- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Breaking down the differences in 2025 stock market forecasts

Image Source: pexels

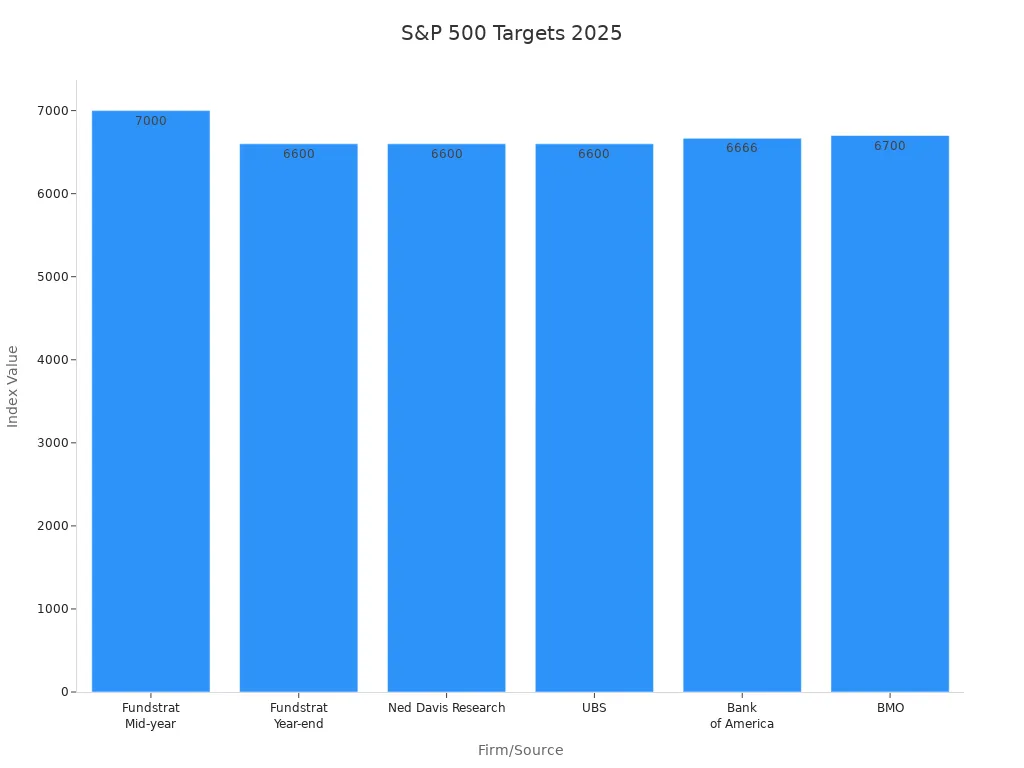

Stock market forecast 2025 targets from Wall Street analysts show a wide range, with S&P 500 predictions spanning from 4,800 to over 7,000. These differences reflect varied views on interest rates, economic growth, and market sentiment. Investors face a challenging year as shifting interest rate expectations and economic uncertainty shape these forecasts. For example, some firms like Fundstrat project gains due to expected Fed cuts and strong earnings, while others rely on technical or unconventional signals. The table below highlights the diversity among Wall Street analysts:

| Firm/Source | S&P 500 2025 Target | Supporting Statistical/Economic Rationale |

|---|---|---|

| Fundstrat (Tom Lee) | Mid-year: 7,000 | Expected 16% rise in first half, 8% total annual gain; Fed interest rate cuts and business-friendly policies support growth. |

| Year-end: 6,600 | ||

| Ned Davis Research | 6,600 | Ongoing Fed easing, disinflation, low recession risk, solid earnings growth; risk of volatility in second half. |

| UBS | 6,600 | Solid economic growth, Fed easing, AI advancements driving market upward. |

| Bank of America | 6,666 | 13% EPS growth forecast to $275; manufacturing recovery; mixed inflation impacts; sector diversification expected. |

| BMO | 6,700 | Bullish outlook with similar economic and earnings growth assumptions. |

Investors should treat forecasts as informed estimates, not guarantees, and consider multiple perspectives before making decisions.

Key Takeaways

- Wall Street analysts have very different 2025 S&P 500 targets, ranging from about 4,800 to over 7,000, due to varied views on economic growth, interest rates, and earnings.

- Forecasts use both historical data and current economic factors, but uncertainty about future events causes wide prediction ranges and mixed market sentiment.

- Investors should avoid relying on a single forecast and instead consider multiple analyst opinions, combining technical and fundamental analysis for better decisions.

