- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Top Picks for Investors Before Trump’s Inauguration

Image Source: pexels

You want to seize the best stocks to buy before trump takes office. These top 10 picks—Wells Fargo, JPMorgan Chase, ExxonMobil, ONEOK, Nucor, Palantir, MicroStrategy, Tesla, Trump Media & Technology Group, and Coinbase—stand out for their strong potential under a new trump presidency. You can benefit from trump-related stocks now, as the trump presidency may bring fast changes in deregulation, tax reform, infrastructure, energy, defense, and tech. Make your move before the window closes.

Key Takeaways

- Invest in stocks tied to Trump’s key policies like deregulation, tax reform, infrastructure, energy, defense, and technology for strong growth potential.

- Top stock picks include Wells Fargo, JPMorgan Chase, ExxonMobil, Tesla, Palantir, and Coinbase, each benefiting from specific policy changes.

- Infrastructure and industrial stocks offer stable returns and job growth, while energy and defense sectors gain from increased spending and relaxed rules.

- Use timing tools like moving averages and market sentiment to enter the market wisely, but steady investing often beats perfect timing.

- Diversify your portfolio across sectors to reduce risk and monitor policy changes closely to adjust your investments as needed.

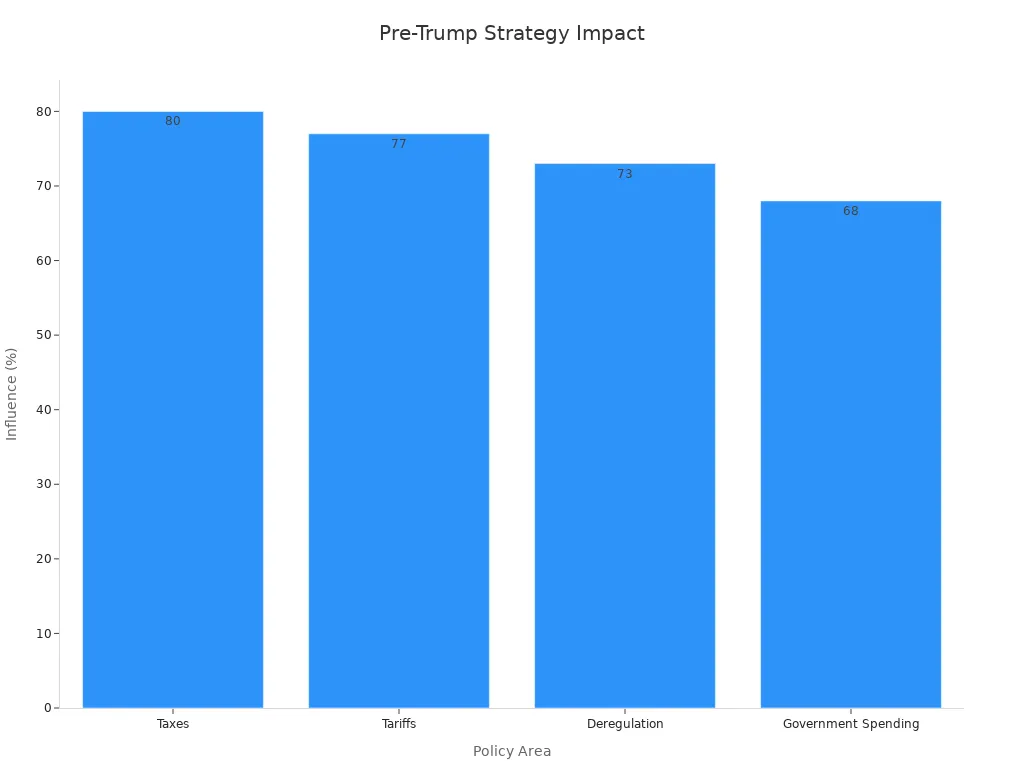

Policy Themes

You need to understand the policy themes that will shape your investment decisions before the trump presidency begins. Each theme offers unique opportunities and risks. By focusing on these areas, you can position your portfolio for potential gains.

