- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

How to Start Investing in HKEX Stock for First-Time Investors

Image Source: pexels

You can start investing in the hong kong stock exchange by following a clear set of steps. First, select a broker and open your account. Verification can take minutes or a few days. Next, deposit money. Some brokers, like Interactive Brokers or moomoo, require no minimum deposit, while others may need USD 100 or more. Choose your stocks or ETFs, such as HKEX stock symbol 388, and begin trading with as little as USD 10. The table below shows the basic process:

| Step | Description | Example Data |

|---|---|---|

| 1 | Open brokerage account | Verification: minutes–days |

| 2 | Deposit money | Minimum: USD 0–100+ |

| 3 | Buy HKEX shares | Start from USD 10 |

| 4 | Review investment | Use limit, stop-loss orders |

You must learn about trading basics, hkex stock price data, and how investment strategies differ from US markets. Always check your risk tolerance and follow reliable hong kong stock exchange news for better investment decisions.

Key Takeaways

- Open a brokerage account with a trusted broker and fund it with as little as USD 10 to start trading HKEX stocks.

- Understand HKEX market hours, order types, fees, and settlement rules to trade confidently and avoid surprises.

- Choose between large, stable companies on the Main Board or higher-growth but riskier stocks on the Growth Enterprise Market.

- Diversify your investments using stocks and ETFs to lower risk and build a balanced portfolio.

- Keep learning about trading strategies, use risk management tools like stop-loss orders, and stay updated with reliable market news.

About HKEX

Image Source: unsplash

What Is HKEX

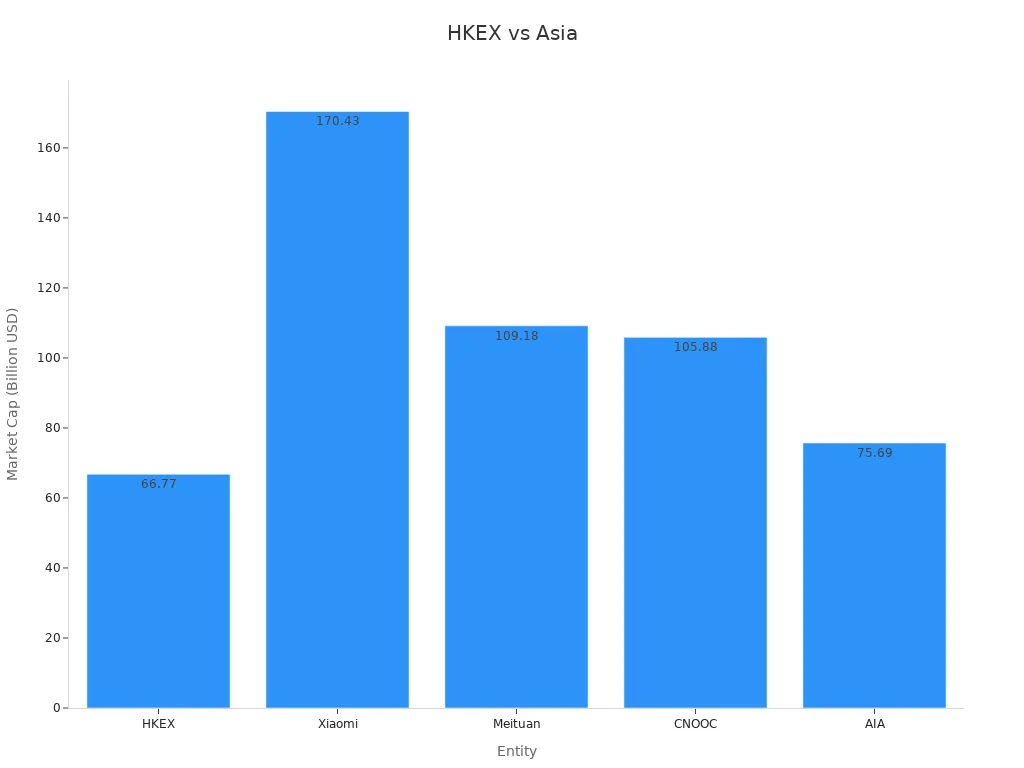

The hong kong stock exchange (HKEX) stands as one of the largest and most important stock exchanges in Asia. You can find many well-known companies listed here, such as Xiaomi, Meituan, and CNOOC. HKEX acts as a bridge between China and the rest of the world, helping companies raise money and giving investors access to a wide range of stocks, bonds, and funds. The exchange operates under strict rules set by the Securities and Futures Commission. This helps protect investors and keeps the market fair.

