- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Growth Stocks vs Value Stocks Key Differences for Investors

Image Source: pexels

Growth stocks and value stocks present different opportunities for investors in 2025. Growth stocks often show high price-to-earnings ratios, with some trading at nearly 30 times forward earnings, while value stocks trade closer to 10 times. Recent market shifts show value stocks outperforming as rising bond yields and trade tensions impact growth stocks. Many investors notice that value stocks, especially in financial and industrial sectors, gain ground when protectionist policies increase. Investing in either style requires careful attention to market trends, risk, and personal goals. Choosing the right mix matters for anyone seeking strong returns from stocks for 2025.

Key Takeaways

- Growth stocks show fast earnings growth and trade at high prices, offering big rewards but with higher risk and price swings.

- Value stocks trade below their true worth, often pay dividends, and provide more stable returns, especially during market uncertainty.

- In 2025, technology and healthcare lead growth stocks, while financials and industrials drive value stocks, reflecting different sector strengths.

- Combining growth and value stocks in a portfolio helps balance risk and reward, smoothing returns during market ups and downs.

- Investors should match stock choices to their goals, risk tolerance, and market trends, using diversification or professional advice to manage risk.

Growth Stocks

Definition

Growth stocks represent companies that expand faster than the average business in the market. These companies often show high price-to-earnings ratios because investors expect strong future earnings potential. Growth stocks usually do not pay dividends. Instead, they reinvest profits to support new products, technology, or market expansion. Many investors look for these stocks for 2025 because they want to benefit from rapid company growth.

A common way to identify growth stocks is by using financial models. For example, the Martin Zweig Growth Investor model checks for accelerating earnings, reasonable valuations, and low debt. This model gave Charles Schwab Corp a 77% rating, passing tests like P/E ratio, revenue growth, and insider transactions. Most growth stocks pass similar tests, even if some criteria like long-term earnings persistence do not always meet the mark.

Key Traits

Growth stocks share several important features:

- Rapid sales and earnings growth compared to other companies.

- High price-to-earnings ratios, reflecting investor confidence in future growth.

- Reinvestment of profits instead of paying dividends.

- Strong focus on innovation, such as new technology or unique products.

- Competitive advantages like patents, brand loyalty, or large customer bases.

- Access to capital for research, development, and expansion.

| Key Trait / Metric | Description |

|---|---|

| High Revenue Growth Rates | Shows fast sales expansion and market acceptance. |

| Market Share Expansion | Indicates a growing customer base and sector strength. |

| Customer Acquisition & Retention | Highlights loyal and expanding customers. |

| Profitability and Margins | Improving margins suggest efficient operations. |

| Innovation & Technological Advancements | Drives market disruption and keeps companies ahead. |

| Scalability of Business Model | Allows growth without large cost increases. |

| Access to Capital | Supports expansion and research. |

Growth Stocks for 2025

In 2025, growth stocks continue to attract attention. Technology companies lead the way, especially those in artificial intelligence, cloud computing, and software. Healthcare and biotech firms also show strong growth due to medical innovation. Renewable energy and fintech companies benefit from new regulations and digital trends.

Recent data highlights several top growth stocks for 2025:

| Company | Sector | Revenue Growth (2024) | Net Income / Profit (2024) | Q1 2025 Growth Metrics |

|---|---|---|---|---|

| e.l.f. Beauty | Cosmetics & Personal Care | +77% net sales | $127.7 million | Gross margin > 70% |

| MercadoLibre | E-commerce & Fintech | +38% net revenue | $1.91 billion (nearly doubled) | Q1 2025 revenue +37%, net profit +44% |

| Nvidia Corp. | Semiconductors (AI & Graphics) | +126% revenue | GAAP net income +586% | N/A |

These companies show strong earnings and sales growth, making them popular choices for investors seeking stocks for 2025. Investors should remember that growth stocks can be volatile, but they offer high rewards for those who believe in their future earnings potential.

