- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

The Best Forums for U.S. Stock Market Insights in 2025

Image Source: pexels

Looking for the top investing communities to boost your stock market knowledge? You have many great options in 2025. Check out r/wallstreetbets, r/stocks, Bogleheads Forum, StockTwits, Seeking Alpha, and Today’s U.S. stocks offer real-time insights. These online communities give you fast updates and access to smart investors.

Did you know? r/wallstreetbets jumped from 2 million to over 13 million followers in just five days during the GameStop surge. Tweets and posts can move stocks by hundreds of percent. One online community can change the market in minutes.

Key Takeaways

- Joining online investing communities gives you fast market updates and helps you make smarter decisions.

- Different forums fit different styles, from long-term investing to fast trading and beginner-friendly advice.

- Active communities offer support, education, and chances to learn from real investors’ experiences.

- Using AI tools and premium clubs can provide deeper research and exclusive stock ideas.

- Try several forums to find the one that matches your goals and enjoy learning while connecting with others.

Why Join Online Communities

Real-Time Market Insights

You want to stay ahead in the fast-moving U.S. stock market. An online community gives you instant updates and alerts about breaking news, earnings, and market shifts. Many investor community members share their thoughts as events unfold. This helps you react quickly and make smarter choices. For example, platforms like FINQ use AI to scan analyst reports, public sentiment, and company data in real time. You get rankings of S&P 500 stocks, so you can spot top performers or avoid weak ones. BlackRock’s team now tracks more real-time signals than ever. They even use trends like job postings to adjust their trading strategies. This approach helps you manage risk and find new opportunities before others do.

Tip: Real-time insights can help you optimize your portfolio and avoid costly mistakes.

Diverse Strategies and Education

You will find every kind of trading strategy in an investor community. Some people focus on long-term growth, while others love day trading or swing trading. You can learn from both. Social media has changed how people share investing resources. In 2005, only 5% of U.S. investors used social media. By 2020, that number jumped to 72%. Many younger investors now rely on these platforms for advice and entertainment. You can pick up new trading strategies, learn from mistakes, and see what works for others. Community-based signals also shape decisions. On copy trading platforms, people often follow traders with strong social profiles. This shows how much a community of investors can influence your choices.

- You get access to guides, tutorials, and real stories from real people.

- You can compare different trading strategies and see which fits your goals.

Networking and Support

You never have to invest alone. An online community connects you with people who share your interests. You can ask questions, get feedback, and celebrate wins together. If you feel stuck, someone in the investor community has probably faced the same problem. You can join discussions, attend virtual meetups, or even find a mentor. This support system makes investing less stressful and more fun. You also build confidence as you learn from others and share your own experiences.

Note: The best investing resources often come from people who have been where you are now.

Top Investing Communities on Reddit

Image Source: pexels

Reddit has become one of the most popular places for stock message boards. You can find all kinds of investment discussions, trading tips, and user-generated investment ideas. Each subreddit has its own style and community vibe. Let’s look at the top subreddits for U.S. stock market insights in 2025.

r/stocks

You want to talk about the latest news, earnings, and trends? r/stocks is your go-to spot. This subreddit focuses on stock discussions for U.S. companies. You will see daily threads about market movers, company updates, and analyst ratings. The community welcomes both beginners and experienced investors. People share investing ideas and ask questions about stocks they are watching. Moderators keep the conversations on track, so you get high-quality posts. The group stays active throughout the trading day, and you can always find someone to chat with about the market.

- Ideal for: Investors who want news, analysis, and thoughtful stock message boards.

- Discussion style: Friendly, helpful, and focused on facts.

r/investing

If you want to dig deeper into investment discussions, r/investing is a great choice. This subreddit covers more than just stocks. You will find posts about bonds, ETFs, real estate, and even global markets. The group values research and long-term thinking. Many users post detailed guides and explain complex topics in simple terms. You can ask about portfolio building or get advice on market cycles. The community loves to debate, but people respect different opinions.

- Ideal for: Investors who want to learn about all types of assets, not just stocks.

- Discussion style: Analytical, educational, and respectful.

r/wallstreetbets

You have probably heard about r/wallstreetbets. This subreddit made headlines during the GameStop surge. The group is famous for bold trades and wild stories. People here love risk and big moves. You will see lots of memes, jokes, and screenshots of wins (and losses). The energy is high, and the posts move fast. Some users share trading tips, but you should always do your own research. Studies show that comment activity on this subreddit can even predict trading volume for certain stocks. If you like excitement and want to see what’s trending, this is the place.

