- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Fidelity App or E*TRADE Which Stock Trading App Is Better for Buying Stocks

Image Source: pexels

If you want the best online broker for buying stocks, you will likely find that fidelity stands out for its easy-to-use interface, strong features, and clear pricing. Many users praise fidelity for its trading tools and smooth experience. e_trade also offers a reliable app, but some say fidelity feels more intuitive for new investors. You will notice that both platforms compete with robinhood, which had_ 3.23 million global downloads in April 2021_, showing how important usability and app design are in the brokerage market. Notifications in these apps can increase your engagement by up to 190%, helping you track orders and prices. When you look at user satisfaction, apps like fidelity and e_trade that focus on quality and clear steps—such as how to buy stocks in fidelity app—tend to keep users loyal. If you want a brokerage that balances cost and features, fidelity remains a top choice.

Key Takeaways

- Fidelity and E*TRADE both offer strong stock trading apps with easy-to-use interfaces and advanced features that help you trade smartly.

- Fidelity stands out for its simple design, powerful research tools, and educational resources, making it great for beginners and serious investors.

- E*TRADE provides more customization, a wider range of assets, and advanced order types for investors who want more control.

- Both apps offer commission-free trading on US stocks and ETFs, plus fractional shares starting as low as $1, making investing affordable.

- Strong security, fast customer support, and reliable platform stability make Fidelity and E*TRADE safe and trustworthy choices for your investments.

Quick Comparison

Image Source: pexels

Key Features

When you compare trading platforms like fidelity, e*trade, and robinhood, you want to look at the features that matter most for buying stocks. Each investment platform offers tools to help you make smart decisions. Here are some important features you will find:

- Profit and Loss (PnL) Tracking: You can see your gains and losses in real time. This helps you understand how your trades perform.

- Average Win/Loss: You get a clear view of your average profits and losses. This shows if your trading strategy works.

- AI-Powered Insights: Both fidelity and e*trade use artificial intelligence to spot trends and give you tips for better trades.

- Profit Factor: You can check the ratio of your total profits to your total losses. This tells you if you are making more than you lose.

- Drawdown: The apps track the biggest drop in your account value. This helps you see your risk.

- Detailed Trade History: You can review every trade, including entry and exit prices. This makes it easy to learn from past trades.

- Risk Management Analysis: The platforms help you see if your stop-loss and take-profit strategies protect your money.

- Emotional Trading Analysis: You get feedback on your trading habits. This helps you avoid emotional mistakes.

- Backtesting: You can test your trading ideas using past data. This lets you practice without risking real money.

You will notice that robinhood focuses on simplicity, while fidelity and e*trade offer more advanced features for serious investors.

Verdict

If you want a simple app for buying stocks, robinhood stands out for its clean design and quick trades. Many new investors like its easy setup. If you want more control and deeper features, fidelity gives you strong tools and detailed analysis. You can track your performance, manage risk, and use AI insights. E_trade also offers a solid experience, but some users find fidelity easier to use. Both fidelity and e_trade support advanced order types and offer better research tools than robinhood. For most investors, fidelity gives the best mix of features, usability, and value among these trading platforms.

Usability

Interface

You want a trading app that feels easy to use. Both fidelity and e_trade focus on_ simple design and clear navigation_. When you open the fidelity app, you see large icons and clear labels. This helps you find what you need fast. E_trade also uses a clean layout, but some users say fidelity feels more organized. Robinhood stands out for its super simple interface. You can swipe and tap to buy stocks in seconds. Many new investors like robinhood because it does not overwhelm you with too many choices.

A seamless user experience with intuitive interfaces reduces the learning curve and increases user satisfaction. Simplicity in design helps you understand the trading process, even if you are new to investing.

You will notice that all three apps use clear symbols and easy language. This makes trading less stressful. Fidelity balances power and simplicity, giving you advanced tools without making the app confusing. E*trade offers many features, but you may need to explore a bit more to find everything.

Account Setup

Setting up your account should not take long. Fidelity guides you step by step, so you know what to do next. You can upload documents and verify your identity right in the mobile app. E*trade also makes account setup simple, but some users report that fidelity feels faster. Robinhood lets you start trading in minutes, which is great if you want to jump into mobile investing quickly.

- Most users finish account setup in less than 10 minutes.

- Both fidelity and e*trade use clear instructions and progress bars.

- Robinhood skips extra steps, so you can buy your first stock almost right away.

