- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Can E*TRADE or Ameritrade Help You Grow Faster?

Image Source: unsplash

Yes, you can grow your investments faster when you use etrade or ameritrade wisely. You get tools that help you save money and make smart choices. Many people think only experts can benefit, but beginners can also use etrade or ameritrade to build wealth. If you want to see real progress, start exploring what etrade or ameritrade offers and take charge of your financial journey.

Key Takeaways

- E*TRADE and TD Ameritrade offer $0 commissions and no minimum deposits, helping you save money and start investing easily.

- Use retirement accounts like IRAs for tax benefits that help your investments grow faster over time.

- Take advantage of powerful research, education tools, and paper trading to learn and make smarter investment decisions without risk.

- Mobile apps and banking integration let you manage your investments anytime and move money quickly for new opportunities.

- If you use margin trading, understand the risks and rewards, monitor your account closely, and follow best practices to grow your investments safely.

Account Types

Choosing the right accounts can make a big difference in how fast your money grows. E*TRADE and TD Ameritrade give you many options, so you can pick what fits your goals. Let’s look at the main types of accounts you can open.

Taxable Accounts

You can open taxable accounts if you want flexibility. These accounts let you buy and sell investments whenever you want. You can use them for stocks, bonds, mutual funds, and more. But you need to know that taxable accounts come with taxes. Every time you sell an investment for a gain or get a dividend, you might pay capital gains tax. This tax can slow down your growth because you lose some money to taxes each year. Many people use taxable accounts for short-term goals or when they want easy access to their money.

Retirement Accounts

Retirement accounts help you save for the future. These accounts include IRAs, Roth IRAs, and 401(k)s. When you use retirement accounts, you get special tax benefits. Your money can grow without paying taxes every year. Some retirement accounts let you deduct your contributions now, while others let you take out money tax-free later. This double tax benefit means your investments can grow faster over time. Research shows that people who use retirement accounts often see better long-term growth than those who only use taxable accounts. You should know that retirement accounts have rules. You might face penalties if you take out money early, and you must start taking money out after age 72.

Tip: Both E*TRADE and TD Ameritrade offer retirement accounts with no minimum deposit. You can start with any amount, which makes it easy for new investors.

| Feature | E*TRADE | TD Ameritrade |

|---|---|---|

| Account Minimum | $0 | $0 |

| IRA Account Opening Fee | $0 | $0 |

| IRA Transfer Out (Partial) | $0 | $0 |

| IRA Transfer Out (Full) | $75 | $0 |

| Maintenance Fee | $0 | $0 |

Open Account

You can open an account online in just a few minutes. Both E*TRADE and TD Ameritrade make the process simple. You choose the type of account you want, fill out your details, and fund your account. You can open multiple accounts, like a taxable account and a retirement account, to match your needs. Many people start with a basic brokerage account and add retirement accounts as they learn more. You can also open accounts for kids, trusts, or even small businesses. With no minimums for retirement accounts, you can start building your future today.

E*TRADE or Ameritrade Benefits

When you look at etrade or ameritrade, you find many benefits that help you grow your money. These platforms give you tools and features that make investing easier and more rewarding. Let’s break down the top benefits you get when you open an account.

$0 Commissions

You save money every time you trade stocks or options on these platforms. E*TRADE and TD Ameritrade both offer $0 commissions for online US-listed stock trading, ETF trades, mutual funds, and options. This means you keep more of your profits. In the past, you paid $1 to $6.95 for each trade. Before 1975, some trades cost hundreds of dollars. Now, you can buy and sell stocks without worrying about high fees. This change happened because of new rules and more competition. App-based brokers pushed prices down, and now you get the benefit.

Tip: Every dollar you save on commissions can go back into your investments. Over time, these savings add up and help your account grow faster.

E*TRADE uses this $0 commission offer to attract new clients. Right now, if you open a brokerage account and deposit money within 60 days, you can get up to $1,000 in cash credits. The more you deposit, the bigger your reward. For example, if you deposit $1,000 to $4,999, you get a cash bonus. If you deposit $200,000 or more, you get even more, up to $10,000 for a $5,000,000 deposit. These rewards show how commission-free trading and cash bonuses work together to give you more value.

