- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Key dates for stock market closures in 2025

Image Source: pexels

You need to know the 2025 stock market holiday schedule to plan your trades. Here are the most important dates when the NYSE and Nasdaq are closed or closing early:

- New Year’s Day: January 1 (closed)

- Martin Luther King, Jr. Day: January 20 (closed)

- Presidents’ Day: February 17 (closed)

- Good Friday: April 18 (closed)

- Memorial Day: May 26 (closed)

- Juneteenth: June 19 (closed)

- Independence Day: July 4 (closed), July 3 (early close)

- Labor Day: September 1 (closed)

- Thanksgiving Day: November 27 (closed), November 28 (early close)

- Christmas Eve: December 24 (early close)

- Christmas Day: December 25 (closed)

Knowing these holidays helps you avoid surprises in your trading. Studies show that stock market holidays can affect trading behavior and returns. For example, the Santa Claus Rally often brings positive returns during the holiday season. Researchers also found that specific dates, like holidays, can cause unusual price swings and higher trading volumes. By understanding the schedule, you can adjust your strategies, manage risk, and plan your investments better. If you wonder, “Is the stock market closed on Martin Luther King Day?”—yes, markets close on that day.

Key Takeaways

- The stock market closes fully on ten federal holidays in 2025, including New Year’s Day, Martin Luther King Jr. Day, and Christmas Day. Mark these dates to avoid trading surprises.

- Early market closures happen on July 3, November 28, and December 24, with trading ending at 1:00 p.m. Eastern Time. Plan your trades carefully on these days to complete transactions on time.

- If a holiday falls on a weekend, the market observes the closure on the closest weekday, usually Friday or Monday. Always check the calendar yearly to stay updated.

- Stock market holidays can cause lower trading volumes and higher price swings. Use these times to review your portfolio and adjust your investment strategy.

- Bank, bond, and stock market holidays differ. Check all relevant holiday schedules to avoid delays in trading, fund transfers, or settlement.

2025 Stock Market Holiday Schedule

Image Source: pexels

Full-Day Closures

You need to know which days the stock market will close for a full day in 2025. The New York Stock Exchange (NYSE) and Nasdaq both follow the same holiday calendar. These closures help you plan your trades and avoid any surprises. The official 2025 stock market holidays include ten federal holidays. The Investopedia article, which uses the NYSE and Nasdaq official calendars, confirms these dates. Sometimes, special events like the funeral of a former president can also cause extra closures.

Here is a table showing all the full-day closures for 2025:

| Date | Holiday Name | Day of Week |

|---|---|---|

| January 1 | New Year’s Day | Wednesday |

| January 20 | Martin Luther King, Jr. Day | Monday |

| February 17 | Presidents’ Day | Monday |

| April 18 | Good Friday | Friday |

| May 26 | Memorial Day | Monday |

| June 19 | Juneteenth National Independence Day | Thursday |

| July 4 | Independence Day | Friday |

| September 1 | Labor Day | Monday |

| November 27 | Thanksgiving Day | Thursday |

| December 25 | Christmas Day | Thursday |

You should mark these dates on your calendar. The market will not open at all on these days. For example, if you want to trade around new year’s day or presidents’ day, you need to plan ahead. These holidays can affect your trading schedule and settlement times.

Note: Sometimes, the market may close for a full day due to special events. In 2025, the funeral of former President Jimmy Carter could lead to an extra closure. Always check for updates from the exchanges.

Early Closures

The stock market also has early closures on certain days. On these days, the NYSE and Nasdaq close at 1:00 p.m. Eastern Time instead of the usual 4:00 p.m. Early closures often happen before or after major holidays. This gives traders and staff more time to prepare for the holiday.

Here are the early closure dates for 2025:

- July 3 (Thursday) – Day before Independence Day

- November 28 (Friday) – Day after Thanksgiving

- December 24 (Wednesday) – Christmas Eve

You should pay close attention to these early closures. If you plan to trade on these days, you have less time to complete your transactions. Early closures can also affect how quickly your trades settle. For example, if you want to buy or sell stocks on Christmas Eve, you must finish before the early closing time.

