- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Trading Days in a Year: Understanding US Stock Market Closures

Image Source: pexels

You will find about 252 trading days in a year on major U.S. stock exchanges. Recent data from Maven Trading shows that this number comes from taking away weekends and market holidays from the calendar year. Knowing when the stock market is closed helps you plan trades and avoid missed opportunities. The number of trading days in a year can shape your investment strategy and timing.

Key Takeaways

- The U.S. stock market has about 252 trading days each year after excluding weekends and major holidays.

- The market closes on ten main holidays and sometimes closes early before or after these days, reducing trading hours.

- Special closures can happen due to emergencies or weather, so always check for updates before trading.

- Trading volume and prices often change around holidays, so plan your trades carefully to avoid surprises.

- Use official sources like NYSE and Nasdaq to track holiday schedules and adjust your strategy for better results.

Trading Days in a Year

Typical Count

You might wonder how many trading days in a year you can expect. On average, the U.S. stock market has about 252 trading days in a year. This number comes from subtracting weekends and public holidays from the total days in a year. The New York Stock Exchange (NYSE) and NASDAQ both follow this schedule.

Here is a simple breakdown:

| Category | Number of Days | Explanation |

|---|---|---|

| Total days | 365 | Calendar days in a year |

| Weekends | 104 | 52 weeks × 2 days (Saturday and Sunday) |

| Public holidays | 9 to 10 | Major U.S. stock market holidays |

| Trading days | ~252 | 365 - 104 - 9 = about 252 |

You will see that weekends take away 104 days each year. Public holidays, like New Year’s Day and Thanksgiving, remove about 9 or 10 more days. If a holiday falls on a weekend, the market usually closes on the nearest weekday. This rule keeps the number of trading days in a year steady.

What Affects the Number

Several factors can change the exact count of trading days in a year. Most years, you will see the same holidays, but sometimes special events or unscheduled closures can reduce the number. For example, the market may close for national days of mourning or during extreme weather events.

You should also know that trading days can show different patterns around holidays and weekends. Here are some important effects:

- Pre-Holiday Effect: The day before a holiday often brings higher returns and lower volatility. Investors feel optimistic and trading activity changes.

- Post-Holiday Effect: Right after a holiday, the market sometimes drops. This can happen because investors sell off stocks or adjust their positions.

- Weekend Effect: Mondays usually have lower returns. News released over the weekend and investor behavior can cause this pattern.

- Holiday shopping season (November-December) increases trading volume, especially in retail stocks. You may notice more activity and price changes during this time.

- Tax season (December-April) also affects trading days. Investors may sell stocks to harvest tax losses or rebalance portfolios, which changes market behavior.

You will find that the number of trading days in a year can shift slightly if there are extra holidays or special closures. Most years, though, you can plan for about 252 trading days. By understanding these patterns, you can make better decisions and manage your investments more effectively.

U.S. Stock Market Holidays

Image Source: pexels

Full Holiday List

You need to know the official stock market holidays if you want to plan your trades well. The New York Stock Exchange (NYSE) and Nasdaq both follow the same holiday schedule. This schedule stays almost the same every year, so you can rely on it for your planning. The Nasdaq website and other official resources update the holiday schedule regularly. These sources give you a verified list of U.S. stock market holidays and keep the information accurate.

Here is a list of the main stock market holidays when the market is closed:

- New Year’s Day (January 1)

- Martin Luther King, Jr. Day (third Monday in January)

- Presidents Day (third Monday in February)

- Good Friday (Friday before Easter Sunday)

- Memorial Day (last Monday in May)

- Juneteenth National Independence Day (June 19)

- Independence Day (July 4)

- Labor Day (first Monday in September)

- Thanksgiving Day (fourth Thursday in November)

- Christmas Day (December 25)

You will notice that the market closes on these days every year. If a holiday falls on a Saturday, the stock market usually closes on the Friday before. If it falls on a Sunday, the market closes on the following Monday. Some federal holidays, like Veterans Day and Columbus Day, do not affect the stock market. The market stays open on those days.

Tip: You should always check the latest holiday schedule from NYSE or Nasdaq before making important trading decisions. These sources provide the most reliable updates about stock market holidays and early closures.

Early Closures

You will also find that the stock market sometimes closes early. These early stock market closures usually happen before or after major holidays. On these days, the market closes at 1:00 PM Eastern Time instead of the usual 4:00 PM. Early closures help traders and staff prepare for the holidays and spend time with their families.

Here are the most common early closure days:

- The day before Independence Day (if July 4 falls on a weekday)

- The day after Thanksgiving (also called Black Friday)

- Christmas Eve (December 24, if it falls on a weekday)

Thanksgiving and Christmas are two holidays that often bring early closures. For example, the market closes early on Black Friday, the day after Thanksgiving. If Christmas Eve is a weekday, you will see the market close at 1:00 PM. These early closures give you less time to trade, so you need to plan ahead.

