- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

How to Stay Calm and Invest Wisely During Uncertain Markets

Image Source: unsplash

You might feel stressed when markets swing up and down. That’s normal. Studies show that market volatility can cause real anxiety, even for people who expect it. News stories and social media can make you worry about sudden drops or try to chase the next big thing. It helps to remember that a strong investment strategy keeps you focused, even when you hear talk about stock market crash prediction. Staying calm gives you more control over your choices.

Key Takeaways

- Stay calm during market swings by following your investment plan and avoiding emotional decisions.

- Keep a long-term focus to ride out market drops and benefit from recoveries over time.

- Diversify your investments across stocks, bonds, and real assets to reduce risk and smooth returns.

- Invest regularly using dollar-cost averaging to lower risk and avoid trying to time the market.

- Know your risk tolerance and liquidity needs, and seek professional advice when unsure to stay on track.

Volatile Markets: Manage Emotions

Image Source: unsplash

Emotional Traps

You might notice your feelings change quickly when you see big swings in the market. Sometimes, you feel excited and want to buy more. Other times, fear makes you want to sell everything. These emotional traps can lead you to make choices you regret later. Research shows that moods and emotions play a big role in how you decide what to do during dramatic market changes. For example, when you feel happy, you might think things will always get better and ignore risks. When you feel worried or upset, you might focus more on danger and forget about possible gains.

Many investors fall into common traps during volatile markets:

- Overreacting to news: News stories and social media can make things seem worse than they are. This can cause you to act too quickly.

- Following the crowd: You might copy what others do, even if it does not fit your plan.

- Regret and second-guessing: You may feel bad about past choices and try to fix them by making new, risky moves.

Tip: Write down your investment goals and rules. When you feel unsure, look at your plan before making any changes. This helps you manage emotions and stick to your strategy.

Studies also show that many investors earn less than they could because they let emotions guide their decisions. Overconfidence and herding—when you follow what everyone else is doing—often lead to more buying and selling, which can hurt your returns. Try to notice when your feelings are driving your choices. Take a step back and ask yourself if your actions match your long-term goals.

Avoid Panic Selling

Panic selling happens when you feel scared during a market drop and rush to sell your investments. This is a common mistake in volatile markets. When you sell in a panic, you often lock in losses and miss out when the market recovers. Many people who panic sell end up with less money and more stress.

- Panic selling can cause you to lose money and miss future gains.

- It can break your long-term plan and delay your financial goals.

- You might feel anxious or upset after selling, especially if the market bounces back.

Behavioral finance experts say that panic selling is driven by fear and quick reactions. News and social media can make these feelings stronger. Sometimes, people think they know more than they do and act too fast, which can make things worse.

Note: Try to stay calm and remember why you invested in the first place. If you feel the urge to sell, take a break and talk to someone you trust. Reviewing your plan can help you avoid rash decisions.

You can protect yourself from panic selling by setting up automatic investments, spreading your money across different types of assets, and checking your plan regularly. These steps create a barrier between your emotions and your actions. They help you stay focused, even when markets feel wild.

Investment Strategy Basics

Long-Term Investment Strategy

When markets feel shaky, you might wonder if you should change your plan. Sticking to a long-term investment strategy is one of the best ways to handle ups and downs. You do not need to guess what will happen next week or next month. Instead, you focus on your goals and let time work for you.

Market corrections happen often. On average, you see a drop of 10% or more every 1.6 years. Bigger drops, like 20% or even 30%, also show up from time to time. Over the past 94 years, the average market drop was about -16.5%. Even with these drops, markets have always bounced back and reached new highs. If you keep your money invested, you give yourself a chance to recover from losses and enjoy future gains.

Here are some facts that show why a long-term focus works:

- The S&P 500 has returned over 10% per year on average. This gives you confidence in a long-term perspective.

- Experts like Warren Buffett and Benjamin Graham say that buy-and-hold investing is the best way to build wealth.

- If you had invested $1,000 in the U.S. stock market in 1926, you would have over $15 million by 2024. That is the power of compounding.

- From 1936 to 2024, the U.S. stock market never had negative returns on any rolling 20-year basis.

- Missing just the five best days in the market over 20 years can cut your returns by more than half.

You can see that a long-term strategy helps you ride out the rough times. It also lets you take advantage of investment opportunities that come up when prices drop. If you try to jump in and out of the market, you might miss the best days and lose out on growth.