Tip: Early closures can lead to lower trading volumes and higher price swings. You may see different market behavior on these days compared to regular trading days.

By knowing the 2025 stock market holidays and early closure dates, you can make better decisions and avoid last-minute problems. Always check the official stock market holiday schedule for any changes.

Stock Market Holidays and Observance Rules

Weekend Holiday Observance

You need to understand how the stock market handles holidays that fall on weekends. The U.S. Federal Holidays List for 2025 sets clear rules. When a holiday lands on a Saturday, the market observes the closure on the Friday before. If a holiday falls on a Sunday, the closure moves to the following Monday. This rule helps keep the schedule consistent for everyone. For example, if Juneteenth falls on a Sunday, the market will close on Monday, June 20. This way, you do not miss out on observing important holidays, even when they overlap with weekends. You should always check the calendar each year because the day of the week for each holiday can change.

Note: These rules apply to both the NYSE and Nasdaq. You will see the same pattern for all major stock market holidays.

Special Cases in 2025

Some years bring unique situations for stock market holidays. In 2025, you will see a few special cases that affect trading:

- Public and national holidays, such as New Year’s Day, Labor Day, and Independence Day, cause full market closures.

- Religious holidays, like Good Friday, lead to market closures in the United States and other countries.

- Memorial days and political events, such as a national day of mourning for a former U.S. president, can prompt unscheduled closures.

- Thanksgiving brings a special schedule. The market closes on Thanksgiving Day and has shortened hours the next day to help reduce volatility.

- Technical maintenance sometimes requires the market to pause trading for system updates.

- You can use strategies like hedging with put options or placing limit orders to manage risks during and after holidays.

- International trading platforms let you trade on other markets when the U.S. exchanges close for a holiday.

You should plan your trades around these special cases. Knowing the full list of stock market holidays and understanding these rules will help you avoid surprises and manage your investments better.

Juneteenth 2025 and Other Notable Dates

Image Source: pexels

Juneteenth 2025

You will see that Juneteenth 2025 is a federal holiday. On June 19, the stock market closes for the day. Banks such as Bank of America, Wells Fargo, and J.P. Morgan Chase also close. You will not get mail from USPS, and their offices stay closed. UPS and FedEx keep working, so you can still send and receive packages. Most stores, including Walmart, Target, and Costco, open as usual. Fast food places like McDonald’s and Burger King serve customers, but some Chick-fil-A locations may close. Schools and DMV offices do not open on this holiday. You should plan your trades and errands before Juneteenth 2025 because many services pause for the day. Online banking and ATMs work, but you might see delays in processing.

Tip: Always check your local store or restaurant hours, as some locations may change their schedule for the holiday.

Other Key Holidays

You need to know the full list of stock market holidays for 2025. These dates help you plan your trades and avoid missed opportunities. The table below shows the main holidays and when the NYSE and Nasdaq close or close early:

| Holiday | Date | Market Status |

|---|---|---|

| New Year’s Day | Jan 1 | Closed |

| Martin Luther King, Jr. Day | Jan 20 | Closed |

| Presidents’ Day | Feb 17 | Closed |

| Good Friday | Apr 18 | Closed |

| Memorial Day | May 26 | Closed |

| Juneteenth | Jun 19 | Closed |

| Day before Independence Day | Jul 3 | Early close at 1:00 p.m. ET |

| Independence Day | Jul 4 | Closed |

| Labor Day | Sep 1 | Closed |

| Thanksgiving | Nov 27 | Closed |

| Day after Thanksgiving | Nov 28 | Early close at 1:00 p.m. ET |

| Christmas Eve | Dec 24 | Early close at 1:00 p.m. ET |

| Christmas Day | Dec 25 | Closed |

You will notice that the market closes early on the day before Independence Day, the day after Thanksgiving, and Christmas Eve. Veterans Day is not a market holiday, so trading continues as usual. If a holiday falls on a weekend, the market usually observes it on the closest weekday. By knowing these holidays, you can avoid trading delays and plan your investments with confidence.