Value Stocks

Definition

Value stocks are shares of companies that appear underpriced based on fundamental analysis. Investors often find these stocks trading at low price-to-earnings or price-to-book ratios. The philosophy behind value stocks comes from Benjamin Graham and David Dodd, who believed in buying stocks at a discount to their true worth. Modern value investing uses systematic methods, such as financial strength checklists and composite quality scores, to select the best candidates. Analysts use a 10-point checklist to measure profitability, stability, and recent improvements. They screen a large universe of companies, select the cheapest by valuation, and then focus on those with the highest quality scores.

Value stocks are officially defined as securities that trade below their intrinsic value, offering a margin of safety for investors.

Key Traits

Value stocks share several important characteristics:

- Low price-to-earnings (P/E) and price-to-book (P/B) ratios

- High book-to-market ratios

- High earnings yield

- Often pay dividends

- Less concentration in a few companies, which reduces risk

- Exposure to macroeconomic factors like inflation and credit spreads

- More scalable and less affected by trading costs

| Evidence Aspect | Numerical Data / Description |

|---|---|

| Valuation Gap Between Growth & Value | Value stocks in the S&P 500 would need to rise over 40% to reach long-term median valuation levels. |

| Russell 1000 Value Index Constituents | 869 companies, more than double the Russell 1000 Growth Index constituents. |

| Index Concentration | Top 3 stocks represent 8% of Value Index vs. 34% of Growth Index, indicating less concentration in value. |

Value stocks often show resilience during periods of market stress. They tend to have higher domestic revenue, making them less sensitive to global trade issues.

Value Stocks for 2025

In 2025, value stocks have shown strong performance. U.S. large cap value stocks have gained 2% year-to-date, while growth stocks have declined by 10%. The market has shifted from momentum-led rallies to value-driven gains. European stocks, which share many traits with value stocks, trade at lower P/E ratios than U.S. stocks, suggesting more room for growth. Fiscal stimulus in Europe, such as Germany’s $546 billion USD infrastructure fund, supports cyclical and value sectors. Healthcare, a defensive sector within value, benefits from trends like aging populations and new drug innovations. Value stocks generate about 70% of their revenue domestically, which helps them weather trade policy changes. Many investors consider value stocks a key part of diversified portfolios of stocks for 2025.

Value vs Growth Stocks

Image Source: pexels

Valuation

Valuation is a key difference in the value vs growth stocks debate. Growth stocks in 2025 trade at much higher price-to-earnings (P/E) and price-to-book (P/B) ratios than value stocks. Investors pay a premium for growth stocks because they expect these companies to increase earnings and sales quickly. Value stocks, on the other hand, have lower P/E and P/B ratios. This suggests that the market may undervalue them or that they have more stable earnings.

| Metric | Growth Stocks (2025) | Value Stocks (2025) | Small-Cap Stocks (Value or Growth) |

|---|---|---|---|

| Price-to-Earnings (P/E) Ratio | Significantly above historical norms; premium multiples reflecting growth expectations | Elevated above long-term averages but lower than growth stocks; relatively more attractive | Trade at more reasonable multiples relative to historical averages and large-cap peers |

| Price-to-Book (P/B) Ratio | Higher P/B ratios; valuation gap with value stocks has expanded significantly | Lower P/B ratios indicating potential undervaluation | Relatively inexpensive on forward P/E and P/B bases compared to large caps |

| Price-to-Sales (P/S) Ratio | Higher multiples reflecting expected faster revenue growth | Lower multiples compared to growth stocks | N/A |

| Price-to-Free Cash Flow Ratio | Higher multiples due to growth expectations | Lower multiples | N/A |

| Price/Earnings to Growth (P/EG) Ratio | Often above 1, indicating premium pricing relative to growth | P/EG below 1 suggests undervaluation relative to growth potential | N/A |

Growth stocks often have a P/E ratio well above 30, while value stocks may trade closer to 10. The price/earnings to growth (P/EG) ratio also shows this gap. Growth stocks usually have a P/EG above 1, while value stocks often fall below 1. This means value stocks may offer more earnings for each dollar invested. Investors use these ratios to compare value vs growth stocks and decide which fits their strategy.

