- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Overnight Futures Trading Explained for New Investors

Image Source: pexels

Overnight trading lets you buy or sell futures contracts when most people sleep. Many new investors find this exciting because you can react to global news at any hour. You do not have to wait for regular futures exchange hours to make decisions. More people have joined overnight trading in recent years. For example, platforms like Robinhood report that up to 25% of their total trading volume happens overnight. The table below shows how much overnight trading has grown:

| Statistic Description | Numerical Value / Detail |

|---|---|

| Robinhood overnight trading volume proportion | Up to 25% of total trading volume |

| Off-exchange volume (proxy for retail activity) | 51.6% (all-time high, surpassing January 2021 peak) |

| Interactive Brokers extended US Treasuries trading hours | From 9 hours to 22 hours |

| Webull launch of 24-hour trading | Enables trading US stocks and ETFs in Asia-Pacific markets |

You might wonder how overnight trading works, why it matters, and what risks or opportunities you face. This guide will help you learn these basics and show you how to start safely.

Key Takeaways

- Overnight futures trading lets you buy and sell contracts outside regular market hours, giving you the chance to react to global news anytime.

- Trading overnight involves lower liquidity and higher volatility, so prices can move quickly and spreads may widen, requiring careful risk management.

- Many experienced traders lead overnight markets, and retail participation is growing, especially in pre-market hours with more ETFs and lower-priced stocks.

- Overnight trading offers unique opportunities to access global markets almost 24 hours a day and respond to important events before regular sessions start.

- Start safely by choosing a broker with good tools, testing strategies with demo accounts, using stop-loss orders, managing risk, and staying informed about global events.

What Is Overnight Trading?

Image Source: unsplash

Key Concepts

Overnight trading lets you buy and sell futures contracts outside the main trading hours. You can trade when the regular session closes and before it opens again. This period includes both after-hours trading and pre-market sessions. Many investors use overnight trading to react to news from other countries or to manage risk when markets move unexpectedly.

You will notice that the futures market stays open almost 24 hours a day. This setup allows you to trade during times when most stock markets are closed. For example, if a major event happens in Europe or Asia while you sleep, you can still respond before the U.S. market opens. This flexibility helps you manage your positions and take advantage of price changes.

Tip: Overnight trading often sees lower trading volume and less liquidity than regular hours. This can lead to bigger price swings and wider gaps between buy and sell prices.

The table below shows how participation rates and liquidity can change during overnight trading for different futures products:

| Metric / Product | Crude Oil Futures (Liquid) | RBOB Gasoline Futures (Less Liquid) |

|---|---|---|

| Extreme Daily Trade Imbalance (%) | 2.8% | 17.5% |

| Extreme Participation Rate (5-minute interval) | 17% | N/A |

| Extreme Participation Rate (30-minute interval) | 9% | N/A |

| Extreme Participation Rate (Full day) | 2.7% | N/A |

You can see that more liquid products like crude oil have lower participation rates, while less liquid products like RBOB gasoline show higher imbalances. This means you may face more risk and bigger price moves in less liquid markets during overnight trading.

Statistical studies show that overnight trading has changed how prices move. After nighttime trading started for metals, agricultural, and energy futures, price swings became smaller. The risk of big losses dropped, and prices became more balanced. Overnight returns in U.S. and international index futures are often positive, with less risk than during the day. These changes help you manage risk and find better trading opportunities.

Why It Matters

Overnight trading gives you the power to act on global news and events as they happen. If a central bank in Europe changes interest rates or a major company in Asia releases earnings, you do not have to wait for the U.S. market to open. You can adjust your trades right away.

Historical data shows that overnight trading can make up a large part of total returns. For example, in U.S. equity markets, the overnight session (from 4:15 p.m. to 9:30 a.m. Eastern Time) delivers an annualized return of 2.6%. This is more than half of the total annualized return of 4.3%. The biggest moves often happen when European markets open, especially after big sell-offs. Sometimes, overnight returns can reverse losses by up to 20%, with 7.5% gains during the European opening hour.

You should also know that trading costs, like commissions, can affect your profits. In the past, these costs made it harder to earn money from overnight trading. Today, more products and lower fees make it easier, but you still need to watch your costs.