Tip: Keep at least three years of cash or safe assets. This “dry powder” helps you avoid panic selling when markets fall. Bonds often rise when stocks drop, giving you a buffer and more choices.

A long-term investment strategy also means you pay less in taxes and fees. You get to enjoy compounding dividends and steady growth. When you stay patient and disciplined, you give yourself the best shot at reaching your goals.

Stock Market Crash Prediction Myths

You might hear people talk about stock market crash prediction as if it is easy. Some claim they know when the next big drop will happen. The truth is, predicting crashes is very hard. Even experts with fancy tools and models struggle to get it right.

Let’s look at what research says about stock market crash prediction:

| Aspect | Evidence Summary |

|---|---|

| Difficulty of Prediction | Crashes are rare and complex. They do not follow simple patterns. Most models cannot predict them well. |

| Machine Learning Advantage | Some machine learning models do better than old methods. They use many types of data, but still cannot predict every crash. |

| Multivariate vs Univariate Models | Using many factors, like prices and news, helps a bit. Still, no model is perfect. |

| Economic Implications | Good models can help investors and policymakers, but they are not foolproof. |

| Limitations | No one can predict every crash. The causes are not always clear. Models cannot always tell if a bubble will burst. |

| Definition of Crash | Experts call a crash any month with returns below the 5th percentile over ten years. |

| Empirical Findings on Predictors | Big price jumps do not always mean a crash is coming. Sometimes, they just mean more risk. |

| Investor Behavior | Many people think crashes will happen more often than they do. This fear can lead to bad choices. |

Trying to time the market based on stock market crash prediction can hurt your returns. If you sell when you feel scared, you might miss the rebound. Many investors who try to predict crashes end up buying high and selling low. This behavior leads to lower gains over time.

A long-term focus helps you ignore the noise. You do not need to guess when the next crash will happen. Instead, you look for investment opportunities that fit your plan. You keep your eyes on your goals and trust your investment strategy.

Note: No one can predict the future. The best way to grow your money is to stay invested, stay calm, and stick to your long-term strategy.

Diversification and Rebalancing

Image Source: pexels

Asset Classes

You might wonder why people always talk about diversification. It means spreading your money across different types of investments, like stocks, bonds, and real assets such as gold or real estate. This helps protect your investment portfolio from big losses when one part of the market drops. If stocks go down, bonds or gold might hold steady or even rise. That way, you do not lose everything at once.

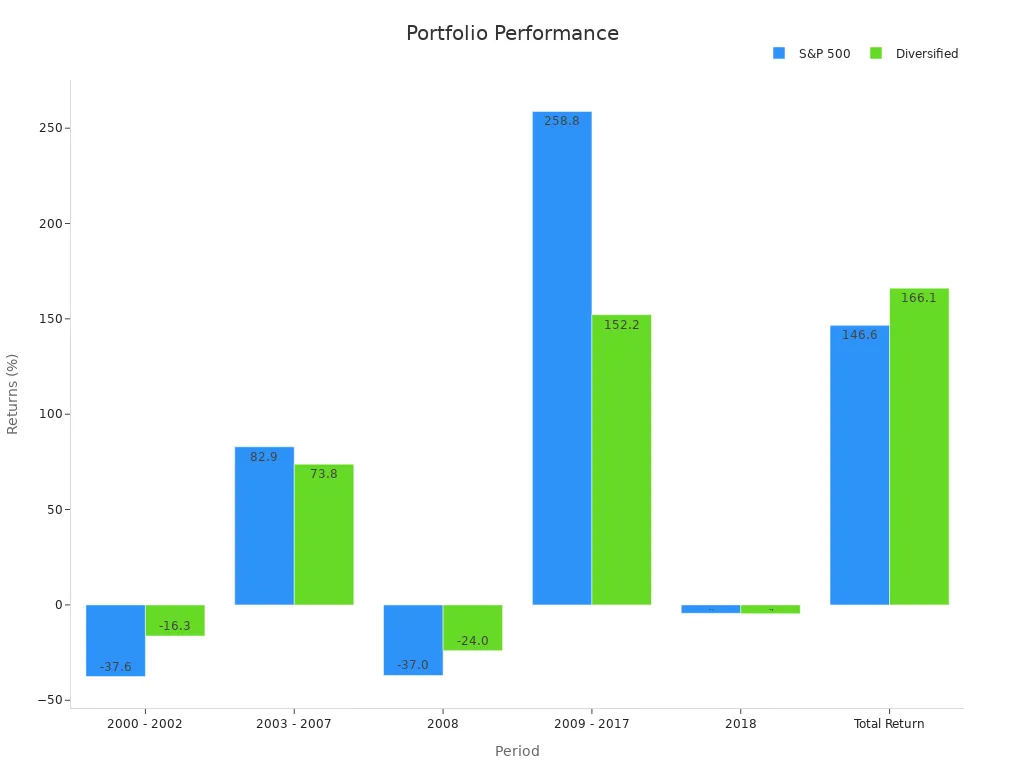

Take a look at how a diversified portfolio compares to just owning stocks:

| Period | S&P 500 Return | Diversified Portfolio Return |

|---|---|---|

| 2000 - 2002 | -37.6% | -16.3% |

| 2003 - 2007 | +82.9% | +73.8% |

| 2008 | -37.0% | -24.0% |

| 2009 - 2017 | +258.8% | +152.2% |

| 2018 | -4.4% | -4.6% |

| Total Return | +146.6% | +166.1% |

| Growth of $100,000 | $246,570 | $266,060 |

You can see that portfolio diversification helps you avoid the worst losses and even grow your money more over time. Adding real assets like gold or real estate can also help. Gold often goes up when stocks or bonds fall, especially during inflation. This mix gives you a smoother ride and helps you stay on track with your financial goals.

Portfolio Rebalancing

Once you build a mix of assets, you need to keep it balanced. Over time, some investments will grow faster than others. If stocks do really well, they might take up too much space in your portfolio. This can make your risk higher than you want.

A rebalancing plan helps you fix this. You sell some of what has grown too much and buy more of what has lagged behind. This keeps your risk level steady and supports your investment goals. Rebalancing also helps you stick to your plan and avoid chasing trends.

- Rebalancing means you “sell high and buy low,” which can boost your long-term results.

- It keeps your portfolio from drifting into risky territory.

- You stay focused on your financial goals, not just short-term gains.

Try to check your mix at least once a year. This simple habit helps you manage risk and keeps your investment portfolio working for you.

Regular Investing Habits

Dollar-Cost Averaging

Dollar-cost averaging (DCA) means you put the same amount of money into your investments on a set schedule, like every month. You buy more shares when prices are low and fewer when prices are high. This simple habit helps you avoid guessing when to buy. You do not need to worry about picking the perfect time.

A study by the CFA Institute shows that DCA can lower your risk during tough markets. For example, in March 2020, a 60/40 portfolio lost about -24.1% in four weeks. If you used DCA, your loss would have been smaller, around -18.7%. DCA also smooths out the ups and downs, making your ride less bumpy. While lump-sum investing sometimes gives higher returns, DCA helps you stay calm and avoid big mistakes.

Tip: Set up automatic investments with your bank or through your Hong Kong bank account. This way, you stick to your plan without thinking about it.

Staying Consistent

Staying consistent means you keep investing, even when the market feels scary or exciting. Many people want to stop or change their plan when things get rough. Research shows that investors who check their accounts too often or try to time the market usually earn less. They let fear or greed guide their choices.

Behavioral finance experts say that regular investing habits help you fight these feelings. When you invest regularly, you do not let emotions take over. You accept that markets go up and down. This mindset helped many people during the 2008 and 2020 downturns. They kept investing and saw their money grow over time.

A steady plan also lets you enjoy the power of compounding. You build wealth slowly, but you build it strong. Many successful investors, like Warren Buffett, say that sticking to your plan is the real secret. You do not need to chase trends or try to outsmart the market. Just keep going, step by step.

Review Risk and Liquidity

Risk Tolerance

You need to know your risk tolerance before you make any big investment decisions. Risk tolerance is how much risk you feel comfortable taking with your money. Some people can handle big ups and downs in the market. Others feel nervous when their investments drop even a little. Your risk tolerance helps you build a financial plan that matches your comfort level.

Research shows that risk tolerance usually stays steady, even during wild markets. For example, a study of over 3,000 investors found that risk tolerance barely changed after the global financial crisis. Most people did not change their behavior much, even when the market dropped. What really changes is how you see risk. When the news is bad, you might feel more scared, even if your true risk tolerance stays the same.

Tip: Write down your risk tolerance and review it once a year. This helps you avoid making choices based on fear or excitement.

Many investors let recent events shape their decisions. This is called recency bias. You might sell after a 15% drop, not because your risk tolerance changed, but because you feel more worried. In good times, you might buy risky assets because you forget about the risks. Try to separate your feelings from your real risk tolerance. This keeps your financial plan on track and helps you reach your financial goals.

