- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Lessons Learned from Today’s Share Market Rise Investor Perspectives

Image Source: unsplash

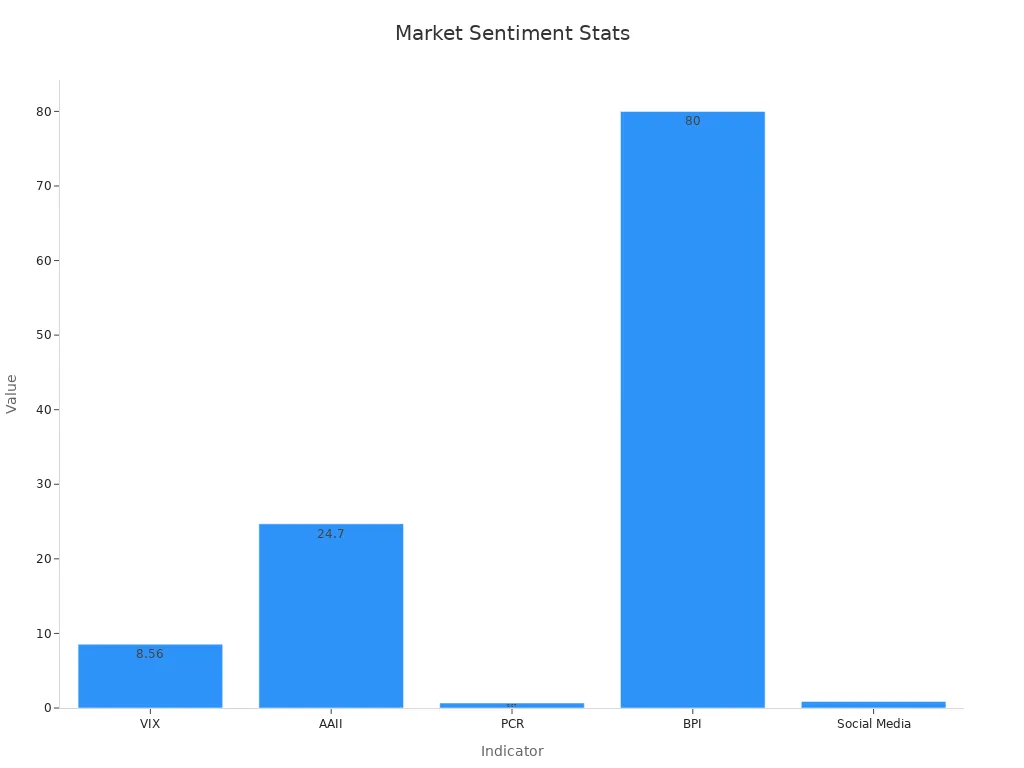

What can you actually learn from today’s market surge? You see many investors feeling a mix of excitement and caution. Some jump in, chasing gains, while others hold back, remembering past swings. Market numbers tell this story too. Take a look at key sentiment indicators:

| Indicator | Metric Description | Numerical Range / Example Values | Interpretation Related to Investor Sentiment |

|---|---|---|---|

| CBOE Volatility Index (VIX) | Measures expected S&P 500 volatility over 30 days | Under 20 = Calm; 20-30 = Uneasy; Over 30 = Volatile; Historical low: 8.56 (Nov 2017) | Lower VIX values correspond to calmer markets and more positive investor sentiment during uptrends. |

| CNN Fear and Greed Index | Market mood on 0-100 scale | 0-24 = Extreme Fear; 25-44 = Fear; 45-55 = Neutral; 56-75 = Greed; 76-100 = Extreme Greed | Higher scores indicate greed and bullish sentiment during market uptrends. |

| AAII Investor Sentiment Survey | Weekly % of bullish, neutral, bearish investors | Bullish avg: 38.8%; Record high: 75%; Bearish avg: 30.6%; Example: Bullish 24.7% (Dec 2022) | Shows shifts in investor mood; higher bullish % signals optimism in uptrends. |

| Put/Call Ratio (PCR) | Ratio of put options to call options traded | PCR < 1 (e.g., 0.67) indicates bullish sentiment | Lower PCR values reflect more call buying, signaling bullish investor sentiment. |

| High-Low Index | % of stocks hitting new highs vs lows | > 50 = More highs (bullish); > 70 = Strong uptrend | Rising index indicates growing market strength and positive sentiment. |

| Bullish Percent Index (BPI) | % of stocks in bullish trends | 70-100% = Market’s hot (bullish); Example: 80% BPI | High BPI values reflect strong bullish trends and positive investor sentiment. |

| Social Media Sentiment | Correlation between social media mood and stock prices | Correlation up to 0.88 between Twitter sentiment and returns | Positive social media sentiment correlates strongly with bullish price movements. |

