- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

US Stock Market Outlook as Experts Weigh in on 2025 Performance

Image Source: pexels

Market experts expect the 2025 US stock market forecast to show moderate, positive momentum. Wall Street strategists project S&P 500 earnings growth between 7% and 11%, with a 9% price gain target.

| Metric | 2025 Forecast | Notes |

|---|---|---|

| S&P 500 EPS | $265 – $268 | Supported by economic expansion |

| Earnings Growth | 7.1% – 11% | Margin improvement possible |

| P/E Ratio | 21.7x | High valuations increase downside risk |

Market experts see opportunities in small- and mid-cap stocks as valuation spreads narrow.Investors should watch for sector rotation between value and growth, especially with U.S. stock market trends showing signs of shifting leadership. Diversification remains essential to manage risk and capture potential upside.

Key Takeaways

- Experts expect moderate gains in the US stock market in 2025, driven by steady economic growth and strong earnings across all sectors.

- Inflation and Federal Reserve policies remain key factors; investors should watch inflation reports and Fed decisions closely to manage risks.

- Technology, healthcare, and utilities sectors offer promising opportunities due to innovation, strong earnings, and defensive qualities.

- Diversifying investments across sectors, styles, and asset classes helps reduce risk and capture potential gains amid market volatility.

- Geopolitical events and market uncertainties could cause sudden changes, so staying informed and flexible is essential for successful investing.

Market Drivers

Image Source: pexels

Inflation & Rates

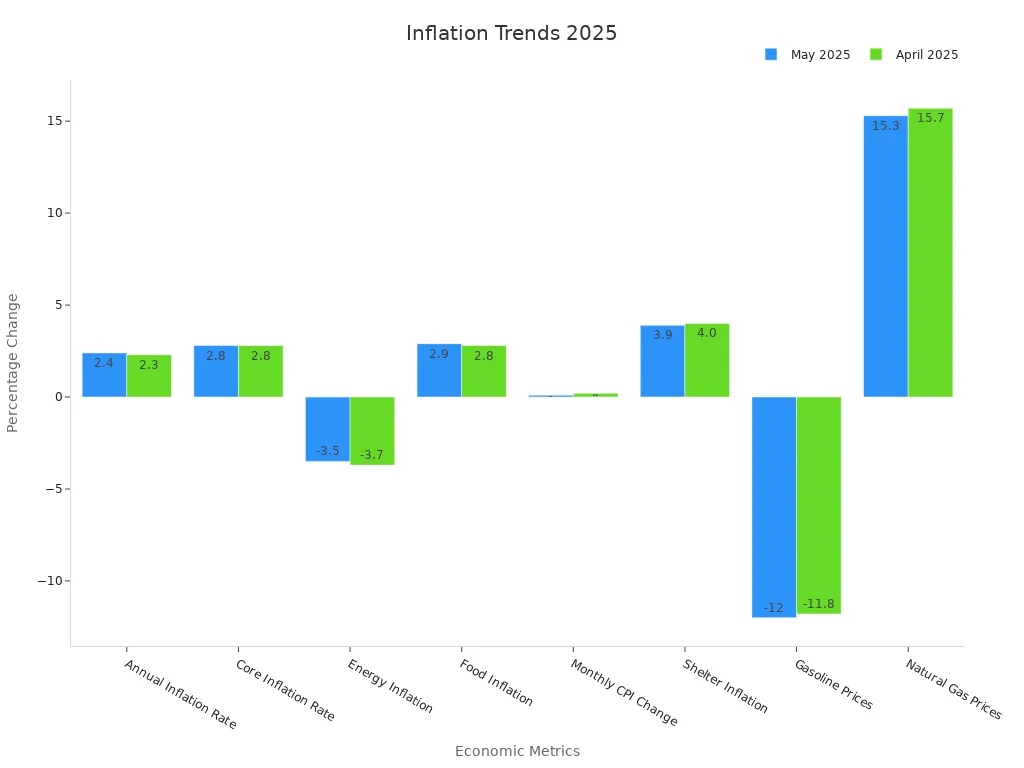

Inflation remains a central concern for the market in 2025. Recent inflation data shows a moderate trend, with the annual inflation rate at 2.4% in May 2025, slightly higher than April’s 2.3%. Core inflation holds steady at 2.8%, matching the lowest levels since 2021. Energy prices continue to decline, while food inflation edges up. The following table summarizes key inflation data:

| Metric | Value (May 2025) | Previous (April 2025) | Notes/Trend |

|---|---|---|---|

| Annual Inflation Rate | 2.4% | 2.3% | Slight increase, below expectations |

| Core Inflation Rate | 2.8% | 2.8% | Steady, at 2021 lows |

| Energy Inflation | -3.5% | -3.7% | Declining energy costs |

| Food Inflation | 2.9% | 2.8% | Slight increase |

| Monthly CPI Change | +0.1% | +0.2% | Below forecast |

| Shelter Inflation | 3.9% | 4.0% | Slight decline |

| Gasoline Prices | -12% | -11.8% | Continued decrease |

| Natural Gas Prices | +15.3% | +15.7% | Elevated but slightly lower |

The Fed’s June 2025 projections indicate inflation could worsen before improving. The median PCE inflation forecast now stands at 3% for 2025. The Fed remains divided: some members expect rates to hold at 4.25%-4.5%, while others see up to two rate cuts. This cautious stance reflects persistent inflation and a resilient labor market. Investors should monitor inflation reports and Fed policy closely, as these factors drive market sentiment and economic data interpretation.

Earnings Growth

Financial experts forecast S&P 500 earnings to rise by 10% to 15% in 2025. All 11 sectors in the S&P 500 are expected to post positive earnings per share growth. No sector faces projected declines, which signals broad-based economic strength. This robust earnings outlook supports optimism in stock markets and financial markets, even as inflation and interest rates remain in focus. Economic growth and productivity gains underpin these earnings projections, with economic data pointing to continued expansion.

Policy & Geopolitics

Policy shifts and geopolitical events shape the market landscape. William Blair’s analysis projects the U.S. economy will stabilize near 2% economic growth in 2025. Policy changes, such as tax cuts and deregulation, are expected to support corporate earnings and consumer spending. In Europe, fiscal expansion and infrastructure investment will narrow the growth gap with the U.S. and stimulate private investment. However, risks remain. Trade protectionism, regional conflicts, and technology decoupling can impact sensitive assets and market volatility. The table below highlights how key geopolitical risks may affect asset prices:

| Geopolitical Risk | Key Sensitive Asset(s) | Expected Direction of Price Impact |

|---|---|---|

| Global trade protectionism | U.S. specialty retail & distribution | Price impact expected downward |

| Middle East regional war | Brent crude oil | Price impact expected upward |

| U.S.-China strategic competition | Taiwanese dollar | Price impact expected downward |

| Global technology decoupling | Chinese yuan | Price impact expected downward |

| Major cyber attack(s) | U.S. dollar | Price impact expected upward |

| Russia-NATO conflict | Brent crude oil | Price impact expected upward |

| Emerging markets political crisis | Latin America consumer staples sector | Price impact expected downward |

| North Korea conflict | Japanese yen | Price impact expected upward |

| European fragmentation | Italy 10-year government bond | Price impact expected upward |

Investors should track economic data, inflation trends, and policy developments to navigate the evolving market environment. Economic resilience and global influences will continue to drive financial markets and stock markets in 2025.

Stock Market Forecast

Bullish Outlook

Wall Street analysts see strong reasons to expect positive momentum in the stock market forecast for 2025. Many experts set the S&P 500 price target as high as 6,500, with earnings per share estimates reaching $270. This optimism comes from several factors. The U.S. economy shows steady expansion, and the labor market remains healthy. Companies continue to invest in artificial intelligence, which boosts productivity and supports higher earnings outlooks. Capital markets stay active, and dealmaking activity remains robust.

The following table highlights key bullish indicators for major asset classes:

| Asset Class | Bullish Indicators / Forecasts | Supporting Data / Commentary |

|---|---|---|

| U.S. Equities | Preference for U.S. equities; S&P 500 price target of 6,500; EPS forecast of $270 | Strong U.S. economic growth, healthy labor market, AI-driven capital spending, robust capital markets and dealmaking activity |

| Gold | Multi-year bullish outlook; price target around $3,000 per ounce by end of 2025 | Strong fundamentals for gold, silver, and platinum; silver target $38/oz; platinum target $1,200/oz |

| Credit Markets | Constructive view with modest changes in high-grade spreads | Resilient balance sheets and earnings; robust credit ecosystem despite policy uncertainty |

| U.S. Dollar (FX) | Bullish outlook; potential to strengthen to new highs in early 2025 | Growth differentials, higher terminal Fed funds rate forecasts, policy expectations post-U.S. election |

| Commodities | Bullish on copper and aluminum due to strong fundamentals and supply constraints | Copper price target $10,400-$11,000 per metric ton; aluminum target $2,850 per metric ton |

| Oil | Bearish outlook with expected surplus and price decline | Brent forecast $73/barrel in 2025, declining to $61 in 2026 due to oversupply |

