- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

How the Number of Trading Days Varies Between the US, China, and Europe

Image Source: pexels

The US stock market typically opens for 252 days each year. China’s stock exchanges operate about 245 days annually. Major European markets, such as those in Germany and the UK, average between 250 and 253 days. Trading hours also differ across these regions. The US runs from 9:30 a.m. to 4:00 p.m. Eastern Time, while China splits its trading hours with a midday break, and Europe usually trades from 9:00 a.m. to 5:30 p.m. local time.

Differences in how many days is the stock market open a year and trading hours can affect investor strategies, market liquidity, and even the mental health of traders.

- Extended trading periods may increase volatility and require new approaches to risk management.

- Retail investors might face higher costs during off-peak trading, while institutions may use advanced tools to adapt.

Knowing how many days is the stock market open a year in each region helps traders plan and adjust their strategies for global coordination.

Key Takeaways

- The US stock market opens about 252 days a year, China about 245 days, and Europe between 250 and 253 days.

- Trading hours differ: the US trades continuously from 9:30 a.m. to 4:00 p.m., China has a midday break, and Europe offers the longest trading window without a lunch break.

- Holidays and cultural differences cause variations in trading days, affecting when markets close and reopen.

- Investors must adjust strategies to different trading calendars and hours to manage risk and take advantage of market opportunities.

- Understanding these differences helps investors improve global coordination, liquidity, and trading performance.

How Many Days Is the Stock Market Open a Year?

US

The United States has some of the busiest major stock markets in the world. The new york stock exchange, the nasdaq composite, and other north american exchanges usually open for 252 trading days each year. These exchanges close on weekends and observe several federal holidays. The most common holidays include New Year’s Day, Martin Luther King Jr. Day, Presidents’ Day, Good Friday, Memorial Day, Independence Day, Labor Day, Thanksgiving, and Christmas. The s&p 500, dow jones industrial average, and nasdaq composite all follow this schedule. When a holiday falls on a weekend, the exchanges may close on the nearest weekday. The new york stock exchange and nasdaq composite sometimes close early before major holidays, which can affect trading volumes. Investors who track the s&p 500 and dow jones industrial average must pay attention to these changes. The number of trading days can shift slightly each year, but the average remains close to 252.

China

China’s major stock exchanges, including those in Shanghai and Shenzhen, open for about 245 trading days each year. These exchanges close on weekends and during several national holidays. The most important holidays are the Chinese New Year, Qingming Festival, Labor Day, Dragon Boat Festival, Mid-Autumn Festival, and National Day. These holidays often last for several days, which reduces the number of trading days. The exchanges in China do not open for trading during these periods. The s&p 500 and dow jones industrial average do not follow the same holiday schedule, so investors who trade across regions must adjust their strategies. The major stock markets in China also close for special events or government announcements. The exchanges in China do not have as many half-day sessions as the new york stock exchange. The number of trading days in China stays close to 245 each year.

Europe

Major stock markets in Europe, such as those in Germany, France, and the United Kingdom, usually open for 250 to 253 trading days each year. The london stock exchange and other major stock exchanges in Europe close on weekends and for public holidays. These holidays include New Year’s Day, Good Friday, Easter Monday, Christmas, and Boxing Day. Some countries have extra holidays, which can change the number of trading days. The s&p 500, dow jones industrial average, and nasdaq composite do not follow the same holiday calendar as European exchanges. Investors who track the dow jones industrial average or s&p 500 must consider these differences when trading across regions. Trading Economics provides data on the number of trading days for European exchanges, but it does not always list the exact figures for each year. The major stock markets in Europe keep their trading days close to the global average, but small differences can affect global trading strategies.

Note: The number of trading days in each region depends on the holiday calendar and special events. Investors who want to know how many days is the stock market open a year should check the official calendars of each exchange.

Major Stock Markets Overview

Image Source: pexels

US Markets

The United States hosts some of the most important major stock markets in the world. The new york stock exchange, nasdaq composite, and other north american exchanges set the pace for global stock exchanges. The s&p 500, dow jones industrial average, and nasdaq composite track the performance of thousands of companies. These exchanges have seen some of the largest single-day declines in history. For example, the dow jones industrial average and s&p 500 both experienced sharp drops during the 2008 stock market crash. The nasdaq composite also faced major single-day declines during the dot-com bubble burst. Investors watch these major stock markets closely because their performance can signal changes in the global economy. The major stock exchanges in the US open for about 252 days each year, giving traders many opportunities to react to news and events.

