- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

A Step-by-Step Guide to Finding the Easiest Trading App for Beginners

Image Source: unsplash

You want the best trading app for beginners, right? Look for a user-friendly platform with simple design, clear menus, and one-tap actions. Apps like Robinhood, E*TRADE, Fidelity, SoFi, and M1 Finance make things easier for beginner investors. These apps focus on ease and offer strong educational resources. You will find low fees and plenty of education, so even beginner investors feel confident. Many user-friendly apps guide beginners with step-by-step tips and extra guidance. With the best trading app for beginners, you can start investing today.

Key Takeaways

- Choose trading apps with simple designs and clear menus to make your first trades easy and stress-free.

- Look for apps that offer strong educational resources like tutorials, demo accounts, and step-by-step guides to build your confidence.

- Pick platforms with low or no fees to keep more of your money working for you as you start investing.

- Use mobile-friendly apps with secure login and easy navigation so you can trade anytime and anywhere safely.

- Start small, practice with demo accounts, and use apps that support beginners with helpful tips and customer support.

Easy Trading App Features

Image Source: pexels

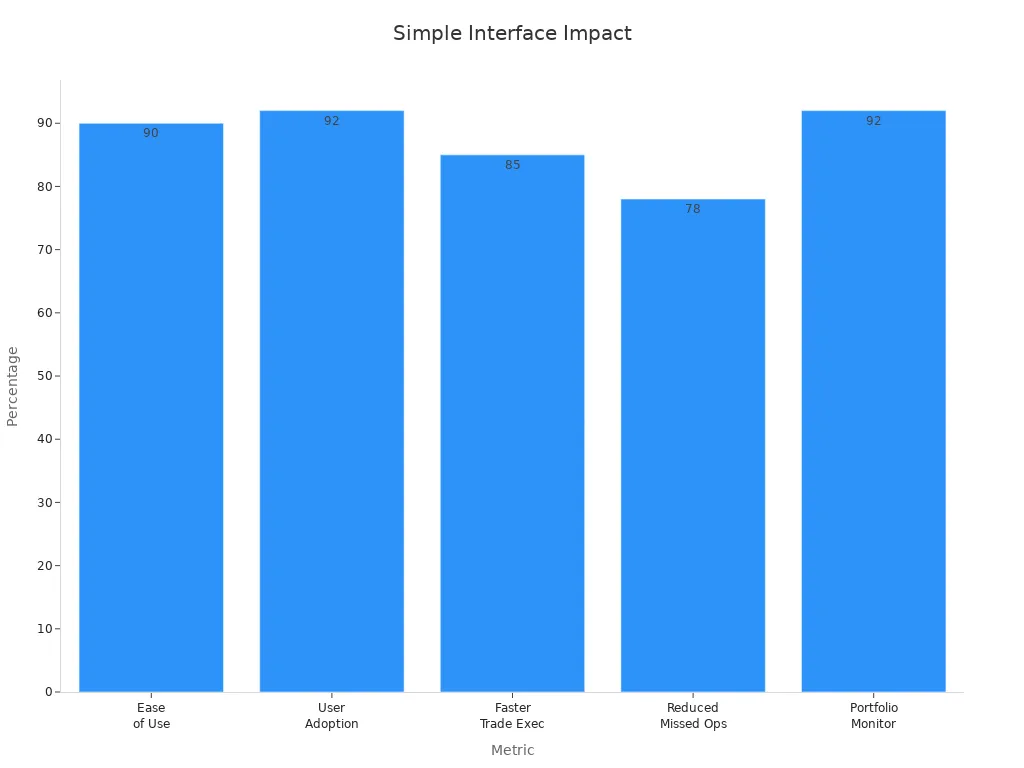

Simple Interface

When you open a trading platform for the first time, you want a simple user interface that feels welcoming. Many beginner investors feel overwhelmed by too many buttons and charts. The most important features for beginners are minimalist dashboards, one-tap buy or sell actions, and uncluttered layouts. A user-friendly interface helps you focus on what matters—making your first trade without confusion. Case studies show that apps designed for beginners use clear menus, dummy trading features, and easy navigation. These features help you learn trading basics before you risk real money.