- A balanced investment approach with diversification and risk management helps navigate market ups and downs while aiming for steady returns.

- Regularly reviewing forecasts and asking key questions about goals, risks, and data sources empowers investors to make informed, confident choices.

Stock Market Forecast 2025: Key Differences

Image Source: pexels

S&P 500 Target Ranges

Wall street analysts have released a wide range of S&P 500 targets for the stock market forecast 2025. Some year-end forecasts predict the S&P 500 could reach as high as 7,000, while others expect levels closer to 4,800. This broad range reflects both optimism and caution among analysts. The diversity in targets comes from different views on economic growth, interest rates, and corporate earnings.

Historical data shows that when analysts make more extreme predictions, they also widen their forecast intervals. This means that as the S&P 500 target moves further from the current level, the range of possible outcomes grows. Analysts do this to account for higher uncertainty and volatility in the stock market. For example, when the S&P 500 target is much higher or lower than average, the confidence interval can be about 50% wider than for moderate forecasts. This approach helps reduce overconfidence and aligns with the unpredictable nature of stocks.

A table below summarizes key statistical factors that influence these target ranges:

| Evidence Type | Description | Key Figures / Metrics |

|---|---|---|

| Historical Valuation-Return Link | Forward Price-to-Earnings (FPE) ratio inversely related to 10-year returns | FPE of 21.5 linked to 2-3% annualized returns if earnings and valuations fall as in past crises |

| Crisis Impact | Major crises caused sharp declines in earnings and valuations | Significant earnings and valuation drops during crises |

| Current Valuation and Forecast | High FPE at 21.5, but forecast expects less severe multiple compression | Expected returns 8-10% annually; earnings growth 8-10%; dividend yield 1-2%; valuation decline 1-2% annually |

| Corporate Profitability | U.S. corporate profits as % of GDP nearly doubled, supporting higher valuations | Profitability increase supports higher fair value FPE multiples (18-19) |

| Macroeconomic Factors | Real GDP growth, inflation, and interest rates support optimistic earnings outlook | Earnings growth and dividend yield create ~15% tailwind; valuation compression near term ~-5% |

| Forecast Divergence | Consensus expects sharp valuation drop to ~16; forecast expects gradual decline to 18-19 | Forecast rejects severe valuation overhang limiting returns to 2-3% |

These factors help explain why S&P 500 targets for the stock market forecast 2025 vary so much. Analysts use both historical patterns and current data to set their ranges, but uncertainty about future events leads to wider intervals, especially for more extreme predictions.

Analyst Sentiment Overview

Analysts show a mix of bullish, bearish, and cautiously optimistic views in their year-end forecasts for the S&P 500. Some expect strong gains, driven by robust earnings growth and possible interest rate cuts. Others remain cautious due to policy uncertainty, inflation, and global economic risks.

Several economic datasets explain this divergence in sentiment:

- The S&P 500’s P/E ratio dropped from over 22x to around 20x in early 2025, reflecting falling valuations as policy uncertainty and slower growth increased.

- Sentiment indicators like the University of Michigan’s Consumer Sentiment Index and The Conference Board’s CEO Confidence Index both declined, showing more caution among consumers and business leaders.

- The CBOE Volatility Index (VIX) spiked, signaling higher market volatility and investor anxiety.

- Key economic indicators such as unemployment rate, retail sales growth, housing starts, and industrial production suggest the U.S. economy is still expanding, but at a slower pace.

- The labor market remains strong, with low unemployment and steady job growth, but consumer spending growth has slowed.

- Housing starts fell due to high mortgage rates, though they remain above pre-pandemic levels.

- Industrial production is recovering, helped by expectations of lower interest rates.

A 2024 report from the Cleveland Federal Reserve used advanced models to analyze sentiment in financial documents. The report found that analyst sentiment can predict economic cycles and often captures information missed by traditional economic measures. Another study showed that market-wide and consumer sentiment, along with macroeconomic variables, affect different sectors in unique ways. For example, short-term interest rates hurt manufacturing and telecom, while positive market sentiment boosts durable goods and utilities.

These findings show why analysts disagree on the stock market forecast 2025. Some focus on strong fundamentals and resilient profits, while others worry about policy risks and slowing growth. The result is a wide range of S&P 500 targets and mixed sentiment about the direction of stocks.

Investors should remember that forecasts reflect both data and human judgment. The wide range of S&P 500 targets and mixed analyst sentiment highlight the uncertainty facing the stock market in 2025.