- Key factors that drive overnight trading include:

- Economic data releases, such as interest rate changes or inflation reports, can boost trading volume.

- Geopolitical events, like elections or trade talks, may cause sharp price moves.

- Seasonal trends in commodities can change demand and supply, affecting futures prices.

- Technical indicators help you spot good times to enter or exit trades, especially when prices move sideways.

Note: Understanding these factors helps you time your trades and manage risk. You can use overnight trading to protect your investments or find new chances to profit.

Overnight trading improves how information flows in the market. Prices reflect news from around the world more quickly. This helps you make better decisions and manage your risk, even when the regular session is closed.

Futures Exchange Hours

Image Source: pexels

Regular vs. Overnight

You might think that futures markets only open during the day, but most futures exchange hours actually cover almost 24 hours. This means you can trade futures contracts both during the main session and outside of it. Regular trading hours usually run from early morning to late afternoon, when most traders and investors are active. During these hours, you see the highest trading volume and the most liquidity. Prices move smoothly because many buyers and sellers participate.

When regular trading ends, overnight trading begins. This period is also called extended futures hours or after-hours trading. Fewer people trade during this time, so you may notice bigger price swings and less activity. The table below shows some key differences between regular and overnight trading hours:

| Metric / Aspect | Regular Trading Hours | Overnight (Extended) Trading Hours |

|---|---|---|

| Trading Volume | Over 95% of total consolidated volume (TCV) | Early hours trading accounts for 0.27% of TCV in first 30 minutes (2024), with after-hours ~3% of TCV post-close |

| Volume Growth Trend | Stable | Early hours trading shows consistent year-over-year growth since 2019; after-hours trading volume remains flat |

| Order Types | Continuous book executions concentrated at start of regular hours (9:30-10 a.m. ET) | Extended day (DAY/PTX) orders make up >95% of early order volume; Immediate-Or-Cancel (IOC) orders peak at 4 a.m. ET |

| Retail Participation | Not specified | Retail orders now comprise more than half of premarket share (4 a.m. – 7 a.m. ET) |

| Security Types | Broad market | Increasing share of ETFs (from 8% to ~25%) and sub-dollar securities (from 5% to ~20%) in premarket volumes |

| Top Securities (Jan 2024 - Mar 2025) | N/A | Top traded stocks: TSLA, NVDA, BABA, PLTR, SMCI; Top ETFs: QQQ, SHV, SPY, TQQQ, TSLL |

You can see that most trading happens during regular hours, but overnight trading is growing, especially in the early morning.

U.S. Overnight Session

The U.S. overnight session covers the hours when the main exchanges close until they open again. During this time, you will find lower liquidity and wider bid-ask spreads. Fewer traders and market makers participate, so it becomes harder to buy or sell large amounts at good prices. Academic research shows that overnight trading often leads to bigger price jumps and reversals. This happens because investors react strongly to news from other countries or sudden events, but there are fewer people to balance out these moves.

You may also notice that retail investors play a bigger role in overnight trading now. Since 2019, pre-market trading volume has grown 15 times, and retail orders make up more than half of the activity before 7 a.m. ET. The types of securities traded have changed too, with more ETFs and lower-priced stocks appearing in the overnight session.

Tip: If you trade during the U.S. overnight session, always check the bid-ask spread and be careful with order size. Lower liquidity can make prices move quickly, and you might not get the price you expect.

How It Works

Market Participants

You will find many types of traders in overnight trading. Some traders have more experience and use larger positions. These traders often work as floor brokers or professional traders. They use both long and short trades to take advantage of price changes. Most commercial firms, like companies that use futures to hedge, do not trade as much overnight. Instead, experienced traders and brokers make up a bigger share of the market during these hours.

- A small group of traders, about 1.1% to 2.5%, are called “overnight informed traders.” They hold positions at the end of the day that often predict the next day’s price moves.

- These traders usually have higher trading activity and manage positions across different contract expirations.

- Data from the CFTC shows that overnight informed traders in crude oil can earn about USD 45,237 per day, while less informed traders may lose around USD 3,401 daily.

- Managed money traders and hedge funds are more active during the day, while overnight trading is led by floor brokers and experienced individuals.

