks often lead in these areas, but you might find a smaller bank that fits you better.

National Banks

Bank Name & Features

When you look for a national bank, you want to know what makes these banks different. National banks follow strict rules set by the Comptroller of the Currency. These rules help keep your money safe and make sure the bank runs smoothly. You can spot a national bank by its charter and the way it handles your accounts.

Here are some important features you will find with national banks:

- National banks must stay well capitalized and well managed at all times.

- The total assets of their financial subsidiaries cannot go over $50 billion or 45% of the parent bank’s assets, whichever is less.

- Every national bank must meet credit-worthiness standards set by the Comptroller.

- The Comptroller must approve any new activities for financial subsidiaries.

- Banks must have strong safeguards to manage risks and keep their business safe.

- Each bank must keep its own identity and protect its limited liability.

- All national banks must follow the law and meet compliance standards.

- The Comptroller can step in and require changes if a bank does not meet these rules.

You also get extra protection because national banks must follow rules about customer information. They use secure systems to handle your data. If something looks suspicious, they must file reports to help stop fraud. These rules make national banks a smart choice if you want safety and strong service.

Tip: National banks often appear on lists of the best banks in the country because they meet high standards and offer a wide range of services.

Comparison Table

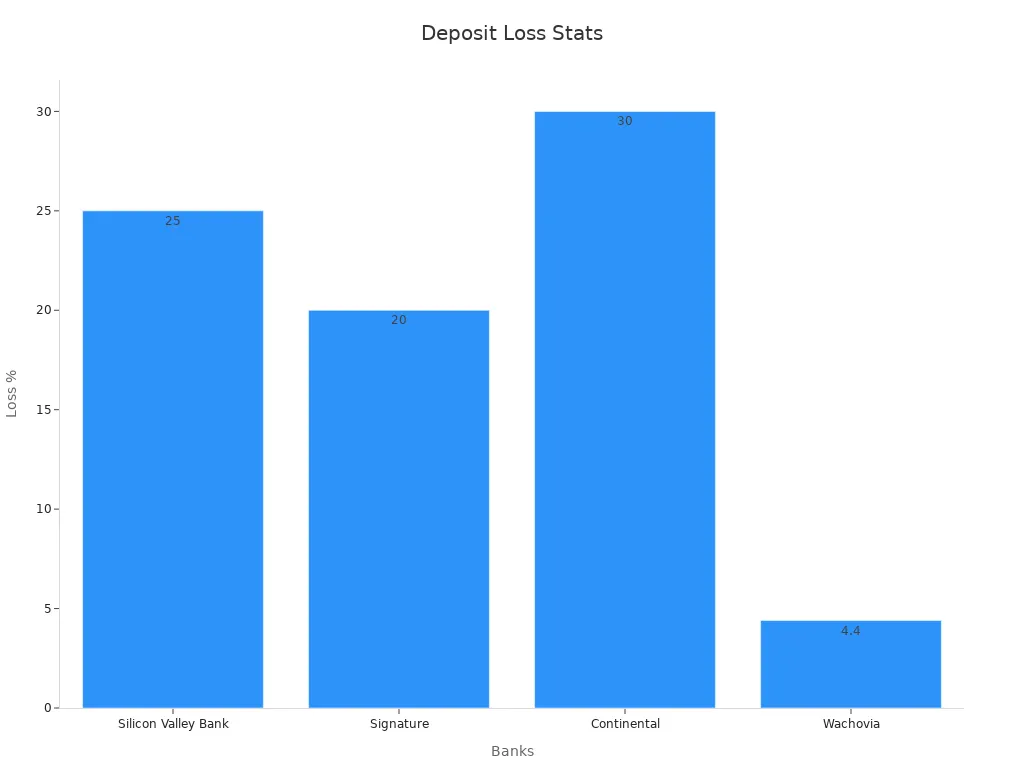

You might wonder how national banks compare when things get tough. Sometimes, banks face big challenges, like sudden deposit withdrawals. The table below shows how some well-known national banks handled deposit losses during stressful times. This helps you see how strong these banks are and why many people trust them.

| Bank Name | Deposit Loss (%) | Time Period |

|---|---|---|

| Silicon Valley Bank | 25% | 1 day |

| Signature Bank | 20% | Few hours |

| First Republic | 50%+ | Few days |

| Continental Illinois | 30% | 10 days |

| Wachovia | 4.4% | 2008 |

You can see that digital banking makes withdrawals happen faster than ever before. Even the best banks must prepare for these changes. When you choose a national bank, you get a bank name that stands for stability and strong rules. This helps you feel confident about where you keep your money.