Risk and Volatility

Risk and volatility are important when comparing value vs growth stocks. Growth stocks tend to be more volatile. Their prices can swing up and down quickly because investors react to news about future earnings. Value stocks usually have less price movement. They often pay dividends, which can help reduce risk.

Investors use several indicators to measure risk:

- Beta: Shows how much a stock moves compared to the market. Growth stocks often have a higher beta, meaning they move more than the market average.

- Standard Deviation: Measures how much a stock’s price changes over time. Growth stocks have a higher standard deviation, showing more price swings.

- Sharpe Ratio: Compares return to risk. A higher Sharpe ratio means better risk-adjusted returns.

- Alpha: Measures how much a stock outperforms the market. Both growth and value stocks can have high alpha, but growth stocks often show more extreme results.

Other tools like the Volatility Index (VIX) and technical indicators help investors track market risk. Value stocks often provide more stable returns, while growth stocks can offer higher rewards but with greater risk. Many investors balance both types in their portfolios to manage risk.

Sector Trends

Sector trends play a big role in the value vs growth stocks discussion. Growth stocks are often found in technology and consumer discretionary sectors. These companies focus on innovation and rapid expansion. In 2025, technology firms, especially those in artificial intelligence and cloud computing, lead the growth stock group.

Value stocks are more common in financials, healthcare, industrials, and energy. These sectors often benefit from economic recovery and stable demand. For example, trucking and RV companies like Winnebago have rebounded as the economy stabilizes. Restaurant chains such as Cracker Barrel have improved profits through better management and pricing.

Recent market shifts show a rotation from growth stocks to value stocks. In early 2025, investors moved away from high-flying technology names and focused on companies with strong earnings and cash flow. Defensive sectors like healthcare and consumer staples outperformed during uncertain times. This shift highlights the importance of sector trends when investing in value vs growth stocks.

Performance Cycles

Performance cycles show how value vs growth stocks behave in different market conditions. Over the past 15 years, growth stocks outperformed value stocks, especially when interest rates stayed low. Growth stocks had annual earnings growth of about 10.5%, while value stocks grew at 3.42%. However, when interest rates rose in 2022, growth stocks fell nearly 30%, while value stocks dropped only 8.5%.

Market transitions often bring changes in leadership. During bull markets and periods of falling interest rates, growth stocks tend to lead. In bear markets or early recovery phases, value stocks often outperform. For example, in 2022, value stocks broke a long-term downward trend and began to outperform as interest rates climbed. Data from Bloomberg shows that in some weeks, value stocks gained over 2% while growth stocks lost ground, marking one of the largest performance gaps since 2000.

These cycles show that value vs growth stocks do not always move together. Investors who understand these patterns can adjust their strategies to take advantage of changing market conditions. Combining both styles in a portfolio can help smooth returns over time and reduce the impact of market swings.

Recent Performance

Image Source: pexels

Historical Trends

Stock market history shows cycles of growth and decline. The S&P 500 index has delivered an average annual return of about 10.33% since 1957. After adjusting for inflation, the real return stands at 6.47%. Investors saw steady growth during the postwar boom, but periods like the stagflation of the 1970s and the financial crisis of 2007–2009 brought sharp declines. For example, the market dropped nearly 57% during the financial crisis, but then rose 330% over the next decade. These cycles highlight the importance of patience and long-term investing.