Chinese Markets

China’s major stock markets include the Shanghai and Shenzhen exchanges. These exchanges play a key role in the global stock exchanges network. The s&p 500 and dow jones industrial average do not include Chinese companies, but many investors compare their performance to Chinese indexes. The nasdaq composite often lists technology firms, while Chinese exchanges focus on both state-owned and private companies. The number of trading days in China, about 245 per year, comes from daily frequency data collected by the WIND database. This database tracks daily prices, turnover, and even 5-minute interval prices. Researchers use this data, along with information from the National Health Commission of the People’s Republic of China, to ensure accurate reporting. The major stock markets in China have also seen some of the largest single-day declines, especially during the 2015 stock market crash. These events show how quickly market conditions can change.

European Markets

Major stock markets in Europe include the london stock exchange, Euronext, and Deutsche Börse. These exchanges help set the tone for trading across the continent. The s&p 500, dow jones industrial average, and nasdaq composite do not list European companies, but investors often compare their performance. The major stock exchanges in Europe usually open for 250 to 253 days each year. The london stock exchange has seen its share of single-day declines, especially during global financial crises. The dow jones industrial average and s&p 500 often move in tandem with European markets during periods of high volatility. The tokyo stock exchange in Japan also plays a role in global trading, but European exchanges remain central for investors tracking major stock markets. These exchanges provide a window into the health of the European economy and often react to news from the US and China.

Trading Hours

Image Source: pexels

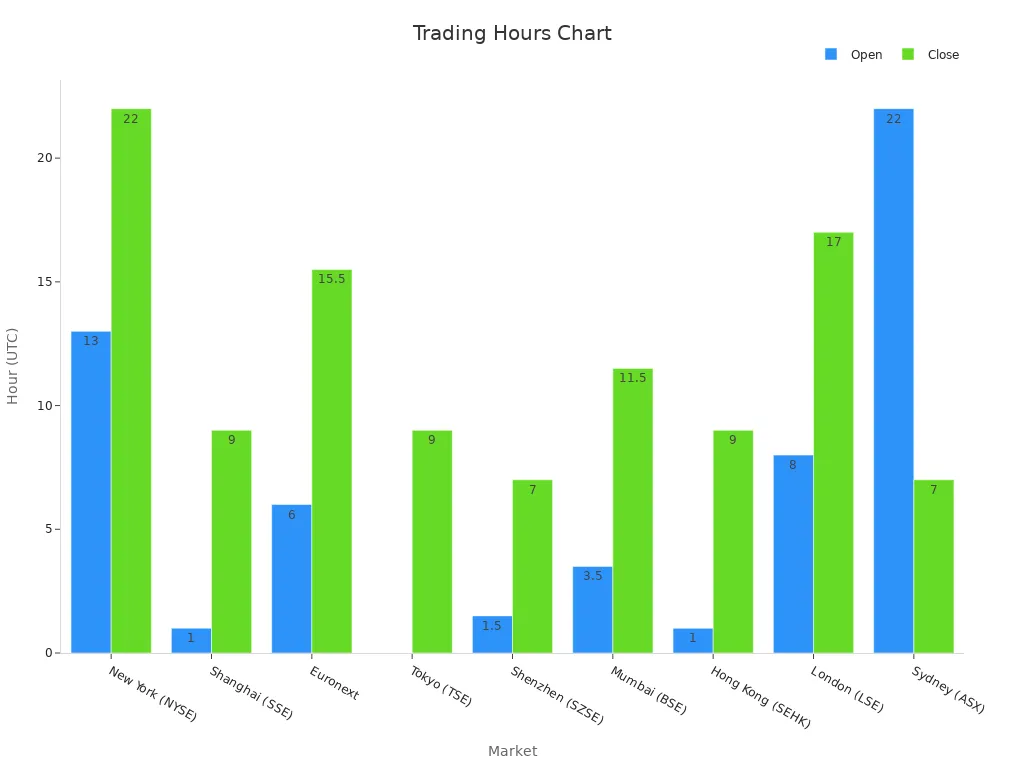

US

The United States stock markets, such as the New York Stock Exchange and Nasdaq, have set trading hours from 9:30 a.m. to 4:00 p.m. Eastern Time, Monday through Friday. These trading hours do not include a lunch break, so trading continues without interruption during the day. Many investors focus on these hours because most trading activity and liquidity happen during this time. Some platforms offer extended trading hours, allowing trades before the market opens and after it closes, but these sessions have lower liquidity and higher risk. The main trading hours in the US help traders plan their strategies and react to news quickly. Patterns like the “Lunch Effect” show that trading slows down around noon, while the last hour, called “Power Hour,” often sees more action. The table below shows the standard trading hours for major markets:

| Region | Exchange | Trading Hours (Local Time) | Lunch Break |

|---|---|---|---|

| North America | NYSE, Nasdaq | 9:30 a.m. - 4:00 p.m. | None |

China

China’s stock exchanges, including Shanghai and Shenzhen, have unique trading hours. The morning session runs from 9:30 a.m. to 11:30 a.m., followed by a lunch break. Trading resumes in the afternoon from 1:00 p.m. to 3:00 p.m. This midday break is common in Asian markets and gives traders time to rest and review news. The trading hours in China are shorter than in the US and Europe, and the lunch break splits the day into two sessions. Some futures markets in China, like the Shanghai Futures Exchange, also offer night trading hours for certain products, which helps traders respond to global events. The table below highlights the trading hours and breaks:

| Exchange | Trading Sessions | Breaks |

|---|---|---|

| Shanghai Stock Exchange | 9:30 a.m. - 11:30 a.m., 1:00 p.m. - 3:00 p.m. | 11:30 a.m. - 1:00 p.m. |

| Shenzhen Stock Exchange | 9:30 a.m. - 11:30 a.m., 1:00 p.m. - 2:57 p.m. | 11:30 a.m. - 1:00 p.m. |

Europe

European stock markets, such as the London Stock Exchange and Euronext, have trading hours that usually start earlier than in the US. The London Stock Exchange opens at 8:00 a.m. and closes at 4:30 p.m. local time, with only a short two-minute break at noon. Other European markets, like Euronext and Deutsche Börse, run from 9:00 a.m. to 5:30 p.m. These trading hours do not include a lunch break, so trading continues throughout the day. The longer trading hours in Europe give investors more time to react to news from Asia and the US. The table below summarizes the trading hours for key European exchanges:

| Exchange | Trading Hours (Local Time) | Lunch Break |

|---|---|---|

| London Stock Exchange (UK) | 8:00 a.m. - 4:30 p.m. | 2-minute break |

| Euronext (Paris, Amsterdam) | 9:00 a.m. - 5:30 p.m. | None |

| Deutsche Börse Xetra (Germany) | 9:00 a.m. - 5:30 p.m. | None |

Trading hours affect how investors around the world coordinate their trades. When trading hours overlap, markets can see higher trading volumes and more price movement. Investors who want to trade across regions must pay attention to these differences. The timing of trading hours can also limit access for some investors, especially if they live in a different time zone. Understanding trading hours helps traders plan their day and manage risk.

Why Trading Days Differ

Holidays

Holidays play a big role in how many days exchanges stay open each year. Each region has its own holiday calendar. For example, the US exchanges close for major holidays like Christmas, New Year’s Day, and Thanksgiving. In Europe, exchanges such as the London Stock Exchange and Euronext close for holidays like Good Friday and Boxing Day. China’s exchanges close for several days during the Chinese New Year and National Day. The table below shows some differences in holiday closures:

| Region/Exchange | Asset Class | Holiday Closure Details |

|---|---|---|

| US (CME Group) | Equity Index Futures | Full closure on Christmas, New Year’s Day; shortened hours on MLK Jr. Day, Presidents’ Day |

| Europe (Eurex) | Various Futures | Official holiday calendars exist; details vary by country |

| China | Various Futures | No detailed holiday closure specifics available |

Traders often check global stock market holiday calendars to plan their strategies. These calendars show that holiday schedules change by country and market, which affects trading days and hours. US holiday closures are well documented, but details for China and Europe are less clear.

Culture

Culture shapes how exchanges set their trading calendars. In some regions, religious and cultural events lead to extra market closures. For example, Middle East exchanges operate Sunday through Thursday because of religious practices. This schedule differs from the Monday through Friday pattern in the US and Europe. Academic studies show that culture also affects how people view time and deadlines. In some cultures, people value strict schedules, while others allow more flexibility. These differences can change how exchanges handle trading days and even how they respond to events like a stock market crash or the largest single-day declines.

- Culture influences how exchanges manage time and communication.

- Misunderstandings about time can cause delays and errors in trading.

- Companies must learn local customs to succeed in different markets.

A cross-cultural study found that time management practices affect job satisfaction and performance. In some cultures, people prefer to handle one task at a time, while others manage many tasks at once. These habits can change how exchanges plan their trading days and react to single-day declines.