| Key Feature | Description | User Benefits and Purpose |

|---|---|---|

| Clear visualization of core metrics | Focus on essential data points like trade volume, total revenue, and trader performance. | Enables quick understanding of key trading metrics and performance trends. |

| Simplicity and minimalism | Use of straightforward chart types and limited metrics to avoid clutter and complexity. | Facilitates easy interpretation and decision-making, especially for users needing quick insights. |

| Interactive and actionable insights | Options to assess, compare, identify top traders, and simulate potential revenue scenarios. | Allows users to explore data dynamically and optimize trading strategies based on insights. |

You can see how a user-friendly interface makes trading easier for beginners. In fact, apps with a simple interface get a high ease of use rating (4.5 out of 5) and a 92% adoption rate for commission-free apps. Most users report faster trade execution and better portfolio monitoring.

Educational Resources

You need strong educational resources when you start using a trading platform. Look for apps that offer tutorials, step-by-step guides, and even demo accounts. These features let you practice trading without risk. Many trading platforms for beginners include videos, articles, and quizzes to help you build confidence. Educational resources make it easier to understand how to buy stocks, track your portfolio, and learn new strategies. Some apps even have live webinars and community forums where you can ask questions and get advice from other beginner investors.

Tip: Always check if the app has a help center or FAQ section. This can save you time when you have questions.

Low Fees

Low fees are a big deal for beginner investors. You want to keep more of your money working for you. Many trading platforms now offer zero commissions, no account minimums, and no recurring fees. For example, SoFi Active Invest lets you start with just $1 and charges no account fees. Robinhood also offers commission-free trades and a $0 account minimum. These low fees help you grow your investments faster and make trading more accessible for beginners.

Mobile App Design

A user-friendly interface on your phone is key. Most beginners want to trade on the go, so mobile app design matters. The best trading platforms use a mobile-first approach with real-time data, customizable dashboards, and easy navigation. Features like dark mode, instant buy/sell, and secure login make trading comfortable and safe. Research shows that mobile-first design improves speed and ease, helping you place trades quickly and manage your portfolio anywhere. Security features like two-factor authentication and biometric login help you feel confident as you learn.

Best Trading App for Beginners

Top Picks Overview

You want to find the best trading app for beginners, so let’s look at the top choices. Many beginner investors start with apps like Robinhood, E*TRADE, Charles Schwab, Fidelity, SoFi, M1 Finance, Vanguard, and Firstrade. These best online brokers stand out because they make trading simple and stress-free. Each app offers unique features that help you learn and grow as an investor.

- Robinhood: You get a clean design and one-tap trades. Robinhood is famous for commission-free trading and a simple dashboard. Many users say it is the best trading app for beginners because you can start with just a few dollars.

- E*TRADE: This app gives you a mix of easy navigation and strong educational resources. You can watch videos, read articles, and even join webinars. E*TRADE is one of the best online brokers for learning the basics.

- Charles Schwab: You get commission-free trades, fractional shares, and great customer support. Schwab is a favorite for beginner investors who want a trusted name and lots of help.

- Fidelity: Fidelity offers a user-friendly app with low fees and a huge library of educational resources. You can find step-by-step guides and even practice with a demo account.

- SoFi: SoFi makes investing easy with a simple interface and no account minimums. You can also access financial planning tools and get help from real people.

- M1 Finance: This app lets you build custom portfolios with just a few taps. M1 Finance is perfect if you want to automate your investments and keep things simple.

- Vanguard: Vanguard is known for low-cost funds and a focus on long-term investing. You get a solid trading platform with lots of support for beginners.

- Firstrade: Firstrade offers commission-free trades and a simple app. You can find educational resources and get started with a small amount of money.