Deregulation

Deregulation stands at the core of the trump presidency. You can expect fewer rules for banks and businesses. This often leads to higher profits and faster growth for financial stocks.

| Metric | 2000 (or 1990s) | 2008 (or 2000s) | Notes/Trend Description |

|---|---|---|---|

| Federal financial regulators’ budget (excluding SEC) | $2 billion | $2.3 billion | Budget increased, indicating more regulatory resources. |

| SEC budget | $357 million | $629 million | SEC budget nearly doubled, showing increased regulation. |

| Total staffing at financial regulatory agencies | ~16,000 employees | ~16,000 employees | Staffing remained stable, no significant cuts. |

| Department of Treasury new rules proposed annually | ~400 (1990s) | >500 (2000s) | Number of new rules increased, indicating more regulation. |

When rules get rolled back, banks and financial firms often see their stock prices rise. You can take advantage of this trend by targeting financial stocks.

Tax Reform

Tax reform can boost corporate profits and drive stock prices higher. Studies show that lower corporate taxes can make US companies more competitive. You may see small- and mid-cap stocks benefit the most, as they rely more on domestic earnings. Tax cuts can also encourage companies to invest and hire more workers, which supports economic growth.

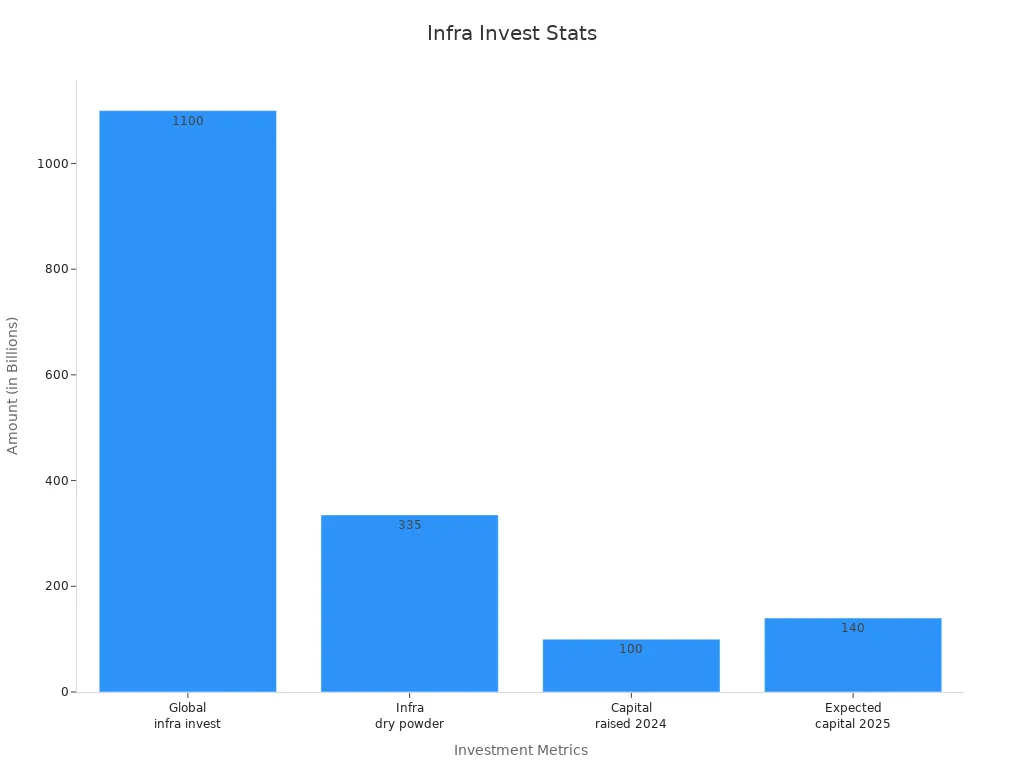

Infrastructure

A trump presidency could bring a surge in infrastructure spending. You can benefit from this by investing in companies that build roads, bridges, and digital networks.

| Statistic / Metric | Value / Description |

|---|---|

| Projected global AI infrastructure spending by 2028 | $220 billion |

| Growth in assets under management in infrastructure funds (last 10 years) | Nearly tripled |

| Average dividend yield of FTSE Developed Core Infrastructure Index | Over 3%, more than double the S&P 500 |

| Infrastructure stocks volatility | Lower than broader market, more stable earnings growth |

Infrastructure stocks offer stable returns and can protect you from inflation.

Energy

Energy policy changes can create winners in both traditional and clean energy sectors. Oil supply shocks and policy uncertainty have a big impact on energy stocks. Clean energy is set to reach nearly 40% of global electricity generation by 2025. You can find strong opportunities in companies leading this transition.