Regional Banks

Top Regional Banks

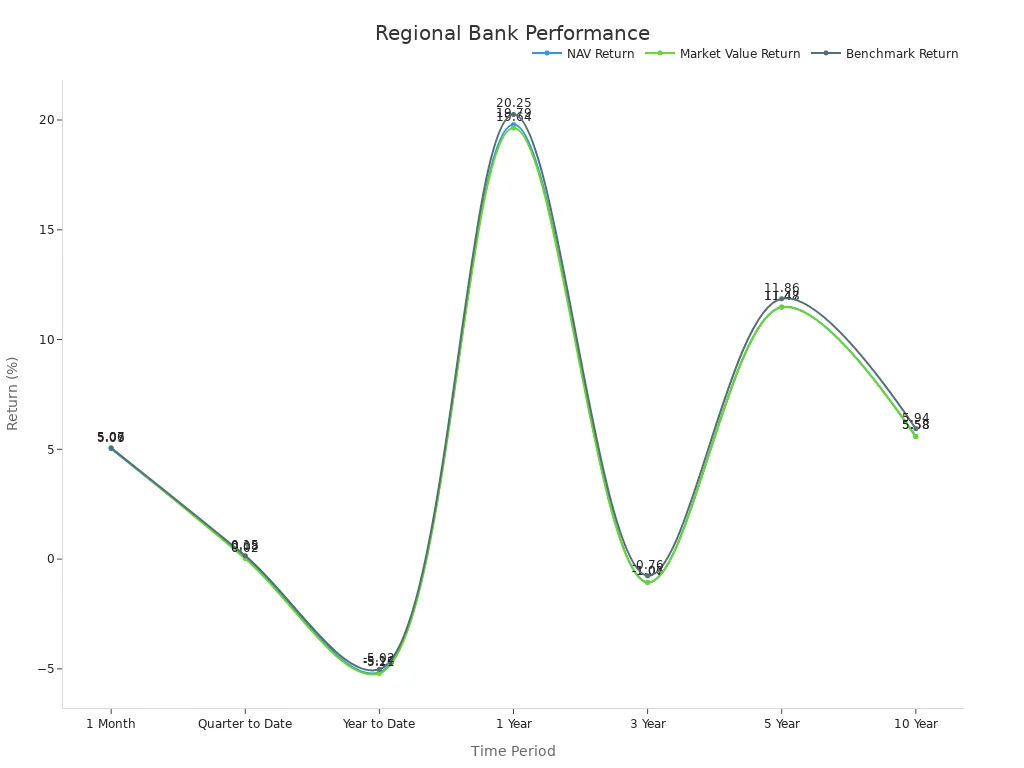

You might want a bank that feels close to home but still offers strong services. Regional banks fill this role. They focus on certain states or areas, so you get local knowledge and personal service. Many people trust these banks because they balance size and community focus.

When you look for america’s best regional banks and credit unions 2025, you should check more than just size. Experts use several metrics to pick the top performers:

- Estimated revenue, which comes from assets under management and expense ratios.

- Recent fund flows, showing how much money investors put in or take out.

- Three-month returns, which tell you how well the bank’s stock or ETF performed.

- Assets under management, showing the total value these banks handle.

- Dividend yields, which reflect the income you might earn as an investor.

- Texas Ratio, which measures how well a bank can handle bad loans.

- Profitability, net loans, and leases, which show financial health.

- Customer surveys and social media reviews, which reveal what real people think.

You can see how these banks perform over time in the chart below. It shows returns for regional bank ETFs, which track the sector’s health.

Tip: Regional banks often offer better customer service and know your local market. You might find lower fees or more flexible loan options here.

Bank Name & Service Area

You want to know which banks serve your area. Here are some examples of top regional banks and where they operate:

- Texas Regional Bank serves the state of Texas. You can open checking or savings accounts, get loans, or use their business banking services. They have many locations and ATMs across Texas. They also support local communities through events and outreach.

