- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Kamala Stocks Review: How Safe Is Her Strategy?

Image Source: pexels

Kamala Harris’s investment strategy uses a conservative and diversified approach, prioritizing safety and risk reduction. She allocates her portfolio across retirement funds, mutual funds, cash, property, and passive index funds. Research shows that a diversified portfolio reduces downside risk, with mathematical models like the safety-first principle supporting this method. Public pension funds and mutual funds, often included in her investment decisions, have shown returns similar to a balanced index portfolio over decades. Kamala stocks avoid potential conflicts of interest by adhering to strict regulatory guidelines. She maintains transparency to limit potential conflicts of interest and protect the integrity of her portfolio.

Key Takeaways

- Kamala Harris uses a diversified portfolio with mutual funds, index funds, bonds, and property to reduce risk and build steady growth.

- Her investment strategy favors passive funds and a long-term focus to avoid market timing risks and benefit from compounding returns.

- Spreading investments across different sectors and asset types helps protect her portfolio from market swings and volatility.

- She follows strict ethical guidelines and transparency rules to avoid conflicts of interest and maintain public trust.

- Regular financial disclosures and compliance with regulations ensure accuracy and reduce risks in her investment approach.

Kamala Harris Stock Portfolio

Image Source: unsplash

Main Holdings

Kamala Harris manages her investment portfolio with a focus on stability and transparency. The main holdings in the kamala harris stock portfolio include a mix of mutual funds, index funds, and retirement accounts. She avoids concentrated bets on individual stocks. Instead, she prefers broad-based funds that track the overall market. This approach helps reduce risk and smooth out returns over time.

Sharesight, a leading portfolio tracking platform, shows that analyzing main holdings involves more than just looking at the names of investments. It tracks total returns, including capital gains, dividends, and currency changes. The platform also breaks down how each holding contributes to the overall performance of the portfolio. By grouping investments by sector, country, or industry, investors can see which areas drive returns and which add risk. Kamala stocks reflect this method, as her portfolio spreads across different sectors and regions.

Returns-based analytics, like those used by Venn, help identify what drives performance in a portfolio. For example, a fund labeled as U.S. growth may actually have significant international exposure. This type of analysis helps investors understand the real sources of risk and return in their investments. Kamala stocks benefit from this approach, as her portfolio avoids hidden risks and maintains a clear structure.

Asset Types

The portfolio of Kamala Harris includes a wide range of asset types. She invests in mutual funds, index funds, bonds, cash, and property. This mix creates a balanced investment portfolio that can weather market ups and downs. Studies of university endowment funds show that asset allocation explains most of the variation in returns over time. Kamala stocks follow this principle by spreading investments across different asset classes.

Her investment portfolio also includes alternative assets such as real estate. Institutional investors, like university endowments, have increased their allocations to alternatives over the years. These assets can provide higher returns and lower risk when combined with traditional investments. Kamala stocks use this strategy to add stability and growth potential to her portfolio.

A well-diversified investment portfolio, like Kamala Harris’s, reduces risk and improves the chance of steady returns. By including a variety of investments, she avoids overexposure to any single asset or sector. This disciplined approach makes the kamala stocks strategy a model for safe investing.

Kamala Stocks Diversification

Fund Spread

Kamala Harris builds her investment portfolio with a strong focus on diversification. She spreads her investments across index funds, target-date funds, bonds, and property. This approach helps her avoid putting too much money into any single asset. By using index funds and target-date funds, she gains exposure to a wide range of stocks and bonds. Bonds add stability to her portfolio, while property offers a hedge against inflation.

A diversified investment portfolio reduces risk by limiting exposure to market swings in any one area. Historical data over the past 40–50 years shows that investment grade bonds provide resilience during equity downturns. Horizontal diversification, which means spreading investments across different asset classes, helps protect wealth and balance returns. Vertical diversification, such as choosing multiple private equity funds by year and strategy, further limits risk.