Expert reviews and user feedback support these recommendations. Many users praise these best online brokers for their ease of use, low costs, and strong educational resources. For example, Charles Schwab stands out for its customer support and fractional shares, while M1 Finance and SoFi get high marks for their easy-to-use apps and helpful features. Most reviews focus on how these apps help you learn and trade with confidence, even if you are new to investing.

User-Friendly Aspects

When you choose the best trading app for beginners, you want a trading platform that feels easy and safe. The best online brokers focus on user-friendly design, clear menus, and helpful support. Many apps offer educational resources like tutorials, articles, and demo accounts. These features help you learn at your own pace and avoid costly mistakes.

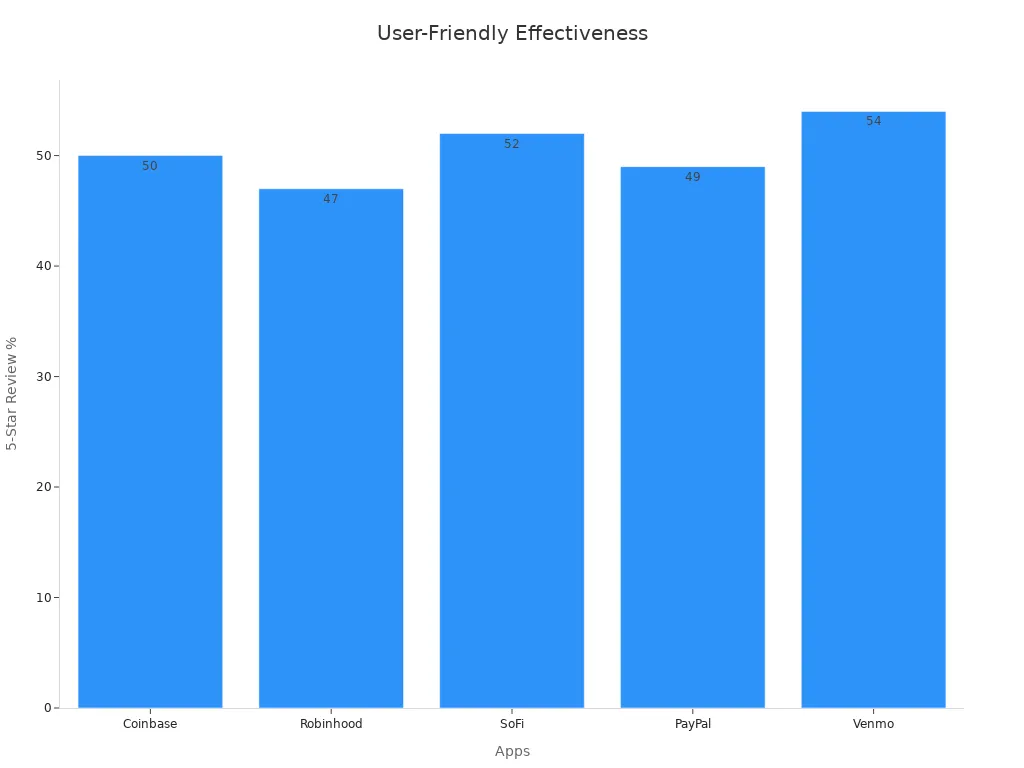

Let’s compare some user-friendly aspects and educational support across popular beginner trading apps:

| App | 5-Star Review % | User-Friendly Aspects Highlighted | Educational Support Evidence | Key User Quotes / Themes |

|---|---|---|---|---|

| Robinhood | ~47% | User-friendly experience (70%) | Tutorials, articles, beginner-friendly design | “Very easy to navigate.” “Great for beginners.” “The tutorials are easy to understand.” |

| SoFi | ~52% | Ease of use, intuitive interface | Informative articles, excellent customer service | “Managing my money is crazy easy!” “Easy to use and links to Cash App.” |

| Coinbase | ~50% | User-friendly experience (31%) | 8% mention educational content; clear explanations, accessible learning, motivating features | “It’s so easy to learn with how they explain everything.” “Very informative and easy to understand.” |

| PayPal | ~49% | User-friendly (23%), exceptional customer service (10%) | Customer service praised for quick, reliable support | “My account problem was solved quickly.” “Staff always ready to resolve issues.” |

| Venmo | ~54% | User-friendly experience (28%), fast and easy transactions | Intuitive design for easy money transfers | “Easiest and fastest way to send and receive money.” “Super easy to use and convenient.” |