- Ideal for: Risk-takers, day traders, and anyone who enjoys fast-paced stock message boards.

- Discussion style: Unfiltered, energetic, and sometimes chaotic.

Note: r/wallstreetbets can move markets. Always double-check any investing ideas you find here.

r/StockMarket

You want a mix of news, analysis, and personal stories? r/StockMarket offers a balanced space for all kinds of investors. The subreddit covers everything from breaking news to long-term strategies. You will find daily threads, Q&As, and polls about the U.S. stock market. The group is smaller than r/stocks, but the conversations are focused and helpful. People share their experiences and ask for feedback on their trades. If you want a friendly place to learn and grow, this subreddit is a solid pick.

- Ideal for: Investors who want a supportive community and a variety of stock message boards.

- Discussion style: Welcoming, informative, and open to all skill levels.

r/personalfinance

You might not think of r/personalfinance as a stock message board, but it is one of the busiest subreddits for investment discussions. The group covers everything from budgeting to retirement planning. Stocks and investing are always hot topics. The community is huge and keeps growing. Between July 2020 and June 2022, the subreddit saw over 130,000 posts and up to 2 million comments each year. More than 250,000 users joined in just one year. Most people join to ask questions, share advice, or learn from others’ mistakes. You can find guides on how to start investing, manage risk, and build wealth over time.

| Timeline | Posts | Comments | Users |

|---|---|---|---|

| July 2020 - June 2021 | ~134,500 | ~1,520,000 | ~237,700 |

| July 2021 - June 2022 | ~131,000 | ~2,040,000 | ~252,500 |

- Ideal for: Beginners, long-term investors, and anyone looking for practical advice.

- Discussion style: Supportive, educational, and focused on real-life solutions.

Tip: r/personalfinance is perfect if you want to learn about investing as part of your bigger financial picture.

You can join one or more of these subreddits to get the most out of Reddit’s stock message boards. Each group offers a different mix of stock discussions, investing ideas, and community support. Try a few and see which one fits your style best.

Leading Stock Market Forums

Image Source: pexels

You want to find the best stock market forums for real insights and support. Each investment forum has its own style, focus, and community. Let’s look at the top choices and see which one fits your needs.

The Motley Fool Community

You might know the motley fool for its famous stock picks and easy-to-read advice. The motley fool community gives you a friendly place to talk about stocks, ask questions, and share ideas. You will find lots of long-term investors here. People love to discuss company fundamentals, earnings, and growth stories. The motley fool also offers premium boards for deeper research and exclusive picks.

- Focus: Long-term investing, stock analysis, and education.

- Strengths: Helpful members, expert articles, and a positive vibe.

- Best for: You, if you want to build wealth over time and learn from experienced investors.

Tip: The motley fool community is great if you want to avoid hype and focus on real research.

Bogleheads Forum

If you like simple investing, you will feel at home in the Bogleheads Forum. This financial forum follows the ideas of John Bogle, the founder of Vanguard. People here believe in low-cost index funds, steady growth, and smart money habits. You can ask about retirement, taxes, and how to build a safe portfolio. The group is very welcoming to beginners and loves to share step-by-step guides.

- Focus: Index funds, long-term planning, and financial independence.

- Strengths: Clear advice, strong moderation, and a huge library of guides.

- Best for: Beginners and anyone who wants a stress-free way to invest.

Note: The Bogleheads Forum is perfect if you want to keep things simple and avoid risky trades.

InvestorsHub

You want fast updates and active stock message boards? InvestorsHub gives you real-time news, charts, and lively discussions. This trading forum is popular with day traders and people who like to follow hot stocks. You can join boards for almost any company or sector. The site also has tools for tracking prices and volume.

- Focus: Active trading, penny stocks, and breaking news.

- Strengths: Fast posts, lots of stock message boards, and real-time alerts.

- Best for: You, if you like to trade often and want to catch quick moves.

Alert: Always double-check tips from InvestorsHub before you trade. Some stocks move fast and carry high risk.

Stockaholics

Stockaholics is a friendly place for all types of investors. You can join discussions about stocks, options, and even cryptocurrencies. The community loves to share charts, strategies, and market news. You will find both beginners and experts here. The site has contests, learning threads, and a relaxed vibe.

