- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Simple Steps to Take When the Stock Market Takes a Dive

Image Source: pexels

If you feel nervous when you see your account balance drop, you are not alone. Many investors wonder why are stocks dropping today and what they should do next. The truth is, a market downturn can feel scary, but history shows these periods do not last forever.

Here are some facts to help you stay calm:

- Bear markets have appeared only about 21.4% of the time in the last 95 years.

- Markets have risen about 78% of the time.

- Most downturns last less than a year.

Market Event Approximate Drop Recovery Time to Previous High 1930s Great Depression 85% 25 years Dot-com Bust (Nasdaq, 2000) 85% 16 years Post-World War II Losses Various About 7 years

You can focus on your long-term goals and take small steps to manage risk. Remember, every downturn is part of investing, and the market has always recovered.

Key Takeaways

- Stay calm during market drops and avoid panic selling to protect your investments and benefit from recoveries.

- Understand common causes of stock drops like global events and economic changes to stay informed and avoid fear-driven decisions.

- Review your investment plan and risk tolerance regularly to keep your strategy aligned with your goals.

- Diversify your portfolio across different asset types to reduce risk and help your investments recover faster.

- Keep investing regularly using dollar cost averaging to buy more shares at lower prices and build wealth over time.

Why Are Stocks Dropping Today

Common Causes

You might wonder, why are stocks dropping today? There are many reasons, and sometimes it feels like the news changes every hour. Some days, you see headlines about big events around the world. Other days, you hear about changes in the economy or new rules from the government. These things can all affect investor sentiment and cause market dips.

Here are some common causes of a market downturn:

- Geopolitical tensions, like recent conflicts between Israel and Iran, can make investors nervous. When this happens, people often move their money into safer places, such as gold or the U.S. dollar.

- Oil prices can jump quickly. For example, oil prices recently surged by 8% because of worries about supply. This often leads to short-term drops in stock prices.

- Technical indicators, like the RSI Bearish and MACD crossover, can signal that stocks might fall. When these indicators show a negative trend, many investors react by selling.

- Sometimes, even good news, like softer inflation data, gets ignored if there is too much market volatility or fear.

You can see from history that these causes are not new. Here’s a quick look at some past events:

| Year | Event Name | Common Causes and Triggers | Impact and Notes |

|---|---|---|---|

| 1929 | Great Depression | Overspeculation, excessive margin trading | Massive market collapse, loss of $14 billion in two days, led to long-term economic downturn |

| 1987 | Black Monday | Automated trading, overvalued stocks, market volatility | Largest one-day percentage drop in history |

| 2000 | Dot-Com Bubble Burst | Speculation in tech stocks | Sharp market downturn following tech stock bubble burst |

| 2008 | Financial Crisis | Housing market collapse, risky mortgage-backed securities, poor regulation | Global credit crisis, collapse of major financial institutions, government bailouts |

| 2020 | COVID-19 Crash | Global pandemic, economic shutdowns, uncertainty | Rapid market decline due to pandemic fears, followed by government and Federal Reserve interventions |

Even though these events caused a downturn, markets have always bounced back. A prolonged market downturn can feel scary, but history shows recovery is possible.

Staying Informed

You might ask yourself, why are stocks dropping today, and how can you keep up? Staying informed helps you understand what’s happening and keeps you from making quick decisions based on fear. Try these tips:

- Check reliable news sources, but don’t let headlines control your emotions.

- Watch for changes in investor sentiment. If you notice more people talking about fear or uncertainty, it can signal a downturn or even a prolonged market downturn.

- Pay attention to technical indicators. Tools like the RSI Bearish and MACD crossover can help you spot when stocks might drop.

- Remember, market volatility is normal. Even when stocks fall, the market usually recovers within six months to a year.

If you focus on the facts and avoid panic, you can handle market dips with more confidence. The answer to why are stocks dropping today often comes down to a mix of news, investor sentiment, and technical signals. Stay calm, stay informed, and remember that every downturn is part of the investing journey.

Stay Calm During a Market Crash

Image Source: unsplash

When you see the headlines about a stock market crash, your first reaction might be fear. That’s normal. But letting emotions take over can hurt your investments more than the crash itself. Staying calm is one of the most important things you can do.