- Other strong regional banks include those focused on the Midwest, Southeast, or Northeast. Each bank name brings its own mix of services, from personal banking to business solutions.

If you want a bank that understands your region, start with these options. You get the benefits of a big bank with the personal touch of a local one.

Credit Unions

Largest Credit Unions

You might wonder why so many people choose credit unions over traditional banks. Credit unions give you a sense of community and often offer better rates. In 2025, the largest credit unions stand out because they serve millions of members and manage billions of dollars. You can trust these rankings because they use data from the NCUA, which collects Credit Union Call Report Data and financial statistics. These reports track membership size, financial health, and growth.

When you look for the best credit unions, you want to know what sets them apart. Many of the largest credit unions have open membership, so you can join if you live, work, or worship in certain areas. Some require you to join an association or make a small donation. You get access to lower loan rates, higher savings rates, and fewer fees. The top credit unions also invest in digital banking, so you can manage your money anywhere.

Here are some features that help you spot the largest credit unions:

- Membership often exceeds one million people.

- Assets can reach over $100 billion.

- They offer nationwide ATM access and strong mobile apps.

- Many provide special programs for students, military, or local communities.

Tip: Rankings for america’s best regional banks and credit unions 2025 use NCUA data, customer surveys, and millions of online reviews. This gives you a full picture of which credit unions lead the way.

Comparison Table

You want to compare credit unions before you join. The table below shows how experts measure financial strength and member benefits. They use CAMEL ratios, savings and loan rates, and other financial figures. These numbers come from year-end statements and help you see which credit unions offer the most value.

| Metric | What It Means | Why It Matters to You |

|---|---|---|

| Capital Ratio | How much money the credit union keeps in reserve | Shows financial safety |

| Asset Quality | Percentage of loans that are late or unpaid | Tells you about risk |

| Management | How well the credit union manages loans and deposits | Reflects leadership strength |

| Earnings | Net income as a share of total assets | Indicates profitability |

| Liquidity | Cash and equivalents compared to total assets | Shows ability to pay members |

| Savings Rate | Average return on your deposits | Higher rates mean more earnings |

| Loan Rate | Average interest charged on loans | Lower rates save you money |

You can see that credit unions focus on member value. When you compare these numbers, you find the right fit for your needs. Some credit unions shine after mergers, offering better rates and stronger financials. Larger credit unions often provide more digital tools and nationwide service.

If you want a place that puts you first, credit unions make a great choice. They combine safety, service, and savings in one package.

Online Banks

Image Source: unsplash

Leading Online Banks

You might want a bank that fits your digital lifestyle. Online banks give you the freedom to manage your money from anywhere. These banks do not have physical branches, so you get lower fees and better rates. You can open an account, transfer money, or pay bills with just a few taps on your phone.

Online banks stand out because they focus on digital experience. They use strong security, clear policies, and easy-to-use apps. Many people choose online banks for their speed and convenience. You can see how well these banks perform by looking at digital banking statistics:

- Customer adoption and engagement show how many people use online banking every day.

- User experience metrics, like app ratings and task completion times, tell you if the app is easy to use.

- Growth numbers, such as deposit and loan growth through digital channels, show how popular these banks are.

- Operational efficiency, like fast transaction processing and low costs, helps banks serve you better.

- Customer satisfaction scores, such as Net Promoter Score (NPS), measure how likely you are to recommend the bank.

Trust and security matter most when you pick an online bank. Leading banks build trust with clear security policies and strong support. They also keep things simple and transparent, so you always know what to expect.

Bank Name & Digital Features

You want to know which online banks lead the market and what digital features they offer. Here is a quick table to help you compare:

| Bank Name | Key Digital Features | App Rating (out of 5) |

|---|---|---|

| Ally Bank | 24/7 mobile banking, automated savings, account aggregation, strong security center | 4.7 |

| Chime | Fee-free overdraft, instant alerts, early direct deposit, subscription tracking | 4.8 |

| Capital One 360 | Mobile check deposit, card lock/unlock, pay-with-points, digital wallet activation | 4.6 |

| Discover Bank | No-fee accounts, mobile bill pay, lost/stolen card management, savings tools | 4.7 |

| SoFi Bank | Automated savings, financial dashboard, pay friends, credit score monitoring | 4.6 |

Tip: Look for features like automated savings, subscription tracking, and strong security tools. These make your banking experience safer and easier.