Note: Experts believe the bull market can continue if economic growth stays on track and inflation remains under control. Investors may see attractive returns, especially in U.S. equities and select commodities.

Bearish Risks

Despite the positive stock market forecast, experts warn about several risks that could limit gains or trigger volatility. High valuations in indexes like the S&P 500 and Nasdaq raise concerns. The Nasdaq’s trailing price-to-earnings ratio stands at 35.78, much higher than its historical median of 20.65. For the S&P 500, the trailing P/E is 25.48, compared to a median of 17.95. Achieving the earnings growth needed to justify these valuations—over 70% for the Nasdaq and more than 22% for the S&P 500—seems unlikely under current economic conditions.

The table below summarizes key risk metrics:

| Metric | Current Value | Historical Median | Required EPS Growth to Normalize | Expert Assessment |

|---|---|---|---|---|

| Nasdaq 100 Trailing P/E | 35.78 | 20.65 | 73.38% | Unlikely to achieve such EPS growth |

| S&P 500 Trailing P/E | 25.48 | 17.95 | ~22.48% | Difficult given macroeconomic conditions |

| CME FedWatch Tool Probability | 71.8% | N/A | N/A | High chance Fed maintains rates, signaling risks of stagflation and slowdown |

The Federal Reserve keeps interest rates in the 4.25% to 4.5% range. Policymakers remain cautious because of inflation and unemployment risks. The CME FedWatch Tool shows a 71.8% chance that the Fed will not cut rates in the next six months. This stance signals the possibility of stagflation or a slowdown in the last half of 2025. If inflation rises or the economy weakens, the market could face sharp corrections.

U.S. Stock Market Trends

U.S. stock market trends continue to attract global attention as investors look for new leadership in the market.In 2025, U.S. stock market performance shows signs of sector rotation. Growth stocks led the rally earlier in the year, but value stocks now gain momentum as investors seek stability. Small- and mid-cap stocks also become more attractive as valuation gaps narrow.

Analysts expect the market to remain sensitive to economic data and policy changes. U.S. stock market trends reflect this shift, with indexes reacting quickly to inflation reports and Federal Reserve announcements. The earnings outlooks for all 11 S&P sectors remain positive, but some sectors may outperform others. Technology and healthcare could lead, while energy and utilities may lag.

Investors should watch U.S. stock market trends closely. The next six months could bring more volatility, especially if global events or economic surprises occur. Diversification across sectors and asset classes helps manage risk and capture opportunities as U.S. stock market developments evolve.

The stock market forecast for 2025 remains mixed. Experts see both upside potential and significant risks. Investors should stay alert to changes in U.S. stock market trends, monitor economic signals, and adjust their strategies as needed.

Risks & Volatility

Image Source: pexels

Geopolitical Events

Geopolitical risks remain a top concern for investors in 2025. Many CEOs now rank geopolitical disruption as a leading challenge, with over one-third expecting it to impact their businesses in the next year. State-based armed conflict has become the number one risk for 23% of survey respondents, rising sharply in global risk rankings. The number of countries where armed conflict is a top executive concern has grown, including regions such as Armenia, Israel, and Poland.

| Data Point | Numerical Value | Description |

|---|---|---|

| Transformations with at least one turning point | 96% | Nearly all global changes involve significant events. |

| Turning points involving major external shocks | 48% | Almost half are driven by geopolitical shocks. |

| CEOs expecting geopolitical disruption as a top force | Over 33% | A significant portion of leaders see this as a key risk. |

| Survey respondents identifying state-based armed conflict as top risk | 23% | Armed conflict now ranks as the leading risk for many. |

These disruptions can trigger sudden changes in inflation and asset prices. Trade tensions, sanctions, and tariffs often lead to higher inflation, especially when supply chains break down. The fed must respond quickly to these shocks, which can create uncertainty for investors. Monitoring global events helps investors prepare for rapid shifts in the market.