Mobile Experience

Mobile trading matters more than ever. Fidelity, e_trade, and robinhood all offer strong mobile apps. You can check your portfolio, place trades, and get alerts from anywhere. Fidelity’s mobile app stands out for its balance of features and speed. You get advanced charts, news, and research tools, but the app still feels easy to use. E_trade’s mobile app gives you lots of customization options. You can set up watchlists and alerts to track your favorite stocks.

Robinhood focuses on speed and simplicity. You can buy and sell stocks with just a few taps. Many users like how robinhood sends instant notifications about price changes and order updates. This keeps you connected to the market at all times.

User satisfaction surveys show that apps with simple interfaces and easy navigation get higher ratings. Metrics like Customer Satisfaction Score (CSAT) and Customer Effort Score (CES) prove that users value apps that make mobile investing easy.

| App | Interface Simplicity | Account Setup Speed | Mobile Features |

|---|---|---|---|

| Fidelity | High | Fast | Advanced + Simple |

| E*TRADE | High | Fast | Customizable |

| Robinhood | Very High | Fastest | Simple + Fast |

You can see that all three apps make mobile investing easy, but fidelity gives you the best mix of power and simplicity. E*trade offers more customization, while robinhood keeps things as simple as possible.

How to Buy Stocks in Fidelity App

Image Source: pexels

Steps to Buy

You can start investing quickly when you know how to buy stocks in fidelity app. First, open the fidelity app on your phone or tablet. Log in with your username and password. You will see your account dashboard. Tap the “Trade” button to begin.

- Search for the stock you want to buy. Enter the company name or ticker symbol in the search bar.

- Select the stock from the search results. You will see its price, chart, and news.

- Tap “Buy.” Enter the number of shares you want. If you want to buy a fraction of a share, fidelity lets you do that.

- Choose your order type. You can pick “Market” to buy at the current price or “Limit” to set your own price.

- Review your order. Check the details to make sure everything is correct.

- Tap “Place Order.” You will get a confirmation message.

Tip: Always double-check the stock symbol before you place your order. This helps you avoid mistakes.

You can repeat these steps any time you want to buy more stocks. The process stays the same for most stocks in the fidelity app.

Tips for Beginners

If you are new and want to learn how to buy stocks in fidelity app, start small. You do not need a lot of money to begin. Fidelity allows you to buy fractional shares, so you can invest with just a few dollars.

- Read the company’s profile and recent news before you buy.

- Use the research tools in the fidelity app to compare different stocks.

- Set price alerts to watch for good buying opportunities.

- Practice with the app’s demo mode if you feel unsure.

Note: Learning how to buy stocks in fidelity app takes practice. Start slow and build your confidence.

You will find that fidelity makes it easy to track your stocks and manage your investments. As you use the app more, you will get better at making smart choices.

Trade Experience

Orders

You want a trading app that makes placing orders simple and fast. In fidelity, you can choose from many order types, such as market, limit, and stop orders. The app guides you through each step, so you do not feel lost. E*trade also offers a wide range of order options. You can set up advanced orders if you want more control. Robinhood keeps things basic. You can place market and limit orders, but you will not find as many advanced choices.

When you use fidelity or e_trade, you can review your order before you submit it. This helps you avoid mistakes. Robinhood lets you swipe to confirm, which feels quick but may lead to errors if you rush. You can also save your favorite trading settings in both fidelity and e_trade, making future trades even easier.

Execution

Fast execution matters when you trade stocks. Fidelity uses real-time data to process your trades quickly. E*trade also focuses on speed, so you do not miss out on price changes. Robinhood is known for its instant trades, but sometimes you may notice delays during busy market hours.

Real-world reports show that high-frequency trading firms use real-time trade reporting systems to reduce latency. This means they can execute trades in milliseconds and gain an edge. Institutional investors use these systems to spot risks and adjust their strategies, which helps lower portfolio volatility.

Fidelity and e_trade both use advanced technology to keep your trading smooth. They also automate trade reporting, which helps them follow rules and avoid fines. Robinhood relies on automation too, but you may not get the same level of detail as with fidelity or e_trade.

Alerts

Staying updated is key in trading. Fidelity lets you set up custom alerts for price changes, news, and order status. E*trade offers similar alert features. You can choose how you want to get alerts—by push notification, email, or text. Robinhood sends instant notifications for trades and price moves, which helps you react fast.

- Automated alerts for market conditions help you make timely decisions.

- You can use alerts to catch good prices or exit trades to avoid losses.

- Advanced analytics in fidelity and e*trade give you real-time feedback on your trading strategies.