Defense

Defense spending often rises during a trump presidency. You can expect defense stocks to benefit from higher budgets and global tensions.

- Geopolitical events boost defense company returns.

- Republican presidents increase excess returns for military-industrial stocks.

- Defense budget announcements drive positive stock performance.

Technology

Technology remains a top investment area. Digital transformation spending is expected to reach $3.4 trillion by 2026.

| Category | Statistic / Forecast | Source / Year |

|---|---|---|

| Digital Transformation Market | Expected to grow from $469.8B in 2020 to $1,009.8B by 2025 (CAGR 16.5%) | Quixy |

| AI spending | To increase from $58.3B in 2021 to $309.6B by 2026 | Markets and Markets |

| Business Adoption | 91% of companies engaged in digital initiatives | Gartner |

You can capture growth by investing in tech leaders and innovators.

By understanding these policy themes, you can make smarter investment choices before the trump presidency begins. Each theme offers a path to profit if you act early and stay informed.

Stocks to Buy Before Trump Takes Office

Image Source: pexels

You want to get ahead of the market. These stocks to buy before Trump takes office give you a strong chance to profit from policy changes. Each company stands out because it matches the main themes of the Trump presidency. You can use this list to build a portfolio that takes advantage of deregulation, tax reform, infrastructure spending, energy policy, and tech innovation.

Wells Fargo – Financials

Wells Fargo is a major U.S. bank. You can expect this stock to benefit from deregulation and tax cuts. The Trump presidency often brings fewer rules for banks. This means Wells Fargo can lend more and earn higher profits. Deregulation also lowers compliance costs. Recent analyst reports show strong loan growth and stable dividends. You get a solid choice for your financial sector exposure.

- Deregulation increases bank profitability.

- Tax cuts boost earnings.

- Wells Fargo has a strong dividend history.

JPMorgan Chase – Banking

JPMorgan Chase is the largest U.S. bank by assets. You can count on this stock to gain from relaxed regulations and a strong U.S. economy. The Trump presidency supports policies that help big banks grow. JPMorgan Chase leads in digital banking and investment services. Analysts see continued growth in revenue and market share.

- Reduced rules mean more lending and trading.

- Tax reform increases net income.

- JPMorgan Chase invests in technology for future growth.

ExxonMobil – Energy

ExxonMobil is a global energy leader. You can expect this company to benefit from policies that favor fossil fuels. The Trump presidency often rolls back environmental rules. This lowers costs for oil and gas producers. ExxonMobil has a strong balance sheet and pays reliable dividends. You get exposure to rising oil prices and global demand.

- Deregulation cuts production costs.

- Support for fossil fuel projects increases profits.

- ExxonMobil invests in new energy sources for long-term growth.

ONEOK – Energy Infrastructure

ONEOK operates pipelines and storage for natural gas and liquids. You can use this stock to tap into the U.S. energy boom. The Trump presidency supports new pipeline projects and faster approvals. ONEOK earns steady income from transporting energy. Analysts highlight its stable cash flow and high dividend yield.

- Pipeline expansion boosts revenue.

- Deregulation speeds up project approvals.

- ONEOK offers reliable dividends for income investors.

Nucor – Steel & Industrials

Nucor is a top U.S. steel producer. You can expect this stock to benefit from tariffs and the Buy American push. The Trump presidency often raises tariffs on imported steel. This helps Nucor sell more steel at higher prices. Tax reform also lowers costs for manufacturers. Nucor invests in new plants and technology.

- Tariffs protect U.S. steel makers.

- Tax cuts increase profits.

- Nucor grows through innovation and expansion.

Note: Industrial stocks like Nucor gain from tax reforms, deregulation, and trade policies. Corporate tax cuts and tariffs support domestic manufacturing.

Palantir – Technology & Defense

Palantir is a software company that serves government and defense clients. You can use palantir stock to benefit from higher defense spending and digital transformation. The Trump presidency often increases the defense budget. Palantir helps agencies manage data and security. Analysts rate palantir stock as a strong buy for its growth in AI and government contracts.

- Defense spending drives revenue growth.

- Palantir leads in AI and data analytics.

- Government contracts provide steady income.

MicroStrategy – Technology & Bitcoin Exposure

MicroStrategy is a tech company known for its large Bitcoin holdings. You can use this stock to gain exposure to both software and cryptocurrency. The Trump presidency may bring lighter crypto regulation and more fintech innovation. MicroStrategy benefits from rising Bitcoin prices and strong software sales.