You can see that user-friendly design and educational resources matter a lot to beginner investors. Robinhood and SoFi both get high marks for ease of use and helpful support. Many users say these apps make it easy to start trading, even if you have never invested before.

Most beginner trading apps focus on making your first steps simple. You get clear instructions, easy account setup, and fast trade execution. Many apps also offer practice accounts, so you can try trading without risking real money. These features help you build confidence and learn how the trading platform works.

Tip: Always check if the app offers live chat or phone support. Quick help can make your trading experience much smoother.

The best trading app for beginners gives you the tools, support, and confidence you need to start investing. You do not need to be an expert. With the right trading platform and educational resources, you can learn, grow, and reach your financial goals.

Best Stock Trading App for Beginners

Stock Trading Tools

When you look for the best stock trading app for beginners, you want tools that make your first steps simple. Many apps focus on user-friendly design and easy tools so you can start trading with confidence. You will find that the best stock trading app for beginners offers:

- Educational features that guide you through every step.

- Simple onboarding to help you set up your account.

- Investment profile quizzes that match you with the right stocks.

- Gamification, like points and badges, to keep you motivated.

- Special offers such as free trades or referral bonuses.

You also want low minimum trade values and transparent fees. Many apps let you buy fractional shares, so you can invest with just a few dollars. Customer support is always available if you need help. You get access to live pricing and can trade on different markets. These features make it easier for beginner investors to get started.