Avoid Panic Selling

Panic selling happens when you let fear push you to sell your investments quickly during a stock market crash. This often leads to bigger losses. Here’s why:

- Panic selling usually means you sell at a low price, locking in your losses.

- Many investors who sell during a market crash miss out on the rebound that often follows.

- Studies show that emotional trading, especially during a stock market crash, can make losses worse. For example, research on the 2015 China stock market crash found that when fear spread on social media, the chance of a crash went up by almost 10% during the event and over 17% after. This shows how quickly emotions can move the market.

Take a look at this table to see how panic selling compares to staying invested:

| What Happens | If You Panic Sell | If You Stay Invested |

|---|---|---|

| During a stock market crash | Lock in losses | Ride out the downturn |

| After the crash | Miss the rebound | Benefit from recovery |

| Long-term results | Lower returns | Higher returns over time |

Tip: Remind yourself that the market has always bounced back after a crash. Staying invested helps you avoid costly mistakes.

Manage Emotions

Managing your emotions during a stock market crash can help you make better choices. Here are some simple ways to keep calm:

- Limit how often you check your account. Watching every dip can make you more anxious.

- Turn off the news for a while. Too much information can make the market crash feel even scarier.

- Talk to someone you trust, like a friend or financial advisor, when you feel worried.

- Take care of yourself. Go for a walk, breathe deeply, or do something you enjoy.

Building emotional strength helps you avoid panic selling and stick to your plan. Investors who manage their emotions well often see better results. Using tools like automatic investing or joining a supportive community can also help you stay disciplined during market volatility.

Remember, a stock market crash is tough, but you can get through it by staying calm and making smart choices.

Review Your Goals and Risk

Check Your Plan

When the market takes a hit, you might feel unsure about your next move. This is the perfect time to look at your investing strategy and see if it still matches your goals. Think of your plan as a map for your financial journey. If you have a policy benchmark, use it as your main guide. This benchmark acts like a five-year business plan for your investments. It helps you measure how well your portfolio is doing and keeps you focused on your long-term goals.

Here are some steps you can follow:

- Compare your current portfolio to your policy benchmark. This helps you see if you are on track.

- Review your plan every year or when big life changes happen.

- Check if your plan covers things like how much risk you want, how much cash you need, and how long you plan to invest.

- Use your benchmark to see if your investment decisions match your investing strategy, especially during a market downturn.

Research shows that sticking to your plan works. During the COVID-19 crash, investors who followed their pre-set investing strategy sold less and bought more. They avoided panic selling and saw better recovery returns. Even if your portfolio drops by 20%, you can get back on track by making small changes, like saving a bit more or spending a bit less.

Tip: Your plan is there to help you stay calm and make smart choices, even when the market feels shaky.

Assess Risk Tolerance

Understanding your risk tolerance is key to making good investment decisions. Risk tolerance means how much ups and downs you can handle without losing sleep. You can use simple tools like questionnaires or talk with a financial advisor to figure this out.

Some ways experts measure risk tolerance include:

- Using surveys that check if your answers stay the same over time.

- Looking at how you react to different market conditions, like a market downturn.

- Matching your choices to model portfolios and seeing if you fit into groups like passive investors or trend followers.

- Adjusting your risk level based on how long you plan to invest.

You can also use an investment policy statement to remind yourself of your risk level. This helps you stick to your strategies and avoid making quick changes when the market gets rough. By knowing your risk tolerance, you can build an investing strategy that fits you and helps you stay on course, no matter what the market does.

Diversify Your Portfolio

Image Source: pexels

When you hear about a stock market crash, you might feel like you need to do something fast. One of the best steps you can take is diversifying your portfolio. This means you spread your money across different types of investments. You do not put all your eggs in one basket. Instead, you mix things up to help protect yourself from big losses.