You might wonder why share market is up today. Recent studies show that investor behavior, like overconfidence or fear, directly changes how markets move. In China, higher investor optimism brings more trades, but in times of stress, negative moods can drag prices down. So, every move you make shapes the market as much as the news does.

Key Takeaways

- Market rises depend on both data and how investors feel, with optimism and caution shaping trends.

- Big factors like Federal Reserve decisions and strong corporate profits drive stock market gains.

- Investor emotions often follow cycles of excitement and fear, influencing buying and selling behavior.

- Avoid rushing in due to FOMO; stick to your plan and balance optimism with careful risk management.

- Use strategies like trend following, diversification, and regular portfolio reviews to succeed in uptrends.

Why Share Market Is Up Today

Image Source: pexels

Key Drivers

You might wonder why share market is up today. The answer starts with the big players: the Federal Reserve and its decisions. When the Fed signals a pause or a cut in interest rates, you often see the s&p 500 and other stocks jump. From 2020 to 2022, changes in Fed policy moved the stock market by shifting exchange rates and changing how investors build their portfolios. This year, the s&p 500 has climbed over 26%, showing strong momentum and a clear uptrend in stocks.

Corporate profits also play a huge role. Companies have shown rising profit margins, which means they are making more money even as inflation stays in the news. This strength gives investors more confidence and supports the bullish rally. When you compare stocks to other assets, like commodities, US stocks lead by a wide margin. The s&p 500 keeps setting new highs, and small-cap stocks look even better as analysts expect interest rates to drop soon.

You can see these market-moving catalysts in the table below:

| Factor/Metric | Quantitative Evidence / Explanation |

|---|---|

| US Stock Market Performance 2024 | Vanguard Total US Stock Market ETF (VTI) up over 26% year-to-date (Nov 22) |

| Comparison with Other Assets | Commodities ETF (GCC) up 15.5%, showing US stocks leading by a wide margin |

| Interest Rate Expectations | Anticipation of US interest rate cutting cycle benefits small-cap stocks and supports broad market gains |

| Small-Cap Stocks Outlook | Analysts at BNP Paribas highlight improved outlook due to rate cuts, attractive valuations, reshoring, and M&A trends |

| Inflation Risk | Higher stock prices may increase PCE inflation, potentially influencing Fed policy decisions and market corrections |

Market Sentiment

Market sentiment shapes why share market is up today just as much as the numbers do. When you see the s&p 500 rising, you feel the bullish energy. Investors get excited, but some stay cautious because inflation and global events can change things fast. Geopolitical tensions, like the Russia–Ukraine war, often push the Volatility Index (VIX) higher, showing more uncertainty in financial markets.

Technical analysis tools, such as MACD and RSI, help you spot bullish confirmation and trends. When these indicators point up, more investors jump in, fueling the uptrend. Social media also plays a part. Studies show that positive sentiment on platforms like Twitter can move the s&p 500 and other stocks. During big events, you see more people talking about financial markets, which can drive even more bullish moves.

You notice that financial markets react quickly to news. When the Fed makes a statement or inflation data comes out, the s&p 500 and other stocks can swing in minutes. This fast pace keeps you on your toes and shows why share market is up today depends on both hard data and how investors feel. The mix of optimism, caution, and external events creates the trends you see in the stock market every day.

Investor Reactions

Image Source: pexels

Optimism and FOMO

You see investor reactions change fast when the market rises. Many investors feel a rush of optimism. They watch the s&p 500 hit new highs and believe the rally will keep going. Some investors talk about how they bought Nvidia early in 2023 and saw it soar nearly 190%. Others mention Microsoft, which gained 42% in the same period. These stories spread quickly and boost investor confidence. You might notice friends or people online saying, “I wish I had bought more stocks before the s&p 500 jumped.” This feeling is called FOMO, or fear of missing out.

