- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Easily Schedule Recurring Stock Investments on Fidelity in 2025

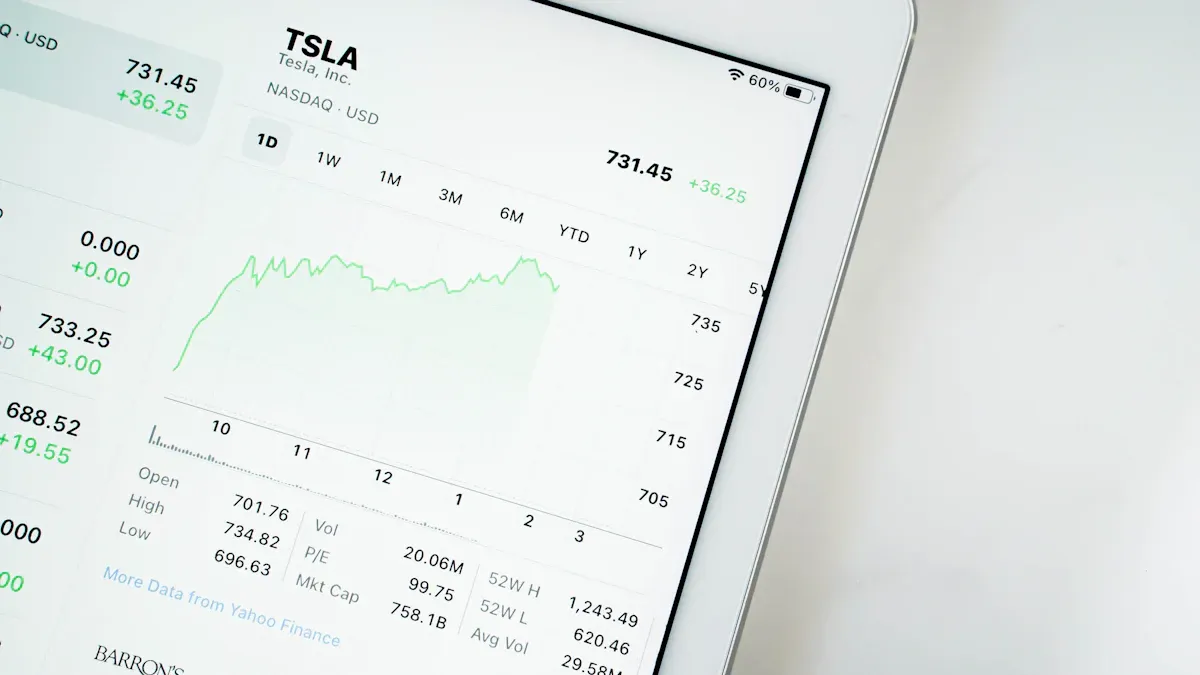

Image Source: pexels

Fidelity lets you set your investing on repeat with just a few clicks. You can use your fidelity account to schedule recurring stock purchases and watch your investments grow automatically. If you want to know how to buy stocks on fidelity, you only need to log in, pick your stocks, choose how much and how often to invest, and confirm your plan. Recurring investments take the stress out of building your portfolio and keep you on track, no matter your experience level.

Key Takeaways

- Set up a Fidelity account and link your bank to start investing quickly and securely.

- Choose up to ten stocks or ETFs and set a regular investment amount and schedule that fits your budget.

- Use recurring investments to build good habits and grow your portfolio automatically without stress.

- Track, edit, or pause your investments anytime through Fidelity’s website or mobile app for full control.

- Recurring investing helps reduce risk by spreading purchases over time and removes the need to time the market.

How to Buy Stocks on Fidelity

Account Setup

You need a fidelity account before you can start investing. If you do not have one, you can open an account online in just a few minutes. You will enter your basic information, like your name, address, and Social Security number. Make sure you choose the right account type for your needs. Many people pick a standard brokerage account, but you can also open retirement or custodial accounts. Once you finish, you will get access to all the tools you need, including the option to set up recurring investments.

Tip: Keep your login details safe. You will use them every time you want to check your portfolio or make changes.

Linking Your Bank

To fund your fidelity account, you must link your bank. This step lets you move money in and out easily. Most people use electronic funds transfer (EFT) because it is fast and simple. You will need your bank’s routing and account numbers. Double-check these numbers to avoid errors. Common mistakes include typos or trying to link an account that does not match your name. If you run into problems, you might get an email asking for more information. Fidelity’s team can help you fix any issues.