Online banks keep improving their apps and services. You get fast support, easy account management, and new features all the time. If you want a bank that fits your busy life, online banks give you the tools you need to stay in control.

Specialized Categories

Best for Savings

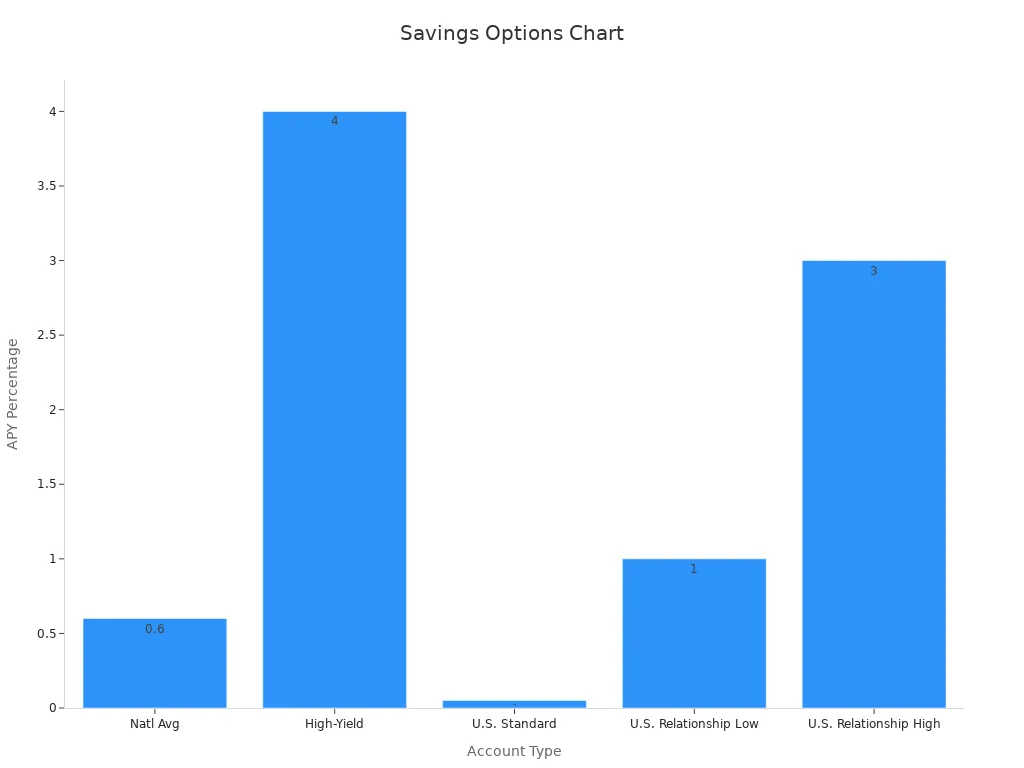

You want your money to grow, so you look for the best banks for savings. High-yield savings accounts stand out because they offer much higher interest rates than regular accounts. Online banks often lead the way, giving you upwards of 4% APY, while the national average sits at just 0.6%. You do not need a big balance or to pay monthly fees. Most accounts are FDIC-insured, so your money stays safe.

| Savings Account Type | Interest Rate / APY Range | Conditions / Notes |

|---|---|---|

| National Average Savings Rate | 0.6% APY | Benchmark rate as of June 18, 2025 |

| High-Yield Savings Accounts | Upwards of 4% APY | Often online banks, low minimums, no monthly fees |

| U.S. Bank Standard Rate | 0.05% APY | Applies to any balance on Bank Smartly savings account |

| U.S. Bank Relationship Rate | 1% - 3% APY | Higher rates for larger balances and qualifying accounts |

Tip: Even a small difference in APY can mean more money in your pocket. For example, $1,000 at 4% APY earns $40 a year, while 4.5% APY earns $45.

