- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Citibank account opening process and threshold comprehensive analysis, 65,000 free ATMs for easy withdrawal, what are the necessary materials for account opening?

Citibank is one of the banks in the US with the largest ATM network, with over 65,000 ATMs nationwide. All customers, regardless of account level, can withdraw money from this bank’s ATMs for free, which is very convenient.

If you have just arrived in the US, you may consider Citibank’s checking account. As long as you meet certain conditions, such as maintaining a certain amount of account balance, you can get a free bank account without monthly fees, which is convenient for daily use.

Citibank account opening threshold

The basic requirements for applying for a Citibank account are:

- At least 18 years old

- US Citizen/Resident

- Have a valid US address

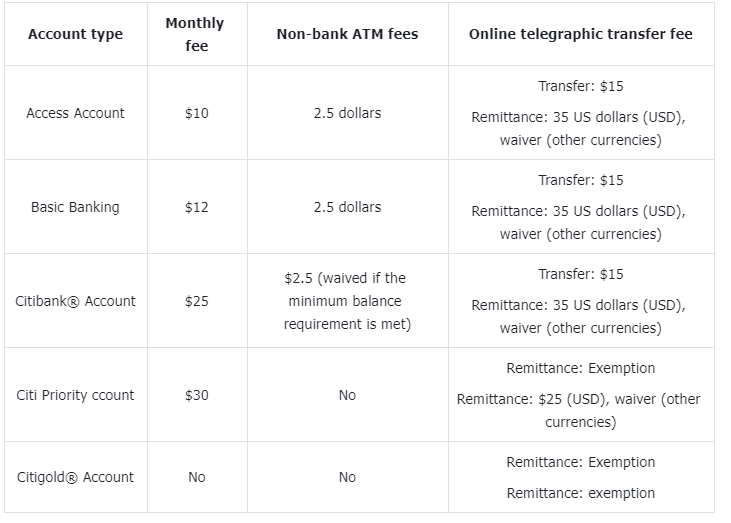

The following are Citibank’s main checking accounts , each with a savings account.

Please note that Citibank account fees may vary depending on your location. The fees listed below are applicable to New York (postal code: 10001). You need to enter your postal code when logging into the Citibank website to find the most accurate account fees.

Citibank account opening minimum deposit

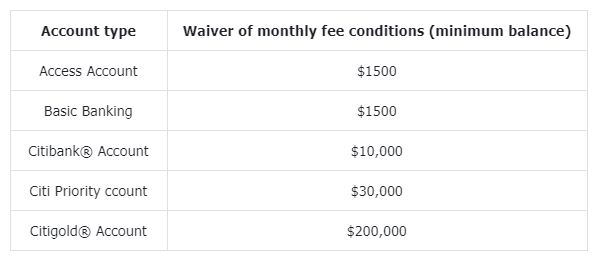

None of the above accounts have a minimum deposit for opening an account. However, if your account balance reaches a certain amount, you can waive the maximum monthly fee of $30.

The exemption monthly fee conditions applicable to each level are as follows:

In addition, Access Account and Basic Account holders can also receive a monthly enhanced direct deposit or pay an eligible bill in exchange for a zero monthly fee.

Citibank account opening documents

The documents/materials required for opening a Citibank online account include:

- Personally identifiable information

- US address

- Social security number

- US Tax Certificate (if applicable)

What documents are required for Citibank to receive overseas remittances?

When using Citibank to receive overseas remittances, you need to provide the following additional information when customers transfer the following currencies:

- US dollar routing number: 021000089

- SORT code for the pound: 185002

- BSB code for Australian dollar: 242200

- IBAN code for Euro: IE91CITI99005123897008

Citibank account opening process

You can quickly open a checking account on the Citibank website. The process is as follows:

- Log in to the Citibank website and enter your postal code.

- Compare different checking accounts , choose the type of account you want to open, and choose whether to include a savings account.

- Complete the online application form , including personal information, identity verification, employment details.

- Set up online login information and agree to bank terms.

- After completing the account opening, you can immediately make the first deposit to meet the conditions for waiving monthly fees.

- The Citibank card will be mailed to your address shortly.

For those of us who are traveling abroad, we may need to send money back home regularly, so we are more concerned about the cost of remittance.

Overseas bank accounts are just the first step in asset allocation. Although traditional banks have many advantages, such as more secure funds and a higher coverage ATM network, there are also many miscellaneous fees in traditional banks, such as non-bank ATM usage fees, foreign currency transaction fees, and remittance intermediary fees.

Although Citibank claims to waive remittance fees (for currencies other than the US dollar), the fees are actually hidden in the exchange rate. However, if you use BiyaPay, you don’t have to worry about these hidden fees because BiyaPay’s remittance fees are much lower than traditional methods. Moreover, when your remittance or withdrawal amount reaches a certain amount, you can enjoy discounts according to the corresponding range.

If you often cross-border remittances, you can consider registering a BiyaPay account**,** BiyaPay supports more than 20 mainstream legal currencies and more than 200 mainstream digital currencies online real-time exchange, to achieve local transfers in most countries or regions around the world, and unlimited amount, can achieve same-day remittance, same-day arrival, so as to achieve the purpose of personal overseas Asset Allocation investment.

Conclusion

The above is the complete content of the Citibank account opening guide. Friends who need to open an account with Citibank can refer to the above content to avoid unnecessary trouble. I wish you a smooth account opening.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.