- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Best Brokers for Beginners and How to Pick the Right One

Image Source: unsplash

If you want to start your investing journey, you might wonder which online brokers are the best for beginner investors. Charles Schwab, Fidelity, Robinhood, and SoFi Active Investing stand out as the best brokers for beginners. These investment broker options attract millions, with Fidelity leading at 51.5 million active brokerage accounts and Schwab close behind. Beginner investors care about more than just numbers. You want a reputable stockbroker with low fees, easy-to-use platforms, strong educational resources, and helpful customer support. Many top online brokers now offer $0 minimum deposits, making opening a brokerage account simple. The best brokers for beginners also give you access to a range of investment options, so you can find what fits you best. With the right stockbroker, you can open a brokerage account and feel confident as you join other beginner investors exploring the world of online brokers and brokerage firms.

Key Takeaways

- Choose a broker with low fees and no minimum deposit to start investing easily and affordably.

- Pick a platform that feels simple and clear to use, so you can trade confidently and learn quickly.

- Look for brokers with strong customer support to get fast help when you have questions or problems.

- Use brokers that offer good educational resources to build your investing knowledge and skills.

- Always check that your broker is regulated by trusted agencies to keep your money safe.

Quick Comparison of Best Brokers for Beginners

Image Source: unsplash

Choosing the right online brokers can feel overwhelming, but a side-by-side look makes it easier. Here’s a quick table to help you compare the best brokers for beginners:

| Broker | Fees & Commissions | Minimum Deposit | Platform Usability | Customer Support | Educational Resources |

|---|---|---|---|---|---|

| Charles Schwab | $0 trading fees, $0 commissions | $0 | Desktop & mobile, some jargon | Phone, chat, email | Videos, articles, webinars |

| Fidelity | $0 trading fees, $0 commissions | $0 | Top-rated, easy to use | Phone, chat, email | Strong, interactive tools |

| Robinhood | $0 trading fees, $0 commissions | $0 | Simple app, very easy | Email, in-app | Basic, limited |

| SoFi Active Investing | $0 trading fees, $0 commissions | $0 | Clean app, beginner-friendly | Fast phone, chat, email | Good for new investors |

Fees and Minimums

You want low-cost trading and no surprises. All four online brokers offer $0 commissions and $0 minimum deposit for a standard brokerage account. This means you can start investing with any amount. Schwab and Fidelity also have no maintenance or brokerage fees for most account types. Robinhood and SoFi Active Investing keep things simple with no trading fees. If you want the lowest barrier to entry, these brokers make it easy.

Tip: Always check for specialty trading fees or broker-assisted trade charges, which can be higher.

Platform Usability

Fidelity stands out for its easy-to-use trading platform. Many users say it feels simple and clear, even if you are new. Robinhood’s app is the most basic and friendly for beginners. SoFi Active Investing also gets high marks for a clean design. Charles Schwab offers a strong platform, but some beginners find the language and layout a bit tricky at first. Most people use desktop or laptop for research and mobile apps for checking their portfolio.

- Fidelity ranks in the 93rd percentile for usability.

- Robinhood and SoFi Active Investing both focus on making things easy for you.

- Schwab’s platform has more features, but you might need time to learn.

Customer Support

Good customer support matters when you open your first brokerage account. SoFi Active Investing shines here, with fast response times and clear answers. You can reach them by phone, chat, or email, and they rank third out of 13 for overall support. Schwab and Fidelity also offer strong support with multiple ways to get help. Robinhood has email and in-app support, but some users wish for faster replies.

| Broker | Average Connection Time | Net Promoter Score (out of 10) | Overall Score (out of 10) |