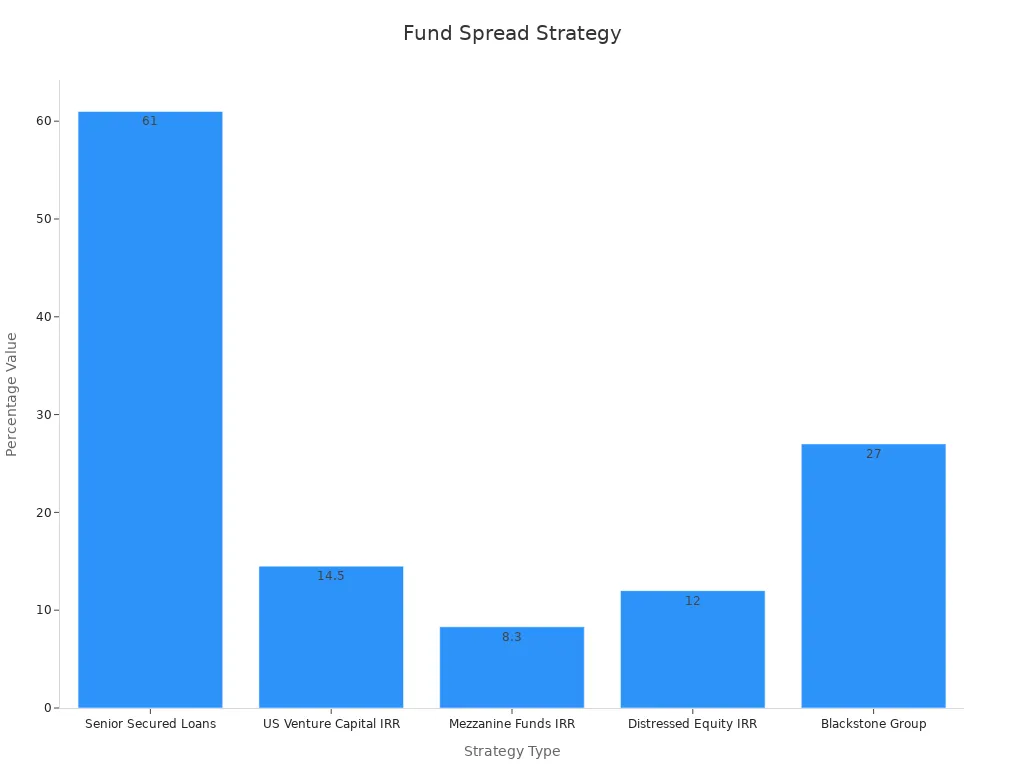

The effectiveness of this fund spread strategy appears in the numbers:

| Metric / Strategy | Numerical Evidence | Interpretation / Relevance to Risk Reduction |

|---|---|---|

| Recovery rate for senior secured loans | 61% average (2021, S&P Global) | Substantial capital recovery from defaults, reducing loss severity |

| U.S. Venture Capital IRR | 14.5% (10-year average) | Higher returns from equity strategies balance risk exposure |

| Mezzanine Funds IRR | 8.3% (10-year average) | Steadier returns from debt strategies add stability |

| Distressed Private Equity Funds IRR | 12% median (12-month, Q3 2020) | Opportunistic returns during downturns, diversifying risk sources |

| Correlation among strategies | Low correlation emphasized | Spreading investments across uncorrelated strategies reduces volatility |

| Example: Blackstone Group | 27% increase in economic income (Q1 2021) | Success of multi-strategy diversification in practice |

Sector Coverage

Kamala Harris’s investment portfolio covers many sectors. She invests in funds that include technology, healthcare, finance, and consumer goods. This broad sector coverage helps her avoid risk from downturns in any single industry. The U.S. Investment Grade credit market now has over 8,300 securities and 900 issuers, a large increase since 2009. This growth gives investors more choices across sectors, ratings, and maturities.

- Quantitative investment strategies use this wide sector coverage to minimize risk.

- Systematic methods find opportunities by looking at differences in value across sectors and maturities.

- Broad sector exposure helps avoid big losses from problems in one area.

- The growth in electronic trading platforms supports better diversification and portfolio safety.