Investor reactions often show up as herding. When you see others buying, you want to join in. Younger and less-experienced investors are even more likely to feel FOMO. Research shows that when FOMO rises, more people jump into the stock market and take bigger risks. The Global FOMO Index tracks this feeling worldwide. When FOMO is high, stock returns drop by about 1.7% to 2%, and market volatility falls by around 2%. You see this in financial markets when everyone seems bullish and eager to buy.

Investor behavior during these times can lead to more trading in riskier assets. Some investors even move money from stocks to Bitcoin or other alternatives, hoping for bigger gains. The top 10 companies made up over 37% of the s&p 500’s gains in early 2023, showing how investor sentiment can focus on a few hot stocks.

Caution and Skepticism

Not all investor reactions are the same. Some investors stay cautious even when the market looks bullish. They remember past downturns and worry about jumping in too late. You might hear someone say, “I’m waiting for a pullback before I buy more stocks.” This shows how investor behavior can shift from optimism to skepticism quickly.

Other investors take profits when they see big gains. They do not want to lose money if the market turns. Some watch the s&p and s&p 500 closely for signs of weakness. They use technical analysis to spot when the bullish trend might end. Investor reactions like these help balance the market and keep it from overheating.

You also see investor sentiment change when news hits. If inflation rises or global events shake financial markets, cautious investors may sell or hold back. This mix of optimism and caution shapes the stock market every day. Your own investor reactions can swing between excitement and fear, just like everyone else’s.

Stock Market Behavior

Emotional Patterns

You might notice that investor behavior often follows a cycle when the market goes up. At first, you feel a wave of optimism. You see prices rise, and you start to believe that gains will keep coming. This early excitement can turn into euphoria. Many investors become overconfident and take bigger risks. You might even see people buying more stocks just because everyone else is doing it.

Researchers use mood indices and statistical models to show how your feelings connect to the market. When you feel positive, you are more likely to buy and take risks. If the market drops, your mood can shift quickly. You might feel fear or even panic. This can lead to selling and less risk-taking. Scientists have measured these feelings using things like heart rate and skin conductance. They found that your emotions change as the market moves, and these changes affect your decisions.

Investor psychology shows that your mood and recent market returns are linked. When the market rises, you feel good and want to buy more. When it falls, you feel nervous and pull back. This cycle repeats over time.

Common Biases

Investor behavior is not always logical. You often see common biases shape what you do in the stock market. One big bias is herd behavior. When you see others buying, you want to join in. This can create a feedback loop. Prices go up, more people buy, and the cycle continues. Sometimes, this leads to bubbles where prices rise far above what they should.

- During uptrends, many investors feel FOMO, or fear of missing out. You might buy stocks just because you see others making money.

- Herd behavior is stronger when the market is rising fast. Studies show that investors follow the crowd more during these times.

- You might also chase past performance, buying stocks that have already gone up a lot. This can be risky if the market turns.

These patterns are not new. The Dot-Com Bubble is a famous example. Many people bought tech stocks because everyone else was doing it. When the bubble burst, prices fell quickly, and many investors lost money. Understanding these biases helps you see why investor psychology matters. If you know how your mind works, you can make better choices and avoid common mistakes. The momentum you see in the market often comes from these emotional and psychological patterns.

Lessons for Investors

Actionable Takeaways

You want to make smart investments when the market is rising. It feels exciting to see your portfolio grow, but you also need to stay careful. Here are some clear lessons you can use right now:

- Stay Disciplined: Don’t let excitement push you into risky investments. Stick to your plan and review your goals often.

- Balance Optimism with Caution: It’s easy to get swept up in the uptrend, but remember that markets can change quickly. Take time to think before making big investment decisions.

- Learn from Real Stories: Many investors have found success by following proven strategies. For example, some traders use the Ichimoku method to spot strong trends and protect their gains. Others use breakout strategies like the Darvas Box to catch stocks as they hit new highs.

- Diversify Your Investments: Don’t put all your money in one place. Spread your investments across different sectors, like technology, consumer goods, and even small-cap stocks. This helps lower your risk if one area falls.