|---|---|---|---|

| SoFi Invest | Under 1 minute | 8.4 | 8.63 |

| Fidelity | Under 2 minutes | 8.2 | 8.40 |

| Schwab | Under 2 minutes | 8.1 | 8.35 |

| Robinhood | 2-3 minutes | 7.5 | 7.90 |

Educational Resources

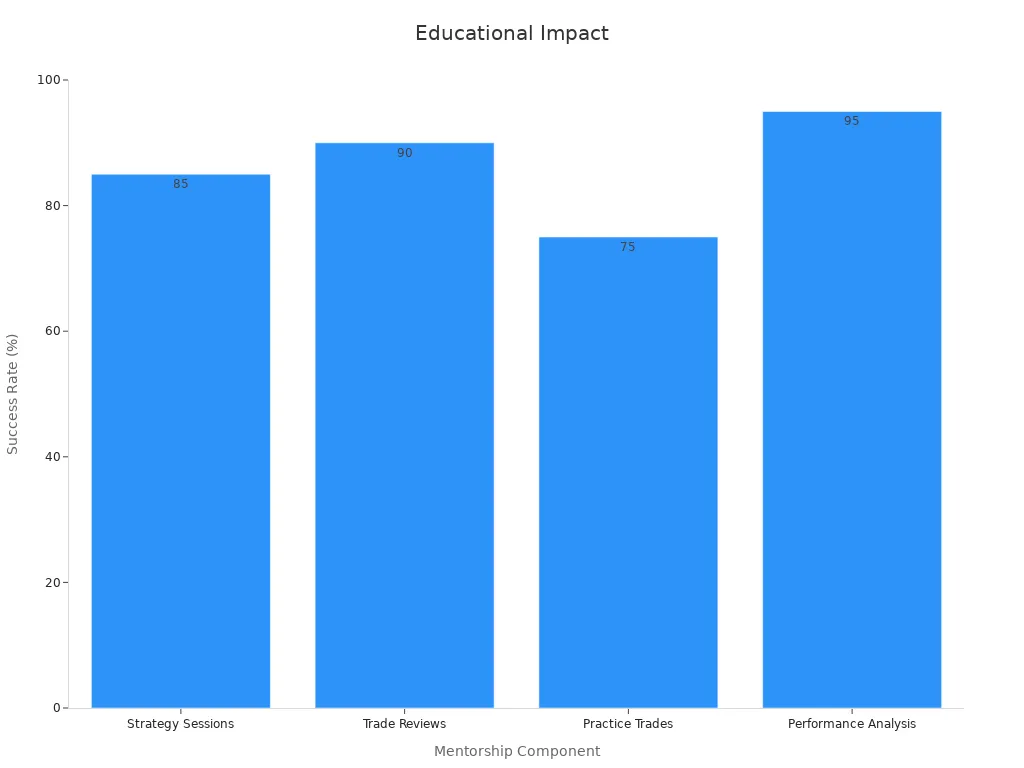

Educational resources help you learn and grow as an investor. Fidelity and Charles Schwab both offer a wide range of educational materials, including videos, articles, and webinars. SoFi Active Investing gives you beginner-friendly guides and tips. Robinhood has some basic education, but not as much depth. Studies show that using structured educational resources, like mentorship and practice trades, can boost your success rate as a beginner.

- Practice tools, trade reviews, and community support help you build confidence.

- Regular use of educational resources leads to better trading habits and higher success.

Note: The best brokers for beginners combine low fees, easy-to-use trading platforms, strong customer support, and rich educational resources. Match your needs to the broker’s strengths to get the most from your brokerage account.

How Beginner Investors Should Choose a Broker

Image Source: pexels

Choosing the right investment broker can feel like a big step. You want to make sure you start strong. Let’s walk through the steps that help beginner investors find the best fit.

Define Your Goals

Start by asking yourself what you want from investing. Do you want to save for retirement, build wealth, or learn how the market works? Your goals shape your choices. Some beginner investors want to trade stocks often. Others want to invest for the long term. If you know your goals, you can pick a stockbroker that matches your style. For example, if you want low-cost trading, look for a broker with no commissions and no hidden fees. If you want to learn, focus on brokers with strong educational resources and advice.

Tip: Write down your goals. This helps you stay focused and avoid emotional decisions.

Check Regulation and Safety

You need to feel safe with your money. Always choose a reputable online stock broker that follows strict rules. Look for brokers registered with FINRA and the SEC. These groups make sure brokers follow the law and protect your money. Investor protection matters. If a broker is not regulated, your money could be at risk. Most top brokers also have insurance to cover your account if something goes wrong.

Note: Never skip this step. Regulation keeps your investments safe.