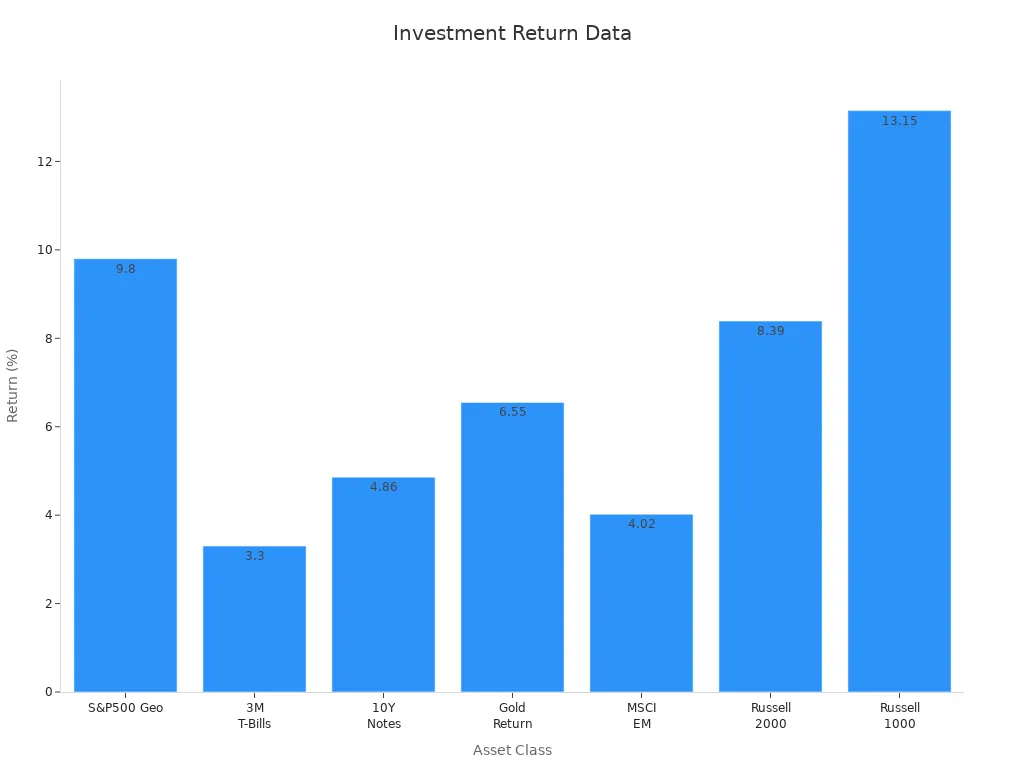

Asset Classes

You have many choices when you build your portfolio. You can invest in stocks, bonds, commodities like gold, and cash equivalents such as money market funds. Each asset class reacts differently during a stock market crash. For example, when stocks fall, bonds or cash equivalents might hold steady or even go up. By diversifying your portfolio, you give yourself a better chance to ride out tough times.

Here’s a simple table to show how different asset classes can help:

| Asset Class | What Happens in a Crash? | Why Include It? |

|---|---|---|

| Stocks | Can drop sharply | Growth over long term |

| Bonds | Often more stable | Lower risk, steady income |

| Commodities | Sometimes rise (like gold) | Hedge against inflation |

| Cash Equivalents | Usually stay steady | Easy access, less risk |

You can think of this as hedging your bets. If one part of your portfolio drops, another part might help balance things out.

Reducing Risk

Diversifying your portfolio is not just about having lots of investments. It is about choosing different types that do not always move together. During a stock market crash, all stocks might fall at once, even in different countries. But if you also own bonds, commodities, and cash equivalents, you lower your risk.

Historical data shows that diversified portfolios lose less money during big downturns. For example, during the Global Financial Crisis, investors who held a mix of stocks, bonds, and other assets saw smaller drops than those who only owned stocks. Even when bonds and stocks both fell in 2022, history suggests that mixing them still works over the long run.

- Diversifying your portfolio helps you avoid severe losses.

- It smooths out the ups and downs, so you do not have to worry as much during a stock market crash.

- You can keep your plan on track and recover faster when the market bounces back.

Tip: Diversifying your portfolio is a smart way to manage risk and protect your money, no matter what the market does.

Keep Investing with Dollar Cost Averaging

Regular Contributions

You might feel nervous about putting money into the market when prices are falling. But making regular contributions is one of the smartest moves you can make. This approach is called dollar cost averaging. You invest a set amount of money at regular intervals, no matter what the market is doing. This way, you buy more shares when prices are low and fewer when prices are high.