Here is a quick look at how long transfers usually take:

| Transfer Method | Typical Processing Time |

|---|---|

| Electronic funds transfer (EFT) | 1–3 business days |

| Bank wire to your bank | Same day |

| Paper check | 5–6 days |

| Transfer between Fidelity accounts | Within minutes |

Placing a Stock Order

Now you are ready to learn how to buy stocks on fidelity. Log in to your account and search for the stock or ETF you want. Click “Trade” and pick the type of order you want to place. Market orders usually fill right away if the stock is active. Limit orders let you set your own price, but they may not fill if the market does not reach your price. Fidelity works hard to get you the best price and fast execution.

- Fidelity’s order system routes your trades to top-performing market centers.

- The team looks for price improvements and quick fills.

- Most shares (over 95%) get a better price than the national best bid and offer.

- The average execution speed is just 0.04 seconds.

If you want to set up recurring investments, you can do that after your first trade. This makes it easy to keep investing without extra effort. Many people use recurring purchases to build their portfolios over time. If you ever wonder how to buy stocks on fidelity again, just follow these steps.

Set Up Recurring Investments

Image Source: pexels

Setting up recurring investments on Fidelity helps you set your investing on repeat. You can build your portfolio without having to remember each trade. Let’s walk through the steps for both the website and the mobile app.

Accessing Recurring Investment Tools

You can start on either Fidelity.com or the Fidelity Mobile® app. Both platforms make it simple to find the recurring investment tools.

On Fidelity.com:

- Log in to your Fidelity account.

- Go to the “Accounts & Trade” menu.

- Select “Recurring Investments” from the dropdown.

- Click “Set Up Recurring Investments” to begin.

On the Fidelity Mobile® app:

- Open the app and log in.

- Tap the “Accounts” tab.

- Find and tap “Recurring Investments.”

- Tap “Set Up Recurring Investments” to get started.

Note: Make sure your bank account is linked before you set up recurring investments. This ensures your trades get funded on schedule.

Choosing Stocks or ETFs

Fidelity lets you pick up to ten different stocks or ETFs for your recurring plan. You can search for your favorite companies or funds right in the tool. If you’re not sure what to choose, you can look at historical performance, but remember that past results do not guarantee future returns. Fidelity’s research team uses a mix of long-term trends and short-term market changes to guide their choices. They look at things like company earnings and world events. Still, you should think about your own goals and maybe talk to a professional before you decide.

Tip: Diversifying your picks can help manage risk. Try to include a mix of stocks and ETFs from different industries.

Setting Amount and Frequency

Now you get to decide how much money to invest and how often. Fidelity gives you three options for frequency: weekly, biweekly, or monthly. You can set a dollar amount for each stock or ETF. The minimum amount may depend on the stock or ETF you choose.

- You can invest in up to ten stocks or ETFs at once.

- Choose a schedule that fits your budget and comfort level.

Here’s a quick look at your options:

| Frequency | Description |

|---|---|

| Weekly | Invest every week |

| Biweekly | Invest every two weeks |

| Monthly | Invest once a month |

- There is no clear evidence that picking weekly, biweekly, or monthly will change your results much over time. The most important thing is to keep investing regularly. Fidelity recommends picking a schedule that feels right for you. Consistency matters more than timing.

Block Quote: “Investing sooner is usually better than waiting. The key is to keep your routine going, no matter which frequency you pick.”

Confirming Your Plan

After you choose your stocks or ETFs, set your amount, and pick your frequency, you will see a summary of your plan. Double-check everything. Make sure your bank account is linked and has enough funds. If everything looks good, confirm your plan.

- You will get a confirmation message or email.

- Your recurring investments will start on the next available date.

- You can always go back and change your plan if your needs change.

Note: You can pause, edit, or cancel your recurring investments at any time from your Fidelity account or the mobile app.

Setting up recurring investments with Fidelity is a great way to build a habit and take the guesswork out of investing. You can relax knowing your money is working for you, even when you are busy.

Requirements and Eligibility

Account Types

You need the right account before you can set up recurring stock investments. Fidelity lets you use several types of accounts for this feature. Most people choose a standard brokerage account. This account works well for buying and selling stocks or ETFs. You can also use retirement accounts, like a Roth IRA or Traditional IRA, if you want to save for the future. Some people open custodial accounts for kids. These accounts let you invest for a child’s future, like college.

Tip: If you are not sure which account fits your goals, you can use the account picker tool on fidelity. It asks a few questions and helps you decide.

Here is a quick list of account types that support recurring investments:

- Individual brokerage accounts

- Joint brokerage accounts

- Roth IRA and Traditional IRA

- Custodial accounts

You can open more than one account if you want to keep your goals separate.

Investment Minimums

You do not need a lot of money to start. Fidelity makes it easy for you to begin with small amounts. For most stocks and ETFs, you can start with as little as $1 USD. This low minimum helps you build a habit without feeling stressed about big numbers.

| Investment Type | Minimum Amount (USD) |

|---|---|

| Stocks | $1 |

| ETFs | $1 |

Some stocks may have higher minimums, but most popular choices let you start small. Make sure your linked bank account, like one from a Hong Kong bank, has enough funds for your plan.If your account does not have enough money, your scheduled investment may not go through.