Compare Fees and Commissions

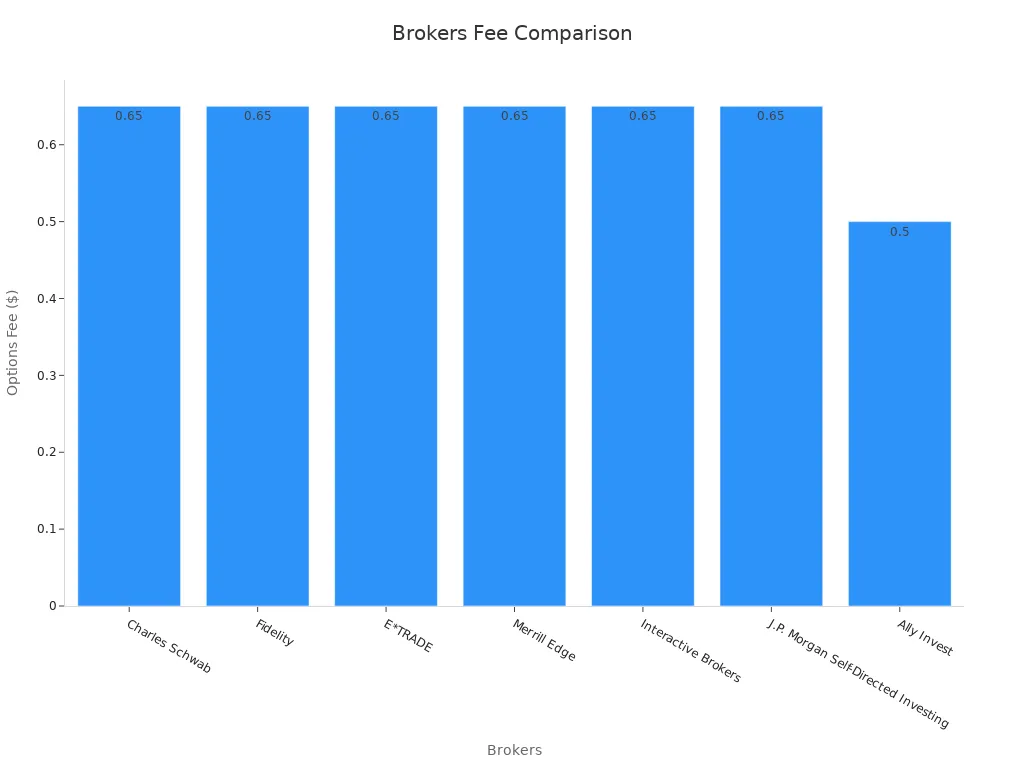

Fees can eat into your returns. Beginner investors should always check the costs before opening an account. Many brokers now offer $0 commissions for stock trades. But some charge for options or special services. Here’s a table to help you compare fees:

| Broker | Minimum Deposit | Stock Trade Commission | Options Trade Commission (per contract) |

|---|---|---|---|

| Charles Schwab | $0 | $0 | $0.65 |

| Fidelity | $0 | $0 | $0.65 |

| E*TRADE | $0 | $0 | $0.65 |

| Merrill Edge | $0 | $0 | $0.65 |

| Interactive Brokers | $0 | $0 | $0.65 |

| J.P. Morgan Self-Directed Investing | $0 | $0 | $0.65 |

| Ally Invest | $0 | $0 | $0.50 |

You see that most brokers offer low-cost trading for stocks. Options trades usually cost $0.65 per contract, except for Ally Invest, which is a bit cheaper. Always read the fine print. Some brokers charge for broker-assisted trades or special account features.

Evaluate Platform and Educational Resources

A good trading platform should feel easy to use. Beginner investors need a platform that is simple and clear. Try out the broker’s website or app before you decide. Look for features like easy navigation, clear charts, and quick trade execution. You want to feel comfortable every time you log in.

Educational resources are just as important. The best brokers offer videos, articles, webinars, and even interactive tools. These educational materials help you learn about stocks, funds, and other investments. Some brokers also offer practice accounts, so you can try trading without risking real money. If you use educational resources often, you will build better habits and make smarter choices.

Advice: Pick a broker with strong educational resources. This will help you grow as an investor.

Assess Customer Support

When you have questions, you want answers fast. Good customer support makes a big difference for beginner investors. Look for brokers with phone, chat, and email support. Some even offer help in their app. You should check how quickly they respond and how helpful they are.

Customer support quality is measured by things like Customer Satisfaction Score (CSAT), Net Promoter Score (NPS), and First Contact Resolution (FCR). High scores mean customers are happy and get their problems solved quickly. A broker with strong support will help you feel confident, especially when you are new.

Advice: Test customer support before you open an account. Ask a question and see how they respond.

Review Investment Options

Beginner investors should look for a broker with a wide range of investment options. You might want to start with stocks or ETFs. Some brokers also offer mutual funds, bonds, and options. Having more choices lets you build a portfolio that fits your goals.

Studies show that options trading is becoming more popular, even for beginners. Research shows that strategies like covered calls and buy-write can help control risk and boost returns. Evidence-based investing, which uses research and data, helps you avoid emotional decisions. This approach focuses on low-cost, diversified portfolios and long-term growth.

| Study/Report | Type of Evidence | Key Findings Relevant to Beginners |

|---|---|---|

| 2020 Options Clearing Corporation Study | Statistical survey and market data | Shows growing demand and effectiveness of options trading, including among retail investors, indicating accessibility and potential benefits for beginners. |

| Academic Research on Options-Based Strategies (2003-2013) | Academic empirical study | Demonstrates that covered call and other options strategies can outperform long stock holdings on risk-adjusted basis, offering risk control and enhanced returns suitable for beginners. |

| Buy-Write Strategy Study (1996-2006) | Long-term performance data | Shows that passive buy-write strategies consistently outperform the index on a risk-adjusted basis, supporting effectiveness of options strategies for stable returns. |

Advice: Choose a stockbroker that offers the investment options you want. Make sure they provide tools for investment research and education.