- Focus: Stock picks, technical analysis, and community learning.

- Strengths: Supportive members, easy-to-use forums, and lots of learning tools.

- Best for: You, if you want to learn, share, and grow with others.

Tip: Stockaholics is a good choice if you want to try new strategies and get feedback from a helpful group.

Investors Hangout

You want a place with less noise and more real talk? Investors Hangout gives you that. This investment forum has boards for thousands of stocks and a strong focus on honest discussion. You can post questions, share research, and connect with people who care about the same companies. The site is free and has fewer ads than some other stock market forums.

- Focus: Company news, honest opinions, and community support.

- Strengths: Clean layout, active boards, and a friendly feel.

- Best for: You, if you want real conversations without hype.

Note: Investors Hangout is great for finding new ideas and talking with people who do their own research.

Yahoo! Finance Forums

Yahoo! Finance Forums have been around for years. You can join stock message boards for almost any public company. People post news, rumors, and opinions all day. The forums are busy, so you get lots of views and replies. You will find both serious investors and casual traders here.

- Focus: Company news, earnings, and market rumors.

- Strengths: Huge user base, fast replies, and easy access.

- Best for: You, if you want quick feedback and a wide range of opinions.

Tip: Yahoo! Finance Forums are good for checking the mood on a stock, but always do your own research before making a move.

Which Forum Fits Your Style?

You might wonder which stock market forums work best for your goals. Here’s a quick look at what different investors want:

| Investor Type | Preferred Metrics and Tools | Focus and Features |

|---|---|---|

| Long-term Investors | Deep fundamental analysis with 650+ metrics including income statements, balance sheets, cash flow, and key ratios | Portfolio management, diversification, detailed research, screening for value investing criteria |

| Active Traders | Comprehensive technical analysis, real-time data feeds, advanced charting tools | Day trading, short-term strategies, fast data access |

| Beginners | Intuitive visualizations, comprehensive screening, accessible pricing | Easy-to-understand market insights, simplified decision-making without complex analysis |

You can use this table to match your style to the right forum. If you want deep research and long-term growth, the motley fool and Bogleheads Forum are strong picks. If you like fast trades and real-time news, InvestorsHub and Yahoo! Finance Forums give you what you need. Beginners often start with Stockaholics or Bogleheads Forum for simple guides and friendly help.

Remember: The best stock market forums help you learn, connect, and make smarter choices. Try a few and see where you feel at home.

Social Platforms and Online Communities

You want to connect with other investors and get real-time updates? Social platforms make this easy. You can join conversations, share investing ideas, and see what others think about the market. These communities help you learn fast and react to news as it happens. Many investors use social listening tools and AI to track mentions of stocks. This gives you a quick look at market sentiment and helps you spot trends before they go mainstream.

StockTwits

stocktwits stands out as a top choice for real-time stock discussions. The platform is built just for investors like you. You can follow trending tickers, check interactive charts, and read short messages from other users. stocktwits lets you join conversations about your favorite stocks and see what’s moving the market. The design makes it easy to jump in and share your thoughts. You get instant feedback and can spot new opportunities fast. Many traders use stocktwits to track breaking news and market shifts. If you want a lively place to discuss stocks, stocktwits is a must-try.

Twitter (FinTwit)

Twitter’s FinTwit community brings together investors, analysts, and experts from around the world. You can follow hashtags, join threads, and see live reactions to earnings or news. FinTwit moves fast. You get opinions, charts, and even memes in real time. Many investors use AI tools to scan tweets for sentiment. This helps you understand how people feel about certain stocks.You can also find global voices, including Today’s U.S. Stocks, which shares U.S. market news in Chinese. This gives you a broader view and helps you spot trends that cross borders.

Discord Groups

Discord groups offer private spaces for focused stock discussions. You can join servers for day trading, long-term investing, or even specific sectors. Many groups use bots and alerts to share news as it breaks. You can chat by text or voice, ask questions, and get feedback from other members. Discord makes it easy to build a close network. Some groups even host live events or workshops. Today’s U.S. Stocks has its own Discord channels, bringing together investors from the U.S. and China for real-time updates.

Facebook Groups

Facebook Groups give you a simple way to join large investing communities. You can search for groups by topic, join discussions, and share your own ideas. Many groups focus on U.S. stocks, but you will also find global communities. Today’s U.S. Stocks runs several active Facebook Groups, connecting investors who want to learn about the U.S. market in Chinese. You can ask questions, post news, and get advice from people with different backgrounds.