Investors should stay alert to geopolitical headlines. Even a single event can cause sharp swings in inflation and stock prices.

Market Uncertainties

Uncertainty in the market has reached levels not seen since the Great Financial Crisis. The CBOE Volatility Index (VIX) closed at 52.3 on April 8, 2025, a level only surpassed during major crises. This high reading signals extreme market turbulence and reflects widespread concern about inflation and policy direction. The fed faces challenges as interest rate uncertainty remains high. The 10-year US Treasury yield stays between 4.5% and 5%, making stocks sensitive to changes in inflation data. Positive inflation news can lower yields and boost stocks, while negative news does the opposite.

Corporate leaders now mention “uncertainty” in 87% of earnings calls, up from 38% in previous quarters. This shift shows how inflation and policy changes dominate business planning. Forecast models estimate a 75% chance of recession in 2025, with a wide confidence interval. The fed’s actions and inflation trends will shape the market’s path.

| Market Event Type | Average Drawdown | Average Duration | Typical Conditions |

|---|---|---|---|

| Corrections without recession | 16.4% | ~4 months | No higher unemployment or recession |

| Bear markets with recession | 35.9% | ~14 months | Higher unemployment, economic contraction |

| 2025 Correction (Feb 19 - Apr 8) | 18.9% | ~1.5 months | Driven by tariffs and policy uncertainty |

Investors should watch inflation data, fed announcements, and global news closely. Volatility will likely remain high as the market reacts to every new development.

Stocks & Strategies

Sector Opportunities

Investors in 2025 face a market shaped by rapid innovation and shifting sector performance. JPMorgan’s outlook highlights three themes driving capital investment: artificial intelligence, power and energy, and security. Companies plan to spend over $315 billion on AI infrastructure, led by Amazon, Microsoft, Google, and Meta. This surge in spending supports technology and software sectors, where falling compute costs create a margin advantage. Healthcare providers also present an attractive opportunity, trading at 13 times forward earnings, below their long-term average. Utilities remain a defensive choice, favored in minimum volatility strategies.

| Sector/Theme | Key Insights | 2025 Implications |

|---|---|---|

| AI-related Technology | $315B planned capex by top 4 U.S. companies | Strong growth driver, supports AI infrastructure |

| Healthcare Providers | 13x forward earnings (below 14x avg.) | Attractive defensive opportunity |

| Utilities | Low sensitivity to growth/inflation | Overweight in defensive strategies |

| Consumer Staples | 21x earnings, above historical average | Less attractive, possibly crowded |

Investors should focus on sectors with strong capital inflows and structural growth. Technology, healthcare, and utilities offer resilience and upside potential for stock investments.