You can see that trader experience, position size, and trading behavior help identify who succeeds in overnight trading. If you want to join, you should learn from these patterns and focus on building your skills.

Global Events Impact

Global events can change overnight trading very quickly. News from other countries, economic reports, or natural disasters can cause big price swings. For example, when the U.S.-China trade war happened in 2019, the CBOE Volatility Index (VIX) jumped to 24.59, showing higher risk. During the early COVID-19 pandemic, the Dow Jones dropped by 37% from its February peak to its March low. At the same time, the Nasdaq Composite Index rose over 40% in 2020 because of strong technology and healthcare stocks.

You may also notice that natural disasters, like Hurricane Katrina in 2005, caused NYMEX crude oil futures to surge by 40%. These events show how overnight trading reacts to world news and market shocks.

When you trade overnight, you need to manage your positions carefully. Here are some important steps:

- Time your trades and use hedging to manage risk.

- Test your strategies over time to see what works.

- Watch global news and use technical analysis to plan your trades.

- Use stop-loss orders and control leverage to protect your money.

- Diversify your trades across different markets.

Note: Transaction costs, like commissions and bid-ask spreads, can reduce your profits. Always check these costs before you trade.

Overnight trading gives you the chance to react to global events, but you must stay alert and use good risk management.

Risks and Benefits

Liquidity and Volatility

When you trade during overnight trading hours, you face different market conditions than during the day. Fewer people buy and sell futures contracts at night. This means the market has lower liquidity. Lower liquidity can make it harder for you to enter or exit trades at your desired price. You may see wider gaps between the price you can buy and the price you can sell, called the bid-ask spread.

Research shows that overnight trading often brings higher volatility. Prices can move quickly, even with small trades. For example, high-yield bond ETFs have higher overnight returns but also show more price swings and wider spreads. These ETFs hold assets that do not trade much at night, so prices can jump more than during the day.

The table below shows some key differences between day and night trading:

| Metric / Aspect | Overnight Trading (Night) | Regular Trading (Day) |

|---|---|---|

| Average Quote Size | Lower, making large trades harder | Higher, easier to trade big amounts |

| Volatility | Higher, prices can change quickly | Lower, prices move more smoothly |

| Bid/Offer Spreads | Wider, increasing trading costs | Tighter, costs are lower |

| Market Participants | Fewer, mostly experienced or professional traders | Many, including retail and institutional |

You should know that after-hours markets have fewer participants. The U.S. Securities and Exchange Commission (SEC) notes that this can make it harder to sell quickly. Wider spreads and higher volatility mean you might pay more or get less when you trade. Even a single large order can move prices a lot at night.

To manage these risks, you need to use good risk management. Always check the market depth and use limit orders to control your entry and exit prices. You can also use stop-loss orders to protect yourself from sudden price moves.

Overnight Fees

When you hold futures contracts during overnight trading, you may need to pay overnight fees. These fees depend on the product you trade and your broker’s rules. Some products, like E-mini FX Futures or Nikkei 225 Micro Futures, charge a fixed fee per contract each night you hold your position.

Here is a table showing typical overnight fees for different margin levels:

| Margin Requirement Level | Fee per Contract (USD/JPY) |

|---|---|

| 3x Margin Requirements | 0.00 (no overnight fee) |

| 2x Margin Requirements | 0.005 to 0.50 per contract |

| Meets Margin Requirements | 0.01 to 1.00 per contract |

You pay these fees daily for each contract you keep overnight. The amount can change based on the futures product and your margin level. Always check your broker’s fee schedule before you trade. These costs can add up, especially if you hold many contracts or trade often at night.

Tip: Overnight fees are just one part of your total trading costs. Combine them with commissions and wider spreads to get a full picture of your expenses.

Opportunities

Overnight trading gives you unique trading opportunities that you cannot find during regular hours. You can react to news from around the world as it happens. If a central bank in Europe or China makes a big announcement, you can trade right away instead of waiting for the U.S. market to open.

You also face less competition at night because fewer traders are active. This can help you find better prices or spot trends before others do. If you have a busy daytime schedule, overnight trading lets you access global markets when it fits your life.

Here are some key benefits and strategies for overnight trading:

- You can trade almost 24 hours a day, five days a week.