Meetup for Investors

Meetup helps you find local and online events for investors. You can join workshops, webinars, or in-person meetups. These events let you network, learn from experts, and share your investing ideas. Many groups use Meetup to organize talks about U.S. stocks and global markets.Today’s U.S. Stocks often hosts events that bring together investors from China and the U.S.This gives you a chance to hear new perspectives and build your network.

Tip: Joining more than one platform helps you see different sides of the market. You get real-time updates, global views, and support from other investors.

Exclusive and Premium Investing Clubs

You might want more than just free forums. Some investors join exclusive or premium clubs for deeper research, expert picks, and a tight-knit community. These clubs often have strict entry rules or paid memberships. Let’s see what makes each one special and who should join.

Value Investors Club

Value Investors Club stands out as one of the most exclusive groups. You need to apply and show your investing skills to get in. Only a few new members join each year. Most members are professionals who share detailed research on small-cap and special-situation stocks. You will find ideas with a median market cap of about $393 million. Many posts come from people who actually own the stocks they write about. This helps reduce hype and risky tips. For example, one recent pick led to a 40% gain in just a few months. If you want high-quality ideas and can pass the tough entry test, this club could be for you.

Note: You must submit a sample write-up to apply. The club keeps things quiet and focused.

Seeking Alpha Premium

Seeking Alpha Premium gives you access to advanced research tools and exclusive articles. You need to pay a monthly fee, usually around $29.99 USD (check the latest exchange rates if you pay from outside the U.S.). The platform asks contributors to use their real names and share their positions, but it relies on honesty. You will find lots of analysis on large-cap stocks, contrarian picks, and even short ideas. Many investors use Seeking Alpha Premium for its data and community ratings. If you want expert opinions and easy-to-use tools, this service fits well.

- Best for: Investors who want deep research and are willing to pay for it.

Corner of Berkshire and Fairfax

This forum brings together fans of Warren Buffett and value investing. You do not need to pay, but you must register and follow strict rules. Members share long-term ideas, discuss annual meetings, and break down company reports. The group values thoughtful posts and polite debate. If you admire Buffett’s style and want to learn from like-minded investors, you will feel at home here.

Real Vision Exchange

Real Vision Exchange is part of a growing trend in premium financial research. You get access to video interviews, macro insights, and a private community. The platform attracts serious investors who want to understand big trends. You may need to pay for full access, but you get unique content and direct chats with experts. If you want to see how top investors think, this club offers a fresh view.

Stockopedia

Stockopedia gives you powerful screening tools and in-depth data. You pay a subscription fee, usually starting at about $25 USD per month. The platform helps you find stocks that fit your strategy, from value to growth. You can join discussions, read expert analysis, and track your portfolio. If you want to use data to make smarter picks, Stockopedia is a strong choice.

Tip: Premium clubs work best if you want exclusive research, expert ideas, and a focused community. Always check the access rules and see if the club matches your style.

Tools and Trend Trackers

AltIndex

You want to spot trends before everyone else? AltIndex helps you do just that. This platform uses artificial intelligence to scan thousands of stocks and rate them from 1 to 100. It looks at things like social media buzz, job postings, website visits, and app downloads. You get real-time alerts and stock recommendations based on what’s happening right now.

Over 20,000 investors use AltIndex. The platform sends out more than 100 daily stock alerts. Many users trust its AI because it has an 80% win rate on its stock picks. You can start with a free plan or choose paid options starting at $29.99 USD per month. If you want more advanced features, higher tiers go up to $99 USD per month. AltIndex also lets you track your portfolio and see how your stocks score each day.

Tip: AltIndex’s AI can help you catch new opportunities by tracking what people are talking about online.

Other Analytics Platforms

You have more choices if you want to dig deeper into data. Many platforms now use AI to help you pick stocks, track your portfolio, and spot market trends.

- Danelfin uses explainable AI to look at over 10,000 features for each stock every day. It helps you with stock picking and keeps an eye on your portfolio.

- Moning gives you tools for tracking your investments, forecasting dividends, and checking stats in a simple dashboard.

- LunarCrush focuses on social media analytics. You can see what people are saying about stocks and get a feel for market sentiment.

- Intellectia AI offers stock picks, swing trading signals, and technical analysis. It even has a financial AI agent to answer your questions.