Brokerage firms improve alert reliability by automating their systems. This keeps you informed and helps you act quickly in the market.

You will find that fidelity and e*trade give you more control over your alerts than robinhood. This makes it easier to manage your trading and stay ahead of market changes.

Range of Offerings

Stocks & ETFs

You want a trading app that gives you access to a wide range of stocks and ETFs. Fidelity, e_trade, and robinhood all let you buy and sell stocks from major U.S. exchanges. You can find popular companies, growth stocks, and index funds in each app. Fidelity stands out for its deep selection of stocks and ETFs, including many international options. E_trade also offers a strong lineup, making it easy for you to diversify your portfolio. Robinhood focuses on simplicity, so you can quickly search and trade stocks or ETFs with just a few taps.

Here is a quick look at how different apps compare:

| App Name | Asset Offering Diversity | Fractional Shares Availability |

|---|---|---|

| Fidelity | Stocks, ETFs, mutual funds, long-term investment tools | Fractional shares available with minimum $1 investment |

| E*TRADE | Stocks, ETFs, mutual funds, options, futures | Fractional shares for stocks and ETFs |

| Robinhood | Stocks, ETFs, options, crypto | Fractional shares for stocks and ETFs |

You can see that all three apps give you strong access to stocks and ETFs. Fidelity and e*trade offer more advanced investment tools, while robinhood keeps things simple.

Fractional Shares

Fractional shares let you buy a piece of a stock instead of a whole share. This feature helps you invest in expensive stocks without needing a lot of money. Fidelity allows you to start with just $1. E*trade also supports fractional shares for stocks and ETFs, making it easy to build a diverse portfolio. Robinhood lets you buy fractional shares as well, so you can own part of big companies like Apple or Tesla.

Trading212 and Webull also offer fractional shares, but you may find that fidelity and e*trade provide more research tools to help you choose the right stocks. Fractional shares make investing more flexible and help you spread your money across different stocks.

Tip: Use fractional shares to invest in high-priced stocks and grow your portfolio over time.

Other Assets

You may want to invest in more than just stocks and ETFs. Fidelity gives you access to mutual funds, long-term investment tools, and even some international assets. E*trade offers options, futures, and fixed income products, so you can try different strategies. Robinhood adds cryptocurrencies to its lineup, letting you trade Bitcoin and Ethereum alongside stocks.

If you want even more choices, apps like Webull and Public.com include bonds, cash management, and alternative assets. Still, fidelity and e*trade remain top picks for investors who want a broad range of stocks and other assets in one place.

Order Types

Basic Orders

When you start trading, you will use basic order types most often. These orders help you buy or sell stocks quickly and easily. The most common basic order is the market order. You place a market order when you want to buy or sell a stock right away at the best available price. This order works well if you want to enter or exit a trading position fast.

Another basic order is the limit order. You use a limit order when you want to set the price for your trade. For example, you can tell the app to buy a stock only if the price drops to $50 USD. If the price does not reach $50 USD, your order will not go through. This gives you more control over your trading.

Stop orders are also important. You use a stop order to sell a stock if the price falls to a certain level. This helps you manage risk and protect your trading profits. Many new investors start with these basic orders because they are easy to understand.

Tip: Always review your order before you submit it. This helps you avoid mistakes in your trading.

Advanced Orders

As you gain experience with trading, you may want to use advanced order types. These orders give you more ways to control your trades. One popular advanced order is the stop-limit order. This order combines a stop order and a limit order. You set a stop price and a limit price. When the stock hits the stop price, the app places a limit order at your chosen price.

Trailing stop orders are another advanced tool. You use a trailing stop to lock in profits as a stock’s price rises. The stop price moves up with the stock, but it does not move down. This helps you stay in a winning trade longer.

Some trading apps, like Fidelity and E*TRADE, offer even more advanced orders. You can use bracket orders, which let you set both a profit target and a stop-loss at the same time. This makes your trading safer and more automatic.

| Order Type | How It Works | When to Use |

|---|---|---|

| Stop-Limit Order | Sets a stop and a limit price for your trade | For more control |

| Trailing Stop | Moves stop price up as stock price rises | To lock in trading gains |

| Bracket Order | Sets profit and loss targets together | For safer trading |

Note: Advanced orders can help you manage risk and improve your trading results. Try them as you get more comfortable with trading.

Trading Technology

Platform Stability

You want a trading app that works smoothly every time you log in. Platform stability means the app stays online, processes your trades, and does not crash during busy market hours. Many trading platforms use advanced technology to keep their systems running, even when thousands of users trade at once. Performance testing checks how well the app handles heavy use. This testing looks at speed, stability, and how the app scales when more people join.