- Managers who use both fundamental and quantitative analysis can build stronger, safer portfolios.

Kamala stocks show the importance of diversification. Her investment strategies and diversification help reduce risk and aim for steady growth. By spreading investments across funds, sectors, and asset classes, she builds a portfolio that can withstand market changes.

Portfolio Risks

Image Source: pexels

Market Volatility

Market volatility remains one of the most significant risks for any investment portfolio. Kamala Harris’s portfolio, with its broad mix of asset classes, still faces the impact of sudden market swings. Major economic events, geopolitical tensions, and policy changes can cause sharp price movements across stocks, bonds, currencies, and commodities. Even a diversified portfolio cannot fully escape these shocks, but it can help reduce their impact.

The 2008 financial crisis showed how quickly volatility can spike. During this period, equity markets experienced annualized volatility levels above 80%. The table below highlights some of the most notable volatility events across different asset classes:

| Date/Event | Description | Volatility (%) / Change | Duration/Notes |

|---|---|---|---|

| 2008-09-15 | Lehman Bankruptcy (Equities) | 82% | Peak during financial crisis |

| 2015-01-15 | Swiss franc unpeg (FX) | EUR/CHF +30%; vol 8%→50% | ~10 trading days |

| Late-2014 | OPEC no production cut (Oil) | 55% (annualized) | Oil price shock |

| 2013 | Fed Taper Tantrum (FX) | Emerging market sell-offs | Several weeks |

Volatility spikes often cluster around major events. Cross-asset correlations tend to rise during these periods, which can reduce the benefits of diversification in a portfolio.

Kamala Harris’s portfolio includes index funds, bonds, and property to help manage these risks. Bonds and property often move differently from stocks, which can cushion losses when equity markets fall. However, during extreme events, even these assets can experience higher volatility. The persistence of volatility in equities, FX, and commodities means that risk management remains essential for any portfolio.

Regulatory and Ethical Factors

Regulatory and ethical factors play a crucial role in shaping the risk profile of an investment portfolio. Kamala Harris’s portfolio follows strict ethical guidelines and disclosure requirements. These rules help prevent potential conflicts of interest and ensure that investments align with legal and ethical standards. Regulatory bodies, such as the SEC, enforce these standards to protect investors and maintain market integrity.

Research from Ethisphere shows that companies with strong ethical leadership outperform their peers by nearly 8% over five years. Organizations with robust ethical cultures achieve almost 40% higher return on assets. These findings suggest that following ethical guidelines and disclosure requirements not only reduces reputational and regulatory risks but also supports better financial outcomes.

Deloitte’s global risk management survey found that 36% of financial institutions see regulatory and compliance risk as a top concern. For investment management firms, this number rises to 81%. The SEC reported a record 868 enforcement actions in 2016, highlighting the growing complexity of compliance. Firms must track evolving regulations, allocate resources, and train staff to meet these challenges.