Let’s look at a simple example. If you invest $500 every month for 10 months, you might buy shares at different prices each time. Over time, you end up with more shares at a lower average price. Here’s how it works:

| Investment Period | Amount Invested | Share Price | Shares Bought |

|---|---|---|---|

| 1 | $500 | $12 | 41.67 |

| 2 | $500 | $11 | 45.45 |

| 3 | $500 | $10 | 50.00 |

| … | … | … | … |

| 10 | $500 | $9 | 55.56 |

By sticking to your plan and making regular contributions, you avoid trying to guess the best time to buy. This makes your investing strategy simple and less stressful.

Tip: If you keep investing regularly, you build wealth over time—even when the market feels shaky.

Benefits in a Market Crash

Dollar cost averaging really shines during a market crash. When prices drop, your fixed investment buys more shares. Over time, this lowers your average cost per share. Here are some key points:

- During big crashes like 1973-1974, 2000-2002, and 2007-2009, dollar cost averaging often beats lump sum investing.

- In the early 2000s dot-com crash, investing $1,000 each month for 70 months gave about a 28% return. This was much better than putting money in a savings account.

- If you try to invest a lump sum at the perfect time, you might miss out. Dollar-cost averaging helps you avoid this risk.

Staying consistent pays off. Warren Buffett once said that if you had invested $100 in 1928 and kept it in the market, it would have grown to over $982,000 today. This shows the power of sticking with your plan, even during tough times.

Note: Dollar-cost averaging helps you stay calm and focused. You do not need to worry about timing the market. Just keep your investing strategy steady and let time do the work.

Look for Opportunities in a Stock Market Crash

A stock market crash can feel scary, but it also brings new opportunities. When prices drop, you get the chance to buy strong companies at lower prices and improve your long-term returns. Let’s look at two smart ways you can make the most of a market crash.

Buying Quality Stocks

During a stock market crash, many investors rush to sell. This can push prices down, even for companies with strong profits and good business models. You can use this time to look for quality stocks. These are companies with steady earnings, strong assets, and a history of bouncing back after tough times.

Quality stocks often recover faster after a market crash. Big investors, like mutual funds and pension funds, usually buy these stocks during a recovery. Their buying power helps prices rise again. Research from past crashes, like the 2007–2009 crisis, shows that when these investors return, quality stocks bounce back first. Smaller or riskier stocks take longer to recover.

You can spot opportunities by looking at:

- Price charts for support and resistance levels

- Moving averages to see if a trend is changing

- Candlestick patterns that show when a stock might turn around

If you focus on quality and avoid chasing risky, undervalued companies, you give yourself a better shot at long-term growth.

Tax-Loss Harvesting

A stock market crash can also help you save on taxes. If you sell investments that have lost value, you can use those losses to lower your tax bill. This is called tax-loss harvesting. When the market is more volatile, you can find more chances to harvest losses.

For example, if your portfolio drops during a crash, you might harvest enough losses to save up to 1% of your total investment in taxes each year. On a $10 million portfolio, that’s $100,000 in savings. You can also use extra losses to offset up to $3,000 of regular income each year, and carry forward any unused losses.

Tip: Use technology or talk to a financial advisor to help you spot tax-loss harvesting opportunities all year, not just at the end.

A stock market crash is tough, but if you stay calm and look for opportunities, you can come out stronger.

Rebalance When Needed

When to Rebalance

You might wonder when you should rebalance your portfolio. The answer is not always simple, but there are some clear signals you can watch for. One common method is to set a threshold. For example, if you want stocks to make up 50% of your portfolio, you can set a 20% band. If stocks rise above 60% or fall below 40%, it is time to rebalance. This approach helps you avoid making too many trades and keeps your costs low.

Here’s a quick table to show different ways you can decide when to rebalance:

| Signal Type | Description | Example Trigger |

|---|---|---|

| Fixed Percentage Deviation | Rebalance if an asset moves by a set percent | 5% above or below goal |

| Relative Rebalancing Band | Use a band based on the original target | 20% of target amount |

| Time-Based | Rebalance on a set schedule (quarterly, yearly, etc.) | Every 12 months |

Many investors find that using a 20% band works well. It keeps your portfolio close to your plan without causing too many trades or tax bills.

Tip: You do not need to rebalance every time the market moves. Wait until your investments drift far enough from your targets.

How to Adjust

When you rebalance, you bring your investments back to your target mix. This means selling some assets that have grown and buying more of those that have dropped. Research shows that this process can actually boost your returns and lower your risk. For example, portfolios rebalanced monthly between stocks, gold, and Treasury futures saw about 1.2% higher returns each year, with less risk.