- Bitcoin exposure offers upside in a crypto-friendly environment.

- Software business adds stability.

- Analysts see potential for higher returns if crypto markets rally.

Tesla – Technology & Energy

Tesla leads in electric vehicles and clean energy. You can expect this stock to benefit from innovation and global demand. The Trump presidency may slow some clean energy policies, but Tesla’s brand and technology keep it ahead. Tesla expands into new markets and products. Analysts remain bullish on its long-term growth.

- EV demand rises worldwide.

- Tesla invests in batteries and solar energy.

- Strong brand drives sales and market share.

Trump Media & Technology Group (DJT) – Media

Trump Media & Technology Group runs Truth Social and other media platforms. You can use this stock to play the rise of alternative media. The Trump presidency brings more attention to conservative platforms. DJT stands out among trump-related stocks for its growth potential. Analysts see high volatility but also big upside if user growth continues.

- Media focus increases during election cycles.

- DJT benefits from political engagement.

- High risk, high reward profile.

Coinbase – Crypto & Fintech

Coinbase is a leading crypto exchange. You can use this stock to profit from the growth of digital assets. The Trump presidency may ease crypto regulations, making it easier for Coinbase to expand. Crypto trading volumes rise with market interest. Analysts recommend Coinbase for its strong position in the fintech sector.

- Lighter regulation supports crypto innovation.

- Coinbase leads in U.S. crypto trading.

- Fintech growth adds to long-term value.

You can see that these standout stocks match the main policy themes of the Trump presidency. Deregulation, tax reform, infrastructure, energy, defense, and technology all play a role. Recent analyst recommendations and sector trends support these picks. BlackRock and other firms suggest overweighting U.S. equities, especially in infrastructure, financials, and technology. You can use these stocks to build a portfolio ready for the next wave of policy changes.

Top US Stock Sector Trends

Image Source: pexels

Infrastructure & Industrials

You can expect infrastructure and industrial stocks to shine under Trump’s policies. Big investments in roads, bridges, and utilities create jobs and boost productivity. Experts project up to 3 million new jobs if the government invests $250 billion each year for seven years. Most of these jobs go to workers without college degrees, helping the middle class. Companies like Caterpillar and Nucor stand to benefit as more money flows into construction and manufacturing. These sectors also see less risk from inflation, making them a smart choice for your portfolio.

Note: Infrastructure spending often leads to stable growth and higher wages for American workers.

Energy & Utilities

You should watch energy and utilities closely. Trump’s push for U.S. energy independence and deregulation supports oil, gas, and utility companies. Firms like ExxonMobil and Occidental Petroleum gain from relaxed rules and new drilling projects. Utilities that invest in grid upgrades and clean energy also benefit. Performance-based regulation rewards companies for meeting goals like grid reliability and customer satisfaction. This means you can find strong returns in both traditional and renewable energy stocks.

- Utilities with modern grids and strong customer service see higher earnings.

- Energy companies profit from new drilling and export opportunities.

Defense & Aerospace

Defense and aerospace stocks often rank among the best performing s&p stocks during periods of rising government spending. Trump’s policies favor higher defense budgets, which boost companies like Lockheed Martin and Northrop Grumman. The global market for AI in defense is set to double by 2030, reaching over $43 billion. U.S. firms lead this growth, thanks to strong government contracts and research funding.

| Metric/Region | Data/Value | Policy Impact |

|---|---|---|

| Global AI in Defense (2023) | $22.45 billion | Driven by higher U.S. defense budgets |

| Projected Market Size (2030) | $43.02 billion | Reflects sustained federal spending |

| North America Revenue Share (2023) | 41.5% | U.S. dominates with government support |

Financials & Banks

You can count on financials and banks to outperform when deregulation and higher interest rates arrive. Banks like JPMorgan Chase and Wells Fargo benefit from fewer rules and stronger profits. After the 2008 crisis, banks built up capital, making them more stable. This resilience helped them weather the COVID-19 pandemic. Policy support remains key for continued lending and growth, especially in the current stock market.

| Aspect | Evidence Summary |

|---|---|

| Bank Stability | Stronger capital buffers since 2008 |

| Lending Capacity | Improved, but credit risk still a concern |

| Policy Impact | Deregulation and tax cuts boost profitability |

Technology & Innovation

You should focus on technology and innovation for long-term growth. U.S. tech companies like Intel and Nvidia gain from tariffs on foreign chipmakers. The innovation-adoption curve shows that new tech spreads quickly when it meets user needs. Sectors like healthcare, manufacturing, and energy see big gains from AI, blockchain, and smart devices. For example, AI tools improve cancer detection by 37%, and smart grids boost energy efficiency by up to 30%. These trends make technology a top us stock sector for future gains.