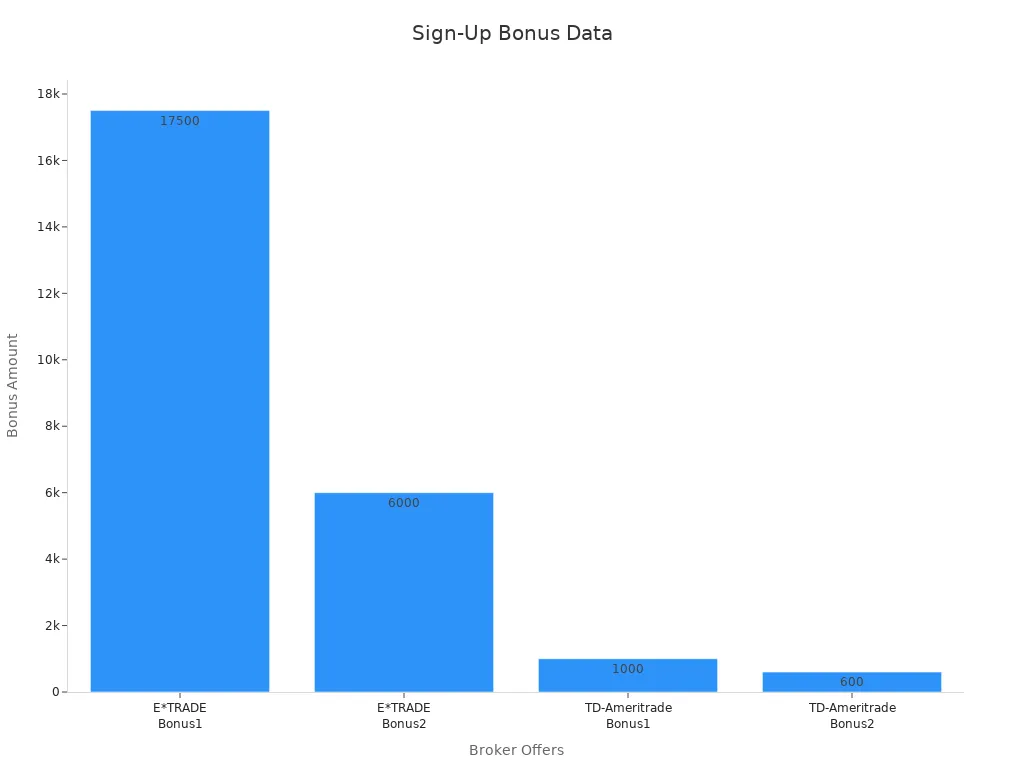

Sign-Up Bonuses

You get rewarded just for opening and funding your account. Both E*TRADE and TD Ameritrade offer sign-up bonuses that can boost your starting balance. These bonuses depend on how much you deposit. The more you put in, the bigger your bonus. This is a great way to start your investing journey with extra cash.

Here’s a quick look at the latest sign-up bonuses:

| Broker | Sign-up Bonus Amount | Minimum Deposit Required | Expiration Date |

|---|---|---|---|

| E*TRADE | Up to $17,500 | $5,000 | 07/31/2024 |

| E*TRADE | Up to $6,000 | $1,000 | 07/31/2025 |

| TD Ameritrade | $1,000 (user comment) | $250,000 | N/A |

| TD Ameritrade | Previous best $600 | N/A | N/A |

You can see that E*TRADE offers some of the highest bonuses in the market. TD Ameritrade also has strong offers, especially for larger deposits. These bonuses give you a head start and make your account more valuable from day one.

Banking Integration

You want your money to move easily between your accounts. Both platforms offer banking integration, so you can link your brokerage account with your checking or savings. This makes it simple to transfer money in and out. You can set up automatic deposits, pay bills, or even use a debit card connected to your brokerage account.

With banking integration, you manage your investments and your cash in one place. This saves you time and helps you stay organized. You can react quickly to market changes, move money for new trades, or take profits when you need them. E*TRADE and TD Ameritrade both make this process smooth, so you never miss an opportunity.

Note: Banking integration also helps you avoid delays. You can fund your account instantly and start trading stocks, options, or ETFs right away.

When you use etrade or ameritrade, you get more than just a trading platform. You get a full set of benefits that make investing easier, cheaper, and more rewarding. These benefits help you grow your account, save on fees, and take advantage of every opportunity in the market. Whether you trade stocks, options, or use advanced tools like thinkorswim, you have everything you need to succeed.