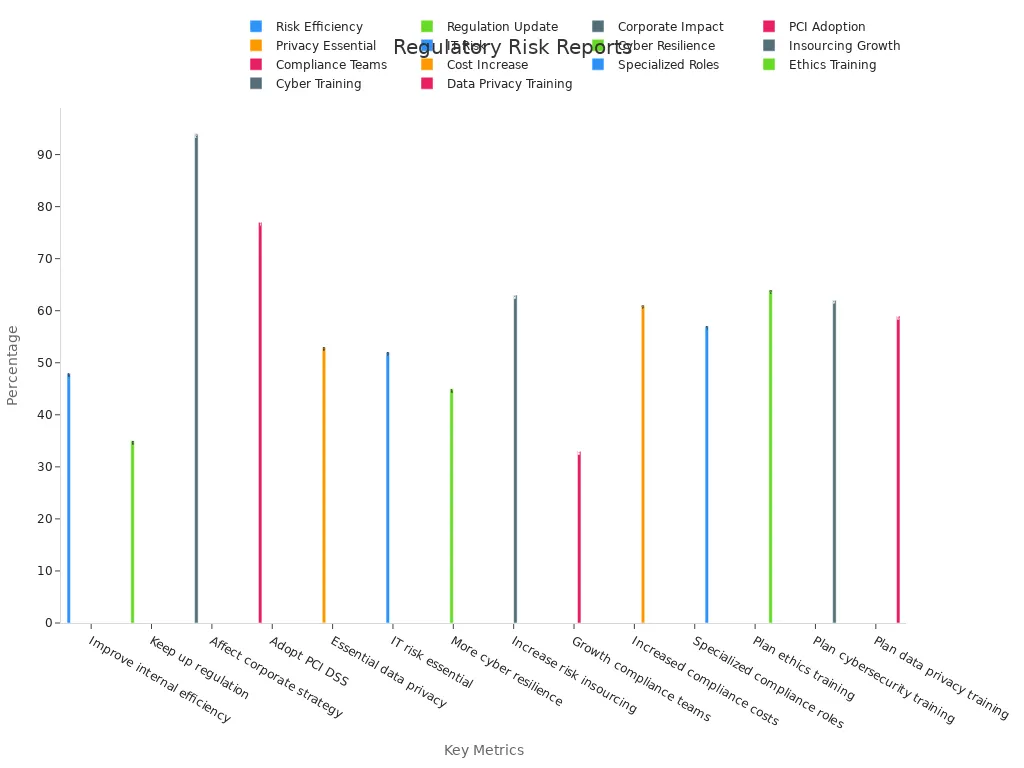

The table below summarizes key statistics related to regulatory and ethical risk management:

| Statistic | Description |

|---|---|

| 48% | Risk and compliance professionals believe AI could improve internal efficiency. |

| 35% | Believe AI helps keep up with regulatory and legislative changes. |

| 94% | C-suite respondents predict AI will significantly affect corporate strategy, with 37% citing risk and compliance strategy as a key area. |

| 77% | Security and IT leaders plan to adopt updated frameworks like PCI DSS 4.0 within 18 months. |

| 53% | Compliance and risk professionals say data privacy is absolutely essential. |

| 52% | IT/information security risk is absolutely essential to organizations. |

| 45% | Companies expect more compliance involvement in cyber resilience. |

| 63% | Corporate risk and compliance professionals report increased insourcing of risk and compliance work. |

| 33% | Predict growth in compliance teams over the next 12 months. |

| 61% | Expect increased costs for senior compliance officers. |

| 57% | Say compliance roles have become more specialized. |

| 64% | Organizations plan training on ethics and code of conduct in next 2-3 years. |

| 62% | Plan training on cybersecurity. |

| 59% | Plan training on data privacy. |

Kamala Harris’s portfolio demonstrates the importance of following ethical guidelines and disclosure requirements. These practices help avoid potential conflicts of interest and build public trust. By maintaining transparency and compliance, her portfolio reduces the risk of regulatory penalties and reputational harm. Investors who prioritize ethical guidelines and disclosure requirements can strengthen their own portfolios and support long-term success.

Investment Strategy

Passive Approach

Kamala Harris uses a passive approach in her investment portfolio. She selects index funds and broad market funds instead of picking individual stocks. This method helps her avoid the risks of market timing and frequent trading. Over the past 35 years, the U.S. stock market has shown positive annual returns in almost 80% of years. Missing just a few of the best days can lower returns a lot. A buy-and-hold approach lets investors recover from downturns more quickly. For example, someone who kept their investment in the S&P 500 during 2008 saw their investment return to break even by 2012. In contrast, moving money to a savings account would have taken 16 years to recover. Compound interest also plays a big role in growing investments over time.

Passive investing has outperformed most active funds. Over the last 15 years, 92% of large-cap active equity funds in the US did worse than the S&P 500. Passive strategies that track broad indices, like the S&P 500 or FTSE Shariah USA Index, have delivered strong results. The HLAL passive ETF, which follows the FTSE Shariah USA Index, grew $100,000 to $169,000, while an active fund grew the same amount to only $133,000. This shows that a passive approach can help an investment portfolio grow steadily.