Note: You can always increase your amount later as your budget grows.

Manage Recurring Investments

Viewing and Tracking

You want to keep an eye on your recurring investments. Fidelity makes this easy for you. You can check your plan anytime on the website or the mobile app. Just log in and go to your account dashboard. Look for the section called “Recurring Investments.” Here, you will see a list of all your active plans. You can view the stocks or ETFs you picked, the amount you invest, and the schedule you set.

If you like to see details, click on each plan. You will find a history of past purchases and the next scheduled date. This helps you track your progress and see how your money grows over time. Some people like to check every week. Others look once a month. You get to choose what works best for you.

Tip: Set a reminder to review your recurring investments every few months. This helps you stay on track with your goals.

Editing or Canceling

Sometimes you need to make changes. Maybe you want to add a new stock, change your amount, or stop a plan. Fidelity lets you edit or cancel your recurring investments anytime. Go to the “Recurring Investments” section in your account. Click on the plan you want to change.

You will see options to update the amount, switch the frequency, or pick different stocks. If you want to stop a plan, just select “Cancel.” The change takes effect right away. You will get a confirmation message so you know your update worked.

Managing your recurring investments with fidelity gives you control and flexibility. You can adjust your plans as your needs change. This way, you always feel confident about your investing journey.

Benefits of Recurring Investing

Image Source: unsplash

Dollar-Cost Averaging

When you set up recurring investments, you use a strategy called dollar-cost averaging. This means you buy the same stock or ETF at regular times, no matter what the price is. Sometimes you buy when prices are high, and sometimes when they are low. Over time, this can help you avoid putting all your money in at the wrong moment.

Many people like dollar-cost averaging because it takes away some of the stress. You do not have to guess the best time to buy. You just stick to your plan. This can help you avoid big mistakes that come from trying to time the market.

Note: Research shows that lump-sum investing often gives higher returns than dollar-cost averaging. For example, studies from Vanguard found that lump-sum investing outperformed dollar-cost averaging about 67% of the time over ten years in the U.S. market. The average portfolio value was about 2.3% higher at retirement. This happens because markets usually go up over time, so investing all your money early can help it grow more. Still, dollar-cost averaging can lower your risk and help you feel more comfortable, especially if you worry about market drops.

Automating Wealth Building

Automatic investing with fidelity makes growing your money simple. You do not have to remember to buy stocks each month. The system does it for you. This can help automate investing and keep you on track, even when life gets busy.

Here are some reasons why automating your investing works so well:

- You build good habits without extra effort.

- You avoid missing out on growth because you forgot to invest.

- You can start small and increase your amount as you get more comfortable.

Fidelity gives you tools to set up and manage your recurring investments. You can check your progress anytime. You stay in control, but you do not have to do all the work yourself. Many people find that automatic investing helps them reach their goals faster.

Tip: Start with an amount that feels right for you. As your budget grows, you can always add more.

Automating your stock investments on fidelity makes growing your money simple. You can start with small, regular amounts and watch your savings build over time. Many people find that automation helps them stick to their plans and avoid mistakes. Research shows that:

- Automated investing encourages steady saving habits.

- It helps you avoid emotional decisions and market timing.

- You can grow your investments with less stress.

Remember to check your plan as your goals change. Automation can help you build good habits and feel confident about your future.

FAQ

How soon do recurring investments start after I set them up?

You usually see your first recurring investment on the next available date you picked. If you set it up today, your plan starts with the next scheduled cycle.

Can I change my recurring investment amount later?

Yes, you can update your amount anytime. Just log in, go to your recurring plan, and pick a new amount. Your changes take effect right away.

What happens if my bank account does not have enough money?

If your bank account, like one from a Hong Kong bank, does not have enough funds, your scheduled investment will not go through.You will get a notification so you can fix the issue.

Can I use recurring investments for any stock or ETF?

You can use recurring investments for most stocks and ETFs on fidelity. Some stocks may not qualify, but you see a list of available choices when you set up your plan.

Is there a fee for setting up recurring investments?

No, you do not pay extra fees to set up or manage recurring investments. Standard trading fees may still apply, depending on your account and the investment.

Streamline your Fidelity recurring investments with BiyaPay! Sign up in just 1 minute to sidestep intricate overseas account setups, enabling effortless funding for your US stock and ETF plans. Our multi-asset wallet converts USDT to USD or other fiat currencies fee-free, with overseas transfers starting at just 0.5%, keeping your Fidelity account primed for automated growth. BiyaPay’s trusted platform bolsters your long-term investment habit. Take action today—visit BiyaPay to fuel your wealth-building journey!

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.