Research and Education

Education Tools

You want to make smart choices in the market. Both E_TRADE and TD Ameritrade give you powerful education tools. TD Ameritrade stands out with its industry-leading resources. You get videos, articles, and live webinars that cover everything from basic trading to advanced margin trading. The thinkorswim platform offers interactive lessons and quizzes. You can learn about the td ameritrade margin account, how to use margin trading, and how to manage risk. E_TRADE also gives you strong research tools. You can use screeners, calculators, and analysis tools to plan your next move. These tools help you understand the market and build your skills.

Tip: Use the education center in thinkorswim to practice new strategies before you try them in the real market.

Here’s a quick look at how advanced research and education tools support your growth:

| KPI Category | Example Metrics and Their Role in Supporting Advanced Tools Usage |

|---|---|

| Student Success | Course success rates, engagement, and outcomes improve with real-time tracking and evaluation. |

| Financial | Automated analytics help you track costs and manage your investing budget. |

| Market Analysis | Real-time data and automated reports help you spot trends and make better decisions. |

Market Research

You need strong research to win in the market. Both platforms give you access to real-time data, news, and expert analysis. Thinkorswim by TD Ameritrade is famous for its advanced research tools. You can use charting, technical analysis, and even backtesting to see how your ideas would have worked in the past. These tools help you spot trends and make smart trades. E*TRADE also gives you deep market research, including analyst ratings and earnings calendars.

Modern research tools give you:

- Real-time reporting and data integration for fast decisions.

- Advanced analysis methods like A/B testing and Conjoint analysis to improve your trading.

- Automated platforms that make research easy for everyone, not just experts.

With these tools, you can react quickly to market changes. You can use thinkorswim to test your strategies and see how they perform. This helps you avoid costly mistakes and improve your trading results.

Paper Trading

You might feel nervous about trading real money. That’s where paper trading comes in. Both E*TRADE and TD Ameritrade let you practice with virtual money. On thinkorswim, you can use paper trading to test your skills in the real market without any risk. This builds your confidence and helps you learn how the td ameritrade margin account works. You can try margin trading, test new analysis tools, and see how your trades would do.

Studies show that paper trading helps you overcome fear and stress. You get to practice your strategies, learn from your mistakes, and improve your trading skills. Many investors who use paper trading feel more ready for the real market. You can track your progress, see your results, and get better every day.

Note: Paper trading is a safe way to learn about the market, margin trading, and the td ameritrade margin account before you risk real money.

Trading Platforms

Image Source: pexels

Choosing the right platform can make your stock trading journey smoother and more successful. E*TRADE and TD Ameritrade both offer strong choices, but each one shines in different ways. Let’s look at what you get when you use these platforms for your account, trades, and trading strategies.

User-Friendly Interface

You want a platform that feels easy to use, especially when you start stock trading. E_TRADE gives you a clean, simple interface. You can open your account, place trades, and manage options without feeling lost. The menus are clear. You see your trades and account balance right away. This helps you focus on your trading strategies instead of searching for features. Many new investors like E_TRADE because it makes stock trading less stressful.

Here’s a quick comparison between user-friendly interfaces and advanced trading tools:

| Feature Category | User-Friendly Interfaces (e.g., E*TRADE) | Advanced Trading Tools (e.g., thinkorswim) |

|---|---|---|

| Primary Focus | Ease of use, accessibility | Customizable charting, technical analysis |

| Key Features | Simple trades, organized menus | 100+ indicators, backtesting, automation |

| Target Users | Beginners, casual traders | Experienced traders, active options users |

| Platform Accessibility | Web and mobile apps | Desktop, web, and mobile |

You can see that E*TRADE’s platform helps you start stock trading with confidence.

Advanced Tools

If you want more power for your trades, TD Ameritrade’s thinkorswim platform stands out. Thinkorswim gives you advanced charting, real-time data, and over 100 technical indicators. You can test trading strategies, use automated analysis, and even set up custom alerts for your account. Many active traders and options fans love thinkorswim because it lets you dig deep into the market. You can backtest trades, scan for stock trading opportunities, and manage complex options trades with ease.

Platforms like thinkorswim focus on giving you every tool you need for serious trading. You get features that help you spot trends, analyze options, and improve your trading strategies. If you want to take your account to the next level, thinkorswim is a top choice.