Sometimes, the market may close early for special reasons, such as technical issues or extreme events. In rare cases, circuit breaker rules can trigger an early close if the market drops sharply. For example, on October 27, 1997, the market closed early because of a big decline in the Dow Jones Industrial Average. After that, the rules changed to make sure early closures only happen when truly needed.

You should remember that the holiday schedule and early closure rules stay consistent from year to year. This consistency helps you plan your trades and avoid surprises. Always check the official schedule before busy times like Thanksgiving and Christmas, so you do not miss important trading opportunities.

When the Stock Market Is Closed

Weekends

You need to know that the U.S. stock market does not open on weekends. Every Saturday and Sunday, trading stops. This rule comes from official market regulations. For example, trades made on weekends must wait until the next business day to get reported. The Financial Industry Regulatory Authority (FINRA) requires that any trade executed on a weekend gets reported by 8:15 a.m. Eastern Time on Monday. This rule shows that the market stays closed on weekends.

You can see this pattern in all official schedules. The New York Stock Exchange (NYSE) and Nasdaq both run from Monday to Friday. They open at 9:30 a.m. and close at 4:00 p.m. Eastern Time. The SIFMA Holiday Schedule lists all holidays but never includes weekends as trading days. This means weekends are always non-trading days. You will not find any trading activity on Saturdays or Sundays.

- The U.S. stock market operates Monday through Friday.

- No trades happen on weekends.

- Standard trading hours are 9:30 a.m. to 4:00 p.m. EST.

- Holidays and weekends both count as non-trading days.

Note: When the stock market is closed on weekends, you cannot buy or sell stocks. You must wait until the next trading day.

Special Closures

Sometimes, you may see the stock market closed on days that are not holidays or weekends. These special closures happen for reasons like national days of mourning, major weather events, or technical problems. For example, after the September 11 attacks in 2001, us markets are closed for several days. The market also closed for a day in 2012 because of Hurricane Sandy.

Stock market closure can also happen if there is a big emergency or a government order. These closures help protect investors and keep the market fair. You should always check for news about special closures, especially during major events. Most of the time, these closures are rare, but they can affect your trading plans.

You will notice that both regular and special closures play a big role in your trading schedule. Knowing when the stock market closed helps you avoid surprises and plan your trades better.

Stock Market Holidays and Trading Impact

Volume and Liquidity

You will notice that stock market holidays and early closures change how much trading happens and how easy it is to buy or sell stocks. On days before major holidays, trading volume often rises as investors adjust their portfolios. Many institutional investors rebalance their holdings at the end of the month, which leads to higher trading activity and better liquidity. For example, the New York Fed found that the last trading day of the month brings more trades and tighter bid-ask spreads, making it easier for you to buy or sell at a fair price.

When the market closes early, such as before Thanksgiving or Christmas, trading hours get cut short. This reduction in hours means less time for trades, which can lower liquidity and make prices move more sharply. During full stock market holidays, trading stops completely, and liquidity drops to zero. After these breaks, you may see a surge in trading and more price swings as the market reacts to news that came out during the closure. Thin trading around holidays can also cause wider bid-ask spreads, so you might pay more to enter or exit a position.

Investor mood also changes during holidays. Studies show that people feel more positive as holidays approach, which can affect how much they trade and the prices they accept. This shift in sentiment can lead to unusual patterns in trading volume and liquidity.

Settlement and Deadlines

Stock market holidays do not just affect trading—they also change how trades settle. The U.S. market now uses a T+1 settlement cycle, which means trades settle the next business day. If a holiday falls right after your trade, settlement gets pushed to the next open day. This can create tight deadlines, especially for global investors who must work across different time zones.

| Aspect | Detail | Impact |

|---|---|---|

| T+1 Settlement | Trades settle next business day | Holidays delay settlement to next open day |

| Allocation Cutoff | 7:00 PM ET on trade date | Requires quick action, especially near holidays |

| Affirmation Cutoff | 9:00 PM ET on trade date | Missing this can cause manual work and higher costs |

You need to plan for these deadlines, especially if you trade near a holiday. Shortened settlement windows and different holiday schedules in other countries can make it harder to complete trades on time. Always check the calendar and prepare for changes in settlement when stock market holidays approach.

Planning for Closures

Strategy Adjustments

You can improve your trading strategy by planning around the stock market holiday schedule. Many investors change their approach during holiday periods. For example, some use the “Sell in May and Go Away” strategy. This method means you move to cash from May to October and invest again from November to April. Studies show this can double the returns of a buy-and-hold approach for large-cap stocks and triple them for small-cap stocks. Other investors combine seasonal strategies, like the Turn of the Month effect or momentum trading, to boost returns and reduce risk.