Key indicators of stability include uptime, order execution without delays, and few errors. If you see frequent order delays or the app crashes, that is a red flag. Reliable trading apps, like Fidelity and E*TRADE, use risk management tools and monitor market conditions to keep things stable. They also use regulatory tools, such as circuit breakers, to prevent big problems during fast market moves.

A stable platform helps you avoid missed trades and protects your investments during market swings.

Speed

Speed is very important in trading. Fast execution lets you buy or sell stocks at the price you want. Algorithmic trading can complete trades in milliseconds, which helps reduce price slippage. This speed is key for strategies like arbitrage, where you try to profit from small price differences across markets.

You can check speed by looking at how quickly your orders go through and if you get trade confirmations right away. Some users open demo accounts to test order speed and look for delays. Watch for signs like slippage or re-quotes, which mean the app is slow. Fidelity and E*TRADE both use AI-powered algorithms to boost decision-making and keep trades fast. They also combine manual and automated systems for balanced performance.

- Execution speed

- Low latency

- Quick trade confirmations

Fast trading helps you react to market changes and take advantage of new opportunities.

Costs

Commissions

You want to keep your trading costs as low as possible. Both fidelity and e*trade offer no commission trades for US stocks and ETFs. This means you pay nothing extra when you buy or sell most stocks. A recent study found that after brokers removed commissions, retail investors saved millions of dollars each day. Before no commission trading, a typical trade could cost you about $5 in fees. Now, you can trade without worrying about these charges.

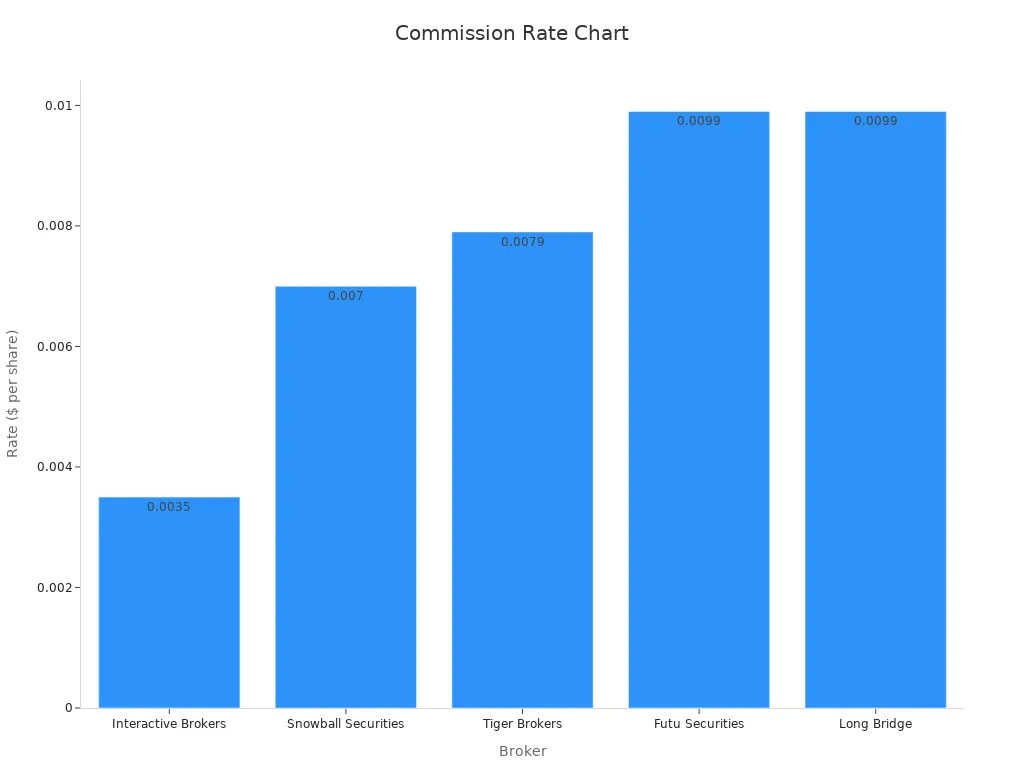

You can see how different brokers compare in the chart below:

Fidelity and e*trade both stand out for their low costs. You get no commission on most trades, which helps you keep more of your money. Some brokers still charge small fees for international stocks or special trades, so always check before you trade.