- Trade Ideas stands out with its AI assistant, Holly. Holly analyzes millions of trading scenarios daily, offers backtesting, and sends real-time alerts. You can connect it to your U.S. brokerage account. Plans range from $118 to $228 USD per month.

Some platforms, like Stocklytics, are free and give you analyst ratings and custom alerts. You can try different tools to see which one fits your style best.

Note: Using AI-powered tools can help you make smarter decisions and react faster to market changes.

Comparison of Top Investing Communities

Key Differences

You have many choices when it comes to online investing communities. Each one offers something unique. Some groups are huge and open to everyone. Others keep things small and only let in a few new members each year. You might want a free group, or you may look for a club with a paid membership for extra features.

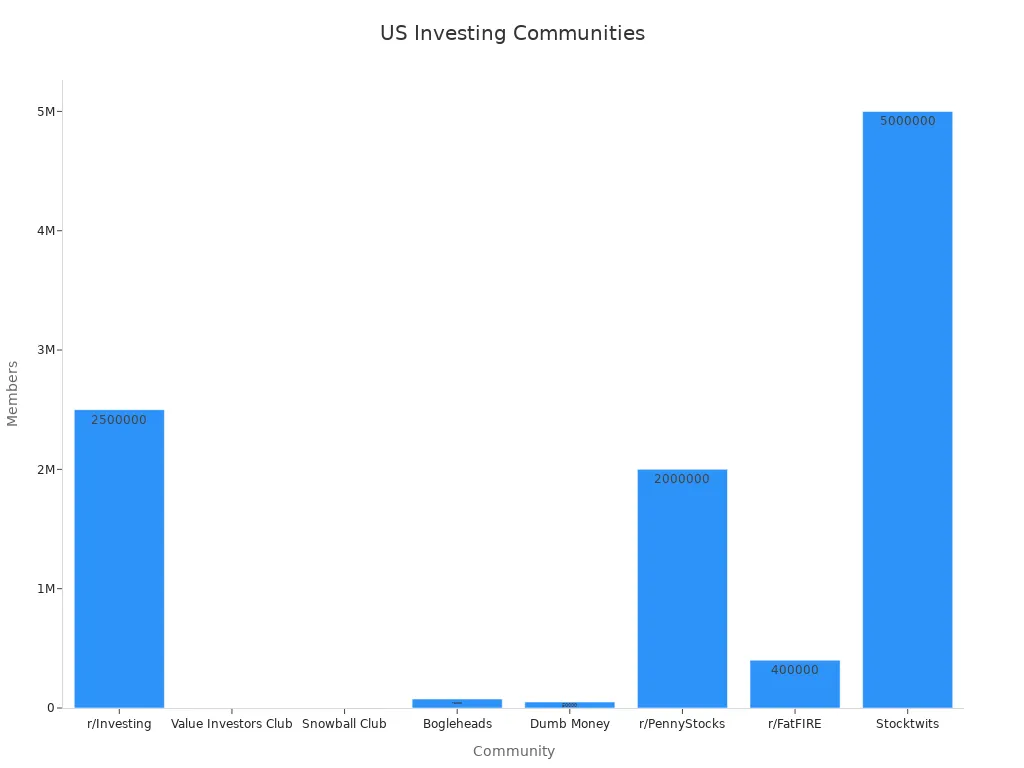

Membership size can make a big difference. For example, Stocktwits has over 5 million users. You get fast updates and lots of opinions. In contrast, Value Investors Club only has about 500 active members. This group is very exclusive. Only 1 in 15 people who apply get in. If you want top-tier investment ideas and don’t mind a tough application, this could be for you.

Some communities focus on serious investing, like r/Investing or Bogleheads. These groups talk about long-term strategies and personal finance. Others, like r/PennyStocks, attract people who want to take big risks for big rewards. You can even find clubs like Snowball Club, which mixes investing with personal growth and charges $300 USD per quarter (check the latest exchange rate if you pay from outside the U.S.).

Take a look at how these communities compare in size:

Tip: Think about what you want from a community. Do you want lots of voices, or do you prefer a smaller, focused group?