You may also notice that trading volume drops during summer vacations and holidays. Lower volume can lead to wider bid-ask spreads and more price swings. To handle this, you can avoid making big trades right before or during holidays. Instead, focus on long-term wealth building and avoid reacting to short-term changes. After a holiday, review your portfolio to make sure your risk level and asset mix still match your goals.

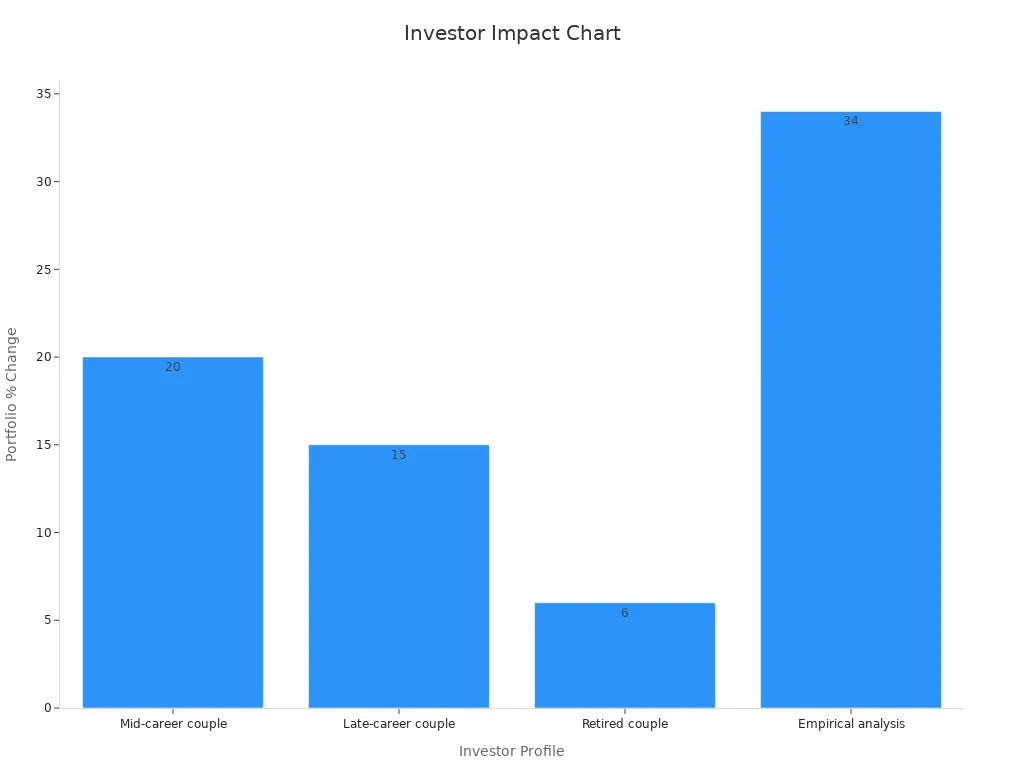

Here is a table showing how different investors adjust their plans when facing market closures or downturns:

| Investor Profile | Market Impact Example | Adjustment Options | Outcome/Insight |

|---|---|---|---|

| Mid-career couple | 20% portfolio drop | Delay retirement by 7.5 months or save 1% more and spend 1.4% less | Modest changes keep retirement plans on track |

| Late-career couple | 15% portfolio drop | Work 9 months longer or save 3% more and spend 2% less | Simple steps help recover even with less time |

| Retired couple | 6% portfolio hit | Cut spending by 1.9% | Small spending cuts help retirees stay on track |

| Empirical analysis | 2020 COVID crash | Most with plans stayed on track; 93% at peak, 75% at trough | Financial plans help avoid panic and keep progress during market closures |

| At-risk investors | Pre-crash at-risk | Market turmoil cut success chance by 33% | Investors without plans face bigger setbacks during closures |

Tip: Do not try to time the market during holiday periods. Stick to your plan and review your trading strategy after the holiday calendar changes.

Tracking Holiday Schedules

You need to stay updated on the stock market holiday schedule to avoid missed trades. Reliable resources help you track every updated holiday calendar and early closure. MarketBeat offers a detailed holiday calendar for NYSE and Nasdaq, listing all full closures and early closing days through 2028. You can also check the NYSE and Nasdaq official websites for the latest holiday schedule and FAQs.

| Resource | What It Offers |

|---|---|

| MarketBeat | Full and early closure dates for NYSE and Nasdaq, updated holiday calendar, FAQs |

| NYSE Website | Official holiday schedule, early closure notices, and trading hour updates |

| Nasdaq Site | Up-to-date holiday calendar, early closure alerts, and trading FAQs |

You should check these resources before making important trades. This habit helps you plan your trading strategy and avoid surprises. Always use an updated holiday calendar to make sure your schedule matches the market.