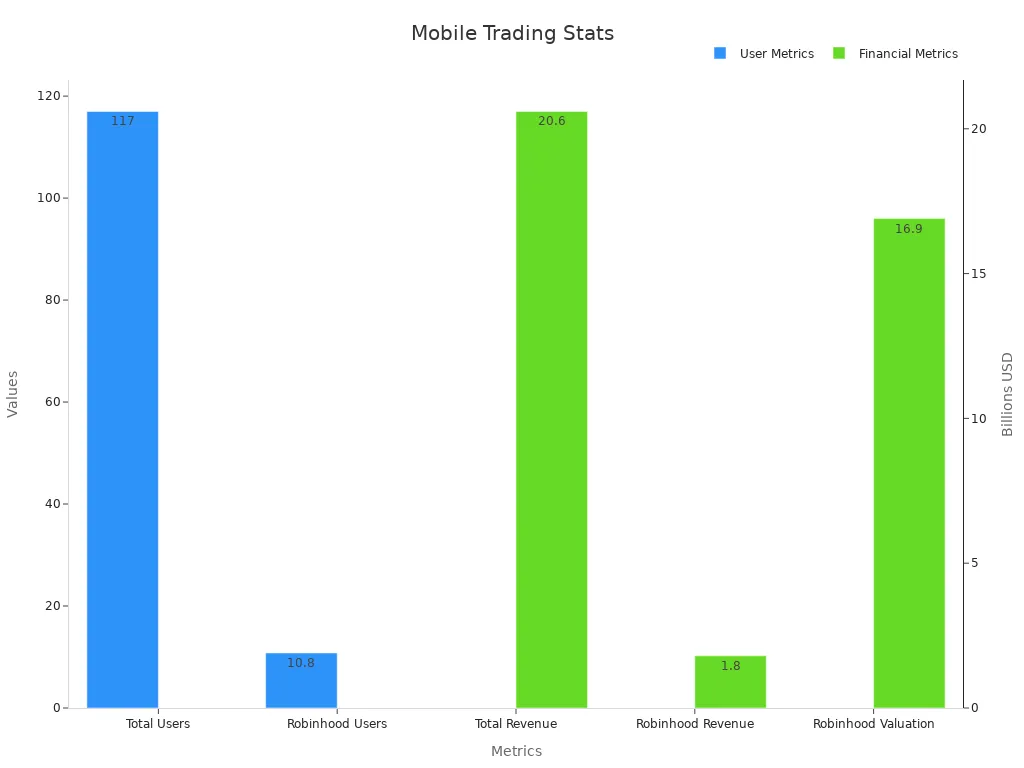

Mobile Apps

You need to manage your account and trades on the go. Both E*TRADE and TD Ameritrade offer mobile apps that let you trade stocks, options, and more from anywhere. You can check your account, place trades, and follow your stock trading plan while you travel or relax at home. The apps are easy to use and give you access to most platform features.

Tip: Use mobile apps to set alerts for your trades and options. This helps you react fast to market changes.

Mobile stock trading apps have become very popular. In 2023, 117 million people used these apps for their trades and account management. The total revenue from stock trading apps reached $20.6 billion, showing how important mobile platforms have become for trading.

You can see that mobile trading is now a big part of stock trading. With E*TRADE and thinkorswim apps, you never miss a chance to manage your account or make trades.

Minimize Costs

Keeping your costs low is one of the best ways to help your accounts grow faster. When you pay less in fees, more of your money stays in your account and keeps working for you. Let’s look at some smart ways to minimize costs with E*TRADE and TD Ameritrade.

Commission-Free ETFs

You can use commission-free ETFs to build your accounts without paying extra to buy or sell. Both E*TRADE and TD Ameritrade offer a wide selection of these funds. Vanguard, for example, now lets you trade nearly 1,800 ETFs with no commission. These include popular choices like the Vanguard Total Stock Market ETF (VTI) and the Vanguard S&P 500 ETF (VOO). You get instant diversification and high liquidity, which means you can buy or sell easily. The “Compare ETFs” tool helps you check expense ratios and find the best fit for your account. With no trading commissions, you can add or change investments in your accounts without worrying about extra costs.

Tip: Even a small 1% annual fee can cut your total returns by up to 30% over 35 years. Low-cost ETFs help you avoid this problem and keep more money in your account.