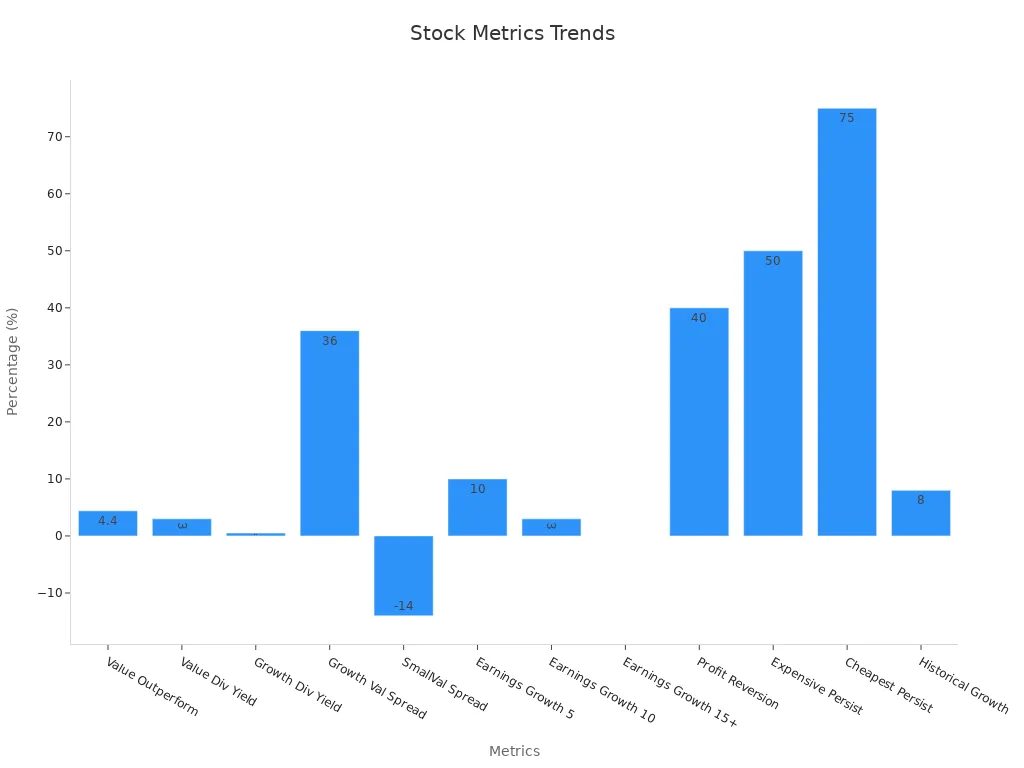

Growth and value stocks have also shown unique patterns. Value stocks have outperformed growth stocks by about 4.4% per year since 1927. However, only a small number of companies can maintain high earnings growth for many years. Most growth stocks do not keep their fast pace for long. Dividend yields also differ, with value stocks yielding around 3% and growth stocks about 0.5%. The table below summarizes key long-term trends:

| Aspect | Data |

|---|---|

| Value stocks average annual outperformance (since 1927) | 4.4% |

| Dividend yield (value vs. growth) | 3% vs. 0.5% |

| Years when value outperformed growth | Nearly 15% premium |

| Earnings growth rarity (10+ years) | Only 3% of companies |

2025 Market Shifts

In 2025, the stock market experienced sharp swings. The S&P 500 posted strong returns in 2023 and 2024, with gains of 26.06% and 24.88%. However, early 2025 brought new challenges. Trade policy changes led to increased volatility. From mid-February to early April, the MSCI US Broad Market Index dropped 17.98%. Technology stocks led a rebound, but small-cap stocks lagged behind.

A major shift occurred between value and growth stocks. In the first quarter, value stocks outperformed growth stocks by 11.64%. Over the 12 months ending April 2025, growth stocks returned 7.18%, while value stocks returned 6.66%. The gap between the two styles narrowed compared to the previous year. These changes show how market leadership can rotate quickly. Investors who focus on long-term investing and diversification can better manage these swings.

International markets also faced turbulence. The MSCI ACWI IMI index fell 15.76% during the same period. Policy uncertainty and economic concerns affected both U.S. and global stocks. These events remind investors that investing always involves risk, but a long-term approach can help smooth out the ups and downs.