After-Hours and Holiday Trading

Image Source: pexels

Possibilities

You may wonder if you can trade stocks when the regular market closes. The answer is yes. Many U.S. stock exchanges offer after-hours trading sessions. These sessions let you buy and sell stocks outside the normal trading hours of 9:30 a.m. to 4:00 p.m. ET. For example, you can trade in the early morning from 4:00 a.m. to 9:30 a.m. ET and in the evening from 4:00 p.m. to 8:00 p.m. ET. Some exchanges, like the New York Stock Exchange and Nasdaq, plan to extend trading hours even further, possibly running almost 24 hours a day from Sunday night to Friday evening, except for holidays.

Here are some ways you can trade after the regular session:

- Use after-hours trading on platforms that support it, such as Nasdaq and NYSE.

- Trade options after the market closes, usually from 4:00 p.m. to 8:00 p.m. ET.

- Take part in special crossing sessions, where trades happen at the closing price.

| Exchange/Market | After-Hours Trading Session Details |

|---|---|

| NYSE | Crossing sessions at 5:00 p.m. with trades at the 4:00 p.m. closing price |

| Nasdaq Systems | Trading until 5:15 p.m., with some programs running until 6:30 p.m. |

| Chicago Stock Exchange | Post-primary sessions until 4:30 p.m.; “E-Session” from 4:30 p.m. to 6:30 p.m. for limit orders |

You can see that trading hours now stretch well beyond the regular session. This gives you more chances to react to news or events that happen after the market closes.

Note: Not all brokers offer after-hours trading. You should check with your broker to see if you can access these extended trading hours.

Risks

After-hours trading brings new risks. You may face lower trading volume, which means fewer buyers and sellers. This can make it harder to get the price you want. Prices may change quickly because fewer people are trading. You might see wider bid-ask spreads, so you could pay more to buy or get less when you sell.

Some risks you should know:

- Lower liquidity can make it hard to complete trades.

- Prices can swing more than during regular trading hours.

- Not all stocks are available for after-hours trading.

- News released after the market closes can cause sudden price changes.

You should also know that not all brokers let you trade during every after-hours session. Some only allow trading during certain times. The rules for trading hours can change, especially as exchanges plan to extend them. Always check your broker’s policy and understand the risks before you trade outside regular hours.

Tip: If you choose to trade after hours, use limit orders to control the price you pay or receive. This helps protect you from sudden price swings.

You gain a real advantage when you know the number of trading days and the U.S. stock market holiday schedule. Market holidays, early closures, and special events can change trading hours, liquidity, and even your returns.

- The market closes on major holidays like New Year’s Day, Thanksgiving, and Christmas.

- Early closes before holidays reduce trading time and affect prices.

- Pre-holiday trading days often bring higher returns than normal days.

Stay updated with official sources such as NYSE and Nasdaq. This helps you plan trades, avoid surprises, and make smarter investment decisions all year.

FAQ

How many trading days are there in a leap year?

You will find about 252 trading days in most years, including leap years. The number may change slightly if extra holidays or special closures occur. Always check the official calendar for the exact count.

What happens if a stock market holiday falls on a weekend?

If a holiday lands on a Saturday, the market usually closes on the Friday before. If it falls on a Sunday, the market closes on the following Monday. This rule keeps the trading schedule consistent.

Can you trade stocks on U.S. market holidays?

You cannot trade on official U.S. stock market holidays. All major exchanges, including NYSE and Nasdaq, stay closed. After-hours trading is also unavailable during these holidays.

How do early closures affect your trading?

Early closures shorten the trading session, usually ending at 1:00 p.m. ET. You have less time to place trades. Liquidity may drop, and prices can move more quickly. Plan your trades ahead of these days.

Holiday closures and early trading halts in the U.S. stock market’s 252 trading days can disrupt your strategy, while high cross-border fees complicate global investments. BiyaPay. empowers you to overcome these challenges by offering a platform where you can simultaneously invest in both U.S. and Hong Kong stock markets. It supports real-time, cost-free conversion of over 200 digital currencies, including USDT, into 30+ fiat currencies like USD and HKD. With its Swift Card enabling payments in 40+ currencies across 190+ countries and remittance fees as low as 0.5%, plus a 1-minute signup, BiyaPay ensures efficient, reliable access to global markets.

Elevate your trading experience now! Join BiyaPay.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.