Is the Stock Market Closed on Martin Luther King Day

Martin Luther King Jr. Day 2025

You may wonder, is the stock market closed on martin luther king day? The answer is yes. Both the NYSE and Nasdaq close every year to honor this important federal holiday. In 2025, you will see the markets closed on Monday, January 20. No trading will take place on this day. If you plan to buy or sell stocks, you need to do so before or after the holiday.

Note: The closure applies to all regular trading. You cannot place trades, and orders will not process until the next open market day.

You should always check the calendar and ask yourself, is the stock market closed on martin luther king day, before making any trading plans in January. This helps you avoid delays and missed opportunities.

Impact on Trading

Is the stock market closed on martin luther king day? Yes, and this closure affects trading patterns in several ways. Studies show that trading volumes drop sharply on the day before regular federal holidays like martin luther king jr. day. After the holiday, trading activity usually increases. This pattern happens because many investors pay less attention to the market before a holiday and return with renewed focus afterward.

You may notice some interesting effects around this holiday:

- Trading volumes are lower on the day before martin luther king, jr. day.

- The day before the holiday often brings higher-than-normal returns, a pattern called the “pre-holiday effect.”

- Investors sometimes feel more optimistic before holidays, which can lead to price swings.

- After the holiday, trading volume rises as investors return to the market.

These trends appear every year, not just in 2025. When you ask, is the stock market closed on martin luther king day, remember that the answer also means you should plan for changes in trading volume and price movement. By understanding these patterns, you can make smarter decisions and avoid surprises.

Bond Market and Bank Holiday Differences

Bond Market Closures

You may notice that the bond market does not always follow the same schedule as the stock market. In 2025, the bond market closes on many of the same days as the NYSE and Nasdaq. These include New Year’s Day, Martin Luther King Jr. Day, Presidents Day, Good Friday, Memorial Day, Juneteenth, Independence Day, Labor Day, Thanksgiving, and Christmas Day. However, the bond market also closes on Columbus Day and Veterans Day. The stock market stays open on those two days.

The bond market also has more early closures. For example, it closes early at 2:00 PM ET on the day before Good Friday, the Friday before Memorial Day, the day before Independence Day, the day after Thanksgiving, Christmas Eve, and New Year’s Eve. The stock market usually closes early at 1:00 PM ET on only a few of these days.

Here is a table to help you see the differences:

| Holiday/Event | Stock Market Status (2025) | Bond Market Status (2025) | Bank Holiday Status (2025) |

|---|---|---|---|

| Veterans Day (Nov 11) | Open | Closed | Closed |

| Columbus Day (Oct 13) | Open | Closed | Closed |

| Christmas Day (Dec 25) | Closed | Closed | Closed |

| Day before Independence Day | Early close at 1:00 PM ET | Early close at 2:00 PM ET | N/A |

| Day after Thanksgiving | Early close at 1:00 PM ET | Early close at 2:00 PM ET | N/A |

| New Year’s Eve | Open (full day) | Early close at 2:00 PM ET | N/A |

Note: The bond market sometimes observes different rules if a holiday falls on a weekend. For example, if New Year’s Day is on a Saturday or Sunday, the bond market may not close at all, while banks might observe the holiday on a weekday.

Bank vs. Stock Market Holidays

You might think that banks and the stock market always close on the same days, but this is not true. Banks, such as those in Hong Kong, follow the federal holiday calendar. The stock market closes on most of these days, but not all. For example, banks close on Veterans Day and Columbus Day, but the stock market stays open. The bond market closes on these days, so you cannot trade U.S. Treasury bonds.