Liquidity Needs

Liquidity means how quickly you can turn your investments into cash without losing money. You need to think about your liquidity needs when you build your financial plan. If you need cash fast, you want to have some money in savings or other easy-to-sell assets.

Keeping enough liquidity helps you handle surprises. For example, if you lose your job or face a big bill, you can use your cash reserves instead of selling investments at a loss. Studies show that having a liquidity buffer protects you during tough times. Banks and big companies use tools like cash flow forecasts and stress tests to spot problems early. You can do the same by checking your savings and planning for emergencies.

- Keep an emergency fund with enough cash to cover three to six months of expenses.

- Use simple ratios, like the Current Ratio or Quick Ratio, to check your liquidity health.

- Review your liquidity needs every year or after big life changes.

Note: A strong financial plan includes both investments for growth and enough liquidity for safety. This balance helps you stay calm and avoid panic when markets get rough.

By checking your risk tolerance and liquidity needs often, you make sure your financial plan fits your life. You can handle market swings and keep moving toward your financial goals.

Seek Professional Advice

When to Get Help

Sometimes, you might feel unsure about what to do with your investments. Market swings can make you second-guess your choices. If you find yourself feeling anxious, confused, or tempted to make big changes, it could be time to talk to a professional. You do not need to wait for a crisis. Many people reach out when they face life changes, like a new job, a move, or a big expense. You might also want help if you are not sure how to build a balanced portfolio or set clear goals.

Professional advisors have seen many market cycles. They know that even experts cannot time the market perfectly. MASECO Private Wealth points out that most investors, even professionals, struggle to pick the right time to buy or sell. Trying to guess the market often leads to costly mistakes. Advisors help you stay patient and stick to your plan, even when the news feels scary. They keep you focused on your long-term goals and help you avoid emotional decisions.

If you feel lost or worried about your investments, reaching out for advice can give you peace of mind and a clear path forward.

Benefits of Guidance

You get many benefits when you work with a professional advisor, especially during uncertain times:

- Advisors help you manage your emotions so you do not make rash decisions.

- They keep you focused on your long-term goals, not just short-term market moves.

- Professionals build diversified portfolios to protect you from big losses.

- They act as a steady voice, helping you ignore media noise and market rumors.

- Advisors teach you about the ups and downs of investing, so you do not panic and sell at the wrong time.

- They use planning tools to match your risk level with your goals, making sure you feel confident in your choices.

A recent study by State Street Global Advisors found that 77% of people with advisors felt they took the right amount of risk during tough markets, compared to only 58% of those who invested alone. Most investors also said their advisor made them feel more confident during times of inflation and market swings. With the right guidance, you can make smarter choices and stay on track, no matter what the market does.

You can handle uncertain markets by staying calm and making thoughtful choices. When you avoid emotional decisions, you give yourself a better chance to reach your goals. A patient and disciplined approach helps you stick to your plan, avoid panic selling, and benefit from market recoveries. Regular investing and checking your risk tolerance keep you on track. If you ever feel unsure, talking to a professional can help. Remember, patience and planning are your best tools for long-term success.

FAQ

What should you do if the market drops suddenly?

Stay calm. Review your investment plan. Avoid selling in a panic. If you feel unsure, talk to a trusted advisor. Remember, markets often recover over time.

How often should you check your investments?

Check your investments once every few months. Too much checking can make you anxious. Focus on your long-term goals instead of daily changes.

Is it safe to keep all your money in stocks?

No, it is not safe. You should spread your money across different assets like stocks, bonds, and real estate. Diversification helps lower your risk.

Can you invest if you only have a small amount of money?

Yes, you can start with a small amount. Many Hong Kong banks let you invest with as little as USD 100. Regular investing helps your money grow over time.

Navigating volatile markets requires a calm approach and a platform that supports smart, cost-effective investing. BiyaPay’s multi-asset wallet offers free conversions between USDT and over 200 cryptocurrencies into fiat currencies like USD or HKD, helping you avoid costly exchange fees during uncertain times. With remittance fees as low as 0.5%, you can diversify into safer assets like bonds or gold to reduce risk and maintain portfolio balance. Its secure platform and one-minute registration let you act quickly without emotional decisions. Ready to invest wisely and stay calm? Join BiyaPay today and build a steady path to your financial goals!

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.