Best for Checking

You want a checking account that keeps your money easy to access and your fees low. The best banks for checking accounts offer no monthly fees, free ATM access, and sometimes even rewards. Many banks now cover overdrafts or reimburse ATM fees, which saves you money.

- Axos Bank Rewards Checking: No monthly fees, up to 3.30% APY, ATM fee rebates.

- Chime Checking Account: No fees, overdraft coverage up to $200, 60,000+ fee-free ATMs.

- Alliant High-Rate Checking: No monthly fees, ATM rebates, 0.25% APY.

- Discover Cash-back Debit: No fees, 1% cash-back on debit purchases.

Common checking account fees include:

| Fee Type | Typical Cost Range |

|---|---|

| Monthly maintenance fees | $10 - $15 per month |

| Overdraft fees | Around $35 per transaction |

| ATM fees | Varies; some banks reimburse $10-$20 monthly |

Look for the best banks that match your spending habits. If you use ATMs often, choose an account with fee reimbursements.

Best for Students

You want a bank that understands student life. The best banks for students offer no monthly fees, no minimum balances, and easy access to your money. Many link your account to your student ID or give you cash bonuses for signing up. These banks score high in trust, digital services, and customer support, based on surveys of over 26,000 U.S. banking customers.

- No monthly maintenance fees

- No minimum balance

- Digital banking tools

- Cash bonuses for new accounts

Student accounts from the best banks help you build good money habits without extra costs.

Best for Small Business

Running a business means you need a bank you can trust. The best banks for small business focus on safety, fraud protection, and strong customer support. Most small businesses use more than one bank, but trust keeps them loyal. Banks that act in your best interest and keep your money safe stand out.

The J.D. Power 2024 study shows that Capital One leads in small business banking satisfaction. Customer satisfaction is rising, with banks offering better advice and problem-solving. You want a bank that helps your business grow and keeps your finances secure.

Choose the best banks for small business that offer tailored advice, easy account management, and strong security.