You should remember that banks may close for holidays even when the stock market is open. This can affect your ability to transfer money or settle trades. If you plan to move funds between your bank and your brokerage account, check both the bank and market holiday schedules.

Tip: Always check the holiday calendars for your bank, the stock market, and the bond market. This helps you avoid delays in trading or transferring money.

The differences in holidays can affect your trading plans. You need to know which days each market closes to avoid surprises.

Planning for 2025 Stock Market Holidays

Trading and Settlement Delays

You need to watch for trading and settlement delays around stock market holidays. When the market closes for a holiday, you cannot buy or sell stocks until it reopens. If you place a trade right before a holiday, your transaction may not settle until after the market opens again. This can affect your cash flow and your ability to react to market changes.

Market holidays often lead to lower trading volumes. You may see bigger price swings because fewer people are trading. Volatility can increase before a holiday as traders adjust their positions. If you trade internationally, you might face even more delays. U.S. and Canadian market closures can change global trading patterns. Always check if your trades will settle on time, especially if you use Hong Kong banks or other international banks.

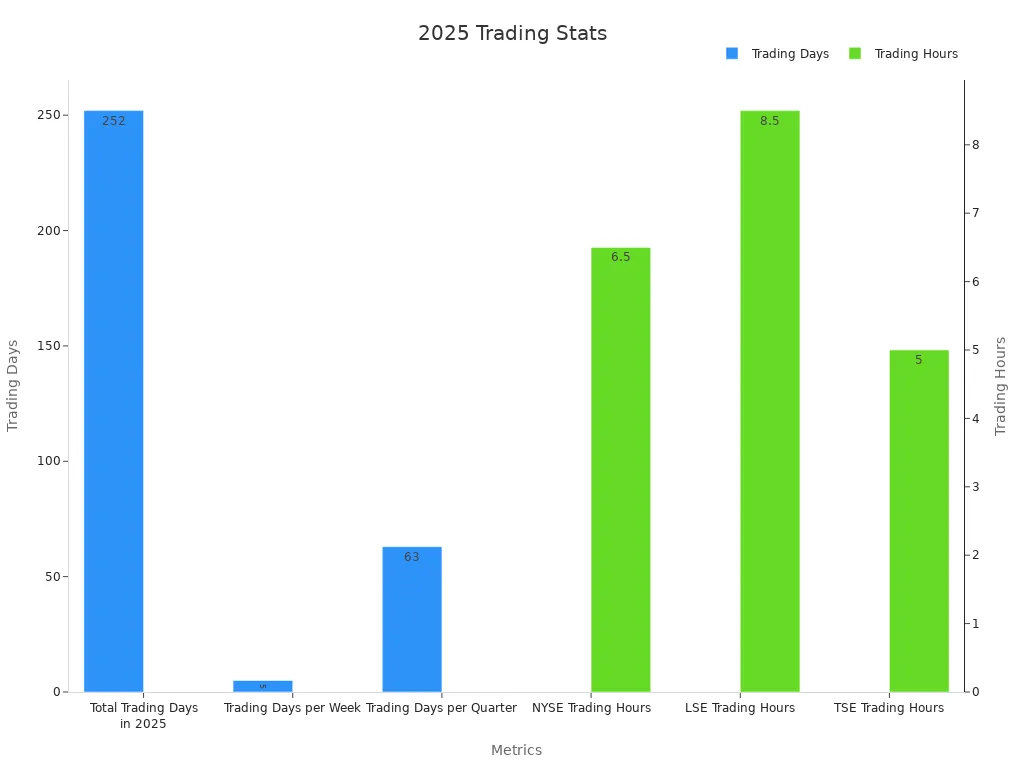

Here is a table to help you understand the trading calendar for 2025:

| Metric | Details |

|---|---|

| Total Trading Days in 2025 | Approximately 252 days (weekdays minus public holidays) |

| Trading Days per Week | 5 days (Monday to Friday) |

| Trading Days per Quarter | About 63 days |

| NYSE Trading Hours | 9:30 AM to 4:00 PM Eastern Time (6.5 hours) |

| Calculation Method | Trading days = Total calendar days - weekends - public holidays |

| Importance for Investors | Understanding holidays and trading days helps in effective trading and planning in 2025 |

Tip: Set calendar alerts for upcoming holidays and early closures. This helps you avoid missed trades and settlement surprises.