Analyst Forecasts: S&P 500 Leaders

RBC Capital

RBC Capital stands as a leading global investment bank with a strong reputation for equity research. Their analysts focus on both macroeconomic trends and company-specific data. For the 2025 S&P 500 outlook, RBC Capital projects a moderate gain, with the index reaching around 5,300 by year-end. This forecast reflects expectations for steady earnings growth and stable economic conditions. RBC recently updated its price target for Boeing (BA) to $230.0 USD, showing a willingness to adjust forecasts as new data emerges. Investors should note that RBC’s approach often emphasizes risk management and sector rotation. They suggest maintaining a diversified portfolio and watching for opportunities in industrial and technology stocks.

Bank of America

Bank of America, one of the largest financial institutions in the United States, provides detailed market analysis through its Global Research division. Their 2025 S&P 500 target stands at 6,666, one of the more bullish year-end forecasts among major banks. The rationale centers on expectations for 13% earnings per share growth, a recovery in manufacturing, and continued strength in consumer spending. Bank of America’s analysts highlight the importance of sector diversification, especially as inflation and interest rates remain uncertain. They have not issued any major revisions to their S&P 500 forecast in recent months. Investors may benefit from focusing on sectors with strong earnings momentum, such as technology and healthcare.

Oppenheimer

Oppenheimer, a respected investment firm with a long history in equity research, takes a constructive view on the S&P 500 for 2025. Their analysts forecast the index to reach 5,500 by year-end. Oppenheimer’s outlook relies on stable corporate earnings, moderate inflation, and supportive monetary policy. They believe that stocks can continue to rise if companies deliver on earnings expectations. Oppenheimer encourages investors to look for high-quality companies with strong balance sheets and consistent dividend growth. They have not made significant changes to their forecast in recent updates.

Yardeni Research

Yardeni Research, led by economist Ed Yardeni, is known for its independent and data-driven market analysis. The firm’s 2025 S&P 500 forecast sits at 5,400. Yardeni’s team expects moderate economic growth and a gradual decline in inflation. Their research points to resilient corporate profits and a healthy labor market as key drivers for stocks. Yardeni Research recommends that investors remain patient and avoid overreacting to short-term volatility. They have maintained a steady outlook, with no major revisions to their forecast.

Goldman Sachs

Goldman Sachs, a global leader in investment banking and financial services, offers a balanced perspective on the S&P 500. Their analysts set a 2025 target of 5,600, reflecting confidence in continued earnings growth and stable valuations. Goldman Sachs notes that the S&P 500 trades at 22.7 times 2025 earnings estimates, which remains elevated but justified by strong corporate performance. The firm highlights the importance of monitoring inflation, interest rates, and geopolitical events. Investors should consider a mix of growth and value stocks to navigate potential market swings. Goldman Sachs has not issued any major forecast revisions recently.

J.P. Morgan Research

J.P. Morgan Research, part of one of the world’s largest banks, provides a cautious but optimistic outlook for the S&P 500 in 2025. Their forecast places the index at 5,200 by year-end. J.P. Morgan’s analysts cite steady earnings growth, modest economic expansion, and manageable inflation as reasons for their view. They emphasize the role of investor sentiment, noting that skepticism often supports ongoing bull markets. J.P. Morgan suggests that investors use market pullbacks as entry points, as historical data shows strong returns following declines of 15% or more. The firm has not made significant changes to its forecast in recent months.

Morningstar

Morningstar, a leading provider of independent investment research, projects the S&P 500 to reach 5,400 in 2025. Their analysts base this forecast on stable earnings projections and reasonable valuation metrics. Morningstar’s research shows that the S&P 500 remains above key technical support levels, such as the 100-day and 200-day moving averages. They recommend that investors focus on companies with strong fundamentals and avoid chasing short-term trends. Morningstar’s outlook has remained consistent, with no major revisions reported.

Fidelity

Fidelity, a global asset management firm, offers a positive but measured view of the S&P 500 for 2025. Their analysts expect the index to close the year at 5,500. Fidelity’s rationale includes steady economic growth, improving corporate earnings, and a supportive policy environment. The firm highlights the importance of diversification and suggests that investors pay attention to sectors benefiting from technological innovation. Fidelity has not issued any recent changes to its S&P 500 forecast.

John Hussman

John Hussman, president of Hussman Investment Trust, is known for his cautious and data-driven approach. He stands out as one of the more bearish analysts, forecasting the S&P 500 to end 2025 near 4,800. Hussman’s outlook reflects concerns about high valuations and the potential for earnings disappointments. He points to the S&P 500’s price-to-earnings ratio, which remains above historical averages, as a reason for caution. Hussman advises investors to prioritize risk management and avoid overexposure to stocks, especially in overvalued sectors. He has not revised his forecast in recent months.