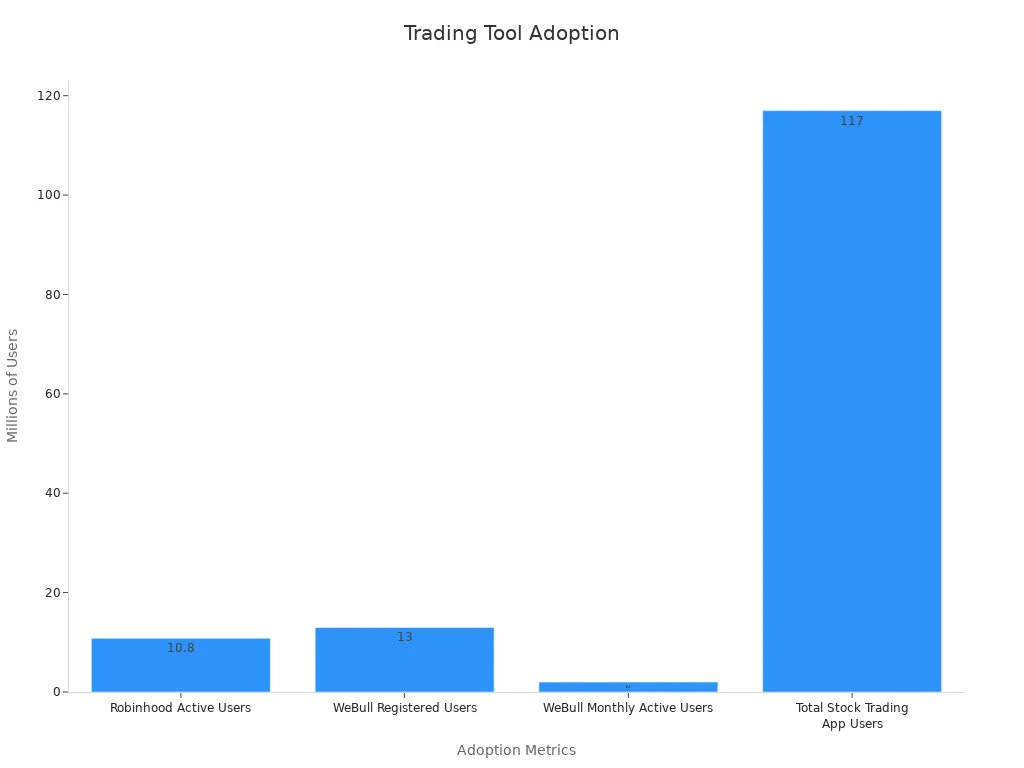

Here’s a look at how popular apps perform:

| Metric | Value | Explanation/Significance |

|---|---|---|

| Robinhood Active Users | 10.8 million | Largest active user base among stock trading apps |

| Robinhood Revenue (2023) | $1.8 billion | Leading revenue figure indicating strong market adoption |

| WeBull Registered Users | 13 million | High registered user count showing broad adoption |

| WeBull Monthly Active Users | 2 million | Active engagement metric validating tool usage |

| Total Stock Trading App Users | 117 million (2023) | Overall market size reflecting widespread tool adoption |

| Trade Republic Valuation | $5.3 billion | High valuation indicating investor confidence in platform |

| Robinhood Valuation | $16.9 billion | Market leader with over double the valuation of closest competitor |

| Stock Trading App Revenue | $20.6 billion (2023) | Total market revenue showing growth and tool strength |

| Revenue Growth Rate | 11.3% increase from previous year | Demonstrates expanding adoption and usage of trading tools |

You can see that millions of users trust these apps. The best stock trading app for beginners stands out by making trading simple and fun for everyone.

Automated Investing

If you want to invest but feel unsure, automated investing can help. Many of the best stock trading app for beginners now include robo-advisory features. These tools build and manage your portfolio for you. You answer a few questions, and the app creates a plan based on your goals.

- Robo-advisors charge lower fees than human advisors, so you save money.

- You can start with a small amount, sometimes even $1.

- The app buys and sells stocks automatically, so you do not need to worry about timing.

- Your investments stay balanced, which helps reduce risk.

- You can customize your plan to match your comfort level.

- The app works all day, every day, so your money is always managed.

Many beginner investors like automated investing because it removes stress and helps you avoid emotional mistakes. Apps like Vanguard Digital Advisor have won awards for being reliable and affordable. You get a user-friendly experience and strong support, which is perfect for beginner investors who want to grow their money with less effort.

How a Trading App Works for Beginners

Image Source: pexels

Account Setup

Getting started with a trading account for beginners is easier than you might think. Most apps guide you through easy onboarding steps. You just need your phone or computer, a valid ID, and some basic information. Here’s a simple way to set up your account:

- Download your chosen user-friendly app from the App Store or Google Play.

- Open the app and tap “Sign Up.”

- Enter your name, email, and create a password.

- Verify your identity with a photo ID.

- Link your bank account to add funds in USD (check the latest exchange rate if you use another currency).

- Review and accept the terms.

Many beginner investors finish these steps in just a few minutes. Some apps offer learning aids and demo trading, so you can practice before using real money. This helps you feel comfortable and confident as you start learning how to trade.

Tip: Always use a strong password and enable two-factor authentication for extra security.

Placing a Trade

Placing your first trade can feel exciting. Most trading apps for beginners make this process simple. You pick a stock, enter the amount you want to invest, and tap “Buy.” That’s it! Some apps even let you buy fractional shares, so you don’t need a lot of money to begin.

Here’s a quick checklist for placing your first trade:

- Search for the stock or fund you want.

- Tap “Buy” or “Trade.”

- Enter the amount in USD.

- Review your order.

- Confirm the trade.

Many beginner investors like to use demo accounts first. These practice modes let you try trading without risking real money. This is a great way to start learning how to trade and build your skills.