You should look at all your accounts, like IRAs and 401(k)s, to make sure your whole portfolio matches your goals. Rebalancing also helps you avoid putting too much money into one asset that might become risky. You can use this time to spread out capital gains, harvest tax losses, or even make gifts to charity.

Note: Rebalancing is not just about numbers. It helps you stay on track with your goals and keeps your risk in check, even when the market feels wild.

By checking your portfolio and making small changes when needed, you keep your investments working for you—no matter what the market does.

Think Long Term

Market Recovery

When you look at the stock market, it can feel like a wild ride. One day, prices drop. The next, they bounce back. If you keep a long-term focus, you will see that every major downturn has ended with a recovery. In fact, after a big drop, the market has delivered an average return of about 56% over three years and more than 200% over ten years. That is a huge difference for anyone who chooses to stay invested.

Take a look at how quickly some markets have bounced back:

| Market Event | Decline Magnitude | Recovery Duration | Key Factors Influencing Recovery |

|---|---|---|---|

| Covid-19 Pandemic Crash | Sharp decline | 141 days to pre-crash levels | Rapid government interventions and quantitative easing |

| Tariff-Induced Sell-Off | ~20% drop | N/A | Geopolitical tensions and trade war fears |

| Dotcom Bubble Burst | Over 20% decline | Much longer, drawn out | Elevated asset prices and rising interest rates |

| Global Financial Crisis (2007-09) | Severe market collapse | Extended recovery period | Housing market downturn, financial institution failures |

Market corrections of 10% or more happen about every two years. Most recoveries take just a few months. Even when the downturn feels endless, history shows that patience pays off. You can find new opportunities when others are afraid to act.

Staying the Course

It is easy to panic when you see your investments fall. But if you stick to your plan, you give yourself the best chance to grow your money. Many companies keep investing in research and development, even during tough times. For example:

- Firms increased R&D spending from $30.93 billion in 1980 to $297.28 billion in 2013, showing their belief in future growth.

- Momentum strategies often bring profits over three to twelve months, so holding your investments can pay off.

- Contrarian strategies—buying when others sell—work well over both short and long periods.

You might feel the urge to sell during a downturn, but that is when many of the best opportunities appear. Markets often overreact, and if you stay calm, you can benefit from the rebound. Every crash in the past century has ended with new highs. Investors who keep their long-term focus and avoid panic selling usually come out ahead.

Tip: Remember, short-term drops do not erase the value of strong companies. If you stay invested and look for opportunities, you set yourself up for future success.

You can handle sudden market drops by staying calm, reviewing your plan, and keeping your focus on the long term. Here’s why discipline pays off:

- Staying invested helps you catch market recoveries and the best trading days.

- Most downturns are short compared to long-term growth.

- Regular rebalancing keeps your risk in check.

Stick to your plan. The market has always bounced back, and your patience will pay off.

FAQ

What should you do if the market keeps dropping?

Stay calm. Review your plan and avoid making quick decisions. If you feel worried, talk to a financial advisor. Remember, markets often recover over time.

Is it a good idea to sell all your stocks during a crash?

No, selling everything can lock in your losses. If you stay invested, you give yourself a better chance to recover when the market bounces back.

How often should you check your investment account during a downturn?

Try not to check your account every day. Checking too often can make you anxious. Set a schedule, like once a month, to review your investments.

Can you still invest during a market crash?

Yes, you can. Many investors keep investing during downturns. You might find good opportunities to buy strong companies at lower prices.

How does diversification help in a market crash?

Diversification spreads your money across different types of investments. If one part drops, another might hold steady. This helps protect your portfolio from big losses.

As market downturns test investor resilience, managing costs and maintaining flexibility are crucial for long-term success. BiyaPay simplifies your investment strategy with its multi-asset wallet, offering free conversions between USDT and over 200 cryptocurrencies into fiat currencies like USD or HKD. This eliminates costly exchange fees, allowing you to diversify into bonds or commodities during volatility. With remittance fees as low as 0.5%, BiyaPay ensures efficient fund reallocations to seize opportunities in quality stocks. Its secure platform and one-minute registration provide the reliability you need to stay focused. Don’t let market dips derail your goals—sign up with BiyaPay today and navigate volatility with confidence.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.