Avoid Fees

You want to keep your accounts free from hidden charges. Watch out for inactivity fees, account maintenance fees, and transfer fees. Both E_TRADE and TD Ameritrade have no maintenance fees for most accounts, but always check your account details. If you plan to move your account, TD Ameritrade does not charge for a full IRA transfer, while E_TRADE may charge $75. Set up automatic deposits to avoid inactivity fees and keep your account active.

Cost Strategies

Choose low-fee investment products for your accounts. Ultra-low-cost ETFs, with expense ratios as low as 0.03%, can save you thousands of dollars over time. BlackRock’s iShares Core ETFs have not paid out capital gains in five years, which means you pay less in taxes. Use broad market ETFs to get instant diversification and reduce risk in your account. Always review your account statements to spot any unexpected charges. By focusing on cost-effective order types and avoiding unnecessary trades, you help your accounts grow faster.

Diversification

Image Source: pexels

Investment Options

You have a huge range of investment choices with E*TRADE and TD Ameritrade. You can buy stocks, bonds, mutual funds, and ETFs. These platforms also let you trade options, which gives you more ways to manage risk or try new strategies. When you use different investment tools, you spread your money across many types of assets. This helps you avoid putting all your eggs in one basket. You can use research tools to compare stocks, look at options, and check out new funds. Many investors use analysis to find the best mix for their accounts. You can even use screeners to filter stocks or options by sector, price, or performance. This makes it easier to build a strong portfolio.

- Cross-asset portfolios with stocks, gold, oil, and bonds often perform better than single-asset portfolios.

- Diversification across sectors, tools like stocks and options, and regions can reduce risk and improve returns.

- ETFs and benchmark indices, such as the KOSPI 200, show high efficiency when you use research and analysis to guide your choices.

Portfolio Mix

You want a mix that fits your goals. Some people like more stocks for growth, while others prefer bonds for safety. You can use research and analysis to decide how much of each asset to hold. Many investors use options to hedge against drops in the market. You can also use mutual funds and ETFs to get instant diversification. These funds hold many stocks and bonds, so you get a balanced mix with one purchase. Regular research helps you adjust your mix as the market changes. You can use analysis tools to check if your portfolio still matches your goals.

- Well-diversified portfolios, including ETFs, often show better efficiency over time.

- Using research and analysis, you can track risk and returns to keep your mix strong.

Bonds and International

You can add bonds and international stocks to your portfolio for even more diversification. TD Ameritrade offers a wide range of bonds, which can help you manage risk when the market gets rough. International stocks give you access to markets outside the U.S. This can protect you if one country’s market falls. Research shows that adding foreign bonds and stocks can lower your overall risk. You can use analysis to see how these assets fit with your other investments. Currency diversification from international options can also help protect against inflation.

- International diversification reduces risk by offsetting losses from local downturns.

- Foreign bonds and emerging markets can boost returns and make your portfolio more stable.

- Research and analysis tools help you track how these assets perform in different market conditions.

Tip: Use research and analysis often to keep your portfolio balanced and ready for changes in the market.

TD Ameritrade Margin Account

The td ameritrade margin account gives you a way to borrow money for trading. You can use margin trading to buy more stocks or other investments than you could with just your cash. This extra buying power can help you grow your account faster, but it also brings new risks. Understanding margin accounts is key if you want to use this tool wisely.

Margin Features

When you open a td ameritrade margin account, you unlock several features that can change how you approach trading. Margin trading lets you borrow up to 50% of the purchase price of securities. For example, if you have $10,000, you can buy up to $20,000 worth of stocks. This doubles your buying power and gives you more flexibility.

Here are some important features you get with a td ameritrade margin account:

- Initial margin requirement: You usually need to put up at least 50% of the value when you buy securities on margin.

- Maintenance margin: You must keep a minimum equity level, often at least 25%, but brokers like TD Ameritrade may set higher limits.

- Margin call: If your account equity drops below the maintenance margin, you get a margin call. You must add funds or sell assets to fix the balance.

- House margin requirements: TD Ameritrade may set stricter rules for certain stocks or during volatile markets.

- Special rules: Short selling, leveraged ETFs, and options trading may have higher margin requirements.

- Advanced strategies: Margin approval lets you use advanced options strategies and short selling.

- Convenient line of credit: You can borrow against your portfolio without extra paperwork.