HKEX has grown quickly over the years. It now ranks as Asia’s third-largest stock exchange by market capitalization, just behind Tokyo and Shanghai. The table below shows the market size of HKEX and some major companies:

| Entity | Market Capitalization (Billion USD) | Date |

|---|---|---|

| HKEX | 66.77 | Jun 18 |

| Xiaomi | 170.43 | Jun 18 |

| Meituan | 109.18 | Jun 18 |

| CNOOC | 105.88 | Jun 18 |

| AIA | 75.69 | Jun 18 |

You can also see the market size compared to others in this chart:

Why Invest in HKEX

You may find many reasons to consider the hong kong stock exchange for your investment. HKEX is the world’s fifth-largest stock exchange by market capitalization. It often leads in global IPO volume, especially with Chinese companies choosing to list here. The exchange holds a unique position because it is the only stock exchange in Hong Kong, which means it faces no local competition.

HKEX also gives you access to the China-Hong Kong Stock Connect program. This program lets you invest in stocks from both Hong Kong and Mainland China, opening up more investment opportunities. HKEX continues to grow by adding new products, such as renminbi-denominated stocks and futures. This helps you diversify your investment and take advantage of China’s growing economy.

Tip: HKEX’s strong rules and focus on investor protection make it a safer place for your investment compared to some other regional markets.

Getting Started

Choose a Broker

You need to pick a broker before you start trading on the Hong Kong Stock Exchange. Brokers help you buy and sell stocks. You can choose a local broker in Hong Kong or an international broker that offers access to HKEX. Many investors use well-known names like HSBC, Standard Chartered, or Bank of China (Hong Kong). Some online brokers, such as Interactive Brokers and moomoo, also let you trade HKEX stocks from outside Hong Kong.

When you compare brokers, look at these factors:

- Trading fees: Check how much each broker charges for every trade.

- Account types: Some brokers offer cash accounts, while others offer margin accounts for more advanced trading.

- Platform features: Make sure the trading platform is easy to use and gives you real-time data.

- Customer support: Good support helps you solve problems quickly.

Tip: International investors can open accounts with brokers like HSBC to access HKEX trading from many countries.

Open and Fund an Account

After you choose your broker, you need to open an account. Most brokers ask for your ID, proof of address, and sometimes a tax document. You can often complete this process online. Some brokers finish verification in minutes, while others may take a few days.

Once your account is open, you must fund it. You can transfer money using a bank transfer, credit card, or sometimes even PayPal. Most brokers accept USD, but check the exchange rate if you use another currency. Some brokers have no minimum deposit, while others may ask for at least USD 100.

Here is a simple table to help you compare funding options:

| Broker Example | Minimum Deposit (USD) | Funding Methods |

|---|---|---|

| HSBC | 100 | Bank transfer |

| Interactive Brokers | 0 | Bank transfer, PayPal |

| moomoo | 0 | Bank transfer, Card |

You can now start trading after you fund your account. Make sure you understand the trading platform before you place your first order. Practice with demo accounts if your broker offers them. This helps you learn trading basics and avoid mistakes.

Trading Basics

Market Hours

You need to know when you can trade on the Hong Kong Stock Exchange. The regular trading session starts at 9:30 AM and ends at 4:00 PM Hong Kong time. There is a lunch break from 12:00 PM to 1:00 PM. The pre-opening session runs from 9:00 AM to 9:30 AM. You can place orders during this time, but trades will not execute until the market opens. Always check the calendar for public holidays, as the exchange closes on those days.