- You can respond to global events and economic news in real time.

- You can focus on highly liquid futures like E-mini S&P 500, Euro FX, Crude Oil, and Gold.

- You can use economic calendars and set alerts for important news.

- You can adjust your position size to manage risk in lower liquidity markets.

- You can use limit orders and wider stop-loss orders to handle volatility.

- You can use trading platforms that offer real-time data and 24-hour access.

The table below shows when you can trade some popular futures products (Central Standard Time):

| Product | Daily Halt/Reopen | Morning Open |

|---|---|---|

| E-mini S&P 500 | 3:15-3:30 p.m., 4-5 p.m. | 7:30 a.m. |

| Gold | 4-5 p.m. | 7 a.m. |

| WTI Crude Oil | 4-5 p.m. | 7:30 a.m. |

| Corn | 1:20 p.m./7 p.m. | 8:30 a.m. |

| Euro FX | 4-5 p.m. | 7 a.m. |

Note: Overnight trading can help you build a flexible schedule and find new ways to profit. Always use risk management to protect your money, especially when markets move fast.

You should remember that overnight trading is not just about risk. It also opens doors to global markets and lets you act on news as it happens. With the right tools and strategies, you can turn these unique hours into real trading opportunities.

Getting Started

Account Setup

You need a trading account with a broker that offers access to overnight futures markets. Many brokers use electronic platforms like CME Group’s Globex, which lets you trade almost 24 hours a day. For example, E-mini S&P 500 futures trade from Sunday 5 p.m. CT to Friday 4 p.m. CT, with short daily breaks. Knowing these trading hours helps you plan your trades and avoid missing important moves. Choose a broker that provides real-time data, charting tools, and strong customer support. Make sure you understand the margin requirements and fees before you start.

Basic Strategies

Start with simple strategies as you learn. Many traders use momentum strategies, which means you follow the direction of price trends. Studies show that foreign traders who hold overnight positions often see positive returns, especially when they use information from currency movements. You can also use technical analysis tools to find good entry and exit points. Test your strategies with a demo account before trading with real money. This helps you see how your plan works in real market conditions.

Tip: Use economic calendars to track global news and events. This helps you spot trading opportunities during overnight sessions.