You have many choices as a beginner investor. Focus on your goals, safety, costs, platform, educational resources, customer support, and investment options. Match the broker’s strengths to your needs. This way, you will find the right investment broker for your journey.

Best Brokers for Beginners Reviewed

Charles Schwab

Charles Schwab works well for beginner investors who want a trusted name and lots of support. You get zero commissions on stocks and ETFs, so you can start investing without worrying about high costs. Schwab’s platform gives you access to the Schwab Starter Kit™, which helps you learn by giving you $50 to invest in top S&P 500 stocks. You can also buy fractional shares for as little as $5, making it easy to start small. Schwab’s educational resources cover everything from basic investing to more advanced topics. The company has won awards for customer service and offers 24/7 support. Schwab’s Accountability Guarantee means you can get a refund on certain advisory fees if you are not happy. This focus on customer satisfaction and beginner-friendly tools makes Schwab a top choice.

Fidelity

Fidelity stands out for its strong educational resources and easy-to-use platform. It is a favorite among beginner investors who want to learn and grow. Fidelity offers zero-commission trading for stocks and ETFs, so you keep more of your money. The platform includes tools like the Young Investor Toolkit and financial literacy apps, which help you build good habits. Fidelity’s customer service gets high marks, and you can reach them by phone or email. The company manages over $9 trillion in assets, showing its strength and trustworthiness. Many surveys rank Fidelity at the top for customer satisfaction and beginner support. If you want a broker that helps you learn and gives you lots of investment choices, Fidelity is a great pick.

Robinhood

Robinhood is popular with young and new investors who want a simple app and fast access to the market. You can start with no minimum deposit and enjoy zero-commission trading on stocks and ETFs. The app is easy to use, so you can buy and sell with just a few taps. Robinhood connects well with social media, which helps you stay up to date with trends. However, the platform offers fewer educational resources and less customer support than some other brokers. Some users find it hard to get help quickly. Robinhood works best if you want a basic, no-frills experience and want to start investing right away.

SoFi Active Investing

SoFi Active Investing is a good fit for beginner investors who want a clean, easy-to-use platform and lots of support. You can open an account with no minimum and start investing with as little as $1. SoFi offers zero commissions on stocks, ETFs, and fractional shares. The platform includes educational guides and access to financial planners if you join SoFi Plus. You can also invest in IPOs and use a robo-advisor for automated portfolios. SoFi’s app scores high in user ratings, and the company has an A+ rating from the Better Business Bureau. While SoFi does not have advanced charting tools, it gives you everything you need to start building your portfolio with confidence.

Tip: Many discount brokers now offer zero-commission trading, so you can focus on learning and growing your investments without worrying about high fees.

When you pick your first broker, keep it simple. Start by knowing what you want from investing. Check if the broker is registered with the SEC or FINRA. Look at fees, account minimums, and how easy the platform feels. Use this checklist:

- Decide if you want a full-service or discount broker.

- Compare all costs and fees.

- Match the broker to your investing style.

- Check for strong support and learning tools.

Choose the broker that fits you best. Take your first step and start investing with confidence!

FAQ

What is the safest way to choose a broker?

You should always check if the broker has registration with FINRA or the SEC. These groups protect your money. Look for clear contact information and strong customer reviews. If you feel unsure, ask questions before you open an account.

Do I need a lot of money to start investing?

No, you do not. Many brokers let you start with as little as $1 USD. You can buy fractional shares and build your portfolio over time. This makes investing easy for everyone.

Can I switch brokers later if I change my mind?

Yes, you can move your account to another broker. Most brokers help you transfer your investments. Some may charge a small fee, usually around $50 USD. Always check the details before you start the transfer.

How do I get help if I have a problem with my broker?

You can contact customer support by phone, chat, or email. Good brokers answer quickly and solve problems fast. If you do not get help, you can file a complaint with FINRA or the SEC.

Launch your investing journey confidently with BiyaPay! Our multi-asset wallet complements top beginner-friendly brokers by offering fee-free USDT conversions to USD and other fiat currencies, with just a 0.5% fee for overseas bank transfers to fund your brokerage account. Register in 1 minute to bypass complex overseas setups, enabling seamless US/HK stock trading for new investors. BiyaPay’s intuitive platform ensures low-cost, reliable access to markets, empowering you to start small and learn fast. Join now—visit BiyaPay to simplify your first steps in investing!

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.