Order Types

You have several order types to choose from when trading. Each type fits different needs and strategies:

- Market orders let you buy or sell stocks quickly at the best available hkex stock price. This works well for highly liquid stocks, but you may face slippage if the stock is not liquid.

- Limit orders give you control over the hkex stock price. You set the maximum price you want to pay or the minimum price you want to receive. This helps you avoid bad trades, but your order may not fill right away.

- Conditional orders allow you to automate trades based on price triggers. You can use these for stop-loss or profit-taking strategies.

You should always think about your trading goals, the liquidity of the stock, and your risk tolerance before choosing an order type.

Fees and Settlement

Trading on HKEX comes with costs. You pay a commission to your broker for each trade. Most brokers charge between USD 2 and USD 10 per trade, depending on the platform and the size of your order. You also pay a transaction levy and a trading fee to the exchange. Taxes may apply, such as stamp duty on stock trades. Settlement usually happens two business days after the trade date (T+2). This means you receive your shares or cash two days after your trade.

| Fee Type | Typical Amount (USD) | Notes |

|---|---|---|

| Broker Commission | 2–10 | Per trade |

| Transaction Levy | 0.003% | Of trade value |

| Trading Fee | 0.005% | Of trade value |

| Stamp Duty | 0.13% | Of trade value (stocks only) |

Note: Always review your broker’s fee schedule before trading. Small fees can add up over time.

HKEX Stock Price Data

You must check hkex stock price data before making any trading decision. You can find real-time hkex stock price information on your broker’s platform or the official HKEX website. Look at the bid and ask prices, trading volume, and recent price changes. These numbers help you understand the market and decide when to buy or sell. Many platforms also show charts and historical hkex stock price trends. Use these tools to spot patterns and plan your trades. Reliable hkex stock price data is key for smart trading and helps you avoid costly mistakes.

How to Invest in Stocks on HKEX

Image Source: pexels

Investing in Hong Kong Stocks

You can invest in stocks on the Hong Kong Stock Exchange by choosing between two main market segments: the Main Board and the Growth Enterprise Market (GEM). The Main Board lists large, established companies. These companies have strict listing requirements and usually carry lower risk. GEM focuses on smaller, high-growth companies. These stocks often have higher risk and less strict requirements.

Here is a table to help you compare the two segments:

| Market Segment | Number of Companies | Market Cap (USD Billion) | Average P/E Ratio | Risk Level |

|---|---|---|---|---|

| Main Board | 2,300+ | 3,990 | 10.90 | Lower |

| GEM | 322 | 5.75 | 20.60 | Higher |

You should understand the difference between buying individual stocks and exchange-traded funds (ETFs). When you buy a single stock, you own a piece of one company. This can bring higher rewards, but it also means higher risk if the company does not perform well. ETFs let you invest in a basket of stocks. This spreads your risk across many companies and helps you avoid big losses from one bad stock.

Tip: If you are new to investing in hong kong stocks, start with companies on the Main Board or consider ETFs for lower risk.

You need to pay attention to trading basics. The minimum trading unit is called a “lot.” For example, you may need to buy 500 shares at once. This can raise the entry cost, so check the lot size before you invest in stocks. You also pay fees like stamp duty (0.1%), trading fees, and settlement fees. Always review these costs before making an investment.

You can use different strategies when investing in hong kong stocks. Value investing means you look for stocks that seem cheap compared to their earnings or assets. Growth investing focuses on companies that are growing fast, even if their stock price looks high. Some investors use technical analysis, which means you study price charts and patterns to make trading decisions.

ETFs and Stock Connect

ETFs offer a simple way to invest in hong kong stocks. You buy one ETF, and you get exposure to many companies at once. This helps you diversify your investment and lower your risk. Many ETFs track the Hang Seng Index or other major indexes. You can buy and sell ETFs during regular trading hours, just like regular stocks.