Margin Rates

If you borrow money to trade, you pay a margin rate. Fidelity and e_trade both offer margin accounts, but their rates can differ. Fidelity’s margin rates are often higher than some competitors, especially for smaller loans. E_trade offers competitive rates, but you should compare the exact numbers for your account size. For example, borrowing $100,000 at a 4% rate means you need at least a 4% return just to break even. Margin costs can add up, so always check the rates before you use leverage.

| Broker Name | Financing Rate Range (BM + %) | Annual Cost for $100,000 Borrowed |

|---|---|---|

| Fidelity | BM + 2.5% to 8.325% | $6,830 - $12,655 |

| E*TRADE | BM + 2.45% to 8.45% | $6,780 - $12,780 |

Tip: Margin trading can increase your gains, but it also increases your risk and costs.

Other Fees

You should also watch for other fees. Both fidelity and e_trade keep most fees low, but you may pay for things like wire transfers, paper statements, or foreign exchange. Currency conversion fees can range from 0.1% to 1%, which can add up if you trade international stocks. Some brokers charge platform fees or inactivity fees, but fidelity and e_trade do not charge these for standard accounts.

A recent example shows that switching to a low-cost brokerage can save you thousands of dollars each year. One investor cut annual commission expenses from $1,500 to $270 by choosing a broker with no commission trades and low costs. Always review the fee schedule before you open an account.

Note: Choosing a brokerage with no commission and low costs helps you keep more of your returns. This is important for cost-sensitive investors who want to grow their portfolios faster.

Research & Tools

Screeners

You want to find the best stocks quickly. Fidelity gives you powerful screeners that help you sort stocks, ETFs, and mutual funds. You can filter by price, sector, market cap, and even dividend yield. This tool saves you time because you do not have to look at each stock one by one. E*TRADE also offers screeners, but many users say fidelity’s screeners feel easier to use. You can set up custom filters and save your favorite searches. This makes it simple to check the market every day.

Tip: Use screeners to spot new opportunities before most investors notice them.

Analysis

Fidelity provides you with strong analysis tools. You get access to detailed charts, technical indicators, and analyst ratings. You can compare stocks side by side. This helps you make smarter decisions. The app shows you price trends, earnings reports, and risk scores. E*TRADE also gives you analysis features, but fidelity often updates its data faster. You can use these tools to check if a stock fits your goals. Many investors trust fidelity because the analysis is clear and easy to understand.

Here is a quick comparison:

| Feature | Fidelity | E*TRADE |

|---|---|---|

| Technical Charts | Yes | Yes |

| Analyst Ratings | Yes | Yes |

| Side-by-Side Compare | Yes | Yes |

| Real-Time Data | Yes | Yes |

News

You need the latest news to stay ahead in the market. Fidelity brings you real-time news from trusted sources. You can read updates about companies, earnings, and market trends right in the app. This helps you react fast when something important happens. E*TRADE also offers news, but some users say fidelity’s news feed feels more complete. You can set alerts for breaking news about your favorite stocks. This feature makes fidelity a top choice for anyone who wants to stay informed on their investment platform.

Note: Reading news every day helps you spot risks and find new chances to grow your money.

Portfolio Analysis

Tracking

You need a clear way to see how your investments perform. Both Fidelity and E*TRADE give you real-time updates on your portfolio. You can check your gains and losses as soon as the market moves. The apps show your account value, recent trades, and how each stock or ETF changes over time. You can use advanced charts and graphs to spot trends. These tools help you understand if your strategy works or if you need to make changes.

Many investors like how easy it is to customize dashboards. You can choose which data to see first, such as daily performance or total returns. This makes it simple to focus on what matters most to you. Both apps let you track different types of assets, including stocks, ETFs, and mutual funds. Some platforms, like TradingView and MarketWatch, also offer strong tracking features and are trusted by many professionals.

Real-time data and easy-to-read visuals help you make quick decisions. You do not have to wait for end-of-day reports. This keeps you informed and ready to act.

Insights

You want more than just numbers. Both Fidelity and E*TRADE provide expert insights to help you understand the market. The apps translate complex data into simple advice. You can read expert commentary, see analyst ratings, and get news updates right in your dashboard. This helps you know why a stock moves, not just how much it moves.

The apps cover many asset classes, so you get a broad view of the market. You can compare stocks, bonds, and even commodities. Customizable dashboards let you set up alerts for important news or price changes. User feedback helps these platforms improve their insights and keep information accurate.

Expert analysis and clear insights help you make smarter choices. When you understand the reasons behind market moves, you can plan your next steps with confidence.