Trading platforms track how well users complete trades and stay engaged. Check out these success rates:

| Metric | Benchmark/Value | Impact/Notes |

|---|---|---|

| User Engagement Rate | 25%-30% | Shows active participation and satisfaction. |

| Trade Completion Rate | 70%-85% | Reflects how well users finish trades, showing process efficiency. |

| Customer Satisfaction Score | 85%-88% | Measures how happy users feel after trading. |

| Conversion Rate (Listings to Trades) | 10%-25% (varies) | Shows how often listings turn into trades, building trust. |

| User Retention Metrics | 60%-75% | Tracks how many users keep using the app over time. |

These numbers show that beginner investors find the process smooth and rewarding. When you use a trading app designed for beginners, you get support every step of the way. You can start learning how to trade, practice with demo accounts, and place real trades when you feel ready. That’s how a trading app works for beginners—simple, safe, and supportive.

Trading App Download and Start

Download Steps

Ready to get started? The trading app download process is quick and easy for beginners. Here’s a simple checklist to help you choose and install the right app:

- Research your options. Look for apps with high ratings, clear menus, and strong educational resources. Read user reviews and check for recommendations from trusted sources.

- Check fees and features. Make sure the app offers commission-free trades, low minimums, and tools that fit your needs.

- Visit the official app store. Search for your chosen app in the App Store or Google Play. Always download from the official source to keep your information safe.

- Start the trading app download. Tap “Install” and wait for the app to finish downloading.

- Open the app and sign up. Enter your details, verify your identity, and link your bank account. Most apps guide you step by step, so you won’t feel lost.

Tip: Many apps offer demo accounts. Try these first if you want to practice before using real money.

First-Time Tips

Your first time using a trading app can feel exciting. To make your experience smooth, keep these tips in mind:

- Set up security features like two-factor authentication. This keeps your account safe.

- Explore the app’s tutorials and help center. Many beginners find these resources helpful for learning the basics.

- Turn on push notifications for important updates, but adjust the settings if you get too many alerts.

- Check the accessibility settings. Good apps make sure everyone can use them, including users with disabilities.

- Give feedback through in-app surveys. Companies use your answers to improve onboarding and make the app easier for beginners.

User satisfaction surveys show that people value clear payment processes, easy navigation, and strong privacy controls. When you follow these recommendations, you set yourself up for a positive start. Remember, the right trading app download can make investing simple and fun.

You now know how to pick the easiest trading app and start your journey. First, look for simple design and clear steps. Next, check for strong support and helpful guides. Use the checklist above to make your choice. Remember, you can start small and learn as you go. Take action today and see how trading can help you reach your goals.

FAQ

What is the easiest trading app for beginners?

You might find Robinhood, SoFi, or M1 Finance the easiest to use. These apps have simple designs, clear menus, and helpful guides. You can start trading with just a few taps.

Do I need a lot of money to start trading?

No, you do not need much money. Many apps let you start with as little as $1 USD. You can buy fractional shares and build your portfolio over time.

Are trading apps safe for beginners?

Most trading apps use strong security features like two-factor authentication and encryption. Always use a secure password and enable extra security settings. This helps keep your account safe.

Can I practice trading before using real money?

Yes! Many trading apps offer demo accounts or practice modes. You can try trading with virtual money first. This helps you learn how the app works without any risk.

Starting your trading journey as a beginner requires a platform that’s simple, cost-effective, and secure. BiyaPay makes it easy with its multi-asset wallet, offering free conversions between USDT and over 200 cryptocurrencies into fiat currencies like USD or HKD. This eliminates costly exchange fees, letting you keep more of your investment. With remittance fees as low as 0.5%, BiyaPay ensures affordable fund transfers, perfect for building your portfolio on a user-friendly app. Its secure platform and one-minute registration get you trading quickly and confidently. Ready to start investing with ease? Download BiyaPay today and take your first steps toward financial success!

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.