Market reports show that S&P 500 earnings projections remain stable, with consensus estimates of $263 for 2025 and $297 for 2026. The index continues to trade above key technical support levels, and analysts expect modest sales and earnings growth in the second quarter. These trends support the moderate but positive outlooks from many leading analysts.

| Key Evidence Point | Details |

|---|---|

| Market Momentum | Despite recent geopolitical tensions, the S&P 500 is up 1.6% year-to-date and remains above key technical support levels (100-day and 200-day moving averages). |

| Earnings Projections | Consensus earnings estimates for the S&P 500 are stable, with projected EPS of $263 for 2025 (7.5% growth) and $297 for 2026 (13.0% growth). |

| Valuation Metrics | The S&P 500 trades at 24.4 times 2024 actual earnings and 22.7 times 2025 estimates, with valuations expected to remain elevated barring inflation or interest rate rises. |

| Q2 Growth Expectations | Analysts forecast modest second quarter sales and earnings growth of 4.0% and 4.5% year-over-year, respectively, indicating steady corporate performance. |

| Market Catalysts | Inflation, interest rates, geopolitical events, and upcoming corporate earnings reports are key factors influencing investor sentiment and equity prices. |

Recent analyst activity also highlights strong growth trends among S&P 500 leaders. For example:

- Palantir Technologies analysts raised second-quarter EPS estimates by 7.69% over the past 60 days, with a consensus estimate of $0.14 per share, implying a 55.6% year-over-year growth rate.

- Howmet Aerospace analysts increased full-year EPS estimates by 6.13%, with a 2025 consensus EPS of $3.46, reflecting 28.6% growth. Howmet has consistently beaten earnings estimates since 2020, with an average earnings surprise of 8.9% over the last four quarters.

These examples show that many S&P 500 companies continue to deliver strong results, supporting the more optimistic stock market forecast 2025 targets from several analysts. However, investors should remain aware of risks from inflation, interest rates, and global events when making decisions about stocks.

S&P 500 Comparison Table

Image Source: pexels

Forecasts at a Glance

The table below compares the main S&P 500 targets for 2025 from leading analysts. Each row shows the analyst or firm, their year-end target, the main reason for their outlook, and their suggested investment strategy.

| Analyst/Firm | 2025 S&P 500 Target | Rationale Summary | Suggested Strategy | Stance |

|---|---|---|---|---|

| Fundstrat | 6,600 – 7,000 | Fed cuts, strong earnings, business-friendly policies | Focus on growth stocks, tech | Bullish |

| Bank of America | 6,666 | 13% EPS growth, manufacturing recovery | Diversify, overweight tech/health | Bullish |

| UBS | 6,600 | AI advancements, Fed easing, solid growth | Seek innovation leaders | Bullish |

| BMO | 6,700 | Bullish on earnings and economic growth | Stay invested, monitor volatility | Bullish |

| Goldman Sachs | 5,600 | Earnings growth, stable valuations | Mix of growth and value stocks | Neutral |

| Fidelity | 5,500 | Steady growth, tech innovation | Diversify, watch tech sectors | Neutral |

| Oppenheimer | 5,500 | Stable earnings, moderate inflation | High-quality, dividend stocks | Neutral |

| Yardeni Research | 5,400 | Resilient profits, healthy labor market | Stay patient, avoid overreacting | Neutral |

| Morningstar | 5,400 | Stable earnings, reasonable valuations | Focus on fundamentals | Neutral |

| RBC Capital | 5,300 | Steady earnings, stable economy | Diversify, watch industrials/tech | Neutral |

| J.P. Morgan | 5,200 | Modest growth, manageable inflation | Buy on pullbacks | Neutral |

| John Hussman | 4,800 | High valuations, earnings risk | Prioritize risk management | Bearish |

The table structure helps investors quickly compare S&P 500 forecasts and see how each analyst’s reasoning and strategy differ.

Rationale and Strategy Differences

Analysts use different models and data to build their S&P 500 forecasts. Some rely on advanced models like LSTM, which use many features and sliding window techniques to capture trends in stocks. Others focus on economic indicators, earnings, and market sentiment. These choices affect the accuracy and confidence of each forecast.