Long-Term Focus

Kamala Harris keeps a long-term focus in her investment portfolio. She invests in funds and assets that she plans to hold for many years. This approach helps her benefit from the power of compounding and reduces the impact of short-term market swings. Historical market trends from 39 developed countries between 1841 and 2019 show that a long-term focus can help investors reach their goals. However, even with a 30-year horizon, there is still a 12% chance of losing money after inflation. Japan’s stock market, for example, had a 30-year real return of -21% from 1990 to 2019. This means that long-term investing is not risk-free, but it does offer better odds for growth.

A global study from 2000 to 2019 found that more passive ownership leads to greater long-term investments in tangible assets and people. Companies with more passive investors spent more on capital, staff, and operations. Evidence-based investing supports a long-term focus by using diversification, low-cost index funds, and the power of compounding. This disciplined approach helps investors avoid emotional decisions and high fees. Kamala Harris’s investment portfolio shows how a long-term focus and passive approach can work together to build wealth and manage risk.

Financial Disclosure Reports

Transparency

Kamala Harris’s financial disclosure reports provide a clear view of her investment approach. These reports show her holdings in mutual funds, index funds, bonds, and property. Federal ethics officials review each financial disclosure report to ensure accuracy and completeness. The U.S. Office of Government Ethics makes these disclosures available to the public, which helps people see how top government leaders manage their investments.

The table below shows the main types of disclosure documents and their role in transparency:

| Type of Disclosure Document | Description | Purpose in Transparency |

|---|---|---|

| Annual Reports (Form 10-K) | Yearly overview with audited financial statements and management discussion. | Gives detailed financial performance and operations to the public. |

| Quarterly Reports (Form 10-Q) | Updates each quarter with financial statements and management commentary. | Offers timely updates on financial condition and events. |

| Earnings Releases | Announcements of key financial metrics like revenue and earnings per share. | Keeps investors informed on recent results and management views. |

| Other Regulatory Filings | Documents submitted to regulatory bodies, including insider share disclosures. | Ensures compliance and reveals ownership interests. |

These disclosures help prevent conflicts of interest and support public trust. Transparent financial disclosure reports allow anyone to check the details of investment holdings. Pension funds and other large investors also use transparent disclosure to report investment returns and fees. This practice helps stakeholders and the public understand performance and costs.

Note: Improved disclosure practices make it easier for policymakers and the public to assess investment strategies and trust the process.

Compliance

Financial disclosure reports also show how Kamala Harris follows rules and regulations. Standardized reports ensure that all information is consistent and complete. Each disclosure includes transaction details, timestamps, and account activity. Compliance reports must meet requirements set by the SEC and other regulatory bodies.

- Standardized reports ensure accuracy and completeness in documentation.

- Compliance reports include transaction reports, account activity, and risk assessments.

- Each report contains timestamps, transaction details, and client information.

- Adherence to the SEC Marketing Rule requires all necessary disclosures about performance data and conflicts of interest.

- Compliance with Generally Accepted Accounting Principles (GAAP) ensures financial accuracy.

- Sarbanes-Oxley (SOX) requires internal controls and executive attestations.

- Audit trails and attestations from executives provide proof of compliance.

These steps help prevent errors and fraud. Disclosure management software and compliance templates make the process more reliable. By following these rules, financial disclosure reports protect both investors and the public. Kamala Harris’s approach shows that strong disclosure and compliance can reduce risk and build confidence in her investment strategy.

Pros and Cons

Strengths

Kamala Harris’s investment portfolio demonstrates several strengths that align with best practices in risk management and long-term wealth building. She uses a diversified portfolio, which includes mutual funds, index funds, bonds, and property. This approach helps reduce risk and provides stability during market fluctuations. Her investment strategy focuses on both qualitative and quantitative factors. She considers company quality, management, and sustainable advantages, while also reviewing financial statements and cash flows. This dual focus supports a robust investment process.

- Qualitative strengths include strong management, brand reputation, and economic moats.