- Review and Adjust Regularly: Check your investments often. If something is not working, make changes. This keeps your portfolio healthy and ready for new market trends.

Tip: When you see a lot of optimism in the market, it’s a good time to double-check your investments. Make sure you are not just following the crowd.

You can see from real case studies that these steps work. For example:

- A trader used Ichimoku indicators to ride a technology stock uptrend, using the Kumo cloud as a guide for stop-losses and locking in gains.

- The Turtle Trading System showed that following trends with discipline can lead to strong returns.

- Investors who forecasted price rebounds in oil or currency markets made smart moves by buying low and selling high.

These stories show that you can build confidence by using tested strategies and learning from others’ experiences.

Strategies for Uptrends

When the market is in an uptrend, you have a chance to grow your investments. But you need the right strategies to make the most of it. Here are some you can use:

- Follow the Trend: Use tools like moving averages or momentum indicators to spot when the market is moving up. Don’t try to guess the top or bottom. Instead, ride the trend until you see signs of change.

- Diversify and Rebalance: Keep your investments spread out. Review your portfolio every few months. If one area grows a lot, you might need to rebalance to keep your risk in check.

- Manage Risk: Always use stop-loss orders to protect your money. Decide how much you are willing to lose before you buy. This helps you stay calm if the market turns.

- Pick the Right Sectors: Focus on areas that do well in uptrends, like technology, innovation, and consumer discretionary stocks. Small- and mid-cap stocks can also offer strong growth during economic recoveries.

- Use Data and Research: Look at both short-term market sentiment and long-term economic trends. The Market Insight Model, for example, combines investor behavior, data analysis, and economic factors to help you make better investment decisions.

Note: Research shows that human-managed funds often do better in bullish markets because they can spot new opportunities and act quickly. In contrast, AI-driven funds are better at protecting against losses during tough times.

Here’s a quick table to help you remember these strategies:

| Strategy | What to Do | Why It Works |

|---|---|---|

| Trend Following | Use technical tools to ride uptrends | Captures gains as the market rises |

| Diversification | Invest in different sectors and stocks | Reduces risk if one area falls |

| Regular Review | Check and adjust your portfolio often | Keeps your investments on track |

| Risk Management | Set stop-losses and know your limits | Protects your capital |

| Sector Selection | Focus on growth and innovation sectors | Taps into strong economic trends |

You can see from research that these strategies help investors do well in uptrends. For example, studies show that trend-following and diversification lead to better results over time. Managing risk and reviewing your investments regularly also help you avoid big losses.

If you want to succeed, keep learning from both your own experiences and those of other investors. Stay alert to changes in the market and adjust your investments as needed. This way, you can build confidence and make the most of every uptrend.

You learned that smart investing means staying balanced and using real data. When you use tools like sentiment scores and real-time analytics, you make better choices. Here are some key points:

- Boosting data accuracy from 90% to 95% cuts errors in half.

- Sentiment scores help you track market mood fast.

- Real-time monitoring keeps your strategy sharp.

Take time to review your own habits. Stay curious, keep learning, and let data guide your next move.

FAQ

What should you do if you feel FOMO during a market rally?

You can pause and review your plan. Try not to rush into trades just because others are buying. Focus on your goals and use data to guide your choices.

How often should you check your investments in an uptrend?

You should check your portfolio every few weeks. This helps you spot changes early. If you see big moves, you can rebalance or adjust your risk.

Is it safe to invest all your money in one hot stock?

No, it is not safe. You should spread your money across different stocks and sectors. This lowers your risk if one stock drops.

How do global events affect the share market?

Global events, like changes in China’s economy or conflicts, can move markets fast. You might see prices swing after news breaks. Stay alert and use trusted sources for updates.

Riding today’s market surge requires discipline to avoid FOMO and smart tools to seize opportunities. BiyaPay’s multi-asset wallet offers free conversions between USDT and over 200 cryptocurrencies into fiat currencies like USD or HKD, helping you dodge high exchange fees during bullish rallies. With remittance fees as low as 0.5%, you can diversify across sectors like technology or small-cap stocks to balance risk and reward. Its secure platform and one-minute registration empower you to act swiftly without chasing trends. Ready to invest wisely in the uptrend? Join BiyaPay today and build a disciplined portfolio for lasting gains!

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.