Pros and Cons

Growth Stocks

Growth stocks offer investors the chance to benefit from rapid company expansion and innovation. Many investors choose growth stocks for their high potential returns, especially during economic booms. These stocks often belong to sectors like technology or biotechnology, where companies can grow quickly. Growth stocks usually reinvest profits, which can lead to compounding returns over time. Investors also find that growth stocks bring portfolio diversification, especially when combined with value stocks or dividend-paying stocks.

Growth stocks attract attention because they often lead market rallies and offer higher liquidity.

However, growth stocks come with higher risk and volatility. Their prices can swing sharply due to market sentiment or changes in earnings expectations. Growth stocks rarely pay dividends, so investors rely on price appreciation for returns. High price-to-earnings ratios make it hard to judge if growth stocks are overvalued. During economic downturns, growth stocks often underperform safer assets. Investors must research carefully to avoid overhyped companies that may not deliver real growth.

| Feature | Growth Stocks |

|---|---|

| Price | Typically overvalued, trading above market average |

| Earnings | High earnings growth potential |

| Risk & Volatility | Higher volatility, higher risk |

| Dividends | Low or no dividends |

Value Stocks

Value stocks appeal to investors who seek stability and income. These stocks usually trade below their market value, with low price-to-earnings and price-to-book ratios. Value stocks often pay higher dividends, which can provide steady income. Many investors find value stocks less volatile, especially during bear markets or recessions. Diversification helps reduce company-specific risk, and holding a mix of value stocks from different sectors can lower overall portfolio risk.

A controlled study showed that value stocks do not always carry the high risk many expect. Investors can reduce unsystematic risk by holding 20 or more value stocks from different industries. Value stocks have outperformed growth stocks over long periods, partly due to dividends and stable earnings.

Value stocks offer a margin of safety, making them attractive during uncertain times.

Still, value stocks may lag behind growth stocks during strong bull markets. Sometimes, these stocks remain undervalued for long periods. Investors may need patience before seeing price appreciation. Value stocks also face systematic risk, such as inflation or economic downturns, which cannot be avoided through diversification.

Investor Suitability

Growth-Oriented Investors

Growth-oriented investors seek opportunities for high returns by focusing on growth stocks. They often look for companies with strong earnings growth, innovative products, and expanding markets. These investors accept higher risk and greater price swings in their portfolios. Many growth-oriented investors have a long investment horizon and a strong financial position. They feel comfortable with significant volatility because they believe in the long-term potential of growth stocks.

Quantitative research shows that growth-oriented investors fall into the aggressive or high risk tolerance category. They willingly accept high levels of risk for the chance of higher returns. Studies reveal that overconfident investors have the highest average investment risk tolerance scores, reaching 29.8, compared to 28.5 for those with steady confidence. This difference in risk tolerance links directly to their willingness to hold more growth stocks. Confidence levels also affect how much risk they take, with overconfidence leading to higher portfolio risk. Advisors use risk tolerance assessments to guide asset allocation, ensuring that growth stocks make up the right share of the portfolio.

Growth stocks attract investors who want to benefit from rapid company expansion. These investors often use systematic models to select stocks with strong earnings and sales growth. They monitor market trends and adjust their holdings as new opportunities arise. Growth-oriented investors understand that investing in growth stocks can lead to large gains, but also sharp losses during market downturns.

Growth-oriented investors thrive on innovation and future potential, making growth stocks a core part of their strategy.

Value-Oriented Investors

Value-oriented investors focus on value stocks that trade below their true worth. They look for companies with low price-to-earnings ratios, strong balance sheets, and steady dividends. Many value-oriented investors have experience in the stock market and a deep understanding of financial statements. They feel optimistic about the long-term potential of undervalued companies, even if short-term results seem disappointing.