Tip: Investing in tech leaders helps you capture growth as new innovations move from early adopters to the mainstream.

Investment Strategies & Risk

Timing Entry

You want to enter the market at the right time. Use moving averages, like the 50-day and 200-day, to spot trends. Look for signals from the Relative Strength Index (RSI) to find overbought or oversold stocks. Many investors also watch the VIX and sentiment surveys to understand market mood. Studies show that waiting for the perfect moment can cost you more than steady investing. Dollar-cost averaging often beats trying to time the market. You can use trendlines and volume data to confirm your entry points.

Tip: Align your entry with both short-term and long-term trends for better results.

Diversification

You lower your risk when you spread your investments. Diversification means owning stocks from different sectors, industries, and even countries. This strategy helps you avoid big losses if one area falls. Risk metrics like beta and standard deviation show how much your portfolio moves with the market. Companies with strong risk management see fewer bad debts and more stable cash flow. Diversification cannot remove all risk, but it protects you from shocks in one sector.

| Metric / Outcome | Statistic / Benefit |

|---|---|

| Bad Debt Write-offs | 40% reduction |

| Cash Flow Predictability | 35% improvement |

| Beta Analysis | Lower sensitivity to market swings |

| Standard Deviation | Reduced portfolio volatility |

Policy Monitoring

You need to watch policy changes closely. Use tools like the VIX, benchmark indices, and earnings ratios to track market health. Macroeconomic data—such as interest rates, inflation, and GDP growth—can signal big shifts. Market sentiment indicators, like the put-call ratio, help you spot bullish or bearish trends. Business intelligence platforms and statistical software give you real-time updates. These tools help you adjust your strategy as new policies roll out.

Managing Volatility

You can manage risk by tracking volatility and using risk-adjusted return metrics. Standard deviation shows how much returns move up or down. Sharpe and Sortino ratios help you compare returns to the risk you take. Managed Volatility strategies adjust your exposure based on recent market swings. These methods lower the chance of big losses and improve your returns per unit of risk. You should rebalance your portfolio often and use stop-loss orders to protect gains.

Note: Volatility targeting and dynamic asset allocation help you stay calm and focused, even when markets get rough.

You have seen the top stocks to buy before Trump takes office. Each pick matches key policy themes and offers strong potential for growth. Acting now lets you capture gains before policy shifts.

- Meta-analyses show that using clear, absolute effect measures helps you understand the real benefits of early action.

Review your portfolio, stay alert to new policies, and consider talking to a professional. Take these steps to position yourself for the next market move.

FAQ

What makes these stocks good picks before Trump takes office?

You get strong growth potential. These companies match Trump’s main policy themes. You can benefit from expected changes in deregulation, tax reform, and spending. Acting now helps you capture gains before the market adjusts.

Should you invest all your money in these stocks?

No, you should not. Diversify your investments. Spread your money across different sectors. This lowers your risk and protects you from big losses if one stock drops.

How do you manage risk when investing before policy changes?

Watch the news for policy updates. Use stop-loss orders to protect your gains. Review your portfolio often. Stay flexible and adjust your strategy as new information appears.

When is the best time to buy these stocks?

You should act before major policy announcements. Early action lets you capture gains before the market reacts. Use tools like moving averages and market sentiment to guide your timing.

With Trump’s inauguration on January 20, 2025, approaching, policy shifts in deregulation, tax cuts, and infrastructure spending create opportunities in stocks like Wells Fargo, ExxonMobil, and Palantir. BiyaPay’s multi-asset wallet offers free conversions between USDT and over 200 cryptocurrencies into fiat currencies like USD or HKD, helping you avoid high fees as markets shift. With remittance fees as low as 0.5%, you can diversify into energy, financials, or tech to capture policy-driven gains. Its secure platform and one-minute registration let you act swiftly before volatility spikes. Don’t miss the window to position your portfolio—Join BiyaPay today for flexible, low-cost investing!

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.