The Stock Connect program gives you even more choices. This program links the Hong Kong Stock Exchange with stock markets in China. You can now invest in stocks from both markets using your HKEX account. Stock Connect has grown in popularity because it makes cross-border trading easier and safer. The HKEX Synapse settlement platform has improved the process by reducing settlement risk and making trades faster.

Since Stock Connect started, more stocks and ETFs have become available. You can now trade in both Hong Kong dollars and Chinese renminbi. The program also provides detailed historical market data. This data helps you see which stocks attract foreign investors. Research shows that stocks favored by northbound investors (those buying from Hong Kong into China) often perform better. You can use this information to make smarter trading decisions.

Note: Stock Connect helps narrow the price gap between Hong Kong and China stocks. It also gives you more information to guide your investment.

Building a Portfolio

Building a strong portfolio is key to successful investing in hong kong stocks. You should not put all your money into one stock. Instead, spread your investment across different sectors and companies. This is called diversification. Diversification helps protect you if one stock or sector performs poorly.

You can use several strategies to build your portfolio. Academic studies show that advanced methods, like combining historical returns, technical indicators, and news sentiment, can improve your results. These methods help you pick the most efficient stocks for your goals. You can also use market-neutral strategies. These involve buying some stocks and selling others short. This approach can lower your risk during market downturns and provide steady gains.

Here are some proven strategies for building a portfolio on HKEX:

- Mix stocks from different sectors, such as finance, technology, and consumer goods.

- Add ETFs to your portfolio for instant diversification.

- Use market-neutral strategies to manage risk, especially during bear markets.

- Adjust your holdings based on your risk tolerance and investment goals.

- Review your portfolio regularly and rebalance if needed.

Tip: Even if you use advanced strategies, always keep your portfolio simple and easy to manage. Start small and grow your investment as you gain experience.

You should always focus on risk management. Set clear goals for your investment. Use stop-loss orders to limit your losses. Stay informed by following market news and trends. By following these steps, you can build a resilient portfolio and succeed in investing in hong kong stocks.

Stock Selection Strategies

Research and Analysis

You need to research each company or sector before making an investment. Start by checking company fundamentals, such as earnings, revenue, and debt levels. Use reliable news sources and financial data to stay updated. Many investors use technical indicators like EMA100 and EMA200 to spot trends in trading. You can also use sentiment analysis tools that review news articles and social media posts. These tools help you understand how other investors feel about a stock.

Here is a table of common tools and datasets for researching HKEX-listed companies:

| Category | Tools / Datasets Used |

|---|---|

| Technical Indicators | EMA200, EMA100 |

| Financial Data | Five years of daily stock price data from HKEX |

| Sentiment Analysis | Loughran–McDonald Dictionary, BERT, Twitter, Stocktwits |

| News Data | FINET news articles, CREDBANK-trained classifier |

| Portfolio Methods | Modern Portfolio Theory, Black-Litterman model |

You can combine these resources to make better trading decisions and improve your investment results.

Setting Goals

You should set clear goals before you start investing. Decide if you want short-term gains or long-term growth. Many investors use benchmarks and metrics to track their progress. For example:

- Compare ESG (Environmental, Social, Governance) scores of companies using HKEX’s ESG metrics display service.

- Set carbon emission baselines and reduction targets if you care about sustainable investment.

- Use portfolio custom scoring and screening to match your investment with your values.

- Review ESG ratings from providers like MSCI and S&P Global to compare companies.

These steps help you measure your investment performance and keep your trading aligned with your goals.

Avoiding Common Pitfalls

You can avoid many mistakes by learning from past case studies and trends. Some investors fail because they do not diversify their portfolio. Others let emotions drive their trading, which often leads to losses. Insufficient research is another common problem.

- A study showed that using technical indicators like EMA and RSI can improve trading results, but not all sectors perform the same.

- Contrarian strategies on HKEX work better for cross-listed stocks, with returns up to 8.01% per month, but only 1.83% for HKEX-only stocks.

- High transaction costs and complex signals can reduce profits.

- Adjusting for risk factors can make some strategies less effective.

Tip: Always diversify your investment, use data-driven strategies, and avoid emotional trading. Review your results often and adjust your approach as needed.