Safety Tips

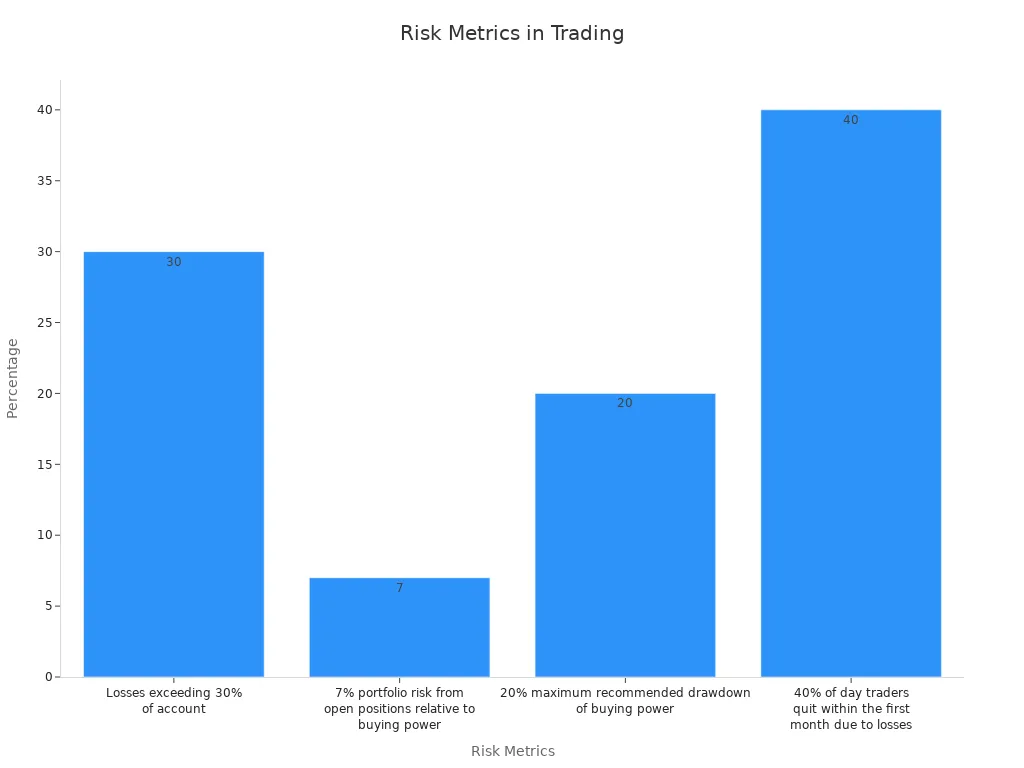

Protecting your money is very important in overnight futures trading. Use risk management techniques like stop-loss orders and proper leverage. Limit your losses to avoid big setbacks. For example, keeping your portfolio risk below 7% of your buying power and limiting drawdowns to 20% can help you stay in the game. The table below shows why these rules matter:

| Numerical Data / Statistic | Explanation / Context |

|---|---|

| Losses exceeding 30% of account | Leads to major difficulty in recovery and increased risk-taking, highlighting the importance of limiting losses. |

| 7% portfolio risk from open positions relative to buying power | Example of prudent risk exposure management in trading positions. |

| 20% maximum recommended drawdown of buying power | General guideline to limit potential losses and preserve capital. |

| 40% of day traders quit within the first month due to losses | Demonstrates the high risk and importance of risk management for trading sustainability. |

| Recommendation to close trades overnight for short-term traders | Risk management strategy to avoid sudden adverse market events when unable to trade. |

| Use of Value at Risk (VaR) | Statistical measure to quantify potential losses, supporting risk management importance. |

Follow these steps to get started safely:

- Learn global market hours and key economic events.

- Use risk management tools like stop-loss orders and proper leverage.

- Test your strategies before trading live.

- Apply technical analysis for better timing.

- Diversify your trades to lower risk.

- Stay disciplined and stick to your plan.

- Choose a trading platform with real-time data and charts.

You have learned what overnight futures trading is, how it works, and why it matters. You face risks like volatility and liquidity, but you also find unique opportunities. Staying informed helps you manage these challenges. For example, changes in tariffs, fund flows, and weather can move prices quickly:

| Commodity/Factor | Key Data | What You Should Watch |

|---|---|---|

| Corn | Funds sold 118,000 contracts | Supply and demand shifts |

| Soybeans | China imposes 100% tariff | Geopolitical news |

| Energies | Natural gas up $0.80 in two days | Technical and macro trends |

Keep learning, use demo accounts, and always protect your capital with strong risk management.

FAQ

What is the main risk of trading futures overnight?

You face higher price swings and lower liquidity at night. Fewer traders join the market, so prices can move quickly. You may not get the price you want when you buy or sell.

Can I trade overnight futures with a small account?

Yes, you can start with a small account. Many brokers let you trade micro futures contracts. Always check the margin requirements and fees. Start with small positions to manage your risk.

How do global events affect overnight futures prices?

Global news, like economic reports or political changes, can move prices fast. You can react to news from China, Europe, or other regions before the U.S. market opens. Stay updated to spot new trading chances.

Do I need special software for overnight trading?

Most brokers offer electronic trading platforms that work 24 hours. You need a platform with real-time data and charting tools. Make sure your broker supports overnight trading and gives you access to global markets.

Are overnight trading fees higher than regular hours?

Overnight trading can cost more. You may pay higher bid-ask spreads and overnight fees. Always check your broker’s fee schedule. Add up all costs, including commissions, before you trade.

As you explore overnight futures trading, managing transaction costs and accessing global markets efficiently are critical to maximizing your returns. BiyaPay offers a seamless solution for traders like you. With its multi-asset wallet, you can effortlessly convert USDT and over 200 cryptocurrencies into fiat currencies like USD or HKD—completely free of charge. This flexibility ensures you can fund your trading accounts or manage profits without losing value to high conversion fees. Plus, BiyaPay’s low 0.5% remittance fees make cross-border transactions cost-effective, while its robust platform supports rapid, secure transfers to keep you agile in fast-moving markets. Ready to streamline your trading? Register with BiyaPay in just one minute and take control of your global investments today.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.