Empirical data from recent surveys in China shows that value-oriented investors often have higher education levels and more experience in trading. Most are between 31 and 40 years old and show optimism about long-term investing. These investors willingly buy value stocks during market downturns, trusting that prices will recover over time. Research from Pzena Investment Management confirms that value stocks have outperformed other strategies since 1975. Value investing offers strong returns and risk levels that match other styles over long periods.

Value-oriented investors prefer a patient approach. They hold value stocks through market cycles, collecting dividends and waiting for prices to rise. Many avoid chasing trends, instead focusing on the fundamentals of each company. This approach helps them manage risk and build wealth steadily.

Value-oriented investors rely on discipline and patience, making value stocks a key part of their investing journey.

Strategies for Stocks for 2025

Pure Approaches

Pure investment approaches focus on a single style, such as only growth or only value stocks. Investors who use pure strategies often build concentrated portfolios. They may hold 50 to 100 stocks in one category. This method can lead to strong returns if the chosen style outperforms. For example, keeping value and momentum strategies separate has shown better risk management and higher returns than blending them. However, pure approaches can also bring more risk. If one sector or style falls, the whole portfolio may suffer.

| Statistic / Insight | Description |

|---|---|

| Portfolio Size Recommendation | Concentrated portfolios of 50-100 stocks per strategy capture benefits without diluting performance. Holding 200+ stocks reduces performance difference between separate and blended strategies. |

| Strategy Separation Advantage | Keeping Value and Momentum strategies separate (pure approaches) yields better returns and risk management than blending them into a single portfolio. |

| Historical Performance | Both Value and Momentum strategies have historically outperformed the market but experience rough periods; sticking to the strategy is crucial for long-term success. |

Pure strategies work best for investors who believe in one style and can handle higher volatility. They must stay disciplined during rough periods and avoid switching strategies too quickly.