Tips for First-Time Investors

Risk Management

You need to protect your investments from unexpected losses. Good risk management helps you stay in the market longer and avoid big mistakes. HKEX uses several strong methods to keep the market safe. Here are some important strategies you can use:

- Margining: You must deposit collateral, called margin, before you start trading. This acts as a safety net if your trades lose value.

- Default Management: If a trader cannot pay, HKEX uses a system that covers losses with the trader’s own money first, then with funds from other members, and finally with the clearing house’s capital. This keeps the market stable.

- Contingency Planning: HKEX has backup systems and disaster recovery plans. These help the market keep running during problems or emergencies.

- Collateral Management: The clearing house checks the quality and amount of collateral. It uses rules to make sure there is enough to cover possible losses.

- Data-Driven Tools: HKEX uses real-time monitoring and analytics to spot risks early and act quickly.

Tip: Always use stop-loss orders and set clear limits for each trade. Review your portfolio often and adjust your strategy if the market changes.

Continuing Education

Learning never stops in trading. The more you know, the better your decisions will be. Many successful investors use different resources to improve their skills:

- Online courses from sites like Udemy and Coursera teach you about trading strategies and market analysis.

- Financial blogs and websites give you daily updates and expert opinions.

- Forums and online communities let you share ideas and learn from others.

- Webinars and podcasts offer new insights and real-life stories from experienced traders.

- Mentorship programs connect you with experts who can guide you.

- Trading simulators let you practice without risking real money.

Research shows that people who keep learning about trading join the market more often and feel more confident. In Japan, young adults who took part in financial education programs became more active investors over time. You can use trading simulators and tools like the HKEX Options Trading Platform to practice and test your strategies before using real money.

Note: Choose a reliable brokerage platform with low fees and good trading tools. Stay updated with market news and use calculators to check your trades.

You can start investing in HKEX stocks by preparing well and learning the basics. Use both fundamental and technical analysis to choose stocks. Diversify your portfolio to manage risk and avoid putting all your money in one place. Start with small amounts and review your progress often. The table below shows common strategies and their benefits:

| Strategy | Benefit |

|---|---|

| Diversification | Lowers risk |

| Fundamental Analysis | Finds undervalued stocks |

| Technical Analysis | Spots trends and opportunities |

Stay patient, keep learning, and seek advice from professionals. Smart investing in Hong Kong stocks can help you build wealth over time.

FAQ

How much money do you need to start investing in HKEX stocks?

You can start with as little as USD 10, depending on your broker and the stock price. Some brokers, like moomoo or Interactive Brokers, have no minimum deposit. Always check the latest exchange rate for accurate conversions.

Can you buy HKEX stocks if you live outside Hong Kong?

Yes, you can. Many international brokers and Hong Kong banks, such as HSBC and Standard Chartered, let you open accounts and trade HKEX stocks from other countries. You only need to provide the required documents for verification.

What is the minimum lot size for HKEX stocks?

Most HKEX stocks trade in lots. The minimum lot size varies by stock. For example, one lot may be 500 shares. Always check the lot size before you place an order.

Do you pay taxes when trading HKEX stocks?

You pay a stamp duty of 0.13% on each stock trade. Other fees include a transaction levy and a trading fee. Your home country may also tax your gains. Check with a tax advisor for details.

Starting your investment journey on the Hong Kong Stock Exchange (HKEX) is exciting, but high fees, currency conversion costs, and complex platforms can be daunting for beginners. BiyaPay makes it easier with an intuitive platform for trading HKEX stocks, U.S. stocks, and cryptocurrencies, all in one account. Benefit from real-time USDT-to-USD/HKD conversions and low remittance fees starting at 0.5%, keeping your costs down.

BiyaPay is registered with U.S. and Canadian financial regulators and compliant as a U.S. registered investment advisor, ensuring your funds are secure. Open an account in minutes to trade confidently and diversify your portfolio. Join BiyaPay today to start investing! Sign up now to grow your wealth in 2025!

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.