Portfolio Positioning

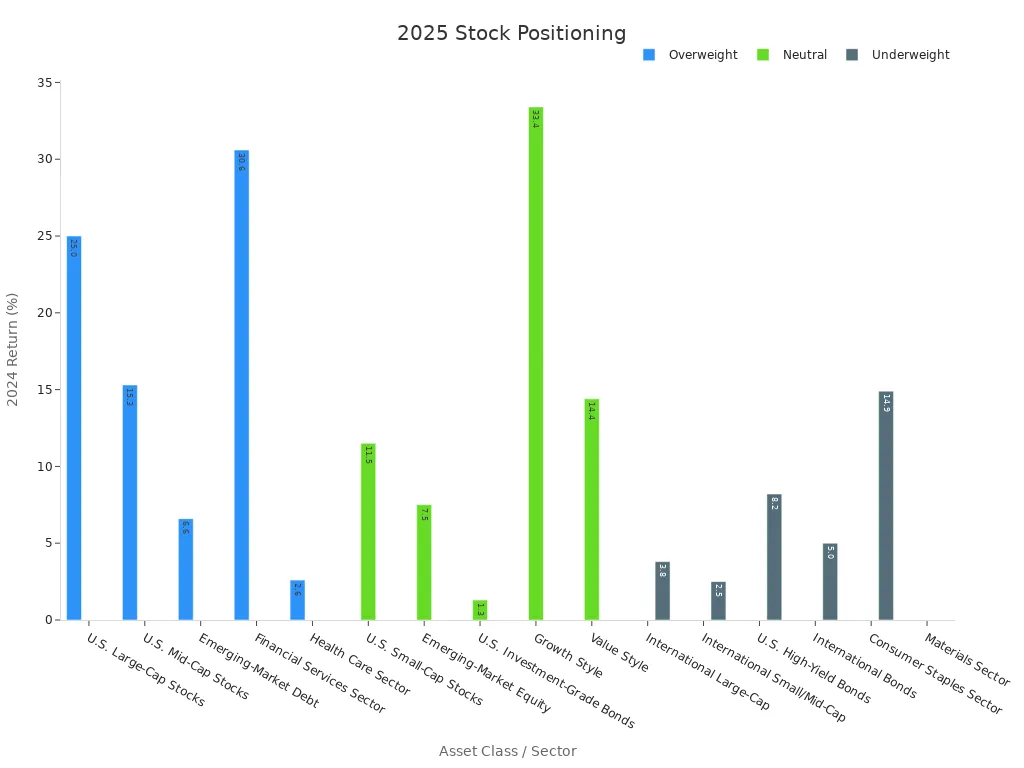

Experts recommend a balanced approach to portfolio construction in 2025. Overweight positions in U.S. large-cap and mid-cap stocks align with historical returns of 25.0% and 15.3% in 2024. Financial services and healthcare sectors also receive overweight recommendations, reflecting their growth and defensive qualities. Morningstar and Seeking Alpha suggest building focused portfolios of 8-12 well-researched stocks, rather than spreading investments too thin. AI and machine learning tools help identify undervalued opportunities and anticipate sector trends.

- Maintain market-weight exposure to growth and value styles, as both show mixed signals.

- Diversify across sectors and themes, not just regions, since sector performance now drives stock returns more than geography.

- Consider modest allocations to emerging-market equity and debt for additional diversification.

- Use sector analysis tools and star ratings to identify undervalued stocks with growth potential.

A well-constructed portfolio balances risk and return. Investors who adapt to sector shifts and use data-driven strategies can better navigate the evolving landscape of stocks and investments.

Market experts expect the US stock market to show moderate gains in 2025. They see opportunities in technology, healthcare, and infrastructure, especially if political changes support economic growth. Morgan Stanley analysts highlight cautious optimism for bonds and rate-sensitive assets. Investors should remember that all forecasts remain speculative and can change quickly.

- Modest interest rate cuts may help biotech stocks, bitcoin, and gold.

- Infrastructure and manufacturing could grow after the election.

- Artificial intelligence and geopolitical events will shape market trends.

Investors should stay diversified and monitor economic and global developments. Personalized advice remains important for navigating the year ahead.

FAQ

What factors could impact the stock market forecast for the last half of 2025?

Market experts believe inflation, fed policy, and global events will shape the stock market forecast. Investors should monitor inflation data, earnings outlooks, and economic data. The next six months may bring volatility if economic growth slows or geopolitical risks rise.

How can investors manage risk in their portfolio during uncertain markets?

Investors can diversify across sectors, indexes, and asset classes. A balanced portfolio helps reduce risk from inflation or sudden changes in financial markets. Monitoring economic data and inflation reports allows investors to adjust investments as market conditions shift.

Which sectors may offer the best returns in 2025?

Technology, healthcare, and utilities could lead stock markets. Market experts expect strong earnings and growth in these sectors. Investors should review sector trends, economic growth, and company earnings before making investments.

Why do market experts recommend watching U.S. stock market trends and global indexes?

U.S. stock market performance” and global indexes reflect changes in economic data, inflation, and policy. Investors who track these trends can spot new opportunities and risks. The next six months may see leadership shifts between growth and value stocks.

How does the fed influence the economy and stock markets?

The fed sets interest rates and responds to inflation. Its actions affect economic growth, stock prices, and investments. Investors should follow fed announcements and inflation reports to understand possible changes in the market.

Seize the 2025 U.S. stock market opportunities with BiyaPay! Our multi-asset wallet enables fee-free USDT conversions to fiat currencies like USD, with just a 0.5% fee for overseas bank transfers, allowing seamless trading of stocks in technology, healthcare, and more. Register in just 1 minute to sidestep complex overseas account setups and execute real-time trades to capitalize on sector rotations or economic shifts.

BiyaPay’s cost-efficient and secure platform empowers you to diversify with confidence. Get started now—visit BiyaPay to register and thrive in the dynamic 2025 market!

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.