Tips for Investors

You can use stock market holidays as natural checkpoints for your investment strategy. Many investors review their portfolios during these breaks. Here are some data-driven strategies you can follow:

- Use holidays like Good Friday, Memorial Day, Independence Day, Labor Day, Thanksgiving, and Christmas to review and rebalance your portfolio.

- Treat Good Friday as a Q1 checkpoint. Check your investments and adjust if the market feels volatile.

- Memorial Day is a good time to prepare for the summer, when trading volume often drops.

- Independence Day lets you review your goals after Q2 earnings reports.

- Labor Day marks the start of a busy market season. Get ready for Q4 earnings.

- Thanksgiving and the short session after it are perfect for reviewing your yearly performance and thinking about tax strategies.

- Christmas is your last chance to finish tax planning and get ready for the new year.

You should also:

- Adjust your positions before holidays to avoid low liquidity periods.

- Check if your trading platform offers pre-market or after-hours trading.

- Read annual letters from market experts, such as the Annual Letter 2025 from Rajeev Prakash Agarwal, for new insights.

Note: Careful planning around holidays helps you manage risk and take advantage of market trends.

You should always check the 2025 stock market holiday schedule before making any trading decisions. Trading hours for different instruments can change around holidays, which may affect your strategy. For example, the table below shows how some trading instruments close early and resume at different times:

| Instrument | Early Closure (Jan 20) | Resumption (Jan 21) |

|---|---|---|

| XAUUSD, XAGUSD | 21:15 | 01:00 |

| ASX200 | 23:00 | 00:50 |

| HK50 | 21:00 | 01:00 |

Bookmark the schedule or save it for quick reference. Stay alert for updates or special announcements from the exchanges to avoid surprises.

FAQ

What time does the stock market open and close?

You can trade on the NYSE and Nasdaq from 9:30 a.m. to 4:00 p.m. Eastern Time. Early closure days end at 1:00 p.m. Eastern Time. Always check your broker’s schedule for any changes.

Does the stock market close for international holidays?

You will see the U.S. stock market close only for U.S. federal holidays. International holidays, such as those in China or Europe, do not affect NYSE or Nasdaq trading hours.

Can you trade stocks when the market is closed?

You cannot trade during regular hours when the market closes. Some brokers offer after-hours or pre-market trading. These sessions have lower volume and higher risk. Always check your broker’s rules.

How do stock market holidays affect settlement times?

Stock market holidays delay settlement. If you buy or sell before a holiday, your trade settles after the market reopens. For example, if you trade on Friday and Monday is a holiday, settlement moves to Tuesday.

The 2025 stock market holiday schedule, with ten full-day closures and three early closures on July 3, November 28, and December 24, underscores the need for strategic planning to avoid trading disruptions and capitalize on global market opportunities. High cross-border fees and the complexity of opening overseas accounts can hinder diversification, especially when coordinating trades across regions like the US and Hong Kong with differing schedules. BiyaPay simplifies this by enabling you to invest in both US and Hong Kong stock markets directly on its platform without needing an overseas account. With real-time, fee-free conversion of over 200 digital currencies, including USDT, into 30+ fiat currencies like USD and HKD, and cross-border remittance fees as low as 0.5%, BiyaPay offers cost-effective access to global markets. A 1-minute BiyaPay account registration ensures swift, secure entry, helping you navigate market closures and optimize your trading strategy.

Plan your trades smarter in 2025! Join BiyaPay.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.