Education

Learning Resources

You need strong learning resources to build your investing skills. Both Fidelity and E*TRADE offer a wide range of educational materials. You can find articles, videos, and webinars that cover topics from basic investing to advanced trading. These resources help you understand how the stock market works and how to use each app’s features. Many users like the step-by-step guides that explain how to buy stocks, manage risk, and read charts.

You can also explore interactive lessons and real-world data activities. Many platforms, such as DataClassroom and Biointeractive, provide hundreds of free resources for students and investors. These programs use real data and visuals to make learning easier. The table below shows some popular educational programs and their features:

| Platform/Program | Grade Levels | Disciplines | Key Usage Statistics / Features |

|---|---|---|---|

| The GLOBE Program | K-16 | Earth & Environmental Science | Over a quarter billion environmental data measurements; training, protocols, citizen scientist app |

| DataClassroom | 6-12 | Current Events, Math, Science | Access to 75+ curated datasets, animated hypothesis tests, graphs, and visuals |

| Biointeractive | 9-12 | Science | Hundreds of free multimedia resources including apps, animations, videos, interactives, virtual labs |

| DataClubs | 6-8 | Science, Other | Three modules with ~10 hours of activities each, printable content, curated datasets in CODAP |

You can use these resources to practice data analysis and improve your decision-making. Many of these tools work well on mobile devices, so you can learn anywhere.

Tutorials

Tutorials help you get started with trading apps. Fidelity and E*TRADE both offer clear, step-by-step tutorials for new users. You can watch short videos or follow written guides that show you how to open an account, place your first trade, and set up alerts. These tutorials use simple language and visuals, making it easy to follow along.

You can also find mobile tutorials that teach you how to use every feature on your phone or tablet. Many users prefer learning on mobile because it fits their busy lives. You can pause, rewind, or replay lessons as needed. Some platforms even offer quizzes and practice exercises to test your knowledge.

Tip: Use tutorials to explore new features and build your confidence before making real trades.

Customer Support

Channels

You want to reach customer support quickly when you have questions or problems. Both Fidelity and E*TRADE give you several ways to get help. You can use live chat, phone support, and email. Many users also reach out through social media platforms like Facebook, Twitter, and Instagram. These channels make it easy for you to choose the best way to connect.

Live chat works well if you want fast answers while using the app. Phone support helps when you need to talk to a real person about your account or a trade. Social media channels let you send messages or comments, and support teams often reply there too. You can also find help centers and FAQs on each app’s website. These resources answer common questions and guide you through basic tasks.

Tip: Try live chat or phone support for urgent issues. Use email or social media for less urgent questions.

Response

You expect quick replies when you contact customer support. Both Fidelity and E*TRADE monitor their response times across all channels. Many support teams use tools that track how fast they answer your questions. These tools show real-time dashboards and reports, so companies know if they meet your needs.

The table below shows average response times for popular support channels:

| Support Channel | Average Response Time | Notes |

|---|---|---|

| 15 minutes or less | Fast replies earn a “Very responsive” badge | |

| Within 1 hour | Quick help for messages and comments | |

| 30-35 minutes | Many brands reply within 35 minutes | |

| Live Chat | About 6 minutes | Most users get answers in under 10 minutes |

| Phone Support | 2 minutes or less | Short wait times, even during busy hours |

You can see that most channels offer fast help. Support teams aim to answer live chats in under 10 minutes and phone calls in about 2 minutes. Social media replies often come in less than 30 minutes. These quick responses help you solve problems and keep your trading on track.

Note: Fast customer support gives you peace of mind. You can trade with confidence, knowing help is always close by.

Security

Protection

You want your investments and personal data to stay safe. Both fidelity and E*TRADE use strong protection measures to guard your account. Today, hackers launch about 26,000 cyberattacks every day. Attacks happen every three seconds. Fintech apps, like fidelity, face more risks because they hold sensitive financial information. You need to know that 97% of fintech apps lack basic security, and 80% use weak encryption. This makes strong protection even more important.

Fidelity follows strict rules to keep your data secure. The app uses secure coding, input checks, and error handling to block common attacks. You get extra safety from multi-factor authentication (MFA), which may include text codes or fingerprint scans. Fidelity also uses encryption to protect your data when stored or sent. The company meets standards like GDPR and PCI DSS, which help keep your information private.

Real-world breaches, like the Capital One incident, show why you need strong security. Always choose apps that update their systems and follow best practices.