- Quantitative strengths involve high gross margins, stable cash flows, and balanced debt levels.

A diversified portfolio with a long-term focus can help investors weather market downturns and benefit from compounding returns.

The table below summarizes the strengths of different investment strategies:

| Investment Strategy | Strengths |

|---|---|

| Markowitz Mean-Variance | Maximizes expected return for a given risk level; widely used and theoretically grounded |

| Risk Parity | Emphasizes equal risk contribution; offers better diversification and risk-adjusted returns |

| Factor Investing | Targets specific risk premia; shows promising risk-adjusted returns |

A portfolio that combines these strengths can adapt to changing market conditions and support steady investment growth.

Weaknesses

Despite its strengths, Kamala Harris’s investment portfolio faces some weaknesses. Every investment strategy has limitations, and her approach is no exception. The portfolio relies on accurate data and sound assumptions. Inaccurate data or subjective inputs can affect portfolio performance. The choice of benchmarks and risk models can also influence results and may mislead investors.

The table below highlights common weaknesses in investment strategies:

| Limitation Category | Description |

|---|---|

| Data Quality and Availability | Reliable data on asset prices and risk measures can be scarce, especially for illiquid assets. |

| Subjectivity and Assumptions | Calculations depend on subjective inputs, introducing bias. |

| Sensitivity to Benchmark | Benchmark choice can mislead performance assessment. |

| Inability to Capture Tail Risk | Historical data may underestimate extreme event risks. |

- Case studies often lack scientific rigor and may not apply to all situations.

- Complex transactions, such as mergers or stock splits, can make portfolio tracking difficult.

- Limited tax efficiency may restrict strategic tax planning within the portfolio.

No single investment portfolio can eliminate all risks. Investors should recognize these weaknesses and use ongoing monitoring and risk management to protect their investment goals.

Kamala Harris’s investment strategy stands out for its conservative, diversified, and transparent approach. She spreads her investment across mutual funds, index funds, bonds, and property. This method helps her manage risk and build long-term wealth. She uses investment choices that follow strict rules and public disclosure. Her investment portfolio avoids risky bets and focuses on steady growth.

Investors can learn from her example. Consider these tips for safe investing:

- Use diversification in every investment decision.

- Choose passive investment funds for lower costs.

- Follow all investment regulations and keep clear records.

- Review each investment for long-term value.

Her investment strategy shows that careful planning and discipline can help anyone reach their financial goals.

FAQ

What types of funds does Kamala Harris prefer in her portfolio?

Kamala Harris prefers index funds, mutual funds, and target-date funds. She avoids individual stock picking. This approach helps her reduce risk and maintain steady growth over time.

How does diversification help her investment strategy?

Diversification spreads investments across different asset classes and sectors. This reduces the impact of losses in any one area. Her portfolio can better withstand market changes and volatility.

Are there any conflicts of interest in her investments?

Kamala Harris follows strict disclosure rules and compliance standards. She avoids direct investments in companies that could create conflicts of interest. Her transparency builds public trust.

Does Kamala Harris invest in international markets?

Her portfolio mainly focuses on U.S. funds. Some index and mutual funds may include international exposure. She does not concentrate on specific foreign markets like China.

How does she ensure compliance with regulations?

She files regular financial disclosure reports. These reports follow SEC and government ethics guidelines. Compliance software and audits help her maintain accuracy and transparency.

Kamala Harris’s disciplined, diversified approach highlights the importance of managing costs and risks in investing. BiyaPay offers a powerful tool to enhance your investment strategy with its multi-asset wallet, enabling free conversions between USDT and over 200 cryptocurrencies into fiat currencies like USD or HKD. This eliminates costly exchange fees, allowing you to efficiently allocate funds across mutual funds, index funds, or property investments. With remittance fees as low as 0.5%, BiyaPay ensures cost-effective transfers, supporting your long-term wealth-building goals. Its secure platform and one-minute registration process provide the reliability and simplicity needed to stay focused on your portfolio. Ready to optimize your investments with ease? Join BiyaPay today and start building a diversified portfolio with confidence.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.