- Competitive interest rates: Margin loans often have lower rates than credit cards or personal loans.

- Repayment flexibility: You can repay margin loans on your own schedule as long as you meet margin requirements.

- Tax benefits: Sometimes, you can deduct margin interest from your investment income.

You can use thinkorswim to track your margin balance, see real-time data, and manage your risk. The platform gives you margin calculators and alerts, so you always know where you stand. Margin trading also lets you diversify your portfolio without selling your current holdings. You can use your stocks as collateral to buy new investments.

Tip: Use the margin calculation tools in thinkorswim to check your buying power before making big trades.

Risks and Rewards

Margin trading can boost your gains, but it can also magnify your losses. The risks and rewards of trading on margin go hand in hand. When the market goes up, your extra buying power can help you earn more. If the market drops, you can lose money faster than with cash-only trading.

Let’s look at some of the main risks and rewards of trading on margin:

- Leverage: You can control more assets with less cash. This means bigger profits if your trades work out.

- Magnified losses: If your investments fall, you lose money on both your cash and the borrowed funds.

- Margin calls: If your account equity drops too low, TD Ameritrade can force you to add money or sell your investments. You might not get a warning before your assets are sold.

- Interest costs: You pay interest on borrowed funds, even if your investments lose value.

- Forced liquidation: If you can’t meet a margin call, TD Ameritrade may sell your securities without notice.

- Interest rate risk: Margin loan rates can change, making borrowing more expensive.

- Short selling risks: If you use margin for short selling, your losses can be unlimited if the stock price rises.

You also get some rewards:

- Increased buying power: You can take advantage of more trading opportunities.

- Portfolio diversification: Margin lets you buy new assets without selling your current holdings.

- Advanced trading strategies: You can use margin for options trading, hedging, and short selling.

- Tax benefits: Margin interest may be tax-deductible, depending on your situation.

Historical data shows that rising margin balances often support market rallies. When investors use more margin trading during bull markets, they can accelerate their investment growth. For example, since 1959, higher margin debt has matched periods of strong market gains. Technical indicators like the stochastic indicator and RSI can show when margin debt is rising too fast, which sometimes signals a market reversal. This means margin trading can help you grow faster in good times, but it can also increase your risk during market downturns.

Cambridge Associates found that leveraged investments, like buyouts, can grow faster than non-leveraged investments when companies perform well. Using margin trading with a td ameritrade margin account can work the same way. If your investments grow and you manage your risk, you can see bigger gains. If things go wrong, losses can pile up quickly.

Note: Always weigh the risks and rewards of trading on margin before you borrow. Margin trading is not for everyone.

When to Use Margin

You should use a td ameritrade margin account only when it fits your trading plan and risk tolerance. Margin trading can help you take advantage of market opportunities, but you need to follow best practices for managing margin accounts.

Here are some best practices for managing margin accounts and minimizing risks with margin trading:

- Understand margin calls. TD Ameritrade will issue a margin call if your equity drops below the maintenance margin. You must act fast to avoid forced selling.

- Respond quickly to margin calls. Add funds or sell assets to meet requirements.

- Avoid margin calls by monitoring your account with thinkorswim. Keep enough cash in your account and don’t overleverage.

- Educate yourself. Use TD Ameritrade’s webinars, articles, and support to learn about margin trading.

- Stay updated on market conditions. Use thinkorswim’s research tools to track volatility and trends.

- Use stop-loss orders and set risk limits to protect your investments.

- Only use margin trading when it matches your strategy and risk level.

- Diversify your portfolio. Don’t put all your borrowed money into one stock or sector.

- Regularly monitor your positions with thinkorswim’s real-time tools.

- Keep extra funds in your account to buffer against sudden market moves.

- Use leverage carefully. Don’t take on more risk than you can handle.

You can also use margin trading to diversify your portfolio or take advantage of short-term opportunities. For example, if you spot a great trade but don’t want to sell your current holdings, you can use your td ameritrade margin account to borrow funds. Thinkorswim makes it easy to track your buying power and manage your trades.

Tip: Minimizing risks with margin trading starts with education and careful planning. Use thinkorswim’s tools to set alerts and monitor your margin levels.

Margin trading is a powerful tool, but it’s not a shortcut to easy profits. The td ameritrade margin account gives you more buying power and flexibility, but you must respect the risks. Always use margin trading as part of a well-thought-out trading plan. If you follow best practices for managing margin accounts and use thinkorswim’s features, you can take advantage of the rewards while minimizing risks with margin trading.