App Security

You want to trust the app you use for trading. Fidelity updates its app often to fix bugs and close security gaps. The app uses strong password rules and supports MFA, including biometrics and time-based codes. Regular code reviews and security checks help find and fix problems before hackers can attack.

Here are some key security features you get with fidelity:

- Data encryption at rest and in transit

- Secure backup and storage for your account data

- Limited use of third-party code to reduce risks

- Network defenses to block outside threats

Fidelity also trains its staff to spot and stop phishing and malware attacks. You get alerts for any strange activity on your account. These steps help keep your money and personal details safe.

Tip: Always use a strong, unique password and turn on all security features in your trading app.

Account Types

Individual

You can open an individual account if you want flexibility and control over your investments. This type of account lets you buy and sell stocks, ETFs, and other assets whenever you choose. You decide how much risk to take and which companies to invest in. Many investors use individual accounts for short-term goals or to try new trading strategies.

- You can trade individual stocks, ETFs, and even options.

- You have full control over your investment choices.

- You can withdraw money at any time without penalties.

Individual accounts often appeal to people who want to react quickly to market changes. You might see higher returns, but you also face more risk. Platforms like Robinhood focus on these accounts, giving you tools for fast trades and speculative investing. You can use advanced order types and set your own pace. However, you should remember that higher risk can lead to bigger losses.

Note: Individual accounts do not have special tax advantages. You pay taxes on any profits you make each year.

Retirement

You can choose a retirement account if you want to save for the future. These accounts, such as IRAs or 401(k)s, help you invest for long-term goals. Retirement accounts often use managed portfolios. These portfolios focus on steady growth, diversification, and lower fees.

| Feature | Individual Account | Retirement Account |

|---|---|---|

| Investment Control | High | Moderate |

| Risk Level | Higher | Lower |

| Tax Benefits | None | Yes |

| Withdrawal Flexibility | High | Limited |

| Fiduciary Duty | Lower | Higher |

Retirement accounts usually come with a fiduciary duty. This means the provider must act in your best interest. You get a more conservative approach, with less focus on risky trades. The goal is to grow your money slowly and protect it from big losses. You may face penalties if you withdraw money before retirement age, but you gain tax advantages and professional management.

Tip: If you want to build wealth for the long term, a retirement account can help you manage risk and reach your goals.

E*TRADE vs. Fidelity

Strengths

You want to know what makes e_trade and fidelity stand out. Both apps give you strong tools for buying and selling stocks. When you compare e_trade vs. fidelity, you see that each platform has unique strengths. You can use these strengths to match your investing style.

Fidelity Strengths:

- You get a user-friendly app with a clean design. Many users say fidelity feels easy to navigate.

- You can access a wide range of investment options. Fidelity offers stocks, ETFs, mutual funds, and retirement accounts.

- You benefit from advanced research tools. The app gives you screeners, real-time news, and detailed analysis.

- You can buy fractional shares starting at $1 USD. This helps you invest in expensive stocks with less money.

- You enjoy strong security features. Fidelity uses multi-factor authentication and regular updates to protect your account.

- You receive fast customer support. Most users get help in minutes through live chat or phone.

- You can use educational resources. Fidelity provides articles, videos, and tutorials for all skill levels.

- You pay no commissions on US stocks and ETFs. This helps you keep more of your returns.

- You get reliable platform stability. Fidelity rarely crashes, even during busy market hours.

- You can track your portfolio with real-time data and clear visuals.

E*TRADE Strengths:

- You have access to a customizable app. E*trade lets you set up watchlists and alerts for your favorite stocks.

- You can trade a wide range of assets. E*trade supports stocks, ETFs, mutual funds, options, and futures.

- You benefit from advanced order types. E*trade gives you more control with stop, limit, and bracket orders.

- You get strong research tools. The app offers screeners, technical analysis, and expert insights.

- You can buy fractional shares for stocks and ETFs. This makes it easy to diversify your portfolio.

- You enjoy competitive margin rates. E*trade often offers lower rates for larger loans.

- You receive fast execution speeds. E*trade processes trades quickly, so you do not miss price changes.

- You can access educational content. E*trade provides webinars, articles, and step-by-step guides.

- You get multiple customer support channels. E*trade offers live chat, phone, email, and social media help.

- You benefit from a stable trading platform. E*trade handles high trading volumes without frequent issues.