Quick Reference Table

Here’s a table to help you see the main differences at a glance:

| Community | Membership Size | Membership Cost | Exclusivity | Focus/Thematic Area |

|---|---|---|---|---|

| r/Investing | Over 2.5 million | Free | Open | Serious capital market investments, quality discussions |

| Value Investors Club | About 500 active | Free (Selective admission) | Highly exclusive (1 in 15 acceptance) | Top-tier investment ideas, fund managers |

| Snowball Club | Over 200 | $300 USD/quarter | Paid membership | Investing + personal development, deal flow insights |

| Bogleheads | Over 75,000 | Free | Open | Personal finance and investing principles |

| Dumb Money | 50,000 | Free | Open | Research tools, multimedia content, diverse sectors |

| r/PennyStocks | Nearly 2 million | Free | Open | High-risk penny stocks, gamified prediction tournaments |

| r/FatFIRE | Nearly 400,000 | Free | Open | Financial independence, early retirement with luxury focus |

| Stocktwits | Over 5 million | Free (premium rooms paid) | Open with premium options | Social media + investing tools, trending tickers |

Note: You can join more than one community to get different views and tools. Try a few and see which one fits your style best.

How to Choose the Right Forum

Match to Your Investing Style

You want a community that fits how you invest. Start by thinking about your goals. Are you a long-term investor who likes steady growth? You might enjoy forums that focus on index funds or value investing. If you love fast trades and market action, look for groups with real-time alerts and active chat rooms. Some forums offer deep research and data tools, while others keep things simple and friendly. Make a list of what matters most to you. This helps you find a stock market forum that matches your needs.

Tip: Try a few communities before you settle on one. You will quickly see which style feels right.

Community Culture and Moderation

A good forum feels safe and welcoming. You want a place where people respect each other and share ideas without fear. The best forums set clear rules and explain what is allowed. They use both human moderators and smart tools to keep things fair. Here are some ways strong communities build trust:

- They choose moderators from the community and let users help shape the rules.

- They share updates about moderation actions and explain why posts get removed.

- They post etiquette guidelines to encourage respect and reduce toxic behavior.

- They use a mix of AI and human judgment to handle lots of posts quickly and fairly.

- They listen to feedback and update their rules as needed.

You should look for forums that talk openly about their rules and treat everyone the same. This makes it easier for you to ask questions and join in.

Free vs. Paid Options

You have a choice between free and paid forums. Free communities let you join right away and see many opinions. They are great for learning and meeting new people. Paid forums often give you extra features, like expert research, exclusive picks, or private chat rooms. Some charge a monthly fee in USD, so check if the price fits your budget. Paid groups may have fewer members, but you often get more focused advice. Think about what you want most—lots of voices or deeper insights.

| Option | Cost | What You Get |

|---|---|---|

| Free | $0 | Open access, big community, variety |

| Paid | $10–$300 USD | Premium tools, expert picks, privacy |

Note: You can start with free forums and move to paid ones if you want more advanced features.

Choosing the right online community can help you grow as an investor. You get real-time tips, support, and new ideas. Try out a few forums to see which one matches your style. Stay active and ask questions. Share your wins and learn from others.

The more you join in, the more you learn. Ready to boost your investing skills? Pick a forum and start today!

FAQ

What is the safest forum for beginners?

You should try Bogleheads Forum. The community welcomes new investors and focuses on simple, safe strategies. You will find clear guides and helpful answers. The moderators keep things friendly and respectful.

Can I trust stock tips from online forums?

You should always double-check any stock tip. Forums can offer great ideas, but not every post is reliable. Do your own research before you invest. If you see a tip, ask questions and look for proof.

Tip: Use trusted sources and compare advice from different forums.

Are paid investing communities worth the money?

Paid communities can offer expert research and exclusive tools. If you want deeper insights and can afford the fee, you may find value. Always check what you get for your money. Some free forums also provide strong support.

How do I avoid scams in stock market forums?

Watch out for users who promise big profits or push you to buy fast. Never share your personal details or send money to strangers. Stick to well-known forums with strong moderation.

- Report suspicious posts.

- Ask for proof before trusting advice.

Transform U.S. stock market insights from top forums into profitable trades with BiyaPay! Our multi-asset wallet offers fee-free USDT conversions to fiat currencies like USD, with only a 0.5% fee for transfers to overseas bank accounts, enabling direct trading of stocks like those in the S&P 500. Sign up in just 1 minute to access secure, real-time transactions, bypassing complex overseas account setups.

Whether acting on r/wallstreetbets trends or Bogleheads’ long-term strategies, BiyaPay ensures cost-effective and seamless investing. Join now—visit BiyaPay to register and turn forum knowledge into market success!

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.