Ongoing Management

Staying on top of your investments is just as important as picking the right stocks or using the td ameritrade margin account. You want your accounts to keep growing, so you need a plan for ongoing management. Let’s break down how you can use research, regular reviews, and smart tools to keep your strategy on track.

Portfolio Review

You should check your accounts often. Regular reviews help you spot problems early and keep your investment strategy working. Many investors underperform their funds by over 1% each year because they make poor timing decisions. If you set a schedule for reviews, you avoid emotional mistakes. Research shows that half of investors act on impulse, and most regret it later. When you review your portfolio, you use research to compare your results to benchmarks. This helps you see if your td ameritrade margin account is helping you reach your goals. Reviews also let you catch underperforming assets before they drag down your returns.

- Regular reviews help you:

- Stay invested through market ups and downs

- Keep your asset mix balanced

- Use research to make better choices

- Avoid panic selling

Rebalancing

Your accounts need rebalancing to stay healthy. Over time, some investments grow faster than others. If you use the td ameritrade margin account, you might see even bigger swings. Rebalancing means you check your current mix against your target. You use research to decide what to buy or sell. This keeps your risk level steady and your strategy strong. Rebalancing also helps you sell high and buy low, which can boost your long-term returns. Many investors use automated tools to make this process easier. These tools use research and analytics to keep your accounts in line with your goals.

Tip: Rebalancing with the td ameritrade margin account can help you manage risk, especially if you use margin trading as part of your strategy.

Alerts and Monitoring

You want to know what’s happening with your accounts at all times. Setting alerts keeps you informed about big changes. Modern platforms like the td ameritrade margin account offer real-time alerts and monitoring tools. These tools use research and analytics to spot risks and opportunities. Continuous monitoring helps you catch problems fast, like system glitches or sudden market moves. Automated alerts can warn you about margin calls, price drops, or changes in your strategy. This reduces manual work and helps you make quick decisions. Research shows that companies using automated monitoring save money and avoid costly mistakes. You can use these tools to protect your accounts and keep your investment strategy on track.

- Benefits of alerts and monitoring:

- Early warning for risks in your td ameritrade margin account

- Real-time updates based on research

- Less chance of missing important changes

- Better control over your strategy

Ongoing management means you use research, reviews, and smart tools to keep your td ameritrade margin account and other accounts growing. Make it a habit, and you’ll stay ahead of the game.

You have powerful tools at your fingertips with E*TRADE and TD Ameritrade. These platforms give you $0 commissions, no minimums, and strong research features. You can use the td ameritrade margin account to boost your buying power and try new strategies.

- Both platforms offer mobile apps, managed portfolios, and banking services.

- The digital experience market keeps growing fast, with North America leading the way.

Keep learning, minimize costs, and review your plan often. Start using these features today to help your td ameritrade margin account and investments grow faster.

FAQ

Can I open an account with no money?

Yes, you can. Both E*TRADE and TD Ameritrade let you open most accounts with a $0 minimum. You can start investing when you are ready to add funds.

Are there any hidden fees I should watch for?

You will not pay commissions for most trades. Still, you should check for transfer fees, wire fees, or special service charges. Always read the fee schedule before you start.

How fast can I withdraw my money?

You can request a withdrawal at any time. Most transfers to your bank take one to three business days. Some methods, like wire transfers, may move faster but could cost extra.

Can I use these platforms if I live outside the United States?

You can open an account if you live in many countries, including China and Hong Kong. Some features may not be available everywhere. You should check the broker’s website for the latest list of supported countries.

E*TRADE and TD Ameritrade offer powerful tools like $0 commissions and thinkorswim to grow your wealth, but navigating volatile markets and high cross-border trading costs remains a challenge. BiyaPay simplifies this with a single platform to trade U.S. stocks, HK stocks, and cryptocurrencies, using real-time USDT-to-USD/HKD conversions to cut costs.

Backed by FinCEN, FINTRAC MSB, and SEC RIA compliance, BiyaPay ensures secure, reliable investing. With account setup in minutes, you can diversify swiftly and seize market opportunities, whether you’re in the U.S. or abroad. Join BiyaPay now to optimize your portfolio! Start trading today to grow faster in 2025!

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.