Statistical metrics such as tracking error, mean absolute error, and mean squared error help measure how much each forecast might differ from actual S&P 500 results. For example, models with more features often show higher accuracy, as seen in past analyses. The S&P 500 also differs from mechanical indexes in market capitalization and security selection, which can impact returns and risk.

Investors should note that bullish analysts expect strong earnings and policy support, while bearish analysts worry about high valuations and possible earnings disappointments. Neutral stances suggest a balanced approach, focusing on diversification and risk control. By comparing these strategies, investors can choose the approach that fits their own goals and risk tolerance.

Interpreting Analyst Predictions

Avoiding Overreliance

Investors often see a wide range of predictions from analysts. No single forecast can capture every market risk or opportunity. Relying too much on one prediction or indicator can lead to mistakes. Investors should use several tools and sources to guide their decisions.

- Technical indicators, such as Moving Averages and Relative Strength Index (RSI), show trends and market sentiment based on past price and volume data. These tools help spot patterns but should not be used alone.

- Combining technical analysis with fundamental research and current news gives a fuller picture.

- Historical data can guide decisions, but it does not always predict future moves, especially during market disruptions.

- Mixing quantitative methods, like analyzing trends and patterns, with qualitative insights, such as expert opinions, creates stronger forecasts.

- Regularly updating forecasts and recognizing the limits of each model helps reduce risk.

Investors should remember that no model or forecast is perfect. Using a mix of data, expert judgment, and current events leads to better decisions.

Building a Balanced Approach

A balanced investment approach helps manage risk and improve returns. Investors can use several performance metrics to measure how well their diversified portfolios perform.

- The Sharpe ratio shows how much extra return an investor gets for each unit of total risk.

- The Treynor ratio measures return compared to market risk.

- The Sortino ratio focuses on protecting against losses by looking at downside risk.

- The Information ratio compares returns to a benchmark, showing how much risk was taken to beat the market.

These metrics help investors compare different investments and understand the risk and reward of each choice. A balanced approach supports diversification, risk control, and the smart use of analyst insights.

Investor Questions to Consider

Before acting on any forecast, investors should ask themselves key questions:

- Does this forecast fit my investment goals and risk tolerance?

- What data and methods did the analysts use?

- How often do I review and update my investment plan?

- Am I considering both technical and fundamental factors?

- What could go wrong if the forecast is incorrect?

- How does this prediction compare to other sources?

Careful questioning and regular review help investors avoid costly mistakes and stay focused on long-term success.

Analysts present a wide range of 2025 stock market forecasts, each shaped by unique models and perspectives. Studies show that combining different forecasting methods, such as ARIMA and LSTM, improves accuracy by capturing more data patterns. Both quantitative and qualitative approaches offer value, but each has limits. Investors should treat forecasts as helpful guides, not guarantees. Focusing on long-term goals, keeping a balanced portfolio, and staying updated with new information can help investors make better decisions. For those seeking more guidance, tracking forecast updates and learning about new tools will support smarter investing.

FAQ

What factors cause analysts to have different S&P 500 forecasts?

Analysts use different models, data, and assumptions. Some focus on earnings growth, while others watch interest rates or global events. These differences lead to a wide range of S&P 500 targets.

How often do analysts update their stock market forecasts?

Analysts review forecasts regularly. They may update targets after major economic reports, earnings releases, or policy changes. Investors should check for updates every quarter or after significant news.

Should investors follow one analyst’s forecast or compare several?

Comparing several forecasts gives a broader view. Each analyst uses unique methods and data. Investors can make better decisions by reviewing multiple opinions and understanding the reasons behind each forecast.

How can investors use forecasts without taking on too much risk?

Investors can use forecasts as one tool among many. They should diversify their portfolios, set clear goals, and review their strategies often. Relying on a mix of data and expert advice helps manage risk.

The wide range of 2025 S&P 500 forecasts, from 4,800 to over 7,000, underscores the complexity of navigating market uncertainties like interest rates and economic growth. For investors looking to diversify across global markets, high cross-border fees and the hassle of opening overseas accounts can be significant barriers. BiyaPay offers a seamless solution, allowing you to invest in both U.S. and Hong Kong stock markets directly on its platform without needing an overseas account. With real-time, cost-free conversion of over 200 digital currencies, including USDT, into 30+ fiat currencies like USD and HKD, and remittance fees as low as 0.5%, BiyaPay outperforms traditional platforms. A 1-minute BiyaPay account registration provides fast, secure access to global markets, enabling you to capitalize on opportunities in U.S. and Hong Kong equities with ease and efficiency.

Start building your global portfolio today! Join BiyaPay.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.