Notable Changes 2025

Mergers & Acquisitions

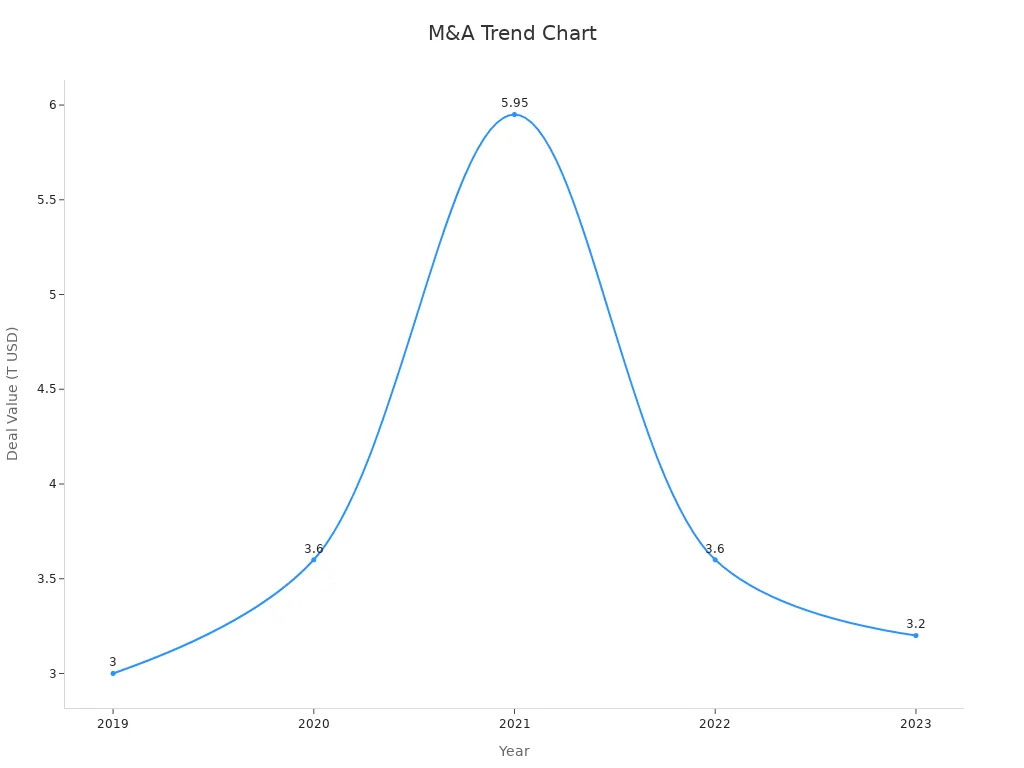

You probably noticed that banks keep changing. In 2025, mergers and acquisitions (M&A) shaped the banking world in big ways. Banks joined forces to stay strong, cut costs, and reach more customers. You see this trend in the numbers. High-value deals over $1 billion rose by 17% in 2024, while smaller deals dropped by 18%. This shows that big banks are getting bigger, and smaller banks face more challenges.

| Year | M&A Deal Value (USD Trillions) | Key Trend |

|---|---|---|

| 2019 | ~3.5 | Stable, strong activity |

| 2020 | ~3.6 | COVID-19 slowdown |

| 2021 | ~6.0 | Record-breaking year |

| 2022 | ~3.6 | Sharp decline |

| 2023 | ~3.2 | Lowest in 10 years |

| 2024 | N/A | Fewer small deals, more large deals |

Banks in the financial and real estate sectors led the way, with over 290,000 deals since 2019. Technology and healthcare also saw strong activity. Many banks now focus on scale and technology. You see more partnerships and bold moves as banks try to keep up with digital trends and new competitors.

You might wonder why this matters. Bigger banks can offer more services and better digital tools. Smaller banks may need to team up or find new ways to compete.

New Banks

You see new banks popping up every year, especially online. These digital banks, called neobanks, work without branches. They use smart technology to give you fast, easy service. Some well-known names include Revolut, Monzo, N26, and Starling Bank. These banks use flexible systems, so they can launch new features quickly.

- Digital banks worldwide are expected to earn $1.61 trillion in net interest income in 2025. This number could reach $2.09 trillion by 2029.

- Digital banking accounts have grown to 1.75 billion globally.

- U.S. banks have closed about 1,646 branches each year since 2018, showing a big shift to online banking.

- Many banks now launch digital spin-offs, cutting operating costs by up to 70%.

Younger people love mobile banking. About 80% of millennials and 64% of Gen Z use digital banking as their main way to manage money. Even Baby Boomers are joining in, with 35% using mobile banking. You see digital wallets growing, too, with 60% of people using one in the past month.

If you want speed, low fees, and cool features, new digital banks give you more choices than ever before.

You now have a complete, easy-to-use list of all U.S. banks for 2025. Use the tables and categories to compare banks and find the best fit for your needs.

- Check back often, as banks change and new options appear.

- Ready to open an account? Pick a few banks, visit their websites, and see what works for you.

Stay informed. The right bank can help you reach your financial goals.

FAQ

What is the difference between a national bank and a regional bank?

National banks serve customers across the United States. Regional banks focus on certain states or areas. You get more local service with a regional bank. National banks usually offer more products and have more branches.

How do I find out if a bank is FDIC insured?

You can check the FDIC BankFind Suite online. Just enter the bank’s name. The tool shows if your bank has FDIC insurance. Most banks in the United States have this protection.

Are online banks as safe as traditional banks?

Yes, most online banks have FDIC insurance. Your money stays protected up to $250,000 per account. Online banks use strong security tools. Always check for FDIC coverage before you open an account.

Can I join any credit union?

Not always. Some credit unions have membership rules. You may need to live, work, or worship in a certain area. Others let you join by making a small donation or joining an association. Check each credit union’s website for details.

Selecting the right bank in 2025—whether national giants like JPMorgan Chase or innovative neobanks—requires balancing safety, services, and costs. With the banking industry reporting a robust 1.16% ROA and digital banks gaining traction, investors need a platform to diversify efficiently. BiyaPay simplifies this by offering a single account to trade US stocks, HK stocks, and cryptocurrencies, with real-time USDT-to-USD/HKD conversions to minimize costs.

Backed by FinCEN, FINTRAC MSB, and SEC RIA compliance, BiyaPay ensures secure, reliable trading. Sign up in minutes to access a dynamic financial ecosystem tailored to your needs. Join BiyaPay now to streamline your investments! Start with BiyaPay today to unlock seamless banking and trading!

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.