You can see the key strengths in the table below:

| Feature | Fidelity | E*TRADE |

|---|---|---|

| User Interface | Clean, easy to use | Customizable, organized |

| Investment Options | Stocks, ETFs, mutual funds, IRAs | Stocks, ETFs, mutual funds, options, futures |

| Fractional Shares | Yes, $1 USD minimum | Yes, for stocks and ETFs |

| Research Tools | Advanced screeners, real-time news | Technical analysis, expert insights |

| Order Types | Basic and advanced | Wide range, including bracket |

| Customer Support | Fast, multi-channel | Fast, multi-channel |

| Platform Stability | High | High |

| Margin Rates | Competitive, higher for small loans | Competitive, lower for large loans |

| Education | Articles, videos, tutorials | Webinars, guides, articles |

| Security | Multi-factor, regular updates | Multi-factor, regular updates |

You can use these strengths to decide which app fits your needs. If you want the best online broker for research and education, fidelity stands out. If you want more asset choices and advanced order types, e_trade gives you more flexibility. When you compare e_trade vs. fidelity, you see both apps offer strong features for buying stocks. Robinhood focuses on simplicity, but you get more depth with fidelity and e*trade.

Weaknesses

You should also know the weaknesses of each app. When you look at e*trade vs. fidelity, you see some areas where each platform could improve. Understanding these weaknesses helps you avoid surprises.

Common Weaknesses in E*TRADE and Fidelity:

- You may find recurring bugs or technical issues. Some users report occasional glitches during updates.

- You might notice missing features compared to other apps. For example, robinhood offers instant crypto trading, which fidelity and e*trade do not match.

- You could experience slow response from development teams. Sometimes, it takes weeks to fix minor problems.

- You may see limitations in scalability. During high market activity, both apps can slow down.

- You might face low retention rates and high churn rates. Some users leave for simpler apps like robinhood.

- You could find that some features are hard to discover. Both apps offer many tools, but new users may feel overwhelmed.

- You may pay higher margin rates for small loans with fidelity. This can increase your trading costs.

- You might see fewer updates for new features. Limited funding can slow down innovation.

- You could miss out on certain asset classes. For example, robinhood lets you trade cryptocurrencies, but fidelity and e*trade focus on traditional assets.

- You may find that customer support sometimes gets busy during peak hours. This can lead to longer wait times.

Note: Competitive analysis shows that understanding weaknesses helps you choose the right app. You can avoid problems that other users face and pick the platform that matches your needs.

When you compare e_trade vs. fidelity, you see that both apps offer strong features, but each has areas to improve. Robinhood keeps things simple, but you lose advanced tools. Fidelity and e_trade give you more depth, but you may need time to learn all the features. You should weigh these strengths and weaknesses before you decide which app to use for buying stocks.

You have many choices for stock trading apps. If you want strong research tools and a simple design, fidelity works well. You get advanced features that help you learn and grow. If you like more asset types and custom options, e_trade gives you flexibility. Robinhood offers quick trades, but you miss out on deep analysis. You should match your needs to the right app. Try fidelity or e_trade if you want more than what robinhood gives. Make your choice and start investing today.

FAQ

How much money do you need to start trading on Fidelity or E*TRADE?

You can open an account with no minimum deposit on both platforms. You may start buying stocks with as little as $1 USD if you use fractional shares. This makes it easy for you to begin investing.

Can you buy international stocks on Fidelity or E*TRADE?

You can buy some international stocks through American Depositary Receipts (ADRs) on both apps. If you want direct access to foreign markets, you may need to use other brokers or special account types.

Are there any hidden fees when trading stocks?

Both Fidelity and E*TRADE offer commission-free trades for US stocks and ETFs. You may pay extra for wire transfers, paper statements, or trading international stocks. Always check the fee schedule before you trade.

Is your money safe with Fidelity and E*TRADE?

Both brokers use strong security measures, including encryption and multi-factor authentication. Your accounts have insurance through the Securities Investor Protection Corporation (SIPC) for up to $500,000 USD, including $250,000 USD for cash claims.

Fidelity and E*TRADE excel with commission-free trading and robust tools, but cross-border fees and platform complexity can challenge investors. BiyaPay simplifies global trading with a user-friendly platform for U.S. stocks, HK stocks, and cryptocurrencies, offering real-time USDT-to-USD/HKD conversions and fees as low as 0.5%.

Backed by FinCEN, FINTRAC MSB, and SEC RIA compliance, BiyaPay ensures secure, reliable investing with multi-factor authentication. Set up your account in minutes to diversify and act swiftly in volatile markets. Join BiyaPay now to streamline your investments! Start trading today to build wealth in 2025!

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.