Regulations

Regulations set the rules for how exchanges operate. Each country has its own laws about trading days, settlement procedures, and ownership. For example, some exchanges ban short selling or have special tax rules. These rules can change how many days the market stays open. Empirical studies of Middle East exchanges show that regulations, along with culture and holidays, explain why trading days differ. These studies use advanced models to analyze calendar anomalies, such as the weekend effect or day-of-the-week effects. They find that trading mechanisms and rules can lead to more or fewer trading days, which can affect how exchanges handle a stock market crash or the largest single-day declines. Regulations also impact how exchanges recover from single-day declines and manage risk.

Impact on Investors

Strategies

Investors change their strategies based on the number of trading days in each market. When the US, China, and Europe have different trading calendars, traders must adjust their plans. For example, the s&p 500, dow jones industrial average, and nasdaq composite all follow the US calendar, while Chinese and European markets close for different holidays. Research shows that trading behavior changes between day and night sessions. During the day, prices reflect more information, and traders react quickly to news. At night, risk increases, and returns behave differently. Skilled day traders focus on short-term price moves and use feedback from price trends. They often trade more when information is unclear or when stocks are volatile. The number of trading days gives these traders more chances to act on new information and adjust their strategies.

Market research finds that traders use several methods to adapt:

- They avoid trading before big news events.

- They use tighter stop losses when markets are quiet.

- They wait for clear price signals before making trades.

- They review recent price action to decide how aggressive to be.

Liquidity

Liquidity means how easily investors can buy or sell stocks like the s&p 500 or dow jones industrial average. When markets have more trading days, liquidity often improves. More trading days mean more chances for buyers and sellers to meet. In the US, the dow jones industrial average and s&p 500 see high trading volumes because the market opens more days each year. In China, fewer trading days can lead to lower liquidity, especially during long holidays. This can cause bigger price swings when the market reopens. Investors must plan for these changes to protect their performance.

Global Coordination

Global investors watch the trading calendars of all major markets. When the US, China, and Europe have different trading days, it becomes harder to coordinate trades. For example, if the s&p 500 is open but China’s market is closed, price movements in the US may not match those in Asia. The dow jones industrial average often reacts to news from Europe and China, but time zone differences and holidays can delay these effects. Investors who trade across regions must track each market’s schedule to avoid surprises. They also need to adjust their strategies to handle gaps in trading and changes in liquidity.

Note: Understanding trading days and hours helps investors manage risk and improve their global trading performance.

The US, China, and Europe each set unique trading days and hours. US markets open longer and do not pause for lunch, while China includes a midday break. Europe offers the longest trading window. Traders notice that early trades, especially in the first two hours, often yield better results. Market strength shifts during the day, with afternoons showing more activity. Certain months, like February and May, present special opportunities. Investors who understand these patterns can plan better and manage risk in global markets.

FAQ

How do trading days affect stock prices?

Stock prices can change more on days with high trading volume. Fewer trading days may lead to bigger price swings after long holidays. Investors often watch for these changes to adjust their strategies.

Why do some markets have a lunch break?

Markets like those in China include a lunch break to give traders time to rest and review news. This break can slow trading activity but helps traders stay alert during the day.

Can investors trade stocks when markets are closed?

Most investors cannot trade stocks when markets are closed. Some platforms offer after-hours trading, but these sessions have lower liquidity and higher risk. Prices may also change more during these times.

Do all countries close markets for the same holidays?

No, each country sets its own holiday calendar. For example, the US closes for Thanksgiving, while China closes for Chinese New Year. Investors must check each market’s schedule before trading.

How do different trading hours impact global investors?

Different trading hours can make it hard for global investors to react to news quickly. Overlapping hours may increase trading volume. Investors often plan trades based on when markets open and close.

Navigating the varying trading days and hours across the US (~~252 days), China (~~245 days), and Europe (~250–253 days) poses challenges for global investors, compounded by high cross-border fees and the complexity of opening overseas accounts. BiyaPay simplifies this landscape by enabling you to invest in both US and Hong Kong stock markets directly on its platform without needing an overseas account. With real-time, fee-free conversion of over 200 digital currencies, including USDT, into 30+ fiat currencies like USD and HKD, and cross-border remittance fees as low as 0.5%, BiyaPay offers unmatched cost efficiency compared to traditional platforms. A 1-minute BiyaPay account registration provides rapid, secure access to global markets, empowering you to coordinate trades seamlessly across regions and optimize your strategy in a dynamic trading environment.

Streamline your global trading today! Join BiyaPay.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.