Hybrid and Diversified Portfolios

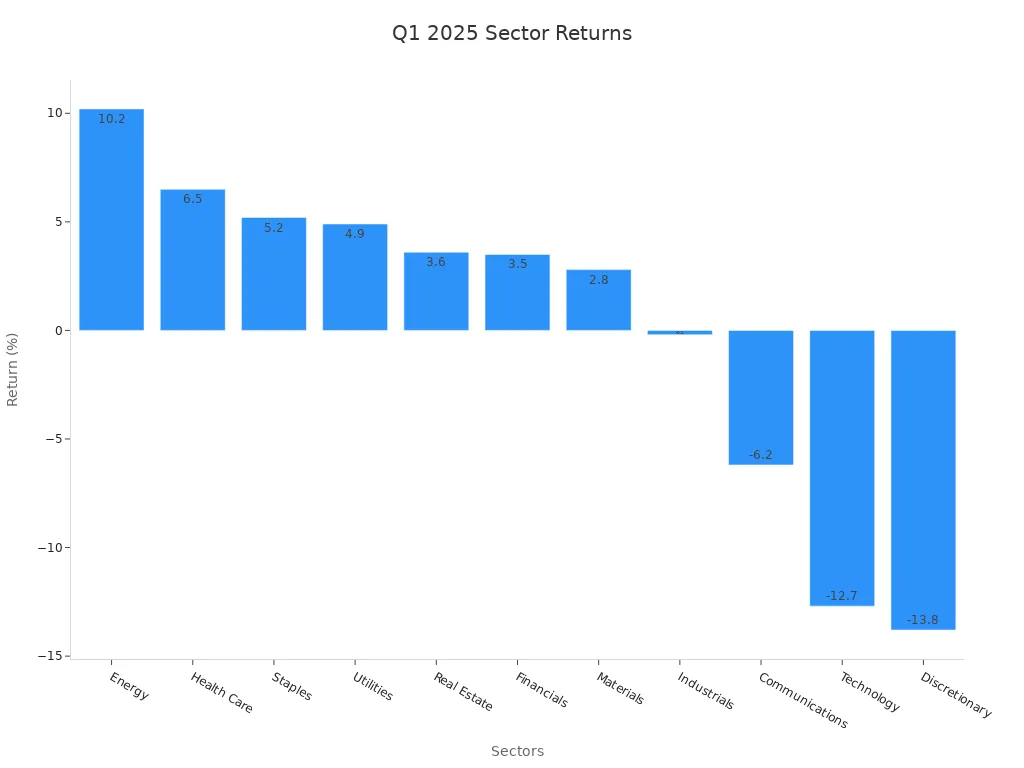

Hybrid and diversified portfolios combine different investment styles, sectors, and even asset classes. This approach spreads risk and can smooth returns during market swings. In 2025, diversified portfolios showed more stability than pure growth portfolios. Seven out of eleven S&P 500 sectors posted positive returns, while the Technology sector dropped by 12.7%. Value stocks outperformed growth stocks, showing the benefit of mixing styles.

| Sector | Q1 2025 Return |

|---|---|

| Energy | +10.2% |

| Health Care | +6.5% |

| Staples | +5.2% |

| Utilities | +4.9% |

| Real Estate | +3.6% |

| Financials | +3.5% |

| Materials | +2.8% |

| Industrials | -0.2% |

| Communications | -6.2% |

| Technology | -12.7% |

| Discretionary | -13.8% |

BlackRock’s 2025 analysis shows that adding assets like gold, infrastructure, and cash-like instruments lowers volatility and improves risk-adjusted returns. Gold helps protect against currency risks, infrastructure offers steady returns, and cash-like assets provide liquidity. These additions make portfolios more resilient than pure equity-focused approaches.

Many investors use the classic 60/40 rule, which splits investments between stocks and bonds. In 2025, some adapt this rule by adding alternative assets to handle new market risks. Hybrid strategies help investors seeking stocks for 2025 manage uncertainty and aim for steady growth.

Growth and value stocks show clear differences in 2025. Growth stocks, such as those in large-cap technology, delivered higher returns and traded at premium valuations. Value stocks, especially in mid and small caps, offered lower prices and potential for broader earnings growth.

| Aspect | Growth Stocks (2024/2025) | Value Stocks (2024/2025) |

|---|---|---|

| 2024 Returns | +33.35% | +14.35% |

| Forward P/E | 29.5 | ~15 |

| Market Outlook 2025 | Continued momentum | Mean reversion possible |

Investors should match their choices to personal goals and current trends. Reviewing portfolios and seeking diversification or professional advice can help manage risk and capture new opportunities.

FAQ

What is the main difference between growth stocks and value stocks?

Growth stocks show rapid earnings increases and trade at higher prices. Value stocks trade below their true worth and often pay dividends. Investors choose growth for potential gains and value for stability.

Are value stocks safer than growth stocks?

Value stocks usually show less price movement and pay dividends, which can lower risk. Growth stocks often have bigger price swings. Investors seeking stability often prefer value stocks.

Which sectors often include growth or value stocks?

Growth stocks often appear in technology and consumer sectors. Value stocks usually come from financials, healthcare, and industrials. The table below shows common sectors:

| Growth Sectors | Value Sectors |

|---|---|

| Technology | Financials |

| Consumer | Healthcare |

| Biotech | Industrials |

Can investors combine growth and value stocks in one portfolio?

Many investors mix both styles to balance risk and reward. This approach can smooth returns during market swings and help achieve long-term goals.

Navigate the 2025 growth and value stock rotation with BiyaPay! Instantly set up in one minute, skipping intricate overseas account barriers, to fund global markets like US and Hong Kong stocks swiftly during market shifts. Our versatile wallet enables cost-free conversions of USDT and other cryptocurrencies to USD and over 30 fiat currencies, with cross-border transfers as low as 0.5%, ensuring your capital is ready for tech or financial plays. BiyaPay’s trusted platform fuels your agile investment moves. Take action—explore BiyaPay to boost your portfolio’s potential!

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.